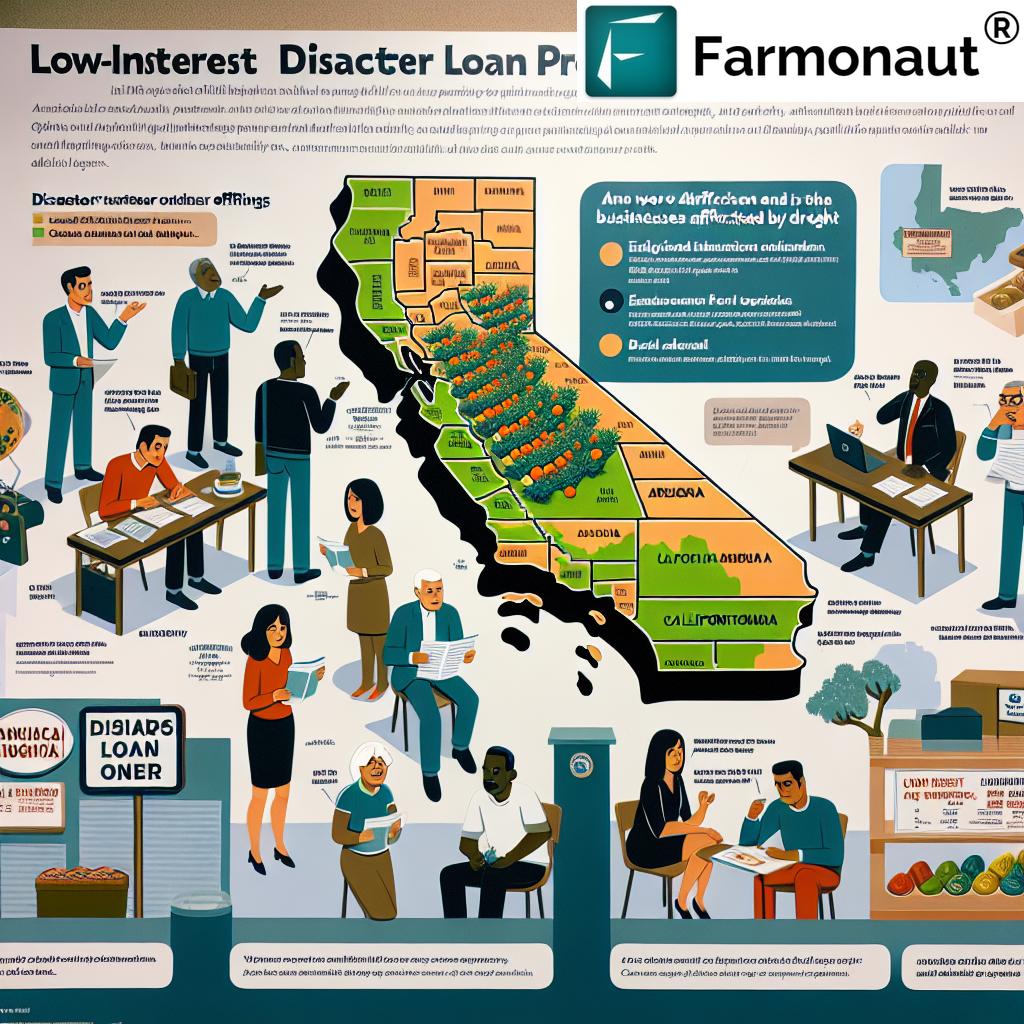

SBA Offers Low-Interest Disaster Loans for California Businesses Affected by Drought: Economic Recovery Support Available

“SBA offers disaster loans up to $2 million with interest rates as low as 3.25% for nonprofits affected by California drought.”

As drought conditions continue to impact businesses across California and neighboring states, we at Farmonaut understand the critical need for economic support in these challenging times. Today, we’re excited to share important information about the U.S. Small Business Administration’s (SBA) recent announcement of low-interest federal disaster loans available to small businesses and private nonprofit organizations affected by the ongoing drought.

Understanding the SBA Disaster Loan Program

The SBA has declared several counties in California, Arizona, and Nevada eligible for disaster loans due to economic losses caused by the drought beginning October 1, 2024. This declaration opens up crucial financial assistance for businesses struggling with the economic impacts of prolonged dry conditions.

Let’s delve into the details of this disaster loan program and how it can benefit affected businesses:

- The Economic Injury Disaster Loan (EIDL) program is now available to eligible small businesses, small agricultural cooperatives, nurseries, and private nonprofit organizations.

- Loans of up to $2 million are being offered with remarkably low interest rates: 4% for small businesses and 3.25% for nonprofits.

- Loan terms can extend up to 30 years, providing businesses with ample time for recovery and repayment.

- These loans can be used for working capital needs, including fixed debts, payroll, accounts payable, and other bills that can’t be paid due to the disaster’s impact.

It’s important to note that while agricultural producers, farmers, and ranchers are generally not eligible for this program, small aquaculture enterprises can apply. This provision recognizes the unique challenges faced by businesses in the aquaculture sector during drought conditions.

Covered Counties and Eligibility

The SBA’s disaster declaration covers a wide range of counties across three states, ensuring that businesses in drought-affected areas have access to this crucial financial support. Let’s break down the covered regions:

California Counties:

- Alpine

- Fresno

- Imperial

- Inyo

- Kern

- Kings

- Los Angeles

- Madera

- Mono

- Orange

- Riverside

- San Bernardino

- San Diego

- San Luis Obispo

- Santa Barbara

- Tulare

- Tuolumne

- Ventura

Arizona Counties:

- La Paz

- Mohave

- Yuma

Nevada Counties:

- Clark

- Douglas

- Esmeralda

- Lyon

- Mineral

- Nye

If your business is located in one of these counties and has experienced economic losses due to the drought, you may be eligible for an SBA disaster loan. It’s crucial to review the specific eligibility criteria and application requirements to ensure you can benefit from this program.

How These Loans Can Help Your Business

The SBA’s disaster loans are designed to provide a lifeline to businesses struggling with the economic impacts of drought. Here are some ways these loans can help:

- Working Capital: Use the funds to cover day-to-day operational expenses that you’re struggling to meet due to reduced revenue.

- Debt Management: Pay off fixed debts that have become challenging to manage with decreased income.

- Employee Retention: Maintain your workforce by using the loan to cover payroll expenses.

- Vendor Payments: Keep up with accounts payable to maintain good relationships with suppliers.

- Adaptation and Innovation: Invest in new strategies or technologies to adapt your business to drought conditions.

For businesses in the agricultural sector, these loans can be particularly beneficial. While direct agricultural producers may not be eligible, businesses that support the agricultural industry, such as equipment suppliers, processors, or distributors, can apply for these loans to offset losses caused by reduced agricultural activity in drought-affected areas.

“The SBA’s drought disaster loan program covers multiple counties across three states: California, Arizona, and Nevada.”

The Application Process

Applying for an SBA disaster loan is a straightforward process, but it’s essential to be thorough and timely. Here’s a step-by-step guide to help you navigate the application:

- Check Eligibility: Confirm that your business is located in an eligible county and meets the SBA’s criteria for small businesses or nonprofits.

- Gather Documentation: Prepare financial statements, tax returns, and other documents that demonstrate your business’s economic injury due to the drought.

- Apply Online: Visit sba.gov/disaster to submit your application electronically. This is often the fastest method.

- Application Review: The SBA will review your application and may request additional information if needed.

- Loan Decision: Once your application is complete, the SBA will make a decision on your loan.

- Loan Disbursement: If approved, you’ll work with an SBA representative to finalize the loan terms and receive the funds.

Remember, the deadline to apply for these disaster loans is November 25, so it’s crucial to start the process as soon as possible.

Leveraging Technology for Drought Resilience

While financial assistance is crucial, businesses in drought-affected areas can also benefit from technological solutions to enhance their resilience. At Farmonaut, we offer innovative tools that can help businesses in the agricultural sector better manage their resources and adapt to challenging conditions.

Our satellite-based crop health monitoring system provides real-time insights into vegetation health, soil moisture levels, and other critical metrics. This data can help farmers and agribusinesses make informed decisions about irrigation, fertilizer usage, and pest management, ultimately optimizing crop yields and reducing resource wastage.

For businesses involved in large-scale agricultural operations, our Agro Admin App offers comprehensive tools for efficient plantation management. This can be particularly valuable for businesses looking to optimize their operations in response to drought conditions.

Comparison of SBA Disaster Loan Options

| Loan Type | Eligible Entities | Maximum Loan Amount | Interest Rate Range | Maximum Loan Term | Eligible Use of Funds | Covered Geographic Areas |

|---|---|---|---|---|---|---|

| Economic Injury Disaster Loans (EIDL) | Small businesses, small agricultural cooperatives, nurseries, and private nonprofits | Up to $2 million | 3.25% for nonprofits, 4% for small businesses | 30 years | Working capital, fixed debts, payroll, accounts payable, other bills | Specified counties in California, Arizona, and Nevada |

| Physical Disaster Loans | Businesses of all sizes and private nonprofits | Up to $2 million | Varies based on availability of other credit | 30 years | Repair or replacement of damaged property | Disaster-declared areas |

| Military Reservist Economic Injury Loans | Small businesses facing financial hardship when a key employee is called to active duty | Up to $2 million | 4% | 30 years | Working capital to cover operating expenses | Nationwide |

Additional Resources for Drought-Affected Businesses

In addition to the SBA’s disaster loans, there are other resources available to help businesses navigate the challenges of drought:

- State-Level Assistance: Many states offer their own drought assistance programs. Check with your state’s agricultural or economic development agencies for additional support.

- USDA Programs: The U.S. Department of Agriculture offers various programs to assist farmers and ranchers during drought conditions.

- Water Conservation Incentives: Look into local and state programs that offer incentives for implementing water-saving technologies and practices.

- Business Counseling: Organizations like SCORE and Small Business Development Centers offer free counseling to help businesses adapt to challenging conditions.

At Farmonaut, we’re committed to supporting the agricultural community through innovative technologies. Our crop loan and insurance verification services can help streamline the process of accessing financial support, while our carbon footprinting tools can assist businesses in monitoring and reducing their environmental impact during these challenging times.

Planning for Long-Term Drought Resilience

While the SBA’s disaster loans provide crucial short-term relief, it’s essential for businesses to plan for long-term drought resilience. Here are some strategies to consider:

- Diversification: Explore ways to diversify your business to reduce reliance on drought-sensitive activities.

- Water Efficiency: Invest in water-saving technologies and practices to reduce your business’s water consumption.

- Drought-Resistant Crops: For agricultural businesses, consider transitioning to more drought-resistant crop varieties.

- Technology Adoption: Embrace technologies like Farmonaut’s satellite-based monitoring to optimize resource use and improve decision-making.

- Financial Planning: Develop a robust financial plan that includes strategies for managing through extended periods of drought.

Our fleet management solutions can help agricultural businesses optimize their operations and reduce costs, which is particularly valuable during challenging economic times.

Conclusion: Navigating Drought Challenges with SBA Support and Innovative Solutions

The SBA’s disaster loan program offers a vital lifeline for businesses affected by the ongoing drought in California and neighboring states. By providing low-interest loans with flexible terms, this program aims to help businesses weather the economic storm caused by prolonged dry conditions.

As we at Farmonaut continue to innovate in the agricultural technology space, we encourage businesses to explore how our solutions can complement financial assistance in building long-term drought resilience. From satellite-based crop monitoring to advanced resource management tools, we’re here to support the agricultural community through these challenging times.

Remember, the deadline to apply for SBA disaster loans is November 25. We urge eligible businesses to take advantage of this opportunity and to explore all available resources for drought assistance. Together, we can build a more resilient and sustainable future for agriculture in drought-prone regions.

FAQs About SBA Disaster Loans for Drought-Affected Businesses

- Q: Who is eligible for these SBA disaster loans?

A: Small businesses, small agricultural cooperatives, nurseries, and private nonprofit organizations in declared counties who have suffered economic injury due to the drought are eligible. - Q: What is the maximum loan amount available?

A: Eligible entities can apply for loans up to $2 million. - Q: What are the interest rates for these loans?

A: Interest rates are as low as 3.25% for nonprofits and 4% for small businesses. - Q: How long do I have to repay the loan?

A: Loan terms can extend up to 30 years, providing ample time for repayment. - Q: Can agricultural producers apply for these loans?

A: Generally, agricultural producers, farmers, and ranchers are not eligible, except for small aquaculture enterprises. - Q: What can the loan funds be used for?

A: Funds can be used for working capital needs, including fixed debts, payroll, accounts payable, and other bills that can’t be paid due to the disaster’s impact. - Q: How do I apply for an SBA disaster loan?

A: You can apply online at sba.gov/disaster or call SBA’s Customer Service Center at (800) 659-2955 for more information. - Q: What is the deadline for applying?

A: The deadline to submit completed loan applications is November 25. - Q: Are there any fees associated with applying for or receiving an SBA disaster loan?

A: There are no application fees or prepayment penalties for SBA disaster loans. - Q: How can Farmonaut’s technologies help businesses affected by drought?

A: Farmonaut offers satellite-based crop monitoring, resource management tools, and other technologies that can help businesses optimize their operations and build resilience to drought conditions.

For more information on how Farmonaut can support your agricultural business during these challenging times, visit our website or contact our customer support team.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Explore Farmonaut’s Solutions

Discover how Farmonaut’s innovative technologies can help your business thrive, even in challenging conditions:

For developers interested in integrating our powerful satellite and weather data into their own applications, check out our API and API Developer Docs.