Unlocking Agricultural Success: Expert Farm Credit Solutions for Texas and New Mexico Producers

“Over 90% of farm credit loans in Texas and New Mexico are tailored specifically for rural agricultural producers.”

In the vast landscapes of Texas and New Mexico, where agriculture forms the backbone of rural economies, access to robust farm credit solutions is paramount for the success of farmers and ranchers. We understand that navigating the complex world of agricultural financing can be challenging, which is why we’ve crafted this comprehensive guide to help you unlock the potential of your agribusiness. Whether you’re a seasoned farmer in Lampasas, Texas, or a young rancher starting out in New Mexico, this article will provide you with valuable insights into the farm credit loans and agricultural financing solutions available to you.

The Importance of Specialized Agricultural Financing

Agricultural financing is not a one-size-fits-all solution. The unique challenges faced by farmers and ranchers require specialized lending options that align with the cyclical nature of agricultural production. From dealing with unpredictable weather patterns to managing fluctuating commodity prices, producers need financial partners who understand the intricacies of the agricultural sector.

In Texas and New Mexico, farm credit institutions have developed a range of products tailored to meet these specific needs. These include:

- Farm credit loans for land acquisition and improvement

- Ranch land financing for livestock operations

- Agricultural equipment loans for modernizing farm machinery

- Operational loans for day-to-day expenses

- Specialized programs for young, beginning, and small farmers

By offering these targeted financial solutions, lenders in the region are helping to foster growth and stability in the agricultural sector.

Innovative Financing Solutions for Modern Agriculture

As agriculture evolves, so do the financial tools available to producers. Today’s farm credit solutions go beyond traditional lending to incorporate cutting-edge technologies and flexible repayment terms that align with agricultural cycles.

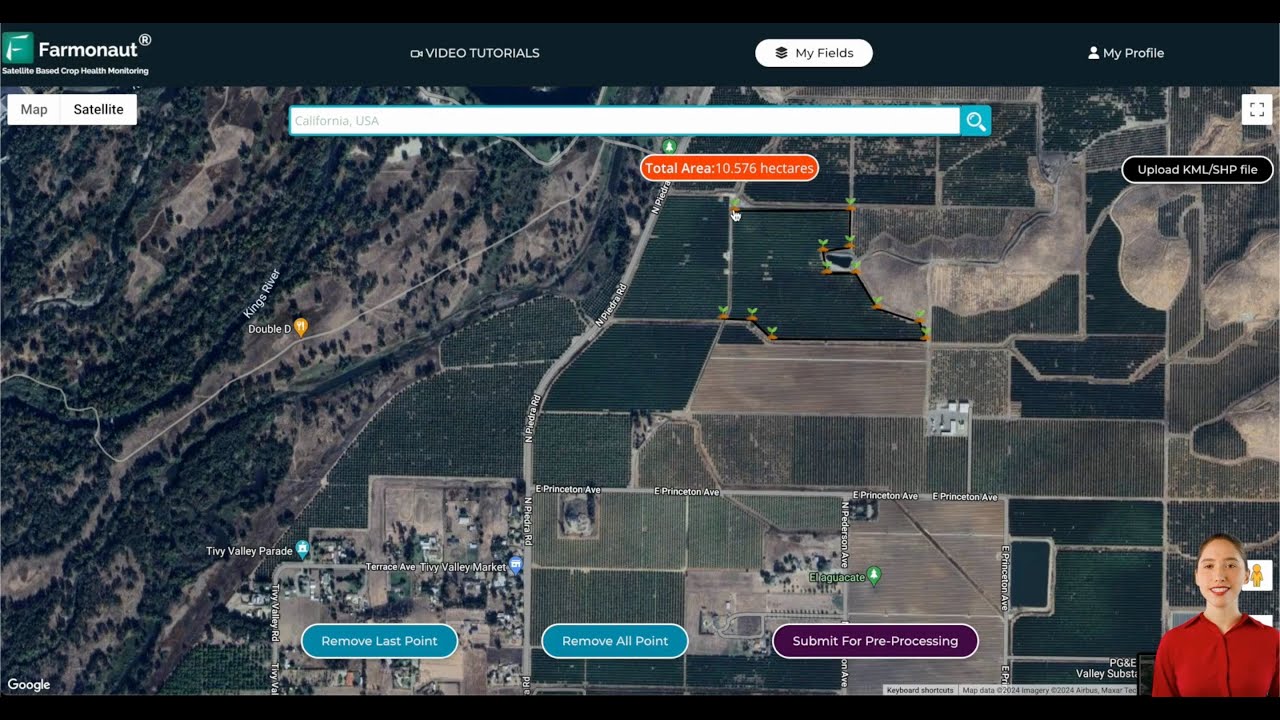

Real-Time Farm Management with Farmonaut

To complement these financial solutions, innovative platforms like Farmonaut are revolutionizing farm management. Farmonaut offers satellite-based crop health monitoring and AI-driven advisory systems, empowering farmers to make data-driven decisions that optimize their operations and financial management.

By integrating Farmonaut’s technology with robust financial planning, farmers can:

- Monitor crop health in real-time to inform lending decisions

- Utilize AI-powered insights for better resource allocation

- Improve cash flow management with data-driven forecasting

- Enhance sustainability practices to qualify for green financing options

Tailored Lending Options for Texas and New Mexico Producers

Let’s delve into some of the specific farm credit loans and financing options available to agricultural producers in Texas and New Mexico:

1. Ranch Land Financing

For ranchers looking to expand their operations or purchase new grazing lands, ranch land financing offers competitive rates and terms suited to the livestock industry. These loans often feature:

- Long-term fixed rates to protect against interest rate fluctuations

- Flexible repayment schedules aligned with cattle market cycles

- Options for purchasing additional acreage or improving existing ranch infrastructure

2. Agricultural Equipment Loans

Modernizing farm equipment is essential for improving efficiency and productivity. Agricultural equipment loans provide:

- Financing for tractors, combines, irrigation systems, and other essential machinery

- Lease options for seasonal equipment needs

- Competitive interest rates with terms that match the expected lifespan of the equipment

“Young and beginning farmers can access specialized loan programs with up to 30% lower interest rates than standard agricultural loans.”

3. Young and Beginning Farmer Programs

To encourage the next generation of agricultural producers, many lenders offer specialized programs for young and beginning farmers. These programs typically include:

- Lower down payment requirements

- Reduced interest rates

- Educational resources and mentorship opportunities

- Flexible credit criteria that take into account the unique challenges of starting in agriculture

For those just starting their agricultural journey, these programs can be a crucial stepping stone to establishing a successful farming or ranching operation.

Specialized Financing for Agricultural Challenges

In addition to traditional land and equipment financing, lenders in Texas and New Mexico offer specialized loans to address specific agricultural challenges:

Irrigation Financing Options

Water management is critical in the arid regions of Texas and New Mexico. Irrigation financing helps farmers invest in efficient water systems, including:

- Center pivot irrigation systems

- Drip irrigation technology

- Water conservation equipment

These loans often come with terms that reflect the long-term nature of irrigation investments and may include features like interest-only payments during the installation period.

Pest and Disease Management Loans

To help farmers combat pest infestations and disease outbreaks, some lenders offer short-term loans specifically for pest and disease management. These loans can cover:

- Purchase of pesticides and fungicides

- Implementation of integrated pest management systems

- Consulting fees for pest control experts

The repayment terms for these loans are often structured to align with the expected recovery of crop yields following treatment.

Leveraging Technology for Financial Management

Modern agricultural financing isn’t just about accessing capital; it’s also about managing that capital effectively. This is where technology platforms like Farmonaut come into play, offering tools that complement financial solutions:

- Satellite-Based Crop Monitoring: Use real-time data to inform financial decisions and loan applications.

- AI Advisory Systems: Get personalized recommendations for resource allocation and investment planning.

- Blockchain Traceability: Enhance transparency in supply chains, potentially improving access to premium markets and financing.

- Resource Management Tools: Optimize operations to maximize the return on financial investments.

By integrating these technological solutions with traditional financial management practices, farmers and ranchers can create a more robust and responsive financial strategy.

Navigating Farm Credit Loans: Tips for Success

Securing the right farm credit loan requires careful planning and preparation. Here are some tips to help you navigate the process successfully:

- Assess Your Needs: Clearly define your financial requirements and how they align with your business goals.

- Prepare Comprehensive Documentation: Gather detailed financial records, business plans, and projections to support your loan application.

- Understand Your Credit Profile: Review your credit report and address any issues before applying for loans.

- Explore Multiple Lenders: Compare offerings from different farm credit institutions to find the best terms and rates.

- Consider Collateral Options: Understand what assets can be used as collateral for secured loans.

- Plan for Contingencies: Build flexibility into your financial plan to account for unexpected challenges.

Cash Management Strategies for Agricultural Producers

Effective cash management is crucial for maintaining financial stability in the cyclical world of agriculture. Here are some strategies to consider:

- Diversify Income Streams: Consider adding value-added products or agritourism to supplement traditional crop and livestock income.

- Utilize Operating Lines of Credit: These can help smooth out cash flow during lean periods.

- Implement Risk Management Tools: Use futures contracts, options, and crop insurance to protect against market volatility and yield losses.

- Adopt Precision Agriculture Techniques: Leverage technologies like those offered by Farmonaut to optimize resource use and reduce costs.

- Maintain Emergency Reserves: Set aside funds to cover unexpected expenses or weather-related losses.

By implementing these strategies and leveraging the right financial tools, producers can build resilience into their operations and better weather the ups and downs of agricultural markets.

Comparing Farm Credit Solutions: Texas vs. New Mexico

While Texas and New Mexico share many similarities in their agricultural landscapes, there are some notable differences in the farm credit solutions available in each state. The following table provides a comparison of key loan types and financing options:

| Loan Type/Feature | Texas | New Mexico |

|---|---|---|

| Interest Rates | From 3.5% | From 3.75% |

| Loan Terms | Up to 30 years | Up to 25 years |

| Eligibility Criteria | Farming/ranching as primary occupation | Includes part-time farmers |

| Specialized Programs for Young Farmers | Extended repayment periods, lower rates | Mentorship programs, reduced down payments |

| Equipment Financing Options | Leasing and purchase options available | Focus on long-term ownership financing |

| Irrigation Loan Specifics | Emphasis on water conservation technology | Includes options for drought mitigation |

| Livestock Loans | Tailored for large cattle operations | Includes options for smaller herds and specialty livestock |

This comparison highlights the nuanced approach to agricultural financing in each state, reflecting the specific needs and challenges of local producers.

The Role of Technology in Modern Agricultural Financing

As we navigate the complexities of farm credit and agricultural financing, it’s crucial to recognize the transformative role that technology plays in modern farming practices. Platforms like Farmonaut are at the forefront of this agricultural revolution, offering tools that not only enhance productivity but also provide valuable data for financial decision-making.

Farmonaut’s Satellite-Based Solutions

Farmonaut’s suite of tools includes:

- Real-time Crop Health Monitoring: This feature allows farmers to track the health of their crops using satellite imagery, providing crucial data for loan applications and financial planning.

- AI-Powered Advisory System: The Jeevn AI system offers personalized recommendations that can help farmers optimize their operations and make informed financial decisions.

- Blockchain-Based Traceability: This technology enhances supply chain transparency, which can lead to better market access and potentially more favorable financing terms.

For developers and businesses looking to integrate these advanced features into their own systems, Farmonaut offers API access. You can explore the API options here and refer to the API Developer Docs for detailed information.

Sustainable Agriculture and Green Financing

As the agricultural sector faces increasing pressure to adopt sustainable practices, many lenders are now offering green financing options. These loans are designed to support environmentally friendly farming methods and can include:

- Preferential rates for organic farming conversions

- Financing for renewable energy installations on farm properties

- Loans for implementing soil conservation practices

- Support for transitioning to low-emission farm equipment

By leveraging these green financing options, farmers can not only contribute to environmental conservation but also potentially reduce their long-term operational costs.

Navigating Rural Real Estate Financing

For many agricultural producers, expanding their land holdings is a key strategy for growth. Rural real estate financing in Texas and New Mexico comes with its own set of considerations:

- Land Valuation: Understanding how agricultural land is valued is crucial for securing appropriate financing.

- Water Rights: In arid regions, water rights can significantly impact land value and loan terms.

- Mineral Rights: Consider the implications of mineral rights on property financing and future income potential.

- Zoning and Land Use: Be aware of any restrictions that may affect the property’s agricultural use.

When exploring rural real estate financing options, it’s important to work with lenders who have expertise in agricultural properties and understand the unique aspects of farm and ranch land valuations.

The Future of Agricultural Financing

As we look to the future, several trends are shaping the landscape of agricultural financing in Texas and New Mexico:

- Increased Integration of Technology: Expect to see more lenders incorporating data from platforms like Farmonaut into their underwriting processes.

- Focus on Sustainability: Green financing options are likely to become more prevalent and may offer more attractive terms.

- Tailored Products for Niche Markets: As agriculture diversifies, financing options for specialty crops and alternative farming methods will expand.

- Enhanced Risk Management Tools: New financial products may emerge to help farmers better manage climate and market risks.

By staying informed about these trends and leveraging available technologies, agricultural producers can position themselves to take advantage of evolving financing opportunities.

Conclusion: Empowering Agricultural Success

As we’ve explored throughout this guide, successful agricultural operations in Texas and New Mexico rely on a combination of robust financial solutions and innovative technologies. From farm credit loans tailored to specific needs to cutting-edge platforms like Farmonaut that enhance decision-making, producers have more tools than ever at their disposal.

By understanding the range of financing options available, implementing sound cash management strategies, and leveraging technological advancements, farmers and ranchers can build resilient and prosperous agricultural businesses. As the industry continues to evolve, those who adapt and utilize these resources will be best positioned for long-term success.

Remember, the key to unlocking agricultural success lies in choosing the right financial partners, embracing innovation, and maintaining a forward-thinking approach to farm management. With the right combination of traditional wisdom and modern solutions, the future of agriculture in Texas and New Mexico looks bright indeed.

Farmonaut Subscriptions

Frequently Asked Questions (FAQ)

Q: What types of farm credit loans are available in Texas and New Mexico?

A: Farm credit loans in Texas and New Mexico include land acquisition loans, equipment financing, operational loans, and specialized programs for young and beginning farmers. There are also options for irrigation financing and pest management loans.

Q: How can young farmers access specialized loan programs?

A: Young farmers can access specialized loan programs through farm credit institutions that offer lower interest rates, reduced down payments, and more flexible terms. These programs often include educational resources and mentorship opportunities.

Q: What role does technology play in modern agricultural financing?

A: Technology plays a crucial role in modern agricultural financing by providing real-time data for decision-making. Platforms like Farmonaut offer satellite-based crop monitoring, AI advisory systems, and blockchain traceability, which can inform lending decisions and improve farm management.

Q: How do irrigation financing options work in arid regions?

A: Irrigation financing options in arid regions typically offer long-term loans for water management systems, including center pivot and drip irrigation technologies. These loans often have terms that reflect the long-term nature of the investment and may include features like interest-only payments during installation.

Q: What should I consider when seeking rural real estate financing?

A: When seeking rural real estate financing, consider factors such as land valuation, water rights, mineral rights, and zoning restrictions. Work with lenders who have expertise in agricultural properties and understand the unique aspects of farm and ranch land.