US Ammonium Sulfate Market: Rising Prices and Supply Challenges Through Q1 2025

“US ammonium sulfate prices are projected to remain high through Q1 2025, affecting over 20 million acres of cropland.”

As we delve into the complexities of the US ammonium sulfate (amsul) market, it’s crucial to understand the multifaceted factors driving the current trends and future projections. In this comprehensive analysis, we’ll explore the intricate web of supply challenges, demand fluctuations, and pricing dynamics that are shaping the fertilizer landscape through early 2025.

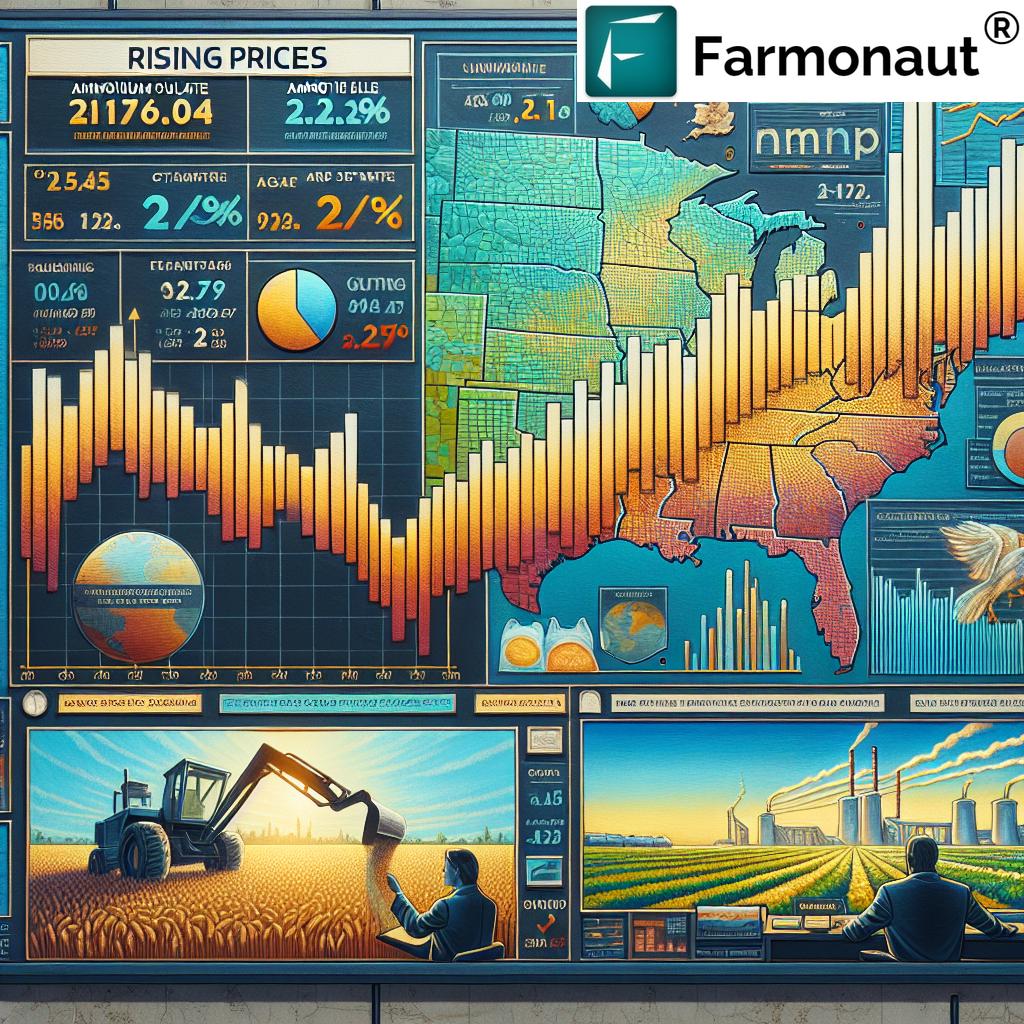

The Current State of the US Ammonium Sulfate Market

The US ammonium sulfate market is experiencing a period of unprecedented volatility, characterized by rising prices and persistent supply challenges. As we navigate through this complex terrain, it’s essential to understand the key drivers behind these market dynamics.

- Elevated Demand: The demand for ammonium sulfate has remained robust, driven by its critical role in agricultural productivity.

- Supply Constraints: Production challenges and inventory depletion have created a tight supply situation.

- Feedstock Costs: Rising costs of key inputs like ammonia and sulfur are pushing amsul prices higher.

- Shifting Buyer Behavior: Farmers and distributors are adopting more proactive purchasing strategies to mitigate price risks.

These factors are converging to create a perfect storm in the US amsul market, with implications that extend well into 2025.

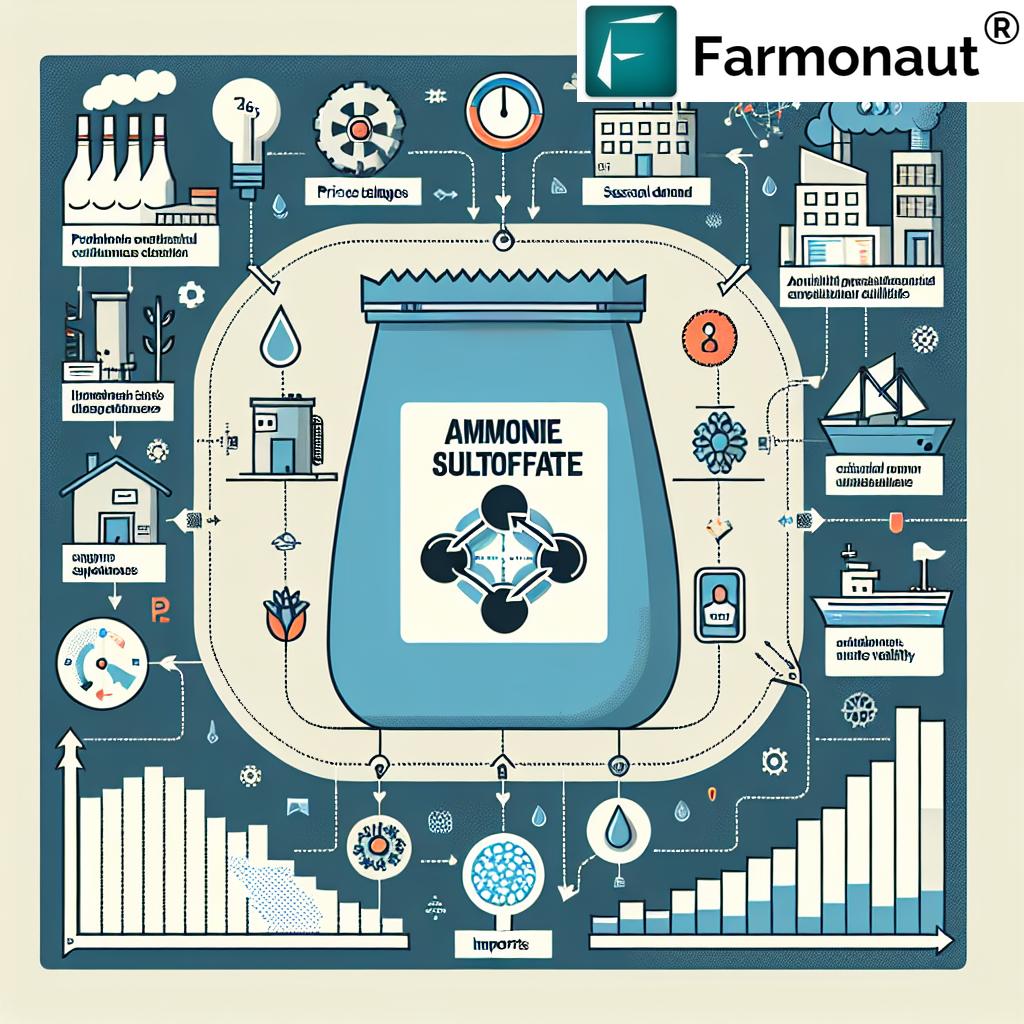

Production Challenges and Inventory Depletion

The US ammonium sulfate production landscape has been marked by significant fluctuations and challenges in recent months. Let’s examine the key aspects:

- Q3 2023 Production Surge: Domestic production saw an 11% increase, reaching 4.8 million short tons and surpassing the five-year average of 4.25 million short tons.

- Q4 2023 Production Decline: Extended downtimes at crucial facilities, including AdvanSix in Virginia and Nutrien in Alberta, led to reduced output.

- Inventory Impact: Strong demand has significantly depleted US inventories, despite the earlier production increase.

- Import Limitations: A 17% year-over-year decrease in imports from July to October 2023 has further tightened supply.

These production challenges have created a ripple effect throughout the supply chain, contributing to the scarcity that’s spilling into the 2024-2025 fertilizer year.

Feedstock Costs and Their Impact on Pricing

The pricing dynamics of ammonium sulfate are intricately linked to the costs of its primary feedstocks: ammonia and sulfur. Here’s how these inputs are influencing the market:

- Ammonia Price Trends: Recent price hikes have been attributed to surging ammonia costs. While there may be a slight seasonal dip in January, the overall trend remains upward.

- Sulfur Cost Increases: Global demand for sulfur is on the rise, pushing prices higher and adding to the cost pressures on amsul production.

- Producer Response: Major producers like IOC have cited these increasing feedstock costs as justification for recent price increases.

The interplay between these feedstock costs and amsul pricing is creating a challenging environment for both producers and consumers in the fertilizer market.

Shifting Buyer Behaviors and Market Dynamics

“Fertilizer price volatility has led to a 15% increase in early purchases by farmers, impacting inventory management strategies.”

The volatile nature of the ammonium sulfate market has prompted significant changes in buyer behavior. We’re observing several key trends:

- Forward Purchasing: Many buyers are opting for early purchases to hedge against potential price increases and volatility.

- Departure from Hand-to-Mouth Buying: The traditional practice of buying only immediate needs is giving way to more strategic, long-term purchasing strategies.

- Earlier Demand Onset: Demand for amsul is beginning earlier than in previous years, though questions remain about its sustained strength as spring approaches.

- Price Expectations: With current prices in the US Corn Belt averaging $380 per short ton (20% higher than last December), further increases are anticipated as the spring application season nears.

These shifts in buyer behavior are reshaping the market dynamics and influencing how producers and distributors manage their inventories and pricing strategies.

Spring Application Season and Its Market Impact

The approaching spring application season is a critical period that significantly influences the ammonium sulfate market. Here’s what we’re anticipating:

- Seasonal Demand Surge: Historically, amsul prices escalate with the onset of the spring application season.

- Supply Chain Pressures: The increased demand during this period often exacerbates existing supply challenges.

- Price Volatility: The combination of high demand and limited supply typically leads to price spikes during the spring months.

- Regional Variations: Different agricultural regions may experience varying levels of price increases and supply constraints.

As we approach this crucial period, both buyers and sellers in the amsul market are preparing for potential disruptions and price fluctuations.

Domestic Production and Import Trends

The balance between domestic production and imports plays a crucial role in shaping the US ammonium sulfate market. Let’s examine the current landscape:

- Domestic Production Challenges: Extended downtimes at key facilities have led to reduced output in recent months.

- Import Decline: The 17% year-over-year decrease in imports from July to October 2023 has further tightened supply.

- Producers’ Response: Some producers have turned to imports to compensate for lower domestic output, but this has had limited impact.

- Global Market Influences: International supply and demand dynamics are increasingly affecting the US amsul market.

These trends underscore the complex interplay between domestic production capabilities and global market forces in the US ammonium sulfate sector.

Long-Term Outlook for the US Fertilizer Market

As we look beyond the immediate challenges, it’s crucial to consider the long-term trajectory of the US fertilizer market, particularly for ammonium sulfate. Several factors will shape this outlook:

- Sustainable Agriculture Practices: The growing emphasis on sustainable farming may influence fertilizer usage patterns and demand.

- Technological Advancements: Innovations in precision agriculture and fertilizer application techniques could impact amsul consumption.

- Regulatory Environment: Changes in environmental regulations and agricultural policies may affect production and usage of ammonium sulfate.

- Global Trade Dynamics: Shifts in international trade patterns and agreements could influence the balance between domestic production and imports.

Understanding these long-term trends is essential for stakeholders across the agricultural value chain to make informed decisions and develop robust strategies.

Fertilizer Inventory Management Strategies

In light of the current market dynamics, effective inventory management has become more critical than ever for both producers and buyers of ammonium sulfate. Here are some key strategies being employed:

- Just-in-Time Inventory: Some buyers are adopting a more agile approach to inventory management to minimize holding costs while ensuring supply.

- Forward Contracting: Locking in prices and quantities through forward contracts is becoming more common to hedge against price volatility.

- Diversification of Suppliers: Buyers are expanding their supplier networks to mitigate risks associated with supply chain disruptions.

- Technology-Driven Forecasting: Advanced analytics and forecasting tools are being utilized to optimize inventory levels and timing of purchases.

These strategies are helping stakeholders navigate the challenging landscape of fertilizer pricing and availability.

Impact on Sustainable Agriculture Practices

The current trends in the ammonium sulfate market are having a significant impact on sustainable agriculture practices. Here’s how:

- Precision Application: High prices are encouraging more precise application of fertilizers, reducing waste and environmental impact.

- Alternative Nutrient Sources: Some farmers are exploring organic alternatives or nitrogen-fixing cover crops to reduce reliance on synthetic fertilizers.

- Soil Health Focus: There’s an increasing emphasis on improving soil health to enhance nutrient retention and reduce fertilizer requirements.

- Technology Adoption: Tools for precise soil testing and variable-rate application are gaining traction to optimize fertilizer use.

These shifts towards more sustainable practices are not only a response to market pressures but also align with broader environmental goals in agriculture.

At Farmonaut, we recognize the importance of these sustainable practices and offer advanced solutions to support farmers in optimizing their fertilizer usage. Our satellite-based crop health monitoring and AI-driven advisory systems provide valuable insights that can help reduce fertilizer waste while maintaining crop productivity.

Price Trend Comparison for US Ammonium Sulfate Market

| Quarter/Year | Estimated Price ($/ton) | Year-over-Year Change (%) | Key Factors Influencing Price | Market Outlook |

|---|---|---|---|---|

| Q1 2023 | 320 | -5% | Seasonal demand, moderate supply | Neutral |

| Q2 2023 | 350 | +2% | Spring application season, tightening supply | Bullish |

| Q3 2023 | 360 | +8% | Production challenges, inventory depletion | Bullish |

| Q4 2023 | 380 | +15% | Rising feedstock costs, early purchases | Strongly Bullish |

| Q1 2024 | 400 | +25% | Continued supply constraints, high demand | Strongly Bullish |

| Q2 2024 | 420 | +20% | Peak application season, limited imports | Bullish |

| Q3 2024 | 410 | +14% | Slight easing of supply, steady demand | Moderately Bullish |

| Q4 2024 | 415 | +9% | Year-end restocking, feedstock volatility | Bullish |

| Q1 2025 | 425 | +6% | Persistent supply challenges, early season demand | Bullish |

This table provides a clear visualization of the projected price trends for ammonium sulfate in the US market from Q1 2023 through Q1 2025. The consistently bullish outlook reflects the ongoing supply challenges and strong demand dynamics discussed throughout this analysis.

Technological Solutions for Fertilizer Management

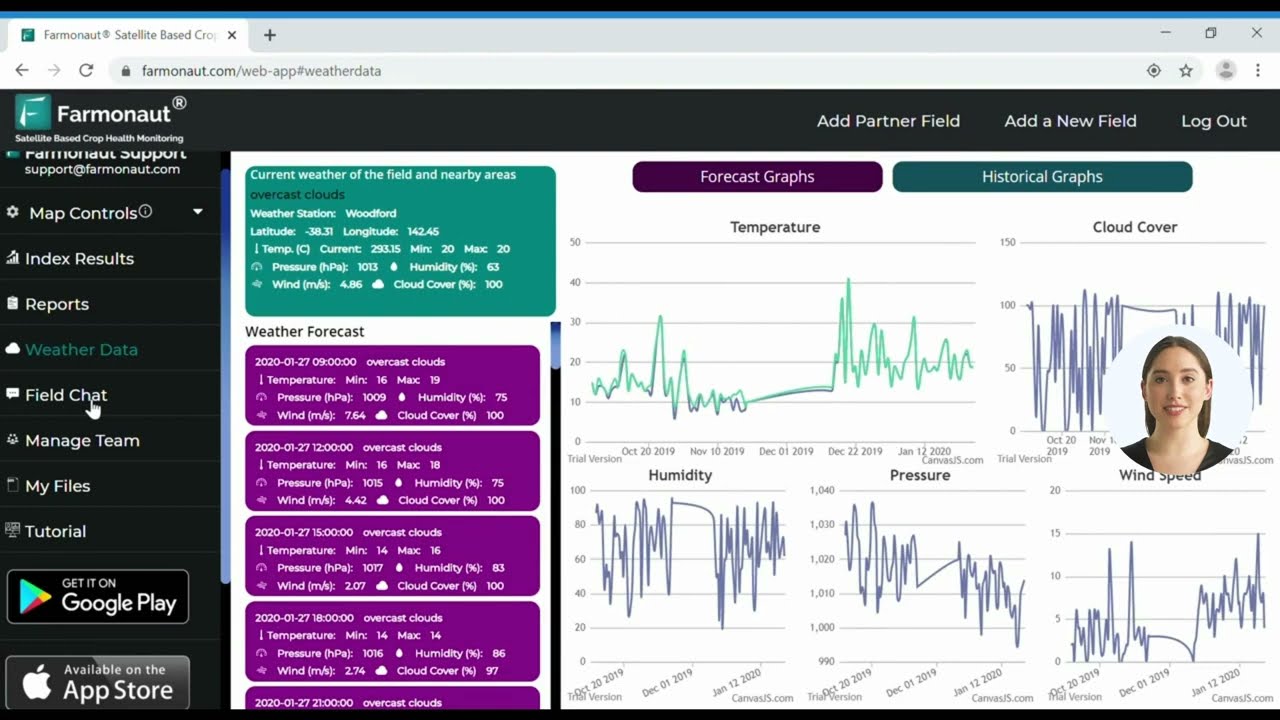

In the face of rising prices and supply challenges, technological solutions are playing an increasingly crucial role in helping farmers optimize their fertilizer use. At Farmonaut, we’re at the forefront of this technological revolution in agriculture.

- Satellite-Based Crop Monitoring: Our advanced satellite imagery technology allows farmers to monitor crop health in real-time, enabling more precise fertilizer application.

- AI-Driven Advisory Systems: Our Jeevn AI system provides personalized recommendations for fertilizer usage based on crop needs and environmental conditions.

- Precision Agriculture Tools: We offer tools for precise soil testing and variable-rate application, helping farmers apply the right amount of fertilizer exactly where it’s needed.

- Data-Driven Decision Making: By leveraging big data and machine learning, we help farmers make informed decisions about fertilizer purchases and application timing.

These technological solutions not only help mitigate the impact of high fertilizer prices but also contribute to more sustainable and efficient agricultural practices.

Explore our range of solutions:

For developers interested in integrating our technology into their own systems, check out our API and API Developer Docs.

Frequently Asked Questions

- Q: What are the main factors driving the increase in ammonium sulfate prices?

A: The main factors include production challenges, inventory depletion, rising feedstock costs (particularly ammonia and sulfur), and strong demand. - Q: How long are ammonium sulfate prices expected to remain elevated?

A: Based on current projections, prices are expected to remain high through at least Q1 2025. - Q: What strategies can farmers adopt to manage high fertilizer costs?

A: Farmers can consider forward purchasing, adopting precision agriculture techniques, exploring alternative nutrient sources, and utilizing technology for optimal fertilizer management. - Q: How is the spring application season likely to impact ammonium sulfate prices?

A: The spring application season typically leads to increased demand and potential price spikes, especially given the current supply constraints. - Q: What role do imports play in the US ammonium sulfate market?

A: Imports have historically played a significant role, but recent data shows a 17% year-over-year decrease, contributing to the current supply tightness.

Conclusion

As we navigate the complex landscape of the US ammonium sulfate market through Q1 2025, it’s clear that challenges and opportunities abound. The persistent high prices and supply constraints are reshaping farming practices, inventory management strategies, and the adoption of technological solutions.

At Farmonaut, we’re committed to supporting farmers and agribusinesses through these challenging times with our advanced satellite-based farm management solutions. By leveraging our technology, farmers can optimize their fertilizer use, reduce costs, and maintain productivity even in the face of market volatility.

As the market continues to evolve, staying informed and adaptable will be key. We encourage stakeholders across the agricultural value chain to explore innovative solutions and sustainable practices to navigate the changing fertilizer landscape successfully.