Washington Apple Industry Challenges & 2024 Trends: Navigating a Perfect Storm

Overview: Washington Apple Industry in 2024

As we step into 2024, the washington apple industry continues to be the backbone of U.S. apple production, consistently producing nearly two-thirds of all apples grown nationwide. This region’s legacy in agriculture, rich soils, and highly efficient farming practices have made Washington State a global leader in apple exports. Yet, today, farmers, agribusinesses, and industry stakeholders are confronting a multifaceted crisis.

The so-called “perfect storm” facing the washington apple industry includes:

- Unrelenting economic pressures from rising farm expenses

- Persistent labor shortages and escalating wages

- Climate change impacts on weather and water availability

- Recent increases in pest threats, notably the apple maggot

- Losses in export opportunities due to global and policy-driven market challenges

- Industry consolidation trends with small apple farms closing at an accelerating rate

These apple market challenges not only threaten industry stability, but also the fabric of communities across the Yakima, Wenatchee, and Okanogan regions. Family farms face existential risks, while larger agri-business operations race to adapt. In this post, we’ll break down each of these critical issues, provide quantitative insights, and explore forward-looking solutions such as precision agriculture in fruit farming. Let’s dive in.

Economic Pressures & Apple Market Dynamics

Rising Costs for Apple Growers

Over the past decade, costs of apple farming in Washington have climbed significantly. Labor now constitutes approximately 60% of total farm expenses—up sharply from 45% in 2009. Meanwhile, energy, packaging, transportation, compliance, and equipment costs have also seen sustained increases. Despite these rising expenses, apple prices in the U.S. market have remained stagnant, hovering at 1990s price levels for key varieties.

This growing disparity between operating costs and stable prices has put immense pressure on profit margins, especially for small and family-owned operations. Between 2017 and 2022, the number of active farms shrank from 2,522 to just 2,335, with 187 washington apple farms closing—a striking indicator of the mounting economic squeeze.

- Profit margins are falling, and financial stress is rising sharply within the washington apple industry.

- The average orchard size has increased, reflecting a trend towards consolidation and fewer, larger players dominating the regional landscape.

Apple Market Challenges: Oversupply and Export Barriers

Enhanced farming efficiencies and the expansion of apple-growing regions have generated periodic oversupplies. This has saturated the domestic market, making it difficult for growers to sell at a profit—especially amid global supply chain disruptions.

The loss of international markets for apples since the imposition of tariffs in 2018 has compounded these issues. Tariff wars, most notably with China, India, and Mexico, disrupted established export routes and slashed revenue from foreign sales. Export opportunities for apples remain fragile in 2024, vulnerable to shifting trade agreements and ongoing global tensions.

- Tariffs imposed in 2018 caused the loss of lucrative markets, contributing to a saturated U.S. market and declining prices.

- More apples are produced than can be profitably sold, prompting storage, price drops, or crop losses.

- The U.S. apple industry—anchored by Washington State—must find new strategies to restore market balance.

Apple market dynamics in Washington thus present a cautionary tale: efficiency and scale can inadvertently drive profitability downward when market expansion fails to keep pace.

Labor Shortages in Apple Farming: A Mounting Challenge

Few issues are as acute in 2024 as labor shortages in apple farming. The washington apple industry is highly labor-intensive, especially during thinning and harvest seasons. Traditionally reliant on a migratory and often international workforce, the sector faces an increasingly constrained labor market.

- Washington’s minimum wage and mandated farmworker protections, while socially progressive, have pushed labor costs dramatically higher than in competing countries.

- In 2023, nearly 20% increase in harvest costs was attributed directly to labor shortages and rising wages.

- Farmers are now competing not just locally, but within global market pressures—where produce from regions with lower labor costs can undercut Washington apples in price-sensitive export markets.

- Smaller farms—lacking large-scale operational budgets—struggle the most to attract and retain skilled workers.

These labor-related challenges ripple across the value chain. Picking delays can cause entire blocks of orchards to become overripe or unsellable, further squeezing farmers’ already narrow profit margins. The ongoing shortage is prompting calls for mechanization, automation, and smarter farm management—realms where satellite-based solutions like Farmonaut are gaining traction.

How Labor Shortages Integrate with Other Challenges

Labor shortages interact with apple market challenges in several ways:

- Higher wages push cost of production up, even as prices remain stagnant.

- Delayed harvests can cause yield losses and downgrade apple quality.

- Increased competition for available workers inflates expenses during critical growth seasons.

The urgent need is to streamline labor management and maximize efficiency per worker hour—one of the main opportunities addressed by Farmonaut’s plantation/farm management platform.

Climate Change Impact on Apple Production in Washington

Few external challenges are as far-reaching and unpredictable as climate change. Evidence is now irrefutable: altered precipitation patterns, reduction in snowpack, shifting temperature norms, and extreme weather events have all hit the Washington apple industry.

- Apple yield losses up to 15% in 2023 were attributed to hailstorms, smoke-tainted air, and erratic temperature swings.

- Reduction in snowpack due to rising temperatures is diminishing water availability during fruit set and sizing—a critical factor for yield consistency.

- Orchardists report increased weather risks, from early spring frosts to late-summer heatwaves, affecting both apple quality and harvest volume.

Shifting growing seasons force farmers to revisit long-standing management calendars, potentially impacting everything from pest emergence to pollinator timing. The Yakima River Basin, the heart of Washington’s apple belt, faces new economic vulnerabilities as water availability becomes less predictable.

Climate Change: Adapting for the Future of Apple Farms

In this turbulent context, solutions are urgently required. Current adaptation strategies underway include:

- Deploying precision agriculture in fruit farming to forecast and manage irrigation more efficiently.

- Investing in weather-resistant rootstocks and novel apple varieties.

- Utilizing advanced monitoring to anticipate stress during extreme weather events and changing growing patterns.

On the sustainability frontier, growers are increasingly evaluating their carbon footprint.

Curious about tracking and reducing carbon emissions on your apple operation?

Learn about Farmonaut’s Carbon Footprinting Tools & Benefits

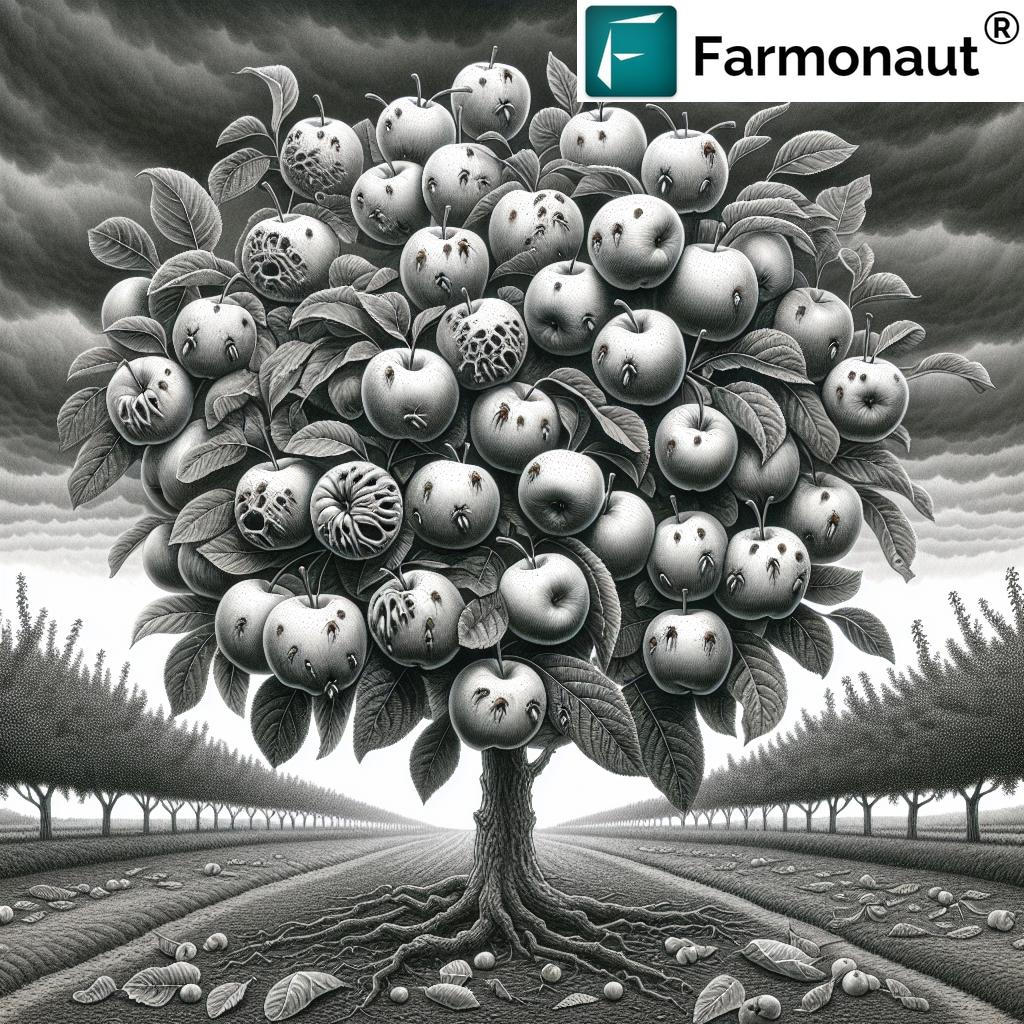

Apple Pest Management Solutions: Combating Emerging Threats

Pest management is a cornerstone issue for the washington apple industry, especially since the appearance of the apple maggot in 1980. This non-native species poses a grave economic threat—if allowed to establish widespread populations, it would trigger quarantine losses and potentially close off both interstate and international markets.

Managing the Apple Maggot and Other Invasive Risks

- Stringent quarantine zones and ongoing monitoring help prevent the spread of maggot populations within susceptible apple-producing regions.

- A significant risk of export loss looms if pest management fails, as key foreign markets demand pest-free certifications.

- Growers are rapidly adopting new integrated pest management (IPM) solutions, including precision monitoring and selective interventions—essential to keep apple maggot, codling moth, and emerging pest pressures in check.

Apple maggot management underlines the need for real-time field data and responsive solutions:

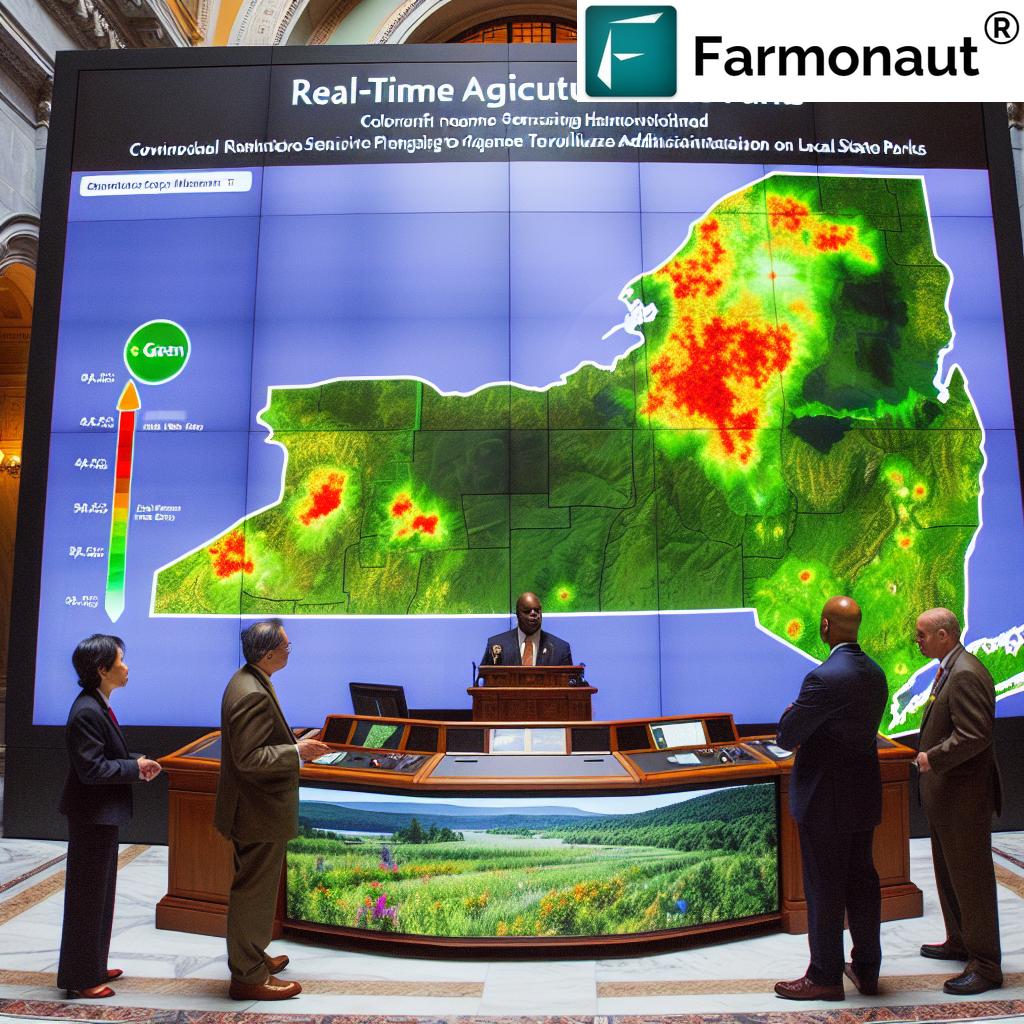

- Satellite-based monitoring (such as via Farmonaut) delivers crucial visibility across large orchard areas, identifying pest outbreaks early and guiding rapid response strategies.

- When paired with AI-based platforms, growers improve decision speed and accuracy, safeguarding production and market access.

This ongoing apple pest management challenge is intimately linked to all other sectoral issues—delays or mismanagement increase costs, threaten yield, and undermine washington’s export reputation.

Consolidation of Apple Farms: Trend, Pressures, and Implications

A Changing Landscape

The convergence of economic, labor, climate, and pest pressures has triggered rapid consolidation of apple farms in Washington State. The region’s orchard landscape is shifting: smaller family farms are disappearing, replaced or absorbed by larger agricultural firms—often supported by private equity.

- Between 2017 and 2022, active farm numbers declined sharply, while average orchard size increased.

- This is not just a statistical trend: fewer growers means less diversity, fewer local jobs, and a more fragile community infrastructure.

- The necessity for large-scale operations to weather low profit margins is driving this consolidation.

Unfortunately, this process threatens the future of small apple farms—entities that historically have contributed most to innovation, rural vitality, and local identity.

New technologies and adaptive tools are essential if small and mid-sized operations are to remain sustainable and resilient within the broader washington apple industry. One way forward: leveraging advanced, scale-neutral solutions like satellite-based crop loan and insurance verification systems—improving smallholder access to financing and risk mitigation, thus helping keep family orchards in business.

Access to Markets and Traceability as Small Farm Survival Levers

In a consolidated and globalized market, traceability is key for any farm hoping to maintain or expand their premium market access—or even access working capital. The demand is rising for verifiable, transparent sourcing:

- Corporate buyers increasingly require blockchain-based traceability for major fruit suppliers.

- Farmonaut’s product traceability platform empowers small and large apple growers alike to demonstrate supply chain integrity, command better prices, and access new export opportunities for apples.

Precision Agriculture in Fruit Farming: Transforming the Future

Amid mounting apple market challenges, precision agriculture stands out as a beacon of hope for the entire washington apple industry. Modern, data-driven approaches—once seen as accessible only to large growers—are now democratized through affordable, satellite-based tools like Farmonaut.

What is Precision Agriculture in Apple Farming?

- It’s about using satellite, AI, and sensor data to guide every management decision.

- This includes optimizing irrigation scheduling (based on real soil moisture), tracking weather stress and pest risk at a granular block level, and automating yield prediction and harvest logistics.

- It enables blockchain traceability, precise resource allocation, real-time fleet tracking, and ongoing crop health monitoring—all from a smartphone or desktop.

- Helps farmers and agribusinesses meet compliance, sustainability, and buyer requirements with less labor and lower risk.

How Precision Solutions Address Washington’s Apple Industry Challenges

By deploying precision agriculture in fruit farming, apple growers can:

- Reduce labor requirements through automated field scouting and AI-driven recommendations.

- Mitigate the impact of changing climate and weather patterns by forecasting crop stress and water needs in advance.

- Bring down farm management costs and optimize input use.

- Embrace green, traceable, and sustainable agricultural practices—all increasingly demanded by buyers and regulators.

Explore Farmonaut’s Fleet Management System for enhanced efficiency in agricultural machinery and resource logistics.

The value of these solutions is especially apparent for farms contending with labor shortages, pest threats, or market volatility. Precision technology enables growers to compete more successfully in a global/apple market shaped by uncertainty.

Washington Apple Industry Challenges & 2024 Trends: Comparison Table

| Key Challenge | Estimated 2023 Impact | 2024 Trend/Prediction | Potential Solutions |

|---|---|---|---|

| Labor Shortages in Apple Farming | ~20% increase in harvest costs Shortfall of thousands of seasonal workers |

Shortages persist; wages forecasted to rise further |

|

| Rising Operating Costs | Labor = 60% of total farm costs Input price hikes (fuel, fertilizer, storage) |

Continued pressure on profit margins—especially for small farms |

|

| Climate Change Effects | Up to 15% apple yield loss Reduced snowpack = water scarcity risk |

Increased volatility of yields; adaptation required |

|

| Pest/Disease Threats | Rising maggot/other pest outbreaks Export market access at risk |

Ongoing high vigilance, stricter export controls |

|

Farmonaut: Advanced Satellite-Based Farm Management for Apples

Innovation in agricultural management is essential for the Washington apple sector to remain globally competitive. Farmonaut answers these challenges by making precision agriculture affordable and accessible through mobile, web, and API-based platforms for all orchard sizes—from small family farms to industrial growers.

Farmonaut Core Technologies for the Apple Industry:

- Satellite-Based Crop Health Monitoring: Instantly track NDVI, soil moisture, plant health, and problem zones across orchards—using only your phone/app.

- AI Advisory & Jeevn Weather System: Receive farm-specific recommendations, real-time warnings, and expert advice tailored to your region’s unique weather and apple varieties.

-

Blockchain Traceability: Win premium contracts and export access by proving origin, safety, and journey of each batch.

Learn about Product Traceability -

Fleet & Resource Management: Optimize vehicle use, fuel, and crew scheduling with simple mobile tools.

Explore Farmonaut’s Fleet Management Platform -

Carbon Footprinting: Track and minimize your environmental impact, improving eligibility for sustainability-focused export trade.

Learn about Carbon Tracking

For agriculture researchers: Farmonaut also provides robust API access (see Farmonaut Satellite Weather API) for integration of real-time crop/weather data into any system or dashboard. Developers can explore detailed docs here.

Accessible for All: Flexible Pricing, Multi-Language, and User-Friendly

Farmonaut’s subscription model is designed for flexibility—serving individual, cooperative, and large-scale farming needs. See below for current plans and options:

Note: Farmonaut is NOT an online produce marketplace, farm input seller, or regulator; our sole focus is empowering U.S. and global apple farmers with advanced management technologies.

FAQ: Washington Apple Industry, Market Challenges, and Farmonaut Solutions

1. Why have so many small apple farms in Washington closed since 2017?

A combination of rising costs for apple growers (labor, compliance, and inputs), stagnant apple prices, difficulty accessing competitive export markets, climate change impacts, and pest threats have squeezed profit margins—especially for small and mid-sized farms. This has resulted in increasing consolidation of apple farms in the state.

2. How does precision agriculture help apple farms deal with labor shortages?

Precision agriculture solutions like those from Farmonaut reduce reliance on manual labor by automating scouting, optimizing irrigation, predicting yield, and supporting more efficient farm operations. This helps even small farms thrive despite labor shortages in apple farming.

3. What are the main climate change impacts facing the Washington apple industry?

Climate change impacts include reduced snowpack (leading to lower water availability), altered precipitation and temperature patterns, increased severity of extreme weather, and a rise in pest and disease pressure. These issues directly affect apple production consistency and quality.

4. Why is the apple maggot such a big threat for Washington’s export markets?

Many international buyers require pest-free certification for import. The establishment of apple maggot and similar pests would result in quarantine, loss of crucial markets, and sharply reduced export revenue—making proactive apple pest management solutions essential for the region.

5. How does Farmonaut make advanced farm management affordable for apple growers?

Farmonaut’s subscription-based platform delivers satellite crop monitoring, AI advisories, resource/fleet management, and blockchain traceability at a fraction of the cost of traditional precision tools—utilizing web, Android, iOS apps, and APIs for universal accessibility.

6. Can small apple farms benefit from precision agriculture, or is this just for large operations?

Absolutely. Farmonaut is built to be scale-neutral and budget-friendly—its core services (satellite imagery, AI recommendations, and crop health tracking) are accessible to very small farmers and cooperatives, as well as industrial-scale operations.

7. Where can I find more details or get started with Farmonaut?

Explore product details, sign up, or connect with our expert team on our main site: Farmonaut App and Platform

Conclusion: The Path Forward for the Washington Apple Industry

The washington apple industry is navigating an era of unprecedented challenges—labor shortages, climbing costs, shifting markets, changing climate, and pest threats. Yet, new hope is emerging:

- Data-driven precision agriculture in fruit farming offers fresh tools for every grower, large or small.

- Solutions like Farmonaut bring modern farm management, sustainable practices, crop health visibility, and supply chain transparency to the region’s fingertips.

- By adopting innovative, scale-accessible technologies, Washington apple growers can regain competitive ground in global and local markets.

As consolidation reshapes the landscape, and as climate and labor issues persist, it is clear that the future of apple production in the United States will hinge on how quickly and effectively the industry embraces new, adaptive, and accessible digital solutions.

The next era of U.S. apple farming is one of smart adaptation—and Farmonaut is proud to play a key role in this agricultural transformation.

To get started on your precision agriculture journey, simply open the Farmonaut web or mobile app from the buttons above, or contact us for a demo and discover how satellite technology and data-driven solutions can empower your apple operation—no matter the size.

For more technical information or integration capabilities, explore the Farmonaut API (API details | developer docs).

The future of Washington’s apples is challenging—but with advanced management tools and a commitment to innovation, our orchards can thrive.