Agricultural Bookkeeping: 7 Key Steps for Farm Success

“Only 40% of farms use dedicated accounting software, yet it can reduce bookkeeping errors by up to 60%.”

Introduction: Why Agricultural Bookkeeping Matters

Agricultural bookkeeping is more than just a routine task for farmers; it is a critical strategy for ensuring the financial health and long-term viability of your farming business. Unlike other sectors, agricultural enterprises—including farming, forestry, and related operations—face unique challenges such as seasonality, price fluctuations, and complex regulations. Mastering agricultural bookkeeping, paired with modern farm accounting software, is a powerful way to optimize tax compliance, streamline financial management, improve inventory control, and support better business decisions.

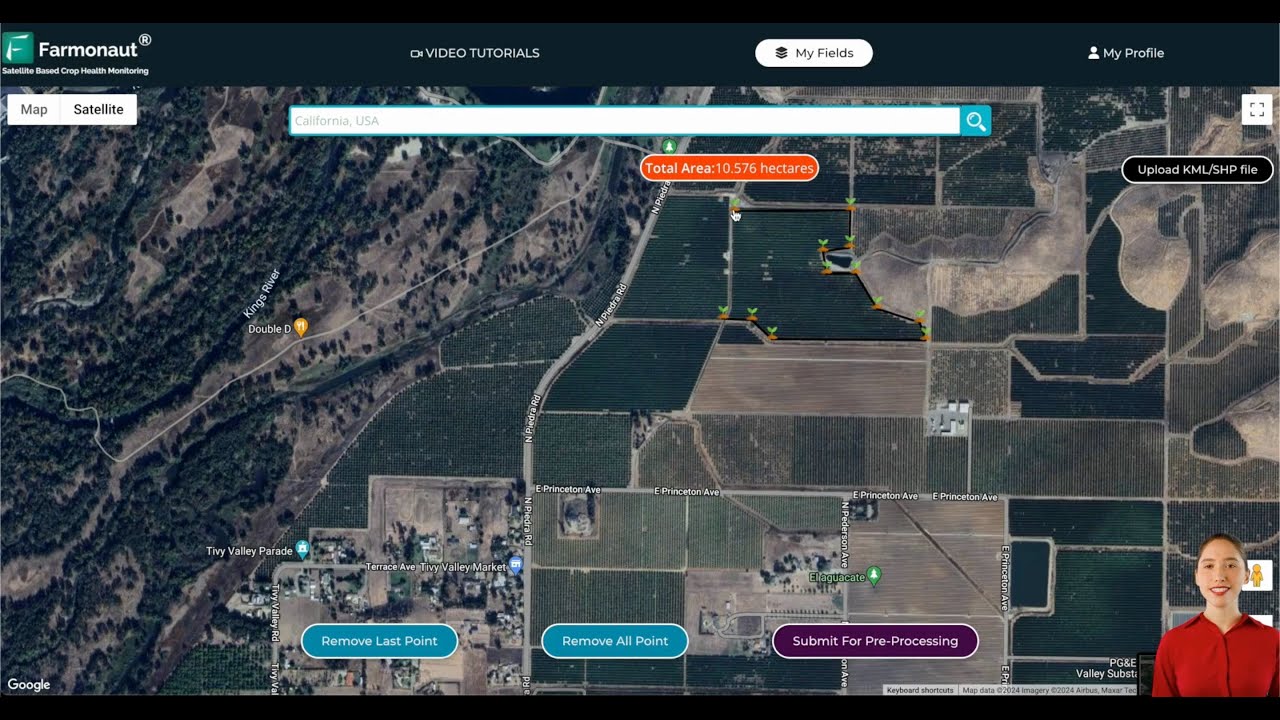

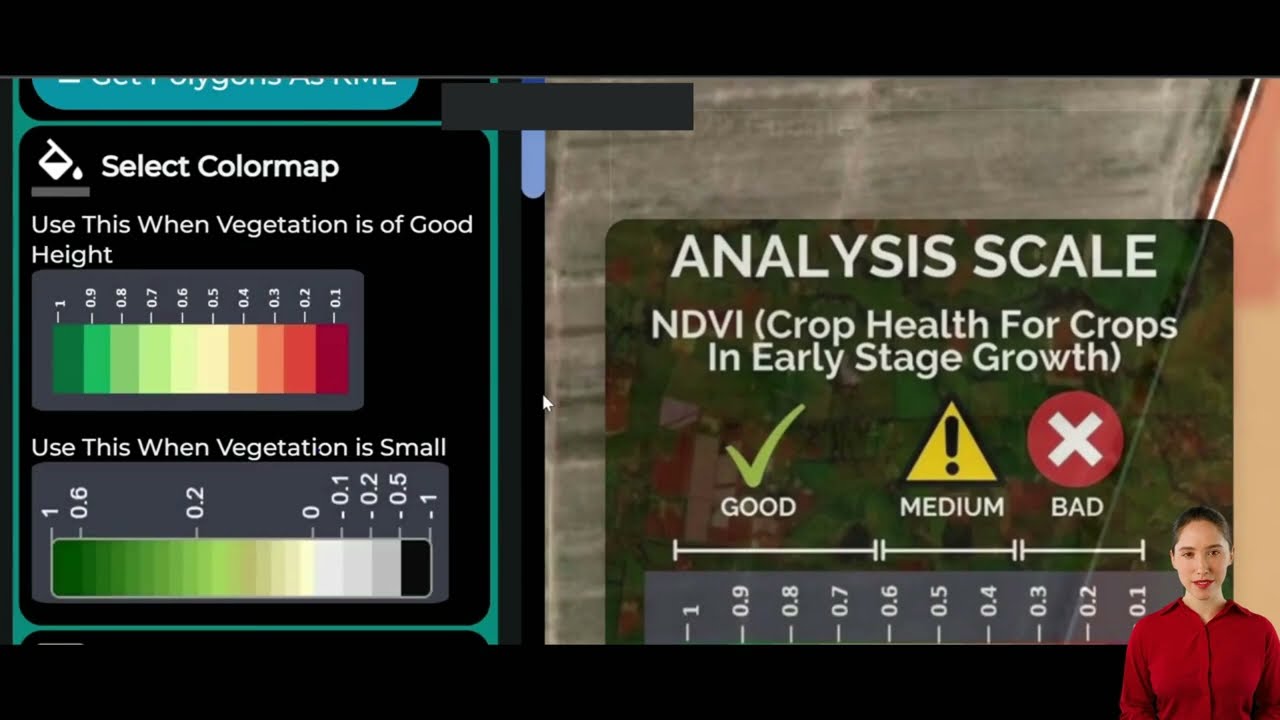

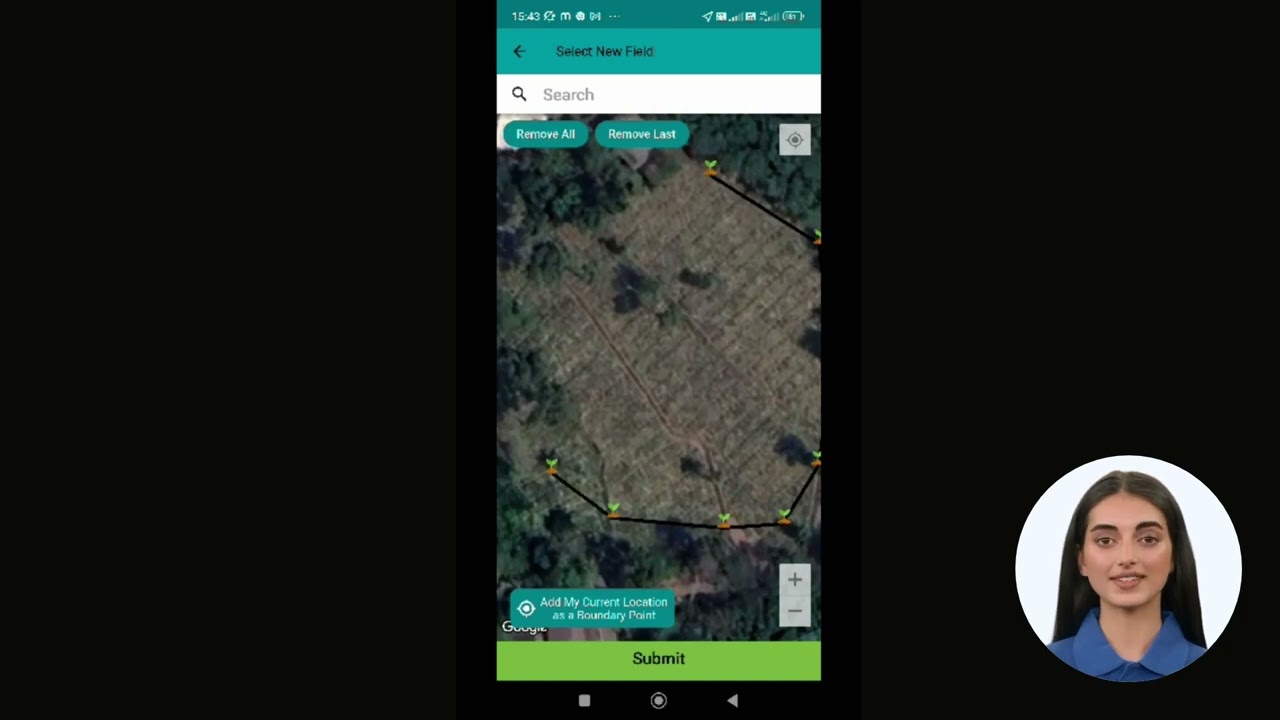

In this comprehensive guide, we’ll explore the essential steps, highlight best practices, provide practical tips, and show how leveraging technology—including tools such as Farmonaut’s precision agriculture platform—can transform your farm’s bookkeeping and overall management.

Understanding Agricultural Bookkeeping

Agricultural bookkeeping involves recording, classifying, and analyzing financial transactions specific to farms. Unlike general business accounting, it must account for factors such as:

- Irregular income and expenses due to seasonality

- Changing commodity prices affecting crop sales

- The long-term nature of investments in land and equipment

- Multiple income streams (e.g., livestock, crops, forestry, government subsidies)

- Complex regulations, tax obligations, and financial reporting standards

Getting agricultural bookkeeping right gives you a clear picture of cash flow, profitability, and compliance needs—essential for making strategic, sustainable business decisions.

Key Components of Agricultural Bookkeeping

Let’s break down the major components involved in effective agricultural bookkeeping:

1. Income and Expense Tracking for Farmers

Careful tracking of all income and expenses is the backbone of farm financial management. This includes:

- Sources of Income: Crop sales, livestock and dairy sales, government payments, forestry products

- Types of Expenses: Seed and fertilizer purchases, feed and veterinary costs, equipment maintenance, payroll costs, water and electricity

Keeping detailed records of every transaction ensures accuracy for tax reporting and provides vital insight into the profitability of your operations.

2. Inventory Management in Agriculture

Proper inventory management helps avoid costly overstocking or shortages of key resources such as seeds, fertilizers, feed, chemicals, and spare parts.

- Monitor inventory levels throughout planting, growing, and harvest seasons

- Regularly update values for crops, livestock, and materials on hand

- Minimize waste and optimize use of resources

Modern farm accounting software and inventory modules can automate this tracking, saving time and preventing errors.

3. Payroll Management for Farms

Handling payroll in agriculture involves more than simply paying wages—it requires managing:

- Different categories of workers (seasonal, part-time, full-time, contractors)

- Accurate payroll records, wage tax withholdings, workers’ compensation

- Compliance with labor and tax regulations

A good payroll management system streamlines this process and ensures full compliance.

4. Tax Compliance for Farmers

Agricultural bookkeeping must support accurate and timely tax filing:

- Stay updated on local, state, and federal tax obligations

- Take advantage of deductions for equipment purchases, use of farm vehicles, depreciation, land improvements, and more

- Utilize available tax credits and government incentive programs

Good bookkeeping helps reduce your tax liability—sometimes by as much as 25% annually.

5. Financial Reporting for Agriculture

Regularly producing clear and accurate financial statements (such as income statements and balance sheets) is critical. These reports allow you to:

- Evaluate your business health at any point in time

- Identify trends in income and expense patterns

- Prepare for meetings with lenders or partners

- Spot opportunities for improvement or growth

Automated financial reporting from farm accounting software makes this process faster and less prone to human error.

Accounting Methods in Agriculture: Cash vs. Accrual Basis

In agricultural bookkeeping, the accounting method you select affects how and when you record transactions:

- Cash Basis Accounting:

Records income when received and expenses when paid. Simpler for smaller farms, but can mask future liabilities or delayed income. - Accrual Basis Accounting:

Records income and expenses as they are earned or incurred, regardless of when money changes hands. Offers a more accurate long-term view but requires detailed tracking.

Choosing the right method depends on your farm’s size, complexity, and reporting needs. Consult your tax advisor or CPA to ensure compliance with regulations and optimal financial management.

Common Bookkeeping Challenges in Agriculture

Bookkeeping for farms isn’t always straightforward. Here are the most common challenges:

- Seasonality

Income and expenses can swing dramatically with the seasons, impacting cash flow management and planning. - Inventory Valuation

Accurately assigning value to unsold crops or livestock at period-end is complex. Techniques like FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) help. - Depreciation of Assets

Allocating the value of long-term assets (equipment, machinery, buildings) over time affects tax deductions and real profit reporting. - Tax Planning and Compliance

Navigating agricultural tax regulations and subsidies requires robust record-keeping and often expert guidance.

Overcoming these challenges is possible with consistent recording, planning, and by utilizing modern technology.

“Accurate agricultural bookkeeping can improve farm tax savings by as much as 25% annually.”

Agricultural Bookkeeping: 7 Key Steps for Farm Success

Let’s walk through the seven vital steps for robust agricultural bookkeeping. Implementing these steps improves financial insight, tax compliance, and supports scalability in your operations.

- Separate Personal and Farm Business Finances

Open dedicated accounts. Use separate bank accounts and credit cards for farming. This makes it easier to track farm income and expenses, avoid confusion, and simplify tax filing. - Consistent Income and Expense Tracking

Develop a routine for recording every transaction. Modern farm accounting software can help automate income and expense tracking for farmers, attaching receipts, categorizing purchases, and maintaining backups. - Maintain Detailed Inventory Records

Track inventory from seed to harvest—monitor crops in storage, livestock numbers, chemicals, feed, and part replacement cycles for equipment. Leverage inventory management in agriculture tools for accuracy. - Accurate Payroll Management for Farms

Classify workers correctly (seasonal, part-time/full-time, contractors). Use payroll modules to ensure compliance with tax and labor regulations, and keep clear records for audits or subsidy applications. - Stay Up-to-date on Tax Obligations and Deductions

Regularly review tax compliance for farmers, understand allowable deductions/credits, and plan for quarterly filing. Hiring a CPA or using tax software can simplify the process. - Generate and Review Financial Reports Regularly

Produce monthly or quarterly balance sheets, income statements, and cash flow statements. Analyze trends to guide your strategic decisions and identify problem areas early. - Leverage Technology and Community Support

Use dedicated farm accounting software for automation, integration with management apps, and consider partnering with community resources for ongoing support.

Step-by-Step Bookkeeping Comparison Table

| Step Number | Description | Purpose | Recommended Software/Tool | Est. Monthly Time (hrs) | Key Benefits |

|---|---|---|---|---|---|

| 1 | Separate Personal & Farm Business Finances | Ensures clarity and compliance in farm records | Dedicated bank account, Farmonaut app, QuickBooks | 1-2 | Easier tax filing, accurate income/expense tracking |

| 2 | Consistent Income & Expense Tracking for Farmers | Captures all transactions for financial accuracy | Farm accounting software, spreadsheets | 6-8 | Reduced errors, better management, audit-ready records |

| 3 | Maintain Detailed Inventory Records | Monitors value and quantities of farm assets | Inventory management modules, Farmonaut | 2-3 | Avoids shortages/overstocking, accurate reporting |

| 4 | Accurate Payroll Management for Farms | Ensures workers are paid correctly, tax compliance | Payroll software, accounting integration | 2-4 | Avoids penalties, accurate deductions, easy audits |

| 5 | Tax Planning, Compliance and Deductions | Reduces liability, maximizes deductions & credits | Tax software, CPA, government resources | 1-2 | Lower taxes, optimized refunds, timely compliance |

| 6 | Generate & Review Financial Reports | Informs decisions, reveals trends, identifies issues | Farm accounting software, spreadsheet templates | 2-3 | Improved planning, transparency, investor confidence |

| 7 | Leverage Technology & Community Support | Automates and validates bookkeeping process | Farmonaut, community college courses, forums | 2-4 | Less manual work, ongoing learning, network support |

Bookkeeping Best Practices for Farms

- Always separate personal and business accounts: Don’t mix receipts or make personal purchases on farm cards

- Digitize receipts and invoices: Use your phone or scanner and attach them to transaction records in your software

- Set aside time for bookkeeping each week: Regular, small sessions prevent end-of-year overwhelm

- Leverage automation: Set up recurring expenses, integrate with your bank, and automate payroll where possible

- Regularly consult with a professional: Schedule at least a yearly review with a certified accountant specializing in agriculture

- Learn continuously: Take advantage of online courses, webinars, and community workshops to stay current with bookkeeping practices

Bookkeeping Mistakes to Avoid

Many farms lose profits each year due to avoidable bookkeeping mistakes. For a deeper dive into common pitfalls and how to avoid them, see our Farmonaut guide to top 5 farm bookkeeping mistakes.

Utilizing Technology & Community Resources in Agricultural Bookkeeping

Using Farm Accounting Software and Apps

Modern farm accounting software brings efficiency and accuracy to income and expense tracking for farmers, payroll management, and inventory management in agriculture. Choose tools that offer:

- Automated data capture: Link your bank, scan receipts, auto-categorize expenses

- Integration with other farm management solutions (such as Farmonaut’s field monitoring, carbon footprinting, and plantation advisory tools)

- Mobile and desktop access: For managing on the go

Farmonaut’s platform integrates satellite-based data and AI with traditional farm record-keeping, providing actionable insights for more robust and accurate bookkeeping.

Benefits of Custom Farm Management Solutions

Integrating bookkeeping with systems that deliver real-time field updates or automate record keeping—such as resource management tools and large-scale farm management solutions from Farmonaut—enables you to scale sustainably and make more informed business decisions.

Community Resources for Bookkeeping Support

- Community colleges and extension programs often offer courses in agricultural finance and farm bookkeeping

- Work-study or internship programs: Local university accounting students may offer cost-effective assistance

- Mentorship programs: Networking with experienced farmers and bookkeepers can provide valuable tips and support

For a curated list of community training and resource hubs, see this resource: Farm Bookkeeping Community Support Guide.

Managing vehicle use and resource allocation on large farms? Our Fleet Management tools support precise tracking, reducing operational costs and improving resource management.

Looking to enhance sustainability while maintaining accurate records? Discover Farmonaut’s Carbon Footprinting module—track emissions, stay compliant, and report environmental performance effortlessly.

Boost your supply chain integrity and compliance with our Blockchain-based Traceability solution, offering secure, verifiable tracking from farm to consumer.

Enhance your access to agricultural finance and protect your investments—use satellite-based crop loan & insurance verification from Farmonaut for quick, fraud-free financing.

Developers and agribusinesses: Integrate real-time crop health and financial data directly into custom applications with the Farmonaut API. For full technical details, read our API Developer Documentation.

How Farmonaut Empowers Modern Farm Bookkeeping

At Farmonaut, our mission is to make precision agriculture and advanced record-keeping accessible to every agricultural business—globally. Through satellite monitoring, AI-driven insights, and real-time management tools, we support farms in maintaining accurate bookkeeping that drives both profitability and sustainability.

From inventory management to resource tracking and financial reporting for agriculture, our technology bridges the gap between traditional farming practices and the demands of today’s data-driven marketplace.

Our scalable, subscription-based packages are available for any size of operation and are accessible via web, Android, and iOS app.

Frequently Asked Questions – Agricultural Bookkeeping

What is the difference between cash and accrual basis accounting in agriculture?

Cash basis accounting records income and expenses when cash is received or paid, making it simpler and suitable for many small farms. Accrual basis accounting records income and expenses as they are earned or incurred, regardless of when money changes hands, offering a more accurate long-term financial picture, especially necessary for larger or complex operations.

Why is agricultural bookkeeping different from other types of business accounting?

Agriculture faces unique aspects such as seasonal income, variable commodity prices, complex inventory management (crops, livestock, seeds), and eligibility for specific tax deductions and credits. These differences require specialized bookkeeping practices and tools.

How can I reduce my tax liability with better bookkeeping?

Detailed and accurate records allow you to identify all allowable deductions and credits for expenses like equipment, repairs, seed and feed, and depreciation. This organization enables you to file timely and accurate tax returns, reducing errors and maximizing savings.

Which software is best for agricultural bookkeeping?

Look for platforms offering integration with banking, payroll, inventory and field data—such as Farmonaut for resource management, QuickBooks for accounting, and specialty farm accounting modules for inventory. The best software automates repetitive work, enables mobile access, and scales with your farm’s needs.

What are common mistakes in farm bookkeeping?

- Mixing personal and business accounts

- Not tracking all expenses or failing to digitize receipts

- Neglecting to update inventory or depreciation schedules

- Missing tax deadlines or ignoring small deductions

Conclusion: Building Financial Resilience through Bookkeeping

Effective agricultural bookkeeping is more than a box-ticking exercise; it is key to the health and growth of every farm, forestry operation, and agricultural enterprise. By implementing the seven key steps, leveraging the latest software and community resources, and integrating with powerful solutions like Farmonaut for precision agriculture and data-driven management, farmers are empowered to optimize returns, ensure compliance, and navigate future challenges with confidence.

Choose the tools and practices that fit your unique operations and commit to consistent, accurate bookkeeping. The result? Stronger financial outcomes, easier tax seasons, and a farm business primed for long-term success.