Farm Machinery Leasing: 7 Powerful Benefits for Farmers

Table of Contents

- Introduction

- Understanding Farm Machinery Leasing

- Farm Machinery Leasing vs. Buying: Estimated Cost & Benefits Comparison

- The 7 Powerful Benefits of Farm Machinery Leasing

- Financial Considerations in Farm Machinery Leasing

- Drawbacks & Challenges of Leasing Farm Equipment

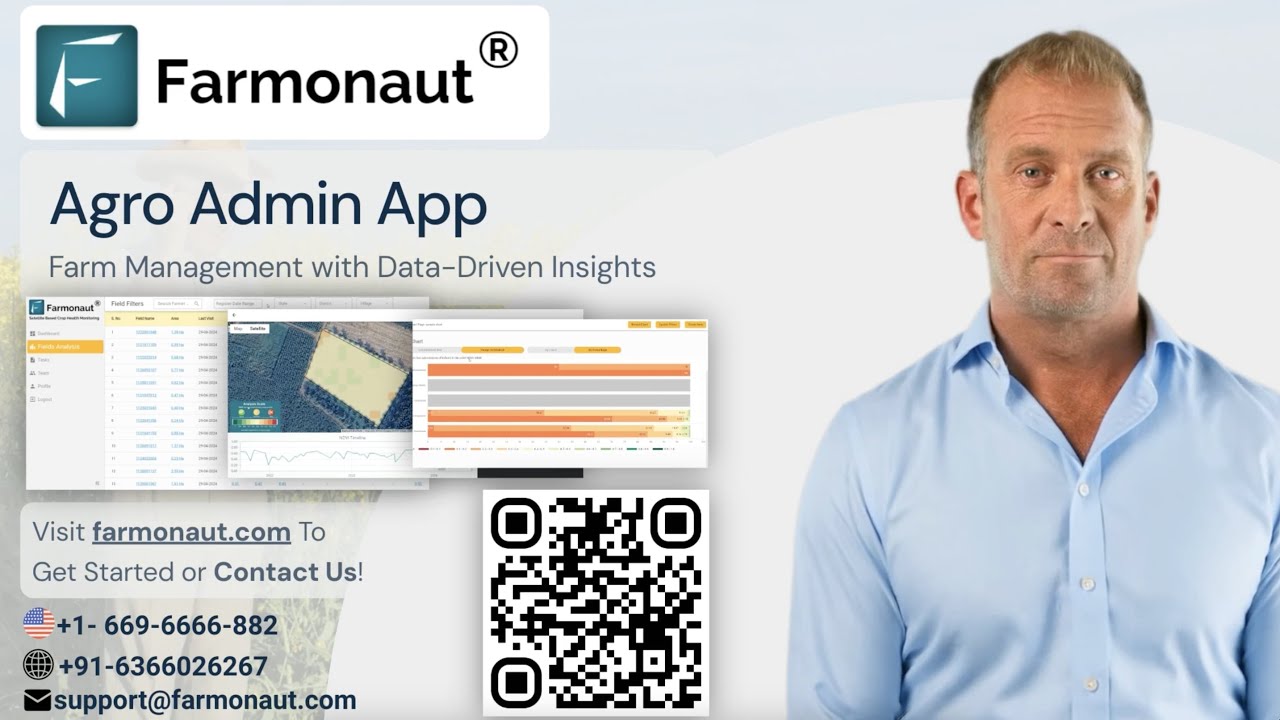

- How Farmonaut Empowers Modern Farm Management

- Leasing Tips & Checklist: Is Leasing Right For Your Farm?

- Frequently Asked Questions

- Conclusion

Introduction: The Rise of Farm Machinery Leasing

In today’s rapidly evolving agricultural landscape, farm machinery leasing offers farmers a powerful alternative to the traditional method of buying and owning equipment. From lower upfront costs to access to the latest agricultural technology, leasing is transforming how modern farms operate, especially with changing financial constraints and increasing demand for flexibility. The benefits of leasing farm machinery extend well beyond immediate savings, allowing farmers to manage cash flow more effectively, invest capital in other operational priorities, and stay competitive in a dynamic market.

If you’ve ever wondered whether leasing vs purchasing farm equipment is right for your farm, this comprehensive guide is here to help. We’ll cover the fundamentals of leasing, explore practical advantages and drawbacks, and share actionable tips to determine if a lease aligns with your farm’s goals. Using optimization suggestions from leading agricultural business sources, this guide ensures you stay informed to make the best business decision.

Understanding Farm Machinery Leasing

Farm equipment leasing involves a contractual agreement between a farmer (the lessee) and a leasing company or lessor, granting the right to use specific agricultural machinery during a predetermined period in exchange for regular lease payments. After the term ends, there are often options to purchase the equipment, renew the lease, or return it.

Leasing is gaining popularity in modern agriculture for both small-scale and large-scale farms due to its financially viable and flexible approach. The process can be customized, structured as either an operating lease (short-term, off-balance-sheet) or a finance lease (long-term, on-balance-sheet), each having distinct financial and tax implications.

Main Types of Agricultural Machinery Lease Options

- Operating Lease: Suited for short-to-intermediate terms, with lease payments often treated as operating expenses. At the end of the agreement, you typically return the equipment or renew the contract; suitable when you want access to latest technology frequently.

- Finance (Capital) Lease: Typically longer-term. Payments may cover the full value of the equipment, and you may take ownership at the end of the lease. Used when the equipment will be core to your farm operations for many years.

Choosing the right structure depends on your operational goals, cash flow, and equipment usage needs.

Farm Machinery Leasing vs. Buying: Estimated Cost & Benefits Comparison

| Factor | Leasing (Estimated Values) | Buying (Estimated Values) | Key Benefit |

|---|---|---|---|

| Initial Cost | $5,000 (down payment, first month, fees) | $30,000 (full asset price upfront) | Leasing lowers initial outlay by up to 60%. |

| Monthly Payments | $600–$900/month (consistent, predictable) | None or $500 (if financing loan) | Predictable cash flow and expense management. |

| Flexibility | High (upgrade, return, or renew) | Low (must sell or trade-in for new models) | Leasing allows for technology upgrades. |

| Maintenance Responsibility | Often included in lease agreement | Owner responsibility; extra cost | Reduced repair/maintenance burden on leasing. |

| Tax Advantages | Leases often 100% tax-deductible as business expenses | Depreciation deducted over equipment’s lifetime | Leasing maximizes yearly deductions. |

| Equipment Upgrade Frequency | Every 2–5 years (as per lease) | Every 7–10 years (after resale/trade-in) | Leasing keeps technology current. |

| Asset Ownership | No (unless buyout at end) | Yes (true ownership and resale value) | Buying offers equity; leasing prioritizes flexibility. |

The 7 Powerful Benefits of Farm Machinery Leasing

Leasing agriculture equipment is a strategic move with multiple benefits for modern-day farmers and agricultural businesses. Here are the 7 key ways in which farmers benefit by choosing a lease over outright purchase:

1. Lower Upfront Costs and Initial Investments

- Minimal initial outlay: Leasing does not require a significant capital expenditure upfront, so farmers, especially those with limited resources or smaller operations, can acquire necessary equipment while conserving precious capital for other priorities.

- Working capital preservation: By not tying up large sums in equipment, farmers can redirect funds towards crop input costs, expansion, or risk management.

- Example: Instead of spending $30,000+ on a new tractor, a lease may only require a $5,000 down payment and manageable monthly payments.

2. Access to the Latest Technology and Efficient Models

- Rapid upgrades: Leasing puts farmers in a position to upgrade to newer machinery at the end of each term—meaning they always have access to the latest advances for efficiency and productivity.

- Competitive edge: Access to newer models helps beat obsolescence, stay compliant with evolving standards, and benefit from data-driven and automated agricultural tools.

- Advantages: Implementing smart technologies (like those monitored by Farmonaut’s large-scale farm management solutions) increases yield, reduces waste, and improves decision-making.

3. Flexible Farm Lease Payments & Better Cash Flow Management

- Alignment with income cycles: Flexible payment plans offered by most leasing companies allow farmers to structure payments in sync with the seasonal nature of agricultural income—pay more after harvest, less in lean months.

- Predictable expense planning: Consistent lease payments help farmers manage cash flow year-round, reducing financial unpredictability and stress.

- Helps in risk mitigation: With seasonal price fluctuations in crops, flexible farm lease payments offer a buffer against unexpected expenses or lower revenue periods.

4. Tax Advantages of Farm Equipment Leasing

- Lease payments as business expenses: Lease expenses are often 100% tax-deductible, reducing your taxable income for the year compared to equipment purchases, which rely on depreciation over many years.

- Accelerated deductions: Enjoy immediate financial advantages, especially for farms aiming for effective tax treatment and annual cash flow management.

- Consult your tax advisor: Always check current guidelines relevant to farm equipment tax advantages in your specific location.

5. Maintenance and Repair Coverage Included

- Reduced repair burden: Many lease agreements include scheduled maintenance and breakdown repair coverage at little or no extra cost to the farmer.

- Ensured operational efficiency: Regular upkeep provided by the lessor ensures that agricultural machinery remains in optimal condition, leading to longer equipment lifespan and less downtime.

- No surprise expenses: Eliminates the risk of costly, unexpected repairs—especially beneficial for small and medium-sized farms operating on thinner margins.

- Use case: For managing large fleets or resources, consider Farmonaut’s fleet and resource management tools to streamline machinery scheduling, reduce downtime, and improve overall efficiency.

6. Capital Preservation and Financial Flexibility

- Free up farm capital: Leasing enables farmers to conserve cash and channel resources toward higher ROI opportunities (input purchases, land acquisition, seasonal labor, or tech upgrades).

- Improved loan and insurance eligibility: Farm capital not tied up in machinery can make it easier to qualify for farm loans and insurance, as you reserve working capital for emergencies or investment.

- Agile business response: Better financial flexibility empowers farmers to respond to market changes, adopt new practices, and take advantage of short-term business opportunities.

7. Risk Management During Economic Downturns

- Reduced downside risk: If agricultural prices collapse or input costs spike, leases allow farmers to avoid being stuck with an illiquid asset or high debt.

- Adapt to changing needs: With options to renew, return, or upgrade, farmers avoid long-term commitments to equipment they no longer need.

- Farm machinery lease vs buy: Leasing insulates you from the risk of asset value depreciation—a crucial factor in modern, tech-driven agriculture.

Financial Considerations in Farm Machinery Leasing

Pursuing a lease involves weighing key financial factors to optimize your farm’s operational goals without unforeseen drawbacks.

1. Calculating the Total Cost of Leasing vs Purchasing Farm Equipment

- Total outlay vs. ownership: Use online calculators or spreadsheets to compare lease expenses (over the full lease period) with the total cost of purchasing, factoring in depreciation, resale value, and maintenance over time.

- Choosing the most beneficial path: For short-to-medium-term needs, leasing often prevails; for long-term, high-usage scenarios, ownership may be more economical.

2. Tax Implications and Deductions

- Lease payments as immediate deductions: With leasing agriculture equipment, many or all payments are classified as current business expenses—potentially offering greater annual tax savings than depreciation alone.

- Always verify current tax law: Consult your accountant or review recognized resources to understand deductions for your farm’s location/jurisdiction.

3. Lease Structure and Cash Flow

- Agree on payment cycles: Choose payment schedules that match your harvest and sales cycles.

- Guard against hidden fees: Review agreements for any hidden or additional charges—ensure that terms are transparent and predictable.

4. Impact on Borrowing and Financial Ratios

- Preserves borrowing power: Not having large liabilities or depreciating machinery on the balance sheet can make it easier to get favorable terms for loans or insurance, like those for crop loans and insurance verification.

Drawbacks & Challenges of Leasing Farm Equipment

Despite compelling benefits, leasing farm machinery may not be the perfect solution for every farmer. Understanding these challenges helps you determine if leasing aligns with your farm’s specific goals.

1. Lack of Ownership Equity

- You do not build equity in the leased asset—at the end of the term, you must return it or pay a residual to purchase.

- This can be a significant disadvantage for farms focused on asset consolidation or whose models are based on maximizing equipment value.

2. Potential for Increased Long-Term Costs

- Over long periods (especially for core, high-usage assets), the total payments for leasing may exceed the outright purchase price plus maintenance and depreciation.

3. Usage Restrictions and Penalties

- Usage caps: Most leases specify annual usage limits (e.g., engine hours). Surpassing these results in additional fees.

- Penalties: Early termination or breach of agreement can mean penalties, adding financial burden.

- Need for careful planning: It is crucial to estimate actual equipment needs and avoid unforeseen costs.

4. Dependence on Lessor

- You rely on the lessor for equipment maintenance (if included) and to supply equivalent replacements if there’s a failure or delay. The experience depends on lessor reliability.

5. Limited Customization

- Some leases may not allow major modifications, meaning you must use the equipment “as is”—potentially restricting flexibility for specialized operations.

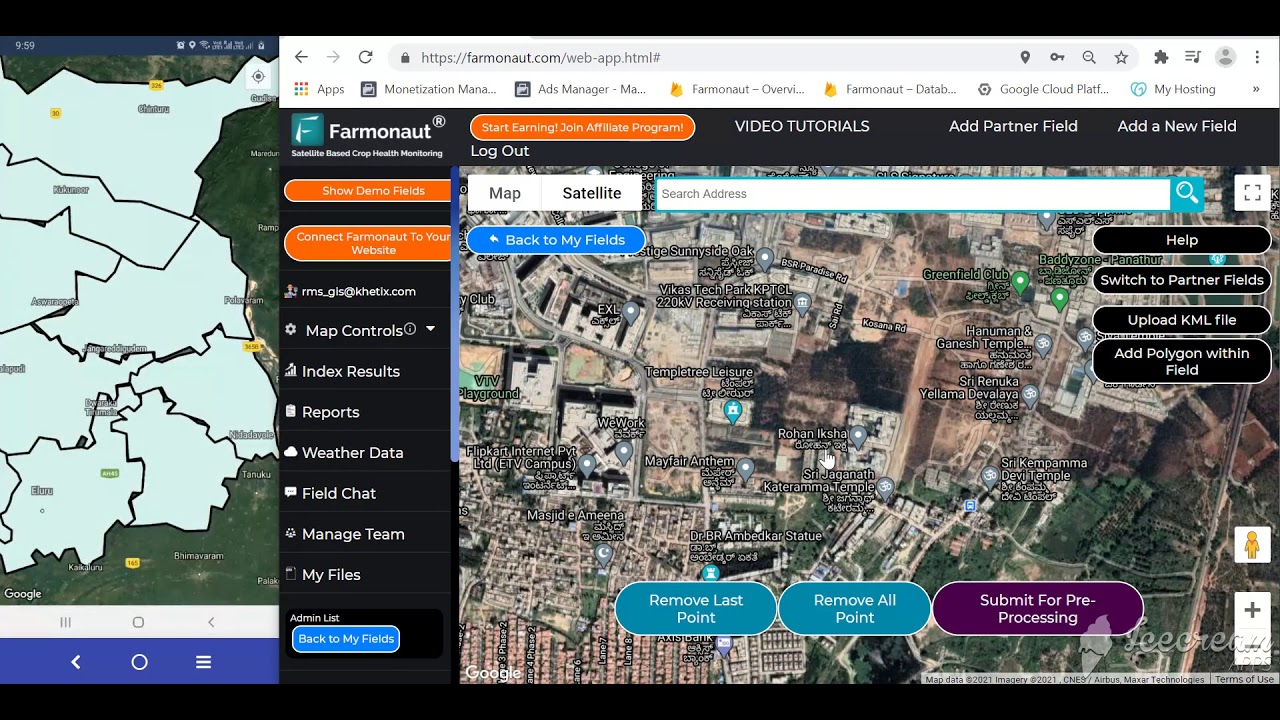

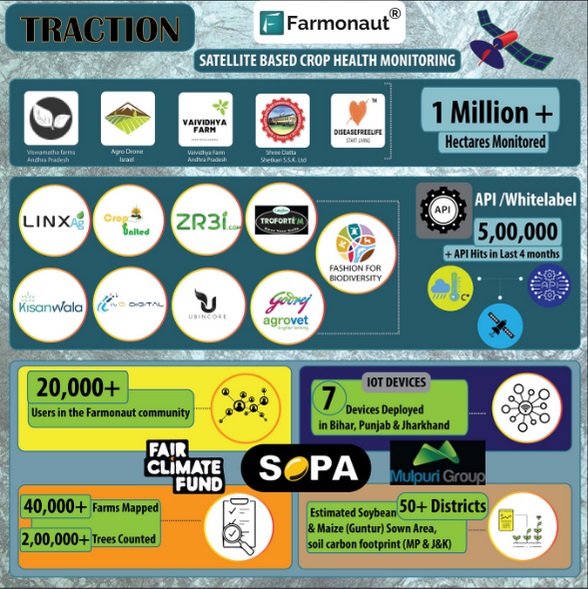

How Farmonaut Empowers Modern Farm Management

While leasing directly addresses machinery access, Farmonaut’s agricultural technology solutions equip farmers with equally cutting-edge tools for optimizing every aspect of their farm. Our technology does not lease or sell physical equipment—but we empower farmers, agribusinesses, and governments to maximize the value of whichever machinery they have by leveraging real-time data, digital fleet management, and resource oversight.

- Real-time satellite-based crop monitoring: Using multispectral imagery to assess crop health, moisture, and nutrient needs—leading to better decisions and reduced input costs.

- AI-based farm advisories: Our Jeevn AI system helps farmers optimize practices with hyper-local weather, growth, and pest forecasts.

- Blockchain traceability: Enhance supply chain transparency and prove to buyers and regulators that your products are authentic and ethically sourced.

- Fleet and resource management: Track vehicle/fleet location, fuel usage, and more for larger operations with Farmonaut fleet tools.

- Carbon footprint tracking: Monitor and reduce farm emissions for sustainability and compliance.

- API integration: Developers and large agri-businesses can connect Farmonaut’s satellite and weather data API (see developer docs) directly into their farm management platforms.

Discover large scale farm management tools for plantation, forestry, advisory, and reporting without the need for new hardware investment.

Farmonaut Subscription Plans

Flexible, affordable, and accessible for all farm sizes.

Leasing Tips & Checklist: Is Leasing Right For Your Farm?

Before entering into an agricultural machinery lease agreement, consider these questions to ensure leasing aligns with your farm’s goals:

-

Usage Patterns:

- How many hours annually will your farm use the machinery?

- Can usage be accurately forecasted, or is it highly variable?

-

Upgrade Cycle and Technology:

- Is access to new features and latest technology (e.g., precision planting, variable rate sprayers) a top priority for your business?

-

Financial Planning:

- Can your farm better manage cash flow with fixed monthly payments, or is a lump sum feasible?

- How critical is capital conservation for risk management?

-

Tax Position:

- Will your business benefit more from annual lease deductions or depreciation?

-

Length of Need:

- Do you need equipment for a specific project/period, or for the long haul?

-

Maintenance Requirements:

- Would you benefit from having maintenance included, or would you prefer the flexibility to repair as needed?

We recommend reviewing your answers and, if necessary, consulting with financial and tax professionals to optimize your leasing decision.

Frequently Asked Questions: Farm Machinery Leasing

Q1: What is the main advantage of farm machinery leasing compared to buying?

Leasing offers lower upfront costs, preserves farm capital, and allows farmers to upgrade to the latest technology more frequently. This enables financial flexibility and better cash flow management.

Q2: How does leasing affect farm taxes?

Typically, lease payments are immediately deducted as business expenses—potentially reducing annual taxable income faster than depreciation of purchased equipment. Always consult a tax advisor for location-specific rules.

Q3: Are maintenance and repairs included in farm equipment leases?

Many leases come bundled with maintenance and repair services, reducing the farmers’ burden and ensuring optimal machinery performance during the lease period.

Q4: Are there usage limitations when leasing agricultural machinery?

Yes, most leases specify a maximum annual usage (e.g., operating hours). Exceeding these can result in additional fees, so it’s important to estimate your needs accurately.

Q5: What are the risks of leasing farm equipment?

The most common risks involve not building equity, potential long-term cost increases, penalties for over-usage or early termination, and dependence on the lessor for equipment and support.

Q6: Can farmers purchase equipment at the end of a lease?

Yes, many lease agreements provide an option to buy the equipment at the end of the contract, often at a predetermined residual value.

Conclusion: Maximizing Outcomes with Farm Machinery Leasing

Farm machinery leasing is re-shaping the future of agriculture by offering flexible, financially viable alternatives to outright equipment ownership. As modern agriculture increasingly demands agility, efficiency, and access to technology, leasing provides a proven way to reduce costs, optimize cash flow, and align equipment with operational goals.

By understanding the benefits of leasing farm machinery—including lower initial expenditure, easier access to new technology, flexible payment options, tax advantages, and reduced maintenance burdens—farmers can effectively manage risk, conserve capital, and focus on growing their agricultural business. However, every farm is unique; it is essential to weigh these benefits against challenges such as lack of ownership and potential long-term costs before deciding.

As a company at the forefront of agricultural innovation, Farmonaut does not provide leasing but empowers farmers with data-driven management solutions for their fields, machinery, and farm resources—driving productivity, sustainability, and business success. To explore more or integrate satellite data into your operations, sign up for Farmonaut’s web, Android, or iOS apps above, or review our large-scale farm management platform.

The best path is one that aligns with your farm’s specific needs, financial position, and vision for the future.