Nickel Stocks Canada: 7 Trends Shaping Mining

“Canada produced over 130,000 metric tons of nickel in 2023, ranking sixth globally in nickel mining output.”

Table of Contents

- Introduction to Nickel Mining in Canada

- Major Nickel Mining Operations in Canada

- 7 Key Trends Shaping Nickel Mining in Canada

- Industry Trends Comparative Table

- Economic Implications of Nickel Mining

- Environmental and Social Considerations

- Farmonaut’s Role in Sustainable Land Management

- FAQs on Nickel Mining in Canada

- Conclusion

Introduction to Nickel Mining in Canada

Nickel mining in Canada has long stood as a cornerstone of the country’s mining sector, powering both local economies and global industries. This versatile metal—renowned for its strength, corrosion resistance, and high-temperature stability—is essential for producing stainless steel and, with the ongoing electric revolution, critical for batteries in electric vehicles (EVs).

Canada is globally recognized due to its substantial nickel reserves. The country ranks among the world’s top nickel producers, with operations spanning key regions including Ontario, Quebec, Labrador, and Newfoundland. These areas are not only rich in minerals, but also pivotal in shaping the country’s economy and addressing the global demand for critical minerals.

As environmental concerns rise and the shift towards renewable energy accelerates, nickel for electric vehicle batteries has transformed the outlook for the Canadian nickel mining industry. However, this transformation is not without challenges: environmental impacts of nickel mining, labor shortages, indigenous rights, and new technological advances have emerged as central themes.

Major Nickel Mining Operations in Canada

Canada boasts several hallmark mining operations responsible for significant Canadian nickel production, each with its own unique history and contribution to the sector:

- Voisey’s Bay Mine (Labrador, Newfoundland and Labrador) – Owned by Vale Canada Limited, Voisey’s Bay is a flagship operation since 2005, underpinning Canada’s reputation in the global nickel market.

- Raglan Mine (Nunavik, Quebec) – Operated by Glencore Canada Corporation since 1997, Raglan is a vital source of nickel output especially from the northern regions.

- Sudbury Basin Mines (Ontario) – This area comprises a cluster of mines operated by Glencore and Vale, set within one of Earth’s oldest and largest known impact basins, rich in nickel and other minerals.

- Crawford Nickel Project (near Timmins, Ontario) – Canada Nickel Company’s innovative project, currently in development, has garnered attention for its advanced carbon storage solutions in mining.

7 Key Trends Shaping Nickel Mining in Canada

Let’s examine the transformative trends steering the future of nickel mining in Canada. Each presents opportunities, challenges, and key developments that collectively define the sector’s trajectory.

1. Rising Nickel Production: Growth and Modernization

A surge in nickel production puts Canada in a competitive global supply position. In 2023, Canadian output surpassed 158,000 tonnes—a figure set to grow further as modernized operations, such as automated mining and tailings processing, take center stage. Major mines in Sudbury, Labrador, and Quebec are increasing capacity and investing in advanced extraction techniques, bolstering both domestic and export supply.

2. EV Battery Demand Fuels Sector Expansion

With electric vehicle adoption accelerating, demand for nickel for electric vehicle batteries is at an all-time high. As automakers pursue high-nickel cathode chemistries for performance and energy density, Canada’s critical minerals become vital. Projections state that EV battery demand could drive a 40% increase in Canadian nickel production by 2030, further cementing the country as a strategic mining hub.

“EV battery demand is projected to drive a 40% increase in Canadian nickel production by 2030.”

3. Environmental Impacts and Carbon Storage Innovation

Environmental impacts of nickel mining remain in focus, with increasing scrutiny of tailings, water quality, and ecosystem disturbance. Canada’s mining sector is leading the integration of sustainable processes such as carbon storage solutions in mining. Canada Nickel Company’s Crawford Nickel Project received over $3 million in federal funding to develop in-process tailings carbonation, transforming mining waste into permanent carbon storage—a pioneering approach in the global mining landscape.

- Mitigating acid mine drainage and heavy metal leaching are paramount to maintaining water and land integrity.

- Sustainable practices such as carbon capture, land reclamation, and eco-friendly ore processing are gaining traction across Canadian mining operations.

For a comprehensive approach to measuring agricultural operations’ carbon impact, Farmonaut’s Carbon Footprinting solution empowers users to monitor emissions, guiding climate-friendly practices.

4. Indigenous Rights and Mining: Social Responsibility

Many nickel mining projects are situated on or near ancestral grounds. The issue of indigenous rights and mining, especially highlighted by the Ring of Fire nickel development, requires rigorous, transparent consultation with First Nations. Recent federal efforts to expedite resource extraction have at times conflicted with Indigenous governance—putting reconciliation and partnership at the heart of the sector’s sustainable future.

- Concerns include land stewardship, revenue sharing, cultural preservation, and the ethical use of ancestral territories.

- Legal frameworks and community agreements increasingly guide project approval processes.

5. New Frontiers: Technology and Automation

From autonomous trucks to remote ore sensing, Canada’s nickel mines are embracing next-generation technologies. Smart fleet and resource management, AI-powered monitoring, and data-driven exploration are revolutionizing operations:

- Technological adoption is closely tied to advanced fleet management tools and data integration, modernizing logistics and environmental tracking.

- Blockchain-based traceability and AI-advisory services enable transparency and risk reduction—both essential for ESG compliance. For supply chain management beyond mining, Farmonaut’s Blockchain Traceability ensures origin transparency and authenticity.

6. Export Markets and Global Competitiveness

With Canadian nickel highly sought-after for its purity and ethical sourcing standards, exports—especially to the US, Europe, and Asia—underscore the sector’s economic role. In 2023, nickel-based exports were valued at $5.8 billion, supporting Canada’s economy and its vision of growing the critical minerals supply chain.

7. Policy and Regulatory Shifts: Federal Drive for Critical Minerals

Canada’s federal government is spearheading policy changes, such as critical minerals strategies, funding for sustainable innovations, and stricter environmental standards. Fast-tracking projects in strategic regions like the Ring of Fire is meant to bolster domestic development, but is also accompanied by regulations to ensure social and environmental responsibility.

- Recent federal incentives and grants target decarbonization and infrastructure building.

- Collaboration between provincial and federal levels aims to balance resource development and regulatory oversight.

Industry Trends Comparative Table: 7 Key Trends in Canada’s Nickel Mining Sector

Economic Implications of Nickel Mining in Canada

The economic footprint of nickel mining in Canada is vast. Mining sustains thousands of jobs, catalyzes regional development, and fortifies the national balance of trade. A few statistics that underscore its importance:

- In 2023, Canada was the world’s sixth-largest nickel producer, with output exceeding 158,668 tonnes.

- Export value of nickel and nickel-based products reached $5.8 billion.

- The sector underpins manufacturing jobs, infrastructure investments, and research into sustainable technologies.

As global shifts toward renewable energy and vehicle electrification persist, nickel’s economic value is forecasted to grow. The sector’s success is also tied to downstream industries—steel manufacturing, electronics, specialty alloys, and battery manufacturing.

Environmental and Social Considerations in Nickel Mining

A. Environmental Challenges

Nickel extraction inherently impacts the environment:

- Habitat disruption and land alteration are significant around major mines.

- Water contamination from tailings and potential heavy metal leaching is among the most serious environmental concerns.

- The 2014 Mount Polley mine disaster, though involving gold and copper, serves as a stark reminder of mining’s risks, highlighting the need for advanced tailings management and remediation strategies.

Many Canadian operations now employ advanced monitoring to address wastewater management and soil stability. Innovations in tailings carbonation and permanent carbon storage are rapidly becoming industry standards. For organizations needing actionable sustainability insights, Farmonaut’s carbon footprinting and advisory tools offer practical solutions for any land-based industries.

For those interested in integrating advanced environmental data into their operations or products, we offer Farmonaut API with extensive developer documentation.

B. Social Governance: Indigenous Rights and Community Impact

The interplay between nickel mining and indigenous rights is increasingly at the forefront, particularly around projects such as the Ring of Fire. The path to responsible mining must incorporate:

- Meaningful consultation and collaboration with indigenous groups

- Respect for traditional land rights and cultural heritage

- Benefit-sharing agreements, environmental restitution, and transparent communication

Failure to resolve these matters risks delaying projects and fostering social discord, while successful models foster economic inclusion and equitable resource access.

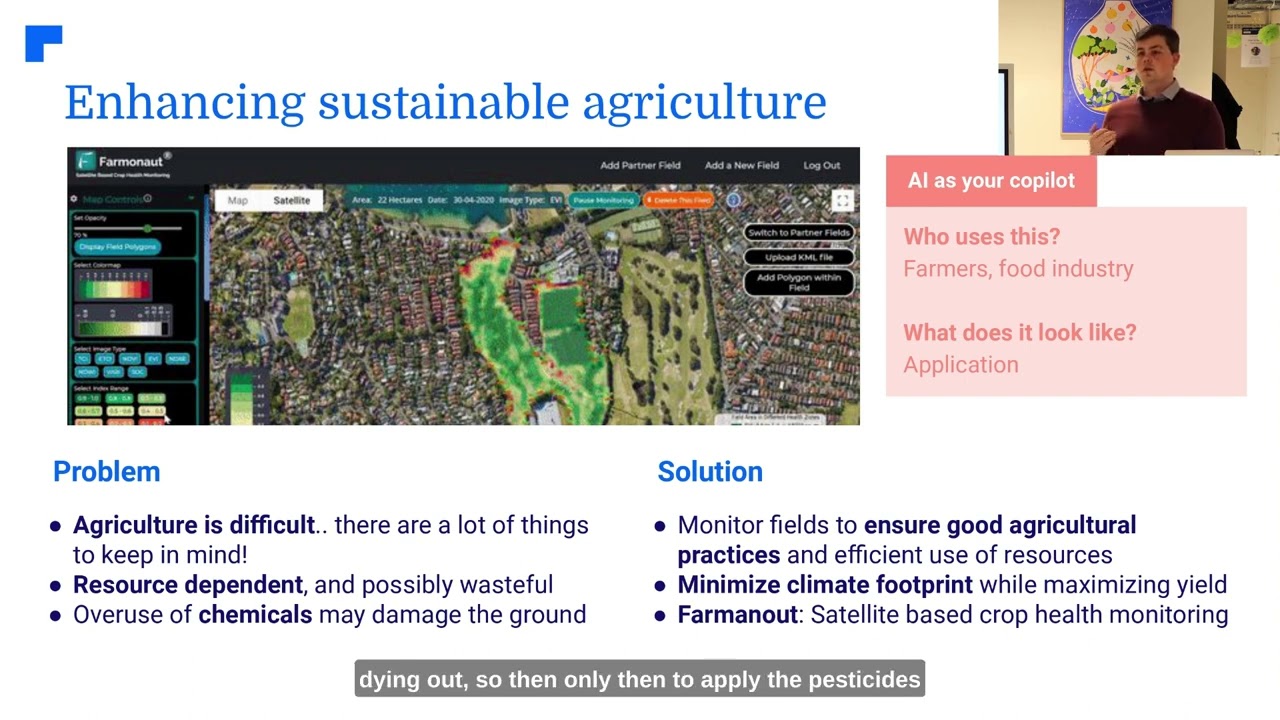

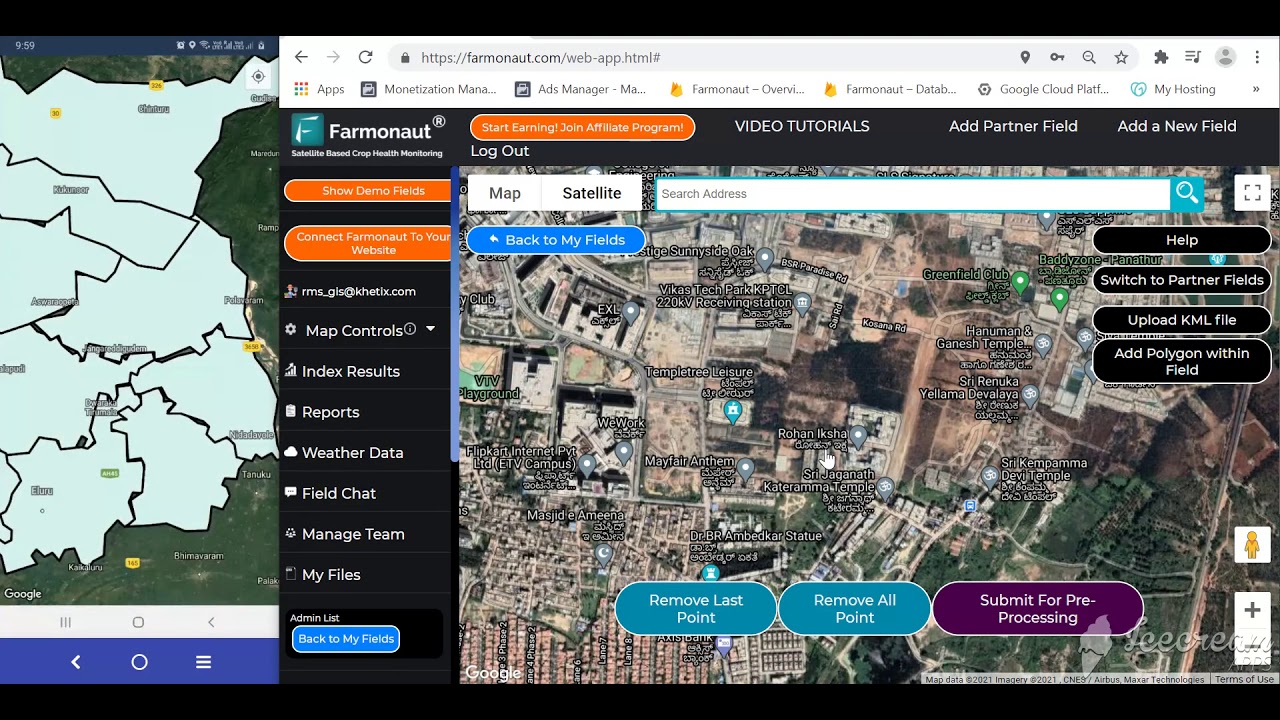

Farmonaut’s Role in Sustainable Land Management

While we at Farmonaut don’t engage directly in mining, our advanced satellite-based technology and AI advisory solutions offer unparalleled capabilities for monitoring land use, assessing environmental impact, and promoting responsible resource management. Our platform empowers agricultural and land-based stakeholders to access real-time crop health data, streamline fleet and logistic management, and monitor carbon emissions for better compliance with sustainability standards.

Our subscription-based service model means farmers, businesses, and governments enjoy:

- Affordable and accessible tools for precision land monitoring

- Customizable data-driven insights for farm, plantation, or industrial land use

- Secure, blockchain-based product traceability to ensure transparent, ethical supply chains

- Scalable solutions to match small, large, and national-scale resource management needs

Stay ahead with satellite-powered decision support—download our app now to experience the future of sustainable land management.

FAQs on Nickel Mining in Canada

What are the main regions for nickel mining in Canada?

The primary nickel mining regions include Sudbury Basin (Ontario), Voisey’s Bay (Labrador, Newfoundland and Labrador), Raglan (northern Quebec), and project areas near Timmins, Ontario. These regions are home to both historic and high-growth mining operations.

Why is Canadian nickel important for EV batteries?

Canadian nickel is prized for its high purity and ethical production standards. Nickel-rich batteries are essential for next-generation electric vehicles, providing higher energy density and longer range—making Canadian supply critical for the global EV market.

What is the Ring of Fire and its significance for nickel mining?

The Ring of Fire is a mineral-rich region in northern Ontario, identified as a major source of critical minerals including nickel, chromite, and copper. Its strategic development is pursued to secure domestic supply chains and meet demand for clean technologies.

How does nickel mining impact the environment?

Key environmental impacts include land disturbance, tailings generation, water contamination, and sometimes air emissions. The sector is increasingly adopting sustainable methods like carbon storage solutions in mining, tailings carbonation, and stringent environmental monitoring to mitigate these impacts.

What rights do Indigenous peoples have in nickel mining areas?

Indigenous communities hold constitutionally protected land and consultation rights. Any mining project—especially large developments—requires thorough engagement, respect for traditional territory, and often, benefit-sharing agreements. The Ring of Fire area is a focal point for these issues.

How does Farmonaut contribute to responsible land management?

While we don’t operate in mining, our technology supports stakeholders in agriculture and land-based industries with satellite monitoring, carbon footprinting, resource management, and blockchain-based traceability—all essential for transparency and sustainable practices.

Conclusion: The Future of Nickel Mining in Canada

As the world pivots to green technology and EVs, nickel mining in Canada becomes increasingly central to the global mineral supply chain. The country’s vast reserves, innovative operational approaches, and commitment to sustainability ensure it will remain a leader in meeting both domestic and international demand for critical minerals.

Still, the sector must balance economic growth with conscientious environmental and social stewardship—by embracing carbon storage innovations, prioritizing indigenous rights, and modernizing operations, Canadian miners are shaping a mindful and resilient industry.

For land managers and agricultural leaders seeking next-generation decision tools, Farmonaut stands ready with satellite, AI, and carbon-tracking solutions to bring the promise of sustainable resource development to your fingertips.