Unlocking Sustainable Wealth: How Timberland Investments Drive Climate Change Mitigation and Financial Growth

“A timberland investment fund raised $480.1 million, aiming to sequester over 6 million tons of CO2 while maintaining sustainable timber production.”

In the rapidly evolving landscape of climate change mitigation and sustainable investing, we are witnessing a remarkable convergence of financial interests and environmental stewardship. At the forefront of this transformative movement is the groundbreaking Manulife Forest Climate Fund, which has successfully closed with an impressive $480.1 million in commitments. This milestone not only signifies a growing investor confidence in sustainable forest investments but also heralds a new era in the fight against climate change through carbon sequestration in forests.

As we delve into the intricacies of this innovative fund and its implications for both investors and the environment, it’s crucial to understand the broader context of timberland investments and their role in climate change mitigation strategies. Let’s explore how this blend of finance and conservation is reshaping the future of sustainable wealth creation.

The Rise of Sustainable Forest Investments

Sustainable forest investments have emerged as a powerful tool in the arsenal against climate change. These investments leverage the natural carbon sequestration capabilities of forests while providing a viable avenue for financial growth. The Manulife Forest Climate Fund exemplifies this approach, aiming to sequester over six million tons of carbon dioxide throughout its operational term.

Key aspects of sustainable forest investments include:

- Carbon credit generation

- Sustainable timber production

- Biodiversity conservation

- Long-term financial returns

By focusing on these elements, investors can contribute to climate change mitigation while potentially reaping financial benefits. This dual approach is particularly attractive in an era where environmental, social, and governance (ESG) factors are increasingly influencing investment decisions.

The Manulife Forest Climate Fund: A Closer Look

The Manulife Forest Climate Fund stands out as a pioneering initiative in the realm of climate-focused investments. With its successful closure and substantial commitments, the fund has positioned itself as a leader in sustainable timberland management. Let’s examine the key features and objectives of this innovative fund:

- Diverse Investor Base: The fund has attracted a wide range of investors, including qualified U.S. investors and international institutional entities.

- Carbon Sequestration Focus: The primary value driver for the fund is carbon sequestration, with a target of over six million tons of CO2 sequestered.

- High-Quality Carbon Credits: The fund aims to deliver premium carbon credits, offering investors options for distribution or sales.

- Sustainable Timber Production: While focusing on carbon sequestration, the fund maintains a commitment to sustainable timber outputs.

- Portfolio Diversification: With over 150,000 acres acquired and nearing 50% deployment, the fund is building a diverse portfolio to support its carbon credit generation strategy.

The success of the Manulife Forest Climate Fund underscores the growing acceptance of timberland as a crucial tool in the fight against climate change. As Tom Sarno, global head of timberland investments at Manulife, aptly stated, this milestone reflects the increasing recognition of forests as an essential component of climate change mitigation strategies.

The Power of Natural Climate Solutions

Natural climate solutions, particularly those involving forests, are gaining traction as effective means to address environmental challenges. The Manulife Forest Climate Fund’s approach aligns perfectly with this trend, showcasing how strategic investments in forestry can yield significant environmental benefits.

Some key advantages of natural climate solutions include:

- Cost-effective carbon sequestration

- Enhancement of biodiversity

- Improvement of air and water quality

- Support for local communities through sustainable practices

By investing in these solutions, we can harness the power of nature to combat climate change while generating potential financial returns. This approach represents a win-win scenario for both investors and the environment.

The Role of Forestry Carbon Credits

Forestry carbon credits play a pivotal role in the Manulife Forest Climate Fund’s strategy. These credits represent a quantifiable and verifiable reduction in greenhouse gas emissions achieved through forest conservation and sustainable management practices. Here’s how they work:

- Carbon Sequestration: As trees grow, they absorb CO2 from the atmosphere.

- Credit Generation: This absorbed carbon is quantified and converted into tradable credits.

- Verification: Independent third parties verify the amount of carbon sequestered.

- Trading: Credits can be sold to companies or individuals looking to offset their carbon emissions.

The fund’s focus on generating high-quality carbon credits provides investors with the opportunity to participate in the growing carbon market while contributing to climate change mitigation efforts.

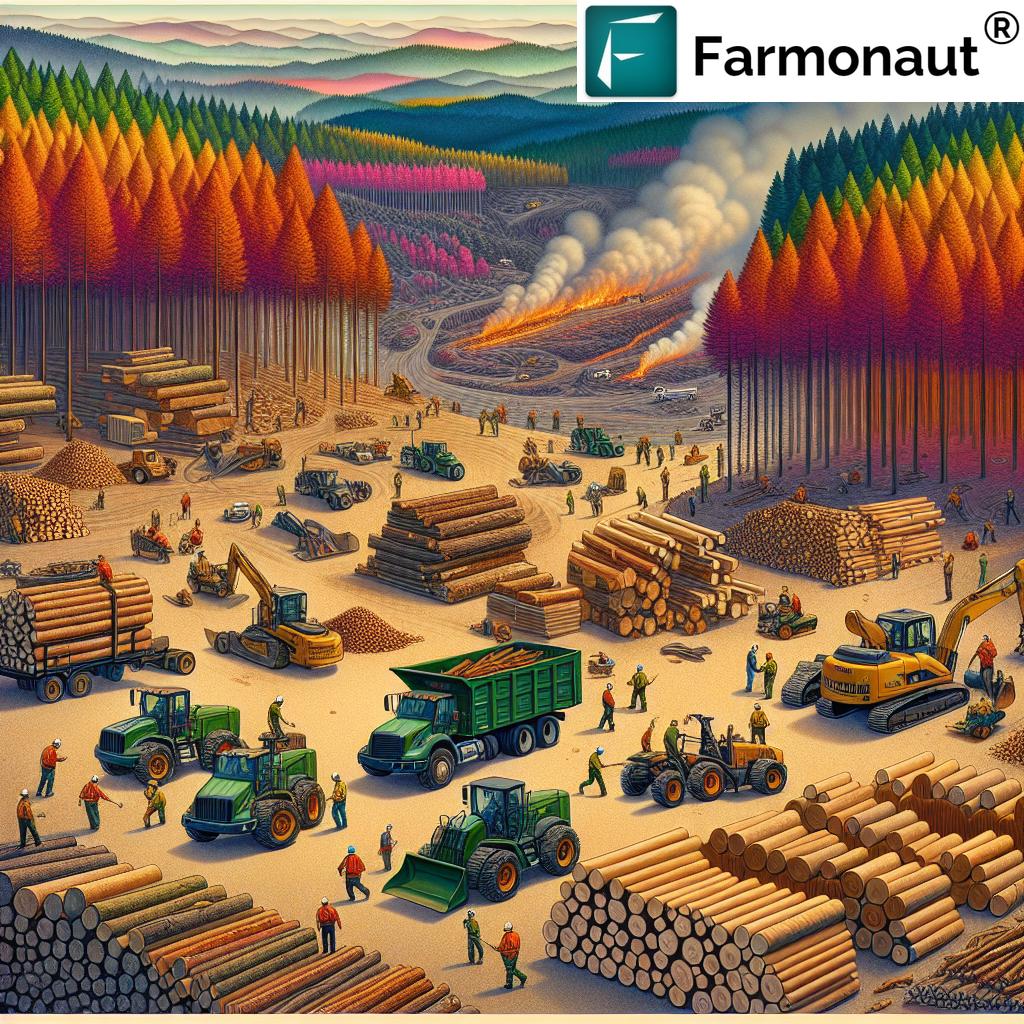

Sustainable Timber Production: Balancing Conservation and Economics

While carbon sequestration is a primary focus, the Manulife Forest Climate Fund doesn’t neglect the economic potential of sustainable timber production. This balanced approach ensures that the fund can generate revenue through traditional forestry practices while maintaining its commitment to environmental stewardship.

Sustainable timber production involves:

- Selective harvesting to maintain forest health

- Reforestation efforts to ensure long-term viability

- Preservation of biodiversity and ecosystem services

- Certification through recognized sustainability standards

By incorporating these practices, the fund demonstrates that economic growth and environmental conservation can go hand in hand, setting a new standard for responsible investing in the forestry sector.

Impact Investing in Forestry: A Growing Trend

The success of the Manulife Forest Climate Fund is indicative of a broader trend towards impact investing in forestry. This approach seeks to generate measurable environmental and social benefits alongside financial returns. As investors become more conscious of their portfolio’s impact on the planet, forestry investments offer an attractive option for those looking to align their financial goals with their values.

Key benefits of impact investing in forestry include:

- Tangible environmental benefits

- Potential for long-term, stable returns

- Diversification of investment portfolios

- Contribution to global climate change mitigation efforts

As this trend continues to grow, we can expect to see more innovative investment vehicles that leverage the power of forests to drive both financial and environmental returns.

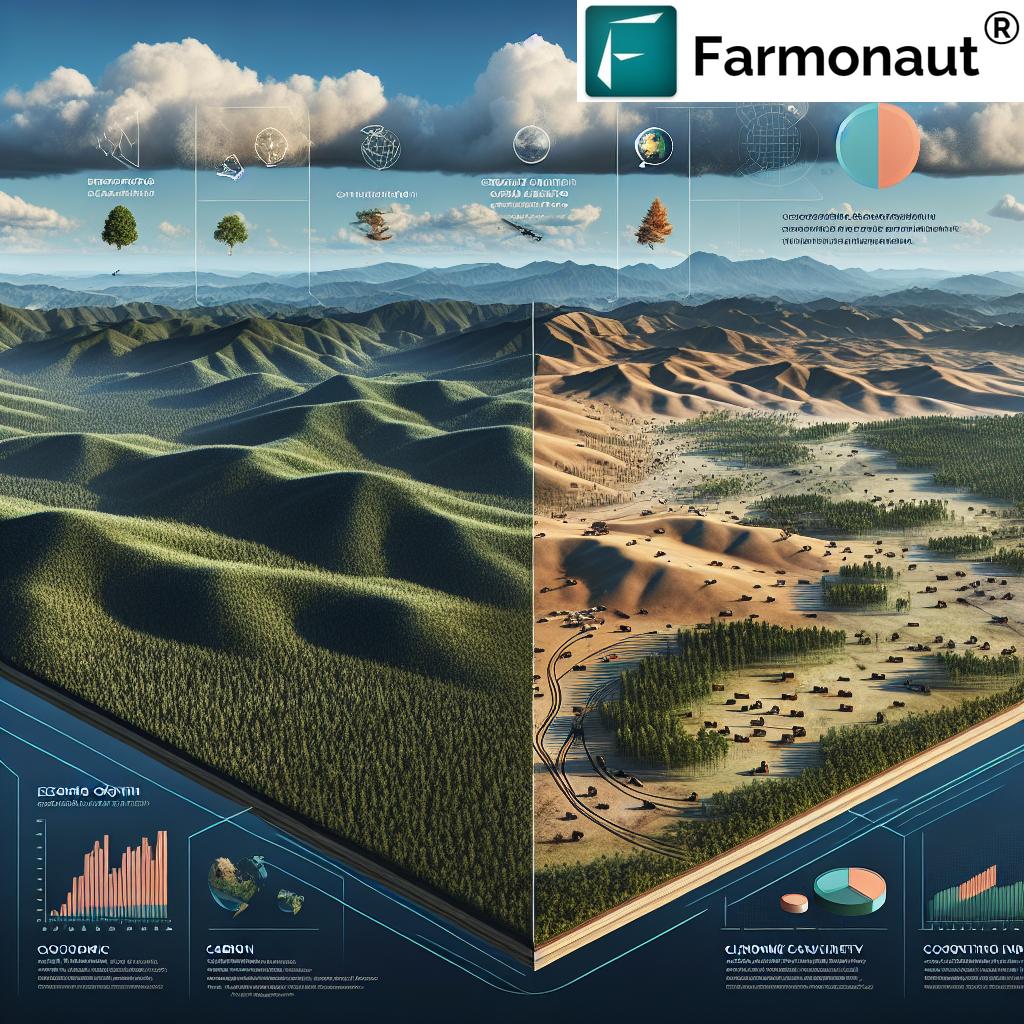

The Role of Technology in Sustainable Forest Management

Advanced technologies play a crucial role in maximizing the effectiveness of sustainable forest investments. At Farmonaut, we understand the importance of leveraging cutting-edge tools to enhance agricultural and forestry practices. While our focus is primarily on agricultural technology, many of the principles and technologies we employ can be applied to forest management as well.

Some key technologies that can benefit sustainable forest management include:

- Satellite imagery for monitoring forest health and carbon stocks

- AI and machine learning for predictive analysis and resource optimization

- Blockchain for transparent and secure carbon credit tracking

- Remote sensing for early detection of forest threats

By integrating these technologies, forest managers can make more informed decisions, improve efficiency, and enhance the overall sustainability of their operations.

The Global Impact of Timberland Investments

Timberland investments like the Manulife Forest Climate Fund have the potential to make a significant global impact on climate change mitigation. As these investments scale up, we can expect to see:

- Increased carbon sequestration on a global scale

- Preservation and restoration of critical ecosystems

- Support for biodiversity conservation efforts

- Economic opportunities for local communities

The ripple effects of these investments extend far beyond the immediate financial returns, contributing to a more sustainable and resilient world for future generations.

Challenges and Considerations

While the potential benefits of timberland investments for climate change mitigation are significant, it’s important to acknowledge the challenges and considerations associated with this approach:

- Long investment horizons

- Regulatory uncertainties in carbon markets

- Potential conflicts between carbon sequestration and timber production

- Need for ongoing monitoring and verification of carbon stocks

Addressing these challenges will be crucial for the continued growth and success of sustainable forest investments.

The Future of Climate-Focused Investments

The success of the Manulife Forest Climate Fund points to a bright future for climate-focused investments. As awareness of climate change grows and investors seek sustainable options, we can expect to see:

- Increased allocation of capital to natural climate solutions

- Innovation in investment vehicles that combine environmental and financial returns

- Greater integration of technology in forest management and carbon monitoring

- Expansion of carbon markets and related financial instruments

These trends suggest that sustainable forest investments will play an increasingly important role in both climate change mitigation and financial portfolios in the years to come.

Comparative Analysis: Traditional vs. Carbon Credit-Enhanced Timber Investments

To better understand the benefits of carbon credit-enhanced timber investments like the Manulife Forest Climate Fund, let’s compare them to traditional timber investments:

| Investment Criteria | Traditional Timber Investment | Carbon Credit-Enhanced Timber Investment |

|---|---|---|

| Potential Annual Return (%) | 3-5% | 5-8% |

| Carbon Sequestration (tons CO2/acre/year) | 1-2 | 3-5 |

| Sustainable Timber Yield (board feet/acre/year) | 300-500 | 200-400 |

| Biodiversity Impact | Moderate | High |

| Climate Change Mitigation Potential | Moderate | High |

| Investment Horizon (years) | 10-15 | 15-20+ |

| Risk Profile | Moderate | Moderate to Low |

This comparison highlights the potential for carbon credit-enhanced timber investments to deliver superior environmental benefits while potentially offering higher financial returns. However, it’s important to note that these investments typically require a longer time horizon and may involve additional complexities related to carbon credit markets.

The Role of Policy and Regulation

The success of sustainable forest investments and carbon markets is closely tied to supportive policy and regulatory frameworks. As governments around the world increasingly recognize the importance of natural climate solutions, we can expect to see:

- Enhanced incentives for forest conservation and restoration

- Standardization of carbon credit verification processes

- Integration of forest carbon into national and international climate strategies

- Development of more robust carbon pricing mechanisms

These policy developments will play a crucial role in shaping the future landscape of timberland investments and their potential for climate change mitigation.

Investor Considerations and Due Diligence

For investors considering timberland investments like the Manulife Forest Climate Fund, thorough due diligence is essential. Key factors to consider include:

- Fund manager’s track record in sustainable forestry

- Quality and location of acquired forestlands

- Carbon credit generation and verification processes

- Alignment with personal or institutional ESG goals

- Long-term market outlook for timber and carbon credits

By carefully evaluating these factors, investors can make informed decisions that align with both their financial objectives and environmental values.

The Intersection of Technology and Sustainable Forestry

At Farmonaut, we recognize the crucial role that technology plays in advancing sustainable practices across various sectors, including forestry. While our primary focus is on agricultural technology, many of the innovative solutions we develop have applications in sustainable forest management as well.

Some key technologies that can enhance sustainable forestry practices include:

- Satellite-Based Monitoring: Our expertise in satellite imagery analysis can be applied to monitor forest health, detect changes in forest cover, and assess carbon stocks over large areas.

- AI-Driven Insights: Advanced algorithms can process vast amounts of data to provide actionable insights for forest managers, helping optimize resource allocation and predict potential risks.

- Blockchain for Traceability: Our experience with blockchain technology can be leveraged to ensure transparent and secure tracking of carbon credits generated from forest conservation efforts.

- Remote Sensing: Cutting-edge sensors can provide real-time data on forest conditions, helping managers make informed decisions about conservation and sustainable harvesting practices.

By integrating these technologies, sustainable forest investments can become more efficient, transparent, and impactful in their efforts to mitigate climate change.

“The fund has acquired 150,000 acres of timberland and is nearing 50% deployment of its portfolio for carbon credit generation.”

The Global Perspective: Forests as a Climate Solution

As we consider the role of sustainable forest investments in addressing climate change, it’s important to take a global perspective. Forests play a crucial role in the Earth’s carbon cycle, and their conservation and restoration are essential for mitigating the impacts of climate change on a global scale.

Key points to consider:

- Forests currently absorb about 2 billion tons of carbon dioxide annually, equivalent to one-third of the CO2 released from burning fossil fuels.

- Deforestation accounts for about 15% of global greenhouse gas emissions.

- Restoring forests could potentially remove up to 10 gigatons of CO2 from the atmosphere annually by 2050.

- Sustainable forest management can contribute to multiple UN Sustainable Development Goals, including climate action, life on land, and sustainable cities and communities.

By investing in sustainable forest management and conservation, we can harness the power of nature to combat climate change while also supporting biodiversity and local communities.

The Role of Partnerships in Scaling Impact

While Farmonaut focuses on agricultural technology solutions, we recognize the importance of partnerships in scaling the impact of sustainable practices across various sectors. In the context of sustainable forest investments, collaborations between financial institutions, technology providers, conservation organizations, and local communities can amplify the positive effects of these initiatives.

Potential benefits of partnerships include:

- Sharing of expertise and resources

- Improved access to markets and funding

- Enhanced monitoring and verification capabilities

- Greater engagement with local stakeholders

By fostering these collaborations, we can create a more robust and effective ecosystem for sustainable forest investments and climate change mitigation.

Education and Awareness: Key Drivers of Change

As we work towards a more sustainable future, education and awareness play crucial roles in driving change. At Farmonaut, we believe in empowering individuals and organizations with knowledge and tools to make informed decisions about sustainable practices.

In the context of sustainable forest investments, education efforts should focus on:

- The importance of forests in climate change mitigation

- The mechanics of carbon markets and credits

- The potential financial and environmental returns of sustainable timber investments

- The role of technology in enhancing forest management practices

By increasing awareness and understanding of these topics, we can foster greater support for and participation in sustainable forest investments and related initiatives.

Looking to the Future: Innovations in Sustainable Forestry

As we look to the future of sustainable forest investments and climate change mitigation, several exciting innovations are on the horizon:

- Advanced Carbon Measurement: New technologies, including LiDAR and hyperspectral imaging, are improving the accuracy of carbon stock measurements in forests.

- Genomics in Forestry: Genetic research is helping develop more resilient tree species that can sequester carbon more efficiently.

- AI-Powered Forest Management: Artificial intelligence is being used to optimize forest management practices, predicting growth rates and identifying optimal harvesting times.

- Drone Technology: Drones are increasingly being used for forest monitoring, providing high-resolution data on forest health and composition.

These innovations have the potential to further enhance the effectiveness and profitability of sustainable forest investments, making them an even more attractive option for investors seeking to combine financial returns with positive environmental impact.

Conclusion: A Path to Sustainable Wealth and Climate Resilience

The success of the Manulife Forest Climate Fund marks a significant milestone in the journey towards sustainable wealth creation and climate change mitigation. By combining the power of financial markets with the natural carbon sequestration capabilities of forests, we are unlocking new possibilities for addressing one of the most pressing challenges of our time.

As we move forward, it’s clear that sustainable forest investments will play an increasingly important role in both investment portfolios and global climate strategies. The convergence of financial innovation, environmental stewardship, and technological advancement is creating unprecedented opportunities for investors, conservationists, and communities alike.

At Farmonaut, while our primary focus remains on agricultural technology, we recognize the interconnectedness of sustainable practices across various sectors. The principles of data-driven decision-making, technological innovation, and sustainability that guide our work in agriculture are equally applicable to forestry and other natural resource management areas.

As we continue to develop and refine our satellite-based farm management solutions, we remain committed to supporting the broader goals of sustainability and climate resilience. Whether it’s through precision agriculture, forest management, or other innovative approaches, the path to a sustainable future requires collaboration, innovation, and a shared commitment to protecting our planet’s vital resources.

The Manulife Forest Climate Fund and similar initiatives represent a promising step towards this future. By unlocking sustainable wealth through timberland investments, we are not only driving climate change mitigation but also paving the way for a more resilient and prosperous world for generations to come.

FAQ Section

Q: What is the Manulife Forest Climate Fund?

A: The Manulife Forest Climate Fund is a timberland investment fund that has raised $480.1 million to invest in sustainably managed forests with a focus on carbon sequestration and generating carbon credits.

Q: How does the fund contribute to climate change mitigation?

A: The fund aims to sequester over six million tons of carbon dioxide through sustainable forest management practices while also maintaining timber production.

Q: What are forestry carbon credits?

A: Forestry carbon credits are tradable certificates representing a quantifiable amount of carbon dioxide sequestered or emissions reduced through forest conservation or management practices.

Q: How do timberland investments generate returns?

A: Timberland investments can generate returns through sustainable timber harvesting, appreciation of land value, and, in this case, the sale of carbon credits.

Q: Are sustainable forest investments considered impact investments?

A: Yes, sustainable forest investments are often categorized as impact investments as they aim to generate measurable environmental benefits alongside financial returns.

Q: How does technology enhance sustainable forest management?

A: Technology such as satellite imagery, AI, and remote sensing can improve monitoring of forest health, optimize resource management, and enhance the accuracy of carbon stock measurements.

Q: What are the potential risks associated with timberland investments?

A: Risks may include long investment horizons, regulatory changes in carbon markets, natural disasters affecting forests, and fluctuations in timber prices.

Q: How can individual investors participate in sustainable forest investments?

A: Individual investors can participate through specialized funds like the Manulife Forest Climate Fund, REITs focused on timberland, or by investing in companies engaged in sustainable forestry practices.

As we conclude this exploration of sustainable forest investments and their role in climate change mitigation, we invite you to consider how you can contribute to these important efforts. Whether through investment, education, or supporting sustainable practices in your own community, every action counts in the fight against climate change.

At Farmonaut, we remain committed to advancing sustainable practices through innovative technology solutions. While our focus is on agricultural technology, many of the principles and technologies we develop have applications across various sectors, including forestry.

To learn more about our satellite-based farm management solutions and how they contribute to sustainable agriculture, we invite you to explore our platform:

For developers interested in integrating our satellite and weather data into their own systems, check out our API:

And for detailed information on how to use our API, refer to our developer documentation:

You can also access our services through our mobile apps:

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Together, we can work towards a more sustainable and resilient future, leveraging the power of technology, sustainable investments, and natural climate solutions to address the pressing challenges of our time.