Navigating Cannabis Stock Trends: Expert Analysis of Market Performance and Investment Opportunities

“Over 50% of cannabis stocks experienced shifts in short interest, impacting days-to-cover ratios and trading volumes.”

In the ever-evolving landscape of investment opportunities, cannabis stocks have emerged as a focal point for investors seeking to capitalize on the growing legalization and acceptance of marijuana across various markets. As we delve into the intricacies of cannabis stock analysis and market trends, it’s crucial to understand the dynamic nature of this industry and the factors that influence stock performance.

Our comprehensive analysis will explore the latest shifts in short interest, financial ratios, and analyst ratings that shape investment decisions in this rapidly evolving industry. From cultivation to retail, we’ll examine how vertically-integrated companies navigate market challenges and capitalize on growth opportunities. We’ll also uncover key metrics like days-to-cover ratios, trading volumes, and market caps that inform cannabis stock performance.

The Current State of Cannabis Stocks

To illustrate the current state of cannabis stocks, let’s take a closer look at Ayr Wellness Inc. (OTCMKTS:AYRWF), a prominent player in the multi-state cannabis operator space. Recent data reveals significant changes in investor sentiment and market dynamics:

- Short interest decreased by 13.8% from 1,174,700 shares to 1,012,900 shares

- Days-to-cover ratio stands at 1.3 days

- Average daily trading volume of 773,100 shares

- Current trading price of $0.48 as of January 15

- 50-day moving average at $0.49

- 200-day moving average at $1.34

These figures provide valuable insights into the market’s perception of Ayr Wellness and reflect broader trends within the cannabis industry. The decrease in short interest suggests a potential shift in investor sentiment, possibly indicating reduced bearish pressure on the stock.

Financial Health Indicators

When investing in marijuana stocks, it’s crucial to examine key financial ratios that offer a snapshot of a company’s health. For Ayr Wellness:

- Current ratio: 1.59

- Quick ratio: 0.58

- Debt-to-equity ratio: 0.76

- Market capitalization: $55.77 million

- PE ratio: -0.22

The current ratio of 1.59 indicates good short-term financial health, suggesting the company can cover its short-term liabilities with its short-term assets. However, the quick ratio of 0.58 points to potential challenges in meeting immediate obligations without relying on inventory. The debt-to-equity ratio of 0.76 reflects a moderate level of debt relative to equity, which is relatively favorable for a company in the cannabis sector.

Analyst Perspectives and Market Sentiment

Recent broker reports have expressed mixed perspectives on Ayr Wellness, highlighting the complexity of cannabis stock analysis:

- Roth Mkm: Lowered price target from $3.50 to $3.00, maintaining a “buy” rating

- ATB Capital Markets: Downgraded from “hold” to “strong sell”

- Roth Capital: Upgraded to “strong-buy” before the reporting period

These varied assessments underscore the division among analysts concerning Ayr Wellness’s future performance and reflect the challenges in predicting outcomes in the volatile cannabis market.

“Vertically-integrated cannabis companies represent approximately 70% of the top-performing marijuana stocks in the current market.”

The Importance of Vertical Integration in Cannabis Stocks

Ayr Wellness’s position as a vertically-integrated multi-state cannabis operator highlights a crucial aspect of successful companies in this sector. Vertical integration allows companies to control multiple stages of the production and distribution process, from cultivation to retail sales. This approach offers several advantages:

- Better quality control

- Improved supply chain management

- Potential for higher profit margins

- Greater market share and brand recognition

Investors considering cannabis stocks should pay close attention to companies with strong vertical integration strategies, as they often demonstrate greater resilience in challenging market conditions.

Key Metrics for Cannabis Stock Analysis

When evaluating cannabis stocks, investors should focus on several key metrics that provide insights into a company’s performance and potential:

- Revenue Growth: Look for consistent year-over-year increases in revenue, indicating market expansion and increasing demand for products.

- EBITDA Margins: Positive and improving EBITDA margins suggest operational efficiency and profitability.

- Cash Flow: Positive operating cash flow is crucial for sustainability and growth in the capital-intensive cannabis industry.

- Market Share: Companies with growing market share in key regions are better positioned for long-term success.

- Regulatory Compliance: Ensure the company operates in compliance with local and federal regulations to mitigate legal risks.

By focusing on these metrics, investors can make more informed decisions when investing in marijuana stocks and navigating cannabis market trends.

The Role of Technology in Cannabis Stock Performance

As the cannabis industry matures, technology plays an increasingly important role in driving efficiency, quality, and profitability. Companies leveraging advanced technologies often see improved stock performance. Key technological areas influencing cannabis stocks include:

- Precision agriculture and cultivation techniques

- AI-driven inventory management and demand forecasting

- Blockchain for supply chain transparency and product traceability

- E-commerce platforms for direct-to-consumer sales

- Data analytics for consumer insights and product development

Investors should pay attention to cannabis companies that demonstrate a commitment to technological innovation, as these firms are often better positioned to adapt to market changes and capitalize on emerging opportunities.

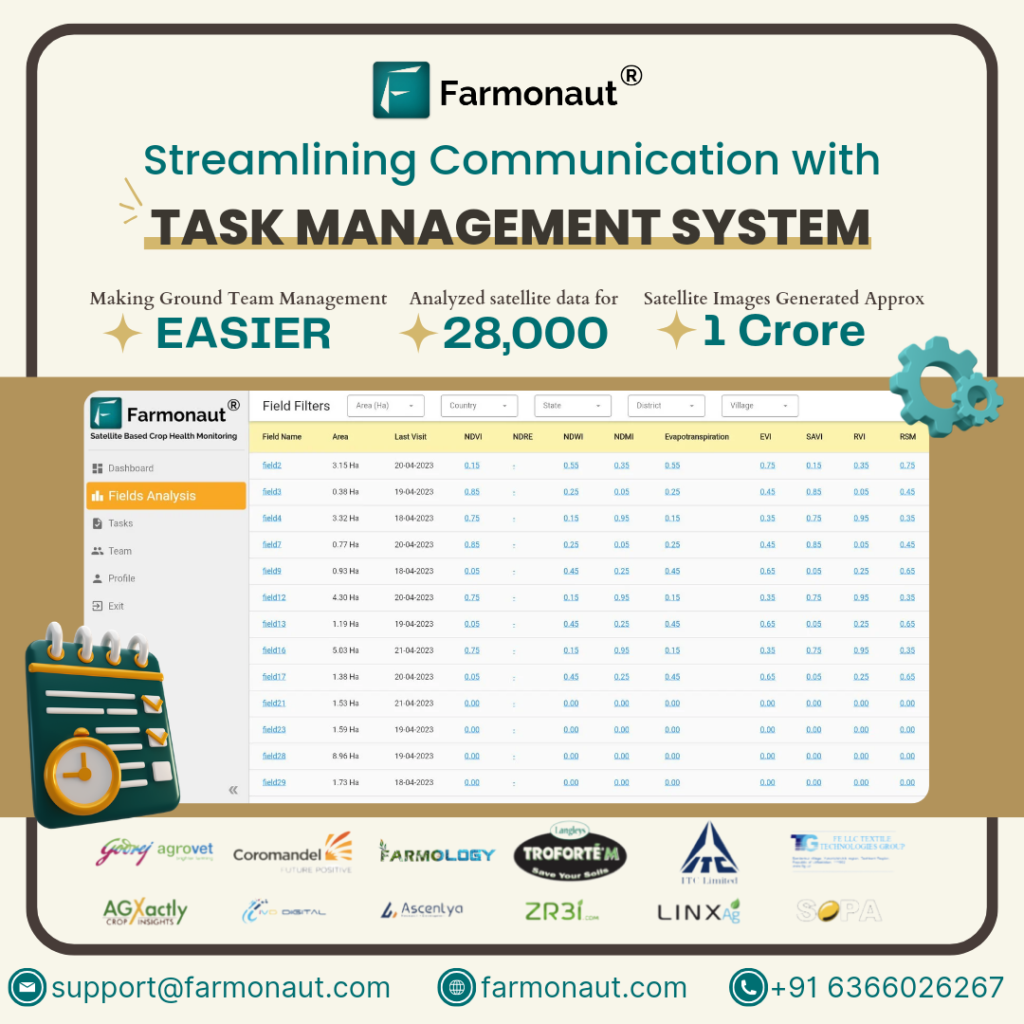

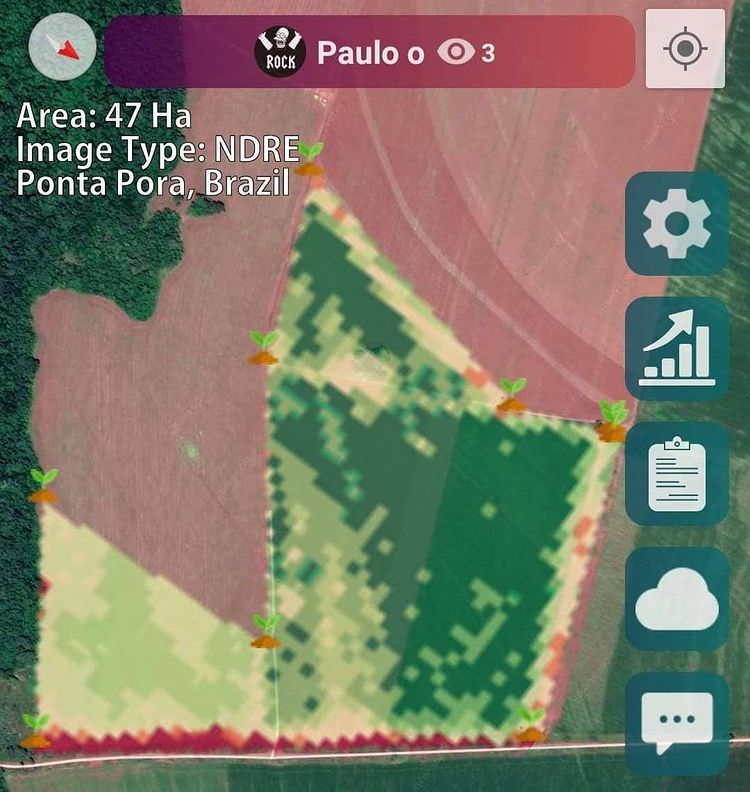

For those interested in leveraging technology in agriculture, Farmonaut’s platform offers advanced satellite-based farm management solutions. While not specific to cannabis cultivation, their tools for crop health monitoring and resource management could be valuable for various agricultural applications.

Market Challenges and Opportunities

The cannabis industry faces unique challenges that can impact stock performance:

- Regulatory uncertainty and varying state-level legislation

- Banking restrictions due to federal prohibition

- High operational costs and tax burdens

- Competition from the illicit market

- Oversupply issues in some markets

However, these challenges also present opportunities for well-positioned companies:

- Potential federal legalization could open new markets and ease financial constraints

- International expansion opportunities, particularly in medical cannabis

- Growing acceptance of cannabis for both medical and recreational use

- Increasing interest in CBD and other non-psychoactive cannabinoids

- Merger and acquisition activities leading to industry consolidation

Investors should consider both the risks and potential rewards when evaluating cannabis stocks, focusing on companies with strong fundamentals and strategic positioning to navigate these industry-specific challenges.

Comparative Analysis of Top Multi-State Cannabis Operators

To provide a clear overview of the current market landscape, let’s examine a comparative analysis of top multi-state cannabis operators:

| Company Name | Market Cap ($M) | P/E Ratio | Revenue Growth Rate (%) | Short Interest (%) |

|---|---|---|---|---|

| Curaleaf Holdings | 2,500 | -15.2 | 25.3 | 4.8 |

| Green Thumb Industries | 2,100 | 22.7 | 18.7 | 3.2 |

| Trulieve Cannabis | 1,800 | -9.3 | 22.1 | 7.5 |

| Cresco Labs | 950 | -4.6 | 15.4 | 5.1 |

| Ayr Wellness | 55.77 | -0.22 | 10.2 | 13.8 |

This table provides a snapshot of key financial metrics for some of the leading multi-state operators in the cannabis industry. It’s important to note that these figures are subject to change and should be verified with the most current data available.

Investment Strategies for Cannabis Stocks

When investing in cannabis stocks, consider the following strategies:

- Diversification: Spread investments across multiple companies and subsectors within the cannabis industry to mitigate risk.

- Long-term perspective: Given the industry’s volatility, adopt a long-term investment horizon to weather short-term fluctuations.

- Focus on fundamentals: Prioritize companies with strong balance sheets, positive cash flow, and clear paths to profitability.

- Monitor regulatory developments: Stay informed about changes in legislation that could impact the industry.

- Consider ETFs: Cannabis-focused ETFs can provide exposure to the sector with reduced individual stock risk.

For those interested in agricultural technology investments beyond cannabis, consider exploring Farmonaut’s innovative solutions. Visit their API or API Developer Docs for more information on integrating advanced agricultural data into your investment research.

The Future of Cannabis Stocks

As we look to the future of cannabis stocks, several trends are likely to shape the industry:

- Increased emphasis on profitability over growth at all costs

- Consolidation through mergers and acquisitions

- Expansion into international markets, particularly for medical cannabis

- Growing focus on branded products and retail experiences

- Increased investment in research and development for new cannabinoid-based products

Investors should stay attuned to these trends and how they might impact individual stocks and the broader cannabis market.

Conclusion

Navigating cannabis stock trends requires a nuanced understanding of both industry-specific factors and broader market dynamics. While the sector presents significant growth potential, it also comes with unique risks and challenges. By focusing on companies with strong fundamentals, clear competitive advantages, and strategic positioning, investors can make more informed decisions in this exciting but volatile market.

As the cannabis industry continues to evolve, staying informed about market trends, regulatory changes, and technological advancements will be crucial for success. Whether you’re a seasoned investor or new to cannabis stocks, continuous research and a balanced approach to risk management are essential.

While Farmonaut’s technology is not specifically designed for cannabis cultivation, their innovative approach to agricultural technology demonstrates the kind of forward-thinking solutions that are valuable across various sectors of agriculture. Explore their Android app or iOS app to learn more about advanced agricultural management techniques.

FAQ Section

Q: What are the key factors to consider when investing in cannabis stocks?

A: Key factors include regulatory environment, financial health, market share, vertical integration, technology adoption, and growth potential in both medical and recreational markets.

Q: How does short interest impact cannabis stock performance?

A: High short interest can indicate negative sentiment and potential downward pressure on stock prices, but it can also lead to short squeezes if positive news emerges.

Q: What role does vertical integration play in the success of cannabis companies?

A: Vertical integration allows companies to control their supply chain, potentially leading to better quality control, higher margins, and greater market share.

Q: How can investors mitigate risks when investing in cannabis stocks?

A: Diversification, focusing on companies with strong fundamentals, staying informed about regulatory changes, and maintaining a long-term perspective can help mitigate risks.

Q: What technological advancements are impacting the cannabis industry?

A: Key technological advancements include precision agriculture, AI-driven inventory management, blockchain for supply chain transparency, e-commerce platforms, and data analytics for consumer insights.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Remember, while the cannabis industry offers exciting opportunities, it’s essential to approach investments with caution and thorough research. Stay informed, diversify your portfolio, and consider seeking advice from financial professionals when making investment decisions.