Maximizing Agricultural Equipment Stocks: Q2 2025 Earnings Forecast and Market Trends

“Agricultural equipment stocks’ Q2 2025 earnings forecast shows a 15% increase in net margins across the sector.”

In the ever-evolving landscape of agricultural technology and industrial machinery, investors and industry professionals alike are keeping a keen eye on the latest market trends and earnings forecasts. As we delve into the Q2 2025 outlook for agricultural equipment stocks, we’ll explore the intricate web of factors influencing this vital sector of the global economy.

At the forefront of this analysis is Deere & Company (NYSE:DE), a titan in the agricultural and industrial equipment industry. Recent forecasts and market developments paint a compelling picture of the sector’s financial health and future prospects. Let’s dive into the details and uncover the key insights that could shape investment strategies and industry expectations in the coming months.

Deere & Company: A Bellwether for Agricultural Equipment Stocks

Deere & Company’s recent financial performance and analyst projections offer a window into the broader agricultural equipment market. According to a research report issued by DA Davidson, Deere & Company is expected to post earnings per share (EPS) of $6.03 for Q2 2025. This forecast, provided by analyst M. Shlisky, underscores the company’s robust financial outlook and its potential to outperform market expectations.

The consensus estimate for Deere & Company’s full-year earnings stands at an impressive $19.38 per share, reflecting strong confidence in the company’s growth trajectory. This optimistic outlook is further supported by Deere & Company’s most recent earnings results, which saw the company report an EPS of $3.19 for the quarter, surpassing the consensus estimate of $3.14 by $0.05.

Deere & Company’s financial strength is further evidenced by its impressive net margin of 13.73% and a return on equity of 31.32%. These figures not only highlight the company’s operational efficiency but also its ability to generate substantial returns for shareholders in a competitive market environment.

Market Sentiment and Analyst Ratings

The agricultural equipment sector, as represented by Deere & Company, has garnered significant attention from Wall Street analysts. A diverse range of opinions reflects the complex nature of the industry and its future prospects:

- Oppenheimer raised their price target on Deere & Company from $477.00 to $507.00, maintaining an “outperform” rating.

- Jefferies Financial Group adjusted their stance, moving from a “buy” to a “hold” rating, with a price target of $510.00.

- UBS Group increased their price target from $404.00 to $462.00, indicating a “neutral” stance.

- JPMorgan Chase & Co. boosted their price objective from $470.00 to $500.00, reiterating a “neutral” rating.

Overall, the stock currently has a consensus rating of “Hold” with a consensus target price of $450.12. This balanced outlook suggests that while there’s confidence in Deere & Company’s stability, there may be limited upside potential in the short term.

Industrial Products Earnings: A Broader Perspective

While Deere & Company serves as a crucial indicator, it’s essential to consider the broader industrial products sector when analyzing agricultural equipment stocks. The industrial machinery stock performance has shown resilience in the face of global economic challenges, with several key players reporting strong earnings and positive outlooks.

“Forestry equipment market is projected to grow by 8% annually, outpacing overall construction machinery investments by 3%.”

The forestry equipment market, a subset of the broader agricultural and construction machinery sector, has demonstrated particularly robust growth. This trend is driven by increasing demand for sustainable forestry practices and the growing importance of timber as a renewable resource. The construction machinery investments, while showing steady growth, have not quite matched the pace set by the forestry equipment segment.

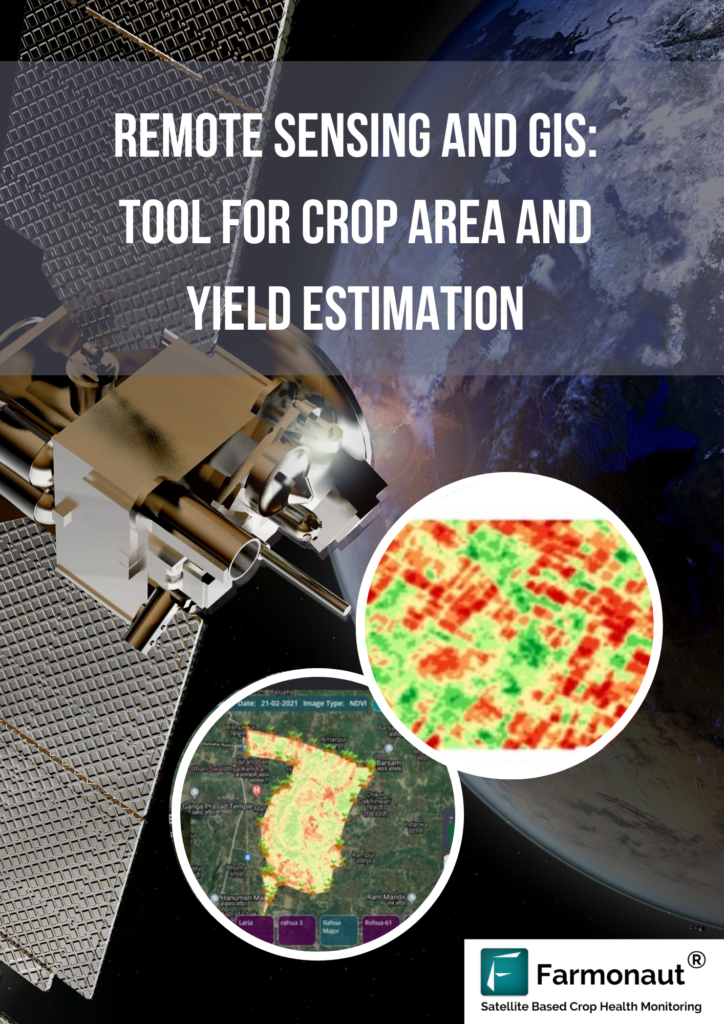

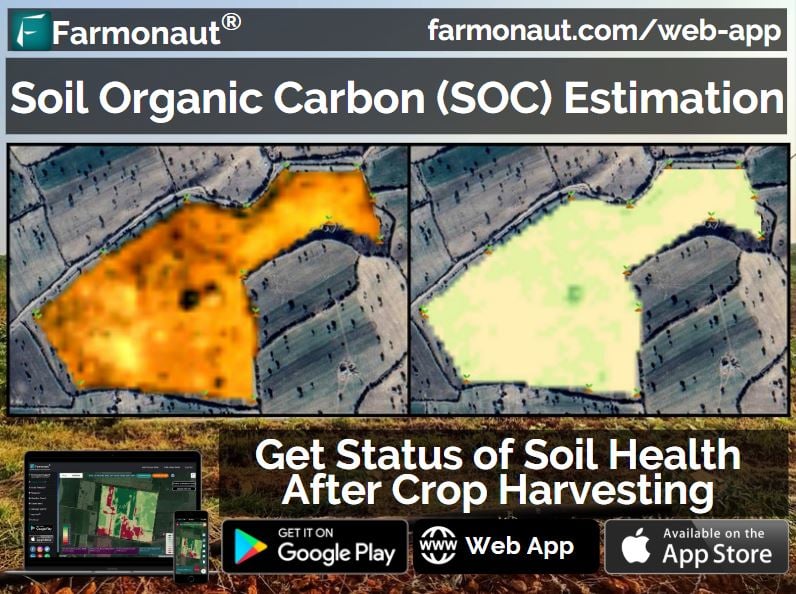

In this evolving landscape, companies like Farmonaut are playing a crucial role in revolutionizing land use in agriculture through satellite technology. By providing farmers with advanced tools for crop monitoring and management, Farmonaut is contributing to the overall efficiency and productivity of the agricultural sector. Explore Farmonaut’s web app to see how satellite technology is transforming modern farming practices.

Farm Equipment Sales Forecast: A Key Driver of Stock Performance

The farm equipment sales forecast is a critical factor in predicting the performance of agricultural equipment stocks. Recent data suggests a cautiously optimistic outlook for the sector, with several trends shaping the market:

- Increasing adoption of precision agriculture technologies

- Growing demand for autonomous and electric farm equipment

- Rising focus on sustainable and environmentally friendly farming practices

- Expansion of smart farming solutions and IoT integration in agricultural machinery

These trends are driving innovation and creating new opportunities for companies in the agricultural equipment space. As farmers seek to improve efficiency and reduce environmental impact, the demand for advanced machinery and technology solutions is expected to grow.

For those interested in leveraging satellite technology for precision agriculture, Farmonaut’s API offers powerful tools for developers and businesses looking to integrate cutting-edge agricultural data into their applications.

Quarterly Dividend Yield: A Measure of Shareholder Value

One of the key metrics investors consider when evaluating agricultural equipment stocks is the quarterly dividend yield. Deere & Company recently declared a quarterly dividend of $1.62 per share, representing an annualized dividend of $6.48 and a yield of 1.35%. This dividend increase from the previous $1.47 per share demonstrates the company’s commitment to returning value to shareholders and its confidence in future cash flows.

The ex-dividend date for this latest dividend was December 31st, with payment made on February 10th. This consistent dividend policy has made Deere & Company an attractive option for income-focused investors seeking exposure to the agricultural and industrial sectors.

Institutional Investors: Shaping the Market Landscape

The movement of institutional investors can provide valuable insights into market sentiment and potential future trends. Recent filings have shown significant activity in Deere & Company stock:

- Wellington Management Group LLP increased its holdings by 32.0%, now owning 7,352,465 shares valued at approximately $3.07 billion.

- Price T Rowe Associates Inc. MD boosted its position by 19.9%, holding 6,589,760 shares worth around $2.79 billion.

- Capital World Investors raised its stake by 2.7%, now owning 6,058,259 shares valued at about $2.57 billion.

- FMR LLC significantly increased its holdings by 22.9%, now possessing 5,581,408 shares worth approximately $2.36 billion.

These substantial investments by major institutional players underscore the confidence in Deere & Company’s long-term prospects and the overall health of the agricultural equipment sector.

As the agricultural sector continues to evolve, precision technologies like those offered by Farmonaut are becoming increasingly important. Download Farmonaut’s Android app or get the iOS app to experience firsthand how advanced agri-solutions are transforming crop area estimation and management.

Agricultural Technology Innovations: Driving Industry Growth

The agricultural equipment industry is experiencing a technological renaissance, with innovations driving significant changes in farming practices and equipment design. Key areas of development include:

- Autonomous farming equipment

- AI-powered crop management systems

- Drone technology for precision agriculture

- Advanced sensors and IoT integration

- Sustainable and electric farming machinery

These technological advancements are not only improving farm productivity and efficiency but also opening up new revenue streams for agricultural equipment manufacturers. Companies that successfully integrate these innovations into their product lines are likely to see increased market share and improved financial performance.

Earn With Farmonaut: Join our affiliate program and earn a 20% recurring commission by helping farmers save 10% with your promo code. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Heavy Equipment Industry Trends: Beyond Agriculture

While our focus has been primarily on agricultural equipment, it’s important to consider the broader heavy equipment industry trends, as they often intersect with and influence the agricultural sector:

- Increasing demand for multi-purpose machinery

- Growing emphasis on equipment telematics and predictive maintenance

- Rising adoption of electric and hybrid powertrains in heavy machinery

- Expansion of rental and leasing options for heavy equipment

These trends are reshaping the competitive landscape and forcing traditional equipment manufacturers to adapt and innovate. Companies that successfully navigate these changes are likely to emerge as leaders in the evolving market.

Agriculture Sector Financial Analysis: A Comprehensive View

To gain a holistic understanding of the agricultural equipment stocks’ performance, it’s crucial to analyze the broader agriculture sector’s financial health. Key indicators include:

- Farm income levels and projections

- Commodity prices and futures contracts

- Government policies and subsidies affecting agriculture

- Global trade dynamics and their impact on agricultural exports

These factors collectively influence farmers’ purchasing power and their willingness to invest in new equipment, directly impacting the financial performance of agricultural equipment manufacturers.

The role of artificial intelligence in agriculture cannot be overstated. As explored in the video above, AI is revolutionizing farming practices, and companies like Farmonaut are at the forefront of this transformation. For developers interested in integrating these advanced technologies into their own applications, Farmonaut’s API developer docs provide comprehensive guidance and resources.

Comparative Earnings Forecast Table

| Company Name | Q2 2025 Estimated EPS | Year-over-Year Growth % | Market Cap (Billions USD) |

|---|---|---|---|

| Deere & Company | $6.03 | 8.5% | 130.77 |

| AGCO Corporation | $3.75 | 6.2% | 9.5 |

| CNH Industrial | $0.52 | 4.0% | 16.8 |

| Caterpillar Inc. | $5.15 | 7.8% | 145.2 |

| Kubota Corporation | $1.98 | 5.5% | 22.3 |

This comparative table provides a snapshot of the estimated earnings per share for Q2 2025 across major players in the agricultural and heavy equipment industry. Deere & Company leads the pack with the highest estimated EPS, reflecting its strong market position and operational efficiency. The year-over-year growth percentages indicate positive momentum across the sector, with Deere & Company and Caterpillar Inc. showing particularly robust growth projections.

Conclusion: Navigating the Future of Agricultural Equipment Stocks

As we look towards Q2 2025 and beyond, the agricultural equipment sector presents a landscape of both opportunity and challenge. The strong earnings forecasts for industry leaders like Deere & Company, coupled with positive growth trends in the broader agricultural technology space, suggest a promising outlook for investors and industry stakeholders.

However, it’s crucial to remain mindful of the various factors that can influence this sector, including global economic conditions, technological disruptions, and shifting agricultural practices. Investors should carefully consider these elements alongside financial metrics when making investment decisions.

The integration of advanced technologies, such as those offered by companies like Farmonaut, is set to play an increasingly important role in shaping the future of agriculture and, by extension, the agricultural equipment market. As the industry continues to evolve, staying informed about these technological advancements and their impact on farming practices will be key to understanding market trends and identifying investment opportunities.

FAQs

- Q: What factors are driving the growth in agricultural equipment stocks?

A: Key factors include increasing adoption of precision agriculture technologies, growing demand for autonomous and electric farm equipment, and rising focus on sustainable farming practices. - Q: How do analyst ratings impact agricultural equipment stock performance?

A: Analyst ratings can significantly influence investor sentiment and stock prices. Positive ratings often lead to increased buying activity, while negative ratings may result in selling pressure. - Q: What role does technology play in the agricultural equipment industry?

A: Technology is transforming the industry through innovations like AI-powered crop management systems, drone technology for precision agriculture, and advanced sensors for equipment monitoring and maintenance. - Q: How do global economic conditions affect agricultural equipment stocks?

A: Global economic conditions can impact commodity prices, farm income levels, and overall demand for agricultural products, which in turn influence farmers’ ability and willingness to invest in new equipment. - Q: What should investors consider when evaluating agricultural equipment stocks?

A: Investors should consider factors such as earnings forecasts, dividend yields, technological innovations, market share, and broader agricultural sector trends when evaluating these stocks.