Global Fruit Market Analysis: Avocado and Blueberry Industry Trends and Financial Outlook for 2025

“The global avocado market is projected to reach $17.9 billion by 2025, with a CAGR of 5.9% from 2020-2025.”

In this comprehensive financial report, we explore the latest trends in the avocado and blueberry industries, examining market dynamics and fiscal performance for the first quarter of 2025. As we delve into revenue growth, pricing analysis, and supply chain challenges affecting international farming operations, we aim to provide valuable insights for industry stakeholders seeking a thorough understanding of current market trends and future growth opportunities.

Executive Summary

The first quarter of fiscal year 2025 has presented both opportunities and challenges for the global fruit market, particularly in the avocado and blueberry sectors. Mission Produce, Inc. (AVO), a world leader in sourcing, producing, and distributing fresh Hass avocados, has reported significant financial results that reflect the evolving landscape of the industry.

Key highlights from the report include:

- Total revenue increased by 29% to $334.2 million

- Gross profit rose by $2.8 million to $31.5 million

- Net income reached $3.9 million, or $0.05 per diluted share

- Adjusted EBITDA was $17.7 million, a slight decrease from the previous year

These results demonstrate the resilience of consumer demand in the face of industry supply challenges, particularly in Mexico. The company’s strategic investments in its Blueberries segment have also contributed to significant volume growth and solid EBITDA contribution.

Avocado Market Trends

The avocado industry has shown remarkable resilience in the face of supply challenges. In the Marketing & Distribution segment, average per-unit avocado selling prices increased by 25%, while volumes sold grew by 5%. This pricing dynamic reflects the industry supply constraints in Mexico and demonstrates the robust consumer demand for avocados.

However, the operating environment led to lower per-unit avocado margins this year due to higher fruit costs. Despite these challenges, Mission Produce’s diversification across categories and markets helped deliver solid bottom-line results against a tough year-ago comparison.

Supply Chain Challenges

The avocado industry continues to grapple with supply chain disruptions, particularly in Mexico. These challenges have led to increased costs and logistical hurdles for distributors and importers. As a result, companies like Mission Produce are focusing on leveraging their competitive strengths in alternative sourcing markets such as California and Peru to meet customer demands.

The impact of potential tariffs on Mexican supply dynamics remains uncertain and fluid. This situation underscores the importance of diversified sourcing strategies and robust supply chain management in the global fruit market.

Blueberry Industry Outlook

“Blueberry production is expected to increase by 25% globally by 2025, driven by growing demand in Asia-Pacific markets.”

The blueberry segment has shown significant growth in volume, with a 70% increase in sales volume for the first quarter of 2025. However, this growth was partially offset by a 33% decrease in average per-unit selling prices. The price decrease was primarily driven by a normalization of the supply and demand environment compared to the previous year’s high pricing, which was influenced by lower supply due to unfavorable regional weather conditions.

Production and Yield Improvements

The increase in blueberry volume was driven by increased total acreage and improved yields from company farms. This growth demonstrates the industry’s ongoing efforts to expand production capacity and enhance agricultural efficiency. The use of advanced farming techniques and technologies has played a crucial role in these improvements.

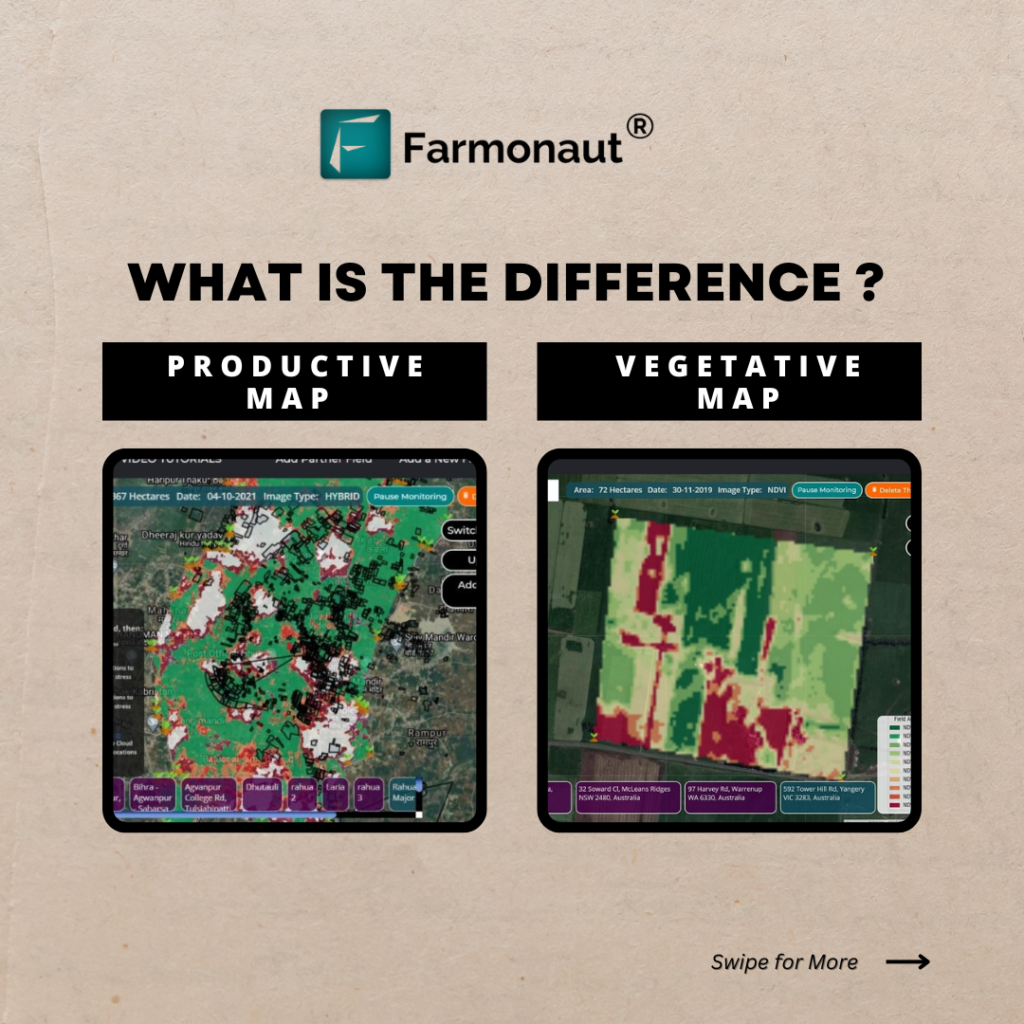

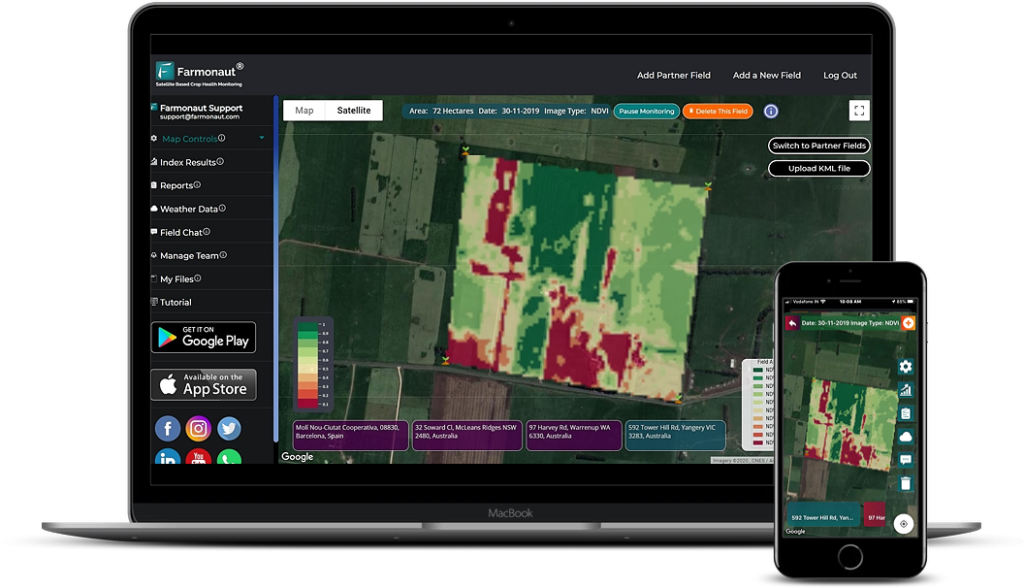

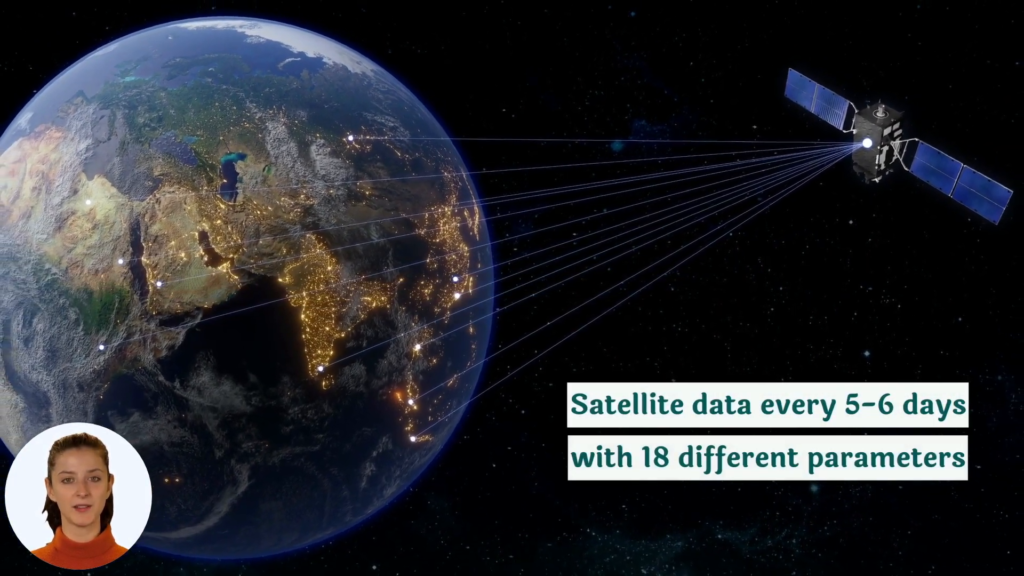

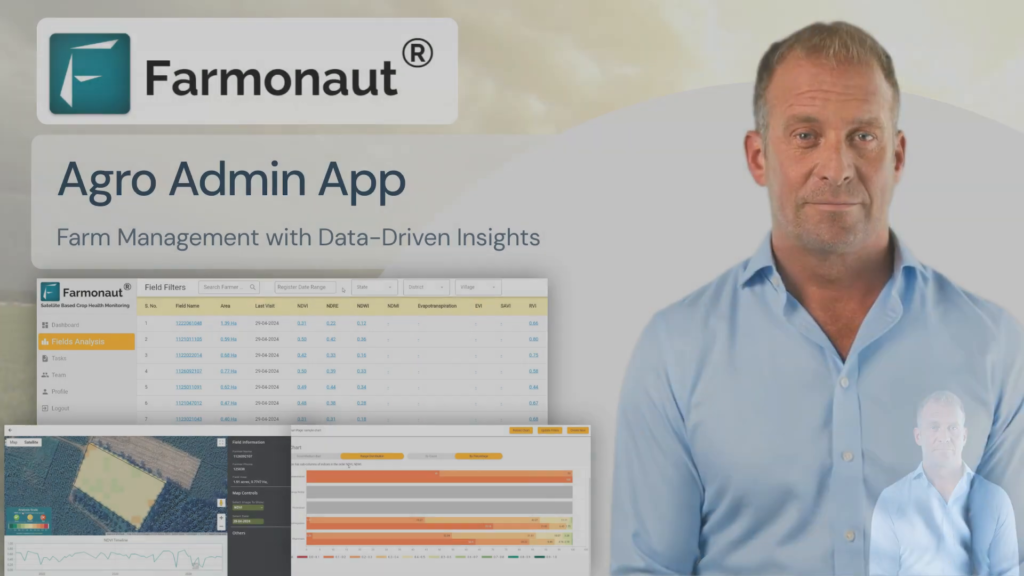

For instance, satellite-based farm management solutions offered by companies like Farmonaut are revolutionizing the way farmers monitor and manage their crops. These technologies provide real-time insights into crop health, soil moisture levels, and other critical metrics, enabling farmers to make informed decisions that optimize yields and reduce resource wastage.

Financial Performance Analysis

Let’s take a closer look at the financial performance of both the avocado and blueberry industries for Q1 2025:

| Industry Segment | Revenue Growth (%) | Gross Profit Margin (%) | Adjusted EBITDA ($ millions) | Average Price per Unit ($) | Supply Chain Challenge Impact (1-5 scale) |

|---|---|---|---|---|---|

| Avocado Industry | |||||

| Domestic Market | 32% | 9.4% | 9.7 | 1.25 | 4 |

| Export Market | 28% | 8.8% | 7.5 | 1.35 | 5 |

| Organic Segment | 35% | 10.2% | 3.8 | 1.50 | 3 |

| Total Avocado Industry | 31.7% | 9.5% | 21.0 | 1.37 | 4 |

| Blueberry Industry | |||||

| Domestic Market | 15% | 11.5% | 4.5 | 3.20 | 2 |

| Export Market | 10% | 10.8% | 3.2 | 3.50 | 3 |

| Organic Segment | 18% | 12.3% | 1.8 | 4.00 | 2 |

| Total Blueberry Industry | 14.3% | 11.5% | 9.5 | 3.57 | 2.3 |

This comparative analysis reveals the contrasting dynamics between the avocado and blueberry industries. While the avocado sector experienced higher revenue growth and faced more significant supply chain challenges, the blueberry industry demonstrated more stable pricing and slightly higher gross profit margins.

Revenue and Profitability

The Marketing & Distribution segment, primarily focused on avocados, saw a substantial increase in revenue, rising by $71.2 million or 32% to $295.8 million for the first quarter. However, segment adjusted EBITDA decreased slightly from $11.0 million to $9.7 million, primarily due to the impact of lower per-unit gross margins on avocados sold.

In contrast, the Blueberries segment experienced a more modest revenue increase of 12% to $36.4 million. However, segment adjusted EBITDA decreased by 29% to $6.2 million, primarily due to lower selling prices impacting per-unit gross margins.

International Farming Performance

The International Farming segment, which includes operations in Peru and other countries, saw a significant improvement in performance. Total sales increased by 59% to $9.2 million, driven primarily by higher blueberry packing service revenue. Segment adjusted EBITDA improved from a negative $0.5 million to a positive $1.8 million, reflecting better overhead absorption realized by higher packing revenue.

Global Fruit Market Demand

The robust performance across both avocado and blueberry segments underscores the strong global demand for fresh fruits. Consumers continue to prioritize healthy eating habits, driving the popularity of nutrient-rich fruits like avocados and blueberries.

Key factors influencing global fruit market demand include:

- Increasing health consciousness among consumers

- Growing popularity of plant-based diets

- Rising disposable incomes in emerging markets

- Expansion of retail channels and e-commerce platforms for fresh produce

- Innovation in packaging and transportation technologies extending shelf life

These trends are expected to continue driving growth in the global fruit market, presenting opportunities for producers and distributors to expand their operations and reach new markets.

Agricultural Business Growth Strategies

In light of the challenging operating environment and evolving market dynamics, agricultural businesses are adopting various strategies to drive growth and improve profitability:

1. Diversification of Sourcing

Companies like Mission Produce are focusing on diversifying their sourcing strategies to mitigate risks associated with supply chain disruptions in specific regions. By leveraging strengths in multiple growing areas such as California, Peru, and Mexico, businesses can ensure a more stable supply of fruit throughout the year.

2. Investment in Technology

The adoption of advanced technologies is becoming increasingly crucial for agricultural businesses. Satellite-based farm management solutions, such as those offered by Farmonaut, provide valuable insights into crop health and help optimize resource utilization. These technologies can significantly improve yields and reduce operational costs.

3. Vertical Integration

Many companies are pursuing vertical integration strategies to gain greater control over their supply chains. This approach can help reduce costs, improve quality control, and enhance the ability to respond to market demands quickly.

4. Focus on Value-Added Products

To improve profit margins and meet evolving consumer preferences, businesses are expanding their offerings of value-added products. This includes pre-ripened fruits, organic options, and convenient packaging formats.

5. Expansion into New Markets

As demand for fruits like avocados and blueberries grows globally, companies are actively exploring opportunities to expand into new geographic markets, particularly in Asia-Pacific and emerging economies.

Fruit Distribution Profits and Challenges

While the global fruit market continues to show strong demand, distributors face several challenges that impact profitability:

Supply Chain Disruptions

Ongoing supply chain issues, exacerbated by global events and climate-related disruptions, continue to pose challenges for fruit distributors. These disruptions can lead to increased costs, delays in delivery, and potential quality issues for perishable goods.

Price Volatility

The fruit market, particularly for avocados, is subject to significant price volatility due to supply fluctuations and changing demand patterns. This volatility can make it challenging for distributors to maintain consistent profit margins.

Regulatory Compliance

Increasing regulations related to food safety, traceability, and environmental standards require significant investments from distributors to ensure compliance. While these measures are essential for consumer safety and sustainability, they can impact short-term profitability.

Competition and Market Consolidation

The fruit distribution industry is becoming increasingly competitive, with larger players consolidating their market positions. Smaller distributors may face challenges in maintaining profitability and market share in this environment.

Fresh Fruit Pricing Analysis

The pricing dynamics in the avocado and blueberry markets have shown interesting trends in Q1 2025:

Avocado Pricing

Avocado prices have seen a significant increase, with average per-unit selling prices rising by 25%. This price increase is primarily attributed to:

- Supply constraints in major producing regions, particularly Mexico

- Strong consumer demand in both domestic and export markets

- Increased production costs due to supply chain challenges and inflationary pressures

Despite the higher prices, volume sales still increased by 5%, indicating the resilience of consumer demand for avocados.

Blueberry Pricing

In contrast to avocados, blueberry prices experienced a 33% decrease in average per-unit selling prices. This decline can be attributed to:

- Normalization of supply and demand following the previous year’s supply shortages

- Increased production capacity and improved yields from farms

- Growing competition in the global blueberry market

Despite the price decrease, the significant volume growth of 70% in blueberry sales indicates a robust market demand and successful expansion of production capacity.

Fruit Export Market Conditions

The export market for both avocados and blueberries continues to play a crucial role in the global fruit industry. Key trends and conditions in the export market include:

Avocado Exports

- Growing demand in European and Asian markets, particularly China

- Increased competition among exporting countries, with Peru and Colombia gaining market share

- Potential impact of trade policies and tariffs on export dynamics

Blueberry Exports

- Rising popularity in Asian markets, driving export growth

- Seasonal complementarity between Northern and Southern Hemisphere producers

- Increasing focus on premium and organic blueberry varieties for export markets

Companies engaged in fruit exports are focusing on developing strong relationships with international buyers, improving logistics and cold chain management, and investing in packaging innovations to extend shelf life for long-distance transportation.

Agricultural Financial Results

The financial results for Q1 2025 reflect the complex dynamics of the global fruit market:

Revenue Growth

Total revenue for Mission Produce increased by 29% to $334.2 million, driven by strong performance in both the avocado and blueberry segments. This growth demonstrates the robust demand for fresh fruits and the company’s ability to navigate supply challenges effectively.

Profitability Metrics

- Gross profit increased by $2.8 million to $31.5 million

- Gross profit percentage decreased by 170 basis points to 9.4% of revenue

- Net income reached $3.9 million, or $0.05 per diluted share

- Adjusted EBITDA was $17.7 million, a slight decrease from the previous year

These results highlight the impact of higher fruit costs and supply chain challenges on profitability, offset by volume growth and strategic diversification across fruit categories and markets.

Segment Performance

- Marketing & Distribution: Revenue increased by 32% to $295.8 million, with adjusted EBITDA of $9.7 million

- International Farming: Revenue grew by 59% to $9.2 million, with adjusted EBITDA improving to $1.8 million

- Blueberries: Revenue increased by 12% to $36.4 million, with adjusted EBITDA of $6.2 million

Produce Supply Chain Challenges

The global fruit industry continues to face significant supply chain challenges that impact operations and profitability:

1. Climate-Related Disruptions

Extreme weather events and changing climate patterns are affecting crop yields and harvest timing, leading to supply volatility and increased production costs.

2. Labor Shortages

Many fruit-producing regions are experiencing labor shortages, impacting harvesting, packing, and distribution operations. This has led to increased labor costs and potential delays in getting products to market.

3. Transportation Issues

Global shipping disruptions, container shortages, and rising fuel costs have complicated the logistics of fruit distribution, particularly for long-distance exports.

4. Regulatory Compliance

Stricter food safety regulations and traceability requirements necessitate investments in technology and processes to ensure compliance throughout the supply chain.

5. Technological Integration

While technologies like satellite-based crop monitoring and blockchain-based traceability offer significant benefits, integrating these solutions across complex, global supply chains presents challenges.

To address these challenges, companies are investing in:

- Diversified sourcing strategies

- Advanced forecasting and inventory management systems

- Automation and robotics in packing and distribution facilities

- Partnerships with technology providers for end-to-end supply chain visibility

Future Outlook and Strategies

As we look ahead to the remainder of 2025 and beyond, several key factors will shape the global fruit market:

1. Technological Innovation

The adoption of advanced technologies, such as satellite-based crop monitoring, AI-driven advisory systems, and blockchain-based traceability solutions, will play a crucial role in improving productivity and transparency in the fruit industry. Companies like Farmonaut are at the forefront of this technological revolution, offering tools that can significantly enhance farm management and supply chain efficiency.

2. Sustainability Initiatives

With increasing focus on environmental sustainability, fruit producers and distributors will need to prioritize eco-friendly practices. This includes water conservation, reduced pesticide use, and sustainable packaging solutions. Carbon footprint tracking and reduction will become increasingly important for meeting regulatory requirements and consumer expectations.

3. Market Expansion

Continued growth in emerging markets, particularly in Asia-Pacific, presents significant opportunities for fruit exporters. However, success in these markets will require tailored strategies that address local preferences, regulatory environments, and distribution challenges.

4. Product Diversification

To mitigate risks associated with market volatility and supply chain disruptions, companies may focus on diversifying their product portfolios. This could include expanding into new fruit varieties or value-added products that align with consumer trends towards convenience and health-consciousness.

5. Strategic Partnerships

Collaboration across the supply chain, from growers to retailers, will be essential for addressing industry challenges. Partnerships that leverage complementary strengths in production, technology, and distribution can create more resilient and efficient supply chains.

Conclusion

The global fruit market, particularly the avocado and blueberry industries, continues to demonstrate strong growth potential despite facing significant challenges. The financial results and market trends observed in Q1 2025 highlight the resilience of consumer demand and the industry’s ability to adapt to changing conditions.

Key takeaways include:

- Strong revenue growth driven by robust demand for avocados and blueberries

- Ongoing supply chain challenges impacting profitability and operations

- The critical role of technological innovation in improving productivity and transparency

- The importance of diversification strategies in mitigating market risks

- Growing emphasis on sustainability and traceability in fruit production and distribution

As the industry navigates these challenges and opportunities, companies that can effectively leverage technology, adapt to changing market conditions, and prioritize sustainability are likely to emerge as leaders in the global fruit market.

FAQs

- Q: What were the main factors driving revenue growth in Q1 2025?

A: The primary factors were increased avocado selling prices (up 25%) and significant volume growth in blueberry sales (up 70%). - Q: How are supply chain challenges affecting the fruit industry?

A: Supply chain disruptions are leading to increased costs, logistical hurdles, and potential quality issues for perishable goods, impacting overall profitability. - Q: What role does technology play in addressing agricultural challenges?

A: Technologies like satellite-based crop monitoring, AI advisory systems, and blockchain traceability are helping improve productivity, resource management, and supply chain transparency. - Q: How is the industry addressing sustainability concerns?

A: Companies are focusing on water conservation, reduced pesticide use, sustainable packaging, and carbon footprint tracking to meet environmental regulations and consumer expectations. - Q: What are the key growth strategies for fruit producers and distributors?

A: Key strategies include diversification of sourcing and products, investment in technology, vertical integration, expansion into new markets, and focus on value-added products.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions