Delaware Court of Chancery: Agricultural Supply Chain Giant Faces Derivative Lawsuit over Fraudulent Accounting Practices

“17 current and former officers of a major agricultural supply chain company face a derivative lawsuit in Delaware.”

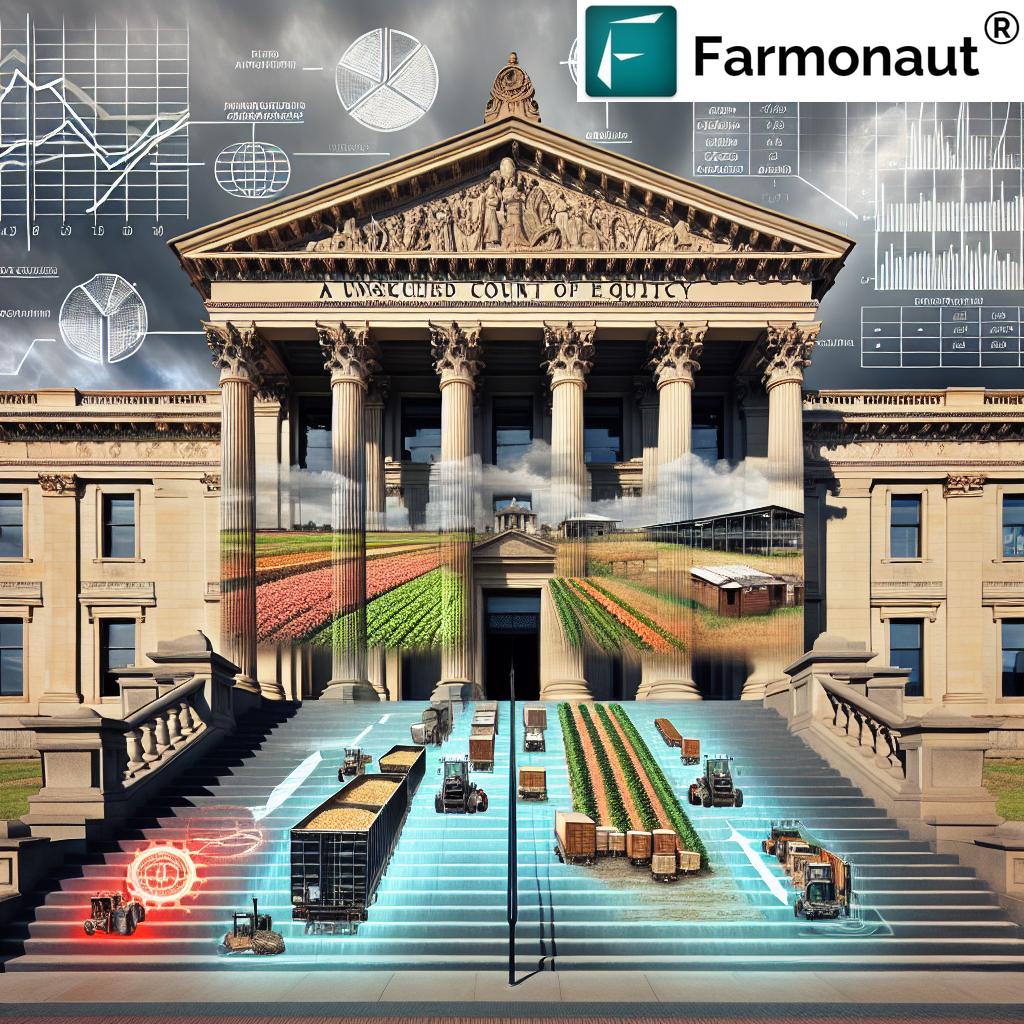

In a startling development that has sent shockwaves through the agricultural industry, we find ourselves at the epicenter of a legal storm brewing in the Delaware Court of Chancery. A major agricultural supply chain company, Archer-Daniels-Midland Co. (ADM), is now embroiled in a derivative lawsuit that threatens to reshape the landscape of corporate governance and financial reporting in the sector. This legal action, targeting 17 current and former officers, stems from allegations of fraudulent accounting practices and misleading disclosures related to the company’s nutrition segment.

As we delve into the intricacies of this case, it’s crucial to understand the far-reaching implications it holds for the agricultural industry, corporate accountability, and the role of the Delaware Court of Chancery in resolving such high-stakes disputes. This lawsuit serves as a stark reminder of the importance of transparency in agricultural company financials and supply chain disclosures, while simultaneously shedding light on potential corporate officer liability under Delaware corporate law.

The Heart of the Matter: Unraveling the Allegations

At the core of this derivative lawsuit lies a series of troubling accusations against ADM, a titan in the agricultural supply chain industry. The complaint, filed on April 3, 2025, in the Delaware Court of Chancery, alleges years of fraudulent accounting and misleading disclosures specifically related to the company’s nutrition segment. This legal action seeks damages from 17 current or former officers who are purportedly entangled in these claims.

The gravity of these allegations cannot be overstated. They strike at the heart of corporate integrity and raise critical questions about the accuracy of agricultural company financials and the reliability of supply chain disclosures. As we navigate through this complex case, it’s essential to consider the broader implications for the industry and the potential ripple effects on investor confidence and regulatory scrutiny.

The Role of the Delaware Court of Chancery

The Delaware Court of Chancery, renowned for its expertise in corporate law matters, now finds itself at the center of this high-profile case. Established in 1792, this court has long been a cornerstone in shaping American corporate governance. Its involvement in this derivative lawsuit underscores the significance of the case and its potential to set precedents in agricultural fraud allegations and corporate accountability.

As we examine the court’s role, it’s crucial to understand how its decisions could influence future interpretations of Delaware corporate law, particularly in cases involving fraudulent accounting practices in the agricultural sector. The court’s handling of this case will likely have far-reaching consequences for how similar disputes are resolved in the future, potentially reshaping the landscape of corporate governance in agriculture and beyond.

Unpacking the Allegations: A Closer Look at Fraudulent Accounting Practices

The crux of this derivative lawsuit revolves around alleged fraudulent accounting practices within ADM’s nutrition segment. These accusations strike at the heart of corporate financial reporting and raise serious questions about the integrity of agricultural company financials. Let’s break down the key elements of these allegations:

- Misleading Disclosures: The lawsuit claims that ADM provided misleading information about its nutrition segment’s performance, potentially inflating its success and profitability.

- Revenue Recognition Issues: There are concerns about how the company recognized revenue within its nutrition division, possibly leading to an inaccurate representation of financial health.

- Manipulation of Financial Metrics: Allegations suggest that key financial metrics may have been manipulated to present a more favorable picture of the company’s nutritional business.

- Inadequate Internal Controls: The lawsuit points to potential weaknesses in ADM’s internal financial controls, which could have allowed for these alleged fraudulent practices to occur undetected.

These allegations, if proven true, could have significant implications not just for ADM, but for the entire agricultural industry. They highlight the critical need for robust financial reporting systems and transparent supply chain disclosures in the sector.

“The Delaware Court of Chancery, established in 1792, is handling a critical case on agricultural fraud allegations.”

The Ripple Effect: Implications for the Agricultural Industry

The ramifications of this derivative lawsuit extend far beyond the courtroom walls of the Delaware Court of Chancery. As we analyze the potential impact, it becomes clear that this case could serve as a watershed moment for the agricultural sector, particularly in areas of corporate governance, financial reporting, and supply chain management.

- Increased Scrutiny of Agricultural Financials: This case is likely to trigger heightened scrutiny of agricultural company financials across the board. Investors, regulators, and stakeholders may demand more rigorous and transparent financial reporting from companies in the sector.

- Enhanced Supply Chain Transparency: The allegations highlight the importance of clear and accurate supply chain disclosures. We may see a push for more detailed and frequent reporting on supply chain operations, especially in complex segments like nutrition.

- Reevaluation of Corporate Governance Practices: The lawsuit could prompt a industry-wide reassessment of corporate governance structures, particularly in how they relate to financial oversight and reporting mechanisms.

- Potential Regulatory Changes: Depending on the outcome, this case could catalyze new regulations or guidelines specific to financial reporting and disclosure practices in the agricultural sector.

- Impact on Investor Confidence: The allegations may shake investor confidence in the agricultural industry, potentially leading to more cautious investment strategies and demands for greater corporate transparency.

Corporate Officer Liability: A Legal Perspective

One of the most significant aspects of this case is its focus on corporate officer liability. The derivative lawsuit targets 17 current and former officers of ADM, bringing to the forefront questions about the extent of personal responsibility in cases of alleged corporate misconduct. This aspect of the case is particularly noteworthy under Delaware corporate law, which is known for its nuanced approach to officer and director liability.

Key considerations in this area include:

- Fiduciary Duty: The lawsuit will likely examine whether the officers in question fulfilled their fiduciary duties to the company and its shareholders.

- Knowledge and Involvement: The court will need to determine the extent of each officer’s knowledge and involvement in the alleged fraudulent accounting practices.

- Business Judgment Rule: This legal principle, which generally protects officers and directors from liability for good faith business decisions, may come into play in the court’s deliberations.

- Potential Personal Liability: The case could set precedents for when and how corporate officers can be held personally liable for company misconduct, especially in cases involving financial reporting and disclosure.

The outcome of this aspect of the case could have far-reaching implications for corporate governance practices not just in the agricultural sector, but across various industries.

The Importance of Accurate Financial Reporting in Agriculture

This case underscores the critical importance of accurate and transparent financial reporting in the agricultural sector. As the industry becomes increasingly complex and globally interconnected, the need for reliable agricultural company financials has never been more paramount. Here’s why:

- Investor Confidence: Accurate financial reporting is essential for maintaining investor confidence in agricultural companies and the sector as a whole.

- Market Stability: Reliable financials contribute to overall market stability, allowing for more informed decision-making by all stakeholders.

- Regulatory Compliance: Proper financial reporting is crucial for meeting regulatory requirements and avoiding legal complications.

- Strategic Planning: Accurate financials are vital for effective strategic planning and resource allocation within agricultural companies.

In light of these factors, companies in the agricultural sector may need to reevaluate their financial reporting practices and strengthen their internal controls to ensure accuracy and transparency.

The Role of Technology in Preventing Fraudulent Practices

As we consider the implications of this case, it’s important to highlight the role that technology can play in preventing fraudulent accounting practices and enhancing transparency in the agricultural sector. Advanced technological solutions can provide more accurate, real-time data and improve the overall integrity of financial reporting and supply chain management.

For instance, blockchain-based traceability solutions can significantly enhance transparency in agricultural supply chains. These systems create an immutable record of transactions and product movements, making it much more difficult to manipulate financial data or engage in fraudulent practices. By implementing such technologies, agricultural companies can not only improve their financial reporting but also build trust with investors, regulators, and consumers.

Additionally, carbon footprinting tools can help agricultural companies accurately track and report their environmental impact. This not only aids in sustainability efforts but also provides another layer of transparency in corporate reporting, which can be crucial in building stakeholder trust.

| Aspect | Details | Potential Impact |

|---|---|---|

| Parties Involved | Archer-Daniels-Midland Co. (ADM) and 17 current/former officers | Precedent for corporate officer liability in agricultural sector |

| Allegations | Fraudulent accounting practices and misleading disclosures in nutrition segment | Increased scrutiny of agricultural company financials industry-wide |

| Legal Jurisdiction | Delaware Court of Chancery | Potential reshaping of corporate law interpretations in agriculture |

| Corporate Governance Issues | Questions about oversight and internal controls | Likely reforms in corporate governance practices across the sector |

| Financial Reporting Concerns | Accuracy and transparency of nutrition segment reporting | Stricter financial reporting standards for agricultural companies |

| Supply Chain Implications | Need for greater transparency in supply chain disclosures | Adoption of advanced traceability technologies in agriculture |

| Potential Outcomes | Damages, corporate reforms, regulatory changes | Far-reaching effects on agricultural industry practices and regulations |

The Way Forward: Ensuring Transparency and Accountability

As the agricultural industry grapples with the fallout from this high-profile case, it’s clear that there’s a pressing need for enhanced transparency and accountability across the sector. Companies must take proactive steps to ensure the accuracy of their financial reporting and the integrity of their supply chain disclosures. Here are some key areas where improvements can be made:

- Strengthening Internal Controls: Companies should invest in robust internal control systems to prevent and detect potential financial irregularities.

- Enhancing Board Oversight: Boards of directors must take a more active role in overseeing financial reporting and risk management processes.

- Implementing Advanced Technologies: Adoption of cutting-edge technologies like blockchain and AI can significantly improve transparency and accuracy in financial reporting and supply chain management.

- Fostering a Culture of Integrity: Companies should prioritize creating a corporate culture that values ethical behavior and transparency at all levels of the organization.

- Regular Audits and Reviews: Frequent, thorough audits and reviews of financial practices can help identify and address potential issues before they escalate.

By focusing on these areas, agricultural companies can work towards rebuilding trust and ensuring the long-term stability and integrity of the sector.

The Role of Technology in Agricultural Transparency

In the wake of this lawsuit, it’s crucial to highlight how technology can play a pivotal role in enhancing transparency and accountability in the agricultural sector. Advanced technological solutions can provide more accurate, real-time data and improve the overall integrity of financial reporting and supply chain management.

For instance, fleet management systems can offer real-time tracking and monitoring of agricultural vehicles and machinery. This not only improves operational efficiency but also provides a clear audit trail for asset utilization and resource allocation, which can be crucial in maintaining transparent financial records.

Similarly, crop loan and insurance solutions that leverage satellite imagery and AI can provide more accurate assessments of crop health and yields. This technology can help prevent fraudulent insurance claims and ensure more transparent lending practices in the agricultural sector.

These technological advancements, when integrated into agricultural operations, can significantly reduce the risk of fraudulent practices and enhance overall transparency in the industry.

Legal Implications and Future Outlook

As this case unfolds in the Delaware Court of Chancery, legal experts and industry observers are closely watching for potential precedents that could reshape corporate liability and governance in the agricultural sector. The outcome of this derivative lawsuit could have far-reaching implications:

- Expanded Officer Liability: The case may result in a broader interpretation of corporate officer liability under Delaware corporate law, potentially exposing officers to greater personal risk in cases of alleged misconduct.

- Stricter Disclosure Requirements: We may see the implementation of more stringent disclosure requirements for agricultural companies, particularly regarding complex business segments like nutrition.

- Enhanced Regulatory Scrutiny: The case could prompt increased regulatory oversight of the agricultural industry, with a focus on financial reporting practices and supply chain transparency.

- Industry-Wide Reforms: Regardless of the outcome, this high-profile case is likely to spur industry-wide reforms in corporate governance, financial reporting, and risk management practices.

As the legal proceedings continue, it’s clear that the ramifications of this case will be felt across the agricultural industry for years to come.

Conclusion: A Watershed Moment for Agricultural Transparency

The derivative lawsuit against ADM in the Delaware Court of Chancery marks a critical juncture for the agricultural industry. It serves as a stark reminder of the importance of transparent and accurate financial reporting, ethical business practices, and robust corporate governance in the agricultural sector.

As we move forward, it’s clear that the industry must embrace change. This includes not only strengthening internal controls and governance structures but also leveraging advanced technologies to enhance transparency and accountability. Companies that proactively address these challenges will be better positioned to thrive in an increasingly scrutinized and regulated environment.

Ultimately, this case underscores the need for a collective effort to uphold the highest standards of integrity and transparency in the agricultural industry. By doing so, we can ensure the long-term sustainability and trustworthiness of this vital sector, benefiting not just investors and stakeholders, but society as a whole.

As we conclude, it’s worth noting that technology companies like Farmonaut are at the forefront of providing solutions that can help agricultural businesses enhance their transparency and efficiency. Through advanced satellite-based farm management solutions, AI-driven advisory systems, and blockchain-based traceability tools, Farmonaut is empowering farmers and agribusinesses to make data-driven decisions and maintain transparent operations.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

FAQ Section

- What is a derivative lawsuit?

A derivative lawsuit is a legal action brought by a shareholder on behalf of a corporation against a third party, often the company’s executives or directors, when it’s believed they have not acted in the best interest of the company. - Why is the Delaware Court of Chancery significant in this case?

The Delaware Court of Chancery is renowned for its expertise in corporate law matters and often handles high-profile business disputes. Its rulings can set important precedents in corporate governance. - What are the main allegations in this lawsuit?

The lawsuit alleges fraudulent accounting practices and misleading disclosures related to ADM’s nutrition segment, potentially inflating its success and profitability. - How could this case impact the agricultural industry?

This case could lead to increased scrutiny of agricultural company financials, enhanced supply chain transparency requirements, and potential regulatory changes in the sector. - What role can technology play in preventing similar situations?

Advanced technologies like blockchain for traceability, AI for data analysis, and satellite-based monitoring can enhance transparency and accuracy in financial reporting and supply chain management in the agricultural sector.

Farmonaut Subscriptions

For those interested in leveraging cutting-edge technology to enhance agricultural operations and transparency, Farmonaut offers a range of solutions:

For developers interested in integrating Farmonaut’s powerful satellite and weather data into their own applications, check out our API and API Developer Docs.