Carajás Mining: 5 Key Infrastructure & Governance Updates

“Carajás hosts the world’s largest iron ore mine, producing over 100 million tonnes annually.”

Introduction: Carajás at the Forefront of Mineral Exploration and Infrastructure Development

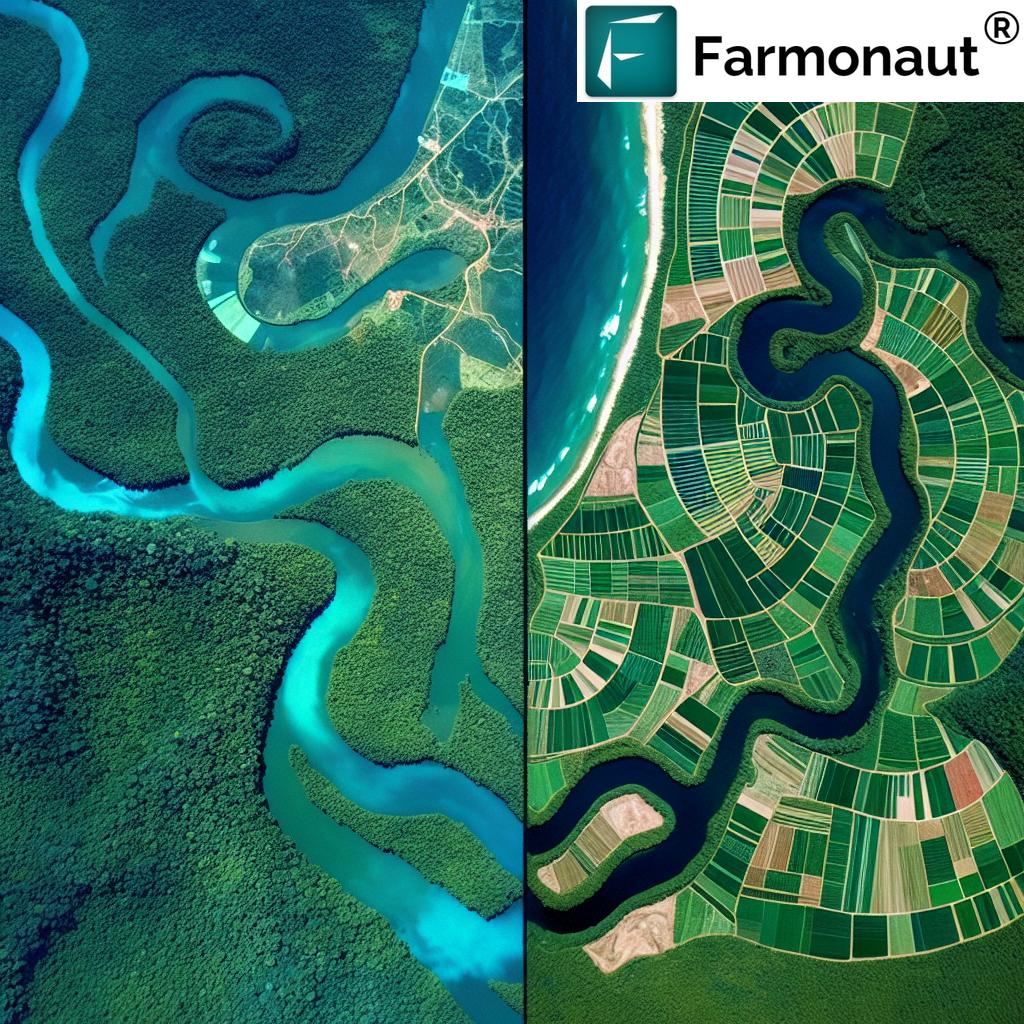

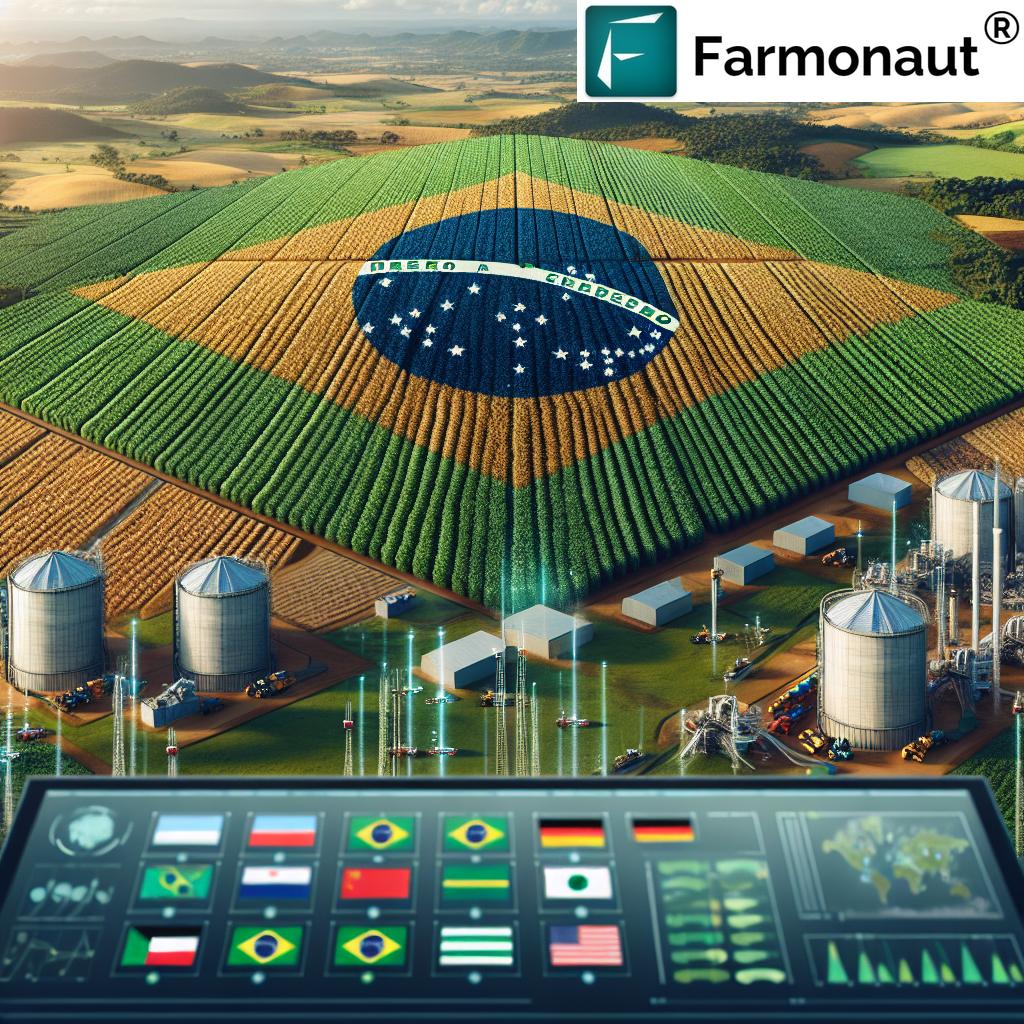

The Carajás region, situated in Pará State, Brazil, stands as a global epicenter for mineral exploration, infrastructure development, and mining investment opportunities. As one of earth’s most prolific mineral provinces, Carajás offers abundant reserves of iron, copper, nickel, and platinum group metals (PGM). This makes it a magnet for companies seeking to capitalize on high-grade, scalable natural resource assets. In light of recent regulatory, environmental, and management updates—especially those pertaining to Bravo Mining Corp. and its flagship Luanga Project—we are witnessing a transformation in how resources are governed, extracted, and commercialized.

In this blog post, we present a comprehensive review of five pivotal infrastructure and governance milestones now shaping the Carajás landscape. Drawing from the latest market disclosures, stakeholder updates, and regulatory announcements, we analyze these changes through an industry-focused lens—perfect for investors, analysts, and resource management professionals looking to understand the region’s trajectory in 2025 and beyond.

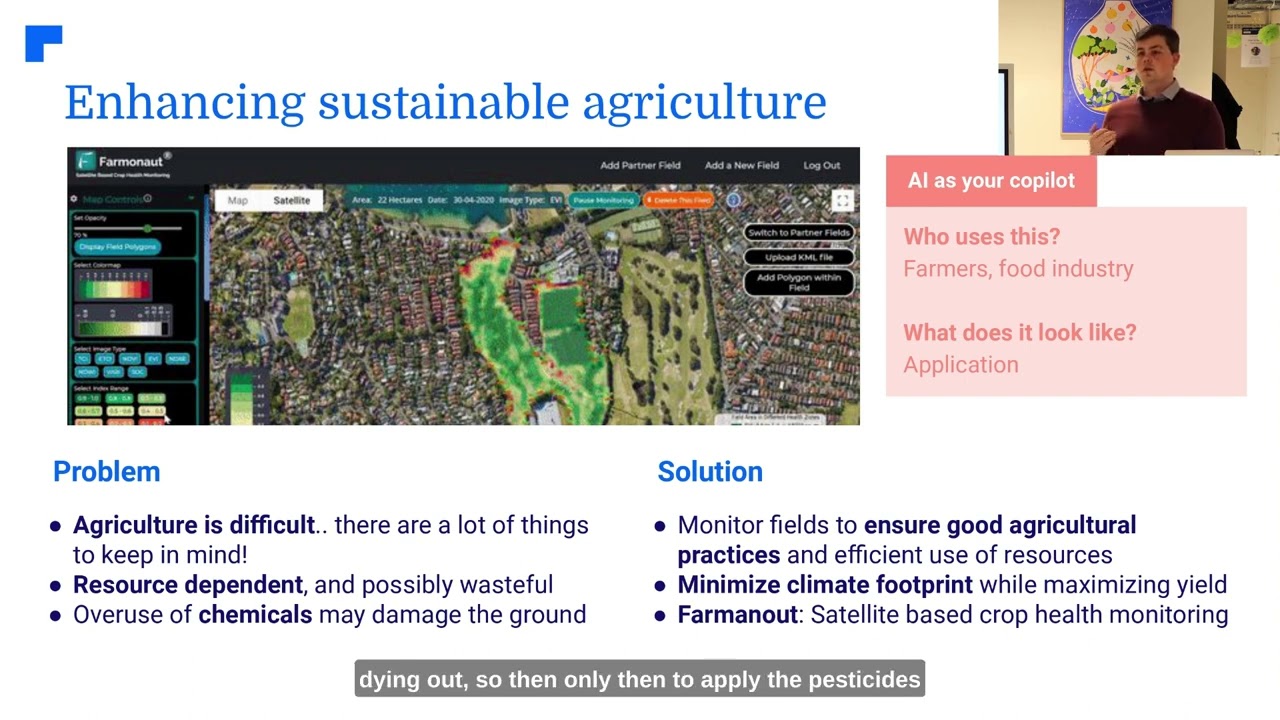

Access real-time farm monitoring, carbon footprint tracking, and advanced advisory tools with Farmonaut smartphone app—enabling sustainable and optimized agricultural and land management for large infrastructure projects. API access is available here, with technical docs at Farmonaut API Developer Docs.

Carajás Mineral Exploration: Regional Context and Strategic Significance

Nestled in the heart of Pará State, the Carajás Mineral Province has long formed the backbone of Brazil’s resource-driven economy. Over the decades, this prolific mining district—home to the largest iron ore mine globally—has attracted both domestic and international attention. The region’s key attributes include:

- Abundant, High-Quality Deposits: Carajás boasts robust reserves of iron, copper, gold, nickel, and PGMs, making it a priority target for resource expansion and new project development.

- Strategic Infrastructure: The area features extensive road, rail, and port facilities, all necessary for moving minerals to export and industrial hubs—further supported by reliable hydroelectric power from the Amazon Basin dams.

- Industry Expertise: Carajás hosts a mining-experienced workforce, robust research collaborations, and progressive regulatory institutions that encourage responsible natural resource management.

As we proceed, our deep dive unpacks why Carajás is the locus of major mining investment opportunities in Brazil and how its evolving governance adds confidence for institutional and retail stakeholders alike.

“Brazil’s mining sector attracted $40 billion in infrastructure investments between 2018 and 2023, boosting Carajás development.”

5 Key Carajás Infrastructure & Governance Updates

In 2025, Bravo Mining Corp.—a prime player in Carajás and listed on the TSX Venture Exchange (TSXV) and OTCQX—announced several significant developments. These updates reflect not only advances in physical infrastructure, but also in corporate governance, asset management, and capital markets best practices. Here we detail the 5 most impactful updates that shape mining prospects and strategic planning for investors and stakeholders:

1. Appointment of Ms. Margot Naudie: Enhancing Board Governance & Audit Oversight

Bravo Mining Corp. has bolstered its public and private board governance by appointing Ms. Margot Naudie—a seasoned capital markets professional with extensive global investment, audit, and ESG leadership experience. Her background includes senior roles at major Canadian asset managers and an educational pedigree spanning Political Science, Economics (McGill University), and an MBA (Ivey School of Business). As Audit Committee Chair, Ms. Naudie will leverage her skillset in capital markets advisory services, financial risk management, and strategic oversight. This is a textbook example of strengthening stewardship and independence in natural resource firms seeking a competitive edge.

- Impact: Improved audit, ESG, and HR oversight, instilling additional confidence in operational transparency and financial reporting for global investors.

- Strategic Value: Her past recognition as a Brendan Wood Top Gun (Platinum) for multiple years underscores the broad range and depth of expertise now accessible to Bravo’s board and shareholders.

2. Successful Technical Succession: Mr. Stuart Comline’s Advisory Transition

The planned retirement of Mr. Stuart Comline—original director and acclaimed technical leader for Bravo—ushers in a new advisory capacity, ensuring continued knowledge transfer. Mr. Comline’s experience in PGM and nickel exploration was vital to Bravo’s acquisition and development of the Luanga Project. His newly formalized advisory role keeps his proven insights close, providing institutional memory as Bravo navigates new project phases.

- Strategic Impact: Succession with technical continuity ensures consistent project execution and risk mitigation, a best practice in evolving natural resource management.

- Investor Relevance: Investors benefit from ongoing access to specialized guidance, reducing uncertainty during leadership transitions.

3. Preliminary Licence Granted for Luanga Project (2025): Regulatory Milestone

The 2025 granting of the preliminary licence for Bravo’s Luanga PGM+Au+Ni Project marks a transformative stage. This regulatory nod follows robust environmental, technical, and social reviews—showcasing alignment with Brazil’s progressive resource management laws and environmental stewardship.

- Infrastructure Development in Para State: The approved project is ideally sited with direct access to paved roads, rail lines connecting to Atlantic ports, and is powered by reliable, low-cost hydroelectric power.

- Business Significance: The licence paves the way for expansion in mining investment opportunities Brazil, attracting joint ventures, financing, and public offerings.

4. Updated Mineral Resource Estimate: Scale, Grade, & Growth Potential

In February 2025, Bravo Mining’s updated Mineral Resource Estimate reported gains in both project tonnage and grade for the Luanga Project. Such an increase solidifies the project’s place among global frontrunners in PGM and nickel exploration. These metrics directly support expanded feasibility, improved operational models, and attractiveness for new capital markets entrants.

- Access Benefits: The site’s shallow depth—amenable to open pit extraction—reduces cost and enhances project economics.

- Infrastructure: The proximity to road and rail access for mining projects and to industrial ports expedites logistics.

5. ESG and Social Initiatives: Workforce, Local Engagement, & Reforestation

ESG (Environment, Social, Governance) priorities are embedded in Bravo Mining’s Carajás operations:

- Local Employment: The recruitment and contracting of workers from adjacent communities increase socio-economic benefits, reducing workforce volatility and ensuring knowledge remains in the region.

- Environmental Stewardship: Over 35,000 high-value trees are being planted in reclamation and buffer zones—an initiative aligned with global sustainability standards and carbon footprinting best practices.

These steps not only strengthen the company’s public and private board governance profile, but also reflect market demand for low-impact, community-positive projects.

Infrastructure & Governance Milestone Summary Table

| Milestone/Update | Estimated Completion Date | Stakeholder(s) Involved | Investment Estimate | Strategic Impact |

|---|---|---|---|---|

| Appointment of Ms. Margot Naudie (Audit, Board Governance) | Q2 2025 | Bravo Mining Corp.; Public & Private Boards | $0.5M (Board Costs, Options) | Strengthens audit & governance, boosts market confidence |

| Technical Advisory Transition: Stuart Comline | Q2 2025 | Bravo Mining Corp.; Technical Committee | $0.2M (Advisory Compensation) | Maintains technical leadership, risk reduction |

| Luanga Project Preliminary Licence Granted | Q1 2025 | Bravo Mining Corp.; Regulatory Bodies; Local Authorities | $5M (Permitting & Compliance) | Accelerates project development; unlocks investment rounds |

| Updated Mineral Resource Estimate | Q1 2025 | Bravo Mining Corp.; Geology Team | $1M (Exploration, Resource Modeling) | Elevates asset value, attracts new market entrants |

| ESG & Social Initiatives (Workforce, Reforestation) | 2025 Ongoing | Bravo Mining Corp.; Local Communities | $1.5M+ (ESG Activities, Tree Planting) | Enhances sustainability, secures community license-to-operate |

Trends in Resource Management and Mining Investment Opportunities in Brazil

The Carajás region, as exemplified by Bravo Mining’s strategic actions, stands at the intersection of global natural resource management and mining investment opportunities Brazil. Several industry trends now shape the capital allocation, project development, and stakeholder expectations in the area:

- Integrated Infrastructure Solutions: The synergistic development of road, rail, and hydroelectric power links drastically reduces operating costs while supporting ESG-aligned logistics.

- Focus on Board Expertise and Audit Quality: Investors, especially in the capital markets and stock exchange environments (TSX Venture, OTCQX), are prioritizing companies with robust governance, independent audit, and a broad range of international business knowledge.

- Expansion of Asset Management Practices: New methods in resource estimation, risk modeling, and environmental forecasting help firms unlock higher asset valuations and enable accurate disclosures, crucial in high-profile exchanges.

- Rise of ESG Metrics: Resource companies—including Bravo—must now demonstrate measurable impacts in carbon footprint reduction. Tools like Farmonaut’s Carbon Footprint Tracking support both mining and agricultural operations in achieving these new regulatory and market standards.

Companies operating in Carajás or other large-scale infrastructure environments can benefit from Fleet Management and Traceability solutions by Farmonaut. These solutions empower resource managers to efficiently oversee machinery logistics, automate compliance, and improve transparency across value chains.

Strategic Project Leadership: Board Governance & Capital Markets Expertise

The public and private board governance structure implemented at Bravo Mining is a key differentiator in Carajás. The diversity and education of its board—combining backgrounds in political science, economics, and MBA-level business management—equips Bravo to anticipate risks, pivot to market opportunities, and satisfy stringent regulatory and exchange requirements. The company’s 2025 board composition features:

- Independent Audit and Compensation Oversight: Led by professionals like Ms. Naudie, who bring global capital markets advisory services skills, audit rigor, and a reputation for stewardship.

- Stock Option Programs for Directors: Bravo’s board has approved a grant of 150,000 incentive stock options, aligned with long-term performance and governance innovations—key for attracting and retaining world-class board talent.

- Succession Planning: Technical transitions are planned and executed to retain advisory capacity, ensuring that domain knowledge informs future investment and operational decisions.

Such frameworks facilitate the smooth evolution of leadership, critical when navigating the volatility of frontier mining and resource development markets.

For organizations seeking to comply with ESG mandates and monitor greenhouse gas emissions, Farmonaut’s Carbon Footprinting solution offers scalable and verifiable tracking using satellite data and AI modeling. This service is especially useful for firms who need timely, credible carbon reporting across landscapes undergoing rapid development.

ESG, Environmental Innovation, & Social Commitment in Carajás

The push for responsible, forward-thinking resource management in Carajás is best illustrated by Bravo’s deep focus on:

- Workforce Localization: Prioritizing local employment fosters social stability, builds community trust, and reduces operational friction.

- Tree Planting & Biodiversity: Planting 35,000 high-value trees assists in land rehabilitation, carbon absorption, and maintaining Brazil’s ecological richness. This aligns directly with international sustainability principles.

- Open, Digital Governance: Operating in a transparent manner—bolstered by routine board audits—enhances legitimacy not only for investors, but for governments, NGOs, and the local population.

Such approaches are increasingly expected by financiers, government agencies, and end-user markets, making them intrinsic to both project viability and social license-to-operate in modern mining.

Natural resource managers and investors can take advantage of satellite-based verification services by Farmonaut to validate land and crop data for environmental, loan, or insurance purposes—streamlining compliance and reducing fraud risk.

For large-scale mining and agriculture projects, Farmonaut’s Large Scale Farm Management tools provide an integrated dashboard for real-time, remote supervision of vast areas, aiding in logistics planning, ESG assurance, and yield/risk analytics.

Farmonaut: Satellite Technology Empowering Mining & Agriculture in Carajás

While Bravo Mining Corp. advances the frontiers of mineral exploration and infrastructure development in Para State, digital innovation is equally transforming agricultural and environmental monitoring. Farmonaut—an agricultural technology leader—offers tools highly relevant for both land managers and mining project owners looking to optimize resource allocation and meet regulatory standards. Some core offerings include:

- Satellite-Based Crop & Land Health Monitoring: Delivers multispectral analytics for identifying vegetation stress, planning reforestation, or tracking surface changes before, during, and after site development.

- AI-Based Advisory and Reporting: The Jeevn AI system enables real-time advice for field managers and oversees critical inputs such as moisture, weather, and nutrient levels.

- Blockchain-Based Traceability: Guarantees transparency and provenance—from seed or mineral extraction to end-user—an advantage for compliance-driven supply chain participants.

- Fleet, Resource, and Carbon Footprint Management: Comprehensive oversight over assets, vehicles, and emissions—features critical for projects navigating complex logistics and strict ESG requirements.

We invite stakeholders to explore Farmonaut’s Traceability Solution for end-to-end resource authenticity and Fleet Management for optimizing vehicles on large mining and agricultural sites.

Frequently Asked Questions (FAQ)

-

What makes Carajás attractive for mining investment opportunities in Brazil?

Carajás combines world-class mineral reserves with a mature, mining-experienced workforce, access to road and rail for mining projects, reliable hydroelectric power, and a track record of progressive resource management. These factors collectively reduce project risk and boost investment potential. -

How does board governance impact mining companies in Carajás?

Firms with experienced, diverse boards—emphasizing independent audit and ESG oversight—are better positioned to attract capital, manage regulatory requirements, and develop sustainable, community-supported assets. -

What are the benefits of using satellite-based management tools in mining and agriculture?

Satellite data enables real-time monitoring of land, crop, or reclamation progress. This supports compliance, risk management, yield optimization, and transparency for both investors and regulators. -

How are carbon emissions managed in Carajás mining projects?

Companies increasingly use AI and satellite tools, such as carbon tracking by Farmonaut, to measure and reduce carbon output. Initiatives like tree planting also help offset emissions and demonstrate sustainability. -

What steps do companies like Bravo Mining Corp. take to engage local communities?

Through local hiring, contracting, and environmental restoration—such as tree planting—companies can maximize shared value, lower operational conflicts, and meet social governance goals. -

Are ESG and audit reforms here to stay in the global mining sector?

Absolutely. Both institutional and retail investors now include audit quality and ESG performance as top selection criteria, especially for companies operating in high-visibility resource provinces like Carajás.

Conclusion: Carajás and the Future of Mining Infrastructure, Investment & Governance

As the mining world’s attention focuses on Brazil—and Carajás in particular—we see a convergence of mineral exploration opportunity, cutting-edge infrastructure development in Para State, and natural resource management excellence. Bravo Mining Corp.’s 2025 updates demonstrate how a blend of technical prowess, robust board governance, strategic ESG, and partnership with a mining-experienced local workforce can catalyze both sustainable growth and capital attraction in a competitive, global market.

For stakeholders across the mining and agricultural spectrum, digital platforms like Farmonaut are essential tools—providing satellite-enabled insights, carbon tracking, and full-scope traceability that future-proof operations against regulatory, financial, and operational risks.

The path forward in Carajás is shaped by investment in people, infrastructure, and technology—ultimately delivering value to shareholders, communities, and the planet. Join us as we continue to monitor and engage with this iconic province at the heart of modern, responsible resource development.