Toronto Annual Financial Filings: 5 Key Compliance Trends for 2025

Introduction

Why 2025 Is a Pivotal Year for Toronto Annual Financial Filings

As we look ahead, 2025 stands out as a transformative year for annual financial statements and compliance requirements in Toronto, Ontario. With the rapid convergence of evolving Canadian securities regulations, increasing adoption of biotechnologies for the remediation of contaminated soils, and stricter enforcement from the British Columbia Securities Commission, companies face an era of heightened responsibility and transparency.

This blog post breaks down the top compliance trends, the regulatory landscape, the integration of new technologies in business filings, and the strategic implications for management and listed companies in the Toronto market.

From filing requirements for Canadian listed companies to the inclusion of forward-looking statements in finance, our aim is to provide an authoritative overview, grounded in the latest developments impacting finance, law, agriculture, and technology sectors in Toronto and beyond.

Overview: Toronto Annual Financial Filings & Canadian Securities Regulations

Every year, Toronto-listed companies must complete a rigorous process of preparing and submitting their annual financial statements, management discussion and analysis (MD&A), and the related certifications. Rooted in both Canadian securities regulations and regional rules—such as those of the British Columbia Securities Commission—these filings play a critical role within the wider finance ecosystem.

The annual filings provide a comprehensive view of a company’s financial position, business events, proposed changes, and performance for investors, regulators, and the broader market. In sectors like mineral exploration and development, accurate and timely financial filings are especially crucial due to heightened risk and constant technological innovation, notably in remediation of contaminated soils and agriculture-related business models.

The breadth and depth of what is disclosed—ranging from historical performance to forward-looking expectations—means that these compliance trends shape more than just financial reporting: they influence market perception, access to the CSE (Canadian Securities Exchange), and potentially the very business direction of Toronto firms.

5 Key Compliance Trends for 2025 in Toronto Annual Financial Filings

The landscape for annual financial statements is shifting quickly. Based on the latest regulatory guidance and market analysis, we have identified five pivotal trends every management-driven company should be aware of:

- Timeliness and Automation of Filings

- Expanded Biotechnological & Environmental Disclosure

- Management Discussion Expansion: More Actionable Insights

- Forward-Looking Statements Scrutiny

- Integration of Climate, Agriculture & Remediation Reporting

1. Timeliness and Automation of Filings

Meeting the prescribed filing deadlines for annual financial statements and related management certifications has always been a cornerstone of compliance for Canadian listed companies. However, the expectation for zero-tolerance delays is tightening.

- Regulators, such as the British Columbia Securities Commission, are poised to enact instant cease trade orders in cases of missed deadlines, with Toronto companies like Pedro Resources Ltd. providing clear recent examples.

- Automation and digitalization are being adopted to streamline the process, reduce human error, and enhance data integrity within filings. This is becoming the norm, not the exception, for compliance teams.

2. Expanded Biotechnological & Environmental Disclosure

As biotechnologies for remediation of contaminated soils and sustainable agricultural practices become central to operational strategies, regulators are mandating more rigorous environmental disclosures. In 2025, the annual statements must now include:

- Detailed reporting on biotech research, development, and deployment—especially for companies exploring a change of business toward technology-enabled remediation or reclamation of contaminated soils.

- Metrics demonstrating environmental performance, including carbon footprint and the adoption of advanced carbon footprinting technology for monitoring emissions and meeting regulatory requirements.

Companies like Pedro Resources Ltd.—with proposed shifts toward biotechnologies for soil remediation—are emblematic of this trend.

3. Management Discussion Expansion: More Actionable Insights

The management discussion and analysis (MD&A) section has evolved from a compliance formality to a crucial investor relations tool. For 2025:

- MD&A is expected to clearly articulate management’s expectations of market dynamics, the rationale behind any proposed changes in business direction, and detailed reporting on the company’s performance within the context of environmental and technological innovation.

- Reports should include specific risk assessments, strategies for resource allocation, and transparent discussion of any significant business events or changes since the last reporting period.

This extension provides investors and regulators with actionable insights into company trajectories, aligning with stricter traceability requirements for operational integrity.

4. Forward-Looking Statements Scrutiny

Forward-looking statements in finance have always been a double-edged sword: offering strategic vision, but under increased scrutiny from securities commissions. Expect 2025 filings to require:

- Explicit delineation between historical financial performance and management’s future expectations, with cautionary statements fulfilling applicable securities laws criteria.

- Clear identification of inherent business risks associated with forward-looking information, especially when discussing new technology, mineral exploration and development, or changes in core business models.

This ensures reasonable expectations are established for market participants and upholds regulatory integrity for Toronto-listed companies.

5. Integration of Climate, Agriculture & Remediation Reporting

The intersection of agriculture, environmental technologies, and financial reporting is more relevant than ever. Companies—particularly with exposure to mineral exploration or soil remediation—are tasked with more granular annual reporting across these vectors:

- Detailed analysis of resource utilization, including fleet management technology in sustainable logistics and large scale farm management tools for environmental stewardship.

- Reporting on innovation within biotechnologies for soil remediation, reclamation technology deployments, and climate adaptation strategies in annual filings.

Annual Compliance Trends Comparison Table

| Compliance Trend | 2024 Estimated Adoption Rate (%) | 2025 Projected Adoption Rate (%) | Relevance to Biotechnologies | Regulatory Impact Level |

|---|---|---|---|---|

| Timely Filing | 92% | 97% | Indirect | Critical |

| Biotechnological Reporting | 54% | 81% | Direct | High |

| Management Discussion Updates | 75% | 98% | Indirect | Medium |

| Forward-Looking Statement Rigor | 82% | 89% | Direct | High |

| Integration of Agri/Remediation/Climate Data | 60% | 84% | Direct | Extremely High |

Biotechnologies for Remediation: New Compliance Pillars in Annual Financial Statements

The Canadian listed company space is experiencing a biotech-driven revolution, especially in mineral exploration and development and environmentally sensitive sectors. Innovations in biotechnologies for soil remediation are reshaping what companies must report:

- Contextual Compliance: When a company proposes a change in business direction—such as Pedro Resources Ltd.’s move toward biotech remediation and reclamation of contaminated soils—filings must reflect the research, anticipated performance, and regulatory approval sought for new technologies.

- Disclosure of Biotech Initiatives: Detailed descriptions of R&D, pilot projects, and field deployments in reclamation technologies, with clear identification of environmental and financial risks.

- Environmental Impact Data: Companies are required to supply measurable outcomes of technological adoption, including effects on emissions, soil quality, and resource usage.

- Carbon Footprint Reporting: Use of carbon footprinting technology platforms is increasingly required for real-time tracking and reporting—elements now routinely reviewed in annual filings.

For both Toronto- and Ontario-based companies, the regulatory bar is higher: comprehensive disclosures fulfill both market obligations and stakeholder expectations for transparency.

These evolving standards give investors and regulators greater insight into business value, business risks, and the sustainability credentials of issuers, ensuring that forward-looking statements in finance related to biotech or environmental remediation are properly grounded in evidence and reasonable expectation.

Transparency: Canadian Securities Regulation, Management Filings & Forward-Looking Statements

The Critical Role of Annual & Management Filings

Maintaining clear, accurate, and timely filings protects both companies and investors. Let’s explore core compliance obligations under Canadian securities regulations, especially those impacting companies listed on the CSE in Toronto and Ontario:

- Annual Financial Statements: Comprehensive, audited statements are the gold standard for performance evaluation. Regulators require these to be coupled with explanations for any variances—especially if business changes or technological adoptions are involved.

- MD&A Updates: At least three key management discussion and analysis filings are required annually, offering a transparent account of business events, market-driven changes, risk factors, and the company’s strategy.

- Management Certifications: Certifications from directors and officers validate the accuracy, completeness, and compliance with the applicable laws of all filings. Any deficiencies trigger escalation with the CSE and may provoke market regulator enforcement.

- Insider Trading Black-Outs: When filing deadlines are missed, as seen in Pedro’s recent notice, management and company insiders are immediately subject to trading restrictions. Adherence to these protocols is strictly enforced.

Forward-Looking Statements: Mitigating Risk & Building Confidence

In 2025, every forward-looking statement in filings must be explicitly qualified and carry a risk disclosure tailored to company-specific and industry-unique contexts. This is particularly crucial when reporting on:

- Anticipated adoption of remediation or reclamation technology in contaminated soils and farming contexts.

- Expected outcomes from shifts toward more sustainable, technology-driven business models.

- Performance benchmarks for technology-enabled operational transformation—such as real-time satellite monitoring in resource management or blockchain-based traceability for reporting value chain risk.

Readers are consistently cautioned not to place undue reliance on projections unless supported by reasonable, well-documented assumptions.

Filings Process, Timelines & the Role of the British Columbia Securities Commission

Toronto’s financial and resource-intensive companies must plan annual filings and certification processes months in advance, as the consequences of delay have never been more significant.

- Prescribed Deadlines: Every Canadian listed company is required to file annual financial statements, MD&A, and certifications within strict timelines (typically by April 30 for a December 31 year-end).

- Consequences of Delay: Companies like Pedro Resources Ltd. may face immediate cease trade orders from the British Columbia Securities Commission. This blocks insider transactions and can erode both market and shareholder confidence.

- Best Practices: Automating data aggregation and validation, implementing advisory systems, and using digital APIs can dramatically improve compliance reliability and streamline resource management, reducing risks of non-compliance.

The emergence of sustainability-driven business models and technology-powered agriculture and remediation puts further focus on the need for robust, transparent, and adaptable compliance systems.

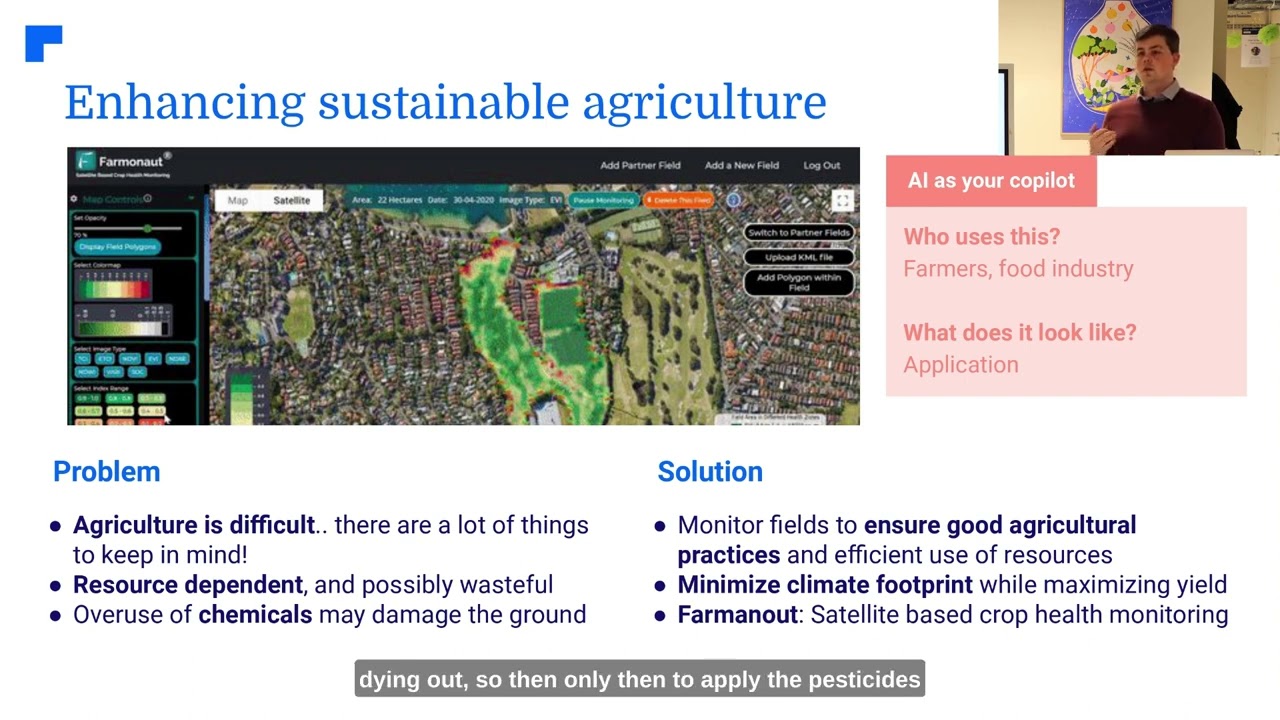

Farmonaut: Advancing Compliance and Business Change Through Precision Agriculture & Technology

In the evolving compliance landscape, technology is reshaping how companies approach annual financial statements and regulatory disclosures. Farmonaut is an agricultural technology company leveraging satellite imagery, AI, and blockchain to deliver actionable data and transparency across the value chain.

Farmonaut’s Technologies Supporting Compliance and Sustainable Reporting

- Satellite-Based Crop Health Monitoring: Using multispectral satellite imagery, Farmonaut helps agri-businesses and management teams monitor crop health, soil moisture, and field variability. These insights provide an auditable basis for environmental disclosures in annual financial statements and support resource management compliance under Canadian regulations.

- AI-Powered Advisory (Jeevn): Farmonaut’s Jeevn AI system analyzes field data and generates actionable management advisories, which companies can include in MD&A disclosures to demonstrate data-driven resource allocation and risk mitigation.

-

Blockchain-Based Traceability: By documenting every step in products’ journeys, Farmonaut’s

traceability solutions support improved regulatory reporting, enhance market confidence in sustainable sourcing, and fulfill transparency requirements in annual and management filings. - Carbon Footprinting: With real-time carbon emission data, companies can meet new climate reporting mandates in financial filings. Learn more about this solution here.

- Fleet & Resource Management: Farmonaut’s resource optimization tools enable companies to minimize operational risk, maximize compliance, and manage reporting of transportation and agricultural machinery use. This IT backbone is integral for responsive reporting under Canadian securities laws.

-

API Integration: Companies and developers can access Farmonaut data directly through

Farmonaut’s API and review the

developer documentation

for integrating real-time field, weather, and compliance data into proprietary systems and regulatory workflows.

Farmonaut’s Value Proposition for Annual Filing Compliance & Resource Management

Our mission is to empower Canadian listed companies and agribusinesses to achieve cost-effective, compliant, and transparent operations by integrating advanced technology into everyday management. Key benefits include:

- Minimized resource wastage and demonstrable progress in sustainable farming and soil remediation—critical for annual reporting and market disclosures.

- Seamless supply chain traceability for consumer-facing agriculture and textile brands—meeting the highest standards in company, management, and financial filings.

- Support for loan and insurance reporting: Satellite-driven verification enhances the credibility of crop loan and insurance applications, reducing fraud while improving financing access for stakeholders.

- Scalability: Solutions serve individual farmers, large farming operations, government stakeholders, and listed companies.

For organizations aiming to develop their in-house compliance and digital transformation frameworks, Farmonaut’s robust API access and frequent data updates stand as a pillar for transparent and auditable resource management in business filings.

Discover the full power of Farmonaut’s advanced technology and subscription offerings below:

FAQ: Toronto Annual Financial Filings & Compliance Trends

1. What happens if a Toronto-listed company misses the annual financial statement filing deadline?

If a company fails to meet its filing requirements for Canadian listed companies, securities regulators such as the British Columbia Securities Commission may issue an immediate cease trade order. This blocks trading by management and insiders until compliance is achieved, and can damage investor confidence.

2. Why are biotechnologies for remediation and reclamation important in 2025 filings?

Biotechnologies for soil remediation have become central due to evolving environmental regulations, market expectations, and the need for sustainable operations in the mineral exploration, farming, and resource sectors. Disclosure of these technologies, their impact, and related risks is now a key part of annual and management filings in Toronto and beyond.

3. What are forward-looking statements in annual filings, and why are they critical?

These are statements regarding anticipated events or performance, outside of historical financial data. In 2025, forward-looking statements in finance must be qualified, supported by reasonable expectations, and clearly disclose business risks, particularly when relating to new business models or technologies.

4. How can technology support compliance with Canadian securities regulations?

Modern technologies—such as those offered by Farmonaut—help automate resource monitoring, supply chain traceability, and environmental performance tracking. This enables companies to generate accurate filings, reduce compliance risks, and respond quickly to regulator and market requirements.

5. What is the role of management in compliance trends for 2025?

Management’s primary role is to ensure timely and truthful disclosure in filings, actively communicate risk, and champion the adoption of innovative tools—like resource management, traceability, and compliance APIs—that support accurate reporting, risk minimization, and sustainable growth.

Conclusion & Resources: Embracing the Compliance and Technology Nexus

As Toronto-listed companies navigate 2025, the intersection of compliance, technology, and sustainable business practices has never been so critical. The evolving expectations under Canadian securities regulations—from annual financial statements and expanded management filings to biotech and environmental reporting—demand a proactive, tech-powered approach.

Leveraging platforms like Farmonaut ensures that companies, agribusinesses, and management teams are equipped to exceed market and regulator expectations. With robust tools for crop health monitoring, resource tracking, traceability, and climate reporting, our solutions empower all levels of the agriculture and resource sectors across Ontario, Toronto, and the wider Canadian market.

For a future-ready compliance framework, explore our platform:

- Farmonaut Web App & Mobile: Access precision agriculture, real-time crop, and resource management solutions from any device.

- Carbon Footprinting: Track, analyze, and report on your carbon footprint for regulatory and investor filings.

- Blockchain Traceability Solutions: Ensure transparency and compliance in your supply chain disclosures.

- Crop Loan and Insurance Verification: Enhance document authenticity for agricultural finance filings.

- Large Scale Farm Management App: Optimize monitoring and compliance in vast agricultural operations.

Stay ahead of compliance trends—start your journey with Farmonaut for a seamless and transparent future in annual financial statements and business development reporting.