Cannabis Growers of Canada: 8 Powerful Trends Shaping 2024

Since the groundbreaking cannabis legalization 2018, the Canadian cannabis industry has embarked on a remarkable journey. The transformation from a strictly regulated medical regime to a dynamic legal recreational market has significantly altered the nation’s agricultural landscape. As one of the first countries to fully legalize cannabis for adult use, Canada stands as a beacon of innovation and adaptation in global cannabis cultivation.

In this in-depth analysis, we explore how cannabis cultivation in Canada has evolved since 2018, highlighting changing regulatory frameworks, economic impact, ongoing challenges, and industry adjustments that collectively define the sector today. We also unveil 8 powerful trends set to shape the trajectory of Canada’s cannabis cultivation in 2024 — providing growers, investors, regulators, and consumers with a data-driven outlook.

Historical Context and Legal Framework

From Limited Medical Use to Nationwide Legalization

Before October 2018, cannabis cultivation in Canada was strictly limited to medical purposes. Under highly controlled regulations, a small segment of producers held licenses to grow plants for patients with doctor-prescribed access. This system, while groundbreaking on a global scale, remained narrow in scope and often challenging for stakeholders due to limited scale and strict oversight.

The Passage of the Cannabis Act

In October 2018, Canada became the second country globally (after Uruguay) to legalize cannabis for recreational use. The Parliament passed the Cannabis Act, a landmark legislation aimed at:

- Providing safe legal access for adults

- Protecting public health and safety

- Eliminating profits for the illicit market and organized crime

- Limiting youth exposure to cannabis

This comprehensive framework encompassed the entire cannabis supply chain, including cultivation, processing, distribution, and sale. It revolutionized the industry by enabling broad participation, investment, and regulatory oversight.

Each province and territory was given authority to adapt elements of the laws, resulting in a patchwork of regulations that reflect the diversity of Canadian society, geography, and political attitudes.

Regulatory Landscape and Cannabis Licenses in Canada

The Canadian cannabis industry operates under robust cannabis regulations Canada. Participation in the legal market requires obtaining appropriate federal cannabis licenses Canada, governed by Health Canada, with additional regulations at the provincial and municipal levels.

Core Cannabis Licenses for Legal Activities

- Cultivation Licenses:

- Micro-cultivation licenses—for small-scale growers, capped at 200 m² (approx. 2,153 square feet) of canopy space.

- Standard cultivation licenses—for larger operations, often associated with industrialized production facilities.

- Nursery licenses—for producing cannabis seeds and starter plants.

- Processing Licenses: Mandatory for converting raw cannabis into products such as dried flower, edibles, extracts, and concentrates.

- Sale/Retail Licenses: Supervise legal points of sale to consumers, with each province and territory developing distinct models for retail operations.

Beyond federal rules, provinces and territories may implement additional restrictions on:

- Legal age limits (typically 18 or 19 years)

- Individual possession amounts (up to 30g in most jurisdictions)

- Home cultivation rules and plant count (e.g., Quebec and Manitoba prohibit non-medical home grow; others permit up to four plants per household).

For detailed licensing requirements, see official government guidance on cannabis industry licenses.

Economic Impact of the Cannabis Industry

The economic impact of cannabis industry in Canada has been significant and multi-dimensional. Since the legalization of recreational sale in 2018:

- The sector contributed an estimated $43.5 billion to Canada’s GDP by 2022.

- Over 98,000 jobs have been created across the supply chain—from cultivation and processing to retail and logistics.

- The government has generated more than $15 billion in tax revenue from the industry.

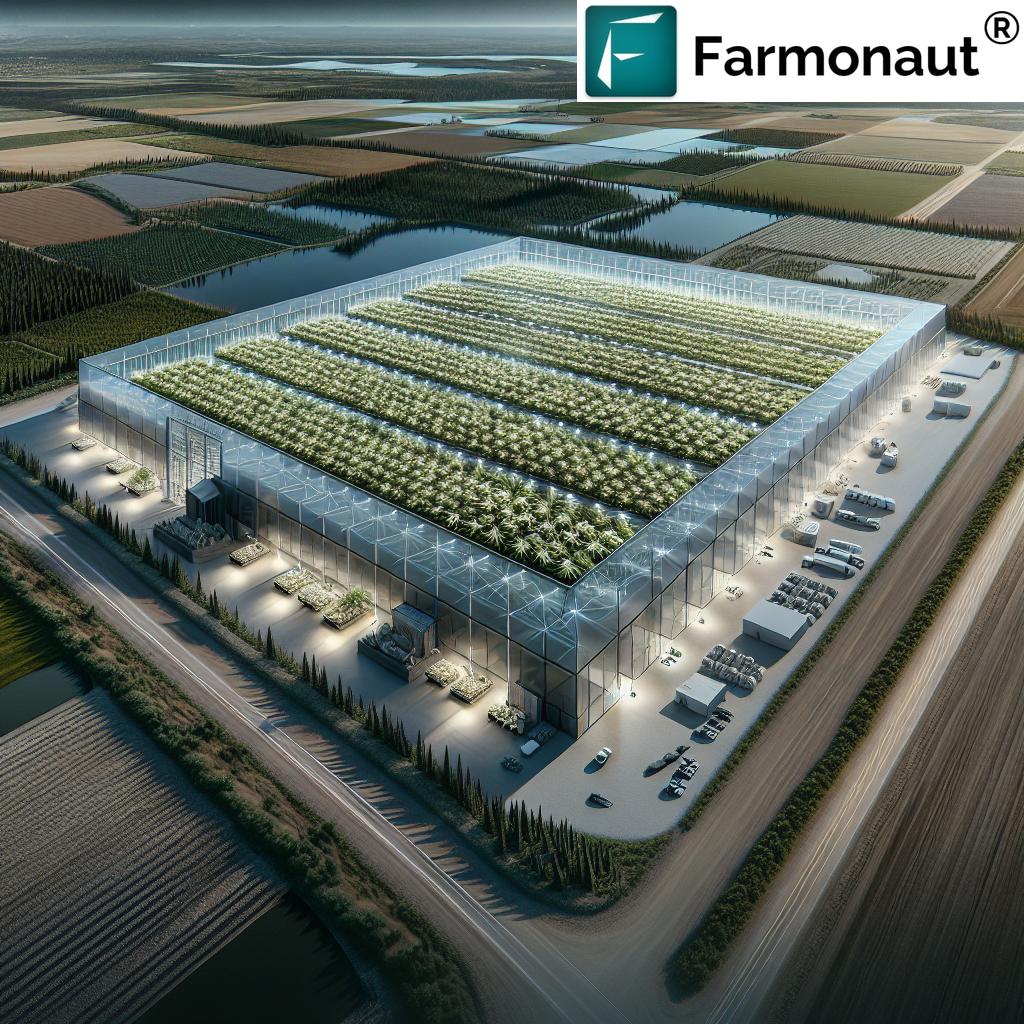

- Sizable investment has flowed into production facilities, with major sites such as the Delta 3 Greenhouse in British Columbia (spanning 1.1 million square feet) and Tweed Farms in Ontario (expanding to 1 million square feet).

This growth extends beyond immediate cannabis supply to agricultural, forestry, and ancillary sectors (security, packaging, real estate, legal, and consulting services). Canada’s success story is also driving global investment interest and policy innovation.

Farmonaut offers valuable tools for cannabis growers Canada and agri-businesses looking to optimize resource management and sustainability. For instance, with the Fleet Management module, businesses can efficiently schedule and track movement of goods and personnel across vast greenhouse zones, enhancing operational productivity and reducing fuel costs.

Industry Challenges and Market Adjustments

Overproduction and Market Pressure

Despite rapid growth and sizable investments, the Canadian cannabis industry has not been without its challenges. Many licensed producers, eager to scale, swiftly built vast indoor and greenhouse facilities to meet anticipated demand. However, by 2023:

- Overproduction led to significant market price fluctuations.

- Approximately one-third of licensed indoor and greenhouse cultivation area was taken offline (according to industry reporting).

- Larger operators diversified into alternative crops (e.g., Aurora Cannabis shifted some operations to ornamental flowers/vegetables).

This volatility underscores a vital lesson: the success of legal markets depends as much on prudent business strategy and efficient operations as on regulatory liberalization.

Consumer Preferences and Product Innovation

Legalization opened the doors for diverse product forms, including:

- Dried flower

- Edibles

- Oils and concentrates

- New strains, infused goods, and value-added wellness products

Licensed processors needed to quickly adapt to shifting market demands, stringent packaging/labeling regulations, and ongoing review of permissible products. Continuous research and consumer education are now central to staying competitive and compliant.

Traceability and Transparency in Cannabis Supply Chains

To strengthen public trust and ensure product safety, robust traceability is paramount. Farmonaut’s Product Traceability module harnesses blockchain technology for supply chain transparency, ensuring each batch’s journey from seed to shelf is tamper-proof and verifiable—key to regulatory compliance and consumer assurance.

Sustainable Cannabis Cultivation Practices

As cannabis production facilities Canada scale up, attention to environmental impact is becoming more pronounced. Legalization has sparked both improved practices and new concerns, particularly regarding:

- Energy intensity: Indoor cultivation relies on intensive artificial lighting, HVAC, and dehumidification systems, raising both carbon footprints and costs.

- Water use and nutrient runoff

- Conversion of farmland to large-scale greenhouse operations, impacting food security and biodiversity.

Adopting sustainable cannabis cultivation practices (with carbon monitoring tools) allows growers to track and reduce emissions, manage waste, and improve compliance with environmental standards. These practices are increasingly important for maintaining the social license to operate.

8 Powerful Trends Shaping the Canadian Cannabis Industry in 2024

We have identified the following eight key trends that illuminate the future of cannabis cultivation in Canada. These trends encapsulate regulatory, technological, ecological, and market disruptions that will reshape how cannabis is cultivated, processed, distributed, and consumed nationwide.

Trends Summary Table: Cannabis Industry Canada, 2024

| Trend Name | Estimated 2024 Impact | Key Challenge/Opportunity | Brief Description |

|---|---|---|---|

| 1. Precision Agriculture & Satellite Monitoring | 35%+ adoption among large-scale facilities | Technology investment; data-driven yields | Integration of satellite imagery and AI-driven farm management for improved crop monitoring, pest/disease prediction, and optimized resource usage. |

| 2. Increasing Regulatory Stringency | New compliance mandates in all provinces | Adapting to evolving rules | Ongoing legislative reviews spur stricter product, advertising, and sustainability controls to address oversupply and public health issues. |

| 3. Market Consolidation | Expected 10-15% reduction in active licenses | M&A, facility optimization | Small and midsize players merge or exit; larger, more efficient operations dominate amid competition and price pressures. |

| 4. Sustainability & Carbon Footprint Reporting | 55%+ major producers adopting emissions tracking | Meeting ESG benchmarks | Adoption of sustainable practices and carbon footprinting tools to minimize environmental impact and bolster social license. |

| 5. Product Innovation & Diversification | 75% offering edibles, vapes, specialty products | Consumer education, regulatory approval | Growth in diverse legal products—edibles, topicals, beverages, and wellness goods—fuels new revenue streams. |

| 6. Digital Traceability & Blockchain | 50%+ of production traceable chain-wide | Transparency, anti-fraud, compliance | Blockchain-enabled tracking ensures regulated, tamper-proof records from seed to shelf, aiding recalls and reinforcing consumer trust. |

| 7. Export Growth & Global Positioning | 30% increase in legal exports (est.) | Navigating international rules | Canadian companies leverage regulatory reputation to access global medical, wellness, and ingredient markets. |

| 8. Integration with Broader Agriculture & Forestry Sectors | 20%+ of growers engage in diversified operations | Sustainable land use, synergies | Co-locating cannabis with other crops or forestry activities to drive economic efficiencies and share best practices. |

Let’s analyze each trend in detail and understand its implications for cannabis cultivation in Canada:

-

Precision Agriculture & Satellite-Based Monitoring

Focus keywords: precision agriculture, satellite monitoring, crop health, data-driven

Technological innovation is redefining best practices in cannabis cultivation in Canada. The shift toward satellite imagery and AI-powered analytics allows growers to monitor vegetation health, identify nutrient deficiencies, and optimize irrigation in real-time, even across millions of square feet of greenhouse space.Farmonaut leads this transformation by providing farmers with real-time crop health monitoring and carbon footprint tracking, making sustainable, precision cannabis growth affordable and accessible.

-

Increasing Regulatory Stringency and Oversight

Keywords: Cannabis Act, regulations, compliance, public health, safety

The aftermath of cannabis legalization 2018 has seen provinces and federal regulators respond to industry challenges by tightening rules—especially around advertising, packaging, and environmental impact. Growers must continuously track the evolving regulatory environment and adapt processes to ensure ongoing compliance, avoiding penalties or loss of licenses. -

Market Consolidation Among Producers

Keywords: market, overproduction, mergers, big facilities

Initial market exuberance in the Canadian cannabis industry led to overbuilt capacity. As prices fell and inefficiencies surfaced, the market adapted via mergers, acquisitions, and closures. While the number of licensed producers soared post-2018, the coming years will see approximately 10-15% reduction in active licenses and a focus on economically viable, lean operations. -

Sustainability & Carbon Footprint Reporting

Keywords: environmental, sustainable cannabis cultivation practices, carbon footprint, emissions

Customers, governments, and shareholders expect a lower environmental impact, especially from energy-intensive indoor grows. Progressive companies now adopt sustainability targets and use carbon tracking software (such as Farmonaut’s Carbon Footprinting solution) to quantify and reduce emissions in compliance with public health and environmental standards. -

Product Innovation and Diversification

Keywords: edibles, concentrates, new products, processing

The breadth of legal products has widened rapidly. Today, edibles, concentrates, infused beverages, wellness items, and medical cannabis lines supplement smoked flower. This innovation creates resilience (against price shocks in commodity flower markets), spurs economic growth, and attracts different customer segments. -

Digital Traceability & Blockchain Implementation

Keywords: traceability, blockchain, transparency, anti-fraud

Digital and blockchain-based traceability systems ensure cannabis distribution can be tracked from seed to sale. This fosters trust with consumers, supports efficient recalls, and satisfies increasingly stringent regulatory mandates across provinces. -

International Export Growth and Global Positioning

Keywords: exports, global market, Canadian cannabis industry

As the international medical and wellness cannabis markets mature, Canadian producers leverage their early-mover advantage, regulatory rigor, and best-in-class cultivation practices to access—and shape—global supply chains. This trend promises new economic opportunities but involves complex regulatory compliance and certification. -

Integration with Agriculture and Forestry Sectors

Keywords: agricultural, forestry, sector synergies, resource management

More cannabis growers now collaborate with broader agricultural and forestry operators. This approach maximizes resource use, supports shared sustainable land management, and opens up diversification—essential in managing market volatility.

With Farmonaut’s Large-scale Plantation Management tools, growers can coordinate across diverse crops and sites, from planting schedules to resource allocation, ensuring operational efficiency.

Farmonaut: Enabling Smart Cannabis Cultivation in Canada

Modern cannabis growers in Canada increasingly rely on digital technologies such as Farmonaut to gain actionable insights and remain competitive in the evolving market.

Farmonaut’s Key Features for Cannabis Cultivation

- Satellite Crop Health Monitoring: Access NDVI/vegetation health, soil moisture, and growth stage data for smarter decisions about irrigation, fertilizer, and pest control, supporting both large-scale and micro-cultivators.

- AI-Based Jeevn Advisory: Receive real-time, personalized crop advisory and weather predictions, reducing risks and maximizing yields amidst unpredictable growing seasons.

- Blockchain-Based Traceability: Stay compliant with cannabis regulations Canada and deliver consumers transparent proof-of-origin for every batch.

- Fleet & Resource Management: Optimize logistics and machinery usage across dispersed greenhouses or indoor facilities with Farmonaut Fleet Management.

- Carbon Footprinting: Quantify, monitor, and reduce the environmental impact of large or energy-intensive operations, aiding regulatory compliance and sustainability goals.

Farmonaut is accessible through Android, iOS, web apps, and via API integration into ERP systems, making state-of-the-art insights available to cannabis growers Canada of all sizes. For custom advisory and crop management at the farm, forestry plot, or greenhouse scale, explore Farmonaut’s Crop Plantation & Forest Advisory.

Explore Farmonaut Subscription Options for Growers

Choose a flexible plan that matches your cannabis cultivation needs, from single-site monitoring to whole-facility management. Transparent pricing—scale as your operation grows!

FAQ: Cannabis Cultivation in Canada

Frequently Asked Questions

-

Q: Can adults grow cannabis at home anywhere in Canada?

A: Most provinces and territories allow adults to grow up to four plants per household for personal use, but Quebec and Manitoba currently prohibit non-medical home cultivation. Always check the latest local rules. -

Q: Is a specific license required for cannabis cultivation?

A: Yes. All legal commercial cannabis cultivation in Canada requires licensing from Health Canada. Options include micro-cultivation, standard cultivation, and nursery licenses. -

Q: How significant is the economic impact of the Canadian cannabis industry?

A: By 2022, the industry contributed about $43.5 billion to GDP, supporting more than 98,000 jobs and generating $15 billion in tax revenue. -

Q: What are the main environmental challenges for growers?

A: Energy consumption in indoor and greenhouse operations is high, emphasizing the need for sustainable practices and carbon monitoring. Water use and land conversion are also critical issues. -

Q: Where can growers find trustworthy, real-time crop analytics and farm management?

A: Farmonaut provides advanced, satellite-powered crop monitoring, blockchain traceability, and AI-powered resource optimization for growers of all scales. -

Q: Are there tools for tracking carbon emissions and sustainability in cannabis operations?

A: Yes. Farmonaut’s Carbon Footprinting offers real-time monitoring and reporting for ESG compliance and sustainability improvement.

Conclusion: Cannabis Growers and the Future Canadian Market

The last five years have seen the Canadian cannabis industry move from prohibition to global leadership. Legalization in 2018 was just the beginning: today’s industry is defined by rigorous regulatory frameworks, a multi-billion dollar economy, and relentless innovation in cultivation, production, and distribution.

Looking ahead to 2024 and beyond, successful cannabis growers Canada will be those who embrace:

- Smart technologies like Farmonaut for precision crop and sustainability management

- Best-in-class environmental and operational practices

- Compliance with evolving cannabis regulations Canada

- Value-added product innovation

As the sector integrates with Canada’s broader agricultural and forestry industries, the opportunity for sustainable growth, efficient resource use, and public benefit expands. The 8 trends outlined above offer both a roadmap for navigating uncertainty and a vision for a future where cannabis is not just an economic engine, but a model of responsible, resource-wise agriculture—with Farmonaut at the digital frontier.