Natural Disaster Crop Insurance: Shocking Trends Unveiled

“Over 60% of global crop insurance claims in 2023 were due to natural disasters, highlighting rising climate risks.”

Table of Contents

- The Importance of Natural Disaster Crop Insurance

- How Crop Insurance for Farmers Works

- Types of Crop Insurance Programs

- Crop Insurance Global Perspectives & Shocking Trends

- Core Challenges in Crop and Farm Insurance Coverage

- The Role of Technology: How Farmonaut Empowers Disaster Risk Management

- Regional Trends: Comparative Table of Crop Insurance Worldwide

- Recent Developments & News

- FAQ – Natural Disaster Crop Insurance

- Conclusion

- Farmonaut Subscription Plans

The Importance of Natural Disaster Crop Insurance

As we face an upsurge in natural disasters and climate risks, agriculture, forestry, and farming sectors worldwide have become increasingly vulnerable. Droughts, floods, hurricanes, wildfires, and other severe weather events threaten to devastate crops, reduce yields, and disrupt the livelihoods of millions of farmers and rural communities.

Natural disaster crop insurance has emerged as a crucial risk management tool—acting as a financial safety net for producers who face catastrophic losses due to unpredictable events. Crop insurance for farmers helps mitigate substantial economic risks, maintain stability in food production, and prevent the emergence of food insecurity during and after natural disasters.

Without adequate insurance coverage, many farmers must confront the risk of financial disaster. They may struggle to recover from losses, potentially leading to reduced production, job losses in rural communities, and increased food prices.

How Crop Insurance for Farmers Works: Essential Mechanisms & Protection

Crop insurance for farmers is designed to alleviate the impact of unforeseen agricultural disasters. Let’s examine how these programs operate:

- Risk Pooling: Large numbers of farmers pay premiums into an insurance pool, spreading risk across many producers to balance financial losses from natural events.

- Claims Process: When crops are damaged or destroyed (e.g., by flood or drought), farmers file claims. The insurer assesses the loss and pays out according to coverage and policy terms. New innovations like index-based insurance are streamlining this process.

- Financial Protection: Crop insurance helps farmers recover and restart after severe events, improving economic stability both for families and regional food systems.

- Government Subsidies: In the United States and many countries, government subsidies help make insurance affordable—especially for smallholders and family farms.

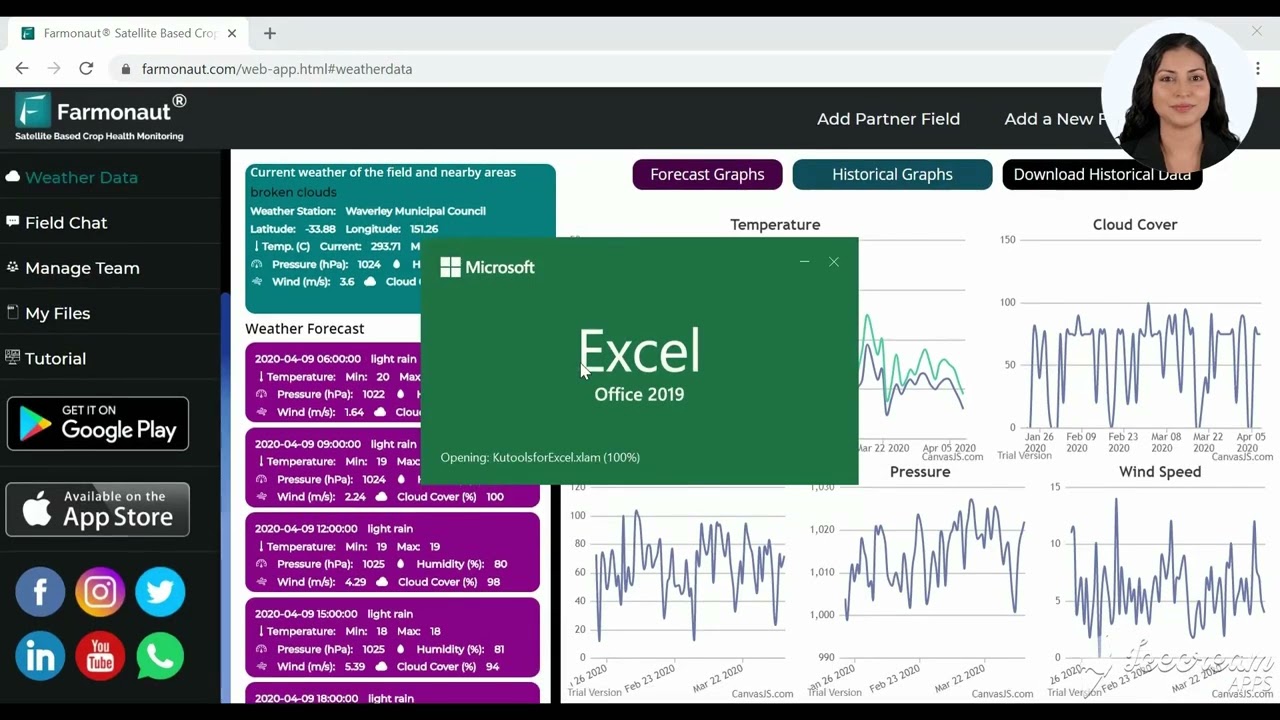

Farmonaut’s Crop Loan and Insurance Solution enables financial institutions and insurance providers to utilize satellite-based verification—helping reduce fraud, ensure claim accuracy, and improve farmer access to insurance and loans.

Types of Crop Insurance Programs: Comprehensive Protection Explained

To understand the scope of risk management offered, let’s break down the types of crop insurance programs available—especially those most common in the United States and globally.

Multi-Peril Crop Insurance (MPCI)

This is the most widely used federal crop insurance program in the United States, offering comprehensive coverage for multiple natural perils. It typically covers risks stemming from:

- Adverse weather (drought, flood, excessive rain, frost, hail, wind)

- Fire, insects, disease, and wildlife

- Yield reduction beyond a chosen percentage of historical crop yields

Farmers may choose to insure a certain percentage of historical average production, providing robust protection against multiple disaster scenarios.

Catastrophic Risk Protection (CAT)

Known as catastrophic crop loss insurance, CAT coverage compensates farmers when losses exceed 50% of historical yields. In the U.S., producers don’t pay a premium but must cover a relatively low administrative fee per crop. This makes CAT a basic but vital safety net for those who can’t afford broader policies.

Noninsured Crop Disaster Assistance Program (NAP)

Not all crops are eligible for standard insurance. NAP supports producers by providing financial assistance for specialty and niche crops, including:

- Certain vegetables, fruits, mushrooms, floriculture, and nut trees

- Producers pay a service fee and, if eligible, receive a percentage of the average market price after disaster-induced losses

Index-Based Insurance

This innovative insurance model is expanding rapidly in developing nations. Instead of individually verifying every crop loss, payouts are made when a predefined index (such as rainfall, temperature, or vegetation health anomalies) is breached.

- Reduces administrative costs

- Particularly beneficial for smallholder farmers in remote or hard-to-reach areas

- Streamlines the claim process for rapid disaster relief

Yield-Based and Revenue-Based Insurance

- Yield Insurance: Protects against yield drops below a certain threshold—regardless of cause.

- Revenue Insurance: Protects against both yield reductions and price drops, ensuring a minimum income regardless of market volatility or natural perils.

Why These Insurance Types Matter

- Enable farmers to manage risk and invest in their businesses

- Support food security and sector stability

- Provide a foundation for climate change adaptation strategies

“Asia-Pacific saw a 35% surge in crop insurance adoption after record-breaking floods and droughts in the last five years.”

Crop Insurance Global Perspectives & Shocking Trends

Let’s take a comparative tour of how natural disaster crop insurance programs have evolved across top agricultural regions. Shocking gaps and new trends emerge, particularly as climate change and crop insurance are now deeply intertwined.

United States: Federal Programs & Adaptive Measures

- Over 300 million acres are insured under various federal programs each year.

- Despite strong program participation, uncovered losses still surpassed $26 billion (2022-2024) primarily due to hurricanes, drought, and wildfires.

- Government subsidies are crucial in making coverage accessible.

India: The Pradhan Mantri Fasal Bima Yojana (PMFBY)

- The PMFBY scheme is one of the world’s largest government-sponsored crop insurance programs.

- Launched in 2016, it aims to stabilize farmers’ incomes and encourage modern practices, offering coverage for food, oilseeds, commercial, and horticultural crops.

- The program’s direct support improves affordability but faces challenges in claims turnaround and awareness among smallholders.

Central America: Disaster Risk Insurance Consortium (DRIFCA)

- Launched in 2022, DRIFCA offers tailored disaster risk insurance for smallholder farmers in Guatemala, El Salvador, and Honduras.

- Focused on climate-smart solutions to help communities rebound after major natural disasters.

European Union (EU): Insurance Gaps and Subsidy Debates

- Extreme weather events cost EU farmers over €28.3 billion annually in crop and livestock losses.

- However, only 20-30% of losses are presently insured, highlighting a vast protection gap.

- The EU is ramping up calls to allocate more subsidies specifically for climate risk coverage.

Studies repeatedly show that farmers in developing nations remain the most vulnerable due to lack of affordable insurance programs and limited government support.

Core Challenges in Crop and Farm Insurance Coverage

Despite the existence of several programs and forms of financial protection for farmers, critical challenges persist globally:

- Underinsurance: Many farmers remain uninsured or underinsured. In the U.S., billions in agricultural losses are left uncovered each year.

- Affordability: High premium costs are prohibitive for small or marginal producers unless government subsidies or NGO support offsets expenses.

- Claims Processing: Complex, slow, or non-transparent claims processes deter participation. Streamlining claims and ensuring quick payouts are crucial.

- Climate Change & New Risks: The increasing severity and frequency of weather events (such as “once-in-a-century” floods now happening every decade) challenge traditional actuarial models. Insurance must adapt by integrating real-time monitoring and climate forecast data.

- Knowledge Gaps: Many smallholder farmers lack information about available programs or face barriers to enrollment in both developed and developing countries.

The Role of Technology: How Farmonaut Empowers Disaster Risk Management

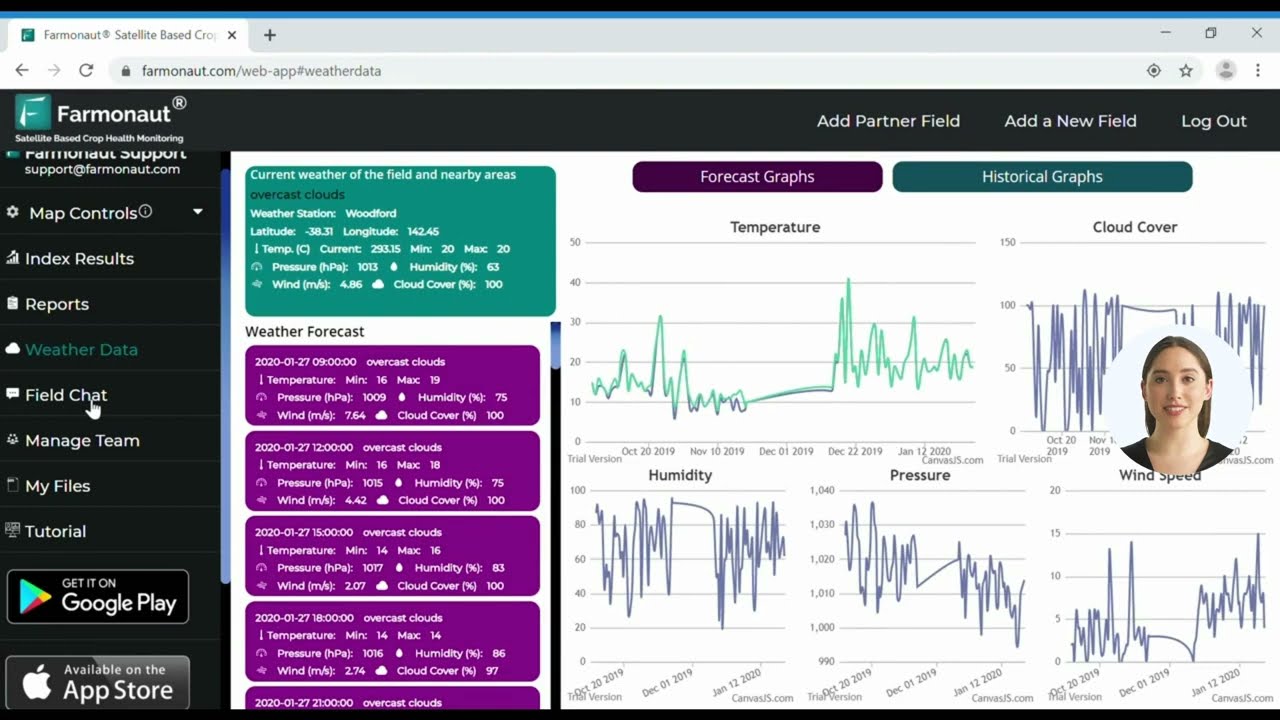

As satellite, AI, and blockchain-based solutions mature, their value in agricultural risk management grows rapidly. At Farmonaut, we are dedicated to transforming traditional farming with advanced, affordable technology that empowers farmers and agriculture-focused businesses worldwide. Our suite of precision agriculture tools and real-time crop monitoring allows proactive management of natural disaster risks.

How Farmonaut’s Platform Redefines Crop Risk & Insurance

- Satellite-Based Crop Health Monitoring: Enables detection of plant stress early, making it possible for farmers and insurers to track damage objectively across wide areas, speeding up claims assessment and providing data-driven verification.

- AI-Driven Jeevn Advisory: Personalized weather forecasts, irrigation alerts, and fertilizer or pest management tips allow growers to anticipate and mitigate damage better—improving yield stability and reducing losses.

- Blockchain Traceability Solutions: Secures records of agricultural production and supply chains, reducing risk for insurers and food companies.

- Carbon Footprinting: Our platform provides real-time emissions tracking, which supports climate change mitigation and sustainability governance.

-

API & Integration: Developers and agribusinesses can access Farmonaut APIs for integrating crop health, weather, and insurance data into their own risk management systems.

Try the Farmonaut API or read the Developer Docs for detailed integration instructions.

Regional Trends: Comparative Table of Crop Insurance Worldwide

To illustrate the crop insurance global perspectives and shocking gaps in protection, review the following comparative trends table for the world’s top agricultural regions:

| Country/Region | Estimated Insurance Adoption Rate (%) | Most Common Covered Disasters | Average Payout Percentage (% of Loss) |

|---|---|---|---|

| United States | 85% | Drought, flood, hurricanes, hail, wildfire, disease | 60-85% |

| India | 37% | Drought, flood, cyclone, pest/disease (via PMFBY) | 50-70% |

| China | 53% | Flood, drought, typhoon, frost | 55-80% |

| EU (Europe) | 20-30% | Hail, drought, flood, frost, storms | 45-60% |

| Brazil | 17% | Drought, hail, flood | 40-60% |

| Central America (DRIFCA) | Under 15% | Flood, drought, hurricane | Varies, index-based (40-65%) |

Key Insight: Even among major food-growing regions, significant percentages of farmers lack adequate insurance, making agricultural systems highly vulnerable to disaster-related shocks and losses.

Recent Developments & News: Shifts in Crop Insurance, Disaster Relief, and Policy Trends

-

Extreme weather costs EU farmers €28 billion a year

– Data reveals shockingly high uninsured losses. The EU agricultural sector faces pressure from climate-driven disasters with limited insurance uptake. -

Georgia lawmakers approve $300M in farm and timber tax breaks after Hurricane Helene

– A major relief move to assist recovery efforts after catastrophic crop and timber losses. -

Federal officials set timeline for Helene aid to farmers as Georgia enacts tax breaks

– Federal and state-level interventions aim to balance gaps not covered by standard crop insurance programs.

These ongoing developments demonstrate the rapidly-changing landscape of natural disaster crop insurance, with policy-makers, technology companies, and agricultural groups all seeking better solutions for financial resilience in farming.

FAQ – Natural Disaster Crop Insurance & Agricultural Risk Management

- What is natural disaster crop insurance?

It is a type of insurance coverage that protects farmers and agricultural producers against economic losses caused by events like droughts, floods, hurricanes, wildfires, and other natural perils. - Who offers crop insurance to farmers?

In most countries, insurance is made available through a mix of private companies, federal or state agencies, and sometimes through cooperative programs or subsidized government schemes. - What are the main types of crop insurance programs?

The most common are Multi-Peril Crop Insurance (MPCI), Catastrophic Risk Protection (CAT), Noninsured Crop Disaster Assistance Program (NAP), yield and revenue-based products, and, increasingly, index-based schemes. - How does climate change impact crop insurance?

Climate change increases the frequency and severity of extreme weather events, making insurance both more necessary and more challenging to price accurately. Programs must factor in unpredictable, high-severity risks—and leverage data-driven technology for adaptation. - How can farmers decide the right insurance for their crops?

Consider your region’s most common natural perils, cost and coverage limits, speed and fairness of the claims process, and whether local governments support premiums through subsidies. - Why do many farmers remain uninsured or underinsured?

Reasons include lack of awareness, unaffordable premiums, limited program availability for specialty or non-traditional crops, and administrative hurdles in the claims process. - How does Farmonaut enhance agricultural risk management?

By providing satellite-based crop monitoring, AI-driven advisory, blockchain traceability, and carbon footprinting, Farmonaut delivers real-time insights and verifications, supporting both farmers and insurers in disaster response and claims validation.

Conclusion: The Future of Natural Disaster Crop Insurance

Natural disaster crop insurance has become an indispensable safety net for the global agricultural sector. As we see more frequent and severe weather events due to climate change, the need for comprehensive insurance programs, faster claims processes, and greater technological integration grows even more urgent.

Despite important progress in countries like the United States and India, challenges in affordability, coverage gaps, and timely assistance remain widespread. Ongoing innovations in agritech—from satellite data to AI, blockchain, and digital platform accessibility as pioneered by companies like Farmonaut—are helping to bridge these gaps and build a more resilient, sustainable food future.

Governments, insurers, food companies, technologists, and farmers will all play critical roles in advancing agricultural risk management. Together, we can mitigate losses, protect food security, and empower producers to not only survive—but thrive—whatever disasters the future holds.

Explore Farmonaut Subscription Plans (For Farms & Enterprise)

Summary

Natural disasters challenge agriculture, forestry, and farming sectors around the world, resulting in significant economic losses and threats to food security. Natural disaster crop insurance programs offer vital financial protection—but ongoing challenges in coverage, affordability, and technological integration remain unresolved. Advances in digital technology, including those provided by Farmonaut, are critical for effective disaster risk management, real-time monitoring, and helping both individual farmers and the global agricultural sector build a more secure, sustainable future. Farmonaut is committed to making precision agriculture accessible and affordable by offering sophisticated, satellite- and AI-driven solutions for monitoring and managing climate risks.