Non-oil Exports in Nigeria: 4,600+ Hybrid Seedlings Boost Farmers

Introduction: Shaping Nigeria’s Non-oil Export Landscape

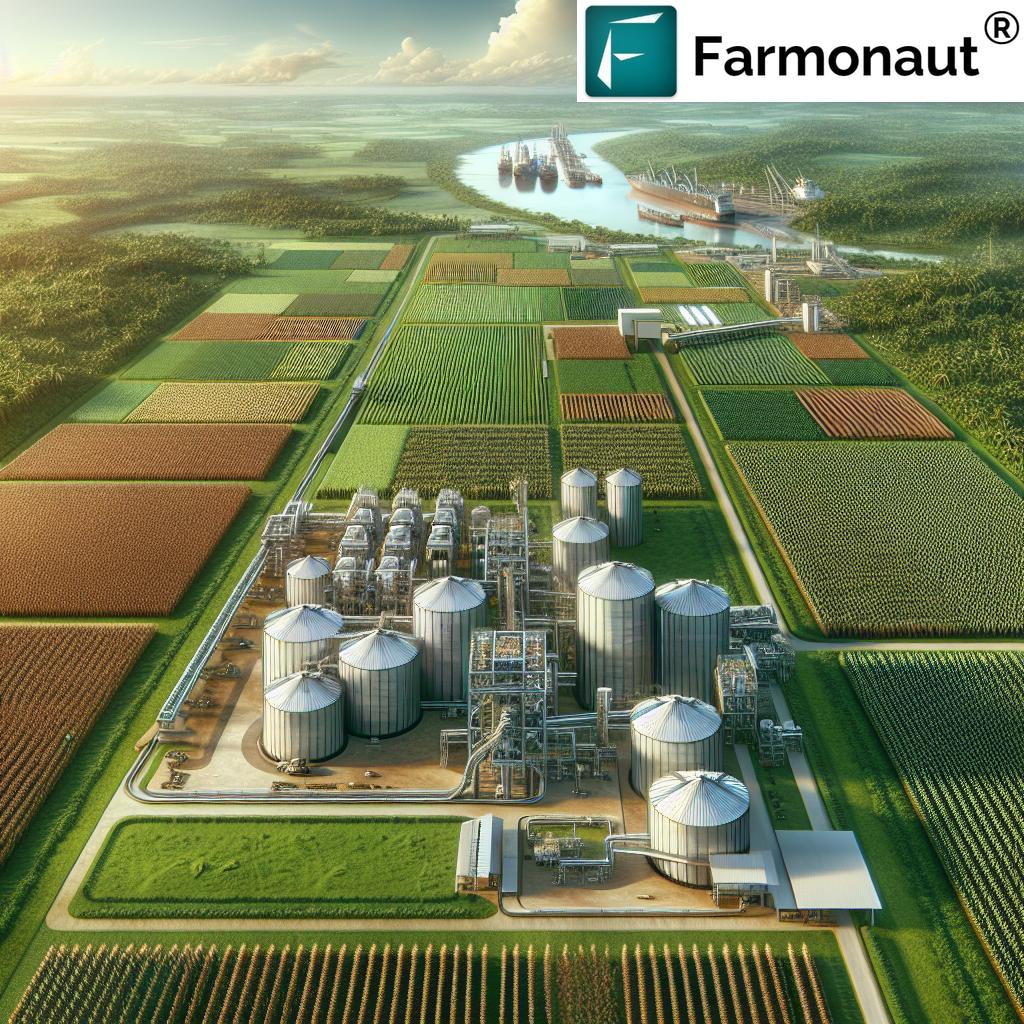

Non-oil exports in Nigeria have experienced a remarkable resurgence. This growth is propelled by robust agricultural sector interventions like hybrid seedlings distribution and strategic support for farmers across all geopolitical zones. As our export ambitions diversify beyond oil, the importance of strengthening agricultural value chains, upholding quality standards for exports, and expanding export opportunities for farmers cannot be overstated.

Nigeria, with its rich agro-ecological diversity, is leveraging initiatives led by the Nigeria Export Promotion Council (NEPC). In 2023, NEPC catalyzed industry trends when it distributed over 4,633 hybrid seedlings—with crops ranging from oil palm and cocoa to groundnut and coffee—directly to local farming communities. This targeted intervention is a game-changer for boosting production volume, quality, and ultimately expanding our non-oil agricultural exports globally.

In this comprehensive report, we’ll delve into the impact of seedlings distribution, emerging export opportunities for farmers, modern agricultural export value chains, digital empowerment for women exporters, and how innovations like Farmonaut’s agri-technology solutions are enabling robust, sustainable agricultural export growth in Nigeria.

Hybrid Seedlings Distribution: A Foundation for Growth

The nationwide distribution of over 4,633 hybrid seedlings marks a pivotal moment in our efforts to reshape non-oil exports in Nigeria. Spearheaded by NEPC and championed by Director-General Dr. Nonye Ayeni, the program spans several states, addressing region-specific crop suitability while focusing on export-driven varieties.

Key State Interventions in Hybrid Seedlings Distribution

- Kogi State: Farmers received oil palm seedlings as a strategic seed intervention for enhancing palm-based exports.

- Akure (Ondo State): Distribution of 2,000+ hybrid cocoa seedlings to farmers for the current planting season.

- Gusau (Zamfara State): Groundnut seedlings distributed to eight communities, driving cluster farming and amplifying export capacity.

- Bayelsa State: 1,500 hybrid cocoa seedlings provided to boost SME-level export production.

- Plateau State: Distribution of 1,100 coffee seedlings and 100 bags of organic fertiliser to communities in Chaha and Vom—strengthening coffee and organic produce exports.

By targeting state-specific agricultural strengths and providing farmers with improved seed varieties and organic fertiliser, the program accelerates productivity, enhances crop resilience, and increases the volume and quality required for international trade.

Hybrid Seedling Distribution & Export Impact Table

To offer a data-driven perspective, the following table summarizes how the distribution of hybrid seedlings translates into tangible increases in farmer participation and export growth:

| Crop Type | Hybrid Seedlings Distributed | Estimated Benefiting Farmers | Main Export Markets | Estimated Export Volume Increase (%) |

|---|---|---|---|---|

| Cocoa | 3,500+ | 2,300 | Netherlands, Germany, USA, UK | 15-18% |

| Oil Palm | 800 | 500 | India, EU, China | 12-14% |

| Groundnut | 700 | 600 | North Africa, Middle East | 10% |

| Coffee | 1,100 | 148 | Italy, Switzerland, USA | 8-10% |

| Sesame | 500 | 420 | Japan, Turkey, Israel | 7% |

| Cowpea | 300 | 250 | West Africa, Europe | 6% |

Export Opportunities for Farmers: Seeds of Global Trade

The hybrid seedling distribution scheme is instrumental in expanding export opportunities for farmers within and beyond Nigeria’s borders. By introducing higher-yield, disease-resistant seedlings and promoting organic fertiliser use, our farmers in Kogi, Akure, Gusau, Plateau, and Bayelsa move closer to meeting stringent international standards.

Key Export-driven Crops and Their Impact

- Cocoa and Coffee Export Nigeria: With cocoa and coffee seedlings distributed in Akure, Bayelsa, and Plateau, we are fortifying farmers’ productivity and access to high-value foreign markets. Demand remains strong in Europe and North America.

- Cluster Farming Communities Nigeria: In Gusau, the groundnut seedling intervention, focused on cluster farming, multiplies collective bargaining power and export volume, especially to regional markets in North Africa and the Middle East.

- Organic fertiliser for farmers: The provision of organic fertiliser in Plateau bolsters sustainable production practices, meeting the preferences of eco-conscious export destinations.

With these targeted efforts, even smallholder farmers gain a stake in the expanding non-oil agriculture exports of Nigeria. The use of improved crop genetics, organic inputs, and modern farming methods ensures that their harvests meet both quantity and global quality benchmarks.

Agricultural Export Value Chains: Trends and Interventions

Our agricultural sector is undergoing a paradigm shift, as hybrid seedling distribution forms the backbone for revitalizing agricultural export value chains in Nigeria. At every stage—production, aggregation, processing, and supply chain logistics—there are deliberate interventions to raise both value and revenue.

Value Chain Development: From Seed to Market

- Sesame and Cowpea Baseline Study: NEPC has undertaken studies, in partnership with international agencies, to map and validate essential quality and value chain steps for sesame and cowpea exports. Insights from these studies are critical for reducing post-harvest losses and ensuring market-ready products.

- Cluster Farming for Scale: The cluster model in Zamfara and other states pools resources, optimizes shared processing, and enables smallholders to meet bulk export demands efficiently.

- Certification and Standards: By promoting organic fertiliser and best agronomic practices, we ensure products from each cluster meet global health and safety standards, expanding access to high-value markets.

- Digitization of Supply Chains: With digital traceability platforms, quality monitoring, and blockchain solutions like those provided by Farmonaut’s Product Traceability, exporters can guarantee product origin, authenticity, and conformity, making Nigeria a preferred source for ethically produced foods worldwide.

The cumulative effect is a robust, transparent, and scalable export ecosystem—one that positions non-oil exports in Nigeria as reliable and competitive globally.

Export Promotion Initiatives: Building Capacity & Access

The NEPC’s export promotion initiatives have established our agricultural sector as a key non-oil export driver. The council, led by Nonye Ayeni, has achieved remarkable milestones in streamlining documentation processes, registering over 1,129 new exporters, and facilitating market entry through strategically located exit points (seaports, airports, and land borders).

Key Features of Recent Export Promotion Initiatives

- Seamless Documentation: Reducing bureaucracy and transaction times for exporters via digitized platforms.

- New Exporter Registration and Training: Equipping 1,129 new exporters with the knowledge and resources needed to comply with international market requirements.

- Support for Women-led Businesses: As part of our gender-inclusive approach, Nigeria is implementing the Women Exporters in Digital Economy (WEIDE) Fund. Women are encouraged to apply and participate, leveraging digital technology for export growth.

These initiatives align with the government’s vision to not only diversify our export base but also increase the participation and capacity of Nigerian exporters in global trade.

Smarter Farming for Increased Exports: Farmonaut’s Role and Tools

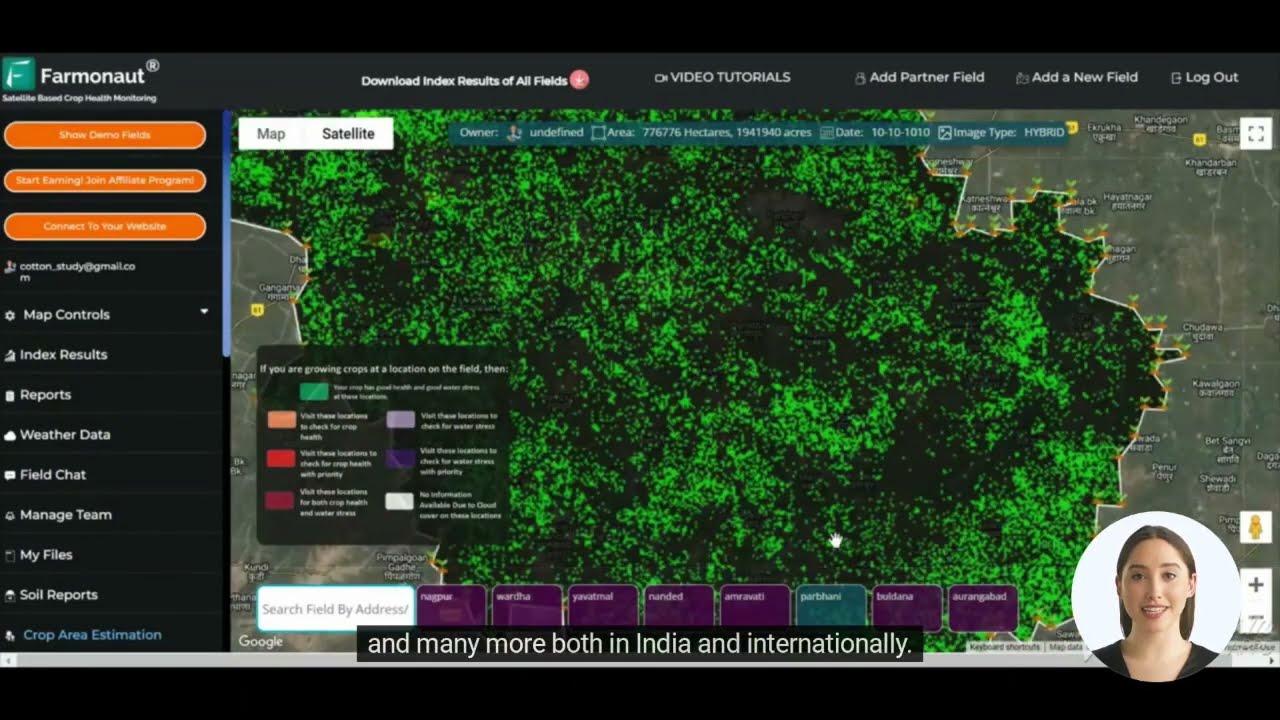

As Nigeria’s export sector modernizes, there’s increasing demand for digital, data-driven tools—all designed to maximize yield, optimize input usage, and ensure export compliance. Farmonaut stands at the vanguard of this revolution with its precision agriculture solutions:

Farmonaut’s Digital Agri-Solutions: Driving Export Growth

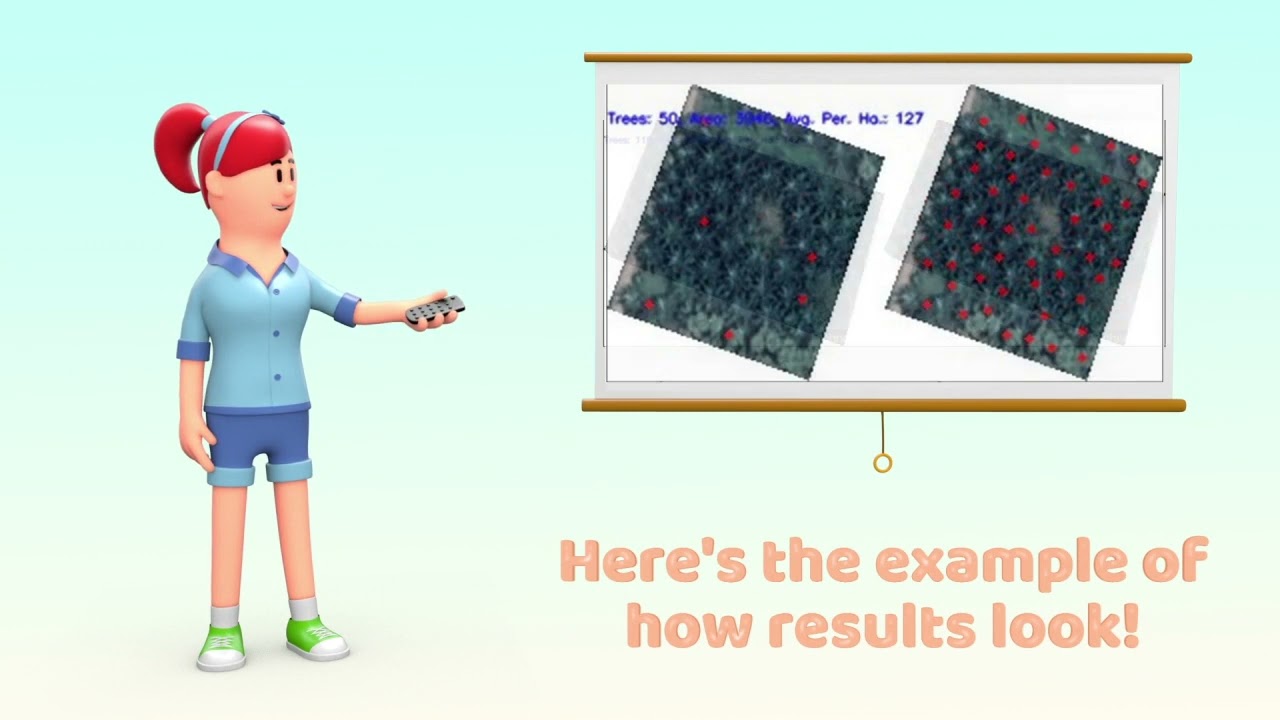

- Satellite-Based Farm Monitoring: Farmonaut enables farmers and agribusinesses to monitor crop health via multispectral satellite images, tracking NDVI, moisture, and more. This real-time intelligence boosts productivity, helps farmers decide on irrigation and fertilization, and curbs crop loss.

- AI Advisory System: The Jeevn AI system delivers field-specific weather, pest, and agronomy advice, ensuring farmers make timely decisions to meet quality standards for exports.

- Blockchain-Based Traceability: Transparency is critical for international buyers. Through Farmonaut’s traceability solution, exporters can record each agricultural product’s journey, reinforcing trust and reducing fraud in the supply chain.

- Fleet Management: With Farmonaut’s Fleet Management Tool, logistics and vehicle deployment for agri-exports are streamlined, cutting down costs and ensuring timely deliveries to exit points such as seaports and airports.

- Carbon Footprinting: Farmonaut’s Carbon Footprinting platform assists large farms and agri-exporters in tracking sustainability metrics—meeting stringent foreign regulatory standards.

- API Access: Developers and agribusinesses can integrate Farmonaut’s satellite, weather, and advisory data into their systems through the Farmonaut API. For technical details, see API Developer Docs.

- Crop Loan & Insurance: Satellite-based verification from Farmonaut’s Crop Loan & Insurance platform enhances access to affordable finance, reducing fraud, and helping farmers scale production for export markets.

- Large-Scale Farm Management: Exporters and cooperatives handling multiple clusters benefit from Farmonaut’s scalable solutions that offer robust data management, crop monitoring, and resource allocation.

Farmonaut supports Nigeria’s non-oil export growth by offering affordable, accessible, and advanced farm management—ensuring our crops are competitive on the world stage.

Quality Standards for Exports: Ensuring Conformity & Market Acceptance

For non-oil exports in Nigeria to command premium prices and acceptance in global markets, quality standards for exports must be scrupulously observed. The NEPC, under Dr. Nonye Ayeni, is dedicated to enforcing conformity by working closely with international organizations such as the ITC Geneva, validating value chains—from seed quality to finished products (e.g., sesame, cowpea).

Key Measures to Ensure High Standards:

- Seeds & Inputs: Provision of high-quality hybrid seedlings and organic fertiliser ensures crops are uniform, high-yielding, and less vulnerable to pests—keeping rejection rates low.

- Training: Continuous farmer training on harvesting, handling, and post-harvest processing standards for different crops destined for export.

- Traceability Systems: Blockchain-based traceability platforms, such as those from Farmonaut, provide irrefutable proof of origin, compliance, and product integrity.

- Routine Inspections: Regular checks and validation studies for crops like sesame and cowpea ensure products meet destination country standards, reducing contract cancellations and rejected consignments.

These efforts pave the way for Nigeria to maintain and scale its competitive advantage in non-oil agricultural exports, winning trust and fostering repeat business with global importers.

Exit Points: Facilitating Non-oil Export Movement

The efficiency of non-oil exports in Nigeria is closely tied to the availability and functionality of multiple exit points—the channels through which export products leave the country. NEPC reports that roughly 95% of non-oil goods are routed via seaports, followed by international airports and land borders.

Nigeria’s Main Export Exit Points (2023)

- Seaports: Six strategically located across the nation’s coastlines, facilitating bulk exports of cocoa, palm oil, groundnuts, sesame, and other perishable and non-perishable goods.

- International Airports: Three functional airports—key for air-freighted, time-sensitive goods.

- Land Borders: Seven border exits serve intra-African export markets, supporting cross-border trade within the ECOWAS region.

Having multiple, well-managed exit points reduces lead times, ensures prompt delivery, and lowers logistical bottlenecks for thousands of registered exporters across Nigeria.

Women in Digital Trade Africa: Empowerment and Growth

A transformative new trend in non-oil exports in Nigeria is the targeted inclusion of women via the Women Exporters in Digital Economy (WEIDE) Fund, a $50 million fund launched in February 2024. NEPC is one of only four business organizations worldwide—and the sole African body—selected to implement this program.

- Purpose: To support women-led businesses in digital trade, equipping them to participate actively and competitively in global markets.

- Applications: Already underway, with women entrepreneurs in agriculture, processing, and export urged to apply.

- Impact: This initiative reinforces the emergence of new digital skills, expands women-run export businesses, and increases diversity in Nigeria’s non-oil export drive.

We actively encourage every women-led business to apply to the WEIDE Fund, as their participation is not only economically empowering but also fortifies the future of digital-driven export promotion initiatives on the African continent.

Frequently Asked Questions (FAQ)

1. What is driving the surge in non-oil exports in Nigeria?

The main drivers include hybrid seedling distribution, improved agricultural value chains, government export promotion initiatives, upgraded quality standards, and easier export documentation processes.

2. How many Nigerian farmers benefited from the 2023 hybrid seedlings distribution?

Over 4,600 hybrid seedlings were distributed, directly benefiting thousands of farmers in Kogi, Akure (Ondo), Gusau (Zamfara), Bayelsa, and Plateau States.

3. Which agricultural crops received the most support for export expansion?

Key crops include cocoa, oil palm, groundnut, and coffee. Each received specially selected hybrid seedlings, organic fertiliser, and export readiness training.

4. How does Farmonaut support farmers and exporters in Nigeria?

Farmonaut offers digital agri-solutions such as satellite-based farm monitoring, AI-driven advisory, product traceability, and fleet management to boost productivity, enable compliance with global quality standards, and facilitate secure, transparent exports.

5. What resources are available for women-led export businesses in Nigeria?

The Women Exporters in Digital Economy (WEIDE) Fund, a $50 million initiative, supports women’s active participation in the digital economy and export trade. Applications are open to qualifying businesses.

6. Where can I access Farmonaut’s tools?

Farmonaut’s precision agriculture platform is accessible via web and mobile apps (Web App, Android, and iOS). Developers can also integrate data with the API.

Conclusion

The strong momentum witnessed in non-oil exports in Nigeria can be attributed to a bold strategy centered around hybrid seedlings distribution, robust export promotion policies, investment in agricultural export value chains, and rigorous enforcement of quality standards for exports. Our state-level interventions, targeted support for cluster farming communities Nigeria, and the embrace of organic and sustainable farming inputs create an enabling environment for both smallholder and commercial exporters.

Moreover, by integrating advanced digital solutions from agri-tech leaders like Farmonaut—including satellite monitoring, AI advisories, and blockchain traceability—our farmers and agribusinesses are better equipped to optimize yield, manage resources, and maintain compliance for seamless entry into international markets. The addition of women in digital trade, powered by the WEIDE Fund, ensures an inclusive and resilient non-oil export ecosystem.

Nigeria’s agricultural future lies in continuously scaling these innovations and strengthening partnerships within our communities. We urge every player—from farmers to exporters—to maximize these opportunities and leverage platforms like Farmonaut for smarter, more profitable farming and export success.