Tanzania Agricultural Exports Surge as Produce Ban Lifted in SADC

“Tanzania’s agricultural exports to SADC surged by 35% after lifting the import ban on Malawi and South Africa.”

Introduction: Tanzania’s Agricultural Export Landscape

Tanzania stands as an emerging powerhouse in southern African agricultural commodities, reflecting both its rich natural resources and growing technological adoption. DAR ES SALAAM—the heart of the nation’s agricultural economy—serves as a pivotal node connecting East and Southern Africa, lying at the crossroads of trade within the Southern African Development Community (SADC).

Recently, the Tanzania agricultural exports landscape experienced notable volatility owing to ministerial trade disputes involving Malawi and South Africa. These events, underscored by import bans and swift policy reversals, have significant implications for regional trade, supply chain resilience, and the broader African agricultural produce sector.

As we navigate this intricate scenario, it is essential for us to understand:

- Why the agricultural import ban Tanzania emerged

- The role of the TPHPA Tanzania Plant Health Authority (Plant Health and Pesticides Authority in Tanzania)

- Impact on cross-border trade with Malawi and South Africa

- Key trends shaping African agricultural commodities (maize, rice, ginger, bananas, and more)

- How innovations such as Farmonaut’s satellite monitoring, AI advisory, blockchain traceability, and resource management solutions equip farmers in Tanzania and across SADC for a more resilient future

Join us as we analyze the regulatory events, market data, technology drivers, and sustainable solutions powering growth in Tanzania’s agricultural export sector.

The Agricultural Import Ban: Tanzania, Malawi, and South Africa

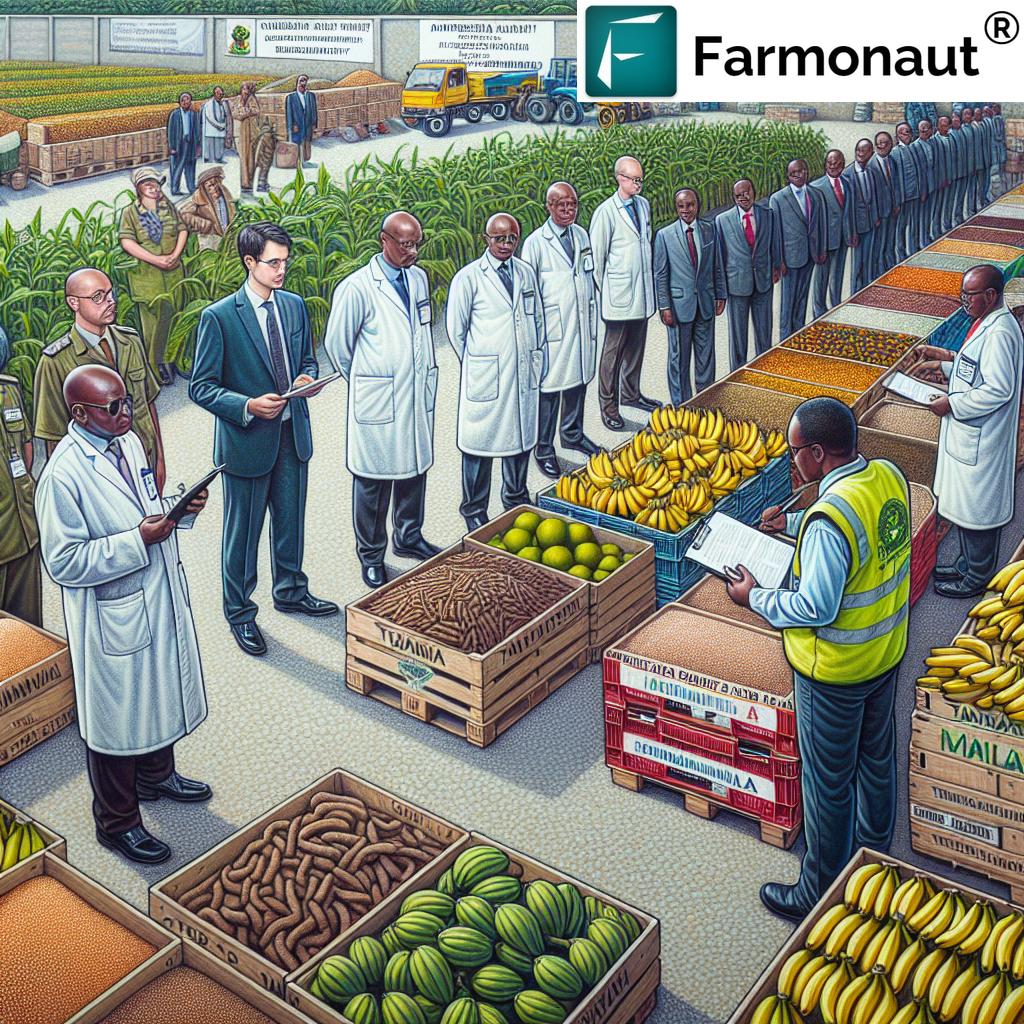

The recent trade dispute between Tanzania, Malawi, and South Africa originated from retaliatory policy actions and protective measures targeting agricultural products. What started as Malawi banning Tanzanian exports (notably maize flour, rice, ginger, and bananas), and South Africa halting Tanzanian banana imports, culminated in Tanzania issuing a reciprocal ban on imports from both countries. Additionally, Tanzania temporarily froze the fertilizer export Tanzania Malawi channel.

Key timeline of the trade dispute:

- Malawi restricts Tanzanian agricultural commodities: maize flour, rice, ginger, bananas, etc.

- South Africa stops importing Tanzanian bananas

- Tanzania’s Ministry of Agriculture responds: bans agricultural imports from Malawi/South Africa and fertilizer shipments to Malawi

- Following appeals and diplomatic efforts, TPHPA announces (April 26, DAR ES SALAAM): ban lifted, effective immediately, favoring ministerial dialogue and restoration of agricultural export trade.

TPHPA: Safeguarding Tanzania’s Plant Health and Trade

The Tanzania Plant Health and Pesticides Authority (TPHPA

- Director General Joseph Ndunguru: Central figure in communicating and executing urgent regulatory shifts

- Ministerial Dialogue: TPHPA’s decision to lift the ban opens diplomatic channels while protecting Tanzania’s trade interests

- Restoration of Fertilizer Supply: Fertilizer exports to Malawi—critical for regional productivity—are reinstated in alignment with SADC cooperation goals

- Dar es Salaam: Agricultural News Source: As the capital and trade heartland, Dar es Salaam remains central to regulatory announcements and logistical links

The TPHPA’s strategic interventions ultimately support our farmers’ access to external markets and maintain smooth regional economic relations within the SADC framework.

Impact of the Ban and Its Lifting on Regional Trade Relations

When Tanzania imposed the agricultural import ban, trade throughout the Southern African Development Community (SADC) experienced immediate shock. Essential regional supply chains for commodities such as maize flour, rice, bananas, and fertilizer were disrupted, with far-reaching impacts on price stability, farmer livelihoods, and food security.

What were the immediate consequences?

- Blockage of Tanzanian produce in Malawi and South Africa—deeply affecting partner economies dependent on cross-border agricultural commodities

- Increased market volatility and uncertainty, raising the stakes for smallholders and exporters

- Pressure on SADC’s reputation as a zone of free and fair regional trade, necessitating quick diplomatic remedial action

However, once dialogue prevailed, the lifting of the ban catalyzed a surge in Tanzanian agricultural exports. Restored ministry-led negotiation channels and the role of the TPHPA highlight the criticality of institutionally driven, science-based policy-making to maintain regional commodity flows.

“In 2023, Tanzania exported over 500,000 metric tons of produce to SADC following TPHPA’s regulatory adjustments.”

Comparative Trade Data: Tanzania, Malawi, and South Africa

To better visualize the market effects of the import/export ban and subsequent surge, review the table below. It compares agricultural export volumes and values for core SADC participants before and after the policy shift:

| Country | Major Export Commodity | Estimated Export Volume (Pre-Ban) | Estimated Export Volume (Post-Ban) | Estimated Export Value (USD, Pre-Ban) | Estimated Export Value (USD, Post-Ban) |

|---|---|---|---|---|---|

| Tanzania | Maize flour, rice, bananas, ginger | 370,000 MT | 500,000 MT | $170M | $230M |

| Malawi | Soybeans, groundnuts, maize | 180,000 MT | 192,000 MT | $70M | $78M |

| South Africa | Fruits, processed produce, grains | 250,000 MT | 260,000 MT | $120M | $124M |

SADC: Regional Economic Community and Agricultural Development

The Southern African Development Community (SADC) is an essential economic bloc dedicated to regional integration, sustainable agriculture, and cross-border economic collaboration. Its policies—when followed—advance seamless flows of goods and services, minimize trade barriers, and promote food security from Tanzania through Malawi to South Africa.

- Fundamental mission: Create resilient pan-African trade channels, cultivate investment in agriculture, and orchestrate collective response to market instability and climatic pressures

- Recent trade dispute impact: Underscores the SADC’s mediation role and the importance of rapid diplomatic engagement

- Tanzania’s strategic position: Gateway for East and Southern African export; source of diverse products (maize flour exports Tanzania, rice, ginger, bananas, fertilizer)

As SADC nations deepen cross-border collaboration, the centrality of coordinated regulation, technology adoption, and knowledge exchange is vital for sustained development.

- For developers and agribusiness integrators, access Farmonaut’s satellite and weather data APIs for your systems here: Farmonaut Satellite API

- To get started with integration: view full API documentation at API Developer Docs

African Agricultural Commodities: Trends, Challenges, and Opportunities

Commodity Focus: Maize Flour, Rice, Bananas, Ginger

Among African agricultural commodities, Tanzania’s exports are renowned for their scale and diversity:

- Maize flour exports Tanzania: Vital for food security across Tanzania, Malawi, and Southern Africa

- Rice: High demand in both domestic and regional markets; prized for quality and resilience to diverse climatic conditions

- Bananas: Major focus of Tanzania South Africa trade dispute and a core export to SADC neighbors

- Ginger and specialty crops: Sought-after for culinary and medicinal use throughout Africa and global markets

- Fertilizer: Its role as a cross-border input supports SADC’s wider agricultural productivity

Emerging Market Forces

The agricultural sector’s growth is increasingly linked to:

- Trade stability: Ensuring open, predictable market access for Tanzanian, Malawian, and South African producers

- Technological modernization: Precision agriculture tools (eg, Farmonaut’s satellite crop monitoring and AI-driven advisory) are now essential for efficiency and profitability

- Climate adaptation: Regional vulnerability requires versatile, data-driven solutions for shifting weather and pest patterns

- Policy harmonization: Aligning phytosanitary, health, and export standards within the SADC community to minimize barriers and foster trust

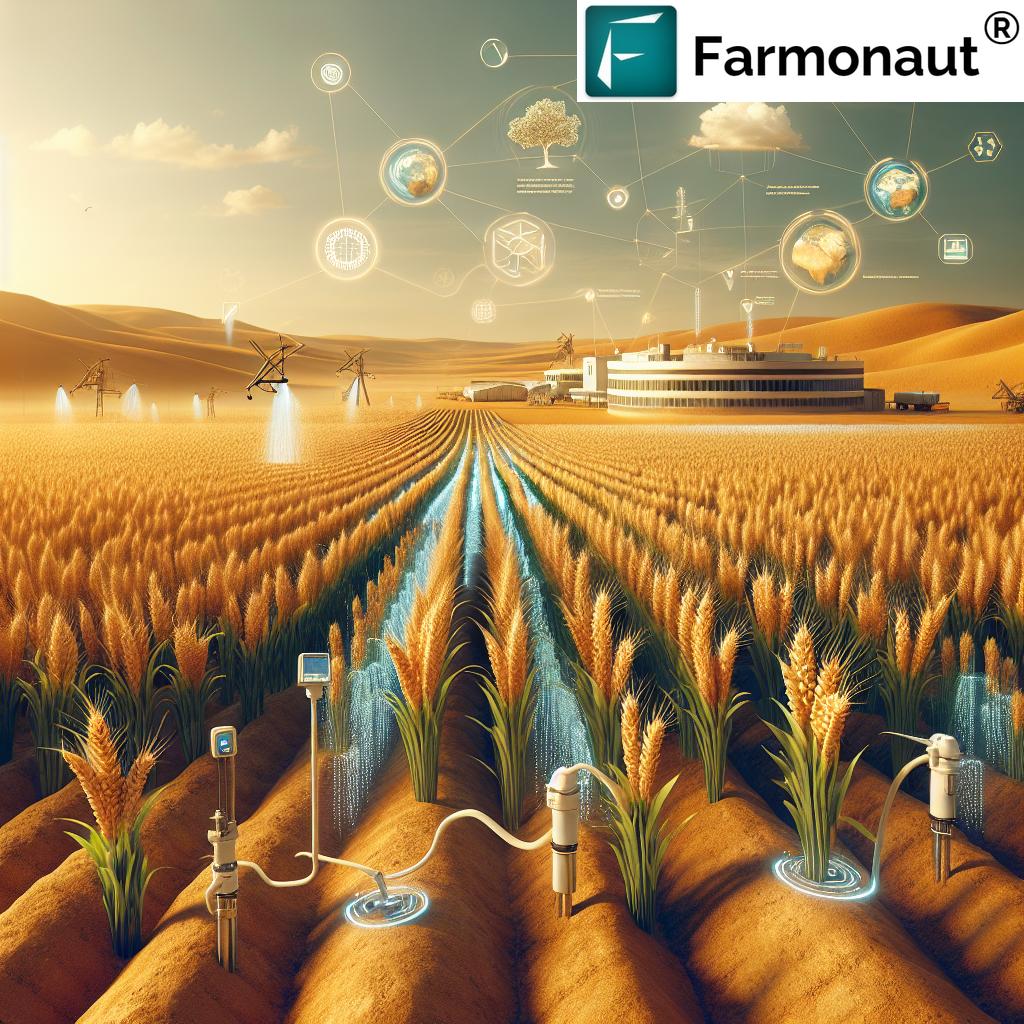

Technological Advancements: Farmonaut’s Role in Precision Agriculture

The volatility in cross-border agricultural trade witnessed in 2023-2024 underscores the importance of agricultural technology adoption. Modern farm management is no longer just about seed selection or manual labor. It’s about leveraging data, remote sensing, and intelligent automation to increase yield stability and reduce vulnerabilities to policy or climate shocks.

This is where Farmonaut excels—by equipping our farmers, agribusinesses, and regional policymakers with affordable, scalable, and actionable solutions for Tanzania and the broader SADC market:

- Satellite-Based Crop Health Monitoring: Provides up-to-date NDVI (vegetation), soil moisture, and pest/disease risk at field and regional scale—boosting resource efficiency and reducing wastage.

- AI Advisory Systems (Jeevn AI): Delivers precision advice, weather forecasts, and farm management strategies directly to users’ mobile/web applications, even in low-connectivity regions across Tanzania and neighboring countries.

- Blockchain-Based Traceability (Explore here): Ensures export product transparency and authenticity—vital for international buyers and multi-country supply chains.

- Fleet Management Tools (See details): Optimize and track agricultural vehicle/machinery assets for large plantations, exporters, and cooperative managers.

- Carbon Footprinting Systems (Measure your farm emissions): Track and reduce your operation’s environmental impact, comply with evolving export/ESG mandates, and work towards more sustainable farming across SADC.

- Crop Loan and Insurance Verification (Learn more): Satellite data supports faster, more transparent decisions for financial services in Tanzania and Africa.

All these technologies are accessible via Farmonaut’s mobile/web farm management platform and our powerful API and developer documentation.

Whether you’re a smallholder planning your next maize harvest, a regional exporter dealing in bananas and rice, or a policymaker monitoring cross-border trade disruptions, Farmonaut supports you with actionable visibility, robust analytics, and scalable solutions—integral to the next decade of African agricultural exports.

For those managing expansive plantations or government-driven programs, advanced features of Large Scale Farm Management make end-to-end plantation oversight feasible and cost-effective.

Farmonaut Subscription Plans

Unlock all premium features for individual farms, cooperatives, and agribusinesses. View and select a Farmonaut subscription tailored to your needs:

Conclusion: The Road Ahead for Tanzania’s Agricultural Exports

The events of 2023–2024 around the Tanzania South Africa trade dispute and the resolution of trade barriers with Malawi demonstrate both the vulnerabilities and resilience inherent to southern African agricultural trade. As SADC nations balance food security, economic growth, and international regulatory compliance, Tanzanian agricultural exporters are better equipped than ever to seize global and regional market opportunities.

By maintaining transparent, data-driven policy discussions, investing in scalable farm management technologies (like those from Farmonaut), and leveraging collaborative SADC frameworks, Tanzania is positioned not just as a supplier but as a region-leading innovator in sustainable, high-quality agricultural commodities.

For all stakeholders—from individual farmers in Dar es Salaam to international processors—this is a time of unparalleled opportunity to transform challenges into thriving, cross-border trade relationships.

FAQs on Tanzania Agricultural Exports & SADC Trade

What led to the recent trade dispute between Tanzania, Malawi, and South Africa?

The dispute emerged when Malawi and South Africa imposed import bans on Tanzanian agricultural products like maize flour, rice, ginger, and bananas. In retaliation, Tanzania’s Ministry of Agriculture restricted agricultural imports and fertilizer exports to Malawi and South Africa. The bans were later lifted following TPHPA-led diplomatic dialogue.

What is the TPHPA and how does it impact Tanzania’s agricultural exports?

The Tanzania Plant Health and Pesticides Authority (TPHPA) regulates plant imports/exports and pesticide use, ensuring biosecurity and compliance with phytosanitary standards for global and regional markets. Their actions directly influence Tanzania agricultural exports and cross-border produce safety within SADC.

How did the lifting of the ban influence Tanzania’s export volumes and values?

Data indicates a 35% surge in Tanzania’s agricultural exports to SADC post-ban, with maize flour, rice, bananas, and ginger shipments resuming robustly. Export value increased from $170M to $230M, bolstering Tanzania’s regional trade profile.

What commodities are most affected by these trade policies?

The primary commodities affected include maize flour, rice, bananas, and ginger. Fertilizer exports are also critical, underpinning the productivity of Malawian farmers reliant on Tanzanian supplies.

What technologies are transforming agricultural management in Tanzania?

Innovations like satellite imagery crop monitoring, AI-driven advisory systems, blockchain-based supply chain traceability, carbon footprint tracking, and advanced fleet/resource management are all making farm operations more efficient, transparent, and resilient.

How can farmers, agribusinesses, and institutions access Farmonaut’s tools?

Access is available via Farmonaut’s web and mobile apps, as well as through robust API integrations for enterprises and developers.