Bridging the Climate Finance Gap: Southeast Asia’s $1 Trillion Challenge for Sustainable Development by 2035

“Southeast Asia needs up to $1 trillion annually by 2035 for climate finance and sustainable development investments.”

As we delve into the complex landscape of climate finance in Southeast Asia, it’s crucial to understand the magnitude of the challenge facing our region. The recent outcomes of COP29 in Azerbaijan have brought to light the significant hurdles we must overcome to achieve sustainable development and combat climate change effectively. In this comprehensive analysis, we’ll explore the $1 trillion challenge that Southeast Asia faces by 2035 and discuss potential solutions to bridge this daunting climate finance gap.

The Current State of Climate Finance in Southeast Asia

The climate finance situation in Southeast Asia remains dire, especially in light of the disappointing results from COP29. The anticipated increase in climate finance from developed nations, moving from US$100 billion to US$300 billion by 2035, falls significantly short of our region’s urgent funding needs. To effectively address climate mitigation and adaptation, Southeast Asia requires annual capital inflows of up to US$1 trillion from private sources by 2035, as public financing alone is insufficient to tackle the escalating climate crisis.

The New Collective Quantified Goal on Climate Finance (NCQG) has sparked dissatisfaction among representatives from the Global South, who criticize it for not framing climate finance favorably for developing nations. These countries advocate for grants and low-interest loans designed to ease financial pressure, rather than extensive reliance on for-profit foreign investments. Moreover, the NCQG’s projected commitments risk losing 20% of their value by 2035 when adjusted for inflation, further complicating an already challenging situation.

Southeast Asia’s Pressing Climate Funding Needs

The Asian Development Bank (ADB) estimates that our region requires approximately US$210 billion annually until 2030—around 5% of its GDP—to establish climate-resilient infrastructure. However, individual countries within Southeast Asia have diverse adaptation costs. For instance, Singapore’s need is around 0.1% of its GDP, while Cambodia’s stands at 2.2%, highlighting the variability in urgency across the region.

Another critical issue we face is the mismatch between energy demand and renewable investment. Southeast Asia is projected to account for a significant portion of global energy demand growth over the next decade. Yet, investment in renewable energy from our region represents merely 2% of global totals. To pivot toward renewable sources effectively by the early 2030s, concessional financing of US$12 billion is vital.

Exploring Alternatives Beyond UN Climate Conferences

Given the inadequacies of the NCQG, Southeast Asia must explore alternatives outside UN climate conferences. Historical precedent suggests that developed nations often falter on climate commitments, with the US$100 billion target remaining unmet until 2022. As such, we need to diversify our approach to climate finance and sustainable development.

Several regional initiatives have emerged as potential solutions:

- Just Energy Transition Partnerships (JETPs): These partnerships involve countries like Indonesia and Vietnam, aiming to transition away from coal reliance.

- Asia Zero Emission Community (AZEC): Led by Japan, this initiative targets mobilization of US$8 billion for decarbonization. However, it faces challenges as a significant portion still incorporates fossil fuels.

- Asean Catalytic Green Finance Facility (ACGF): This facility focuses on loans for green infrastructural projects.

- Singapore’s Financing Asia’s Transition Partnership (FAST-P): This initiative envisions a blended finance approach to support sustainable development in the region.

While these initiatives show promise, questions loom over whether they can substantially mitigate the prevailing financing gap. A 2021 study by Swiss Re emphasizes the high stakes of inaction, projecting potential GDP declines of 37.4% for ASEAN countries by 2048 if average global temperatures surge 3.2 degrees Celsius above pre-industrial levels.

“ASEAN countries could face a 37.4% GDP decline by 2048 if global temperatures rise significantly.”

Bridging the Gap: Innovative Financing Solutions

To enhance our response to climate change, Southeast Asia must broaden its financing avenues. Some innovative strategies include:

- Debt-for-nature swaps: These financial transactions can help reduce a country’s debt burden while simultaneously funding conservation efforts.

- Green bonds: These fixed-income financial instruments can help raise capital for climate and environmental projects.

- Support for new global tax conventions: These initiatives aim to increase tax revenues for sustainable development.

While essential, these measures alone may not suffice, underscoring the urgent need for decisive actions amid tight timelines.

The Role of Technology in Climate Finance and Sustainable Development

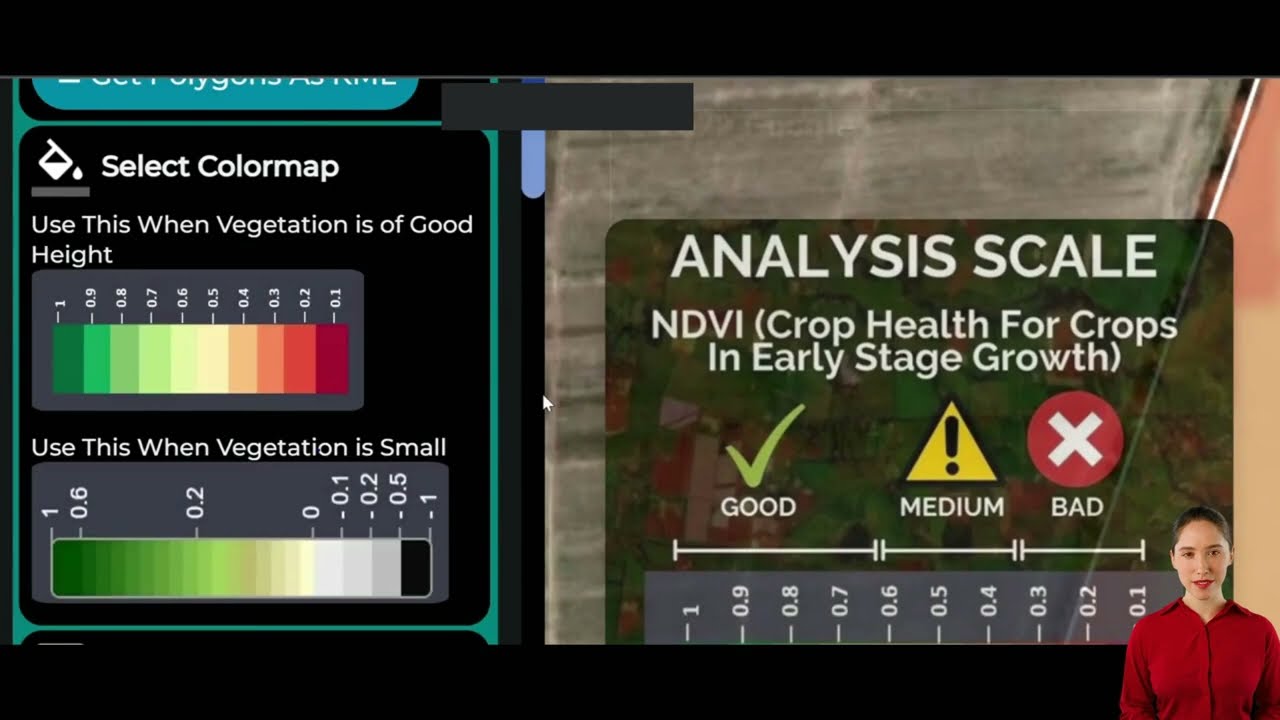

As we navigate the complex landscape of climate finance, it’s crucial to recognize the role of technology in driving sustainable development and bridging the finance gap. Innovative solutions like those offered by Farmonaut can play a significant role in optimizing resource use and promoting sustainable agriculture practices.

Farmonaut’s satellite-based farm management solutions provide valuable tools for precision agriculture, helping farmers make data-driven decisions that can lead to more efficient use of resources and improved crop yields. This technology can contribute to reducing the overall climate impact of agriculture while improving productivity and resilience.

By leveraging technologies like AI, blockchain, and satellite imagery, we can create more transparent and efficient systems for climate finance allocation and monitoring. This can help ensure that funds are used effectively and contribute meaningfully to sustainable development goals.

Comparative Analysis: Climate Finance Challenges and Solutions for Southeast Asia

| Challenge | Impact | Required Investment | Potential Solutions | Benefits |

|---|---|---|---|---|

| Funding Gap | Insufficient resources for climate adaptation and mitigation | Up to $1 trillion annually by 2035 | Green bonds, Debt-for-nature swaps | Increased capital for sustainable projects |

| Limited UN Support | Inadequate global climate finance commitments | $300 billion by 2035 (falls short) | Regional initiatives (JETPs, AZEC) | Tailored solutions for Southeast Asian context |

| Energy Transition | High reliance on fossil fuels | $12 billion in concessional financing | Just Energy Transition Partnerships | Accelerated shift to renewable energy |

| Climate-Resilient Infrastructure | Vulnerability to climate-related disasters | $210 billion annually until 2030 | Asean Catalytic Green Finance Facility | Enhanced resilience to climate impacts |

| Private Sector Engagement | Insufficient private investment in climate solutions | Significant portion of $1 trillion annual need | Blended finance approaches (e.g., FAST-P) | Increased private sector participation in climate finance |

The Path Forward: Integrating Technology and Finance for Sustainable Development

As we work to bridge the climate finance gap in Southeast Asia, it’s clear that a multifaceted approach is necessary. This approach should combine innovative financing mechanisms, technological solutions, and strong regional cooperation. Here are some key strategies we must consider:

- Leveraging technology for efficient resource use: Platforms like Farmonaut can play a crucial role in optimizing agricultural practices, reducing waste, and improving productivity. By promoting such technologies, we can make significant strides in sustainable development while potentially reducing the overall financing needs.

- Enhancing regional cooperation: Initiatives like the Asean Catalytic Green Finance Facility demonstrate the power of regional collaboration. We must continue to strengthen these partnerships and create new ones to pool resources and share best practices.

- Engaging the private sector: Given the enormous financing needs, it’s crucial to create attractive investment opportunities for the private sector in climate-related projects. This could involve de-risking mechanisms, blended finance approaches, and clear regulatory frameworks.

- Capacity building and knowledge sharing: We must invest in building local expertise in climate finance and sustainable development. This includes training financial institutions, government officials, and local communities in assessing and implementing climate-related projects.

The Role of Agriculture in Climate Change Mitigation

Agriculture plays a significant role in both contributing to and potentially mitigating climate change. In Southeast Asia, where agriculture is a key economic sector, adopting sustainable farming practices is crucial. Here’s where technologies like those offered by Farmonaut can make a substantial impact:

- Precision agriculture: By using satellite imagery and AI-driven insights, farmers can optimize their use of water, fertilizers, and pesticides, reducing both costs and environmental impact.

- Carbon sequestration: Improved farming practices can help increase soil carbon content, contributing to climate change mitigation.

- Reduced deforestation: By improving productivity on existing farmland, we can reduce pressure to clear forests for agricultural expansion.

Investing in sustainable agriculture technologies and practices should be a key component of our climate finance strategy in Southeast Asia.

The Importance of Transparency and Accountability in Climate Finance

As we work to mobilize the massive amounts of capital needed for climate action in Southeast Asia, ensuring transparency and accountability in the use of these funds is paramount. This is where technologies like blockchain, which Farmonaut incorporates in its traceability solutions, can play a crucial role:

- Tracking fund flows: Blockchain can provide an immutable record of how climate finance is allocated and used, enhancing trust among donors and recipients.

- Measuring impact: Advanced data analytics can help quantify the impact of climate finance initiatives, ensuring that funds are achieving their intended outcomes.

- Reducing fraud and misuse: Transparent systems can help minimize the risk of funds being misappropriated or used ineffectively.

By integrating such technologies into our climate finance mechanisms, we can build trust, improve efficiency, and ultimately increase the flow of funds into critical climate action projects.

Conclusion: A Call to Action for Southeast Asia

The $1 trillion challenge for sustainable development in Southeast Asia by 2035 is undoubtedly daunting, but it’s a challenge we must meet head-on. The potential consequences of inaction—from devastating economic impacts to irreversible environmental damage—are too severe to ignore.

As we move forward, we must:

- Advocate for more ambitious global climate finance commitments

- Strengthen regional cooperation and initiatives

- Embrace innovative financing mechanisms

- Leverage technology to enhance efficiency and transparency in climate action

- Engage the private sector more effectively

- Invest in capacity building and knowledge sharing

By taking these steps, we can bridge the climate finance gap and pave the way for a sustainable, resilient future for Southeast Asia. The time for action is now—let’s rise to the challenge together.

FAQ Section

Q: What is the estimated annual climate finance need for Southeast Asia by 2035?

A: Southeast Asia needs up to $1 trillion annually by 2035 for climate finance and sustainable development investments.

Q: How much does Southeast Asia need annually until 2030 for climate-resilient infrastructure?

A: According to the Asian Development Bank, the region requires approximately $210 billion annually until 2030 for climate-resilient infrastructure.

Q: What is the potential economic impact of climate change on ASEAN countries?

A: A 2021 study by Swiss Re projects that ASEAN countries could face a 37.4% GDP decline by 2048 if global temperatures rise significantly.

Q: What are some alternative financing options for climate action in Southeast Asia?

A: Some alternatives include debt-for-nature swaps, green bonds, Just Energy Transition Partnerships (JETPs), and regional initiatives like the Asean Catalytic Green Finance Facility (ACGF).

Q: How can technology contribute to addressing climate change and sustainable development in Southeast Asia?

A: Technologies like satellite-based farm management solutions (e.g., Farmonaut), AI, and blockchain can improve resource efficiency, enhance transparency in climate finance, and promote sustainable practices in sectors like agriculture.

For more information on how technology can support sustainable agriculture and climate action, explore Farmonaut’s solutions:

For developers interested in integrating Farmonaut’s satellite and weather data into their own systems, check out our API and API Developer Docs.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!