Kazakhstan Chemical Industry: Powerful 2024 Fertilizer Growth Trends

Kazakhstan’s chemical industry is witnessing robust growth in 2024, particularly in fertilizer production, driven by powerful government support. By expanding domestic capacity, implementing strategic industrial policies, and harnessing abundant natural resources, Kazakhstan is making significant strides in meeting national and regional agricultural input demand. In this blog, we explore vital trends, industrial measures, and technological solutions advancing Kazakhstan’s chemical sector—including fertilizer markets, coal-based chemical initiatives, and the country’s journey toward agricultural self-sufficiency. Discover how advanced tools like Farmonaut’s satellite management platform are also transforming industry practices, empowering smarter, sustainable growth in Kazakhstan’s industrial landscape.

“Kazakhstan’s fertilizer production surged by over 15% in 2024, marking a record growth in the chemical industry.”

Table of Contents

- Kazakhstan Chemical Industry: 2024 Overview

- Impact of the Chemical Sector on Kazakhstan’s Economy

- Key Fertilizer Growth Trends for 2024

- Kazakhstan Fertilizer Industry Growth Trends (2021-2024)

- Major Enterprises & Export Potential

- Government Support Measures Fueling Growth

- Emergence of Coal-Based Chemical Production in Kazakhstan

- Industrial Technology and Digital Transformation

- Farmonaut: Empowering Precision Fertilizer Application

- 2024 Outlook: Self-Sufficiency, Food Security & Strategic Priorities

- Frequently Asked Questions (FAQ)

- Conclusion

Kazakhstan Chemical Industry: 2024 Overview

As of 2024, the chemical industry in Kazakhstan represents a cornerstone in national industrial diversity and economic growth. From the capital city, Astana, the nation’s government has prioritized proactive policies, recognizing the sector as critical for both agricultural and industrial advancement. The industry now contributes approximately 4.6% to Kazakhstan’s total manufacturing output, reinforcing the interconnectedness of agricultural chemicals, metallurgy, construction materials, and key industries.

Buoyed by robust investments and government support, the volume of chemical production in 2023 exceeded 1 trillion tenge (US$1.9 billion), spanning fertilizers, pesticides, phosphates, chromium compounds, calcium carbide, paints, household chemicals, automotive chemicals, and lubricants. Notably, chemical sector growth in Kazakhstan has averaged a solid 5% annual increase over the past five years, with 2024 breaking records due to sharp rises in fertilizer manufacturing and export activities.

If we examine the first quarter of 2024, production in the chemical sector increased by 12.5% compared to the previous year, reaching a record 406 billion tenge (US$785 million). This uptick reflects both growing demand from domestic agricultural markets and expanding export channels facilitated by new industrial projects in polypropylene, sodium cyanide, fertilizers, and yellow phosphorus.

Impact of the Chemical Sector on Kazakhstan’s Economy

Our chemical sector doesn’t function in isolation—it underpins various pillars of the Kazakhstan economy. Fertilizer output is essential to agriculture, notably impacting food security, crop yields, and sustainable land use strategies, while serving as a principal input for metallurgy, construction, and building materials industries. With the demand for essential fertilizers—notably for nitrogen, phosphorus, and potassium—on a steady rise, industrial development Kazakhstan-wide has become more closely aligned with self-sufficiency objectives and global competitiveness.

- Agriculture: Domestic fertilizer production supports major crop producers, enhancing food security and ensuring greater yields for Kazakhstan’s vast agricultural lands.

- Industrial Use: Products such as chromium compounds, paints, calcium carbide, and specialty chemicals drive the country’s manufacturing and construction sectors.

- Exports: Kazakhstan chemical exports are expanding due to improved output quality and rising global demand for ammonium nitrate, ammonium phosphate, and phosphates.

Through these synergies, the growth of the fertilizer market Kazakhstan, in particular, delivers critical support for rural livelihoods, bolsters GDP, and enhances Kazakhstan’s export potential.

Key Fertilizer Growth Trends for 2024

2024 has established new benchmarks for Kazakhstan fertilizer production volumes and industry modernization. Here are the most significant trends:

- Domestic Fertilizer Manufacturing: Accelerated output in ammonium phosphate, urea, potassium chloride, and emerging dicalcium phosphate, aiming to cover at least 80% of national demand by year-end.

- Strategic Government Support: The Ministry of Industry and Construction has introduced policies such as VAT exemption on raw materials for pesticides, exclusive rights for exporting ammonium-based products, and tighter price controls to prevent speculation.

- Raw Material Self-Sufficiency: Ambitious targets—to fully meet Kazakhstan’s internal need for nitrogen, phosphorus, and potassium fertilizers by 2030—are driving investments in both traditional and coal-based chemical manufacturing.

- Production Growth Rate: 2024’s fertilizer sector surge is largely attributed to the commissioning of new plants, scaling of advanced manufacturing facilities, and greater integration with digital and resource management tools.

- Export Expansion: Government support and international market demand have led to a notable 12% increase in Kazakhstan’s chemical exports in 2024.

“Government support measures boosted Kazakhstan’s chemical exports by 12% in 2024, strengthening its industrial development.”

Kazakhstan Fertilizer Industry Growth Trends (2021–2024)

To better visualize the trend in Kazakhstan fertilizer production and the impact of sectoral growth, review the table below. It summarizes major fertilizer output and highlights notable government measures:

| Year | Fertilizer Type | Estimated Production Volume (thousand tons) | Estimated YoY Growth Rate (%) | Government Support Measures |

|---|---|---|---|---|

| 2021 | Nitrogen Fertilizers | 900 | 4.5% | Initiation of strategic roadmap for chemical sector growth Kazakhstan |

| 2021 | Phosphate Fertilizers | 650 | 5.0% | Launch of investment incentives and infrastructure upgrades |

| 2021 | Potash Fertilizers | 300 | 3.0% | Modernization of domestic mining resources |

| 2022 | Nitrogen Fertilizers | 1,050 | 5.2% | Implementation of VAT exemption for raw materials in pesticides |

| 2022 | Phosphate Fertilizers | 700 | 7.7% | Expansion of state funding for upgrade projects |

| 2022 | Potash Fertilizers | 350 | 6.8% | Increased subsidization for national fertilizer needs |

| 2023 | Nitrogen Fertilizers | 1,250 | 6.9% | Strengthened regulation on illegal exports of ammonium nitrate/phosphate |

| 2023 | Phosphate Fertilizers | 820 | 8.6% | Ammonium/urea facilities upgrade and capacity expansion measures |

| 2023 | Potash Fertilizers | 420 | 7.1% | New project launches and infrastructure investments |

| 2024 | Nitrogen Fertilizers | 1,500 | 12.5% | Market price stabilization, exclusive export rights for ammonium-based fertilizers |

| 2024 | Phosphate Fertilizers | 900 | 11.2% | Push towards full self-sufficiency and expansion of ammonium phosphate production |

| 2024 | Potash Fertilizers | 700 | 15.3% | Introduction of large-scale coal-chemical production projects |

Major Enterprises & Export Potential: The Heart of Kazakhstan’s Fertilizer Growth

Our fertilizer and chemical manufacturing landscape is driven by several key enterprises. KazAzot, Kazphosphate, Kaustik, and the Atyrau Oil Refinery form the backbone of major output, responding to both internal and external market demand. These entities not only ensure sufficient supply for our national agriculture sector but also drive increased chemical exports, particularly in ammonium and phosphate compounds.

- KazAzot: Specializing in the production of ammonium nitrate and urea, crucial for agricultural chemicals Kazakhstan and food security frameworks.

- Kazphosphate: A leader in phosphorus and potassium fertilizers Kazakhstan relies on for sustained agri-growth.

- Kaustik: Focused on chlorine and caustic soda; also a growing player in industrial exports.

- Atyrau Oil Refinery: Significant for the integration of petrochemical byproducts into the fertilizer market Kazakhstan.

Exports are further protected and expanded through the establishment of exclusive export rights for ammonium-based products, stabilizing both prices and supply amid increased global demand.

Government Support Measures Fueling Kazakhstan’s Chemical Industry Growth

Recognizing the strategic value of chemical sector growth Kazakhstan, our government has undertaken decisive actions to bolster both domestic manufacturing and exports, enabling Kazakhstan to compete regionally and globally. Key measures include:

- Exemption from VAT on raw materials for pesticide manufacturing, lowering the entry barrier for local manufacturers and catalyzing market innovation.

- Establishment of exclusive export rights for ammonium phosphate and ammonium nitrate, protecting national resources and further stabilizing market prices.

- Investment in infrastructure and R&D to increase project launches for ammonia, urea, and phosphate-based fertilizers—including yellow phosphorus and dicalcium phosphate.

- Introduction of market price controls to keep fertilizers accessible for Kazakh farmers, thus upholding the country’s food security strategy.

Such consistent measures ensure progressive annual growth, with production volume and quality scaling up to meet not only domestic demand but also international export expectations.

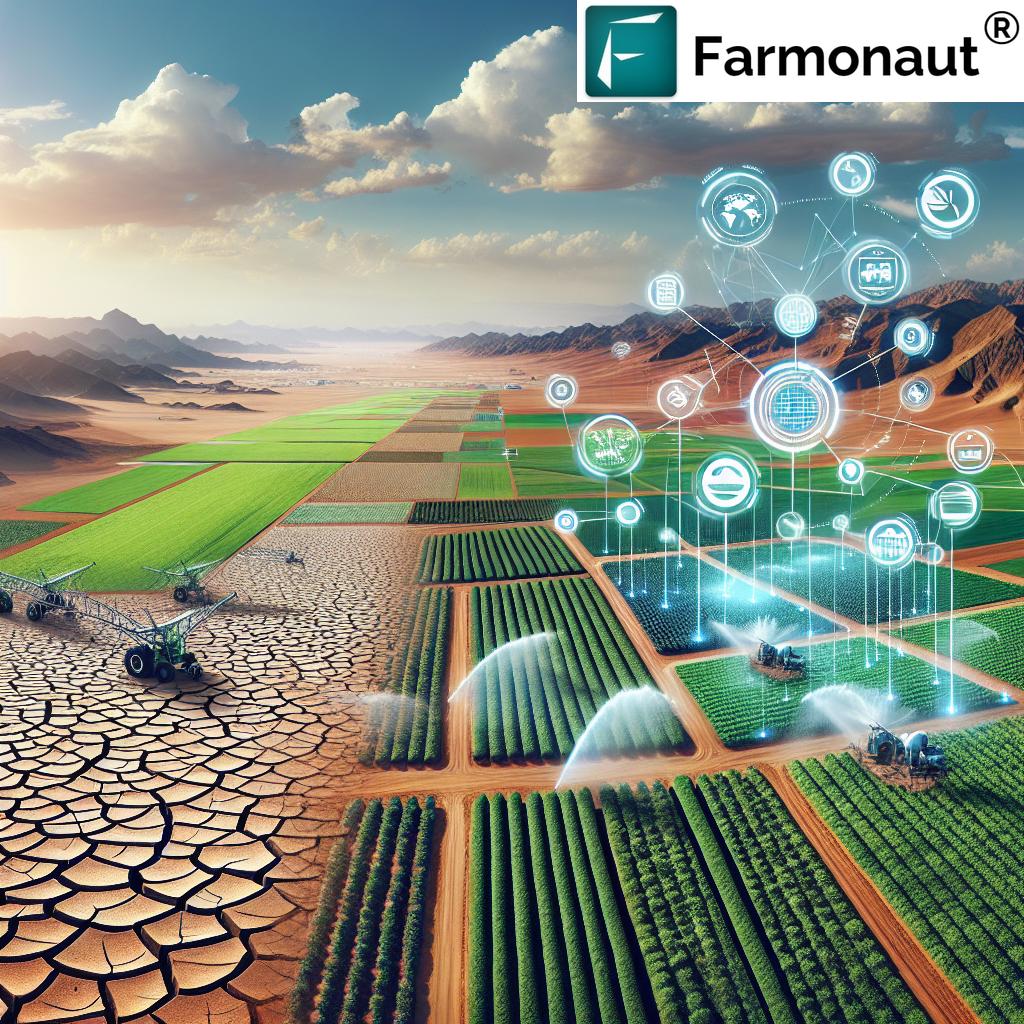

Emergence of Coal-Based Chemical Production in Kazakhstan

Kazakhstan is leveraging its vast domestic coal reserves to diversify the chemical sector and reduce import dependence. Coal-based technology enables the sustainable production of key input fertilizers and chemicals, with a focus on ammonia, urea, and absorbent materials.

- New Production Facilities: 2024 saw the commissioning of several ammonia and urea factories utilizing coal-chemical pathways. This supports both fertilizer self-sufficiency and higher value-add exports.

- Partnerships with Scientific Institutions: Domestic coal mining enterprises now work with research institutes to produce innovative products such as nanomaterials, fertilizer grades, and absorbents.

- Industrial development Kazakhstan: The coal-chemistry sector is expected to further boost industrial output, employment, and technological transfer to other manufacturing sectors.

Coal-based chemical production Kazakhstan is a linchpin in achieving the national target for meeting 80% of fertilizer requirements via domestic manufacturing by the decade’s end.

Industrial Technology and Digital Transformation

To sustain this dynamic growth, Kazakhstan’s fertilizer and chemical industries are embracing digitalization and advanced resource management:

- Satellite Monitoring: Real-time satellite data enables fertilizer application optimization, early pest detection, and efficient crop management—all crucial for maximizing farm productivity and minimizing waste.

- AI and Blockchain: Advanced analytics strengthen supply chain traceability, reduce fraud, and provide regulatory oversight for fertilizer and chemical exports.

- Carbon Footprinting: New carbon tracking standards, such as those provided by platforms like Farmonaut Carbon Footprinting, help chemical and agricultural industries measure and reduce their environmental impact.

- Fleet and Resource Management: Logistics technology ensures safe delivery and proper storage of hazardous materials and agricultural chemicals Kazakhstan farmers depend on for increased yields.

These technological innovations position Kazakhstan to meet both its own fertilizer demand and export ambitions, while also staying compliant with international environmental and trade standards.

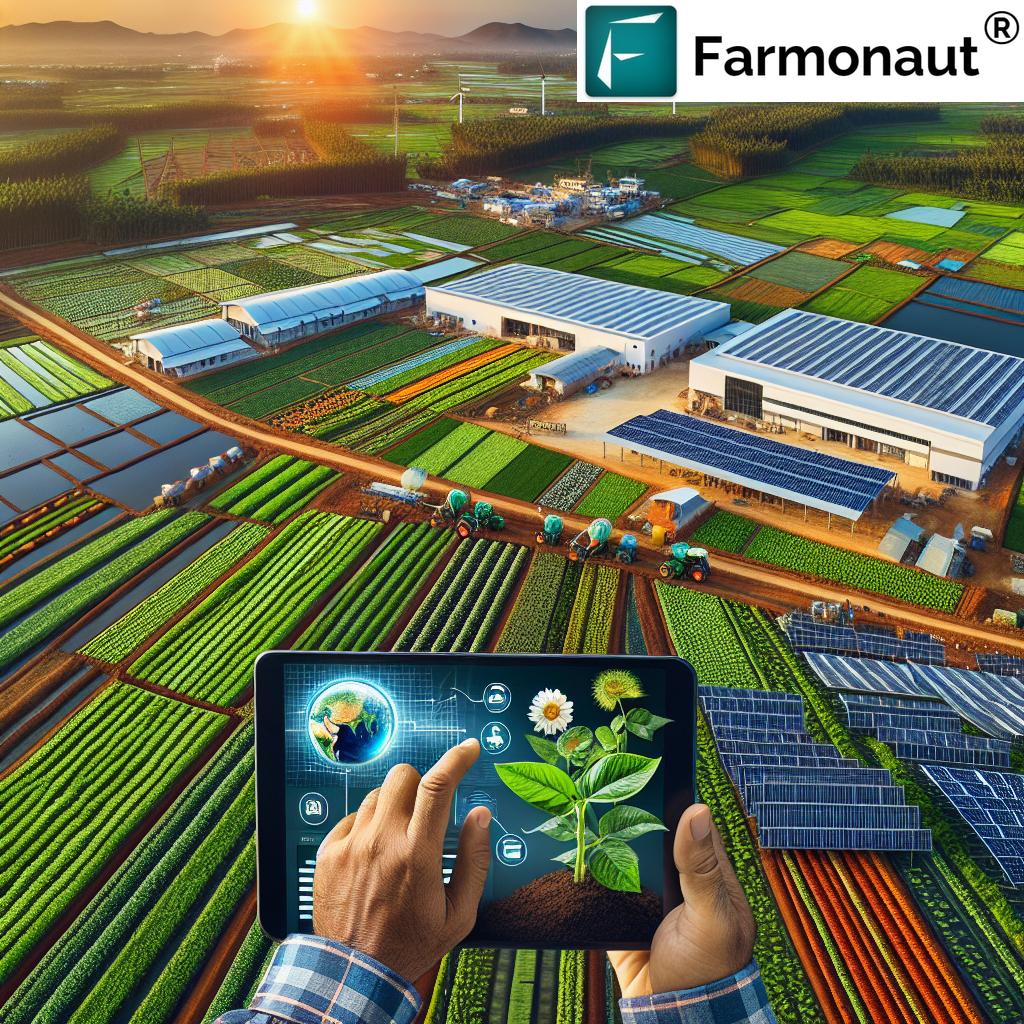

Farmonaut: Empowering Precision Fertilizer Application in Kazakhstan

A core element in modernizing Kazakhstan’s agricultural chemical sector is the adoption of affordable, satellite-powered farm management platforms such as Farmonaut. Here’s how such innovations support our country’s industrial and agricultural growth trajectory:

- Satellite-Based Crop Health Monitoring: Farmonaut provides real-time, science-based measurements of vegetation indices (NDVI), soil moisture, and stress mapping, enabling accurate fertilizer dosage and timing.

- AI-Based Advisory (Jeevn AI): Delivers predictive pest and disease alerts, weather patterns, and resource optimization, all tailored to farmer needs—vastly improving input efficiency.

- Blockchain-Enabled Traceability: Used for end-to-end product provenance and to verify the authenticity of agricultural chemicals and fertilizers. This enhances trust across the supply chain and export markets. Learn more about Farmonaut Traceability platform.

- Fleet Management: For large agri-enterprises and cooperatives, Farmonaut’s Fleet Management tools ensure efficient transport scheduling, secure pesticide and fertilizer transit, and real-time vehicle health reports.

- Secure Financing: Satellite data facilitates collateral-free crop loans, insurance eligibility, and rapid settlement claims. Explore crop loan & insurance verification solutions.

Farmonaut’s API and Developer Docs allow seamless integration for Kazakh agricultural companies and research bodies looking to enhance their digital capabilities.

For farm managers overseeing large-scale farms, invest in scalable management apps such as Farmonaut Agro Admin. This solution monitors thousands of hectares with a single, centralized dashboard, a game changer for regional cooperatives and government projects.

With cost-effective precision and advanced analytics, Farmonaut positions Kazakhstan’s agriculture and industrial sectors for an optimized, sustainable future.

Farmonaut Subscriptions: Choose Your Plan

Unlock advanced crop monitoring, advisory, and resource management for Kazakhstan’s farms, agribusinesses, and research institutes. Our flexible subscription model adapts to all farm sizes or organizational needs.

2024 Outlook: Self-Sufficiency, Food Security & Strategic Priorities

As Kazakhstan moves towards 2030, the priority remains clear: achieving fertilizer self-sufficiency and ensuring food security for the nation’s population. Strategic goals include:

- Full coverage of domestic demand for nitrogen, phosphorus, and potassium fertilizers via new and expanded plants—including 1.5 million tons of ammonium phosphate, 800,000 tons of urea, and 700,000 tons of potassium chloride annually.

- Stable supply of phosphate and ammonium-based products, driving agricultural productivity, rural employment, and GDP expansion.

- A shift towards value-added exports, with Kazakhstan chemical exports forecasted to grow year-on-year, supported by regulatory, digital, and infrastructure policies.

- Continuous investment in sustainable coal-based chemical production, green technologies, and carbon emission management.

An integrated approach, combining government policy, digital transformation, and industry modernization, positions the country to unlock its chemical sector’s full potential.

Kazakhstan’s Planned Fertilizer Output Through 2030:

- 1,500,000 tons of ammonium phosphate

- 800,000 tons of urea

- 700,000 tons of potassium chloride

- 300,000 tons of dicalcium phosphate

By achieving these benchmarks, we will not only meet 80% of national fertilizer needs but also emerge as a dominant regional supplier in the Eurasian market.

Frequently Asked Questions (FAQ)

What is driving the recent growth in Kazakhstan’s chemical industry?

The growth is fueled by a combination of government support measures (such as VAT exemption, exclusive export rights), large-scale industrial investments, expansion of coal-based chemical facilities, and the rising demand for agricultural and industrial chemicals both locally and globally.

How is Kazakhstan working towards self-sufficiency in fertilizer production?

Kazakhstan’s government has set targets to fully cover domestic fertilizer demand by 2030, particularly for nitrogen, phosphorus, and potassium. New production plants for ammonium phosphate, urea, potassium chloride, and dicalcium phosphate are being constructed to achieve this aim.

What role do digital tools like Farmonaut play in this sector?

Platforms like Farmonaut provide satellite-based crop health analytics, resource optimization, product traceability, carbon footprinting, and fleet management—raising input efficiency, environmental compliance, and financial access for Kazakhstan’s agricultural value chain.

What are the main export products of Kazakhstan’s chemical sector?

Kazakhstan is a major exporter of ammonium nitrate, ammonium phosphate, urea, phosphates, chromium compounds, and other agricultural chemicals. The government safeguards these exports with exclusive rights and regulatory controls.

How will coal-based chemical production influence industry growth?

Coal-based chemical production adds diversity to Kazakhstan’s industrial base, reducing import reliance and enabling the manufacture of essential fertilizers and high-value chemicals. This supports both food security and export expansion.

Where can I access Farmonaut’s crop monitoring and management solutions?

Farmonaut’s solutions are available via web and mobile apps. The platform offers flexible subscription plans, advanced API access, and dedicated modules for agribusinesses, cooperatives, governments, and corporate clients.

Does Farmonaut offer support for sustainability initiatives?

Yes, through its carbon footprinting and resource tracking tools, Farmonaut helps organizations measure, report, and reduce their environmental impact for chemical and agricultural supply chains.

Conclusion

The Kazakhstan chemical industry stands on the threshold of a new era in 2024, marked by unprecedented growth in fertilizer production, increased export potential, and a powerful synergy between digital transformation and government policy. As we advance towards 2030, domestic manufacturing, sustainability, and food security will define our industrial strategy. Tools like Farmonaut will play a critical supporting role—enabling smarter, data-driven resource allocation and holistic supply chain management.

By continuing this trajectory, Kazakhstan not only solidifies its agricultural base and national self-reliance but also positions itself as a competitive regional leader in the global fertilizer and chemical market. The journey ahead promises even greater integration of innovative technology, resource efficiency, and strategic planning—ensuring that our chemical sector thrives for years to come.

For organizations aiming to ensure product integrity and consumer trust, discover Farmonaut’s Traceability solutions—ideal for food safety, agro-exporters, and bulk chemical logistics.

Interested in fleet optimization? Explore Farmonaut’s Fleet Management module to streamline chemical, fertilizer, and agricultural transport.

Monitor large plantations or government-backed farm clusters with Farmonaut’s Large Scale Farm Management app, providing complete administrator control over thousands of hectares.

Make smarter decisions for sustainability and compliance using Farmonaut’s carbon footprinting solutions.

Banks can accelerate crop loans and insurance settlements using Farmonaut’s verified crop monitoring for insurance & finance.