Chemical Industry in Kazakhstan: 7 Key Trends Powering 2024 Growth

“In 2024, Kazakhstan’s fertilizer production is projected to increase by 15%, meeting rising domestic agricultural demand.”

Introduction

Kazakhstan is rapidly strengthening its position as a chemical industry powerhouse in Central Asia, thanks to bold government policies, robust domestic fertilizer demand, and a national vision to diversify its economy. As the world pays closer attention to securing agricultural resources and advanced materials, Kazakhstan’s chemical industry steps up—fueling not just agriculture, but the entire spectrum of manufacturing. In this comprehensive analysis, we explore the seven key trends powering 2024 growth in the chemical industry in Kazakhstan, and examine how this progress is reshaping the future of both industry and food security.

We, as observers and stakeholders in the chemical and agricultural landscape, understand how vital these trends are—not just for farmers, but for the nation’s strategic independence. By delving deep into Kazakhstan fertilizer production, government support for the chemical sector, and digital transformation, let us embark on a detailed journey of discovery and insight.

Overview: Chemical Industry in Kazakhstan

Located at the crossroads of Eurasia, Kazakhstan boasts extensive raw material resources and a legacy of heavy industry. Today, its chemical sector accounts for an estimated 4.6% of the total manufacturing industry, according to the Astana government’s statistics. With annual production volume exceeding 1 trillion tenge (over US$1.9 billion), key products include:

- Fertilizers: ammonium phosphate, urea, potassium chloride, dicalcium phosphate

- Pesticides & phosphates

- Chromium compounds, calcium carbide

- Polypropylene, sodium cyanide, yellow phosphorus

- Paints, household and automotive chemicals, lubricants

- Oil refinery chemicals and building materials

Major players such as KazAzot, Kazphosphate, Kaustik, and Atyrau Oil Refinery dominate both domestic demand and export aspirations. The industry has maintained an average annual growth of 5% over the past five years, underpinned by steady investment and progressive government initiatives.

Astana’s efforts go beyond production volume; they focus on strategic food security for Kazakhstan, economic diversification, and state-of-the-art innovations in both materials and digital agriculture. In this landscape, the rise of satellite-based crop monitoring and resource management solutions like those offered by Farmonaut play a pivotal role in meeting Kazakhstan’s agricultural and industry sector needs.

“The chemical industry in Kazakhstan contributes over 2% to the nation’s GDP, fueling both agriculture and industrial sectors.”

Key Trends and Estimated Impact Table

| Trend | Description | Estimated Impact on Fertilizer Production (thousand tons, 2024) | Estimated Impact on Domestic Demand (% Change, 2024) |

|---|---|---|---|

| 1. Fertilizer Production Surge | Expansion of ammonium phosphate, urea, potassium chloride & dicalcium phosphate output | +800 (to ~3.3 million total) | +15% (driving domestic fertilizer demand Kazakhstan) |

| 2. Government Support for Chemical Sector | VAT exemptions, pricing controls, exclusive export rights, support for local manufacturers | +400 | +6% |

| 3. Coal Chemistry Development Kazakhstan | New ammonia, urea projects using coal feedstock and technology collaboration | +350 | +4.5% |

| 4. Technological Innovation & Digital Ag | Adoption of satellite, AI, and digital farm management for optimized input use | +200 | +2% |

| 5. Export Expansion & Trade Stabilization | Crackdown on illegal exports, stronger foreign markets for value-added chemicals | +150 | +1.5% |

| 6. Cross-Industriy Integration | Synergies with metallurgy, construction, and manufacturing industry trends Kazakhstan | +100 | +1% |

| 7. Sustainability & Food Security | Emphasis on strategic food security Kazakhstan with full nutrient self-sufficiency by 2030 | +150 | +2% |

1. Surge in Fertilizer Production to Meet Domestic Demand

First and foremost among 2024’s driving forces is the sharp increase in fertilizer production to meet Kazakhstan’s domestic agricultural demand. This year, planned fertilizer output is set to cover over 80% of national needs. The government and chemical industry leaders are determined to reach:

- 1.5 million tons ammonium phosphate

- 800,000 tons urea

- 700,000 tons potassium chloride

- 300,000 tons dicalcium phosphate

This surge is critical—especially as the government targets full self-sufficiency in nitrogen, phosphorus, and potassium fertilizers by 2030. The emphasis on ammonium phosphate and potassium highlights a shift towards crops and soils requiring tailored nutrition. With over 406 billion tenge of chemical products produced in Q1 2024 alone, production is up 12.5% year-on-year—reflecting Kazakhstan’s newly invigorated focus.

From a policy perspective, ensuring domestic supply means mitigating risks of import dependency, smoothing seasonal price shocks, and reinforcing the nation’s ability to safeguard crop yields regardless of global market turbulence. For the agricultural chemicals sector, this translates to a stable, affordable base of essential inputs—an advantage underscored by the recent spike in global fertilizer prices.

In this context, precision agriculture tools such as Farmonaut’s satellite-based farm management empower both farmers and fertilizer producers. By providing real-time crop health monitoring, Farmonaut ensures more effective and sustainable use of nitrogen, potassium, and phosphate fertilizers—helping realize the nation’s ambitious goals. For agribusinesses and cooperatives looking to digitize operations and optimize input use, Farmonaut’s Large Scale Farm Management Tools offer actionable benefits, including higher yield forecasting and reduced wastage.

2. Government Support and Regulatory Measures: Stabilizing Growth and Securing Supply

Kazakhstan’s meteoric rise in the chemical sector owes much to robust government support and smart regulatory intervention. The Ministry of Industry and Construction, reporting in May from Astana, confirmed a multi-pronged approach:

- VAT Exemption: The removal of value-added tax for raw materials used in pesticide production incentivizes local manufacturers and decreases input costs for farmers and agricultural suppliers.

- Export Regulation: Establishing exclusive export rights for ammonium phosphate and ammonium nitrate—preventing illegal exports and stabilizing domestic prices.

- Direct Sector Support: Additional measures are aimed at enhancing domestic processing capacity and stimulating private investment, especially for new sodium cyanide plants and advanced yellow phosphorus projects.

Astana’s interventions have produced real results: production exceeded 1 trillion tenge, with a focus on safeguarding national interests. By supporting Kazakhstan’s fertilizer production and defending against global volatility, these proactive moves underline a clear strategic food security Kazakhstan policy.

For industry participants, regulatory clarity has fostered capital investment, with expansion projects in fertilizers and specialty chemicals swiftly gaining momentum. These moves, in turn, help secure reliable supplies for both smallholder and industrial-scale farming operations.

To streamline operational risk and financing for farms and agribusinesses, Farmonaut’s Crop Loan and Insurance Verification Solutions harness satellite data, effectively reducing fraud for lenders and offering faster, more transparent access to credit.

3. Coal Chemistry Development Kazakhstan: Harnessing Local Resources for Future-Ready Fertilizers

Kazakhstan is unlocking new growth through the development of coal chemistry, capitalizing on its substantial reserves. Recent government meetings have clarified the direction—pushing for large-scale coal-to-chemicals initiatives, with a heavy emphasis on ammonia and urea production.

Key features of this trend include:

- Strategic Partnerships: Expanding projects with East China Engineering and others for world-class ammonia and urea outputs.

- Innovation in Products: Not limited to fertilizers but extending into absorbents, nanomaterials, and diesel fuel using coal as a feedstock.

- Job Creation & Regional Growth: Local coal mining and processing enterprises are working with research institutes, deepening regional supply chains.

Expected results in 2024 include a 350,000-ton annual increase in fertilizer production from new coal-based capacities. For Kazakhstan, this means higher value-add at home, reduced reliance on imports, and a stronger export profile across industrial and agricultural chemicals.

For enterprises tasked with logistical oversight of large coal and chemical projects, Farmonaut’s Fleet and Resource Management Tools deliver streamlined oversight—ensuring efficient, safe, and cost-effective transport of bulk materials across vast distances.

4. Technological Innovation and Digital Agriculture: Data-Driven Growth

2024 brings a new wave of technological transformation for Kazakhstan’s chemical and agricultural sectors. As global competition heats up, digitalization and AI—once a niche—are now essential for maximizing efficiency, sustainability, and market competitiveness.

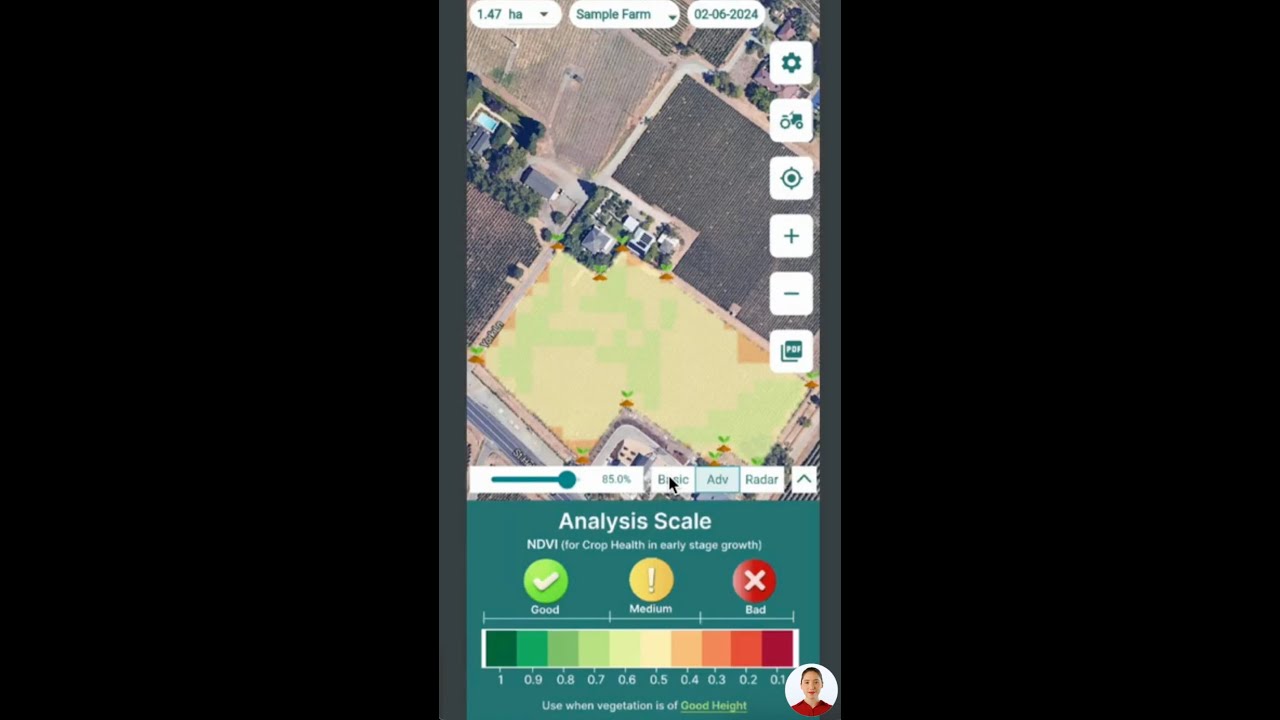

- Satellite-Based Crop Health Monitoring: Real-time detection of vegetation health (NDVI), soil moisture, and pest presence ensures precise, targeted fertilizer application—minimizing losses and maximizing returns for every tenge invested.

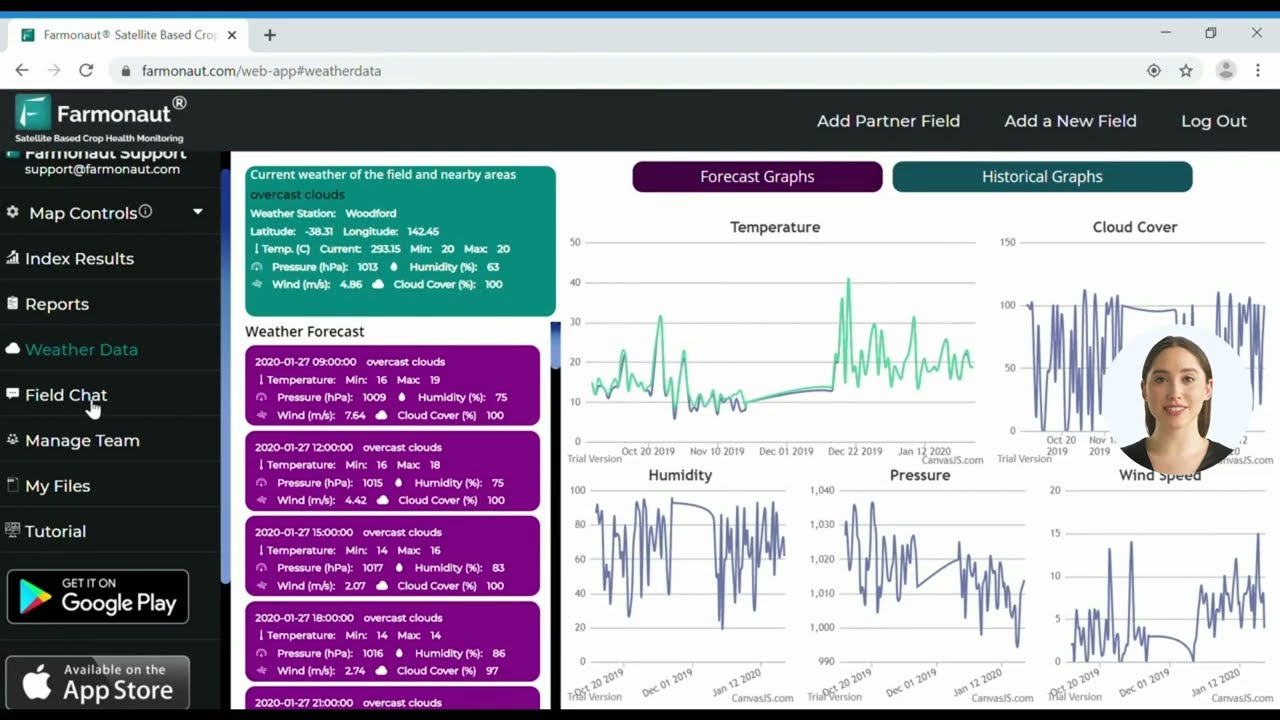

- AI Advisory & Farm Management: By leveraging machine learning, farmers and agribusinesses receive expert crop recommendations on weather, irrigation needs, and fertilizer scheduling.

- Blockchain-Based Traceability: For export-oriented and food safety-conscious producers, digital supply chain transparency is crucial. Each shipment of agrarian and chemical goods can be traced from mine or synthesis, through distribution to farm, and on to end markets.

Tools like Farmonaut’s Carbon Footprinting Service track emissions in real time—enabling manufacturers and agribusinesses to align compliance with Kazakhstan’s emerging sustainability norms and international standards.

These innovations are the backbone of the modern agricultural chemicals sector, contributing to higher yields, reduced environmental impact, and vastly improved input planning in a data-driven ecosystem.

To experience these cutting-edge features first-hand, try the official Farmonaut platform:

If your agribusiness or cooperative wants to integrate satellite and weather analytics into existing systems, use our API & review our API developer documentation for an end-to-end integration.

5. Export Expansion and Trade Stabilization: Securing International and Domestic Markets

Kazakhstan’s growing chemical production is now aimed at both domestic stability and active expansion into foreign markets. With regulatory measures in place to prevent illegal exports of ammonium phosphate and ammonium nitrate, the state has balanced internal supply needs with competitive external trade.

- Ammonium, Phosphate, and Potassium Products: These key fertilizers, alongside chromium compounds and advanced chemicals, are central to Kazakhstan’s ambitions in Eurasian and overseas markets.

- Price and Volume Controls: Government-implemented mechanisms help avoid domestic shortages during spikes in international prices, protecting local farmers and industries.

- Expanding Value Chains: Chemical producers are now adding value through downstream products (paints, automotive lubricants, advanced building materials), boosting industrial growth Kazakhstan’s export profile.

Such policies ensure robust growth in manufacturing, reinforce food security, and amplify the country’s presence as a leading supplier in global agricultural chemicals sector value chains.

To confidently present product origins and quality to buyers—both local and international—explore Farmonaut’s Product Traceability Solution for seamless blockchain tracking from field to market.

6. Integration Across Industries & National Economic Diversification

The chemical industry in Kazakhstan is not an isolated sector: it is intricately woven into the nation’s broader push for economic diversification and industrial growth Kazakhstan.

- Building Materials: Calcium carbide, paints, and chemical additives play prominent roles in construction, which is rapidly expanding across Kazakh cities and infrastructure projects.

- Metallurgy and Refining: Chromium compounds and specialty chemicals support both non-ferrous metallurgy and advanced processing at oil refineries.

- Automotive & Household Chemicals: Kazakhstan’s manufacturers are now producing high-quality lubricants, detergents, and cleaning agents for domestic and regional markets, further reducing import dependence.

These synergies are propelling overall manufacturing industry trends Kazakhstan, increasing domestic value-add and creating jobs from the laboratory to the assembly line.

For enterprises seeking to track and analyze the performance of diversified production sites and supply chains, Farmonaut’s Large Scale Farm & Agri-Business Management Dashboard provides a consolidated view, making resource allocation and real-time decision making more efficient across agricultural and allied industries.

7. Focus on Sustainability, Food Security, and Advanced Materials

Kazakhstan has placed strategic food security at the center of its chemical industry policy. With a 2030 objective to fully meet domestic demand for key fertilizers—nitrogen, phosphorus, and potassium—the nation is investing in sustainability and next-generation materials.

- Domestic Input Sovereignty: Meeting all major fertilizer needs from local production, including innovative blends designed for arid steppe agriculture.

- Sustainability Metrics: State and private sectors are increasingly adopting carbon footprint tracking, waste minimization, and resource recycling.

- Advanced Material Science: New research is creating nanomaterials, high-performance absorbents, and efficient agro-chemical delivery agents.

These efforts support Kazakhstan’s alignment with international environmental benchmarks, power the agricultural chemicals sector to greater heights, and safeguard the nation’s food self-sufficiency in a volatile global market.

Satellite Technology & Farmonaut: Empowering Modern Agriculture and the Chemical Industry

At the crossroads of chemistry and agriculture, Farmonaut is reimagining how data, AI, and satellite imagery amplify the impact of fertilizers and chemicals in Kazakhstan. Our mission is to make precision agriculture accessible and affordable for all—empowering every link in the agricultural value chain.

How Farmonaut Empowers Farmers & Industry Stakeholders:

- Satellite-Based Monitoring: Our platform provides accurate NDVI, crop health, and soil moisture data—maximizing yields while optimizing input use.

- Real-Time AI Guidance (Jeevn AI): Personalized advice on fertilizer scheduling, irrigation, and pest management—tailored locally for Kazakhstan’s cropping patterns.

- Blockchain Traceability: Secure, end-to-end visibility into the journey of every agricultural product or chemical lot across supply chains—fostering transparency and food safety.

- Resource and Fleet Management: Tools to optimize agro-chemicals distribution, monitor transport logistics, and lower operational costs.

- Environmental & Carbon Tracking: Dedicated dashboards for carbon footprinting as Kazakhstan’s industries target sustainability and compliance.

Who Benefits?

- Smallholder and large-scale farmers

- Chemical sector manufacturers and distributors

- Agro-industrial corporations and logistics teams

- Financial institutions providing agricultural credit and insurance

- Government agencies managing food security & subsidy programmes

With scalable solutions and accessible mobile/web apps, Farmonaut drives positive change in every sector touched by Kazakhstan’s chemical industry transformation. Learn more or subscribe via the fully integrated payment gateway below.

Frequently Asked Questions (FAQ): Chemical Industry in Kazakhstan

What are the main products of Kazakhstan’s chemical industry?

The chemical industry in Kazakhstan primarily produces fertilizers (ammonium phosphate, urea, potassium chloride), pesticides, phosphates, chromium compounds, calcium carbide, sodium cyanide, polypropylene, paints, household and automotive chemicals, lubricants, and building materials.

How much does the chemical industry contribute to Kazakhstan’s economy?

Currently, the chemical sector accounts for approximately 4.6% of Kazakhstan’s manufacturing industry and more than 2% of the nation’s GDP, powering growth in agriculture, metallurgy, building, and related industries.

What policies support Kazakhstan’s fertilizer production and chemical sector?

Government support includes VAT exemptions for pesticide production inputs, exclusive export rights for certain fertilizers, active investments in coal chemistry development, support for local manufacturers, and regulatory measures to stabilize prices and prevent illegal exports.

What role does technology play in Kazakhstan’s agricultural chemicals sector?

Technology, especially satellite-based monitoring, artificial intelligence, and blockchain traceability, optimizes fertilizer use, increases production efficiency, improves supply chain transparency, and supports environmental goals for both farmers and industrial producers.

How is Kazakhstan addressing food security via the chemical industry?

The government aims to fully meet domestic demand for nitrogen, phosphorus, and potassium fertilizers by 2030, prioritizing local production and sustainable resource management. This ensures stable crop yields and reduces reliance on imports.

How can businesses access Farmonaut’s technologies?

Farmonaut’s precision agriculture tools are accessible via web and mobile apps. For integrating satellite/weather analytics, use our API and consult the developer documentation. Subscriptions are available directly within our platform and pricing table above.

Conclusion

The chemical industry in Kazakhstan stands on the threshold of an unprecedented era—where strategic innovation, government backing, and digital transformation converge to enhance agricultural output, industrial power, and economic self-sufficiency. These seven key trends not only amplify the sector’s immediate growth but anchor Kazakhstan’s ambitions for a resilient, diversified, and sustainable future.

Crucially, the union of chemical manufacturing, technological advancement, and forward-thinking policy has positioned Kazakhstan as a model for other emerging market economies aiming to blend natural resource wealth with industrial modernization. From expanded fertilizer production to digital farm management and global traceability, every step is powered by vision and actionable progress.

As we move into 2024 and beyond, leveraging tools like Farmonaut for real-time crop analytics, resource management, and

blockchain-backed supply chain security will remain essential. Together, industry, government, and technology can realize Kazakhstan’s aim of not only meeting domestic demand but also setting new standards for sustainable industrial growth, food security, and agricultural success.