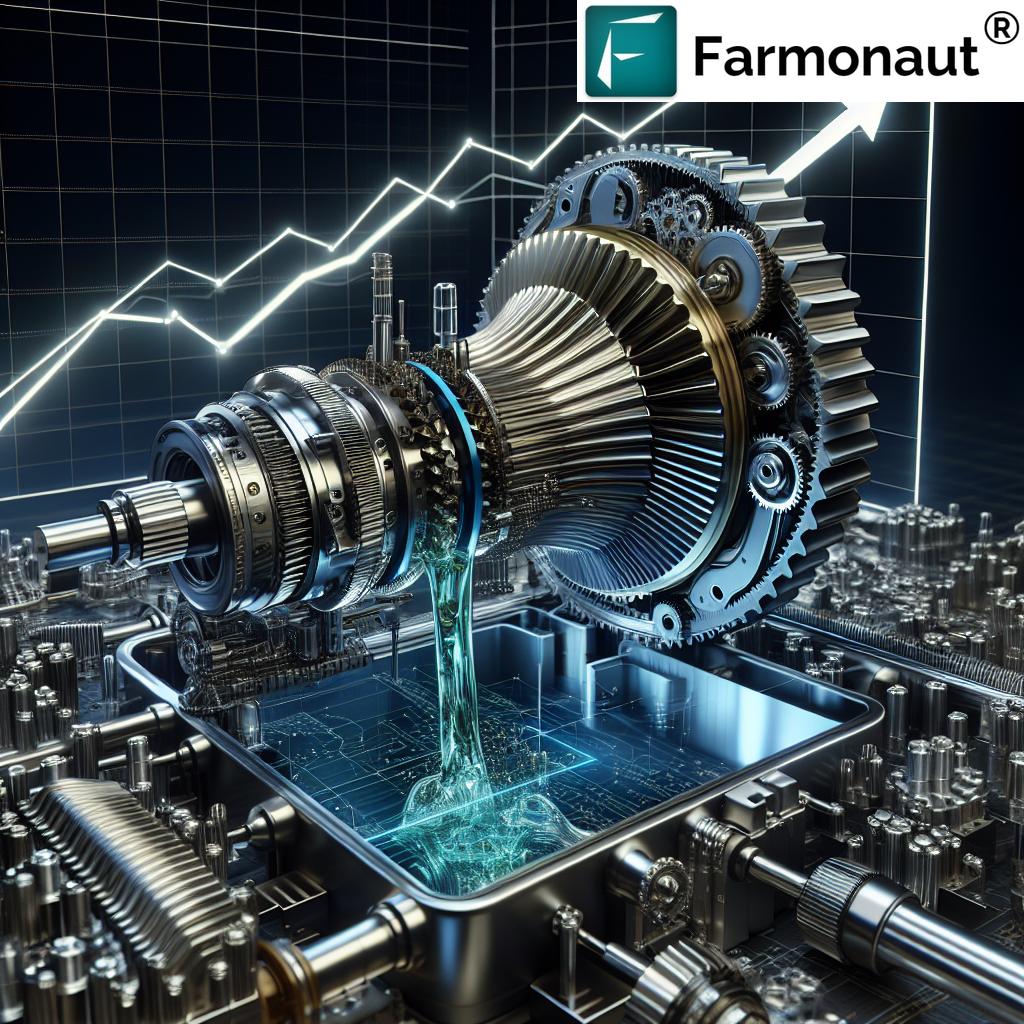

Global Transmission Fluids Market: Forecasting Growth and Trends in Automotive and Off-Road Industries through 2029

“The global transmission fluids market is projected to reach USD 19.70 billion by 2029, growing at a 4.7% CAGR.”

As we dive into the intricate world of transmission fluids, we find ourselves at the cusp of a significant market transformation. The global transmission fluids market is poised for remarkable growth, with projections indicating a surge to USD 19.70 billion by 2029. This comprehensive forecast sheds light on pivotal trends shaping the automotive and off-road vehicle industries, emphasizing the escalating demand for cutting-edge transmission systems like Continuously Variable Transmissions (CVTs) and Dual-Clutch Transmissions (DCTs).

In this extensive analysis, we’ll explore various fluid types, including mineral and synthetic oils, and their applications across different sectors. Our goal is to provide readers with invaluable insights into market drivers such as aftermarket services, maintenance requirements, and the profound impact of developing economies on industry expansion.

Market Overview and Key Drivers

The transmission fluids market is experiencing a significant uptick, driven by several key factors:

- Aftermarket Service Industry Growth: The expansion of aftermarket services is propelling the transmission fluids market by fueling demand for routine maintenance and fluid replacement.

- Aging Vehicle Fleet: As vehicles age, their transmission systems require more frequent servicing, leading to increased consumption of transmission fluids.

- Convenience Factor: The proliferation of service centers, quick-lube facilities, and DIY maintenance options has made fluid replacement more accessible, further boosting demand.

- Advanced Transmission Systems: The rise of sophisticated transmission technologies like DCTs and CVTs necessitates specialized high-performance fluids, creating new market opportunities.

These drivers collectively contribute to the projected 4.7% CAGR between 2024 and 2029, underlining the robust growth potential of the transmission fluids market.

Segment Analysis: Types of Transmission Fluids

The transmission fluids market encompasses various types, each catering to specific needs and applications:

1. Automatic Transmission Fluids (ATF)

ATFs remain a dominant segment, owing to the prevalence of automatic transmissions in passenger vehicles. These fluids are engineered to provide optimal lubrication, heat dissipation, and friction control in automatic transmission systems.

2. Manual Transmission Fluids

While less common in modern vehicles, manual transmission fluids continue to play a crucial role in certain vehicle segments and regions where manual transmissions are still preferred.

3. Other Types (CVT and DCT Fluids)

The “Other Types” segment, primarily comprising CVT and DCT fluids, is emerging as the fastest-growing category. The increasing adoption of CVTs and DCTs in modern vehicles is driving demand for these specialized fluids, which offer enhanced performance and efficiency.

Base Oil Composition: Mineral vs. Synthetic

The choice of base oil significantly influences the performance and characteristics of transmission fluids:

Mineral Oil-Based Fluids

Mineral oil-based transmission fluids represent the second-largest segment in the market. Their popularity stems from:

- Cost-effectiveness, making them attractive for budget-conscious consumers

- Suitability for older vehicle models and less demanding applications

- Widespread availability and familiarity among mechanics and DIY enthusiasts

Synthetic Oil-Based Fluids

Synthetic transmission fluids are gaining traction due to their superior performance attributes:

- Enhanced thermal stability and oxidation resistance

- Improved low-temperature fluidity and high-temperature protection

- Extended service intervals, contributing to reduced maintenance costs

- Better compatibility with advanced transmission systems like CVTs and DCTs

The shift towards synthetic fluids is particularly pronounced in high-performance vehicles and regions with extreme climate conditions.

End-Use Industry Dynamics

“South America is emerging as the fastest-growing transmission fluids market due to infrastructure projects and agricultural mechanization.”

The transmission fluids market serves two primary end-use sectors:

1. Automotive Sector

The automotive industry remains the largest consumer of transmission fluids, driven by:

- Growing global vehicle production and sales

- Increasing average vehicle age in developed markets, necessitating more frequent fluid changes

- Rising adoption of advanced transmission technologies in passenger and commercial vehicles

2. Off-Road Vehicle Sector

The off-road vehicle segment is emerging as the second-fastest growing market for transmission fluids, propelled by:

- Rapid mechanization of agriculture, especially in developing economies

- Increased demand for construction and mining equipment in infrastructure projects

- Growing popularity of recreational off-road vehicles

Regional Market Dynamics

The global transmission fluids market exhibits diverse regional trends:

North America

North America maintains a significant market share, driven by:

- High vehicle ownership rates and a large existing vehicle fleet

- Strong aftermarket service industry

- Early adoption of advanced transmission technologies

Europe

The European market is characterized by:

- Stringent environmental regulations promoting fuel-efficient transmissions

- Growing demand for electric and hybrid vehicles, impacting fluid formulations

- Increasing focus on synthetic and bio-based transmission fluids

Asia-Pacific

The Asia-Pacific region presents significant growth opportunities due to:

- Rapid urbanization and increasing disposable incomes driving vehicle sales

- Expanding automotive manufacturing sector

- Growing awareness of vehicle maintenance among consumers

South America

South America emerges as the fastest-growing market, fueled by:

- Large-scale infrastructure projects increasing demand for construction equipment

- Accelerating agricultural mechanization

- Government investments in energy infrastructure and urban development

Market Trends and Innovations

Several key trends are shaping the future of the transmission fluids market:

1. Shift Towards Longer-Lasting Fluids

Manufacturers are developing transmission fluids with extended service life, reducing the frequency of fluid changes and aligning with consumers’ desire for lower maintenance costs.

2. Bio-Based and Environmentally Friendly Formulations

Growing environmental concerns are driving research into bio-based and more sustainable transmission fluid options, especially in regions with strict environmental regulations.

3. Tailored Fluids for Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is creating demand for specialized transmission fluids that can meet the unique requirements of these powertrains, including enhanced electrical properties and compatibility with new materials.

4. Integration of IoT and Predictive Maintenance

Advanced sensors and IoT technologies are enabling predictive maintenance solutions, allowing for more precise timing of transmission fluid changes based on actual usage and conditions.

Market Challenges and Opportunities

While the transmission fluids market presents significant growth potential, it also faces several challenges:

Challenges:

- Volatility in Raw Material Prices: Fluctuations in base oil prices can impact profit margins and pricing strategies.

- Increasing Complexity of Transmission Systems: The diversity of transmission technologies requires manufacturers to develop a wide range of specialized fluids.

- Environmental Regulations: Stringent regulations on emissions and waste disposal necessitate continuous innovation in fluid formulations.

Opportunities:

- Emerging Markets: Rapid industrialization and increasing vehicle ownership in developing economies offer substantial growth prospects.

- Technological Advancements: Ongoing developments in transmission technologies create opportunities for innovative fluid formulations.

- Aftermarket Potential: The growing vehicle fleet globally presents significant opportunities in the aftermarket segment.

Competitive Landscape

The global transmission fluids market is characterized by intense competition among key players, including:

- ExxonMobil Corporation (US)

- Shell plc (UK)

- BP plc (UK)

- TotalEnergies SE (France)

- Chevron Corporation (US)

- Petroliam Nasional Berhad (PETRONAS) (Malaysia)

- FUCHS SE (Germany)

- Valvoline Inc. (US)

- LUKOIL (Russia)

- Motul (France)

These companies are focusing on strategies such as product innovation, strategic partnerships, and geographical expansion to strengthen their market position.

Future Outlook and Market Projections

The transmission fluids market is poised for steady growth, with projections indicating:

- Market size reaching USD 19.70 billion by 2029

- A compound annual growth rate (CAGR) of 4.7% from 2024 to 2029

- Continued dominance of the automotive sector in market share

- Rapid growth in the off-road vehicle segment, particularly in developing regions

- Increasing adoption of synthetic and specialized transmission fluids

These projections underscore the robust growth potential and evolving landscape of the global transmission fluids market.

Market Share by Transmission Fluid Type and Region (2029 Forecast)

| Region | Mineral Oils (%) | Synthetic Oils (%) | Others (%) |

|---|---|---|---|

| North America | 30 | 60 | 10 |

| Europe | 25 | 65 | 10 |

| Asia-Pacific | 40 | 50 | 10 |

| South America | 45 | 45 | 10 |

| Rest of World | 50 | 40 | 10 |

This table provides a comprehensive overview of the projected market share distribution across different regions and transmission fluid types by 2029. It highlights the growing preference for synthetic oils in developed markets like North America and Europe, while mineral oils maintain a stronger presence in emerging markets. The “Others” category, which includes specialized fluids for CVTs and DCTs, shows consistent market share across regions, indicating the global adoption of advanced transmission technologies.

Implications for Stakeholders

The evolving transmission fluids market presents several implications for various stakeholders:

For Manufacturers:

- Invest in R&D to develop advanced fluid formulations

- Expand product portfolios to cater to diverse transmission technologies

- Focus on sustainable and environmentally friendly options

For Automotive OEMs:

- Collaborate with fluid manufacturers to develop tailored solutions

- Consider fluid performance in transmission design and optimization

For Aftermarket Service Providers:

- Stay updated on the latest fluid specifications and technologies

- Offer comprehensive transmission maintenance services

For End-Users:

- Understand the importance of using the correct transmission fluid

- Consider long-term benefits of premium synthetic fluids

Conclusion

The global transmission fluids market is on a trajectory of significant growth, driven by technological advancements in vehicle transmissions, increasing vehicle production, and growing awareness of the importance of proper maintenance. As we approach 2029, the market is expected to reach USD 19.70 billion, with a CAGR of 4.7% from 2024 to 2029.

Key trends shaping the market include the shift towards synthetic and specialized fluids, the growing importance of the off-road vehicle segment, and the rapid expansion in emerging markets, particularly South America. The industry faces challenges such as raw material price volatility and stringent environmental regulations, but these also present opportunities for innovation and market differentiation.

For stakeholders across the value chain, from manufacturers to end-users, staying abreast of these trends and adapting to the changing landscape will be crucial for success in the evolving transmission fluids market. As vehicles become more sophisticated and environmental concerns take center stage, the role of advanced transmission fluids in ensuring optimal performance, efficiency, and sustainability will only grow in importance.

FAQs

- What are the main types of transmission fluids?

The main types include Automatic Transmission Fluids (ATF), Manual Transmission Fluids, and specialized fluids for CVTs and DCTs.

- Why is South America emerging as the fastest-growing market for transmission fluids?

South America’s rapid growth is driven by large-scale infrastructure projects, increasing agricultural mechanization, and government investments in energy and urban development.

- What are the advantages of synthetic transmission fluids over mineral-based fluids?

Synthetic fluids offer better thermal stability, improved low-temperature fluidity, extended service intervals, and enhanced compatibility with advanced transmission systems.

- How is the shift towards electric vehicles impacting the transmission fluids market?

The rise of electric vehicles is creating demand for specialized fluids with enhanced electrical properties and compatibility with new materials used in EV powertrains.

- What role does the aftermarket play in the transmission fluids market?

The aftermarket sector is a significant driver of demand, fueled by the need for routine maintenance, fluid replacements, and the growing global vehicle fleet.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

For more information on Farmonaut’s satellite-based farm management solutions, visit our API page or check out our API Developer Docs.