Indian Spice Market Update: Cardamom Prices Soar in Kerala Auctions, Export Trends Revealed

“Kerala auctions saw cardamom prices soar, with small and large varieties impacting India’s spice export market worth billions.”

Welcome to our comprehensive analysis of the Indian spice market, with a particular focus on the recent cardamom price surge in Kerala auctions and its implications for the global spice trade. As leaders in agricultural technology, we at Farmonaut are committed to providing you with the most up-to-date and insightful information on spice market prices and cardamom auction trends.

In this extensive blog post, we’ll delve into the intricacies of India’s thriving spice export market, exploring the factors driving price fluctuations, quality grading standards, and the growing influence of sustainable farming practices. Whether you’re an exporter, trader, or simply an enthusiast of the spice industry, this article will equip you with valuable knowledge to navigate the dynamic landscape of the global spice trade.

The Cardamom Boom: Kerala’s Golden Spice

Kerala, often referred to as the “Spice Garden of India,” has once again taken center stage in the global spice market. Recent auctions in the state have witnessed a remarkable surge in cardamom prices, sending ripples through the entire spice industry. Let’s break down the key factors contributing to this price hike:

- Demand-Supply Imbalance: A combination of increased global demand and lower production due to unfavorable weather conditions has created a supply shortage.

- Quality Premium: Kerala’s cardamom is renowned for its superior quality, commanding higher prices in both domestic and international markets.

- Export Opportunities: Growing interest from international buyers, particularly in the Middle East and Europe, has fueled competition in the auctions.

To better understand the current market dynamics, let’s take a look at the following table comparing cardamom prices and export trends:

| Cardamom Type | Origin | Quality Grade | Current Price (INR/kg) | Price Change (%) | Export Volume (Metric Tons) | Export Value (USD Million) | Major Export Destinations |

|---|---|---|---|---|---|---|---|

| Small Cardamom | Kerala | Grade A | 1,800 | +15% | 5,000 | 150 | Saudi Arabia, UAE, USA |

| Large Cardamom | Sikkim | Premium | 1,500 | +10% | 1,200 | 30 | Pakistan, Bangladesh, UK |

| Small Cardamom | Kerala | Grade B | 1,600 | +12% | 3,500 | 90 | Japan, Germany, Canada |

| Large Cardamom | Sikkim | Standard | 1,300 | +8% | 800 | 18 | Nepal, Bhutan, Singapore |

As evident from the table, both small and large cardamom varieties have experienced significant price increases, with small cardamom from Kerala leading the pack. This surge has had a profound impact on India’s spice export market, which is already valued at billions of dollars annually.

The Rise of Organic Spice Cultivation

One of the most notable trends in the Indian spice industry is the growing emphasis on organic spice cultivation. This shift towards sustainable farming practices is not just a response to environmental concerns but also a strategic move to cater to the increasing global demand for organic products.

Key aspects of organic spice cultivation include:

- Soil Health Management: Utilizing natural fertilizers and crop rotation to maintain soil fertility.

- Pest Control: Implementing biological pest control methods instead of chemical pesticides.

- Water Conservation: Adopting efficient irrigation techniques to minimize water usage.

- Biodiversity: Encouraging diverse plant species to create a balanced ecosystem.

The impact of organic cultivation on spice quality and market value cannot be overstated. Organic spices often command premium prices in international markets, providing farmers with higher returns on their investments.

At Farmonaut, we understand the importance of sustainable farming practices in the spice industry. Our satellite-based crop health monitoring system helps farmers make informed decisions about irrigation, fertilizer usage, and pest management, optimizing crop yields while minimizing resource wastage. To learn more about our innovative solutions, visit our web app or download our mobile apps:

Spice Quality Grading: A Crucial Factor in Price Determination

The quality of spices plays a pivotal role in determining their market value. In India, the Spices Board has established stringent quality grading systems to ensure that exported spices meet international standards. Let’s explore the grading criteria for some of the most sought-after Indian spices:

Cardamom Grading

- Extra Bold (EBO): 8mm and above

- Bold (BO): 7-8mm

- Superior (SPR): 6-7mm

- Standard (STD): Below 6mm

Black Pepper Grading

- Grade I: 4.25mm and above

- Grade II: 4.00mm to 4.25mm

- Grade III: 3.75mm to 4.00mm

- Grade IV: 3.25mm to 3.75mm

Turmeric Grading

- Finger: Whole rhizomes

- Bulb: Round or ovate rhizomes

- Split: Longitudinally split rhizomes

- Powder: Ground turmeric

These grading systems ensure that buyers can make informed decisions based on the quality of the spices they are purchasing. For exporters and traders, understanding these grading criteria is essential for maximizing profits and maintaining long-term relationships with international clients.

Regional Price Variations: From Singtam to Siliguri

“India’s spice industry faces dynamic price fluctuations, with regional variations of up to 20% from Singtam to Siliguri.”

The Indian spice market is characterized by significant regional price variations, influenced by factors such as local production, transportation costs, and market demand. Two notable spice trading hubs that exemplify these variations are Singtam in Sikkim and Siliguri in West Bengal.

Singtam: The Large Cardamom Hub

Singtam, located in the East Sikkim district, is renowned for its large cardamom trade. The town’s proximity to cardamom plantations gives it a competitive edge in terms of freshness and quality. However, its remote location can lead to higher transportation costs, affecting the final market price.

Siliguri: The Gateway to Northeast Spices

Siliguri, often referred to as the “Gateway to Northeast India,” serves as a crucial trading point for spices from Sikkim, Darjeeling, and other northeastern states. Its well-connected transportation network allows for more competitive pricing, often resulting in lower prices compared to Singtam.

The price difference between these two locations can be as high as 20%, highlighting the importance of understanding regional market dynamics for traders and exporters. Factors contributing to these variations include:

- Transportation Costs: The challenging terrain of Sikkim increases logistics expenses.

- Storage Facilities: Better storage infrastructure in Siliguri helps in price stabilization.

- Market Access: Siliguri’s position as a major trading hub attracts more buyers, influencing prices.

- Local Demand: Variations in local consumption patterns affect market prices.

For spice traders and exporters, navigating these regional price variations is crucial for optimizing profits and ensuring a steady supply chain. At Farmonaut, we provide real-time data and insights that can help stakeholders make informed decisions in this dynamic market landscape.

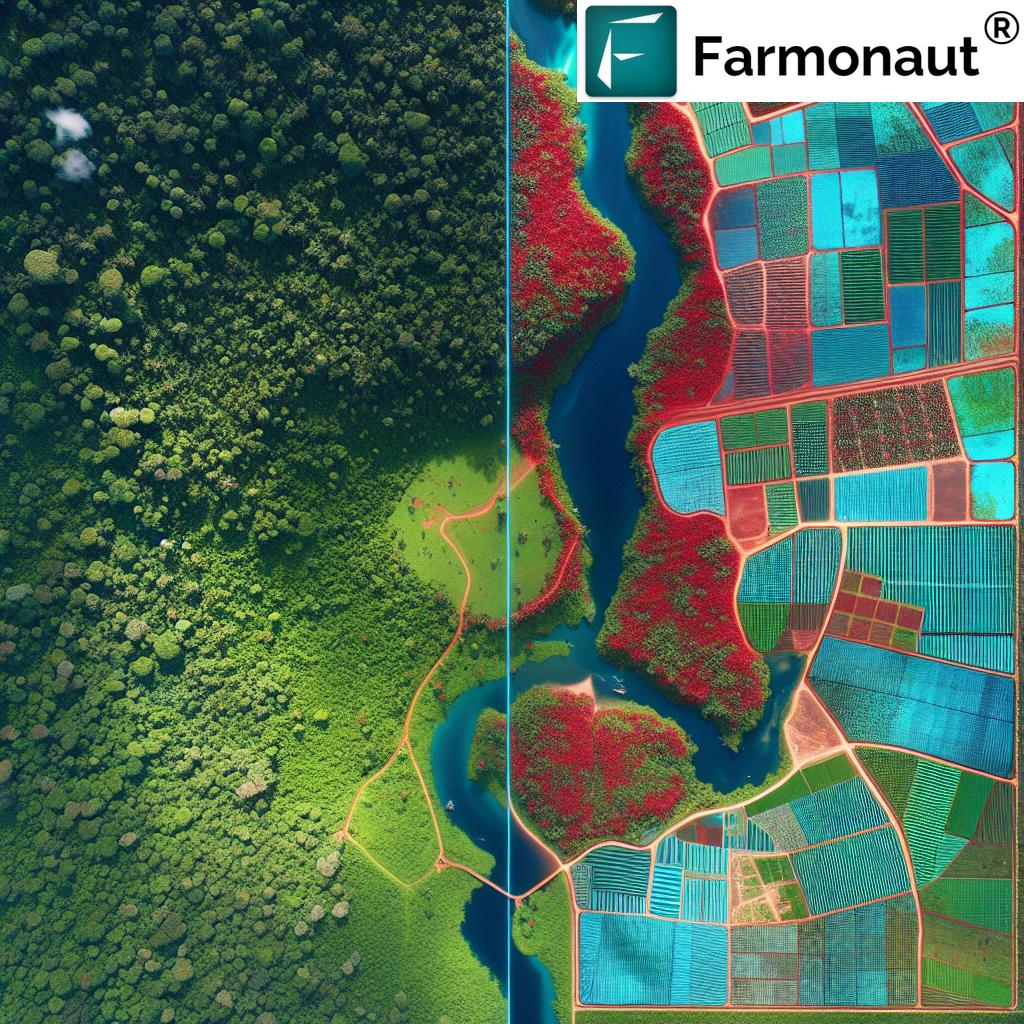

The Impact of GI Tags on Spice Values

Geographical Indication (GI) tags have become increasingly important in the spice trade, adding significant value to products and influencing market prices. These tags not only protect the unique characteristics of spices from specific regions but also help in building consumer trust and commanding premium prices in international markets.

Some notable Indian spices with GI tags include:

- Alleppey Green Cardamom (Kerala)

- Malabar Pepper (Kerala)

- Guntur Sannam Chilli (Andhra Pradesh)

- Naga Mircha (Nagaland)

- Sikkim Large Cardamom (Sikkim)

The GI tag ensures that these spices meet specific quality standards and are produced using traditional methods unique to their regions of origin. This certification often translates to higher market values and increased demand from discerning international buyers.

Export Trends and International Market Dynamics

India’s spice export market has shown remarkable resilience and growth over the years. According to recent data from the Spices Board of India, the country’s spice exports have consistently increased in both volume and value. Key trends in the international spice trade include:

- Diversification of Export Destinations: While traditional markets like the USA and EU remain strong, there’s growing demand from emerging markets in Africa and Southeast Asia.

- Value-Added Products: There’s an increasing focus on exporting value-added spice products like essential oils, oleoresins, and spice blends.

- Organic and Sustainable Spices: The demand for certified organic and sustainably produced spices is on the rise, especially in developed markets.

- Quality Compliance: Stricter food safety norms in importing countries have led to enhanced quality control measures in the Indian spice industry.

For exporters and traders looking to capitalize on these trends, staying informed about international market dynamics is crucial. Farmonaut’s advanced agri-solutions can provide valuable insights into crop health and yield predictions, helping stakeholders make data-driven decisions in the global spice trade.

The Role of Technology in Spice Cultivation and Trade

As the spice industry evolves, technology is playing an increasingly crucial role in enhancing productivity, ensuring quality, and streamlining trade processes. At Farmonaut, we’re at the forefront of this technological revolution in agriculture. Our satellite-based farm management solutions offer numerous benefits to spice farmers and traders:

- Precision Agriculture: Our satellite imagery helps farmers optimize irrigation, fertilizer use, and pest management.

- Crop Health Monitoring: Real-time data on crop health allows for timely interventions, ensuring higher yields and better quality.

- Yield Prediction: Advanced algorithms help in accurate yield estimation, aiding in better market planning.

- Traceability: Our blockchain-based solutions enhance supply chain transparency, a crucial factor in the international spice trade.

To explore how Farmonaut can revolutionize your spice cultivation or trading business, visit our web app or check out our API services at Farmonaut API. For detailed information on integrating our solutions, refer to our API Developer Docs.

Sustainable Spice Farming Practices

Sustainability has become a key focus in the spice industry, with both producers and consumers increasingly aware of the environmental impact of farming practices. Sustainable spice farming not only ensures long-term viability but also often results in higher quality products that command premium prices in the market.

Key sustainable practices in spice cultivation include:

- Water Conservation: Implementing drip irrigation and rainwater harvesting techniques.

- Soil Health Management: Using organic fertilizers and practicing crop rotation to maintain soil fertility.

- Integrated Pest Management: Employing natural predators and biological controls to minimize pesticide use.

- Agroforestry: Integrating spice cultivation with tree planting to enhance biodiversity and provide shade.

- Energy Efficiency: Utilizing solar power for drying and processing spices.

These practices not only benefit the environment but also contribute to the production of high-quality spices that meet international standards. At Farmonaut, we support sustainable farming through our advanced monitoring and advisory systems, helping farmers make environmentally responsible decisions while optimizing their yields.

GST Implications and Policy Changes in the Spice Industry

The implementation of the Goods and Services Tax (GST) has had significant implications for the Indian spice industry. Understanding these tax structures and staying updated on policy changes is crucial for all stakeholders in the spice trade. Here are some key points to consider:

- GST Rates: Most whole spices are taxed at 5% under GST, while processed spices and spice oils may attract higher rates.

- Input Tax Credit: Farmers and traders can claim input tax credit on various inputs, potentially reducing overall tax liability.

- E-way Bills: Mandatory for interstate transportation of goods valued above a certain threshold, impacting logistics in the spice trade.

- Export Incentives: Various export promotion schemes under GST aim to boost India’s spice exports.

Recent policy changes by the Indian government have also aimed at promoting spice exports and supporting domestic farmers. These include:

- Simplification of export procedures

- Increased focus on organic certification

- Support for establishing spice parks and processing facilities

- Initiatives to promote lesser-known Indian spices in international markets

Staying informed about these policy changes and tax implications is essential for making strategic business decisions in the spice industry.

The Future of India’s Spice Industry: Trends and Projections

As we look towards the future, several trends are shaping the landscape of India’s spice industry:

- Increased Mechanization: Adoption of advanced harvesting and processing technologies to improve efficiency and quality.

- Focus on Value-Added Products: Growing emphasis on spice extracts, essential oils, and custom blends for international markets.

- Digital Marketplaces: Rise of online platforms connecting spice producers directly with global buyers.

- Climate-Resilient Varieties: Development and promotion of spice varieties that can withstand changing climatic conditions.

- Blockchain in Supply Chain: Increased use of blockchain technology for enhancing traceability and transparency in the spice trade.

Projections indicate a continued growth trajectory for India’s spice exports, with a focus on high-value, quality-certified products. The industry is also likely to see increased investment in research and development, particularly in areas of pest resistance and flavor enhancement.

Conclusion: Navigating the Spice Market with Confidence

The Indian spice market, with its recent cardamom price surge and evolving export trends, presents both challenges and opportunities for industry stakeholders. By staying informed about market dynamics, embracing sustainable practices, and leveraging technological solutions like those offered by Farmonaut, participants in the spice trade can navigate this complex landscape with confidence.

Whether you’re a farmer looking to optimize your spice cultivation, a trader seeking market insights, or an exporter aiming to meet international standards, the key lies in adapting to changing market conditions and embracing innovation. With the right tools and knowledge, the vibrant world of Indian spices continues to offer a wealth of possibilities for growth and success.

Frequently Asked Questions (FAQ)

- What factors are driving the recent surge in cardamom prices in Kerala auctions?

The price surge is primarily due to increased global demand, reduced production due to unfavorable weather conditions, and the superior quality of Kerala cardamom. - How does organic spice cultivation impact market prices?

Organic spices often command premium prices in international markets due to growing consumer preference for chemical-free products and their perceived higher quality. - What role do GI tags play in the spice trade?

GI tags add value to spices by certifying their unique qualities tied to specific geographical origins, often resulting in higher market prices and increased consumer trust. - How can technology like Farmonaut’s solutions benefit spice farmers?

Farmonaut’s satellite-based solutions help farmers optimize irrigation, monitor crop health, predict yields, and implement sustainable farming practices, leading to improved productivity and quality. - What are the key export trends in the Indian spice industry?

Key trends include diversification of export destinations, increased focus on value-added products, growing demand for organic spices, and stricter quality compliance measures.