Unlocking Rural Prosperity: How Sustainable Agricultural Finance Drives Development in India

“NABARD’s innovative credit programs have reached over 100 million rural households in India, boosting farm productivity by 30%.”

In the heart of India’s agricultural landscape, a quiet revolution is taking place. We are witnessing the transformation of rural economies through sustainable agricultural finance and innovative development schemes. As we delve into this comprehensive exploration, we’ll uncover how these initiatives are not just changing the face of farming but are also paving the way for rural prosperity on an unprecedented scale.

The Role of Sustainable Rural Development in India’s Growth Story

Sustainable rural development is the cornerstone of India’s vision for inclusive growth. It encompasses a holistic approach that goes beyond mere agricultural productivity to include financial inclusion, infrastructure development, and social empowerment. At the forefront of this movement is the National Bank for Agriculture and Rural Development (NABARD), which has been instrumental in crafting and implementing agricultural finance schemes that are tailored to the unique needs of India’s diverse rural communities.

These schemes are not just about providing credit; they’re about creating a sustainable ecosystem where farmers can thrive. By focusing on long-term sustainability, these initiatives ensure that the benefits of development reach even the most remote corners of rural India.

Agricultural Finance Schemes: Catalysts for Change

The landscape of agricultural finance in India has evolved significantly over the years. Today, we see a plethora of schemes designed to address various aspects of rural development:

- Kisan Credit Card (KCC) Scheme: This revolutionary program provides farmers with easy access to credit for their seasonal agricultural operations.

- Rural Infrastructure Development Fund (RIDF): Focuses on creating vital infrastructure in rural areas, from irrigation systems to rural roads.

- Self Help Group (SHG) Bank Linkage Program: Empowers rural women by providing them with financial independence and entrepreneurship opportunities.

These schemes, among others, form the backbone of India’s rural credit programs, each playing a crucial role in enhancing farm productivity and fostering rural prosperity.

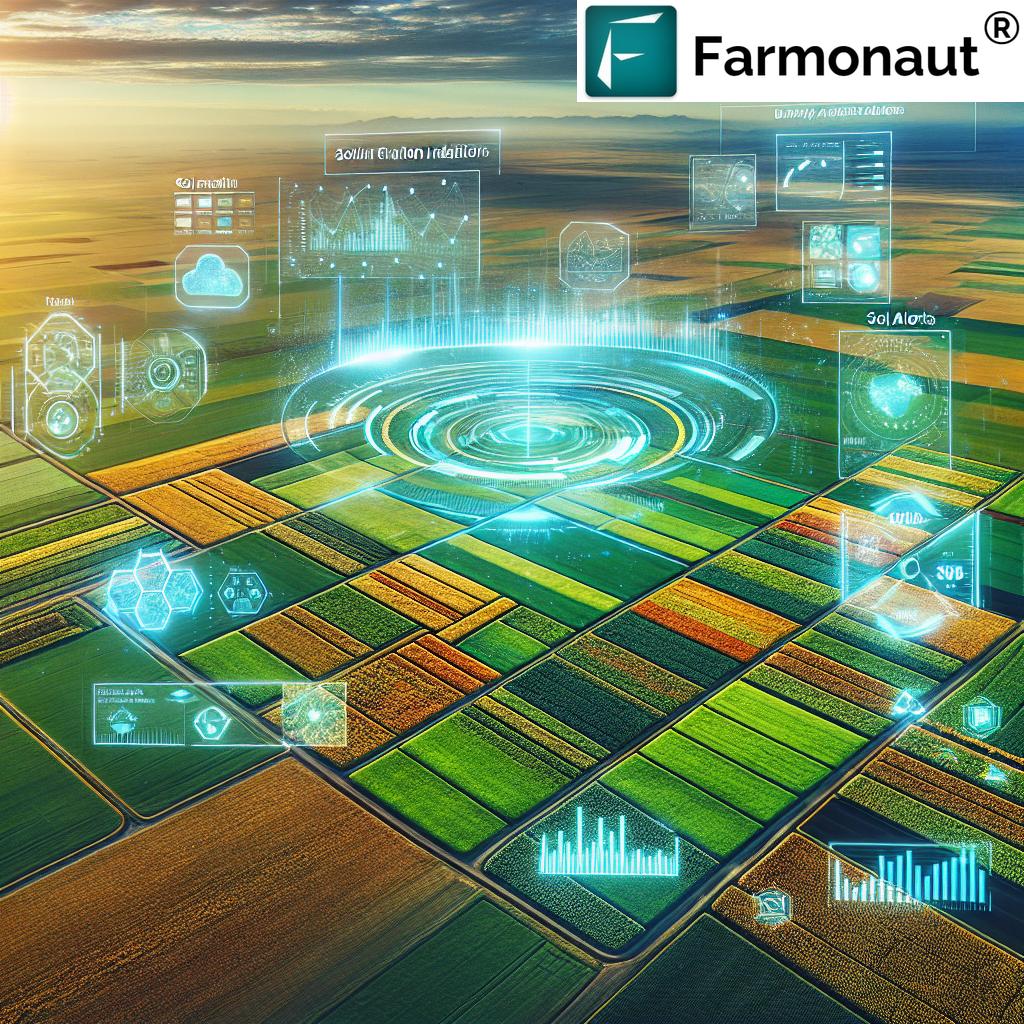

Enhancing Farm Productivity Through Financial Innovation

One of the key objectives of agricultural finance schemes is to boost farm productivity. By providing timely and adequate credit, these initiatives enable farmers to invest in better seeds, modern equipment, and improved farming techniques. The results are tangible:

- Increased crop yields

- Diversification of agricultural activities

- Adoption of sustainable farming practices

Moreover, these schemes often come bundled with training programs and advisory services, ensuring that farmers not only have access to credit but also the knowledge to utilize it effectively.

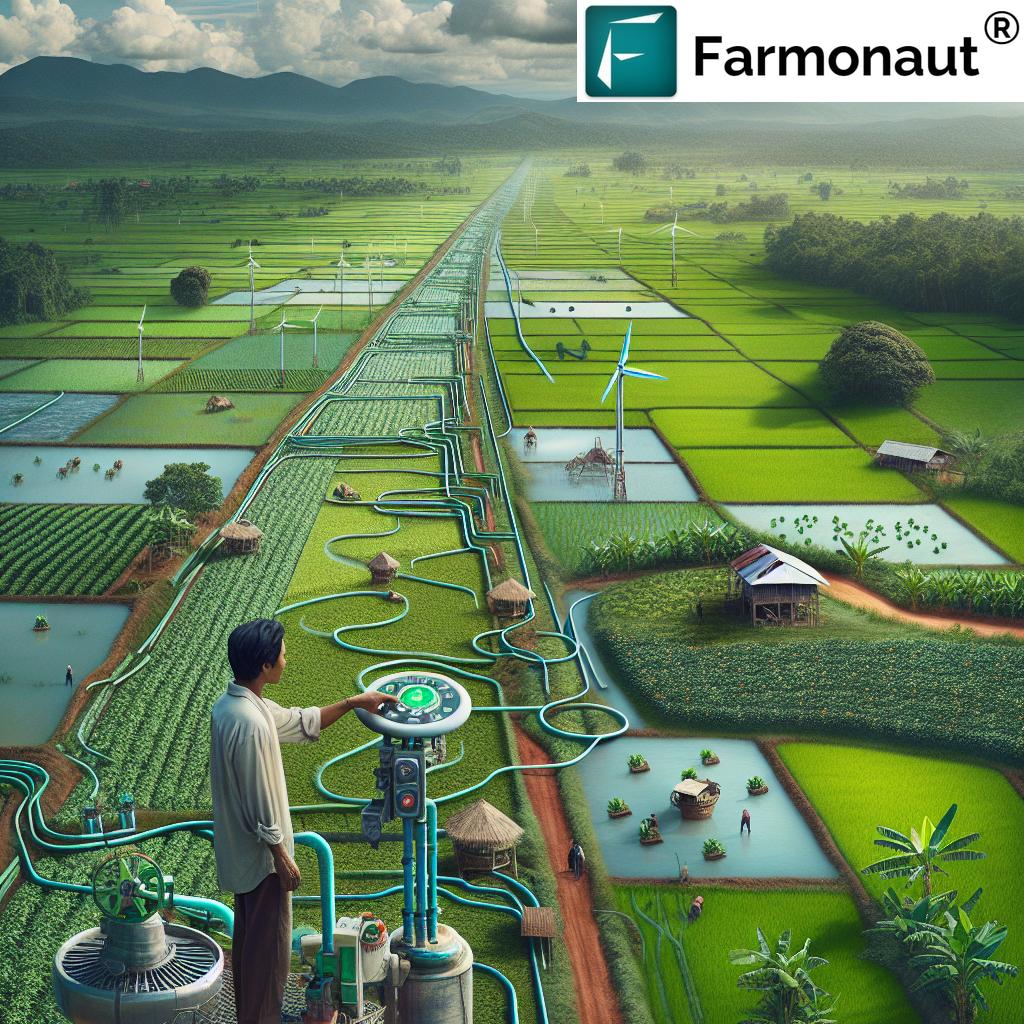

Rural Infrastructure Projects: Building the Foundation for Growth

Sustainable rural development is incomplete without robust infrastructure. NABARD’s focus on rural infrastructure projects has been a game-changer in this regard. These projects include:

- Irrigation facilities

- Rural roads and bridges

- Warehouses and cold storage units

- Rural marketing yards

By investing in these critical areas, we’re not just improving agricultural output but also creating new opportunities for rural employment and enterprise.

Bankable Agriculture Models: Bridging the Gap Between Finance and Farming

The concept of bankable agriculture models is revolutionizing the way financial institutions view agricultural lending. These models demonstrate the viability and profitability of various agricultural ventures, making it easier for banks to assess and approve loans for farmers.

Key features of bankable agriculture models include:

- Detailed cost-benefit analysis

- Risk assessment and mitigation strategies

- Integration of modern farming techniques

- Market linkage considerations

By promoting these models, we’re not only facilitating easier access to credit but also encouraging farmers to adopt more efficient and profitable farming practices.

Cooperative Bank Regulations: Ensuring Stability and Growth

Cooperative banks play a vital role in India’s rural financial ecosystem. To ensure their stability and effectiveness, robust regulations are essential. These regulations focus on:

- Improving governance structures

- Enhancing financial reporting standards

- Implementing risk management practices

- Promoting digital transformation

By strengthening cooperative banks, we’re creating a more resilient rural financial system that can better serve the needs of farmers and rural entrepreneurs.

Women Empowerment in Agriculture: A Key to Rural Development

Empowering women in agriculture is not just a matter of social justice; it’s a smart economic strategy. Numerous initiatives are focused on enhancing the role of women in farming:

- Special credit lines for women farmers

- Skill development programs

- Promotion of women-led agri-enterprises

- Support for women’s self-help groups in agriculture

By unleashing the potential of women in agriculture, we’re not only boosting productivity but also creating more inclusive and resilient rural communities.

Rural Financial Inclusion: Bringing Banking to the Unbanked

Financial inclusion is a cornerstone of sustainable rural development. Efforts in this direction include:

- Expanding banking networks in rural areas

- Promoting digital financial services

- Simplifying KYC norms for rural customers

- Introducing no-frills bank accounts

These initiatives are crucial in bringing formal financial services to previously unbanked populations, thereby reducing their vulnerability to exploitative informal lending practices.

“Satellite-based crop monitoring technology has increased agricultural yields by 25% for 500,000 Indian farmers in the last 5 years.”

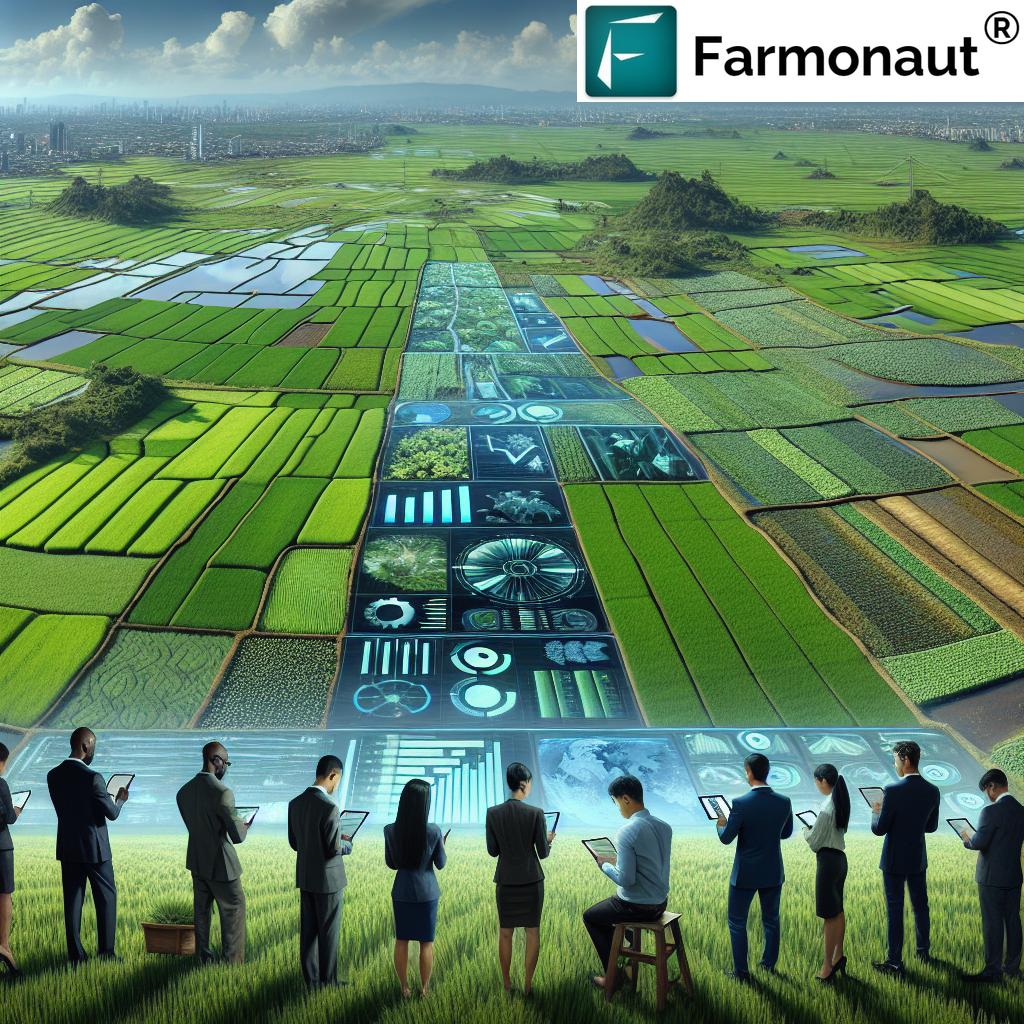

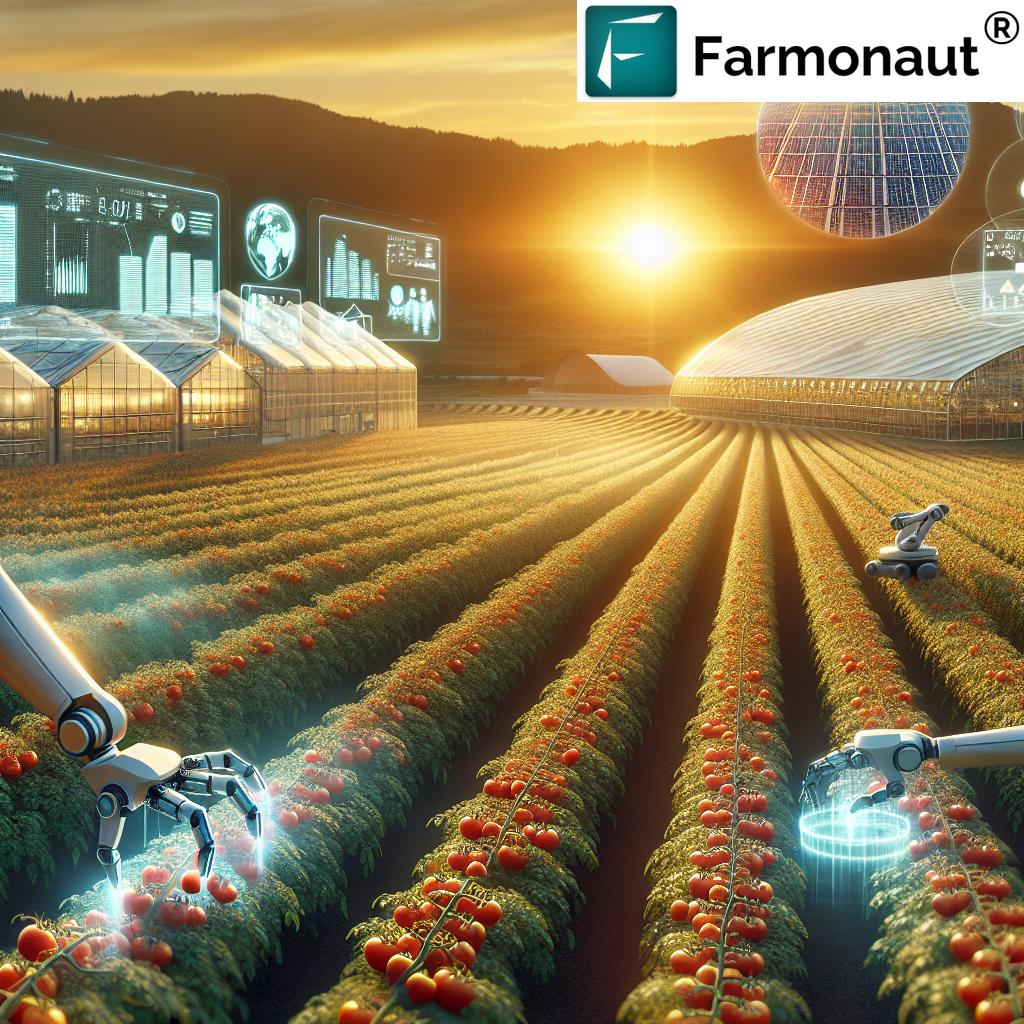

Agricultural Technology Adoption: The Future of Farming

The adoption of agricultural technology is pivotal in modernizing Indian agriculture. We’re seeing a surge in the use of technologies like:

- Precision farming techniques

- IoT-based crop monitoring

- Drone technology for crop assessment

- AI-powered advisory services

One notable example is Farmonaut, a pioneering company that offers satellite-based crop health monitoring services. Their technology allows farmers to make data-driven decisions, optimizing resource use and improving crop yields.

Farmonaut’s services are accessible through various platforms, including  and

and  .

.

Impact of Developmental and Supervisory Policies

The impact of various developmental and supervisory policies on rural communities has been profound. These policies have led to:

- Improved credit flow to agriculture and allied sectors

- Enhanced rural infrastructure

- Increased farm incomes

- Greater financial literacy in rural areas

By continually refining these policies based on feedback and changing needs, we ensure that they remain relevant and effective in driving rural development.

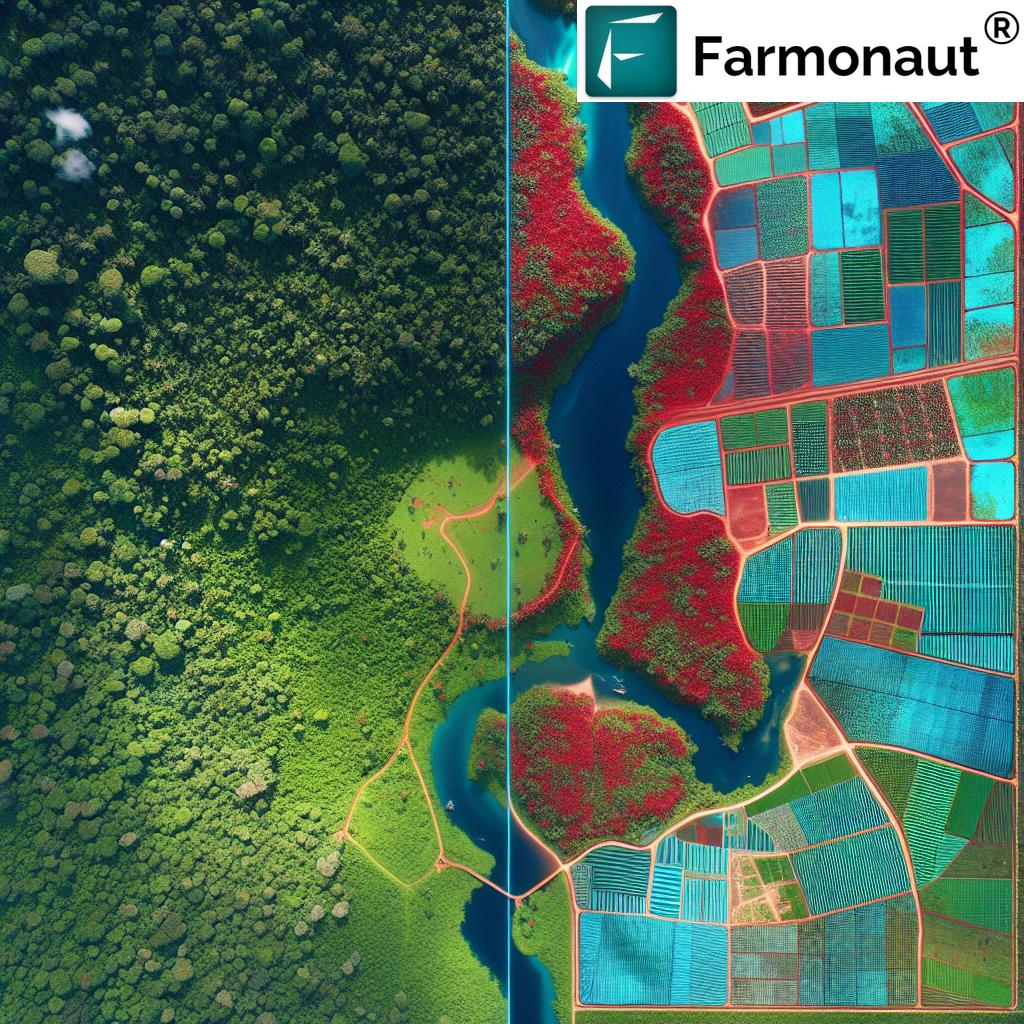

The Role of Technology in Agricultural Finance

Technology is playing an increasingly important role in agricultural finance. From digital lending platforms to satellite-based crop monitoring, technological innovations are making finance more accessible and efficient for farmers.

For instance, Farmonaut’s API and developer documentation allow for seamless integration of their satellite data into various agricultural applications, further enhancing the tech ecosystem in agriculture.

Sustainable Agricultural Finance Initiatives in India

| Initiative Name | Implementing Agency | Focus Area | Estimated Impact |

|---|---|---|---|

| Kisan Credit Card Scheme | NABARD & Commercial Banks | Easy credit access for farmers | Over 65 million cards issued |

| National Rural Livelihood Mission | Ministry of Rural Development | Women empowerment & rural entrepreneurship | 70 million households reached |

| Pradhan Mantri Fasal Bima Yojana | Ministry of Agriculture & Farmers Welfare | Crop insurance | 38 million farmers covered |

| e-NAM (National Agriculture Market) | Small Farmers’ Agribusiness Consortium | Online trading platform for agricultural commodities | 1,000+ mandis connected across India |

The Future of Agricultural Finance in India

As we look to the future, several trends are shaping the landscape of agricultural finance in India:

- Increased focus on climate-resilient agriculture

- Integration of blockchain for transparent supply chains

- Expansion of micro-insurance products for small farmers

- Growth of agri-tech startups and their role in finance

These trends point towards a more resilient, technology-driven, and inclusive agricultural finance ecosystem.

Conclusion: A Path to Sustainable Rural Prosperity

As we’ve explored throughout this blog, sustainable agricultural finance is not just about providing credit; it’s about creating an ecosystem that supports the holistic development of rural India. From innovative credit programs to the adoption of cutting-edge technologies like those offered by Farmonaut, we’re witnessing a transformation in the way agriculture is practiced and financed in India.

The journey towards rural prosperity is ongoing, but with continued focus on sustainable development, financial inclusion, and technological innovation, we are confident that India’s agricultural sector will continue to thrive and contribute significantly to the nation’s economic growth.

Farmonaut Subscriptions

Frequently Asked Questions

- What is sustainable agricultural finance?

Sustainable agricultural finance refers to financial services and products designed to support long-term agricultural productivity while considering environmental and social factors. - How does NABARD contribute to rural development?

NABARD plays a crucial role by providing refinance to lending institutions in rural areas, supervising Cooperative Banks and RRBs, and promoting financial inclusion. - What is the Kisan Credit Card scheme?

The Kisan Credit Card scheme is a credit system introduced by the Indian government to provide farmers with timely access to credit for their agricultural needs. - How does technology like Farmonaut’s satellite monitoring help farmers?

Farmonaut’s satellite monitoring technology provides farmers with real-time data on crop health, allowing them to make informed decisions about irrigation, fertilization, and pest control, ultimately improving yields and reducing resource waste. - What are some challenges in implementing agricultural finance schemes in India?

Challenges include reaching remote areas, addressing the diverse needs of different farming communities, and ensuring the proper utilization of credit.

By addressing these critical aspects of sustainable agricultural finance, we continue to pave the way for a more prosperous and resilient rural India. The integration of traditional financial wisdom with modern technological solutions, as exemplified by platforms like Farmonaut, represents the future of agricultural development in the country.