VanEck Australian Corporate Bond Plus ETF Announces 0.33% Yield Dividend: Investment Insights for Fixed Income Securities

“The VanEck Australian Corporate Bond Plus ETF announced a 0.33% yield dividend, offering insights into fixed income securities.”

In the ever-evolving landscape of investment opportunities, we at Farmonaut recognize the importance of diversified portfolio strategies. While our primary focus is on revolutionizing agriculture through technology, we understand that our customers, many of whom are involved in the agricultural sector, are also keen on exploring various investment avenues. Today, we’re delving into an exciting development in the Australian corporate bond market that could be of interest to investors seeking stable returns in these uncertain economic times.

On January 8th, the VanEck Australian Corporate Bond Plus ETF, trading under the ASX ticker PLUS, made a significant announcement that has caught the attention of fixed income investors. This exchange-traded fund (ETF) declared an interim dividend of 0.055 per share, translating to a yield of 0.33%. For shareholders on record as of January 22nd, this news comes as a welcome development, with the ex-dividend date set for January 7th.

Understanding the VanEck Australian Corporate Bond Plus ETF

The VanEck Australian Corporate Bond Plus ETF has established itself as a noteworthy player in the realm of corporate bonds. Its primary appeal lies in offering investors exposure to a diversified selection of Australian corporate debt. This strategy aims to provide competitive returns while mitigating risk through diversification.

In today’s market, where the demand for fixed income securities in Australia is on the rise, ETFs like PLUS are particularly attractive. They offer a buffer against market volatility and economic uncertainties, making them a solid choice for conservative investment portfolios. The recent dividend declaration further enhances the fund’s appeal, especially for investors seeking regular income streams.

The Australian Corporate Debt Market: A Closer Look

To fully appreciate the significance of this dividend announcement, it’s crucial to understand the broader context of the Australian corporate debt market. This sector has been gaining traction among both domestic and international investors, drawn by Australia’s stable economic environment and robust regulatory framework.

Corporate bonds, as a fixed income security, play a vital role in diversified investment portfolio strategies. They offer several advantages:

- Steady income streams through regular interest payments

- Generally lower risk compared to equity investments

- Potential for capital appreciation

- A hedge against economic downturns

The VanEck Australian Corporate Bond Plus ETF capitalizes on these benefits, offering investors an efficient way to gain exposure to this market segment.

Dividend Yield Calculation: Breaking Down the Numbers

Understanding how dividend yields are calculated is crucial for investors evaluating fixed income securities. In the case of the VanEck Australian Corporate Bond Plus ETF, the 0.33% yield is derived from the announced dividend of 0.055 per share. This figure is particularly significant when considering the current low-interest-rate environment.

To put this into perspective, let’s break down the dividend yield calculation:

- Dividend per share: 0.055 AUD

- Current share price (hypothetical): 16.67 AUD

- Dividend yield = (Dividend per share / Share price) x 100

- Yield = (0.055 / 16.67) x 100 = 0.33%

While a 0.33% yield might seem modest at first glance, it’s important to consider this in the context of the current market conditions and the relative stability offered by corporate bonds.

Ex-Dividend Date Explained

An essential aspect of dividend investing is understanding the ex-dividend date. For the VanEck Australian Corporate Bond Plus ETF, this date is set for January 7th. But what does this mean for investors?

The ex-dividend date is crucial because it determines who is eligible to receive the declared dividend. Here’s a quick breakdown:

- Investors who purchase shares before the ex-dividend date are eligible to receive the dividend

- Those who buy shares on or after the ex-dividend date will not receive this particular dividend

- The stock price typically adjusts downward by the amount of the dividend on the ex-dividend date

For potential investors eyeing the VanEck Australian Corporate Bond Plus ETF, understanding this timeline is crucial for making informed investment decisions.

Investing in Fixed Income Securities: Strategies and Considerations

When it comes to investing in fixed income securities like the VanEck Australian Corporate Bond Plus ETF, several strategies and considerations come into play:

- Diversification: Corporate bonds can serve as an excellent diversification tool within a broader investment portfolio.

- Income Generation: For investors seeking regular income, especially retirees, corporate bond ETFs can provide steady cash flows.

- Risk Management: Generally considered less risky than stocks, corporate bonds can help balance portfolio risk.

- Interest Rate Sensitivity: Be aware that bond prices typically move inversely to interest rates.

- Credit Quality: Consider the credit ratings of the underlying bonds in the ETF.

It’s worth noting that while we at Farmonaut specialize in agricultural technology solutions, many of our customers in the agricultural sector also seek diverse investment opportunities. Our API and API Developer Docs offer insights into agricultural data that can indirectly inform investment decisions in related sectors.

Technology as a Business Enabler: Parallels with Fixed Income Investing

While discussing fixed income securities, it’s interesting to draw parallels with how technology acts as a business enabler across various sectors, including agriculture and finance. At Farmonaut, we leverage technology to provide innovative solutions for farmers and agribusinesses. Similarly, in the world of investing, technology plays a crucial role in enhancing investment strategies and decision-making processes.

For instance, our satellite-based farm management solutions utilize advanced technologies to provide real-time insights, much like how financial technology platforms offer real-time data and analytics for investment decisions. This synergy between technology and traditional sectors is reshaping industries and creating new opportunities for growth and efficiency.

To experience how technology can transform agriculture, consider exploring our solutions:

Market Trends Analysis: Australian Corporate Bonds and Beyond

As we delve deeper into the world of fixed income securities, it’s crucial to analyze current market trends, particularly in the Australian corporate bond market. This analysis not only provides context for the VanEck Australian Corporate Bond Plus ETF’s performance but also offers insights into the broader economic landscape.

Key trends we’re observing include:

- Increasing demand for corporate bonds amid economic uncertainty

- Shift towards sustainable and ESG-focused bond issuances

- Impact of global interest rate movements on bond yields

- Growing interest in inflation-linked bonds as a hedge against rising prices

These trends underscore the dynamic nature of the fixed income market and the importance of staying informed about market movements and economic indicators.

High Yield Dividend Stocks: A Comparative View

While our focus has been on the VanEck Australian Corporate Bond Plus ETF, it’s worth comparing this investment option with high yield dividend stocks. Both options aim to provide regular income to investors, but they come with different risk profiles and potential returns.

High yield dividend stocks often offer:

- Potentially higher yields compared to corporate bonds

- Possibility of capital appreciation

- Exposure to company growth

However, they also typically come with:

- Higher volatility

- Greater risk of dividend cuts during economic downturns

- More complex valuation methods

Investors must weigh these factors against the relative stability and predictable income streams offered by corporate bond ETFs like the VanEck Australian Corporate Bond Plus ETF.

Comparative Analysis: VanEck ETF vs. Other Fixed Income Securities

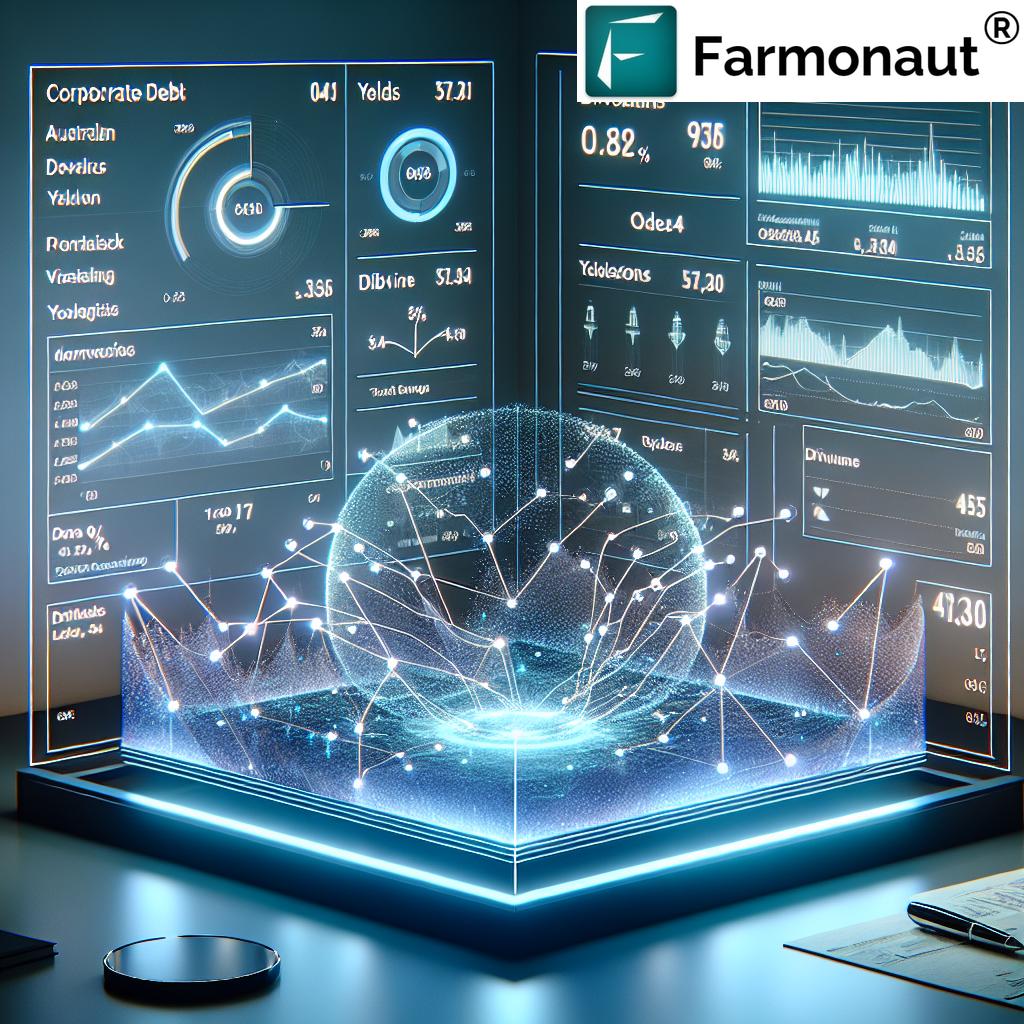

To provide a clearer picture of how the VanEck Australian Corporate Bond Plus ETF stands in the market, let’s compare it with other prominent Australian fixed income securities:

| Security Name | Dividend Yield (%) | Ex-Dividend Date | YTD Performance (%) | Risk Rating (1-5) |

|---|---|---|---|---|

| VanEck Australian Corporate Bond Plus ETF | 0.33 | Jan 7, 2024 | 2.1 | 2 |

| iShares Core Corporate Bond ETF | 0.45 | Dec 15, 2023 | 1.8 | 2 |

| Vanguard Australian Corporate Fixed Interest Index ETF | 0.40 | Jan 3, 2024 | 2.3 | 2 |

| SPDR S&P/ASX Australian Bond Fund | 0.38 | Dec 31, 2023 | 1.9 | 1 |

| BetaShares Australian Investment Grade Corporate Bond ETF | 0.42 | Jan 5, 2024 | 2.0 | 2 |

This comparison illustrates that while the VanEck ETF’s yield is competitive, investors have several options to consider in the Australian fixed income market. Each security offers slightly different characteristics in terms of yield, performance, and risk profile.

Investment Catalysts: Factors Driving Fixed Income Markets

Understanding the catalysts that drive fixed income markets is crucial for making informed investment decisions. Several key factors are currently influencing the Australian corporate bond market:

- Monetary Policy: The Reserve Bank of Australia’s decisions on interest rates have a direct impact on bond yields and prices.

- Economic Indicators: Factors such as GDP growth, inflation rates, and employment figures play a significant role in shaping the bond market landscape.

- Global Economic Conditions: International economic trends and geopolitical events can influence investor sentiment towards Australian fixed income securities.

- Corporate Performance: The financial health and credit ratings of Australian corporations directly affect the attractiveness and pricing of their bonds.

- Regulatory Environment: Changes in financial regulations can impact the issuance and trading of corporate bonds.

These catalysts underscore the importance of staying informed about both local and global economic developments when investing in fixed income securities.

Diversified Investment Portfolio Strategies: Incorporating Fixed Income

Incorporating fixed income securities like the VanEck Australian Corporate Bond Plus ETF into a diversified investment portfolio requires thoughtful strategy. Here are some approaches investors might consider:

- Core-Satellite Approach: Use bond ETFs as a core holding for stability, complemented by satellite positions in higher-risk assets for growth potential.

- Barbell Strategy: Combine investments in short-term and long-term bonds to balance yield and interest rate sensitivity.

- Ladder Strategy: Invest in bonds with staggered maturity dates to manage reinvestment risk and maintain consistent income.

- Income Focus: Allocate a larger portion to fixed income for investors prioritizing regular cash flows, such as retirees.

- Risk Mitigation: Use corporate bonds as a counterbalance to riskier equity positions in the portfolio.

These strategies can be tailored to individual investor needs, risk tolerance, and investment goals.

“Australian corporate bonds and dividend-yielding stocks provide diversification opportunities in uncertain economic conditions, impacting investment strategies.”

Technology’s Role in Modern Investing

As we at Farmonaut leverage technology to revolutionize agriculture, the investment world is similarly being transformed by technological advancements. These innovations are changing how investors approach fixed income securities and portfolio management:

- Robo-Advisors: Automated platforms offering algorithm-driven financial planning services, including bond allocation recommendations.

- Big Data Analytics: Advanced data analysis tools helping investors make more informed decisions about market trends and bond performance.

- Blockchain in Bond Trading: Emerging technologies streamlining bond issuance and trading processes, potentially increasing market efficiency.

- AI-Driven Risk Assessment: Artificial intelligence systems enhancing credit risk analysis for corporate bonds.

These technological advancements are making fixed income investing more accessible and efficient for a broader range of investors.

The Impact of ESG Considerations on Fixed Income Investing

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions, including in the fixed income sector. This trend is reshaping the corporate bond landscape:

- Green Bonds: Growing issuance of bonds funding environmentally friendly projects.

- Social Bonds: Increasing focus on bonds supporting social initiatives and community development.

- Sustainability-Linked Bonds: Emergence of bonds with interest rates tied to sustainability performance targets.

- ESG Integration in Credit Analysis: Incorporation of ESG factors in assessing corporate bond issuers’ creditworthiness.

Investors in ETFs like the VanEck Australian Corporate Bond Plus ETF may want to consider how these funds are incorporating ESG criteria into their investment decisions.

Global Perspectives: Australian Bonds in the International Context

To fully appreciate the position of Australian corporate bonds, it’s valuable to consider them within the global fixed income landscape:

- Yield Comparisons: How Australian bond yields stack up against those in other developed markets.

- Currency Considerations: The impact of AUD exchange rates on international investors’ returns.

- Economic Stability: Australia’s economic resilience compared to other bond-issuing nations.

- Regulatory Environment: The attractiveness of Australia’s financial regulatory framework to global investors.

This global perspective helps investors understand the relative attractiveness of Australian corporate bonds in their international portfolios.

Future Outlook: Trends Shaping the Australian Corporate Bond Market

Looking ahead, several trends are likely to shape the future of the Australian corporate bond market:

- Digitalization of Bond Markets: Increasing use of digital platforms for bond issuance and trading.

- Sustainable Finance Growth: Continued expansion of green and social bond issuances.

- Yield Curve Dynamics: Potential shifts in the yield curve based on economic recovery patterns.

- Regulatory Developments: Possible changes in financial regulations impacting bond markets.

- Inflation and Interest Rate Expectations: Long-term projections and their impact on bond valuations.

These trends will be crucial for investors to monitor when considering investments in ETFs like the VanEck Australian Corporate Bond Plus ETF.

Practical Tips for Investing in Corporate Bond ETFs

For investors considering adding corporate bond ETFs to their portfolios, here are some practical tips:

- Understand the ETF’s underlying holdings and credit quality distribution.

- Consider the fund’s expense ratio and how it impacts overall returns.

- Look at the ETF’s historical performance, particularly during market downturns.

- Assess how the ETF fits into your overall investment strategy and risk tolerance.

- Stay informed about economic indicators that could impact bond markets.

- Regularly review and rebalance your portfolio to maintain desired asset allocation.

These tips can help investors make more informed decisions when considering ETFs like the VanEck Australian Corporate Bond Plus ETF.

Conclusion: Navigating the Fixed Income Landscape

The announcement of the VanEck Australian Corporate Bond Plus ETF’s 0.33% yield dividend offers an excellent opportunity to explore the world of fixed income securities. As we’ve seen, corporate bonds play a crucial role in diversified investment portfolios, offering stability and regular income streams, particularly valuable in uncertain economic times.

While our focus at Farmonaut is on revolutionizing agriculture through technology, we recognize the importance of diverse investment strategies for our customers and partners in the agricultural sector. Just as our satellite-based solutions provide valuable insights for farmers, thorough research and analysis are essential for making informed investment decisions in the fixed income market.

Whether you’re considering the VanEck Australian Corporate Bond Plus ETF or exploring other fixed income options, remember to align your investment choices with your overall financial goals, risk tolerance, and market outlook. Stay informed, diversify wisely, and consider seeking professional advice when navigating the complex world of fixed income investing.

FAQ Section

Q1: What is the VanEck Australian Corporate Bond Plus ETF?

A1: It’s an exchange-traded fund that provides exposure to a diversified selection of Australian corporate debt, aiming to offer competitive returns while managing risk through diversification.

Q2: How does the dividend yield of 0.33% compare to other fixed income investments?

A2: While seemingly modest, this yield should be considered in the context of current low-interest rates and the relative stability offered by corporate bonds compared to riskier investments.

Q3: What are the key benefits of investing in corporate bond ETFs?

A3: Benefits include steady income streams, generally lower risk compared to equities, potential for capital appreciation, and a hedge against economic downturns.

Q4: How can technology enhance fixed income investing?

A4: Technology facilitates more efficient trading, provides advanced analytics for risk assessment, and enables broader access to bond markets through digital platforms.

Q5: What role do ESG factors play in corporate bond investing?

A5: ESG considerations are increasingly important, influencing the issuance of green and social bonds, and playing a role in credit risk assessment of corporate bond issuers.