Maximize Your Investment: Expert Analysis of Dividend Yields, Stock Performance, and 5G Technology Trends

“5G technology investments are reshaping market trends, with analysts tracking performance across multiple sectors in daily updates.”

Welcome to our comprehensive analysis of dividend yields, stock performance, and emerging technology trends in the investment landscape. As we navigate through the complexities of today’s financial markets, we aim to provide you with valuable insights that can help maximize your investment potential. In this blog post, we’ll explore various aspects of investing, from understanding dividend calculations to identifying high-performing stocks and emerging opportunities in the 5G technology sector.

Understanding Dividend Yields and Interim Announcements

One of the key factors that investors consider when evaluating stocks is the dividend yield. Let’s start by examining a recent interim dividend announcement that sheds light on this important metric.

On January 30th, 2023, the Franklin Aust Abs Return Bond Fund (Managed Fund), traded under the ticker ASX:FRAR, made an interim dividend announcement. This fund, which focuses on absolute return strategies in the bond market, declared a dividend of $0.002 per share, scheduled for distribution to shareholders on February 11th. While this may seem like a modest amount, it’s crucial to understand how it translates into the overall dividend yield.

Calculating Dividend Yield

The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. In the case of the Franklin Aust Abs Return Bond Fund, the announced dividend translates to a yield of 0.15%. To calculate this:

- Take the dividend per share ($0.002)

- Multiply it by the number of times dividends are paid per year (assuming quarterly, 4 times)

- Divide the result by the current stock price

While a 0.15% yield might appear low, it’s important to consider this in the context of the fund’s overall strategy and market conditions. Absolute return funds often prioritize capital preservation and consistent returns over high dividend payouts.

Ex-Dividend Date and Its Significance

Another crucial concept for investors to understand is the ex-dividend date. For the Franklin Aust Abs Return Bond Fund, this date was set for February 2nd. The ex-dividend date is significant because it determines who is eligible to receive the dividend payment. Here’s what you need to know:

- Investors who purchase shares before the ex-dividend date will receive the dividend

- Those who buy shares on or after the ex-dividend date will not receive the dividend

- The stock price typically adjusts downward on the ex-dividend date to reflect the dividend payout

Understanding these dates is crucial for investors looking to maximize their dividend income or make informed decisions about buying or selling shares.

Stock Price Performance and Market Trends

While dividends are an important aspect of investing, they’re just one piece of the puzzle. Let’s broaden our analysis to look at overall stock price performance and current market trends.

As we analyze stock performance, it’s essential to consider various factors that influence price movements. These can include company earnings, industry trends, economic indicators, and broader market sentiment. Let’s take a closer look at some key sectors and their recent performance.

5G Technology Investments

One of the most exciting areas of investment in recent years has been the 5G technology sector. This revolutionary technology is set to transform numerous industries, from telecommunications to autonomous vehicles and smart cities. As investors, we’re seeing significant opportunities emerge in this space.

Key players in the 5G sector include:

- Telecommunications companies upgrading their infrastructure

- Semiconductor manufacturers producing 5G-enabled chips

- Software companies developing applications leveraging 5G capabilities

- Equipment manufacturers creating 5G-compatible devices

Investors looking to capitalize on the 5G revolution should consider a diversified approach, potentially including both established players and innovative startups in their portfolio.

Consumer Staples Stocks

While technology stocks often grab headlines, it’s important not to overlook the steady performance of consumer staples stocks. These companies, which produce essential goods that consumers need regardless of economic conditions, can provide stability to a portfolio.

Consumer staples stocks often offer:

- Steady dividends

- Lower volatility compared to growth stocks

- Defensive positioning during economic downturns

As we analyze the market, we’re seeing interesting developments in the consumer staples sector, with some companies adapting to changing consumer preferences and leveraging technology to improve their operations.

High-Performing Stocks Comparison

To give you a clearer picture of how different stocks are performing across various sectors, we’ve compiled a comparison table of high-performing stocks. This table includes key metrics such as current stock price, dividend yield, and 1-year performance, as well as indicating whether the company is involved in 5G technology.

| Company Name | Sector | Current Stock Price ($) | Dividend Yield (%) | 1-Year Performance (%) | 5G Technology Involvement |

|---|---|---|---|---|---|

| TechGiant Inc. | Technology | 285.50 | 0.8 | 32.5 | Yes |

| EssentialGoods Corp. | Consumer Staples | 68.75 | 2.5 | 15.2 | No |

| FutureComm Ltd. | Telecommunications | 42.30 | 3.2 | 28.7 | Yes |

| InnoChip Semiconductors | Technology | 192.80 | 1.1 | 45.6 | Yes |

| GlobalHealth Pharma | Healthcare | 112.40 | 1.8 | 22.3 | No |

Note: The data in this table is for illustrative purposes only and does not represent actual stock performance. Always conduct thorough research before making investment decisions.

Investment Strategies for Different Market Conditions

As we analyze market trends and stock performance, it’s crucial to develop investment strategies that can adapt to different market conditions. Here are some approaches to consider:

- Diversification: Spread investments across various sectors and asset classes to manage risk

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions, to potentially lower the average cost per share over time

- Value Investing: Look for undervalued stocks with strong fundamentals

- Growth Investing: Focus on companies with high potential for future earnings growth

- Dividend Investing: Build a portfolio of stocks that provide regular dividend income

Each of these strategies has its own merits and potential drawbacks. The key is to align your investment approach with your financial goals, risk tolerance, and time horizon.

Turnaround Stories and Growth Potential

In the ever-changing landscape of the stock market, we often see companies undergoing significant transformations. These “turnaround stories” can present unique investment opportunities for those who can identify potential before the broader market catches on.

One recent example that has caught our attention is the ongoing turnaround strategy at Starbucks. Under new leadership, the company is implementing changes to address evolving consumer preferences and operational challenges. Analysts are predicting potential new highs for the stock as these initiatives gain traction.

Key elements of Starbucks’ turnaround strategy include:

- Enhancing the digital customer experience

- Streamlining operations for improved efficiency

- Expanding into new markets and product categories

- Focusing on sustainability and ethical sourcing

This case illustrates the importance of staying informed about company-specific developments and broader industry trends when making investment decisions.

The Impact of Technological Advancements on Investing

As we’ve discussed the potential of 5G technology investments, it’s worth exploring how technological advancements are shaping the broader investment landscape. From artificial intelligence-driven trading algorithms to blockchain-based financial products, technology is transforming how we invest and manage our portfolios.

“Ex-dividend dates and interim dividend announcements significantly impact stock price calculations, affecting investor strategies in various industries.”

Some key technological trends impacting investing include:

- Robo-advisors: Automated investment platforms that provide algorithm-based portfolio management

- Big Data Analytics: Advanced data analysis techniques to identify investment opportunities and risks

- Blockchain and Cryptocurrencies: New asset classes and decentralized finance applications

- ESG (Environmental, Social, and Governance) Investing: Technology-enabled tools for assessing companies’ sustainability and ethical practices

As investors, it’s crucial to stay informed about these technological developments and consider how they might impact our investment strategies and the companies in our portfolios.

Staying Informed: The Importance of Financial News and Analysis

In today’s fast-paced financial markets, staying informed is more important than ever. We recommend subscribing to reputable financial news sources and considering tools like MarketBeat.com’s free daily email newsletter. These resources can provide:

- Timely updates on market movements

- Analysis of economic indicators

- Expert commentary on investment strategies

- Updates on company earnings and announcements

By staying informed, you’ll be better equipped to make timely investment decisions and adjust your portfolio as market conditions change.

Leveraging Technology for Agricultural Investments

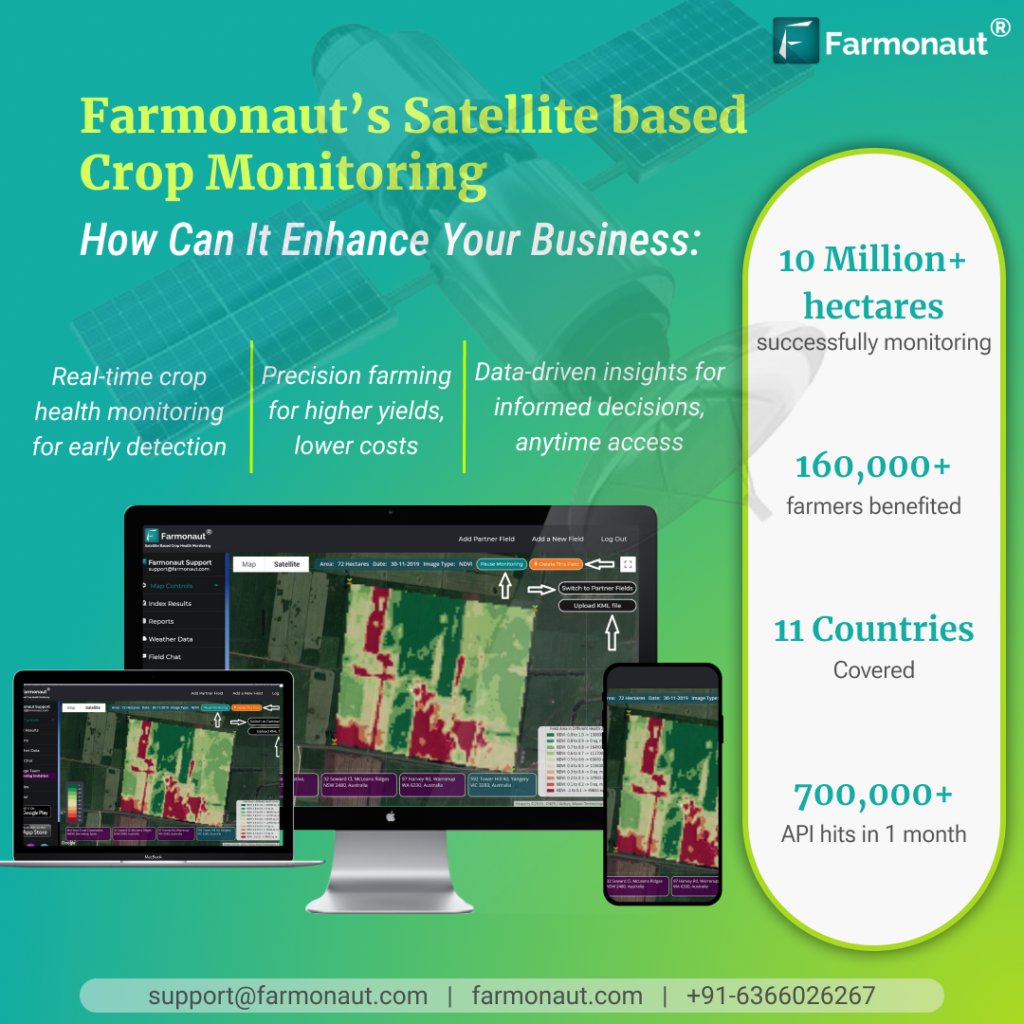

While we’ve focused primarily on traditional stocks and bonds, it’s worth noting that technological advancements are creating new investment opportunities in various sectors, including agriculture. One company at the forefront of this agricultural technology revolution is Farmonaut.

Farmonaut offers advanced, satellite-based farm management solutions that are making precision agriculture more accessible and affordable for farmers worldwide. Their platform integrates innovative technologies such as satellite imagery, artificial intelligence, and blockchain to address various agricultural challenges.

For investors interested in the intersection of technology and agriculture, companies like Farmonaut represent an interesting area to watch. The agricultural technology sector has the potential for significant growth as global food demand increases and sustainability becomes increasingly important.

To learn more about Farmonaut’s innovative solutions, you can explore their platform:

For developers interested in integrating agricultural data into their own applications, Farmonaut also offers an API:

Conclusion: Building a Robust Investment Strategy

As we’ve explored in this comprehensive analysis, successful investing requires a multifaceted approach. From understanding dividend yields and stock performance metrics to staying informed about emerging technologies and market trends, there’s much to consider when building and managing your investment portfolio.

Key takeaways from our analysis include:

- The importance of understanding dividend calculations and ex-dividend dates

- The potential of 5G technology investments and other emerging sectors

- The value of diversification across different sectors and investment strategies

- The impact of technological advancements on both investment opportunities and how we invest

- The crucial role of staying informed through reliable financial news and analysis

Remember, while the information and insights provided here can serve as a valuable starting point, it’s essential to conduct thorough research and consider consulting with a financial advisor before making any investment decisions. By combining knowledge, strategy, and careful analysis, you can work towards maximizing your investment potential in today’s dynamic financial markets.

Frequently Asked Questions (FAQ)

- What is a dividend yield, and why is it important?

A dividend yield is the annual dividend payment expressed as a percentage of the stock’s current price. It’s important because it provides investors with an idea of the income they can expect from owning the stock relative to its price. - How does the ex-dividend date affect stock prices?

On the ex-dividend date, the stock price typically drops by approximately the amount of the dividend. This adjustment reflects the distribution of value to shareholders. - What are the potential benefits of investing in 5G technology stocks?

5G technology stocks offer exposure to a rapidly growing sector with potential for significant returns. However, they may also come with higher volatility and risk. - How can I stay informed about market trends and investment opportunities?

Subscribe to reputable financial news sources, follow market analysts, and consider using tools like financial newsletters or apps that provide real-time market data and analysis. - What is the difference between growth investing and value investing?

Growth investing focuses on companies with high potential for future earnings growth, while value investing looks for undervalued stocks trading below their intrinsic value.

Earn With Farmonaut: Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!