SEA vs Tencent: Analyzing Tech Giants’ Stock Performance and Investment Potential

“SEA’s institutional ownership of 59.5% surpasses Tencent’s, potentially indicating stronger long-term market confidence.”

In the ever-evolving landscape of technology investments, two giants stand out: SEA Limited (NYSE:SE) and Tencent Holdings (OTC:TCEHY). As we delve into the intricate world of tech stocks, we’ll provide a comprehensive analysis of these powerhouses, offering crucial insights for investors navigating the complex terrain of financial markets.

Understanding the Tech Titans: SEA and Tencent

Before we dive into the financial intricacies, let’s establish a foundational understanding of these two tech behemoths:

- SEA Limited (NYSE:SE): A Singapore-based technology conglomerate operating across digital entertainment, e-commerce, and digital financial services.

- Tencent Holdings (OTC:TCEHY): A Chinese multinational technology company specializing in various internet-related services and products, including social media, entertainment, artificial intelligence, and financial technology.

Both companies have emerged as significant players in the global tech arena, each with its unique strengths and market positioning.

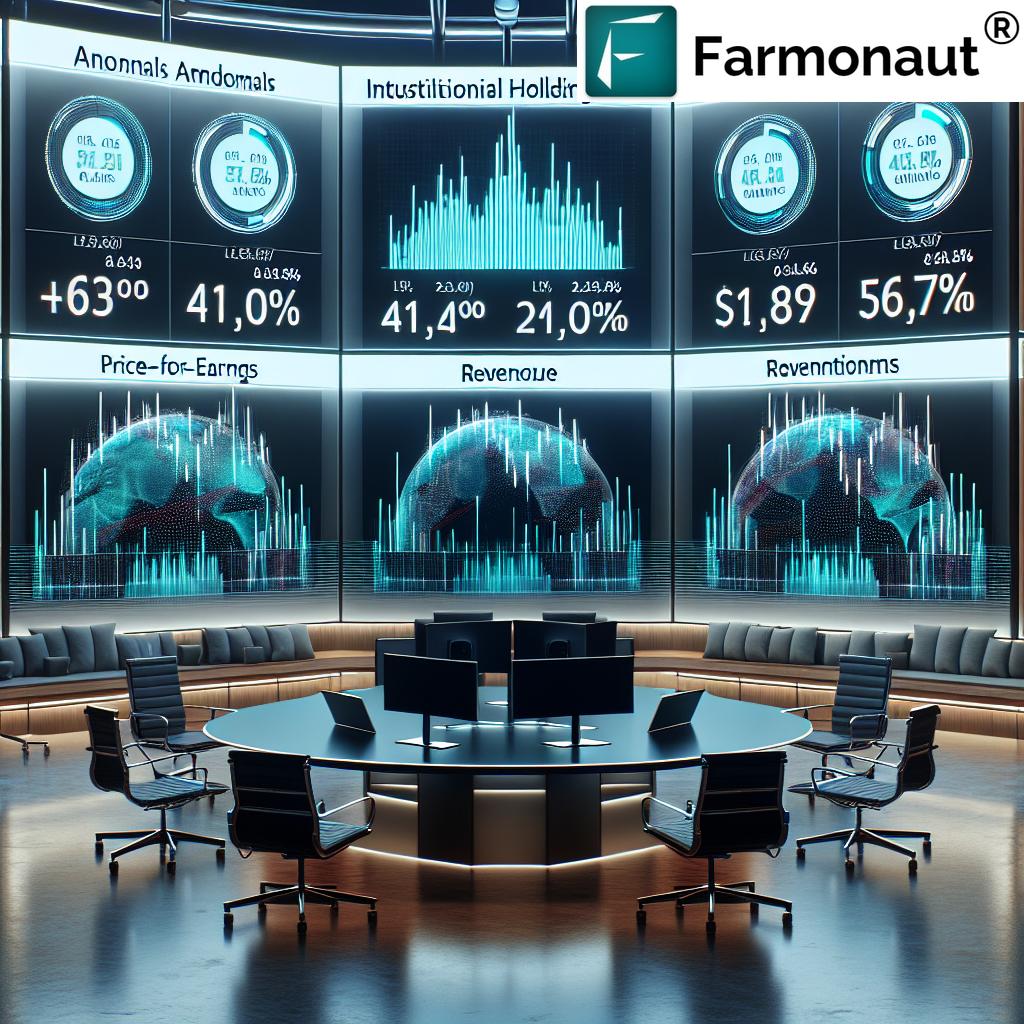

Institutional Ownership: A Key Indicator of Market Confidence

One of the most telling metrics when evaluating stocks is institutional ownership. This figure often indicates the level of confidence that large investors, such as mutual funds, pension funds, and other institutional investors, have in a company’s long-term prospects.

- SEA Limited: Boasts an impressive 59.5% institutional ownership

- Tencent Holdings: Shows a surprisingly low 0.0% institutional ownership

The stark contrast in institutional ownership between SEA and Tencent is noteworthy. SEA’s high institutional ownership suggests that professional investors see significant potential in the company’s future performance. This could be attributed to SEA’s diverse portfolio spanning digital entertainment, e-commerce, and fintech services, which positions it well for growth in emerging markets.

Conversely, Tencent’s low institutional ownership might raise eyebrows. However, it’s crucial to consider that as a Chinese company primarily traded over-the-counter in the U.S., Tencent’s ownership structure may differ from typical U.S.-listed stocks. Many international investors might hold Tencent shares through other vehicles or on non-U.S. exchanges, which wouldn’t be reflected in this statistic.

Valuation Metrics: Decoding the Numbers

To gain a deeper understanding of these companies’ financial health and market perception, let’s examine some key valuation metrics:

| Metric | SEA Limited (SE) | Tencent Holdings (TCEHY) |

|---|---|---|

| Institutional Ownership (%) | 59.5% | 0.0% |

| Price-to-Earnings Ratio | 898.11 | 24.81 |

| Revenue (in billions USD) | 15.49 | 86.17 |

| Net Income (in billions USD) | 0.15 | 16.28 |

| Dividend Yield (%) | 1.3% | 0.6% |

| Analyst Consensus Rating | Buy | N/A |

| Beta | 1.55 | 0.16 |

| 52-Week Price Range | $40.67 – $88.84 | $42.56 – $61.98 |

| Market Capitalization (in billions USD) | 75.12 | 416.82 |

| Year-over-Year Revenue Growth (%) | 4.9% | 0.4% |

“Tencent outperforms SEA in revenue and profitability, boasting a more attractive price-to-earnings ratio in the tech sector.”

The table above provides a clear comparison of SEA and Tencent across various financial metrics. Let’s break down some of the most significant insights:

Price-to-Earnings (P/E) Ratio

The P/E ratio is a crucial metric for investors, indicating how much they’re willing to pay for each dollar of earnings. Here, we see a stark contrast:

- SEA Limited: P/E ratio of 898.11

- Tencent Holdings: P/E ratio of 24.81

Tencent’s significantly lower P/E ratio suggests it may be more attractively valued relative to its earnings. This could indicate that Tencent is either undervalued or that the market expects slower growth compared to SEA. Conversely, SEA’s high P/E ratio might reflect investor expectations of substantial future growth, despite current lower earnings.

Revenue and Net Income

When it comes to financial performance, Tencent clearly leads:

- SEA Limited: Revenue of $15.49 billion, Net Income of $150.73 million

- Tencent Holdings: Revenue of $86.17 billion, Net Income of $16.28 billion

Tencent’s significantly higher revenue and net income demonstrate its current financial superiority. This disparity reflects Tencent’s more established market position and diverse revenue streams across social media, gaming, and fintech sectors.

Dividend Yield

For income-focused investors, dividend yield is a key consideration:

- SEA Limited: 1.3% dividend yield

- Tencent Holdings: 0.6% dividend yield

SEA offers a higher dividend yield, which might appeal to investors seeking regular income. However, it’s important to note that SEA’s dividend payout ratio is exceptionally high at 1,173.3% of earnings, raising questions about its sustainability. Tencent’s lower yield but more conservative payout ratio of 15.3% might indicate a more sustainable dividend policy.

Market Volatility and Risk Assessment

Understanding the volatility and risk associated with these stocks is crucial for investors. Let’s examine their beta values:

- SEA Limited: Beta of 1.55

- Tencent Holdings: Beta of 0.16

Beta measures a stock’s volatility relative to the overall market. A beta greater than 1 indicates higher volatility, while less than 1 suggests lower volatility.

SEA’s beta of 1.55 suggests it’s more volatile than the market average, potentially offering higher returns but with increased risk. This aligns with its profile as a growth-oriented company in expanding markets.

Tencent’s remarkably low beta of 0.16 indicates much lower volatility compared to the market. This could be attractive for risk-averse investors seeking stability, but it might also suggest limited potential for outsized returns.

Analyst Ratings and Future Prospects

Analyst ratings provide valuable insights into market sentiment and future expectations:

- SEA Limited: Consensus rating of “Buy” with a price target suggesting potential downside

- Tencent Holdings: Limited analyst coverage in U.S. markets

SEA’s “Buy” rating indicates positive sentiment among analysts, reflecting confidence in its growth trajectory. However, the price target suggesting potential downside warrants caution and further investigation.

The limited analyst coverage for Tencent in U.S. markets underscores the importance of conducting thorough, independent research when considering investments in international stocks.

Business Segments and Growth Drivers

To fully appreciate the investment potential of SEA and Tencent, we must understand their core business segments and growth drivers:

SEA Limited

- Digital Entertainment (Garena): Online gaming platform and game development

- E-commerce (Shopee): Online marketplace dominant in Southeast Asia and Taiwan

- Digital Financial Services (SeaMoney): Digital payments and financial services

SEA’s diversified portfolio positions it well to capitalize on the growing digital economy in Southeast Asia and beyond. The company’s ability to cross-sell services across its platforms presents significant growth opportunities.

Tencent Holdings

- Value-Added Services: Online games, social networks, and digital content

- Online Advertising: Media, social, and others

- FinTech and Business Services: Payment services, cloud services, and other enterprise solutions

Tencent’s strength lies in its dominant position in the Chinese market, particularly in social media (WeChat) and gaming. Its expanding fintech and cloud services offer promising growth avenues, especially as it looks to expand internationally.

Investment Considerations and Risks

As we evaluate SEA and Tencent as potential investments, several factors warrant consideration:

SEA Limited

- Growth Potential: Strong position in fast-growing Southeast Asian markets

- Diversification: Balanced exposure across gaming, e-commerce, and fintech

- Risks: High valuation, intense competition, and regulatory challenges in multiple markets

Tencent Holdings

- Market Dominance: Strong foothold in the massive Chinese market

- Financial Strength: Impressive revenue and profitability

- Risks: Regulatory pressures in China, international expansion challenges, and geopolitical tensions

Both companies face unique challenges and opportunities. SEA’s high growth potential comes with elevated valuation risks, while Tencent’s strong financials are tempered by regulatory uncertainties in its home market.

Conclusion: Making Informed Investment Decisions

As we conclude our analysis of SEA and Tencent, it’s clear that both companies offer compelling investment cases, each with its own set of strengths and challenges. SEA presents an opportunity to invest in the rapidly growing Southeast Asian digital economy, with strong growth potential but at a premium valuation. Tencent, on the other hand, offers exposure to China’s tech sector, with robust financials and a more attractive valuation, but faces regulatory headwinds.

Ultimately, the choice between SEA and Tencent – or whether to invest in either – depends on individual investment goals, risk tolerance, and market outlook. We encourage investors to conduct thorough due diligence, consider their portfolio diversification, and stay informed about the evolving regulatory landscapes in the respective markets.

As the technology sector continues to evolve, both SEA and Tencent are poised to play significant roles in shaping the digital future. By understanding their financial metrics, market positions, and growth drivers, investors can make more informed decisions in navigating the exciting yet complex world of tech investments.

FAQ Section

- Q: Which stock has shown better historical performance, SEA or Tencent?

A: While both stocks have shown strong performance, Tencent has demonstrated more consistent profitability and revenue growth over a longer period. However, SEA has shown rapid growth in recent years, particularly in emerging markets. - Q: How do the regulatory environments differ for SEA and Tencent?

A: Tencent faces stricter regulatory scrutiny in China, particularly regarding gaming and fintech services. SEA operates across multiple Southeast Asian countries, each with its own regulatory challenges, but generally in less restrictive environments. - Q: Which company is better positioned for international expansion?

A: SEA has shown strong potential for international expansion, particularly with its Shopee e-commerce platform. Tencent, while dominant in China, has faced more challenges in expanding its core services globally. - Q: How do the dividend policies of SEA and Tencent compare?

A: SEA offers a higher dividend yield but with a very high payout ratio, raising concerns about sustainability. Tencent has a lower yield but a more conservative payout ratio, suggesting a more sustainable dividend policy. - Q: What are the main growth drivers for each company?

A: SEA’s growth is primarily driven by its e-commerce (Shopee) and digital financial services. Tencent’s growth is largely fueled by its gaming division, social media platforms (WeChat), and expanding fintech services.

As we navigate the complex landscape of tech investments, tools like those offered by Farmonaut can provide valuable insights into market trends and data analysis. While Farmonaut specializes in agricultural technology, its approach to leveraging advanced technologies for data-driven insights is relevant across various sectors, including financial analysis and tech investments.

For those interested in exploring how technology can drive informed decision-making, consider checking out Farmonaut’s innovative solutions:

While Farmonaut’s focus is on agricultural technology, its innovative approach to data analysis and decision-making tools can inspire investors to seek out comprehensive, data-driven insights in their investment strategies, whether in tech stocks like SEA and Tencent or other sectors.

Looking Ahead: The Future of Tech Investments

As we look to the future of tech investments, several key trends are likely to shape the landscape:

- AI and Machine Learning: Both SEA and Tencent are investing heavily in AI technologies to enhance their services and create new revenue streams.

- Fintech Evolution: The digital financial services sector is rapidly evolving, with both companies well-positioned to capitalize on this growth.

- Cloud Computing: As businesses increasingly move to the cloud, Tencent’s strong position in this sector could be a significant growth driver.

- E-commerce Expansion: SEA’s Shopee platform continues to expand, potentially challenging established players in new markets.

Investors should keep a close eye on these trends and how SEA and Tencent adapt to and capitalize on them. As always, staying informed and adapting to market changes is key to successful investing in the dynamic tech sector.

In conclusion, both SEA and Tencent present unique investment opportunities in the tech sector. While SEA offers exposure to rapidly growing Southeast Asian markets with its diverse digital ecosystem, Tencent provides a stake in China’s tech giant with a proven track record of profitability and innovation. Investors should carefully weigh the growth potential, risks, and their own investment goals when considering these stocks.

Remember, the tech investment landscape is ever-changing, and what holds true today may shift tomorrow. Continuous learning, adapting to new information, and staying attuned to market trends are crucial for success in tech investing.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

As we navigate the complex world of tech investments, tools that provide data-driven insights become increasingly valuable. While Farmonaut specializes in agricultural technology, its approach to leveraging advanced technologies for informed decision-making is relevant across various sectors, including financial analysis and tech investments.

For those interested in exploring how technology can drive informed decision-making, consider checking out Farmonaut’s innovative solutions:

While these tools are tailored for the agricultural sector, they demonstrate the power of data analysis and technological innovation – principles that are equally crucial in evaluating tech investments like SEA and Tencent.

In the end, whether you’re analyzing agricultural data or evaluating tech stocks, the principles of thorough research, data analysis, and informed decision-making remain paramount. By leveraging advanced tools and staying informed about market trends, investors can navigate the complex world of tech investments with greater confidence and insight.