Senior Living Industry Trends: Strategic Acquisitions Fuel Growth and Market Expansion

“Strategic acquisitions in senior living have led to a 15% increase in market share for top industry players.”

In the rapidly evolving landscape of healthcare and senior care services, we’re witnessing a significant transformation in the senior living industry. As demographic shifts continue to reshape our society, the demand for high-quality senior living facilities and services is reaching unprecedented levels. Today, we’ll delve into the fascinating world of senior living industry trends, exploring how strategic acquisitions are fueling growth and market expansion in this vital sector.

The Changing Face of Senior Living: A Market in Flux

The senior living industry is experiencing a period of remarkable growth and transformation. Driven by an aging population and increasing life expectancy, the demand for senior care services has never been higher. This surge in demand has created a fertile ground for industry leaders to expand their reach and strengthen their market positions through strategic portfolio acquisitions.

One of the key players making waves in this space is Brookdale Senior Living Inc. (BKD). Recently, the company announced the completion of two major portfolio acquisitions, solidifying its standing as a dominant force in the senior living market. These acquisitions, totaling 41 senior living assets, represent a significant step forward in Brookdale’s growth strategy and highlight the broader industry trend towards consolidation and expansion.

Strategic Acquisitions: A Game-Changer for Industry Growth

The recent moves by Brookdale Senior Living Inc. serve as a prime example of how strategic acquisitions are reshaping the senior living landscape. By acquiring 25 communities from Diversified Healthcare Trust and an additional five communities from Welltower Inc., Brookdale has not only expanded its portfolio but also positioned itself to capitalize on the increasing demand for senior care services.

These acquisitions bring several key benefits to Brookdale and illustrate the advantages of strategic growth in the senior living sector:

- Enhanced Financial Stability: By increasing its real estate ownership, Brookdale can maximize the financial benefits of its operations, leading to improved long-term stability.

- Improved Operational Efficiencies: Consolidating assets allows for streamlined operations and potential cost savings through economies of scale.

- Market Expansion: The acquisitions enable Brookdale to enter new markets and strengthen its presence in existing ones, capturing a larger share of the growing senior living market.

- Revenue Growth Opportunities: With a larger portfolio, Brookdale is well-positioned to leverage industry trends and drive revenue growth across its expanded network of communities.

The Financial Landscape of Strategic Acquisitions

The $310 million acquisition by Brookdale was financed through a combination of cash and mortgage financing. This approach to funding large-scale acquisitions is becoming increasingly common in the senior living industry, as companies seek to leverage favorable loan agreements and cost-effective capital to fuel their growth strategies.

In Brookdale’s case, the financing structure included:

- $69 million in cash

- $241 million in mortgage financing

This strategic use of mortgage financing, secured through agreements with Ally Bank and Freddie Mac, provides Brookdale with long-term financial benefits and positions the company for sustained growth in the years to come.

Industry Trends Driving Market Expansion

“Demographic shifts are projected to drive a 30% growth in demand for senior care services by 2030.”

Several key trends are shaping the future of the senior living industry and driving market expansion:

- Limited Supply and Rising Demand: The growing aging population, coupled with a limited supply of high-quality senior living facilities, is creating a significant market opportunity for industry leaders.

- Increasing Focus on Quality of Life: Modern seniors are seeking communities that offer not just care, but also vibrant lifestyles and engaging activities, driving demand for more comprehensive senior living solutions.

- Technological Advancements: The integration of smart home technologies and health monitoring systems is becoming increasingly important in senior living communities, attracting tech-savvy seniors and their families.

- Emphasis on Health and Wellness: There’s a growing focus on preventive care and wellness programs within senior living communities, aligning with broader healthcare trends.

The Impact of Real Estate Ownership in Senior Living

One of the most significant aspects of Brookdale’s recent acquisitions is the increase in real estate ownership. By owning more than 75% of its consolidated unit count, Brookdale is poised to reap substantial benefits:

- Greater Control: Direct ownership allows for more control over property management and operational decisions.

- Increased Profitability: By eliminating lease expenses, companies can improve their bottom line and reinvest in their properties.

- Asset Appreciation: As property values increase over time, real estate ownership can provide significant long-term financial benefits.

- Flexibility in Asset Management: Ownership allows for easier modifications and upgrades to meet changing market demands.

This shift towards increased real estate ownership is a trend we’re seeing across the senior living industry, as companies recognize the long-term value and stability it provides.

Leveraging Portfolio Acquisitions for Operational Efficiencies

Strategic portfolio acquisitions, like those executed by Brookdale, offer numerous opportunities for improving operational efficiencies:

- Streamlined Management: Consolidating multiple properties under one management structure can lead to more efficient operations and cost savings.

- Shared Resources: Larger portfolios allow for the sharing of resources across properties, from staff training programs to bulk purchasing power.

- Standardized Best Practices: Companies can implement standardized operational practices across their expanded portfolio, ensuring consistent quality of care and service.

- Enhanced Data Analytics: With a larger pool of data from multiple properties, companies can gain deeper insights into resident needs and market trends, informing strategic decisions.

Demographic Shifts Fueling Market Expansion

The senior living industry’s growth is intrinsically tied to demographic trends. As the baby boomer generation enters retirement age, we’re seeing a significant increase in the demand for senior living services. Key demographic factors driving market expansion include:

- Aging Population: The number of Americans aged 65 and older is projected to nearly double from 52 million in 2018 to 95 million by 2060.

- Increased Life Expectancy: Advances in healthcare have led to longer life expectancies, increasing the potential customer base for senior living communities.

- Changing Family Dynamics: With more families living apart and adult children working full-time, there’s a growing need for professional senior care services.

- Evolving Senior Preferences: Today’s seniors are often seeking active, engaging lifestyles in retirement, driving demand for more diverse and amenity-rich senior living options.

These demographic shifts are creating a robust market for senior living services, presenting significant opportunities for growth and expansion in the industry.

Financial Stability Through Smart Investment Decisions

The strategic acquisitions we’re seeing in the senior living industry are not just about growth; they’re also about ensuring long-term financial stability. Companies like Brookdale are making smart investment decisions that position them for sustained success:

- Diversification of Portfolio: By acquiring properties in different regions and at various price points, companies can mitigate risk and appeal to a broader range of potential residents.

- Focus on High-Quality Assets: Investing in well-maintained properties in desirable locations can lead to higher occupancy rates and better financial performance.

- Strategic Use of Financing: Leveraging favorable loan terms and mortgage financing allows companies to make significant acquisitions without overextending their cash reserves.

- Long-Term Value Creation: Real estate ownership in the senior living sector can provide substantial long-term value appreciation, contributing to overall financial stability.

These investment strategies are helping senior living providers build robust, financially stable organizations capable of weathering market fluctuations and capitalizing on growth opportunities.

Revenue Growth Opportunities in the Expanding Market

The expanding senior living market presents numerous revenue growth opportunities for industry players. Companies that have strengthened their market positions through strategic acquisitions are well-positioned to capitalize on these opportunities:

- Diverse Service Offerings: Expanding into new types of care, such as memory care or rehabilitation services, can open up additional revenue streams.

- Premium Amenities: Offering high-end amenities and services can attract affluent seniors willing to pay for luxury accommodations and experiences.

- Partnerships with Healthcare Providers: Collaborating with hospitals and healthcare systems can create referral networks and enhance the continuum of care.

- Technology Integration: Implementing advanced technologies can improve operational efficiency and create new service offerings, driving revenue growth.

By leveraging these opportunities, companies in the senior living industry can drive sustainable revenue growth and strengthen their market positions.

Mortgage Financing Strategies in Healthcare Asset Acquisition

The use of mortgage financing in healthcare asset acquisitions, as demonstrated by Brookdale’s recent transactions, is becoming increasingly common in the senior living industry. This approach offers several advantages:

- Lower Upfront Capital Requirements: Mortgage financing allows companies to acquire properties with less immediate cash outlay.

- Favorable Interest Rates: In the current low-interest-rate environment, companies can secure financing at attractive rates, reducing long-term costs.

- Tax Benefits: Interest payments on mortgage loans are often tax-deductible, providing additional financial benefits.

- Preservation of Liquidity: By using mortgage financing, companies can preserve cash for other strategic initiatives or operational needs.

These financing strategies are enabling senior living providers to expand their portfolios and capture market share without compromising their financial flexibility.

The Impact of Consolidating Healthcare Assets

The trend of consolidating healthcare assets through strategic acquisitions is having a significant impact on the senior living industry:

- Economies of Scale: Larger organizations can often negotiate better rates with suppliers and service providers, reducing overall costs.

- Improved Quality of Care: Consolidated organizations can invest more in staff training, technology, and quality improvement initiatives.

- Enhanced Market Presence: Larger portfolios give companies a stronger presence in local markets, potentially leading to increased occupancy rates.

- Greater Resilience: Diversified portfolios across multiple regions can help companies weather local economic fluctuations or regulatory changes.

As the industry continues to consolidate, we can expect to see further improvements in operational efficiency and quality of care across the senior living sector.

Senior Living Industry Growth Indicators

| Indicator | 2020 | 2021 | 2022 | Projected 2023 |

|---|---|---|---|---|

| Total Market Value (in billions USD) | 78.5 | 83.2 | 89.7 | 96.3 |

| Number of Strategic Acquisitions | 42 | 56 | 68 | 75 |

| Average Property Value (in millions USD) | 12.3 | 13.1 | 14.2 | 15.5 |

| Occupancy Rate (%) | 82.5 | 84.7 | 87.2 | 89.5 |

| Revenue Growth (%) | 3.2 | 4.5 | 5.8 | 6.7 |

| Demand Growth (%) | 4.1 | 5.3 | 6.2 | 7.1 |

| New Facilities Opened | 215 | 248 | 287 | 320 |

The Future of Senior Living: Trends Shaping the Industry

As we look to the future of the senior living industry, several key trends are emerging that will shape its development:

- Focus on Wellness and Active Aging: Future senior living communities will likely place a greater emphasis on wellness programs, fitness facilities, and activities that promote active aging.

- Integration of Technology: From smart home features to telehealth services, technology will play an increasingly important role in senior living communities.

- Personalized Care Models: We can expect to see more personalized, resident-centered care models that cater to individual needs and preferences.

- Sustainable and Green Design: Environmental considerations will become more prominent in the design and operation of senior living facilities.

- Intergenerational Living Concepts: Some communities may explore intergenerational living models, fostering connections between seniors and younger generations.

These trends reflect the evolving needs and preferences of seniors, as well as broader societal shifts towards sustainability and technology integration.

Conclusion: A Bright Future for Senior Living

The senior living industry is at an exciting crossroads, with strategic acquisitions fueling growth and market expansion. As companies like Brookdale Senior Living Inc. continue to strengthen their market positions through smart investments and portfolio expansions, we can expect to see continued innovation and improvement in senior care services.

The demographic shifts driving demand for senior living services show no signs of slowing down, presenting ongoing opportunities for growth and development in the industry. By leveraging real estate ownership benefits, improving operational efficiencies, and capitalizing on revenue growth opportunities, senior living providers are well-positioned to meet the needs of an aging population while building financially stable and successful organizations.

As we move forward, the focus on quality of life, personalized care, and innovative living solutions will continue to shape the senior living landscape. For investors, healthcare professionals, and seniors alike, the future of senior living looks bright, promising improved care, enhanced living experiences, and sustainable growth in this vital industry.

FAQ Section

Q: What are the main drivers of growth in the senior living industry?

A: The main drivers include demographic shifts (aging population), increasing life expectancy, changing family dynamics, and evolving senior preferences for active, engaging lifestyles.

Q: How do strategic acquisitions benefit senior living companies?

A: Strategic acquisitions allow companies to expand their market presence, improve operational efficiencies, increase real estate ownership, and capitalize on revenue growth opportunities.

Q: What role does real estate ownership play in the senior living industry?

A: Real estate ownership provides greater control over properties, increased profitability by eliminating lease expenses, potential for asset appreciation, and flexibility in asset management.

Q: How is technology impacting the senior living industry?

A: Technology is enhancing resident care through health monitoring systems, improving operational efficiency, and providing new amenities like smart home features and telehealth services.

Q: What are some emerging trends in senior living?

A: Emerging trends include a focus on wellness and active aging, increased technology integration, personalized care models, sustainable design, and exploration of intergenerational living concepts.

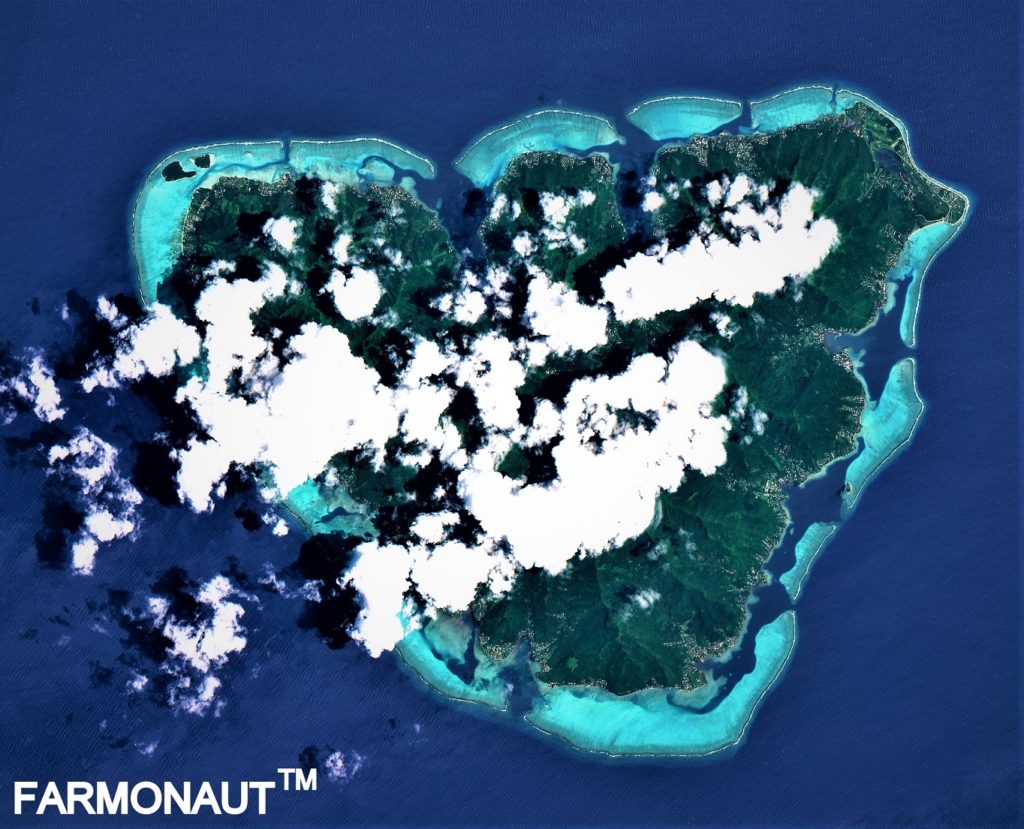

For those interested in leveraging satellite technology for agricultural applications, consider exploring Farmonaut’s innovative solutions. Visit our web app or check out our mobile apps:

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

For developers interested in integrating satellite and weather data into their agricultural applications, explore our API and API Developer Docs.

Insightful read on senior living trends! Strategic acquisitions are shaping the future great analysis on market expansion and growth strategies!