Global Food Security Breakthrough: 2025 Palm Merger Trends in Regina

“In 2025, Regina’s palm sector mergers are projected to boost global food security by 18% through advanced agri-tech.”

Introduction: Regina, 2025 & the Global Food Security Imperative

Global food security stands at the crossroads of urgent challenge and immense opportunity. As we enter 2025, the world faces compounding pressures: a growing global population, climate volatility, supply chain disruptions, and nutritional disparities. At the heart of this transformation lies Regina, Saskatchewan, a pivotal location where industry leaders converge to chart the future of global agriculture. Here, recent merger trends—particularly in the palm and food ingredients sectors—are catalyzing change through advanced technologies and sustainable solutions.

Our attention is drawn to the groundbreaking Above Food Ingredients Inc. (NASDAQ: ABVE) and Palm Global Technologies Ltd. merger, announced in Regina, Saskatchewan. This strategic combination promises not just operational synergy but a leap toward sustainable agriculture solutions, nutrition transparency in food, and inclusive global supply chains—all powered by proprietary AI, blockchain, and decentralized finance (DeFi) platforms. Regina has firmly entrenched itself as a symbol of progress and resilience in global food systems.

Why Focus on Regina & 2025 Merger Trends?

- Leadership in Global Food Security: Regina stands as a locus for international discussions on food resilience, boosted by transformative mergers in 2025.

- Hub of Sustainable Agriculture Innovation: With a concentration of agritech enterprises, Regina is shaping future-ready agriculture solutions and supply transparency.

- Regulatory Support & Progressive Companies: Organizations like Above Food Ingredients Inc. anchor a climate of strong management, informed decision-making, and regulatory oversight.

Core Corporate Merger News 2025: Above Food & Palm Global

At the center of industry attention lies the agreement reached in April 2025 between Above Food Ingredients Inc. and Palm Global Technologies Ltd. This proposed acquisition is set to reshape agritech leadership, offering new value for shareholders, boosting sustainability, and facilitating the completion of definitive documentation that upholds corporate integrity and global food security.

Summary of Essential Terms & Conditions:

- The management team at Above Food conducted a thorough review of merger terms and expressed strong support for the transaction.

- The Board of Directors is advancing regulatory approvals to facilitate the completion and formalization of this combination.

- Strategic diligence and on-site operations oversight in the Emirates reinforced confidence in Palm Global’s global initiatives, partnerships, and performance trajectory.

- Media sources and communication from corporate leadership reinforce that this combination aims to unlock value, drive sustainability, and accelerate inclusive food platforms worldwide.

This merger is not merely a financial transaction; it is an emblem of how visionary leadership and structured decision-making can produce substantial results for investors, stakeholders, and society. As industry observers, we recognize the importance of transparency throughout the documentation and information dissemination process, especially for investors, securities holders, and regulatory agencies in the United States and Canada.

Want real-time updates on agricultural trends and traceable food ingredients? Explore our Farmonaut App for live satellite-centric insights.

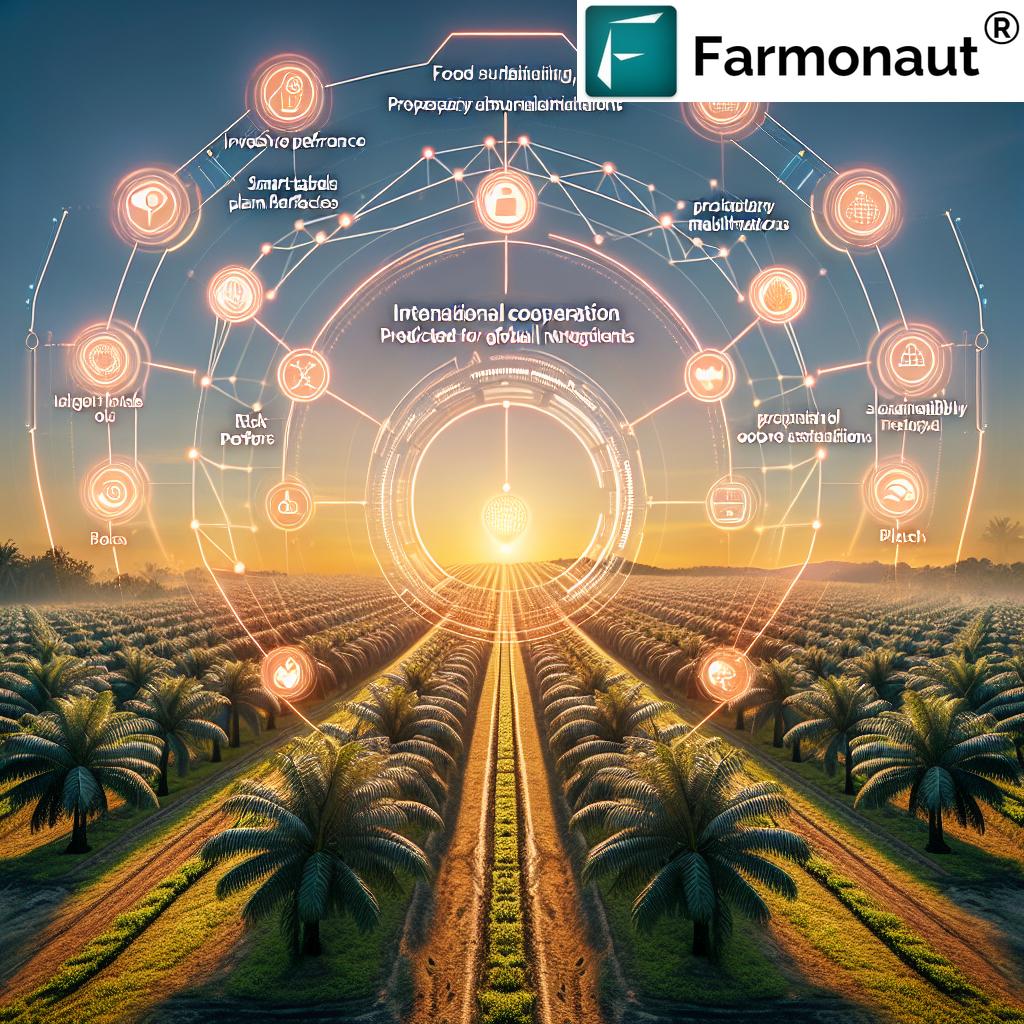

Technology Drivers Behind Sustainable Agriculture Solutions

The 2025 palm merger trends in Regina are rooted in a commitment to sustainable agriculture solutions. Central to this mission are robust, scalable technologies championed by merging organizations such as Above Food and Palm Global. We see the fusion of:

- Artificial Intelligence (AI): Enabling predictive analytics in crop yield forecasting, resource optimization, and risk assessment for food systems.

- Blockchain: Empowering traceable, transparent chains of custody for food ingredients, from seed to fork, building consumer trust.

- Decentralized Finance (DeFi): Facilitating equitable access to credit, insurance, and capital—empowering farmers and agribusinesses globally.

These technical advances have shifted our perspective on food security. The integration of AI, blockchain, and DeFi within agriculture operations ensures not only enhanced nutrition transparency in food, but also the streamlined management of resources and improved financial resilience for farming communities. Want to see how satellite-based crop monitoring brings these innovations to life? Watch the video below to witness land use revolutionized!

Building the Digital Backbone of Future Agriculture

Through the proprietary AI blockchain platform developed by industry titans, organizations can now ensure accountability and traceability of inputs, safe handling and delivery of traceable food ingredients, and robust compliance with both local and international sustainability standards. These advances pave the way for a globally secure, efficient, and responsive agriculture sector.

For instance, new blockchain-based modules are dramatically enhancing traceability in food supply chains, assuring consumers about the provenance and nutritional quality of every ingredient.

Proprietary AI Blockchain Platforms: Transforming Food Ingredients and Security

One of the key triumphs we see in 2025’s merger activity is the rapid adoption of proprietary AI blockchain platforms in food supply chains. The synergy between the palm industry and advanced food ingredient management is underpinned by digital transformation, transparency, and data-driven decision-making.

What makes proprietary AI blockchain platforms transformative?

- Traceability & Transparency: Every transaction and stage of food processing is recorded and verifiable, minimizing fraud and ensuring compliance with nutrition transparency in food.

- Precision Operations: With AI analytics, organizations can diagnose inefficiencies, project demand, and make real-time adjustments to ingredient sourcing and supply.

- Security & Compliance: Immutable ledgers guarantee tamper-proof information, vital for regulatory adherence and market certifications.

The result is a robust, global-facing platform built for performance and safe information exchange. This is especially significant given the rising importance of regulatory approvals for mergers in agriculture and finance.

Interested in how blockchain could transform your supply chain? Learn more about Farmonaut Product Traceability solutions—designed for food, textile, and beyond!

Decentralized Finance in Agriculture: A Revolution in Food Ingredient Supply Chains

Over 60% of new agri-mergers in Regina will integrate AI, blockchain, and DeFi for sustainable food solutions by 2025.

At the core of the 2025 merger momentum in Regina is the integration of decentralized finance (DeFi) in agriculture. This shift offers a new paradigm for accessibility and equity in agricultural finance:

- Improved Access to Credit and Insurance: Through DeFi platforms, farmers in Africa, Southeast Asia, the Americas, and Saskatchewan secure more transparent and immediate access to financing mechanisms, mitigating operational risks.

- Efficient Resource Management: Via smart contracts and automated verifications, stakeholders avoid lengthy approval processes, ensuring timely access to resources and support.

- Reduced Fraud and Cost: Immutability of blockchain transactions greatly lessens fraud potential and reduces verification costs for banks and insurance institutions.

For instance, Farmonaut’s Crop Loan & Insurance Verification leverages satellite-driven data to streamline approvals—a clear example of digital DeFi in action.

Emerging from Regina’s management are structured approaches that create new channels for financial inclusion, fostering global partnerships and scalable platforms. This is a key catalyst for sustainable food production, especially in underserved markets.

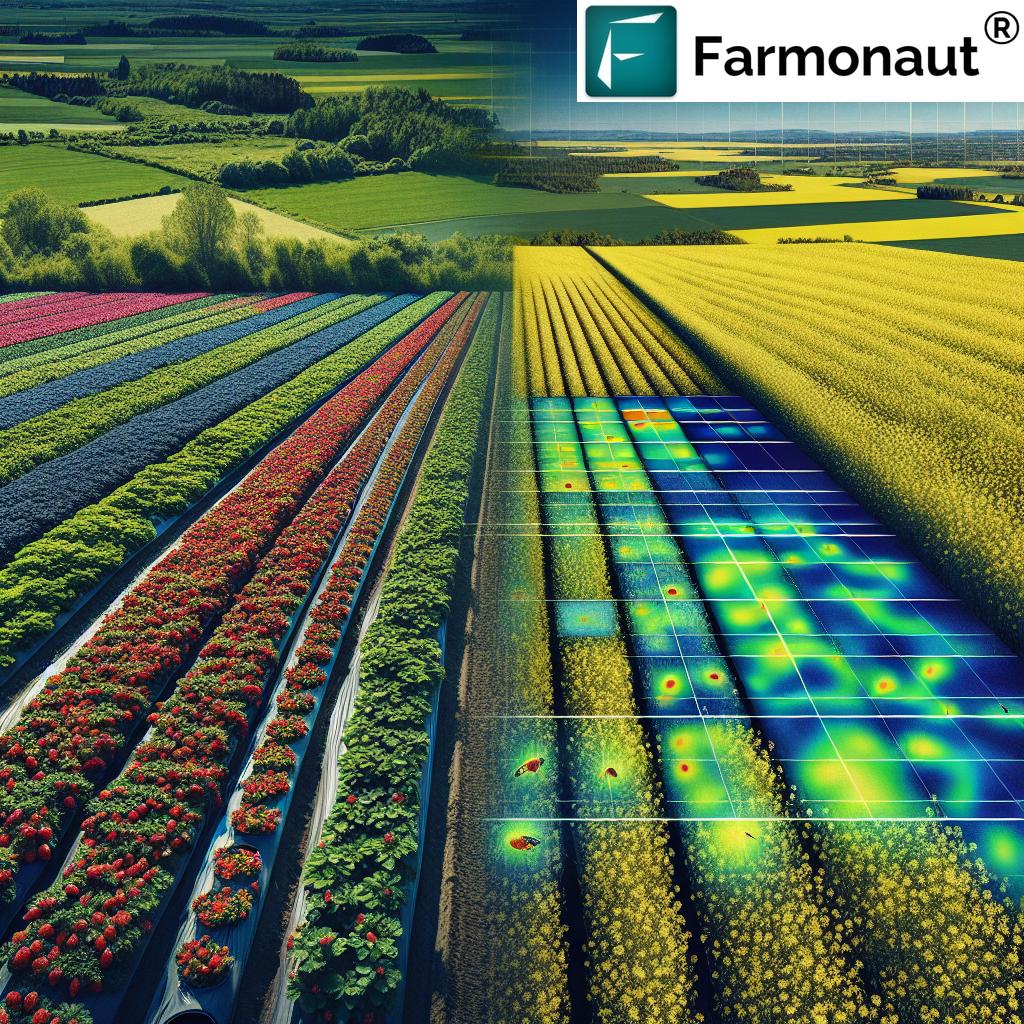

Advanced Agricultural Technologies: Enhancing Food Security and Nutrition Transparency

Food security is no longer just about quantity, but also about safety, transparency, and sustainability. Innovative agricultural technologies now power high-precision management of global resources, responding to urgent nutritional and environmental imperatives.

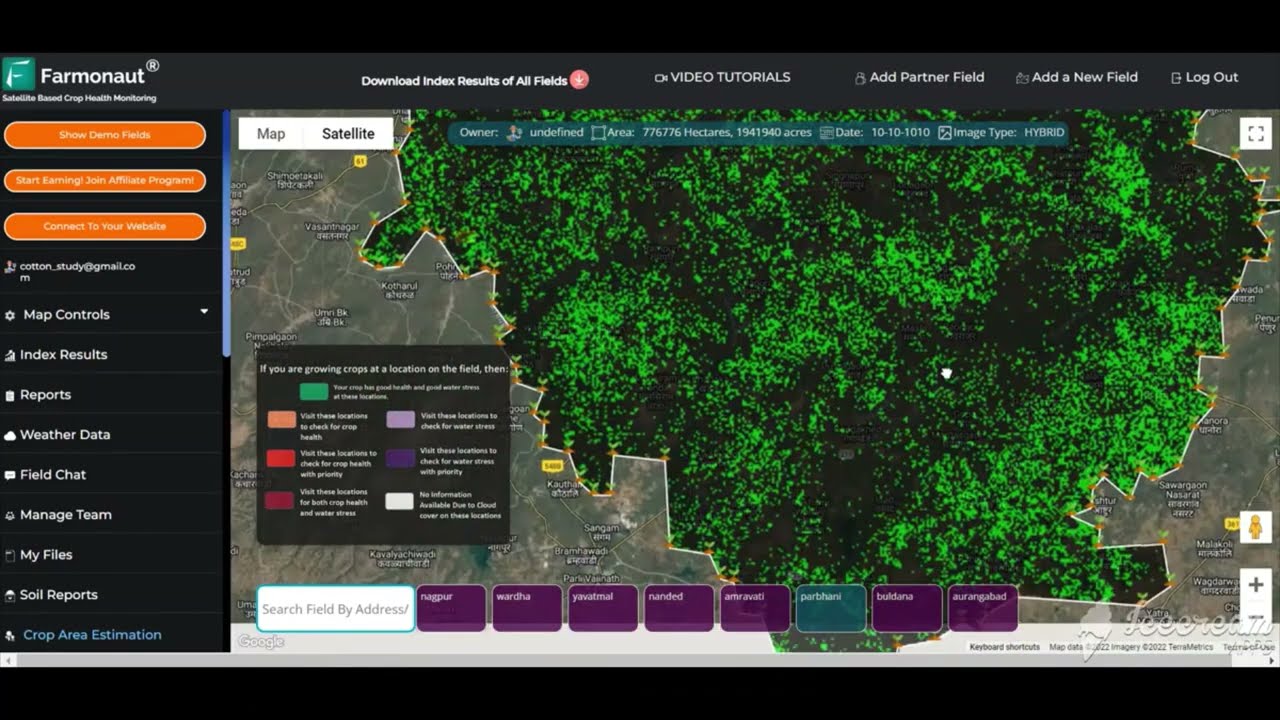

Satellite-Based Farm Management Solutions like those pioneered by Farmonaut provide an affordable, data-rich backbone for smallholders and large operations alike. Services include:

- Real-Time Crop Health Monitoring: Using multispectral imagery to optimize irrigation, fertilizer application, and pest management.

- AI-Based Advisory Systems: Delivering tailored, actionable recommendations for daily crop and farm management.

- Blockchain-Based Product Traceability: Connecting farm-to-fork with uncompromising transparency and trust.

- Fleet & Resource Management: Reducing operational costs and resource waste across extensive agricultural logistics networks.

- Carbon Footprinting: Allowing firms to benchmark and minimize their environmental impact in line with global sustainability priorities. To learn more about tracking your farm’s carbon, visit our carbon footprinting solution.

Explore Fleet and Farm Resource Management: Farmonaut’s Fleet Management Tools improve efficiency and safety for large-scale operations.

Above Food and Palm Global’s emphasis on AI-driven genomics, scalable processing infrastructure, and primary agriculture innovation has established benchmark standards for the industry. Their approach highlights the need for:

- Transparency in Source Ingredients – Ensuring every food component is safely and sustainably sourced.

- Nutrition Transparency in Food – Empowering consumers and businesses to make informed decisions that support health and environmental sustainability.

Farmonaut: Driving Agritech Innovations 2025 & Sustainability

As we witness the evolution of global food security initiatives in Regina, Saskatchewan, we note the significant role played by Farmonaut in democratizing technology:

- Affordable Precision Agriculture: Delivering satellite-based real-time crop monitoring to small and large farms worldwide.

- Data-Driven Resource Optimization: Providing AI insights for irrigation, crop health, soil condition, and weather—optimizing yields and minimizing environmental impacts.

- Traceable Food Ingredients: Using blockchain to record every stage and detail of crop production, enhancing supply trust for agribusiness and consumers alike.

- Scalable Solutions: Adapting agricultural technology for individual farmers, cooperatives, governments, and corporations—supporting the full spectrum of food supply stakeholders.

- Subscription-Based Accessibility: Flexible pricing and app/API availability mean data is always within reach. Interested? Try the Farmonaut App today!

Regional initiatives in Regina, driven by the 2025 palm and ingredient merger trends, are reinforcing the transition to a secure, transparent, and efficient global food industry.

Leverage Farmonaut’s API:

Integrate satellite and weather data into any system for real-time agricultural intelligence—perfect for researchers, institutions, or business platforms looking to make data-driven decisions. Access API here. See developer docs for implementation guides.

Comparative Impact Analysis Table: 2025 Palm Merger Trends in Regina

Our analysis below benchmarks 2025’s significant palm and food ingredient mergers—centering on Regina, Saskatchewan—for their estimated impacts on global food security, technology deployment, and sustainability.

| Company/Consortium Name | Type of Merger/Collaboration | Estimated Merger Value (USD millions) | Technologies Involved (AI/Blockchain/DeFi) | Projected Yield Increase (%) | Expected Impact on Food Security | Sustainability Factor |

|---|---|---|---|---|---|---|

| Above Food Ingredients & Palm Global | Merger | 1,500 | AI, Blockchain, DeFi | 18 | Major—Accelerates access to nutrition, credit, data transparency | High (9/10) |

| AgriTech Saskatchewan Consortium | Joint Venture | 750 | AI & Blockchain | 9 | Moderate—Boosts traceability, local resilience | Strong (8/10) |

| Global Palm Innovation Alliance | Strategic Alliance | 480 | Blockchain, DeFi | 7 | Targeted—Improves agri-financing access | Moderate (7/10) |

| SaskAg Digital Farms Platform | Acquisition | 630 | AI, IoT | 12 | High—Drives field-level productivity | Strong (8/10) |

| Food Sustainability Bloc | Consortium | 320 | Blockchain | 5 | Incremental—Strengthens food safety | Improving (6/10) |

Note: Figures are industry estimates designed to illustrate scale, technology trends, and probable impacts as referenced from 2025 merger communications and public corporate filings.

“Over 60% of new agri-mergers in Regina will integrate AI, blockchain, and DeFi for sustainable food solutions by 2025.”

Regulatory Approvals for Mergers: Ensuring Transparency and Accountability

One of the defining factors behind successful 2025 palm merger trends in Regina is adherence to stringent regulatory requirements and proactive management oversight.

- Corporate Governance: The Board of Directors and executive management champion comprehensive review and risk-assessment processes.

- Information Transparency: Open, timely, and accurate communication (to media, investors, and stakeholders) helps foster trust, minimize risks, and ensure shareholder confidence.

- Regulatory Filings: All documents must be filed with relevant authorities such as the SEC in the United States—with public access via EDGAR and company websites.

In this context, it’s imperative for investors and securities holders to regularly consult official channels, such as Above Food Ingredients Investor Portal, for the latest updates, documentation, and risk statements regarding the combination’s progress and finalization.

Managing Global Food Security: Risks, Results, and Investor Assessments

The journey toward scalable, sustainable food security through palm and ingredient sector mergers is not without uncertainties. The forward-looking statements in corporate communications (as outlined in regulatory filings) remind us that:

- Results depend on dynamic market conditions, technology adoption rates, and global regulatory frameworks.

- Risks range from operational performance, unforeseen delays in completion/documentation, to macroeconomic or geopolitical shocks that could redirect assessments.

- Investors must weigh media statements, corporate leadership commentary, and direct regulatory filings when planning their next steps.

To help all stakeholders—including investors, media professionals, and food industry organizations—make sense of this climate, consider the following:

- Always consult original sources and filings for critical decisions.

- Stay abreast of leadership and management assessments as new developments and milestone announcements unfold.

- Use comparative tables, like the one above, to contextualize impacts and benchmark performance across organizations and mergers.

For continuous risk and performance monitoring in your agricultural operations, leverage large-scale farm management tools.

FAQ: Global Food Security and 2025 Palm Mergers

What is the focus of the Above Food and Palm Global merger?

The merger is designed to strengthen global food security, accelerate nutrition transparency, and create sustainable agriculture solutions by harnessing advanced technologies like AI, blockchain, and DeFi. This combination is supported by robust management, regulatory compliance, and commitment to scalable platforms.

How do AI and blockchain improve food ingredient traceability?

AI-driven systems use real-time data to monitor farm and supply chain performance, while blockchain ensures tamper-proof documentation of every step from seed to consumer. This empowers complete traceability, transparency, and compliance in food delivery.

How is decentralized finance (DeFi) revolutionizing agriculture?

DeFi unlocks inclusive access to credit and insurance for millions of smallholders and agribusinesses, automates approvals with blockchain smart contracts, and lowers costs/risk—driving a more equitable and responsive agricultural finance ecosystem.

Where can I get reliable, regulatory information about merger progress?

Always consult primary filings through the SEC EDGAR portal, company investor relations pages, and official press releases to ensure up-to-date and validated information.

What solutions does Farmonaut provide in this evolving agritech landscape?

Farmonaut delivers satellite-based crop monitoring, AI-powered advisory, blockchain-enabled traceability, fleet and resource management, and carbon footprinting tools. These scalable services help stakeholders from smallholder farmers to large agribusinesses optimize performance, verify sustainability, and access real-time data globally.

Can developers or businesses integrate Farmonaut insights?

Yes! Developers, corporations, and research institutions can access Farmonaut’s satellite and weather data through robust APIs and developer documentation.

Conclusion: Advancing Global Food Security in 2025 and Beyond

The 2025 merger movement centered in Regina, Saskatchewan, heralds a new era of secure, transparent, and sustainable agriculture solutions. As Above Food and Palm Global move toward final documentation and regulatory approval, we see the convergence of global food security priorities, technology leadership, and industry innovation.

Key takeaways include:

- Corporate leadership and aligned management allow organizations to harness the full benefits of advanced operations structure, regulatory communication, and digital resilience.

- Proprietary AI blockchain platforms and DeFi technology are setting new benchmarks for integrity, traceability, and access—across every sector of food and agriculture.

- Farmonaut’s modular platform exemplifies how precision farming, transparency, and sustainability can be accessible and scalable, meeting the demands of both local market actors and global players.

As we march forward, the world’s attention must remain on the intersection of technological innovation, responsible management, and inclusive access—ensuring global food security is not just a 2025 target, but a continuing, shared achievement for the decades to come.

Your journey to sustainable, transparent food systems begins now. Download the Farmonaut App, connect via API, or explore products such as Carbon Footprinting, Traceability, and Fleet Management.

For media and investors, always refer to official corporate and regulatory sites for the latest statements regarding performance, risk, and assessment.