Vietnam Canada Trade Opportunities: 2025 Market Trends & Growth

- Overview: Vietnam Canada Trade Opportunities in 2025

- SIAL 2025 Ottawa: Expanding Vietnamese Food Exports to Canada

- Canada Vietnam Supply Chain Diversification: Trends & Implications

- Vietnam Canadian Market Growth 2025: Drivers and Projections

- Key Opportunities: Raw Materials, Processed Food, and New Product Lines

- CPTPP Benefits for Vietnam Canada Trade

- Leveraging Farmonaut for Vietnam-Canada Agriculture Value Chain Advancement

- Vietnam-Canada Trade Growth and Market Trends Overview [Table]

- Frequently Asked Questions (FAQ)

- Conclusion: Building a Resilient Trade Future

“Vietnamese food exports to Canada surged by 20% in 2023, highlighting robust trade growth under CPTPP agreements.”

Overview: Vietnam Canada Trade Opportunities in 2025

Canada and Vietnam are poised at the crossroads of a dynamic new chapter in global trade. As 2025 approaches, the Vietnam Canada trade opportunities are more robust and diversified than ever. Recent participation by Vietnamese businesses in major agriculture and food exhibitions such as SIAL 2025 in Ottawa underscores Vietnam’s intent to align with Canada’s push for market and supply chain diversification. With a significant surge in Vietnamese food exports to Canada and unprecedented engagement from both sides, new patterns are emerging—highlighting growth, innovation, and mutual benefit.

Each year, Vietnam exports over $10 billion USD in goods into the Canadian market, with supply and production chains becoming increasingly integrated. Factors such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), geo-economic shifts, and evolving tastes among Canadian consumers are fueling not only volume but also variety, opening direct access channels for sectors including food, agriculture, raw materials, and processed products.

This article will explore the latest market trends, rising demand, Vietnam Canada trade opportunities, and strategies for businesses and suppliers in both countries to capitalize on this growth.

SIAL 2025 Ottawa: Expanding Vietnamese Food Exports to Canada

The SIAL 2025 agriculture and food exhibition in Ottawa was a turning point for Vietnamese companies aiming to showcase their expanding range of goods in the Canadian and wider North American markets. From raw input materials—such as rice and spices—to innovative processed foods including dairy items and chocolate, the variety highlighted Vietnam’s increasing scale in both product development and supplier numbers.

- More enterprises participated this year than ever before, reinforcing Vietnam’s ambition to become a primary supplier to Canada.

- The exhibition spotlighted Vietnam’s new and creative food products, many of which are unfamiliar in Canada. This includes deep-processed lines spanning both traditional and novel tastes.

- Vietnamese food exports to Canada signal a shift from basic commodity supply chains towards value-added products with greater traceability, appealing to Canadian consumers’ growing desire for authenticity and quality.

Key government support, export development agencies, and the Vietnam Trade Office in Ottawa played crucial roles in facilitating B2B connections, paving the way for future participation at larger scale and with greater product diversity.

As part of the comprehensive strategy, Vietnamese businesses are also leveraging opportunities such as exporting Vietnamese rice to Canada and introducing processed food products Vietnam Canada has not encountered before. By participating in SIAL 2025, these companies not only aim to reach customers and partners directly but also gain valuable insights into evolving Canadian preferences and potential supply chain partnerships. This strategic outreach is an essential step in building a broader and more resilient customer base.

Canada Vietnam Supply Chain Diversification: Trends & Implications

Canada’s government and business sectors have made supply chain diversification a strategic priority, responding to global trade tensions and recent disruptions. Vietnamese enterprises now find themselves in a unique position: Canada’s importers are actively seeking new suppliers and sourcing raw materials for local processing and manufacturing—not just finished food items.

Let’s break down the key trends:

- Size and Potential: With the Canadian market valued at over $10 billion USD in annual Vietnamese goods imports, the opportunity for growth is vast, especially if current 12.9% annual growth rates continue.

- Direct Supply Chains: Historically, approx. $4 billion USD worth of Vietnamese product exports to Canada were routed through U.S. supply chains. Recent trade conflict is “opening direct” Canada-Vietnam routes, making Vietnamese sourcing more attractive and competitive.

- Raw Materials Exports: Canadian firms are increasingly interested in Vietnam raw materials export markets—from agricultural commodities to specialty ingredients for local food processing and manufacturing.

This realignment of the Canada Vietnam supply chain is also creating opportunities on both sides to reduce dependence on any single major market, strengthening economic resilience and promoting new connections between supply, logistics, and production networks.

“Canada-Vietnam bilateral trade reached $10.5 billion in 2023, marking a 15% year-over-year increase in market activity.”

Vietnam Canadian Market Growth 2025: Drivers and Projections

The numbers tell an impressive story. In the first two months of 2025 alone, Vietnam exported $1.7 billion USD worth of goods to Canada—a 12.9% rise over the previous year’s period. If sustained, Vietnam’s exports to Canada may exceed $11 billion USD for the full year, with a projected trade surplus approaching $10 billion USD.

Multiple factors are fueling this Vietnam Canada market trend:

- CPTPP Implementation: The Comprehensive and Progressive Agreement for Trans-Pacific Partnership offers tariff reductions and new market entry points, especially for food/agricultural suppliers, processed foods, and textile/apparel enterprises.

- Consumer Preferences: The Canadian market is experiencing rising demand for specialty and high-value foods, including rice, seafood, dairy, spices, and chocolate—categories in which Vietnam is rapidly innovating.

- Supply Chain Realignment: Canadian buyers are bypassing the U.S. ‘middleman’ in favor of more direct, traceable, and efficient imports from Vietnam.

- Business Participation: Vietnamese companies continue to scale up at exhibitions and trade fairs, actively seeking collaborations and customer feedback to refine product offerings.

By aligning with CPTPP standards and leveraging new channels for trade, Vietnamese businesses are well-positioned to capture greater Canada market share across food, raw materials, and processed food lines.

Key Opportunities: Raw Materials, Processed Food, and New Product Lines

At the forefront of Vietnam Canada trade opportunities are several high-potential categories. Let’s explore the leading product lines showcased, the range of goods on offer, and the industries driving growth.

1. Raw Materials & Inputs for Processing Chains

- Rice: With Canadian consumers showing a preference for specialty and premium rice, exporting Vietnamese rice to Canada is a core strategy. New varieties and improved quality are expanding the reach of Vietnamese suppliers.

- Spices: Pepper, cardamom, and other high-demand spices are increasingly included not just as raw imports but as key ingredients in Canadian local manufacturing.

- Seafood: Vietnamese seafood, especially shrimp and pangasius, remains a fundamental growth driver, boosting bilateral agriculture trade between Vietnam and Canada.

2. Processed Food Products Vietnam Canada Consumers Want

- Dairy and Confectionery: Companies such as those from Vietnam are introducing deep-processed products like dairy, chocolate, and block-packaged foods, responding to changing consumer demands.

- Ready-to-Eat and Convenience Foods: These items are seeing rising demand as Canadian households seek more convenient meal solutions that are both authentic and diverse.

3. Specialty and High-Value Lines

- Organic and Traceable Goods: With food traceability becoming a requirement, products with blockchain-backed transparency, such as those enabled by traceability solutions from Farmonaut, can make Vietnamese brands more attractive to Canadian importers.

- Sustainable and Carbon-Conscious Products: There is a strong movement in Canada towards zero-carbon and sustainably sourced food. Vietnamese exporters can gain a competitive edge by tracking and showcasing carbon footprinting data with Farmonaut tools.

CPTPP Benefits for Vietnam Canada Trade

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is the cornerstone for modern Vietnam Canada trade opportunities in 2025. Let’s examine how this free trade agreement is reshaping market access:

- Tariff Reductions: Most Vietnamese agricultural and food products benefit from reduced or eliminated tariffs under CPTPP, making them more competitive versus other countries’ exports to Canada.

- Market Access: New quotas and streamlined customs procedures simplify entry of fresh and processed goods into Canada, particularly for seafood, rice, pepper, and tropical fruits.

- Supply Chain Integration: The agreement encourages direct trade, allowing Canadian firms to directly source Vietnam’s raw materials for local processing, supporting both countries’ production chains.

- Standards Alignment: CPTPP promotes the adoption of higher standards around food safety, traceability, and environmental responsibility—a strong match for Vietnamese businesses equipped with advanced fleet management and blockchain solutions.

By leveraging CPTPP, both sides can build a more efficient, resilient, and value-driven partnership, responding to evolving market development trends.

Leveraging Farmonaut for Vietnam-Canada Agriculture Value Chain Advancement

To capitalize on the evolving Vietnam Canada trade opportunities, suppliers, exporters, and agribusinesses need advanced tools for monitoring crop health, managing production, ensuring traceability, and complying with sustainability standards.

Farmonaut is at the forefront of these needs, offering scalable technologies for all stakeholders:

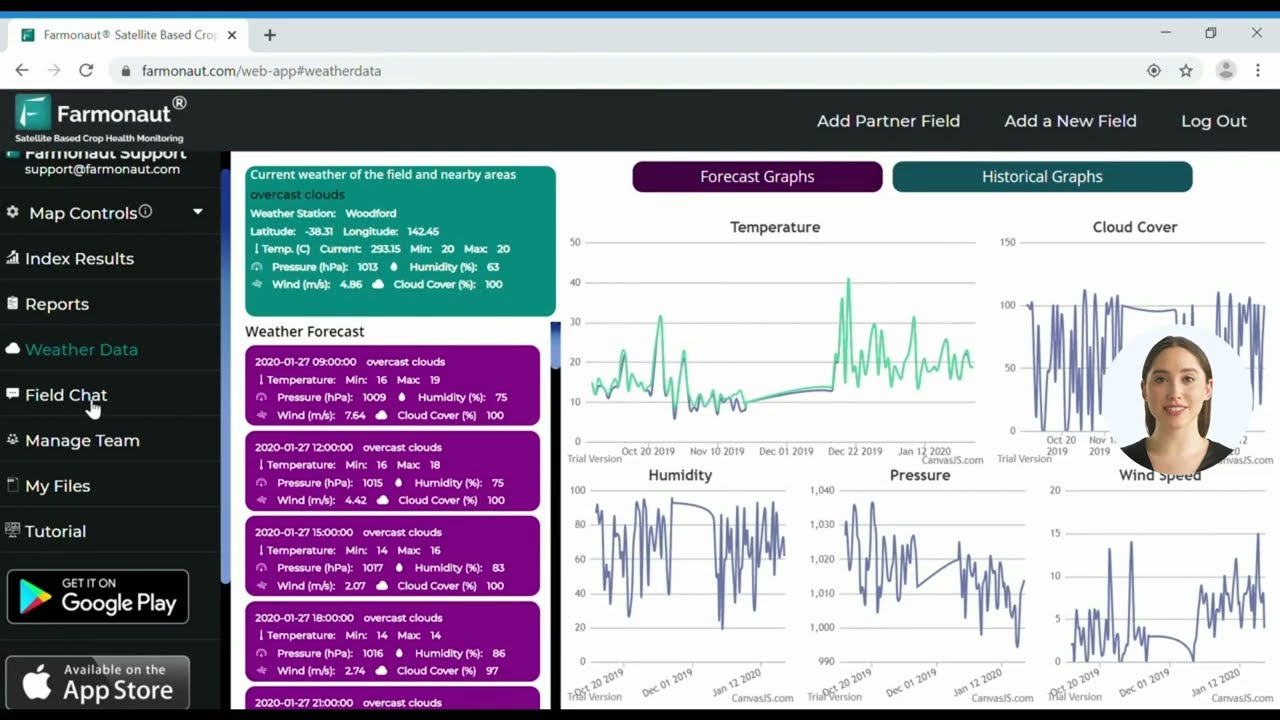

- Real-time Satellite Crop Monitoring: Vietnamese and Canadian farmers can use Farmonaut’s web, Android, and iOS apps to receive satellite-derived insights on vegetation health, irrigation, soil moisture, and other crucial variables. These enable optimized resource allocation, yield improvement, and more predictable supply for export markets.

- Blockchain Traceability: Farmonaut’s blockchain infrastructure offers transparent, tamper-proof traceability for all goods across the agri-supply chain. This is vital for building consumer trust in food imports—see the Farmonaut Traceability Solution.

- Fleet & Resource Efficiency: Logistics and local processing are simplified with automated fleet and resource management tools from Farmonaut Fleet Management, helping reduce costs and meet shipping timelines at scale.

- Carbon Footprinting: Stakeholders can document and reduce the carbon intensity of supply chains with Farmonaut Carbon Footprinting, boosting eligibility for environmentally sensitive Canadian customers and meeting new regulatory demands.

- Large-Scale & Governmental Applications: Policy planners and cooperatives can access in-depth analytics and remote monitoring via Farmonaut’s Large Scale Farm Management platform—ideal for managing compliance, subsidy distribution, and strategic export planning.

- API Access & Custom Integrations: Developers and businesses can power their own software stacks using the Farmonaut API for satellite and weather data, with comprehensive developer documentation.

These smart agriculture technologies are now accessible for all stakeholders—from small producers aiming for export compliance, to large businesses optimizing global supply chains. Our collective readiness and adoption of innovation will determine the future scale of Vietnam Canadian market growth 2025.

Vietnam-Canada Trade Growth and Market Trends Overview

For clear, data-driven decision-making, we present a comparative analysis of Vietnam’s major export categories to Canada, their 2023 performance, 2025 projections, growth rates, and the enabling effects of CPTPP.

This overview helps stakeholders in both nations identify the most promising areas for growth, prioritize investment, and respond to shifting demand dynamics in the Vietnam Canada trade ecosystem.

Satellite-Based Farm Monitoring Subscription Plans

Select a precision agriculture package that fits your organization’s needs and gain access to key features: real-time crop health, blockchain traceability, and more.

Frequently Asked Questions (FAQ)

What are the key Vietnam Canada trade opportunities for 2025?

The main Vietnam Canada trade opportunities lie in raw materials (rice, spices, seafood), processed food products, specialty items, and textile/garment exports. CPTPP and direct supply chain links are accelerating market access, while Canadian demand for high-value, traceable goods is rising. New product lines and increased participation in trade exhibitions such as SIAL Ottawa are expanding Vietnam’s footprint.

How does CPTPP benefit Vietnamese exports to Canada?

CPTPP reduces or eliminates tariffs for most Vietnamese goods, simplifies customs processes, and improves market access for food, agriculture, and manufacturing exports. It also supports standards for food safety, transparency, and supply chain integration, making Vietnamese products more attractive in the Canadian market.

Why is supply chain diversification between Canada and Vietnam important?

Canada Vietnam supply chain diversification strengthens resilience against trade disruptions and reduces over-reliance on single-source countries or indirect routes (e.g., the U.S.). It creates opportunities for direct supplier relationships, improves the efficiency of logistics, and supports growth in both economies.

What are the top exported goods from Vietnam to Canada?

Vietnam’s major exports to Canada include seafood, rice, coffee, garments, footwear, spices (notably pepper), processed food, and electronics. Specialty processed foods and high-value dairy products are emerging categories for growth.

How can agriculture businesses in Vietnam and Canada use technology to enhance trade?

By deploying tools such as Farmonaut’s satellite-based management platform, businesses can monitor crop health, ensure traceability, manage fleets, and optimize resources, meeting more stringent Canadian standards and increasing competitiveness.

Does Farmonaut act as a marketplace, manufacturer, or regulatory authority in supply chains?

No, Farmonaut is not a marketplace, manufacturer, or regulatory agency. It is a technology provider supplying advanced precision agriculture solutions, data analytics, and agri-traceability platforms for stakeholders across the value chain.

Conclusion: Building a Resilient Trade Future

As we move into 2025, Vietnam Canada trade opportunities stand at their most promising yet, driven by supply chain diversification, strong bilateral engagement, and the competitive advantages offered by the CPTPP. With Vietnamese businesses expanding in market scale, product diversity, and technological innovation, both countries are benefiting from higher trade volumes and more resilient supply pathways.

Agricultural and food producers who embrace data-driven platforms and sustainable practices—like those enabled by Farmonaut’s suite of crop monitoring, traceability, and carbon tracking tools—are ideally positioned to lead in this next era of growth. This is crucial for meeting Canadian consumer demand for quality, transparency, and environmental responsibility, as well as for maintaining compliance with new regulatory frameworks.

By continuing to innovate, invest in technology, and build strong business and logistical connections, stakeholders on both sides can ensure that the Vietnam-Canada trade partnership remains a model for resilience and sustainable expansion in global agriculture and food markets.

- Monitor crops in real time, optimize inputs, and improve yields with Farmonaut’s web and mobile apps

- Access crop health, pest, irrigation, and weather data on your Android:

Download Farmonaut Android App - Get powerful analytics and satellite insights on iOS:

Download Farmonaut iOS App - Automate farm logistics and manage resources efficiently with Farmonaut Fleet Management Solutions

- Integrate precision agri data into your system with our API access and developer docs

- Track greenhouse gas emissions and achieve compliance using Farmonaut Carbon Footprinting

- Enhance your product’s supply chain credibility with product traceability solutions

- Support policies and regional planning for large-scale agriculture via the Agro Admin dashboard