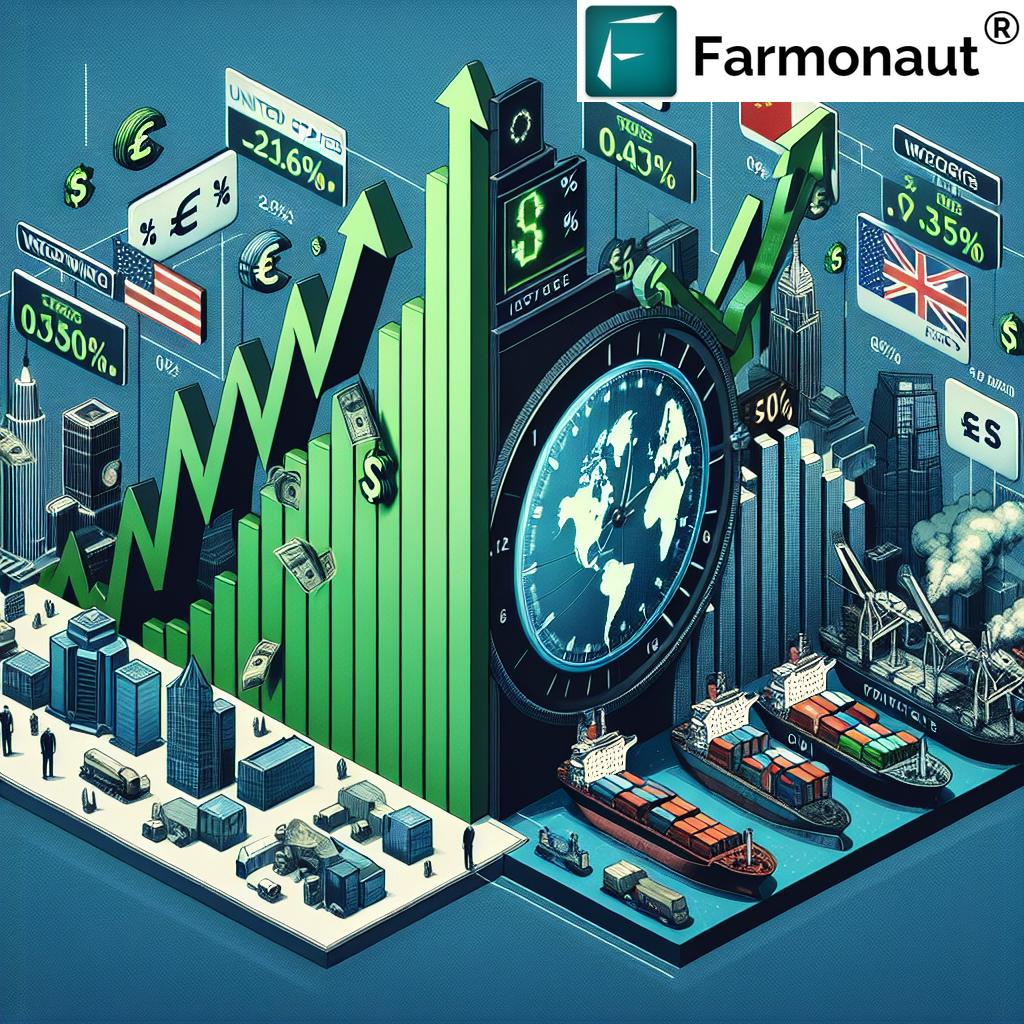

Global Market Turmoil: How US Dollar Strength and Rising Yields Impact World Economy

“The US dollar reached two-year highs, causing global stock markets to decline and impacting bond yields and equity valuations.”

In today’s interconnected global economy, the strength of the US dollar and fluctuations in bond yields can have far-reaching consequences. We’re witnessing a period of significant market turmoil, where these factors are reshaping the financial landscape across the world. Let’s dive into the complexities of this situation and explore how it’s affecting various aspects of the global economy.

The Rise of the US Dollar

The US dollar has been on a remarkable upward trajectory, reaching levels not seen in over two years. This surge in strength has sent ripples through global stock markets, causing significant declines and reshaping the dynamics of international trade and investment. As a reserve currency, the dollar’s movements have outsized effects on the world economy.

- Impact on emerging markets

- Shifts in commodity prices

- Changes in international trade balances

The strengthening dollar has particularly affected emerging market economies, many of which have dollar-denominated debts. As the dollar appreciates, these debts become more expensive to service, potentially leading to financial stress in these countries.

Bond Yields and Equity Valuations

Alongside the dollar’s rise, we’ve seen a significant uptick in bond yields, particularly in US Treasuries. This increase has profound implications for equity valuations and the broader financial markets.

“Treasury yields hit a 14-month peak, affecting corporate earnings expectations and increasing borrowing costs for businesses worldwide.”

The relationship between bond yields and equity valuations is complex but crucial to understand:

- Higher yields make bonds more attractive compared to stocks

- Increased borrowing costs can reduce corporate profitability

- Market expectations shift, affecting investment strategies

As yields rise, the required rate of return for equities also increases, putting downward pressure on stock prices. This dynamic is particularly evident in growth stocks, which are more sensitive to changes in interest rates.

Global Stock Market Decline

The confluence of a strong dollar and rising yields has led to a broad decline in global stock markets. We’ve observed significant drops across major indices:

- S&P 500 and Nasdaq futures down 0.4% and 0.6% respectively

- European markets showing weakness, with Eurostoxx 50, FTSE, and DAX futures all in negative territory

- MSCI index of Asia-Pacific shares (excluding Japan) falling by 1.6%

This global stock market decline reflects investor concerns about valuations, future earnings potential, and the overall economic outlook in light of changing monetary conditions.

Consumer Price Index and Inflation Concerns

The robust US jobs data has intensified focus on upcoming consumer price index (CPI) figures. Analysts are closely watching these numbers for signs of persistent inflation, which could influence Federal Reserve policy decisions.

Key points to consider:

- Core CPI expectations of 0.2% increase

- Potential for higher-than-expected inflation to eliminate hopes for monetary easing

- Year-on-year Personal Consumption Expenditure (PCE) concerns if exceeding 3%

The interplay between inflation, interest rates, and economic growth is a delicate balance that central banks must navigate. The Federal Reserve’s decisions in response to these indicators will have significant implications for global markets.

Interest Rate Hike Speculation

With inflation remaining above target levels, there’s growing speculation about potential interest rate hikes. The Federal Reserve’s approach to monetary policy is under intense scrutiny, as market participants try to anticipate future moves.

Factors influencing interest rate decisions:

- Inflation persistence

- Labor market strength

- Global economic conditions

- Financial market stability

Any shift in interest rate expectations can have cascading effects on various asset classes, from bonds to equities to real estate.

Currency Market Volatility

The strengthening US dollar has led to significant volatility in currency markets. We’ve seen notable movements in major currencies:

| Currency Name | Current Exchange Rate vs. USD | Percentage Change (Last 30 Days) | Percentage Change (Year-to-Date) |

|---|---|---|---|

| Euro (EUR) | 0.92 | -2.1% | -5.7% |

| British Pound (GBP) | 1.25 | -3.4% | -7.2% |

| Chinese Yuan (CNY) | 7.23 | -1.8% | -4.5% |

| Japanese Yen (JPY) | 150.2 | -2.7% | -9.1% |

The euro has declined over eight consecutive weeks, reaching its lowest levels since November 2022. Similarly, the British pound has fallen to a 14-month low, partly due to concerns over increased government borrowing.

Oil Price Fluctuations

Oil prices have surged amid geopolitical tensions and sanctions, adding another layer of complexity to the global economic picture. We’ve seen notable increases in both Brent crude and US crude prices.

Factors driving oil price volatility:

- Declining Russian exports

- US sanctions

- Global demand fluctuations

- OPEC+ production decisions

These oil price movements have implications for inflation, consumer spending, and economic growth across various regions.

China’s Economic Indicators

China’s economic data presents a mixed outlook, adding another layer of complexity to the global economic picture. We’ve observed:

- Strong export figures

- Increased imports

- Significant trade surplus with the US

These indicators come amid growing trade tensions and have implications for global supply chains and economic growth projections.

Corporate Earnings Expectations

As the earnings season begins, investors are closely watching corporate performance metrics. The rising yields and strengthening dollar have implications for earnings expectations:

- Higher borrowing costs may impact profitability

- Currency fluctuations can affect international revenues

- Changing consumer behavior in response to economic conditions

Companies with significant international operations or dollar-denominated debts may face particular challenges in this environment.

Global Economic Indicators

Beyond the US and China, various global economic indicators are shaping market sentiment:

- European economic growth forecasts

- Japanese monetary policy decisions

- Emerging market economic performance

- Global trade volumes and patterns

These indicators provide a broader context for understanding the current market turmoil and its potential long-term implications.

Implications for Agriculture and Farming

The global market turmoil has significant implications for the agricultural sector. Farmers and agribusinesses must navigate a complex landscape of currency fluctuations, changing input costs, and evolving trade dynamics.

In this context, tools that provide real-time insights and data-driven decision support become increasingly valuable. Platforms like Farmonaut offer advanced solutions for precision agriculture, helping farmers optimize their operations in uncertain economic times.

Farmonaut’s satellite-based farm management solutions provide farmers with crucial data on crop health, weather patterns, and resource management. This information can be invaluable for making informed decisions in a volatile economic environment.

The Role of Technology in Navigating Market Challenges

As global markets face turbulence, technological solutions play a crucial role in helping businesses adapt and thrive. In the agricultural sector, platforms like Farmonaut are at the forefront of this technological revolution.

Farmonaut’s advanced agri-solutions, such as precision crop area estimation, demonstrate how technology can provide valuable insights in challenging economic times. By leveraging satellite imagery and AI, farmers can make more informed decisions about resource allocation and crop management.

Adapting to Economic Uncertainty

In times of economic uncertainty, businesses across all sectors must be agile and responsive. For the agricultural industry, this means:

- Embracing data-driven decision-making

- Optimizing resource utilization

- Exploring new markets and diversification opportunities

- Leveraging technology for improved efficiency

Farmonaut’s suite of tools, including its API and mobile applications, provides farmers and agribusinesses with the capabilities to adapt to changing market conditions.

The Future of Global Markets

As we look to the future, the interplay between US dollar strength, bond yields, and global economic indicators will continue to shape market dynamics. Key areas to watch include:

- Central bank policies and their global impact

- Evolving trade relationships and geopolitical tensions

- Technological advancements and their effect on various industries

- Sustainability concerns and their influence on economic decisions

In this evolving landscape, staying informed and leveraging cutting-edge technologies will be crucial for businesses and investors alike. Farmonaut’s commitment to revolutionizing land use in agriculture through satellite technology exemplifies the kind of innovation that will be essential in navigating future market challenges.

Conclusion

The current global market turmoil, driven by US dollar strength and rising yields, presents both challenges and opportunities across various sectors. As we’ve explored, the impacts are far-reaching, affecting everything from stock markets and currency exchanges to commodity prices and corporate earnings.

In these uncertain times, data-driven insights and technological solutions become increasingly valuable. For the agricultural sector, platforms like Farmonaut offer powerful tools to navigate these complex market conditions. By providing real-time, satellite-based farm management solutions, Farmonaut empowers farmers and agribusinesses to make informed decisions and optimize their operations.

As we move forward, staying adaptable, embracing innovation, and leveraging advanced technologies will be key to thriving in this dynamic global economic landscape.

FAQ Section

Q: How does US dollar strength affect global markets?

A: A strong US dollar can lead to decreased competitiveness of US exports, impact emerging market economies with dollar-denominated debts, and influence commodity prices globally.

Q: What are the implications of rising bond yields?

A: Rising bond yields can lead to increased borrowing costs for businesses and consumers, affect equity valuations, and potentially slow economic growth.

Q: How do global economic indicators influence market sentiment?

A: Economic indicators such as GDP growth, inflation rates, and employment figures provide insights into economic health and future prospects, influencing investor confidence and market trends.

Q: What role does technology play in navigating market challenges?

A: Technology provides real-time data, analytics, and decision-support tools that help businesses and investors make informed choices in volatile market conditions.

Q: How can farmers adapt to economic uncertainty?

A: Farmers can adapt by leveraging precision agriculture technologies, diversifying crops, optimizing resource use, and staying informed about market trends and trade policies.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!