Shocking Drop in U.S. Import Prices: Unveiling Economic Game-Changers and Fed Rate Cut Potential

In a surprising turn of events, the latest Labor Department economic report reveals a significant US import price drop, sending ripples through the economic landscape and potentially paving the way for Federal Reserve rate cuts.

Unpacking the September Surprise: A Closer Look at U.S. Import Prices

The Labor Department’s recent report has set the economic world abuzz with its revelations about U.S. import prices. September witnessed a noteworthy 0.4% decrease in import prices, a figure that aligns closely with economic forecasts but carries far-reaching implications. This decline is particularly significant as it represents the first annual drop since February, marking a potential turning point in economic trends.

At the heart of this decline lies a substantial 7.0% drop in fuel import prices, acting as the primary driver behind the overall decrease. This fuel import cost decline not only impacts immediate economic indicators but also sets the stage for potential shifts in various sectors, from transportation to manufacturing.

The Ripple Effect: Economic Impact of Falling Import Prices

The economic impact of falling import prices extends far beyond mere numbers on a report. These figures serve as crucial inflation indicators, offering insights into the broader economic health and potential future trends. The September data, in particular, suggests a tempering of inflationary pressures, a factor that could significantly influence monetary policy decisions.

- Reduced production costs for businesses relying on imported materials

- Potential for lower consumer prices across various sectors

- Implications for domestic producers competing with imports

For a deeper dive into how these economic shifts might affect agricultural practices, consider exploring Farmonaut’s innovative solutions.

Year-Over-Year Trends: A Shift in Economic Tides

The significance of the September figures becomes even more apparent when viewed through the lens of year-over-year price changes. With import prices falling 0.1% compared to the previous year, we’re witnessing a reversal of the inflationary trend that has dominated recent economic discussions.

This shift in year-over-year trends could have far-reaching consequences:

- Potential easing of inflationary pressures on consumers

- Reassessment of monetary policies by central banks

- Implications for international trade dynamics

Export Prices: A Tale of Two Sectors

While import prices have taken center stage, the story of export prices adds another layer to this economic narrative. The Labor Department report highlights a decline in export prices, with non-agricultural exports leading the downward trend. This presents a complex picture of the U.S. economy’s position in global trade.

Key points in export price trends 2023:

- Overall decrease in export prices

- Non-agricultural exports experiencing more significant declines

- Agricultural exports facing unique challenges and opportunities

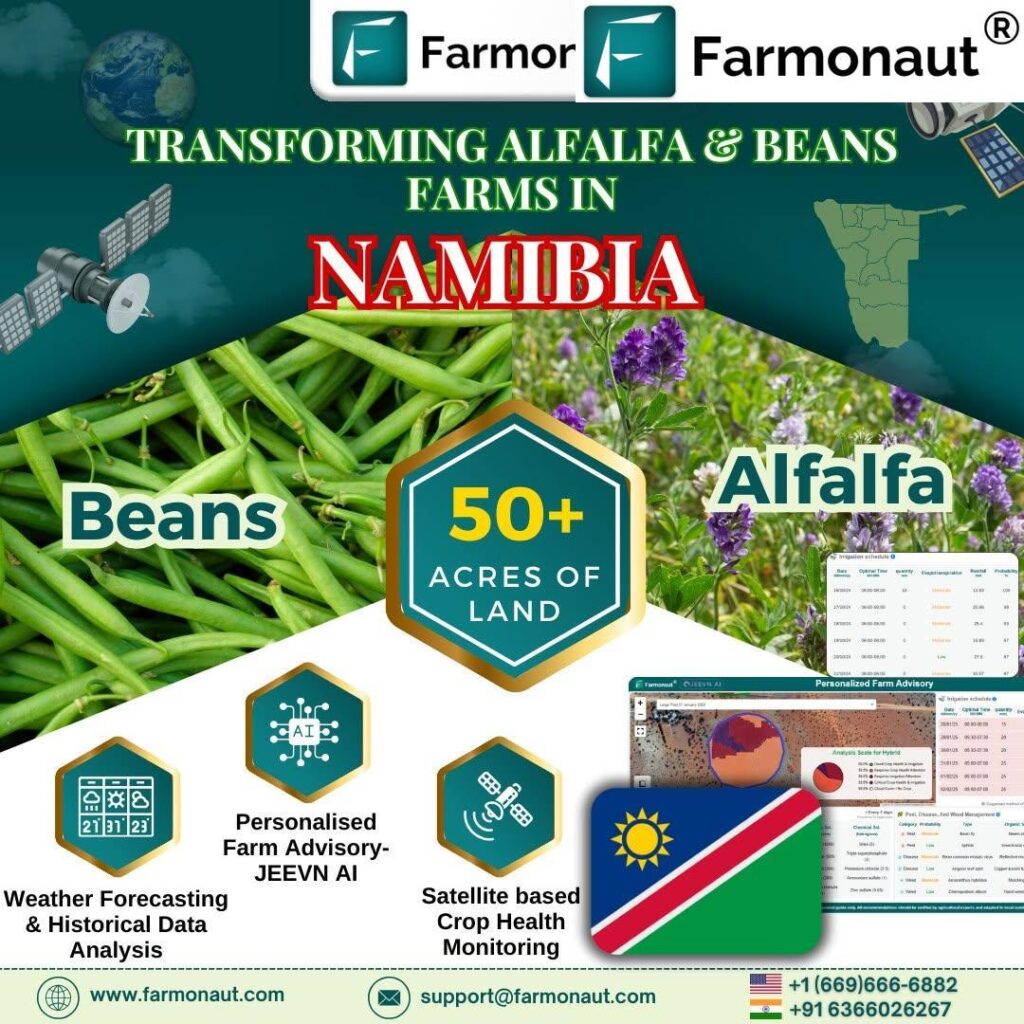

For farmers looking to navigate these changing economic waters, Farmonaut’s satellite-based crop monitoring can be an invaluable tool.

Federal Reserve Rate Cut Potential: A New Economic Horizon

Perhaps the most tantalizing aspect of these economic shifts is the growing speculation around Federal Reserve interest rates. The muted inflationary pressures suggested by the import price data have sparked discussions about potential rate cuts, a move that could reshape the economic landscape.

Factors influencing the Federal Reserve rate cut potential:

- Sustained low inflation indicators

- Global economic pressures and trade dynamics

- Domestic economic growth and employment figures

As these economic shifts unfold, staying informed is crucial. Farmonaut’s API offers real-time data that can help businesses adapt to changing conditions. Explore Farmonaut’s API

Implications for Agritech: Navigating Economic Shifts

For agritech companies like Farmonaut, these economic indicators offer valuable insights into market conditions. As agricultural exports face pricing challenges, precision farming solutions become increasingly crucial for optimizing crop yields and reducing production costs.

How Farmonaut’s technology addresses these challenges:

- Satellite-based crop monitoring for efficient resource management

- AI-driven analytics for improved decision-making

- Real-time data to adapt to market fluctuations

Discover how Farmonaut’s iOS app can help you stay ahead of these economic trends.

Looking Ahead: Economic Forecasts and Market Adaptations

As we digest the implications of the September Labor Department report, attention turns to future economic forecasts. Analysts are closely watching how these trends in import and export prices will evolve and what they might mean for various sectors of the economy.

Key areas to watch:

- Continued trends in fuel and energy prices

- Impact on consumer goods and inflation rates

- Potential shifts in global trade patterns

- Federal Reserve’s response and interest rate decisions

For developers looking to integrate economic data into their applications, Farmonaut’s API documentation is an excellent resource. Check out the API Developer Docs

Conclusion: Adapting to a Changing Economic Landscape

The recent drop in U.S. import prices, as revealed by the Labor Department’s September report, marks a significant moment in our economic narrative. From the substantial decline in fuel import costs to the nuanced trends in export prices, these figures paint a picture of an economy in flux, with potential far-reaching consequences.

For businesses, especially in sectors like agriculture and technology, staying ahead of these trends is crucial. Tools like Farmonaut’s satellite-based crop monitoring and AI-driven analytics offer valuable resources for navigating these economic shifts, ensuring sustainable practices and improved profitability in an evolving global market.

As we look to the future, the potential for Federal Reserve rate cuts adds another layer of intrigue to this economic puzzle. Whether you’re a farmer adapting to changing export conditions, a business leader strategizing for the future, or simply an engaged citizen trying to understand the economic forces at play, staying informed and adaptable will be key to thriving in this dynamic economic environment.

In conclusion, while the drop in import prices may have come as a shock, it opens up a world of possibilities and challenges. By leveraging cutting-edge technologies and staying attuned to these economic indicators, we can turn these challenges into opportunities for growth and innovation.