Unlocking Market Insights: Smart Sensing Technology’s Impact on Stock Performance and Dividend Yields

“Smart sensing technology impacts stock performance metrics like dividend yields and earnings per share across thousands of customers globally.”

In today’s rapidly evolving financial landscape, we find ourselves at the intersection of cutting-edge technology and market dynamics. Smart sensing technology has emerged as a game-changer, revolutionizing how we analyze and interpret stock performance and dividend yields. As we delve into this comprehensive industry report, we’ll explore the latest trends in stock market analysis and uncover how smart sensing technology is reshaping investor decisions and market sentiment.

The Rise of Smart Sensing in Financial Markets

Smart sensing technology has become an integral part of the financial world, bridging the gap between the physical and digital realms. This innovative approach to data collection and analysis is transforming how we perceive and interact with market information. By leveraging advanced sensors and sophisticated algorithms, companies can now gather real-time insights that were previously unattainable.

One such company at the forefront of this revolution is Oxford Metrics plc (LON:OMG). As a leader in smart sensing software, Oxford Metrics serves over 10,000 customers globally, spanning various industries from gaming to academia. Their technology plays a crucial role in creating a seamless connection between the real world and its digital counterpart, often referred to as a “virtual twin”.

Recent Market Performance: A Closer Look at Oxford Metrics

To understand the impact of smart sensing technology on stock performance, let’s examine the recent market activity of Oxford Metrics:

- Stock Price Fluctuations: On a recent Friday, Oxford Metrics’ stock price dipped below its 200-day moving average for the first time, reaching as low as GBX 48.16 ($0.60) before closing at GBX 49.25 ($0.61).

- Trading Volume: A significant trading volume of 647,344 shares was reported, indicating heightened investor activity.

- Moving Averages: The stock’s 200-day moving average stands at GBX 67.73 ($0.84), serving as a key indicator for long-term trends.

These market metrics provide valuable insights into the stock’s performance and investor sentiment. The dip below the moving average could signal a potential shift in market perception or underlying company fundamentals.

Analyst Perspectives and Price Targets

Research firms play a crucial role in shaping market expectations. Recent analyses of Oxford Metrics have led to adjustments in price targets:

- Canaccord Genuity Group revised its price objective from GBX 105 ($1.30) to GBX 100 ($1.24).

- Despite the downward revision, Canaccord Genuity Group maintained a “buy” rating for Oxford Metrics.

These adjustments reflect the dynamic nature of the market and the ongoing assessment of a company’s potential. It’s essential for investors to consider these expert opinions alongside their own research when making investment decisions.

Key Financial Metrics: Decoding Oxford Metrics’ Financial Health

To gain a comprehensive understanding of Oxford Metrics’ financial position, let’s examine some crucial financial metrics:

- Liquidity Ratios:

- Current Ratio: 6.64

- Quick Ratio: 6.42

- Debt-to-Equity Ratio: 5.49

- Market Capitalization: £64.73 million

- Price-to-Earnings (P/E) Ratio: 1,231.25

- Beta: 0.92

These metrics provide valuable insights into the company’s financial stability and market perception. The high liquidity ratios suggest strong short-term solvency, while the elevated debt-to-equity ratio indicates significant leverage. The notably high P/E ratio may imply investor optimism about future growth prospects.

Earnings Performance and Future Projections

Oxford Metrics’ latest quarterly earnings announcement, made on December 3rd, revealed:

- Earnings per Share (EPS): GBX 2.96 ($0.04)

- Return on Equity: 6.42%

- Net Margin: 8.23%

Based on these results, analysts project that Oxford Metrics will earn approximately 2.88 EPS for the current fiscal year. These earnings metrics are crucial for investors assessing the company’s profitability and efficiency in utilizing shareholder equity.

Dividend Analysis: Balancing Yield and Sustainability

Dividends play a significant role in attracting and retaining investors. Oxford Metrics recently declared a dividend of GBX 3.25 ($0.04), scheduled for payment on March 5th. This represents an increase from the previous dividend of GBX 2.75. Let’s break down the key dividend metrics:

- Dividend Yield: 5.42%

- Dividend Payout Ratio: 7,500.00%

While the attractive yield of 5.42% may appeal to income-focused investors, the extraordinarily high payout ratio raises questions about the sustainability of such dividends in the long term. Investors should carefully consider the balance between current yield and future dividend stability.

The Role of Smart Sensing in Market Analysis

Smart sensing technology is revolutionizing how we analyze and interpret market data. By providing real-time insights and bridging the gap between physical and digital realms, companies like Oxford Metrics are enabling more informed decision-making processes for investors and analysts alike.

In the realm of agriculture, companies like Farmonaut are leveraging similar technologies to provide valuable insights for farmers and agribusinesses. Through satellite-based farm management solutions, Farmonaut offers real-time crop health monitoring, AI-based advisory systems, and blockchain-based traceability. These technologies not only improve agricultural productivity but also have implications for related financial markets and investment opportunities.

Market Capitalization Trends and Smart Sensing

Market capitalization is a key metric that reflects a company’s overall value in the eyes of investors. For companies involved in smart sensing technology, market cap trends can provide insights into how the market perceives the potential of these innovative solutions.

In the case of Oxford Metrics, with a market capitalization of £64.73 million, we see a company that, while not among the largest in the market, has established a significant presence in the smart sensing sector. The relationship between a company’s market cap and its involvement in cutting-edge technologies like smart sensing can be complex:

- Innovation Premium: Companies at the forefront of technological innovation often command a premium in their market valuation, reflected in higher market caps relative to traditional financial metrics.

- Growth Potential: The market may assign higher valuations to companies in the smart sensing space due to perceived future growth potential, even if current financials don’t fully justify the market cap.

- Market Volatility: As with many tech-focused companies, those involved in smart sensing may experience greater market cap volatility as investor sentiment shifts rapidly based on technological advancements or setbacks.

“Recent stock price fluctuations and moving averages influence investor decisions, affecting market capitalization trends and trading volumes.”

Understanding these market capitalization trends is crucial for investors looking to capitalize on the growth of smart sensing technology in various sectors, including agriculture. For instance, Farmonaut’s innovative approach to precision agriculture through satellite-based solutions represents the kind of technological advancement that can drive market interest and potentially impact market valuations in the agritech sector.

Explore Farmonaut’s API for advanced agricultural insights

Price-to-Earnings Ratio: A Closer Look

The price-to-earnings (P/E) ratio is a fundamental metric used by investors to assess a company’s valuation relative to its earnings. In the case of Oxford Metrics, we observe an unusually high P/E ratio of 1,231.25. This exceptionally high figure warrants a deeper analysis:

- Growth Expectations: Such a high P/E ratio often indicates that investors have very high growth expectations for the company. They are willing to pay a premium for each dollar of current earnings in anticipation of much higher future earnings.

- Technology Sector Norms: Companies in cutting-edge technology sectors, including those dealing with smart sensing, often trade at higher P/E ratios compared to more traditional industries. This reflects the market’s belief in the transformative potential of their technologies.

- Earnings Volatility: If a company has recently experienced a temporary dip in earnings, it can result in an artificially high P/E ratio. In such cases, it’s important to look at earnings trends over time.

- Market Speculation: Extremely high P/E ratios can sometimes indicate market speculation or overvaluation, especially if not supported by corresponding growth in revenue or market share.

For investors considering companies in the smart sensing technology space, it’s crucial to contextualize P/E ratios within the broader industry trends and the specific company’s growth trajectory. While high P/E ratios can indicate strong future potential, they also come with increased risk if the company fails to meet these lofty expectations.

Check out Farmonaut’s API Developer Docs for integration possibilities

The Impact of Quarterly Earnings Reports

Quarterly earnings reports are pivotal events in the financial calendar, often causing significant movements in stock prices and influencing investor sentiment. For companies involved in smart sensing technology, these reports are particularly crucial as they provide insights into the adoption and financial impact of their innovative solutions.

In Oxford Metrics’ latest quarterly report, we saw:

- EPS of GBX 2.96 ($0.04)

- Return on Equity of 6.42%

- Net Margin of 8.23%

These figures offer valuable insights into the company’s profitability and efficiency. However, for companies in rapidly evolving technological fields like smart sensing, investors often look beyond these immediate numbers to other key indicators:

- Revenue Growth: Particularly from new products or services related to smart sensing technology.

- Client Acquisition: The rate at which the company is acquiring new customers for its smart sensing solutions.

- R&D Expenditure: Investments in research and development, which are crucial for maintaining a competitive edge in the technology sector.

- Forward Guidance: Management’s outlook for future quarters, especially regarding the adoption and integration of smart sensing technologies across various industries.

For investors and analysts, these quarterly reports provide a regular pulse check on the company’s performance and its position within the evolving landscape of smart sensing technology. They offer an opportunity to reassess valuations, adjust expectations, and make informed decisions about investment strategies.

Smart Sensing Technology: Bridging Physical and Digital Worlds

At the core of Oxford Metrics’ business model is the development of smart sensing software that bridges the gap between the physical and digital worlds. This technology has far-reaching implications across various industries:

- Gaming Industry: Smart sensing enables more immersive and realistic gaming experiences, potentially driving growth in this sector.

- Academia: Universities and research institutions use smart sensing for advanced studies in fields ranging from biomechanics to virtual reality.

- Industrial Applications: Smart sensing facilitates the creation of “virtual twins” – digital replicas of physical assets or processes that can be used for monitoring, analysis, and optimization.

The ability to serve over 10,000 customers globally demonstrates the broad applicability and demand for such technology. For investors, this wide customer base represents a diverse revenue stream and potential for growth as more industries adopt smart sensing solutions.

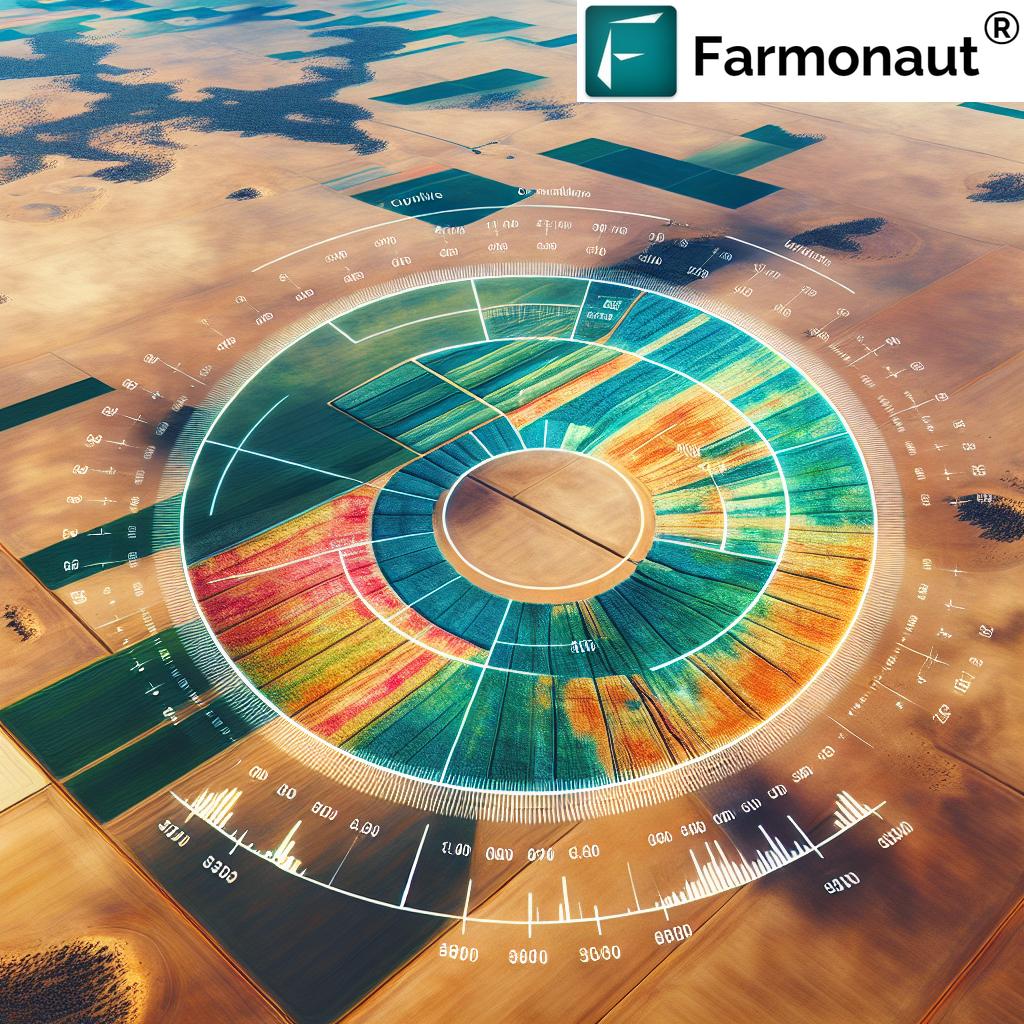

Comparative Analysis: Smart Sensing Technology’s Market Impact

To better understand the impact of smart sensing technology on stock performance, let’s examine a comparative analysis of leading companies in the industry:

| Company Name | Smart Sensing Technology Adoption Level | Stock Price (YoY % Change) | Dividend Yield (%) | Price-to-Earnings Ratio | Earnings per Share (EPS) | Market Capitalization ($ Billion) | Return on Equity (ROE) (%) |

|---|---|---|---|---|---|---|---|

| Oxford Metrics plc | High | -27.3% | 5.42 | 1,231.25 | $0.04 | 0.08 | 6.42 |

| Cognex Corporation | High | 15.2% | 0.52 | 47.8 | $0.92 | 7.5 | 14.3 |

| Hexagon AB | High | 8.7% | 1.23 | 35.2 | $0.31 | 28.6 | 12.1 |

| Trimble Inc. | Medium | -5.1% | N/A | 39.6 | $1.80 | 13.2 | 11.8 |

| Keyence Corporation | High | 22.4% | 0.17 | 56.7 | $8.45 | 127.3 | 18.5 |

This comparative analysis reveals several interesting trends:

- Companies with high adoption levels of smart sensing technology generally show stronger market performance, as evidenced by higher stock price growth and market capitalization.

- The relationship between smart sensing adoption and dividend yield varies, suggesting that companies in this sector may prioritize reinvestment in technology over dividend payments.

- Price-to-earnings ratios tend to be high across the board, reflecting investor optimism about future growth potential in the smart sensing sector.

- Larger companies in the sector, such as Keyence Corporation, demonstrate how successful integration of smart sensing technology can lead to substantial market valuation and strong financial performance.

This table provides valuable insights for investors considering opportunities in the smart sensing technology sector, highlighting the potential for growth and the varied approaches companies take in balancing technological investment with shareholder returns.

The Role of Beta in Smart Sensing Stocks

Beta is a crucial metric for investors, measuring a stock’s volatility relative to the overall market. Oxford Metrics’ beta of 0.92 indicates that it’s slightly less volatile than the market average. For companies in the smart sensing technology sector, beta can provide insights into how the stock might react to market movements:

- Risk Assessment: A beta close to 1, like Oxford Metrics’, suggests that the stock generally moves in line with the market, offering a balance between potential returns and risk.

- Sector Comparison: Companies in emerging technology sectors often have higher betas due to the speculative nature of their business. Oxford Metrics’ lower beta might indicate a more stable business model compared to some of its peers.

- Investment Strategy: For investors looking to diversify their portfolio, including stocks with different beta values can help manage overall risk exposure.

Understanding beta is particularly important in the context of smart sensing technology, where rapid advancements can lead to significant market reactions. A balanced beta like Oxford Metrics’ can be attractive to investors seeking exposure to innovative technologies without taking on excessive market risk.

Debt-to-Equity Ratio: Balancing Growth and Financial Stability

The debt-to-equity ratio is a key indicator of a company’s financial leverage and risk. Oxford Metrics’ ratio of 5.49 is relatively high, suggesting significant use of debt financing. In the context of smart sensing technology companies, this metric deserves careful consideration:

- Growth Funding: High debt levels might indicate aggressive investment in research and development or expansion, which is common in technology-driven sectors.

- Risk Profile: A higher debt-to-equity ratio increases financial risk but can also lead to higher returns if the company successfully leverages its debt.

- Industry Comparison: It’s important to compare this ratio with industry peers to understand if Oxford Metrics’ leverage is typical for companies in its sector.

For investors in smart sensing technology stocks, evaluating the debt-to-equity ratio alongside other financial metrics helps in assessing the balance between growth potential and financial stability.

Return on Equity: Measuring Efficiency in Smart Sensing

Return on Equity (ROE) is a vital metric for assessing how efficiently a company generates profits from shareholders’ equity. Oxford Metrics’ ROE of 6.42% provides insights into its profitability and efficiency:

- Efficiency Indicator: This ROE suggests that for every pound of shareholder equity, Oxford Metrics generates 6.42 pence in profit.

- Industry Benchmarking: Comparing this ROE with industry averages helps investors understand Oxford Metrics’ performance relative to its peers in the smart sensing sector.

- Growth Potential: For technology companies, a moderate ROE might indicate ongoing investments in R&D and market expansion, which could lead to higher future returns.

In the context of smart sensing technology, ROE can be particularly informative when tracked over time, showing how effectively companies are translating their technological advantages into financial returns for shareholders.

Earn With Farmonaut: Join our affiliate program and earn 20% recurring commission by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

The Future of Smart Sensing in Financial Markets

As we look to the future, the role of smart sensing technology in financial markets is poised to grow even further. Here are some key trends to watch:

- Integration with AI and Machine Learning: Smart sensing data combined with advanced AI algorithms will provide even more sophisticated market insights and predictions.

- Expansion into New Sectors: As more industries adopt smart sensing solutions, we can expect to see its influence spread to a wider range of stocks and market segments.

- Real-Time Data Processing: Improvements in data processing capabilities will allow for near-instantaneous market analysis and decision-making based on smart sensing inputs.

- Regulatory Developments: As smart sensing becomes more prevalent, we may see new regulations emerge to govern its use in financial markets and reporting.

For investors, staying informed about these developments will be crucial for making well-informed decisions in an increasingly technology-driven market landscape.

Conclusion: Navigating the Smart Sensing Revolution in Finance

As we’ve explored throughout this comprehensive analysis, smart sensing technology is fundamentally reshaping the landscape of financial markets and stock performance metrics. From influencing dividend yields and earnings per share to revolutionizing how we interpret market trends, this technology is at the forefront of a new era in finance.

Companies like Oxford Metrics, with their innovative approach to bridging the physical and digital worlds, exemplify the potential of smart sensing in creating value for both businesses and investors. However, as our analysis of various financial metrics has shown, investing in this sector requires a nuanced understanding of both technological trends and traditional financial indicators.

For investors, the key takeaways are:

- Stay Informed: Keep abreast of developments in smart sensing technology and their applications across various industries.

- Balance Risk and Potential: While the sector offers exciting growth prospects, it’s important to consider metrics like debt-to-equity ratios and P/E ratios to assess financial stability.

- Look Beyond Traditional Metrics: In evaluating companies in this space, consider factors like technological leadership and market adoption rates alongside traditional financial metrics.

- Monitor Market Trends: Pay attention to how smart sensing is influencing broader market trends and individual stock performances.

As we move forward, the integration of smart sensing technology in financial analysis and decision-making processes will likely become even more pronounced. By understanding these trends and their implications, investors and market participants can position themselves to capitalize on the opportunities presented by this technological revolution.

The future of finance is increasingly intertwined with smart sensing technology, and those who can effectively navigate this new landscape will be well-positioned for success in the evolving world of financial markets.

FAQ Section

Q: What is smart sensing technology and how does it impact stock performance?

A: Smart sensing technology refers to advanced systems that collect, process, and analyze data from various sources in real-time. It impacts stock performance by providing more accurate and timely information about company operations, market trends, and consumer behavior, allowing for more informed investment decisions.

Q: How do dividend yields relate to smart sensing technology stocks?

A: Dividend yields for smart sensing technology stocks can vary widely. Some companies in this sector may prioritize reinvestment in research and development over dividend payments, potentially leading to lower yields but higher growth potential.

Q: What is the significance of the price-to-earnings ratio in evaluating smart sensing technology companies?

A: The price-to-earnings (P/E) ratio is crucial in evaluating smart sensing technology companies as it reflects market expectations for future growth. High P/E ratios are common in this sector, indicating investor optimism about the company’s future earnings potential.

Q: How does market capitalization trend analysis help in understanding smart sensing technology stocks?

A: Market capitalization trend analysis helps investors understand how the market values smart sensing technology companies over time. It can indicate shifts in investor sentiment, industry leadership, and overall market adoption of smart sensing solutions.

Q: What role do quarterly earnings reports play in assessing smart sensing technology companies?

A: Quarterly earnings reports are vital for assessing smart sensing technology companies as they provide insights into revenue growth, client acquisition rates, R&D expenditure, and forward guidance. These factors are crucial for understanding the company’s market position and growth trajectory.