Urea Forecasts 2025: Shocking Global Market Predictions

Introduction: Urea’s Pivotal Role in Agriculture

Urea, as a nitrogen-rich fertilizer, plays a fundamental role in global agriculture by improving soil fertility, enhancing crop yields, and supporting food security. As we move into 2025, urea market trends and global urea prices are undergoing dynamic shifts. These shifts are influenced by technological advancements, evolving trade policies, regulatory changes, and volatile supply chains. For stakeholders across the value chain—including producers, traders, policymakers, and farmers—it is critical to understand the demand, production, technology, and regulatory context shaping the urea landscape.

In this comprehensive analysis, we delve into the shocking global market predictions for urea in 2025, offering insights into consumption trends, regional performance, price dynamics, technological innovations, and the impact of environmental regulations. Leveraging accurate data and expert perspectives, we unravel the complexities of the current and future urea market.

“Global urea demand is projected to rise by 3% in 2025, driven by expanding agricultural needs.”

Current Urea Market Overview (as of May 2025)

The urea market in early 2025 displays considerable regional fluctuations in both production and pricing. These dynamics reflect the ever-changing factors impacting sectors from agricultural production to global trade negotiations. Let’s break down the current situation:

Key Regional Urea Prices (March 2025)

- United States: $382 per metric ton (MT) driven by strong agricultural demand and supply disruptions resulting from adverse weather and logistical challenges. (Source)

- China: $253 per MT with output affected by ongoing downstream demand fluctuations and plant restarts after maintenance. (Source)

- Russia: $345 per MT, with constant supply and seasonal demand challenges under persistent trade pressures. (Source)

- Saudi Arabia: $362 per MT, underpinned by high international demand and expectations around major Indian tenders. (Source)

- Egypt: $411 per MT due to constrained global availability and robust export demand. (Source)

Looking to enhance farm resource management? Our Fleet Management solution enables agribusinesses to track, optimize, and reduce logistics costs efficiently.

Global Urea Market Trends 2025: Navigating Dynamic Shifts

As we analyze urea market trends 2025, several pivotal factors emerge. These include changing consumption patterns, advancements in sustainable urea production, supply chain shifts, and evolving environmental regulations. Global fertilizer demand continues to grow, supported by expanding agricultural activities and the adoption of high-efficiency fertilizers.

- Urea’s Dominance: Remains the primary source of nitrogen for crops globally, despite growing competition from alternative fertilizers and eco-friendly products.

- Supply/Demand Volatility: Geopolitical tensions, trade policies, raw material price swings, and regional weather conditions all affect urea supply and demand growth.

- Environmental Focus: Stricter environmental regulations are promoting investments in enhanced urea products and sustainable production processes.

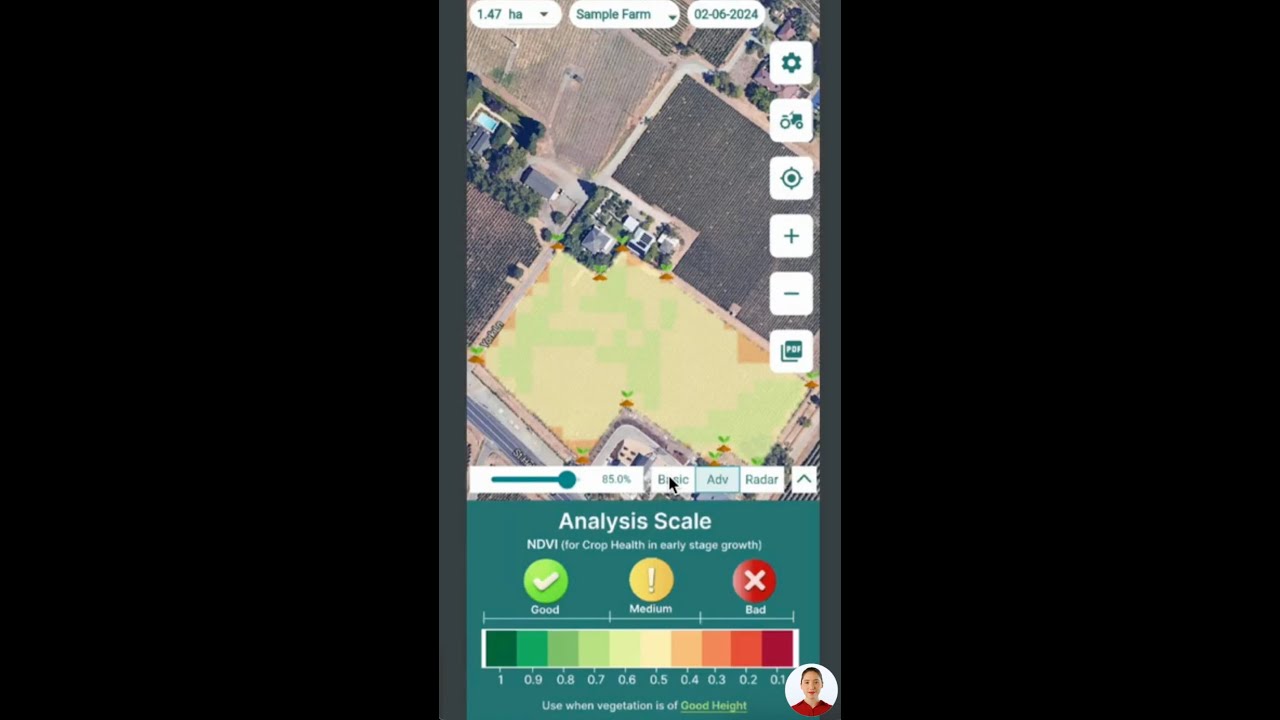

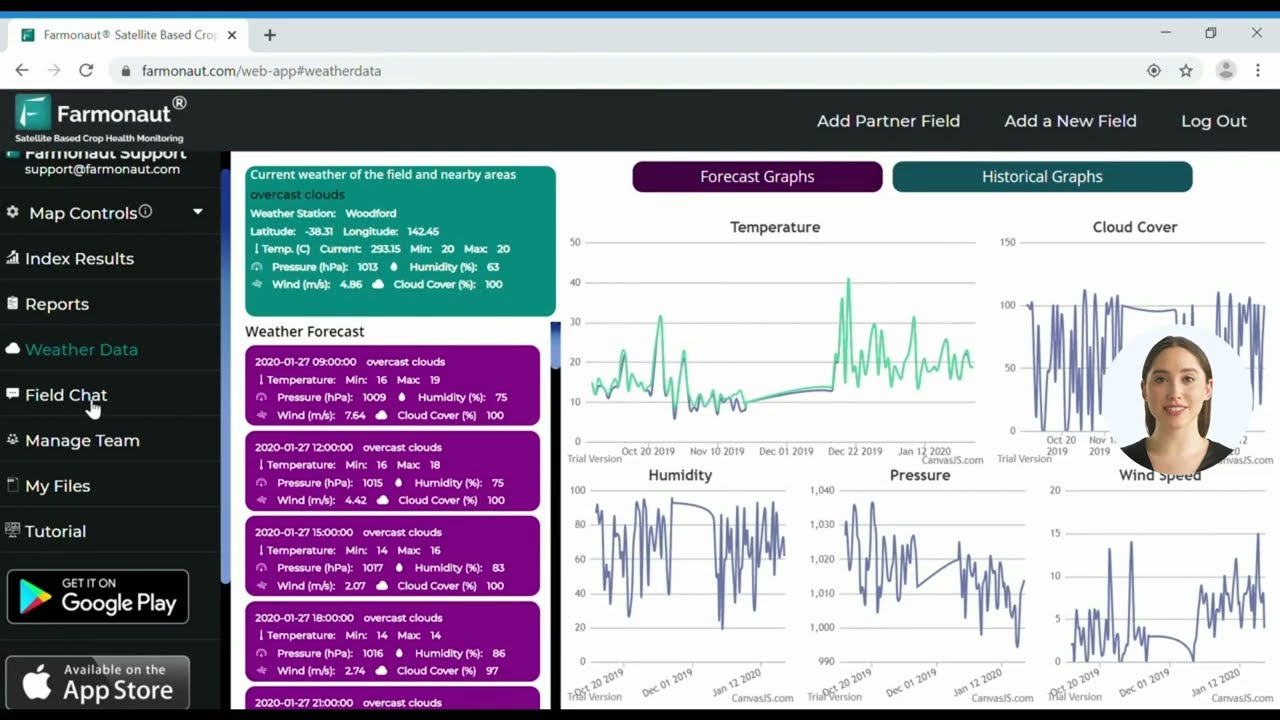

- Technology Adoption: From satellite-based decision tools (like those offered by Farmonaut) to slow-release coatings, innovation is transforming the fertilizer sector.

Urea Fertilizer Demand & Consumption Trends

One of the most significant drivers in global agriculture is the persistent rise in urea fertilizer demand. Forecasts indicate that the trend will continue, especially in regions with intensive farming and population growth.

- China’s Market: Urea production in China is the world’s largest, with agricultural demand growing 4% in 2024 to 38.3 million t/a. It is expected to stabilize near 38 million t/a in 2025, peaking in 2026, before declining slightly by 2029. (Source)

- Outside China: Urea demand outside China is set to rise from 123 million tons in 2024 to 137 million by 2029—a clear indication of robust adoption and usage across Asia-Pacific, Europe, and the Americas.

- Global Nitrogen Demand: Projected to grow from 117 million tons N (2024) to 123 million tons N by 2029, driven by growing agricultural requirements.

These numbers reinforce the pivotal role of urea in boosting yields and enhancing soil fertility, particularly where high-density planting and expansion of cultivation areas are prominent.

Ensure compliance and transparency in your farm-to-market journey. Farmonaut Product Traceability utilizes blockchain to enhance supply chain integrity, building consumer and partner trust.

Global Urea Prices & Pricing Dynamics

Understanding the factors influencing urea prices requires careful examination of raw material costs, changing supply patterns, and demand surges. 2025 is poised to witness significant price fluctuations across global and regional markets.

“Urea prices may fluctuate up to 15% in 2025 due to regulatory changes and supply chain shifts.”

Key Drivers Behind 2025 Urea Price Volatility

- Natural Gas Prices: As the primary raw material for urea production, natural gas costs have a direct impact. Market shocks, such as those in 2021, saw urea prices surge over 100% due to gas price spikes (source).

- Trade Tariffs and Policies: With ongoing U.S. tariffs on Chinese, Moroccan, and Russian imports, trade flows are regularly disrupted, creating uncertainty and adjusting global urea pricing.

- Environmental Regulations: Increasingly stringent in the European Union and elsewhere, these policies drive up costs and promote alternatives, reshaping overall environmental regulations urea market dynamics.

- Geopolitical Pressures: Ongoing conflicts, sanctions, and diplomatic disputes (especially involving Russia and the Middle East) may exacerbate supply challenges and pricing unpredictability.

- Seasonal & Weather Conditions: Adverse weather and climate anomalies disrupt logistics and local supply, especially in high-consuming regions like the United States, India, and Brazil.

- International Tendering: Large-volume procurement by countries such as India can create further price volatility on the spot market.

Overall, the urea market in 2025 is expected to remain highly dynamic, requiring vigilant monitoring by all stakeholders.

Concerned about your environmental impact? Discover Farmonaut Carbon Footprinting—track and reduce emissions to support sustainable farming and regulatory compliance.

Factors Influencing Urea Prices & Market Dynamics

To anticipate future developments, we must assess the interconnected factors influencing urea prices and market dynamics. Leading influences include production costs, global trade patterns, technology, regulations, and consumer demand.

Key Factors in Detail

- Natural Gas Price Fluctuations: Being the primary raw material for urea, gas market volatility directly translates into cost instability and supply unpredictability.

- Trade Policy & Tariffs: International tariffs and anti-dumping duties, especially from the United States targeting China, Russia, and Morocco, impact price competitiveness and alter global supply dynamics.

- Environmental Regulations: Legislative trends in the EU and major importers (e.g., India, Brazil) push for eco-friendly fertilizer use, enhancing markets for enhanced-efficiency fertilizers (EEFs) such as sulfur coated urea (SCU).

- Technological Advancements: Investments in precision agriculture urea solutions, green ammonia production, satellite crop monitoring (learn more), and AI-optimization are reshaping efficiency and sustainability.

- Seasonal/Regional Weather Conditions: Severe weather can result in localized shortages and transport logistics issues, contributing to temporary price surges.

- Supply Chain Shocks & Disruptions: Bottlenecks from raw material, transportation, or labor disruptions have widespread effects on production capabilities and pricing.

- Global Agricultural Trends: Changing planting technologies and intensification in emerging regions further drive up demand and pressure on supply.

- Geopolitical Developments: Ongoing international tensions and sanctions (notably with Russia, Middle East, and China) heavily influence shipping routes, trade flows, and market sentiment.

Digitalize large-scale plantations and forests seamlessly. Explore Farmonaut’s Large Scale Farm Management App to remotely supervise, monitor, and optimize field operations via AI and satellite.

Technological Advancements & Sustainable Urea Production

One of the most exciting developments in the nitrogen fertilizer market is the ongoing transformation brought about by technological advancements aimed at boosting efficiency, tracking environmental impacts, and making sustainable urea production the industry’s new standard.

Key Innovations Shaping the Urea Market

- Green Ammonia: The shift from fossil to renewable energy sources in ammonia synthesis is underway. Green ammonia production dramatically reduces carbon footprint—and in turn, the emissions profile of urea fertilizer.

- Precision Agriculture Urea: Adoption of digital tools such as satellite crop health monitoring, AI-based advisory, and data-driven fertilizer application (experience with Farmonaut) is revolutionizing how, when, and where urea is applied, minimizing waste and maximizing yields.

- Enhanced-Efficiency Fertilizers (EEFs): Innovations like sulfur coated urea (SCU) provide slow-release nitrogen, improving nutrient uptake, sulfur coated urea benefits, and minimizing leaching or runoff—key to better resource efficiency and lower environmental risk.

- Blockchain Traceability: Supply chain transparency driven by blockchain platforms (such as Farmonaut’s traceability module) is growing in relevance among corporate buyers and regulators.

- Carbon Footprint Monitoring: Agribusinesses can now track greenhouse gas emission profiles for urea use, respond to sustainability reporting mandates, and access carbon credits.

Safeguard farmers and institutions against insurance fraud. Check out Farmonaut Crop Loan & Insurance Verification for satellite-powered, tamperproof crop monitoring and claim authentication.

Regional Market Insights: Asia-Pacific, Americas, Europe, Middle East & Africa

Asia-Pacific – The Global Urea Demand Powerhouse

- With over 70.1% market share, this region—led by China and India—drives both production and demand.

- Regional governments are increasingly pushing sustainable practices and investing in enhanced-efficiency, low-emission fertilizers.

- Indian government tenders have outsized influence on global pricing, given the country’s import dependency.

North America – Technology-Led Growth

- The United States capitalizes on precision farming and advanced, sustainable fertilizer technologies.

- Periodic supply disruptions—often weather- or transport-related—can trigger local price surges.

- Regulatory focus is on nitrogen application efficiency and pollution reduction.

Europe – Regulation Spurs Innovation

- Stringent environmental standards drive adoption of eco-friendly urea alternatives and slow-release products like sulfur coated urea.

- Policy incentives and emission penalties continue to shape the nitrogen fertilizer market.

Middle East & Africa – Export-Oriented Production Hubs

- Saudi Arabia and Egypt leverage abundant natural gas resources and cost-competitive production for export markets.

- Export demand is particularly strong from India and Southeast Asia.

- Regional price volatility is influenced by both global demand and geo-political supply disruptions.

Latin America – Growing Consumption, Supply Vulnerabilities

- Key agricultural economies such as Brazil and Argentina are expanding urea adoption.

- Import dependency exposes the region to international market shocks and price instability.

2025 Global Urea Market Forecast Summary Table

Below is a comprehensive comparative table summarizing 2025 urea prices, demand growth, regulatory and technological trends by key region. This table offers a concise, actionable snapshot for those tracking region-wise urea market trends.

| Region / Country | Estimated Urea Price (USD/ton) | Projected Demand Growth (%) | Regulatory Impact | Key Technological Trends |

|---|---|---|---|---|

| Asia-Pacific (China, India) | $253 – $380 | +2.7% | Medium | High-density planting, green ammonia, EEFs |

| North America (United States) | $382 | +2.3% | Medium | Precision agriculture, slow-release urea, AI advisory |

| Europe | $360 – $412 | +1.7% | High | Sulfur coated urea, digital farm management |

| Middle East & Africa (Saudi Arabia, Egypt) | $362 – $411 | +3.5% | Low | Export-driven modernization, carbon tracking |

| Latin America (Brazil, Argentina) | $370 – $395 | +4.1% | Medium | Import-focused, mobile farm management |

Farmonaut Solutions: Driving Precision Agriculture Urea Application

At Farmonaut, we are committed to making precision agriculture and sustainable urea fertilization accessible and affordable to everyone. Our suite of digital tools—including satellite imagery crop health monitoring, real-time AI advisory, blockchain-based traceability, and fleet/resource management—empowers individual farmers, agribusinesses, and governments to optimize fertilizer use, minimize waste, and promote sustainable, climate-smart practices.

- Satellite Data: Real-time insights into crop health, NDVI, and soil moisture allow targeted urea application for yield optimization.

- Jeevn AI Advisory: Personalized recommendations for crop and fertilizer management, weather preparedness, and best practices.

- Blockchain Traceability: Transparent, tamperproof supply chain tracking to meet global standards and boost market confidence for agricultural produce.

- Carbon Footprinting: Track emissions data for compliance, reporting, and access to emerging carbon markets.

- API Access: Integrate Farmonaut’s data into your own agricultural management or research tools with our API platform.

Market Outlook: The Road Ahead for Urea in 2025

Looking towards the end of 2025 and beyond, the global urea market is projected to grow from $98.9 billion (2024) to $154.1 billion by 2033, marking a compound annual growth rate (CAGR) of 5.7%. (Source) This anticipated rise is underpinned by:

- Consistent agricultural demand growth in densely populated regions, especially within Asia-Pacific.

- Ongoing technological advancements (precision farming, AI, blockchain) bolstering fertilizer use efficiency.

- The growing influence of sustainability policies, carbon tracking, and environmental compliance.

- Increased investment in green ammonia and EEFs, ensuring more sustainable urea production systems.

- Heightened volatility risks due to geopolitical tensions, natural disasters, and sudden regulatory changes.

For industry stakeholders, the ability to rapidly adapt to changing pricing, regulations, and technologies will be critical for success in this evolving landscape.

FAQ: Urea Market 2025

- What are the main factors influencing urea prices in 2025?

- Prices are mainly driven by natural gas costs, regional demand fluctuations, trade policies (tariffs), geopolitical tensions, and environmental regulations.

- Is the demand for urea expected to increase worldwide?

- Yes. Global urea demand is projected to rise by approximately 3% in 2025 due to population growth, expanding agricultural areas, and intensive cultivation practices.

- How do environmental regulations impact the urea market?

- Stricter environmental policies encourage sustainable urea production and the adoption of enhanced-efficiency fertilizers (like SCU), increasing costs for non-compliant traditional urea.

- What technological advancements are reshaping urea application?

- Key advancements include precision agriculture tools (satellite monitoring, AI advice), green ammonia production, EEFs, blockchain-based traceability, and carbon footprint tracking.

- How can Farmonaut help optimize urea application and compliance?

- Farmonaut provides affordable, satellite-derived crop intelligence, AI-driven farm advisory, blockchain traceability, and resource management to improve fertilizer use efficiency, yield, and sustainability.

- Where can I access Farmonaut’s solutions?

- Download the Farmonaut app for web, Android, and iOS, or integrate Farmonaut API (learn more) into your own digital platforms.

Conclusion

The urea market in 2025 stands at a critical intersection of rising demand, heightened pricing volatility, rapid technological innovation, and intensifying environmental focus. As we experience these fast-moving shifts, success depends on adaptability, transparency, and a willingness to embrace digital and sustainable solutions such as those offered by Farmonaut.

Whether you’re a farmer, trader, policymaker, or agribusiness, staying informed and agile is key to thriving as the future of urea in global agriculture continues to evolve.