Unveiled: Russia’s Game-Changing Wheat Export Pricing Strategy Shakes Global Markets

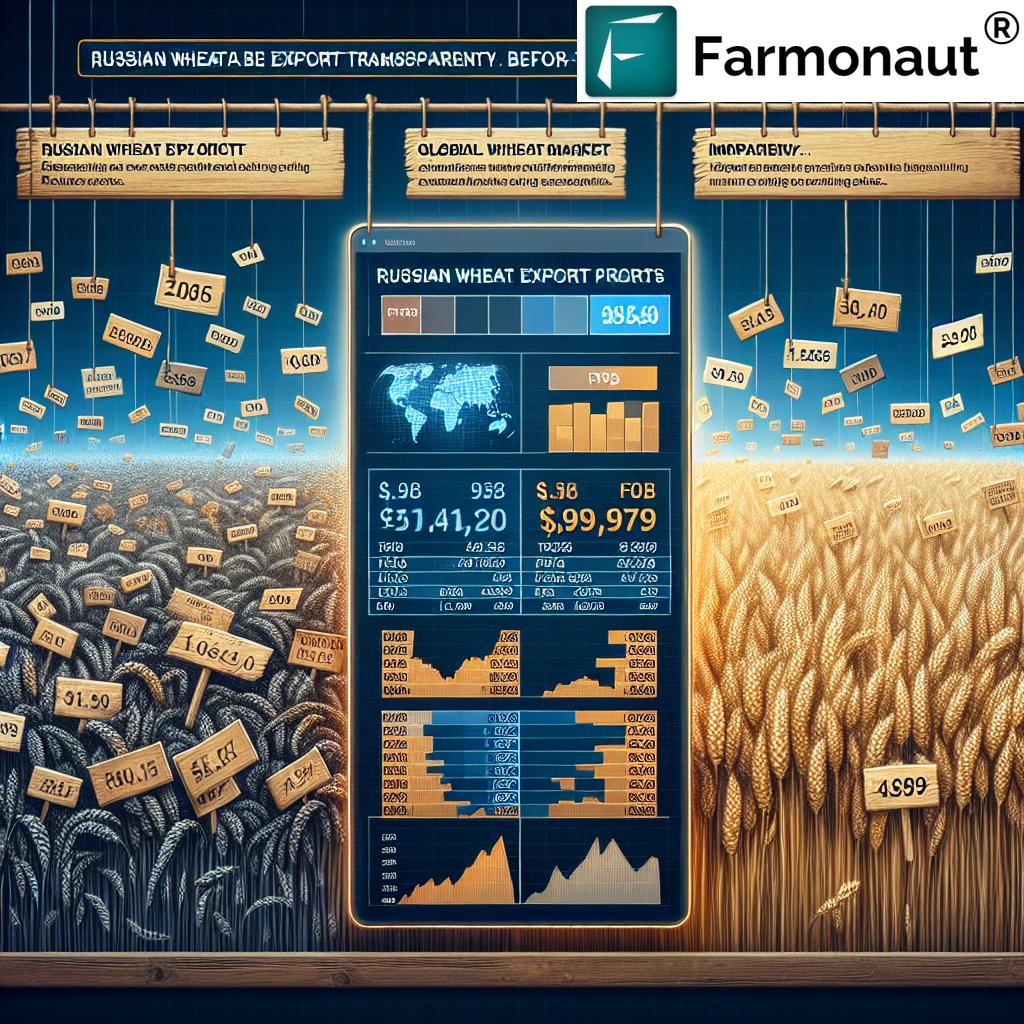

In a groundbreaking move that’s sending ripples through the global wheat market, Russia, the world’s largest wheat exporter, has unveiled a new wheat export pricing strategy that promises to reshape the landscape of international grain trade. The Russian Grain Exporters Union, representing a staggering 80% of the country’s grain exports, has taken the unprecedented step of publishing indicative wheat prices for exports, a decision that’s set to have far-reaching implications for wheat producers and consumers worldwide.

The Game-Changing Move: Transparency in Russian Wheat Export Pricing

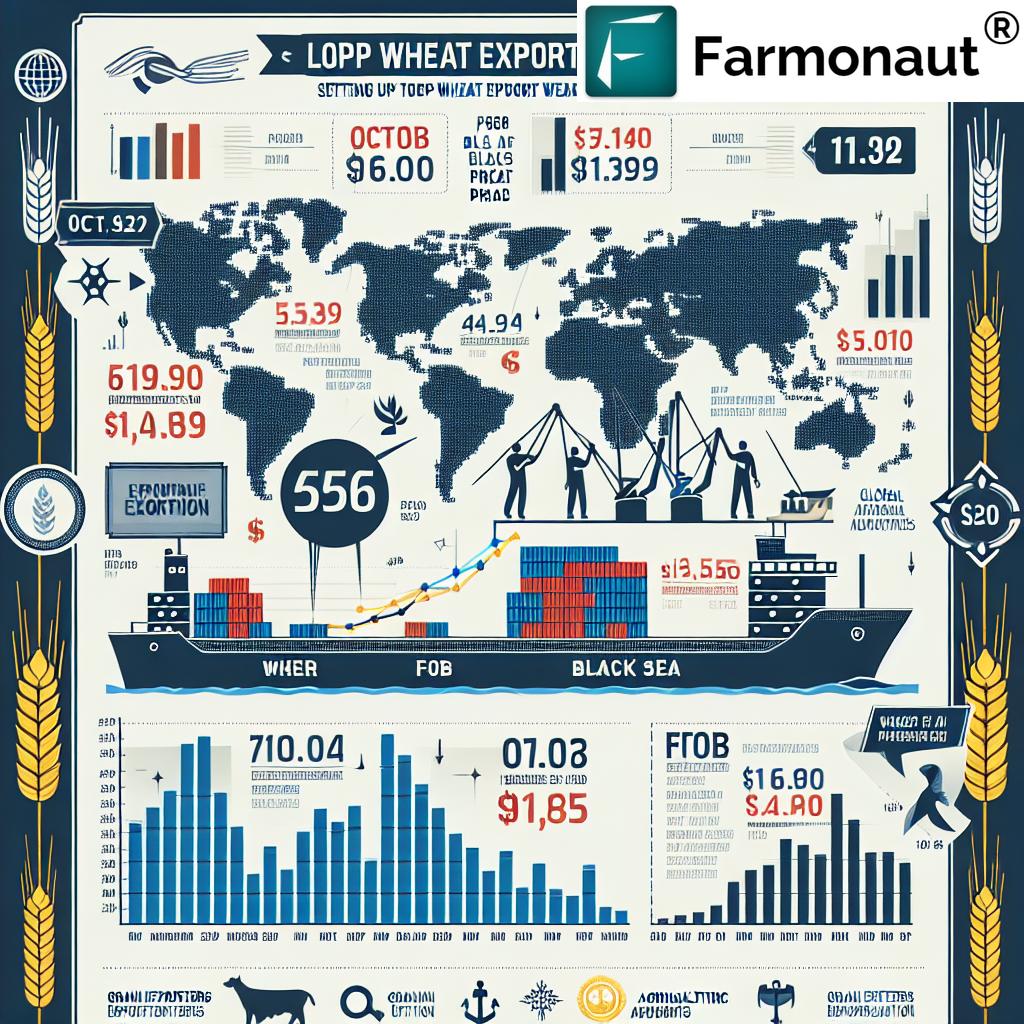

At the heart of this seismic shift is the drive for greater transparency in Russian grain export pricing. By making public the indicative prices for wheat exports, Russia is not only addressing concerns about low selling prices but also establishing a clear benchmark for the global wheat trade. This move comes after extensive discussions with the Russian agriculture ministry, highlighting the coordinated effort to stabilize and strengthen Russia’s position in the international wheat market.

The newly published prices focus on FOB Black Sea wheat, providing crucial information for October, November, and December exports. This level of detail offers unprecedented insight into Russia’s wheat export strategies, allowing market participants to make more informed decisions and potentially leveling the playing field in global grain trade.

Understanding the Impact on Global Wheat Markets

The global wheat market impact of Russia’s new pricing strategy cannot be overstated. As the world’s leading wheat exporter, Russia’s decisions have the power to influence wheat prices and trade patterns across the globe. By providing clear wheat export quotations, Russia is potentially setting a new standard for transparency in international grain markets.

- Enhanced market predictability

- Potential stabilization of global wheat prices

- Improved planning capabilities for importers and exporters

For farmers and agricultural businesses looking to stay ahead of these market shifts, leveraging advanced agricultural technologies can be crucial. Farmonaut’s satellite-based crop monitoring app offers invaluable insights for optimizing crop production and market timing.

The Role of the Grain Exporters Union in Shaping Policy

The Grain Exporters Union has emerged as a pivotal player in formulating and implementing this new pricing strategy. By working closely with the Russian agriculture ministry, the union has ensured that the indicative prices reflect both market realities and national economic interests. This collaboration underscores the importance of public-private partnerships in shaping effective agricultural policies.

The union’s initiative in publishing FOB Black Sea wheat prices is particularly significant. These prices serve as a crucial reference point for international buyers, offering clarity on what to expect when engaging in wheat trade with Russia. For those interested in accessing real-time agricultural data, Farmonaut’s Satellite Weather API provides valuable insights into market-influencing weather patterns.

Breaking Down the New Pricing Guidelines

The Russian wheat export pricing strategy is built on a foundation of flexibility and market responsiveness. While the Grain Exporters Union has provided indicative prices, it’s important to note that these serve as guidelines rather than strict mandates. This approach allows individual exporters to adapt to specific market conditions and buyer requirements, ensuring that Russian wheat remains competitive in the global marketplace.

- Indicative prices for different export periods

- Consideration of production costs and market dynamics

- Flexibility for exporters to negotiate within the given framework

For a deeper understanding of how these pricing strategies might affect local agricultural markets, farmers can utilize Farmonaut’s Android app or iOS app for real-time crop monitoring and market analysis.

The Rationale Behind Russia’s New Approach

Several factors have contributed to Russia’s decision to implement this new pricing strategy:

- Addressing concerns over low selling prices in the international market

- Mitigating the impact of rising production costs on Russian wheat farmers

- Tackling issues related to payment delays in wheat exports

- Enhancing Russia’s competitive position as the world’s largest wheat exporter

By establishing clear guidelines for the world’s largest wheat exporter, Russia aims to create a more stable and predictable environment for both domestic producers and international buyers. This move is expected to reinforce Russia’s dominance in the global wheat trade while potentially influencing pricing strategies of other major wheat-exporting nations.

Implications for Novorossiysk Wheat Exports

The port of Novorossiysk, a key hub for Russian wheat exports, is set to play a crucial role in implementing this new pricing strategy. As one of the primary gateways for FOB Black Sea wheat shipments, Novorossiysk’s export volumes and pricing will be closely watched by global market participants.

The new indicative prices are likely to influence:

- Export volumes through Novorossiysk

- Pricing negotiations for wheat shipments

- Logistics and supply chain management for exporters

For businesses involved in grain logistics and export operations, staying informed about these developments is crucial. Farmonaut’s API developer docs offer valuable resources for integrating real-time agricultural data into business operations.

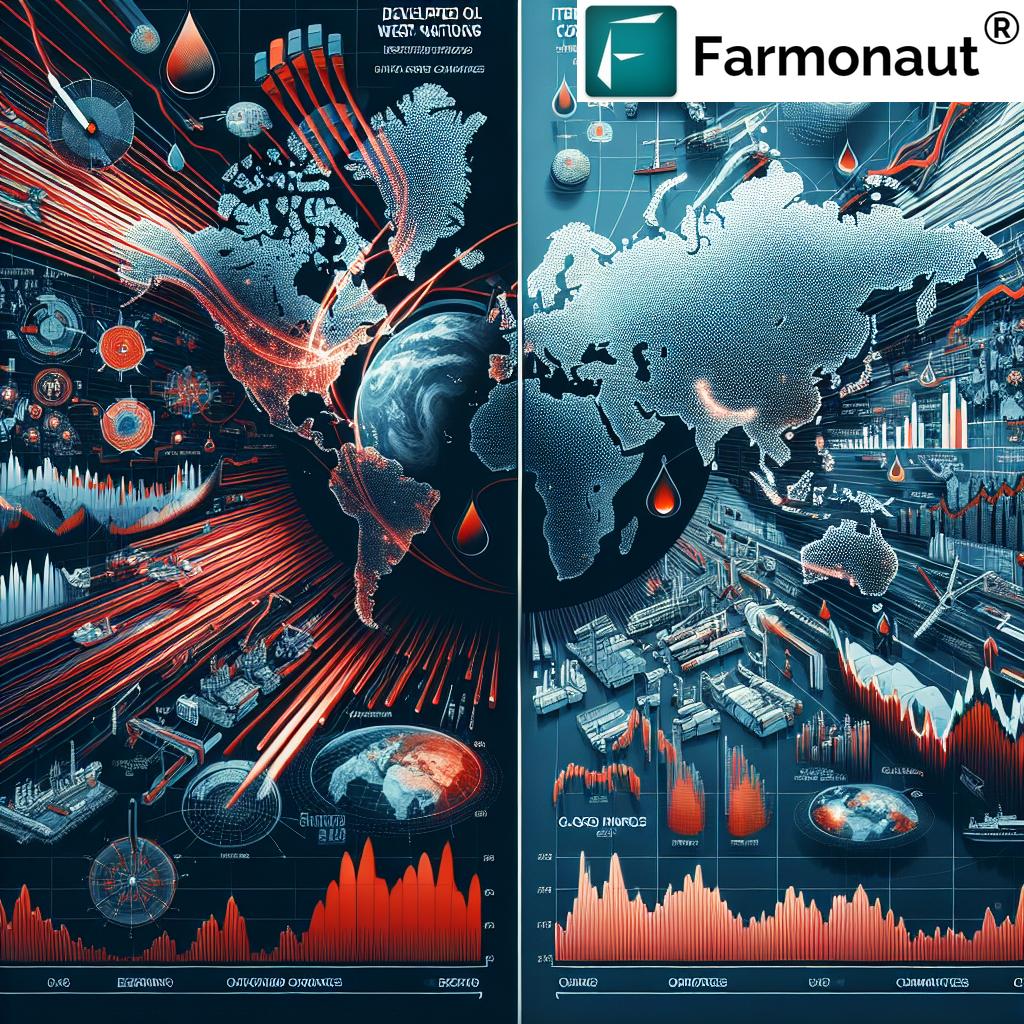

Global Market Reactions and Future Outlook

The international response to Russia’s new wheat export pricing strategy has been mixed, with some market analysts praising the move towards greater transparency, while others express concerns about potential market distortions. Key observations include:

- Increased interest from traditional wheat importers in Russian grain

- Potential shifts in global wheat trade patterns

- Speculation about responses from other major wheat-exporting countries

As the situation evolves, it will be crucial for stakeholders in the global wheat market to closely monitor developments and adjust their strategies accordingly. The coming months will likely reveal the full impact of Russia’s pricing initiative on international wheat trade dynamics.

Conclusion: A New Era in Global Wheat Trade

Russia’s bold move to publish indicative wheat export prices marks a significant milestone in the evolution of global grain markets. By enhancing Russian wheat export transparency, this strategy has the potential to reshape international wheat trade, influencing everything from pricing mechanisms to trade relationships.

As the world’s agricultural markets continue to adapt to this new reality, staying informed and leveraging cutting-edge technologies will be key to success. Whether you’re a farmer, trader, or policy maker, understanding these market shifts is crucial. Tools like Farmonaut’s satellite-based crop monitoring and weather APIs can provide valuable insights to navigate these changing times.

The global wheat market is entering a new era of transparency and strategic pricing. As Russia sets the pace, the world watches and adapts, ushering in a potentially more stable and predictable future for international wheat trade.