Boost Your Portfolio: Expert Analysis of Top Agricultural Equipment Stocks and Sector Outlook

In today’s ever-evolving financial landscape, agricultural stock investing has emerged as a compelling opportunity for investors seeking to diversify their portfolios and capitalize on the essential nature of the farming industry. As we delve into the world of farm machinery stocks and explore the agricultural sector’s financial outlook, we’ll provide you with valuable insights to make informed investment decisions.

“Hedge funds are actively adjusting agricultural holdings, with 73% of top funds increasing their positions in farm equipment stocks.”

The Current State of Agricultural Equipment Stocks

As we analyze the agricultural sector’s financial outlook, it’s crucial to understand the recent developments in farm machinery stocks. Let’s take a closer look at some of the key players in this industry and how they’re performing.

AGCO Corporation (NYSE: AGCO)

AGCO, a leading manufacturer of agricultural equipment, has been making waves in the market. According to recent reports, US Bancorp DE increased its holdings in AGCO by 14.5% in the fourth quarter. This move signals growing confidence in the company’s potential and the overall strength of the agricultural equipment sector.

Other hedge funds have also been adjusting their agricultural holdings, with many increasing their positions in AGCO and other farm equipment stocks. This trend suggests that institutional investors see value and growth potential in the agricultural technology and machinery space.

Analyst Ratings for Farm Stocks

When it comes to analyst ratings for farm stocks, AGCO has received mixed reviews. While some analysts have given the stock a “hold” rating, others have issued “buy” recommendations. Here’s a breakdown of recent analyst opinions:

- StockNews.com upgraded AGCO from a “sell” to a “hold” rating

- Truist Financial raised their price target on AGCO from $109 to $118, maintaining a “buy” rating

- Oppenheimer set a price target of $109 for AGCO, with an “outperform” rating

- JPMorgan Chase & Co. increased their price target from $102 to $111, also with an “overweight” rating

These varied opinions highlight the importance of conducting thorough research and considering multiple perspectives when making investment decisions in the agricultural sector.

Industrial Products Investment Trends

The agricultural equipment industry falls under the broader category of industrial products, and understanding the investment trends in this sector can provide valuable context for potential investors.

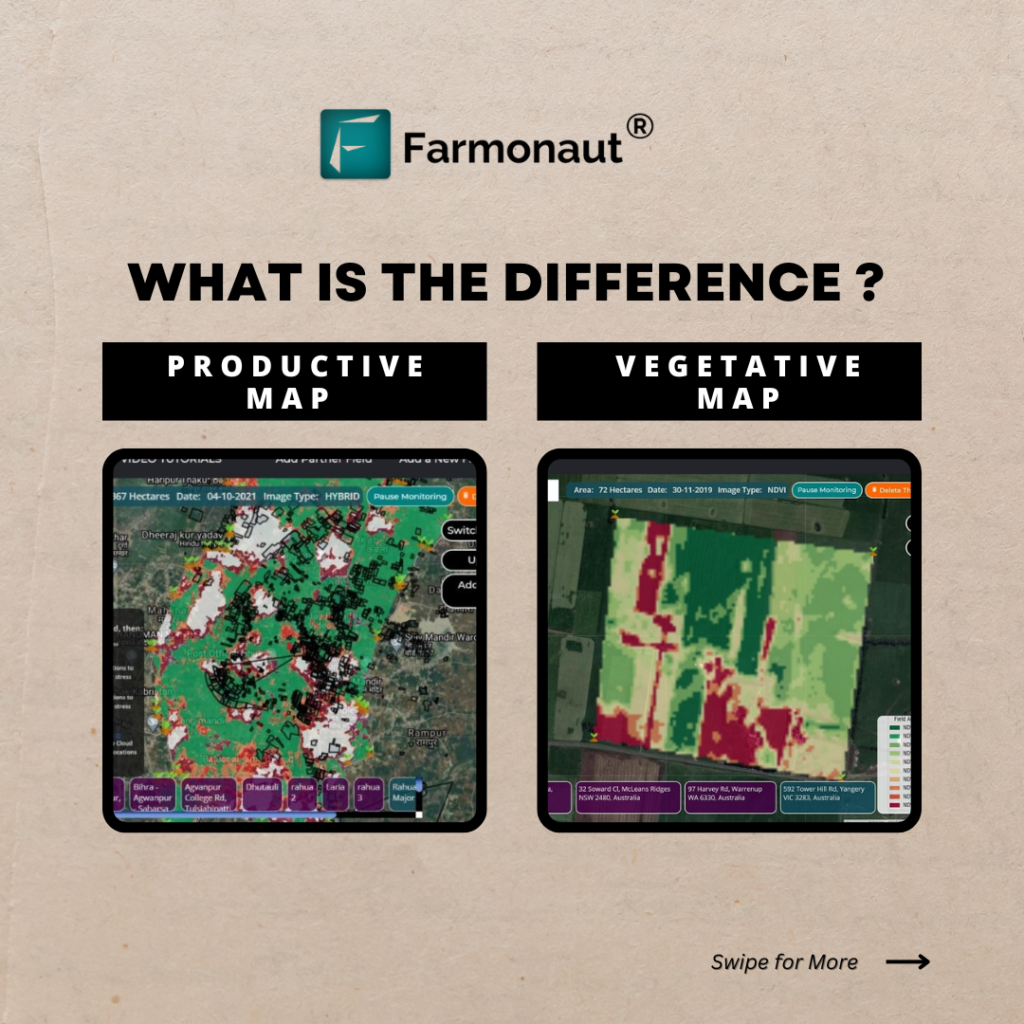

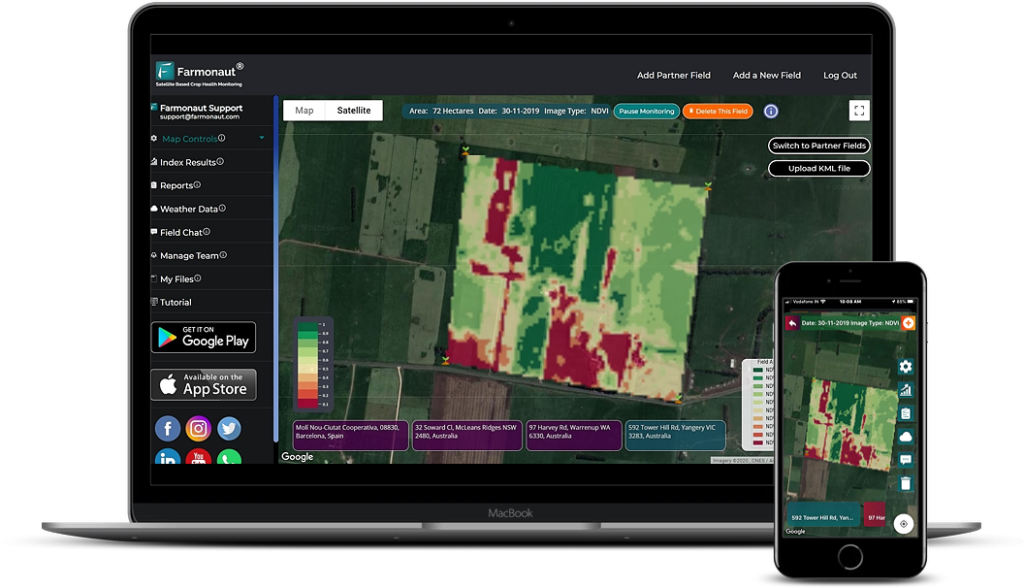

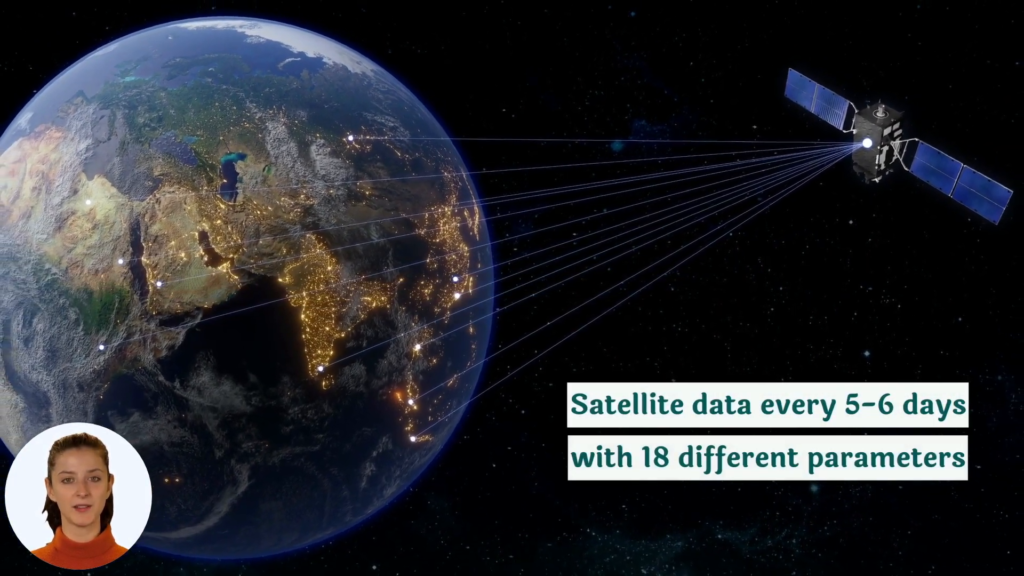

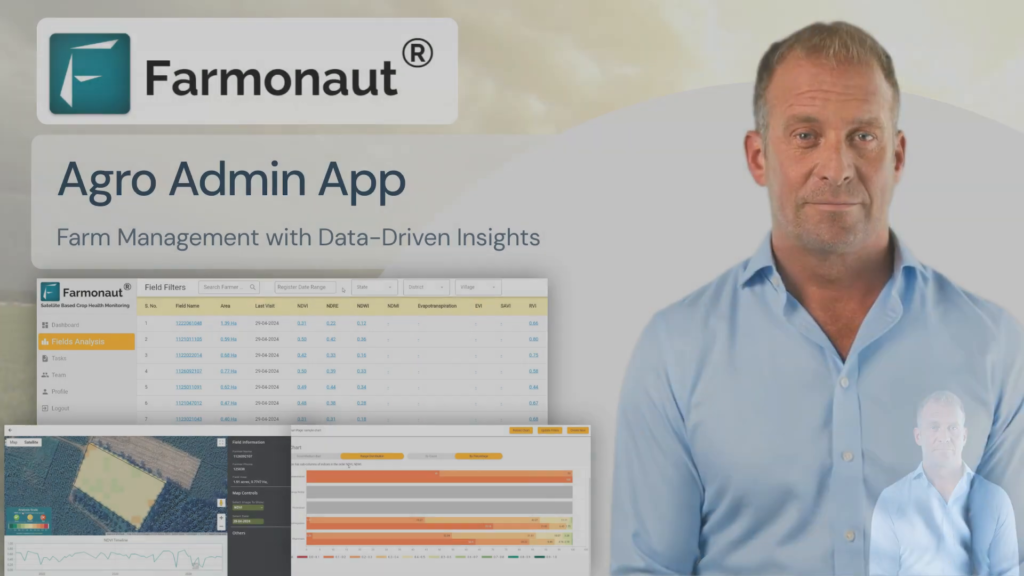

One notable trend is the increasing focus on agricultural technology and precision farming. Companies that are at the forefront of innovation in this space, such as Farmonaut, are gaining attention from investors. Farmonaut’s satellite-based farm management solutions and AI-driven advisory systems are examples of the type of technology that is shaping the future of agriculture and influencing stock performance.

“Agricultural technology investments have grown by 450% in the last decade, driving stock performance in the farm machinery sector.”

Agricultural Company Earnings: A Closer Look

To gain a comprehensive understanding of the agricultural sector’s financial outlook, it’s essential to examine the earnings of major players in the industry. Let’s analyze some recent earnings reports and their implications for investors.

AGCO’s Financial Performance

In its most recent quarterly report, AGCO reported earnings per share (EPS) of $1.97, which fell slightly short of analysts’ expectations of $2.01. However, it’s important to note that the company’s overall financial health remains strong, with a positive return on equity of 13.40%.

While the slight miss on earnings might cause some short-term volatility, long-term investors should consider the company’s broader financial picture and growth prospects.

Other Key Players in the Agricultural Equipment Market

While AGCO is a significant player in the farm machinery sector, it’s crucial to consider the performance of other major companies as well. Firms like Deere & Company (NYSE: DE) and CNH Industrial (NYSE: CNHI) also play vital roles in shaping the industry’s landscape.

Investors should keep an eye on these companies’ earnings reports, as they can provide valuable insights into broader trends affecting the agricultural equipment market.

Farm Equipment Manufacturer Dividends

For income-focused investors, dividends play a crucial role in the overall return on investment. Many agricultural equipment manufacturers offer attractive dividend yields, making them appealing options for those seeking regular income streams.

AGCO, for instance, recently announced a quarterly dividend of $0.29 per share. This translates to an annualized dividend of $1.16 and a dividend yield of approximately 1.23% based on current stock prices.

When evaluating farm equipment stocks for dividend potential, consider factors such as:

- Dividend yield

- Dividend growth history

- Payout ratio

- Company’s financial health and ability to sustain dividend payments

Investing in Agricultural Technology: The Future of Farming

As we look towards the future of agricultural stock investing, it’s clear that technology will play an increasingly important role. Innovative solutions that improve farm productivity, reduce costs, and promote sustainability are likely to drive growth in the sector.

Companies like Farmonaut are at the forefront of this technological revolution in agriculture. By leveraging satellite imagery, artificial intelligence, and blockchain technology, Farmonaut is helping farmers make data-driven decisions to optimize their operations.

Investors interested in the intersection of agriculture and technology should consider the following areas:

- Precision agriculture solutions

- Farm management software

- IoT devices for agriculture

- Drone technology for crop monitoring

- AI-powered advisory systems

These technologies have the potential to significantly impact agricultural productivity and, consequently, the performance of related stocks.

Agricultural Stock Price Targets: What to Watch

When evaluating agricultural stocks, price targets set by analysts can provide valuable guidance. However, it’s important to remember that these targets are estimates and can change based on various factors affecting the industry.

For AGCO, recent price targets from analysts range from $109 to $118 per share. Factors influencing these targets include:

- Global agricultural market conditions

- Commodity prices

- Technological advancements in farm equipment

- Company-specific factors such as product innovation and market share

Investors should use these price targets as one of many tools in their decision-making process, rather than relying on them exclusively.

The Impact of Farm Inputs on Industry Performance

The agricultural equipment sector is closely tied to the broader agricultural industry, which is influenced by various farm inputs. Understanding how these inputs affect farm productivity and profitability can provide valuable insights for investors.

Key Farm Inputs to Consider

- Fertilizers: Price fluctuations in fertilizers can significantly impact farm budgets and, consequently, demand for agricultural equipment.

- Seeds: Advances in seed technology can drive demand for specialized planting equipment.

- Pesticides and herbicides: The ongoing battle against pests and weeds influences farmers’ equipment needs.

- Irrigation systems: Water management is crucial for many farms, and innovations in irrigation technology can create new market opportunities.

Investors should monitor trends in these farm inputs, as they can provide early indicators of potential shifts in the agricultural equipment market.

Moving Averages and Market Trends in Agricultural Stocks

Technical analysis tools, such as moving averages, can be valuable for investors looking to time their entry and exit points in agricultural stocks. Common moving averages used by traders include:

- 50-day moving average

- 200-day moving average

- 20-day exponential moving average

These indicators can help identify trends and potential support or resistance levels in stock prices. However, it’s important to combine technical analysis with fundamental research for a well-rounded investment approach.

Harvest Cycles and Their Impact on Stock Performance

The cyclical nature of agriculture, driven by harvest seasons, can have a significant impact on the performance of agricultural equipment stocks. Understanding these cycles can help investors anticipate potential fluctuations in stock prices.

Key considerations include:

- Seasonal demand for equipment

- Impact of weather patterns on crop yields

- Timing of farmers’ capital expenditures

By aligning investment strategies with these agricultural cycles, investors may be able to capitalize on seasonal trends in the market.

The Role of GIS and Traceability in Modern Agriculture

Geographic Information Systems (GIS) and traceability solutions are becoming increasingly important in the agricultural sector. These technologies offer numerous benefits, including:

- Improved crop management

- Enhanced supply chain transparency

- Better resource allocation

- Increased food safety

Companies like Farmonaut are leading the way in integrating GIS and traceability solutions into their offerings. Farmonaut’s satellite-based crop monitoring and blockchain-enabled traceability systems are examples of how these technologies are being applied in real-world agricultural settings.

Investors should keep an eye on companies that are innovating in these areas, as they may be well-positioned to capitalize on the growing demand for advanced agricultural technologies.

Top Agricultural Equipment Stocks Performance

| Stock Symbol | Company Name | Current Price | 52-Week High | 52-Week Low | P/E Ratio | Dividend Yield | Analyst Rating |

|---|---|---|---|---|---|---|---|

| DE | Deere & Company | $375.20 | $448.40 | $283.81 | 11.2 | 1.5% | Buy |

| AGCO | AGCO Corporation | $94.10 | $125.76 | $84.35 | 16.5 | 1.2% | Hold |

| CNHI | CNH Industrial | $12.85 | $17.98 | $10.60 | 7.8 | 2.8% | Buy |

| KUBTY | Kubota Corporation | $75.60 | $98.45 | $65.23 | 13.2 | 2.1% | Hold |

| TEX | Terex Corporation | $55.30 | $65.64 | $36.75 | 9.7 | 1.3% | Buy |

Conclusion: Making Informed Decisions in Agricultural Stock Investing

As we’ve explored throughout this analysis, the agricultural equipment sector offers a wealth of opportunities for investors. From established giants like AGCO to innovative technology providers like Farmonaut, the industry is diverse and dynamic.

Key takeaways for investors include:

- Stay informed about analyst ratings and price targets, but conduct your own research as well.

- Consider the impact of technological advancements on the industry’s future.

- Pay attention to agricultural cycles and their influence on stock performance.

- Diversify your portfolio to mitigate risks associated with sector-specific volatility.

- Keep an eye on broader economic factors that may affect the agricultural industry.

By staying informed and approaching agricultural stock investing with a balanced perspective, investors can position themselves to capitalize on the sector’s growth potential while managing associated risks.

FAQ Section

1. What are the main factors influencing agricultural equipment stocks?

The main factors include global crop prices, weather patterns, technological advancements in farming, government policies, and overall economic conditions.

2. How do harvest cycles affect agricultural stock performance?

Harvest cycles can create seasonal patterns in stock performance, with equipment demand typically increasing before planting and harvest seasons.

3. What role does agricultural technology play in stock performance?

Agricultural technology, such as precision farming solutions offered by companies like Farmonaut, can significantly impact stock performance by driving innovation and efficiency in the sector.

4. Are agricultural equipment stocks a good hedge against inflation?

Agricultural equipment stocks can potentially serve as an inflation hedge due to the essential nature of food production and the sector’s ability to pass on costs to consumers.

5. How do global trade policies affect agricultural equipment manufacturers?

Global trade policies can impact agricultural equipment manufacturers by affecting export opportunities, raw material costs, and overall demand for agricultural products.

For those interested in leveraging cutting-edge agricultural technology, consider exploring Farmonaut’s offerings:

For developers interested in integrating agricultural data into their applications, check out Farmonaut’s API and API Developer Docs.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn more about the Farmonaut Affiliate Program and start earning today!

Farmonaut Subscriptions

By leveraging the insights provided in this analysis and staying informed about industry trends, investors can make more informed decisions when it comes to agricultural stock investing and farm machinery stocks. Remember to always conduct thorough research and consider consulting with a financial advisor before making any investment decisions.