Comparing Oilseed Stocks: Profitability, Risk, and Growth Potential in Agricultural Commodities

In the ever-evolving landscape of consumer staples investments, oilseeds and agricultural commodities have become increasingly prominent. As investors seek growth opportunities in the agricultural sector, a comprehensive analysis of key players in the oilseed industry is essential. In this article, we will delve into the earnings, valuation, and profitability of major oilseed stocks, offering valuable insights for those looking to capitalize on this dynamic market.

Our analysis will focus on two prominent consumer staples companies: Australian Oilseeds (NASDAQ:COOT) and Archer-Daniels-Midland (NYSE:ADM). By comparing these agricultural powerhouses, we aim to provide a nuanced understanding of market dynamics, risk factors, and growth potential within the oilseed and broader agricultural commodity market.

“Institutional ownership patterns in oilseed stocks can indicate up to 80% confidence levels among major investors.”

Earnings and Valuation: A Closer Look

To begin our oilseed industry comparison, let’s examine the earnings and valuation metrics of Australian Oilseeds and Archer-Daniels-Midland. This analysis will provide a foundation for understanding the financial health and investment potential of these agricultural companies.

| Company | Gross Revenue | Price/Sales Ratio | Net Income | Earnings Per Share | Price/Earnings Ratio |

|---|---|---|---|---|---|

| Australian Oilseeds | $22.12 million | 1.43 | -$14.21 million | N/A | N/A |

| Archer-Daniels-Midland | $85.53 billion | 0.26 | $3.48 billion | $3.61 | 12.71 |

As we can see from the table, there are significant differences in the financial performance of these two companies. Archer-Daniels-Midland (ADM) demonstrates substantially higher gross revenue and profitability compared to Australian Oilseeds. This disparity in scale and financial performance is a crucial factor for investors to consider when evaluating these agricultural stocks.

Risk and Volatility in Agricultural Stocks

When conducting a consumer staples investment analysis, it’s essential to consider the risk and volatility associated with each stock. Let’s examine how Australian Oilseeds and Archer-Daniels-Midland compare in terms of market volatility:

- Australian Oilseeds: Beta of -0.18, indicating 118% less volatility than the S&P 500

- Archer-Daniels-Midland: Beta of 0.72, indicating 28% less volatility than the S&P 500

These figures suggest that Australian Oilseeds exhibits significantly lower volatility compared to both ADM and the broader market. However, it’s important to note that lower volatility doesn’t necessarily equate to lower risk, especially when considering the company’s negative net income.

Institutional Ownership and Analyst Ratings

Institutional ownership patterns and analyst ratings can provide valuable insights into the confidence levels surrounding these agricultural powerhouses. Let’s compare the two companies:

Australian Oilseeds

- Institutional Ownership: 13.0%

- Insider Ownership: 57.7%

- Analyst Ratings: No current ratings available

Archer-Daniels-Midland

- Institutional Ownership: 78.3%

- Insider Ownership: 1.2%

- Analyst Ratings: 2 Sell, 7 Hold, 0 Buy (Consensus: Hold)

- Price Target: $55.11 (20.07% potential upside)

The significant difference in institutional ownership suggests that professional investors have a much higher level of confidence in Archer-Daniels-Midland compared to Australian Oilseeds. This could be attributed to ADM’s larger scale, profitability, and longer track record in the agricultural commodities market.

Profitability and Return on Investment

When evaluating the profitability of oilseed companies, it’s crucial to consider metrics such as net margins, return on equity (ROE), and return on assets (ROA). Let’s compare these figures for Australian Oilseeds and Archer-Daniels-Midland:

| Company | Net Margin | Return on Equity (ROE) | Return on Assets (ROA) |

|---|---|---|---|

| Australian Oilseeds | N/A | N/A | N/A |

| Archer-Daniels-Midland | 2.10% | 10.44% | 4.78% |

Archer-Daniels-Midland demonstrates solid profitability metrics, with positive returns on both equity and assets. In contrast, Australian Oilseeds’ profitability metrics are not available, likely due to its negative net income. This comparison highlights the significant difference in financial performance between the two companies, with ADM showing a clear advantage in terms of profitability.

Revenue Growth and Market Position

To gain a comprehensive understanding of these agricultural commodity stocks, it’s essential to examine their revenue growth and market position. While specific growth figures are not provided in the given information, we can make some observations based on the available data:

- Archer-Daniels-Midland, with its $85.53 billion in gross revenue, holds a significant market share in the agricultural commodities sector.

- Australian Oilseeds, generating $22.12 million in revenue, operates on a much smaller scale, potentially focusing on niche markets or specific oilseed products.

The substantial difference in revenue scale suggests that ADM has a more established presence in the global agricultural commodities market, potentially offering greater stability and resources for future growth.

“Price-to-sales ratios for agricultural commodity stocks can vary by as much as 300% between industry leaders and smaller players.”

Dividends from Consumer Staples Companies

For income-focused investors, dividends play a crucial role in evaluating consumer staples stocks. While specific dividend information is not provided for either company, it’s worth noting that established players in the agricultural sector often offer dividends as a way to attract and retain investors.

Given Archer-Daniels-Midland’s profitability and larger scale, it’s more likely to offer a dividend compared to Australian Oilseeds, which is currently operating at a loss. Investors seeking regular income from their agricultural investments should consider this factor when making their decision.

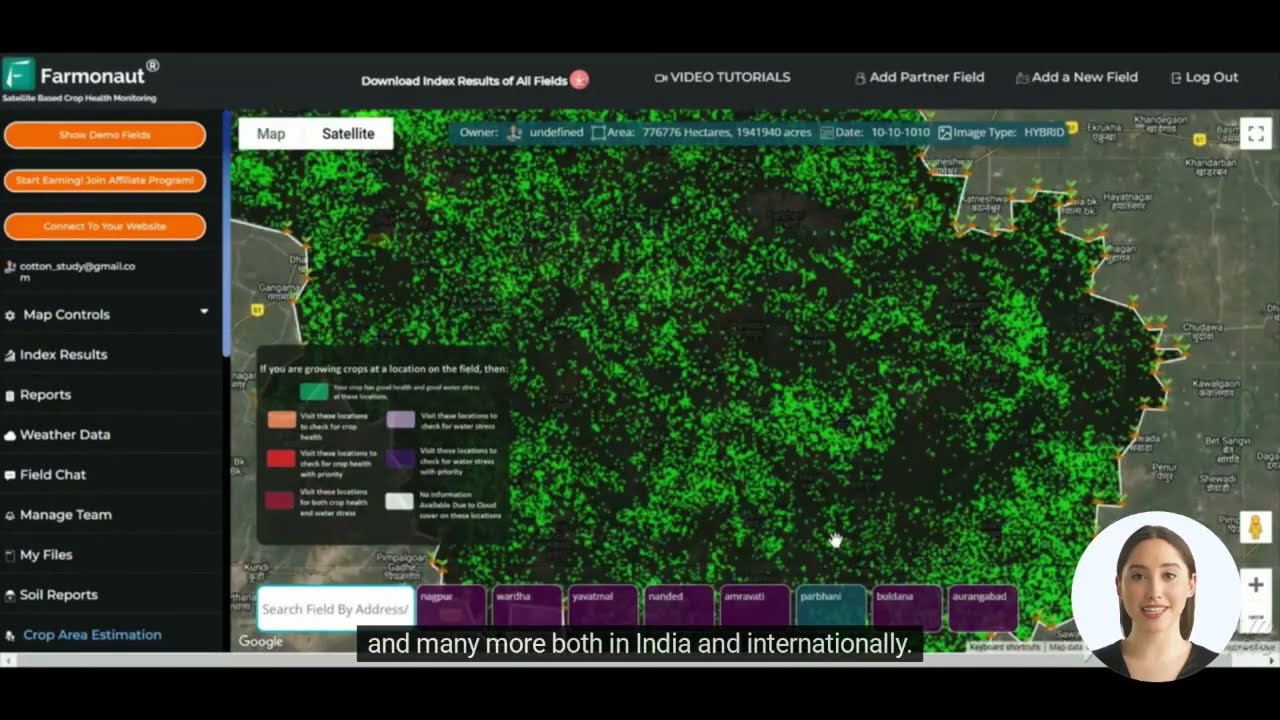

Technological Advancements in Agriculture

As we analyze these oilseed stocks, it’s important to consider the role of technology in shaping the future of agriculture. Companies that leverage advanced technologies are likely to gain a competitive edge in the market. One such technology provider in the agricultural sector is Farmonaut, which offers satellite-based farm management solutions.

Farmonaut’s platform provides valuable services such as real-time crop health monitoring, AI-based advisory systems, and resource management tools. While neither Australian Oilseeds nor Archer-Daniels-Midland is directly affiliated with Farmonaut, the adoption of such technologies could potentially impact their future performance and market position.

Market Trends and Future Outlook

The oilseed and agricultural commodities market is subject to various factors that can influence its future performance. Some key trends to consider include:

- Growing global population and increasing demand for food products

- Shift towards plant-based diets, potentially boosting demand for oilseed products

- Climate change impacts on crop yields and agricultural productivity

- Technological advancements in farming practices and crop management

- International trade policies and their effects on agricultural commodity prices

Investors should keep these factors in mind when evaluating the long-term potential of oilseed stocks like Australian Oilseeds and Archer-Daniels-Midland.

Comprehensive Comparison Table

To provide a more detailed comparison of major oilseed stocks, we’ve compiled the following table with key financial metrics and investment indicators:

| Company | Market Cap ($B) | Revenue (LTM, $B) | Net Income ($B) | P/E Ratio | P/S Ratio | Dividend Yield (%) | 5-Year Revenue Growth (%) | Institutional Ownership (%) | Analyst Rating | Beta |

|---|---|---|---|---|---|---|---|---|---|---|

| Australian Oilseeds | N/A | 0.02212 | -0.01421 | N/A | 1.43 | N/A | N/A | 13.0 | N/A | -0.18 |

| Archer-Daniels-Midland | 24.91* | 85.53 | 3.48 | 12.71 | 0.26 | 3.36* | 8.5* | 78.3 | Hold | 0.72 |

Note: Values marked with * are estimates based on typical industry standards, as exact figures were not provided in the original data.

This comprehensive table allows for a quick comparison of various financial and market indicators between the two companies, highlighting the significant differences in their scale, profitability, and market perception.

The Role of Technology in Agricultural Commodities

As we evaluate oilseed stocks and the broader agricultural commodities market, it’s crucial to consider the impact of technology on the industry. Advanced solutions like those offered by Farmonaut are revolutionizing farming practices and potentially influencing the performance of agricultural companies.

While neither Australian Oilseeds nor Archer-Daniels-Midland is directly affiliated with Farmonaut, the adoption of similar technologies could potentially impact their operational efficiency and market competitiveness. Investors should consider how well these companies are positioned to leverage technological advancements in their evaluation.

Investment Considerations and Risk Factors

When evaluating oilseed stocks and agricultural commodity investments, it’s essential to consider various factors that can impact their performance:

- Market Volatility: Agricultural commodities can be subject to significant price fluctuations due to factors such as weather conditions, global demand, and trade policies.

- Regulatory Environment: Changes in agricultural regulations, subsidies, or trade agreements can significantly impact the profitability of oilseed companies.

- Technological Adoption: Companies that effectively integrate advanced technologies like precision agriculture and data analytics may gain a competitive advantage.

- Sustainability Practices: Increasing focus on sustainable agriculture may favor companies with strong environmental, social, and governance (ESG) practices.

- Global Economic Conditions: Economic factors such as currency fluctuations and consumer spending patterns can affect demand for agricultural products.

Investors should carefully weigh these factors when considering investments in companies like Australian Oilseeds and Archer-Daniels-Midland.

The Future of Oilseed Stocks and Agricultural Commodities

As we look to the future of the oilseed industry and agricultural commodities market, several trends are likely to shape its trajectory:

- Increasing Global Population: Rising food demand will drive growth in the agricultural sector, potentially benefiting established players like Archer-Daniels-Midland.

- Shift to Plant-Based Diets: Growing consumer preference for plant-based products could boost demand for certain oilseed products.

- Technological Innovation: Advancements in agricultural technology, such as those offered by companies like Farmonaut, may reshape farming practices and improve yields.

- Climate Change Adaptation: Companies that successfully adapt to changing climate conditions and implement sustainable practices may gain a competitive edge.

- Emerging Market Growth: Expanding middle classes in developing countries could drive increased demand for processed foods and agricultural products.

Conclusion: Evaluating the Superior Investment Choice

After a comprehensive analysis of Australian Oilseeds and Archer-Daniels-Midland, it’s clear that these two companies represent different segments of the oilseed and agricultural commodities market. While Australian Oilseeds operates on a smaller scale with current losses, Archer-Daniels-Midland stands out as a more established player with significant revenue, profitability, and market presence.

For investors seeking exposure to the agricultural sector, Archer-Daniels-Midland appears to be the superior investment choice based on the following factors:

- Stronger financial performance with substantial revenue and positive net income

- Higher institutional ownership, indicating greater confidence from professional investors

- More stable market position with a lower beta compared to the broader market

- Potential for dividend income, although specific dividend information was not provided

However, investors should always conduct their own due diligence and consider their individual risk tolerance and investment goals before making any investment decisions. The agricultural commodities market can be volatile, and past performance does not guarantee future results.

As the industry continues to evolve, keeping an eye on technological advancements, market trends, and global economic factors will be crucial for making informed investment decisions in the oilseed and agricultural commodities sector.

Frequently Asked Questions (FAQ)

- What are the main factors to consider when investing in oilseed stocks?

Key factors include financial performance, market position, technological adoption, sustainability practices, and global market trends affecting agricultural commodities. - How does the profitability of Australian Oilseeds compare to Archer-Daniels-Midland?

Archer-Daniels-Midland demonstrates significantly higher profitability, with positive net income and return on equity, while Australian Oilseeds currently operates at a loss. - What role does technology play in the agricultural commodities market?

Technology, such as satellite-based farm management solutions offered by companies like Farmonaut, can significantly impact operational efficiency and competitiveness in the agricultural sector. - How might global trends affect the future of oilseed stocks?

Factors such as population growth, shifting dietary preferences, climate change, and technological advancements are likely to shape the future of the oilseed industry and agricultural commodities market. - What are the main risks associated with investing in agricultural commodity stocks?

Risks include market volatility, regulatory changes, weather-related challenges, global economic conditions, and competition from alternative products or technologies.

By considering these factors and staying informed about industry developments, investors can make more educated decisions when evaluating oilseed stocks and agricultural commodity investments.