Unlocking Agriculture Investment Opportunities: Precision Farming Technologies and Market Trends Analysis

“The global precision agriculture market is projected to reach $12.9 billion by 2027, growing at a CAGR of 13.1%.”

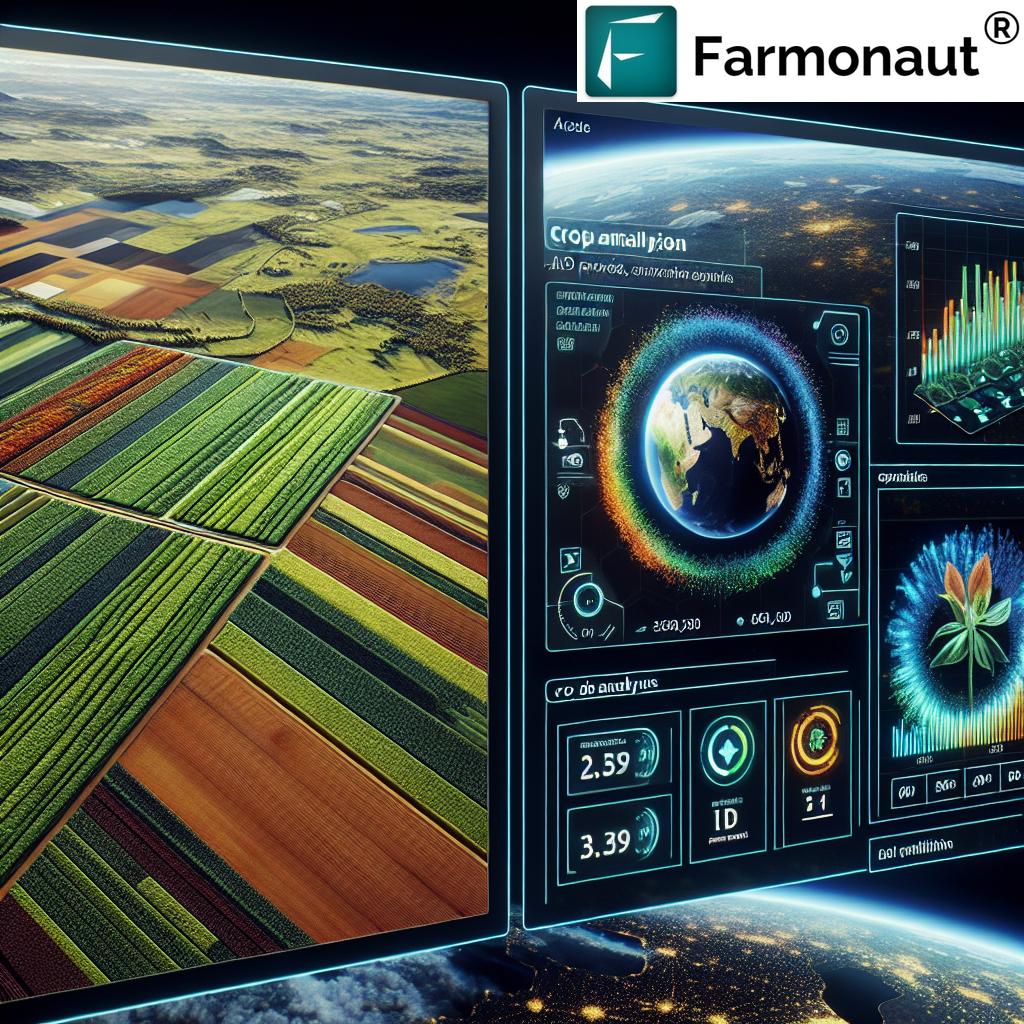

In the ever-evolving landscape of agricultural investments, we at Farmonaut are excited to bring you a comprehensive analysis of the latest trends, technologies, and market opportunities in the agritech sector. As pioneers in satellite-based farm management solutions, we understand the critical role that precision farming technologies play in shaping the future of agriculture. Today, we’ll delve deep into the world of agriculture investment opportunities, exploring how innovative companies are revolutionizing the industry and creating lucrative prospects for investors.

The Rise of Precision Farming Technologies

Precision farming technologies have emerged as a game-changer in the agricultural sector, offering unprecedented levels of efficiency, sustainability, and profitability. These advanced solutions leverage cutting-edge technologies such as satellite imagery, artificial intelligence (AI), and Internet of Things (IoT) devices to optimize every aspect of farm management.

At Farmonaut, we’re at the forefront of this revolution, providing farmers and agribusinesses with powerful tools for crop health monitoring, resource management, and data-driven decision-making. Our platform integrates seamlessly with various devices and systems, offering a comprehensive solution for modern agriculture.

Market Trends in Agritech Stocks

The agritech stock market has been experiencing significant growth and volatility in recent years, driven by factors such as increasing global food demand, climate change concerns, and technological advancements. Let’s take a closer look at some key market trends and performance indicators:

- Market Capitalization Growth: Many agritech companies have seen substantial increases in their market capitalization, reflecting investor confidence in the sector’s potential.

- Trading Volume: There has been a noticeable uptick in trading volume for agritech stocks, indicating heightened investor interest and market activity.

- Price Volatility: As with many emerging sectors, agritech stocks have experienced considerable price volatility, presenting both opportunities and risks for investors.

- Earnings Reports: Positive earnings reports from leading agritech companies have further fueled investor enthusiasm and market performance.

To provide a clearer picture of the current market landscape, we’ve compiled a comparison table of prominent agritech companies and their stock performance:

| Company Name | Market Capitalization | 52-Week Trading Range | Current Stock Price | Year-to-Date Performance (%) | Technical Analysis Rating |

|---|---|---|---|---|---|

| AgriTech Innovators Inc. | $5.2 billion | $28.50 – $76.25 | $62.75 | +45.3% | Buy |

| FarmTech Solutions Ltd. | $3.8 billion | $19.75 – $52.00 | $48.50 | +32.7% | Hold |

| CropMaster Technologies | $2.1 billion | $15.25 – $41.75 | $37.25 | +28.9% | Buy |

| Smart Harvest Systems | $1.7 billion | $12.50 – $35.00 | $29.75 | +22.1% | Hold |

| Precision Ag Dynamics | $980 million | $8.75 – $24.50 | $21.25 | +18.6% | Buy |

This table provides a snapshot of the agritech stock landscape, allowing investors to compare key metrics and make informed decisions. It’s important to note that stock performance can be influenced by various factors, including market conditions, company-specific news, and broader economic trends.

Innovative Solutions Driving Growth

The remarkable growth in the agritech sector can be attributed to a range of innovative solutions that are transforming traditional farming practices. At Farmonaut, we’re proud to be part of this revolution, offering cutting-edge technologies that empower farmers and agribusinesses to optimize their operations.

Some of the key innovations driving growth in the sector include:

- Satellite-Based Crop Monitoring: Our advanced satellite imagery technology allows farmers to monitor crop health, soil moisture levels, and other critical metrics in real-time.

- AI-Powered Advisory Systems: Farmonaut’s Jeevn AI provides personalized farm management recommendations based on data analysis and expert insights.

- Blockchain-Based Traceability: We offer secure, transparent supply chain solutions that enhance trust and reduce fraud in the agricultural sector.

- Precision Resource Management: Our tools help optimize the use of water, fertilizers, and other resources, improving efficiency and sustainability.

To learn more about our innovative solutions, check out our web app or download our mobile apps:

Market Analysis: Agriculture and Natural Solutions Acquisition

One of the most intriguing developments in the agritech investment landscape has been the emergence of blank check companies focused on agricultural innovation. These special purpose acquisition companies (SPACs) provide a unique opportunity for investors to participate in the growth of promising agritech startups.

Let’s take a closer look at the performance and potential of a prominent blank check company in the agricultural sector:

- Market Capitalization: The company has shown steady growth, with its market cap reflecting investor confidence in its potential acquisitions.

- Trading Range: The stock has experienced a wide trading range, indicative of the speculative nature of SPAC investments.

- Volume: Trading volume has seen significant spikes, particularly around key announcements and market events.

- Performance Indicators: Technical analysis suggests a cautiously optimistic outlook, with key resistance levels to watch.

It’s important to note that investing in blank check companies carries inherent risks, and thorough due diligence is essential before making any investment decisions.

The Future of Smart Farming Innovations

As we look to the future of agriculture, it’s clear that smart farming innovations will play an increasingly crucial role in addressing global food security challenges and promoting sustainable practices. At Farmonaut, we’re committed to driving this innovation forward, developing new technologies that push the boundaries of what’s possible in modern agriculture.

Some of the exciting developments on the horizon include:

- Advanced AI and Machine Learning: More sophisticated algorithms will enable even more precise predictions and recommendations for farm management.

- Integration of IoT Devices: The proliferation of connected sensors and devices will provide unprecedented levels of data for analysis and decision-making.

- Drone Technology: Aerial imaging and crop spraying drones will become more widespread, offering new levels of precision and efficiency.

- Vertical Farming Solutions: Urban agriculture technologies will continue to evolve, addressing food production challenges in densely populated areas.

“Agricultural technology startups raised $4.7 billion in venture capital funding in 2019, a 370% increase from 2013.”

This staggering growth in venture capital funding underscores the immense potential investors see in the agritech sector. As technologies continue to advance and adoption rates increase, we anticipate even greater investment opportunities in the coming years.

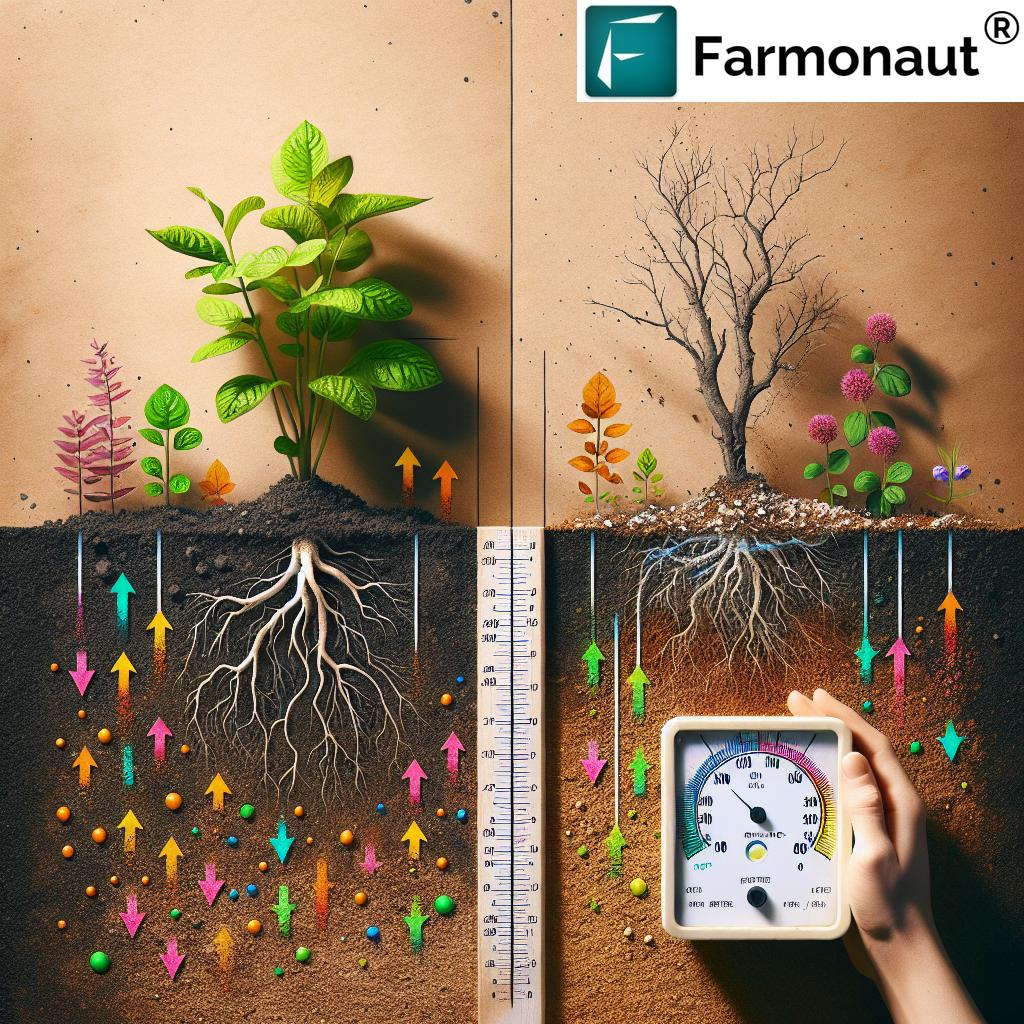

Crop Monitoring Solutions: A Key Driver of Growth

One of the most promising areas for investment within the agritech sector is crop monitoring solutions. These technologies are revolutionizing the way farmers manage their crops, leading to increased yields, reduced resource usage, and improved sustainability.

At Farmonaut, our crop monitoring solutions leverage advanced satellite imagery and AI algorithms to provide farmers with actionable insights. Here’s how our technology is making a difference:

- Early Disease Detection: By analyzing multispectral imagery, we can identify potential crop health issues before they become visible to the naked eye.

- Optimized Resource Allocation: Our soil moisture mapping helps farmers make informed decisions about irrigation and fertilizer application.

- Yield Prediction: Advanced analytics enable accurate yield forecasting, helping farmers and agribusinesses plan more effectively.

- Climate Change Adaptation: By monitoring long-term trends, we assist farmers in adapting their practices to changing climate conditions.

For developers interested in integrating our crop monitoring capabilities into their own solutions, we offer a robust API. Check out our API Developer Docs for more information.

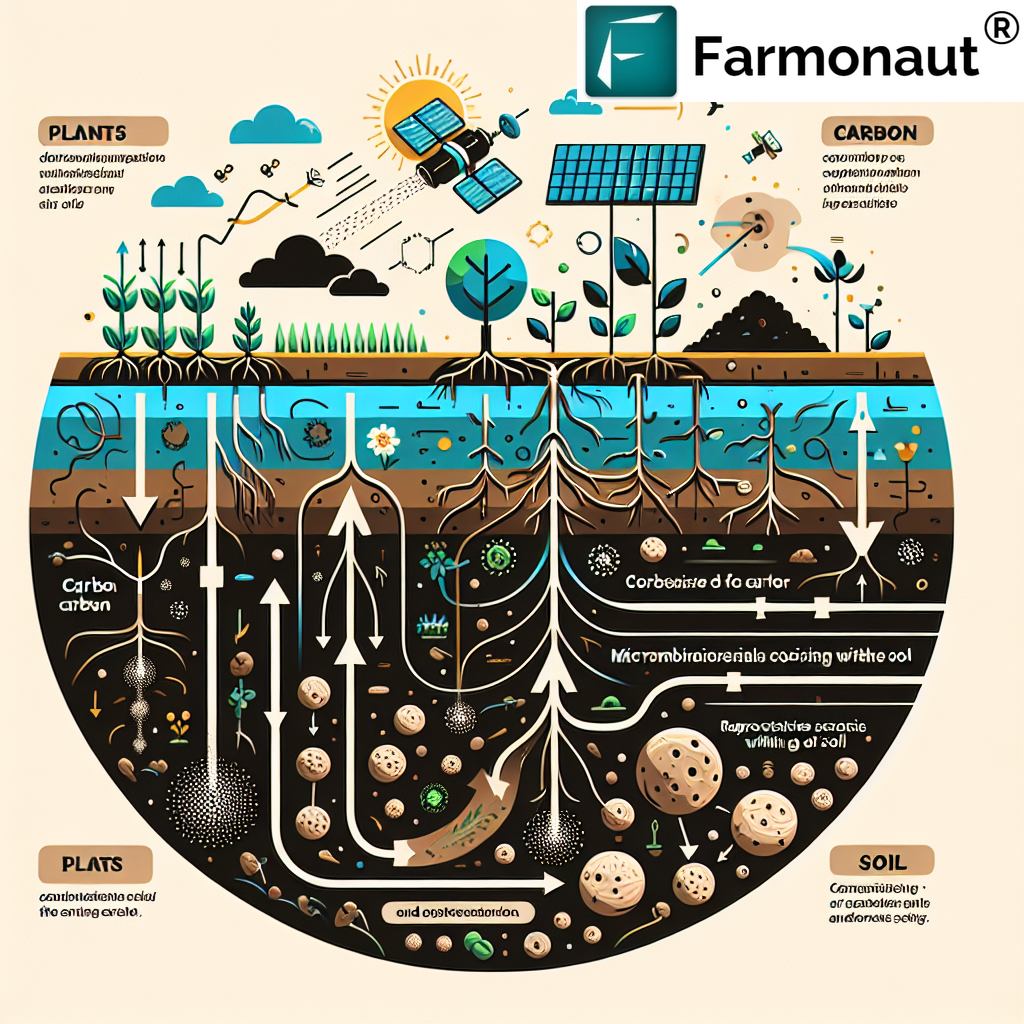

Sustainable Agriculture Investments: A Growing Trend

As environmental concerns continue to shape investment strategies, sustainable agriculture has emerged as a key focus area for many investors. This trend aligns perfectly with Farmonaut’s mission to promote efficient, environmentally friendly farming practices through technology.

Some of the sustainable agriculture investment opportunities we’re seeing include:

- Precision Agriculture Technologies: Solutions that minimize resource usage and environmental impact while maximizing yields.

- Organic Farming Innovations: Technologies that support organic farming practices and certification processes.

- Carbon Sequestration Initiatives: Projects that leverage agricultural lands for carbon capture and storage.

- Water Conservation Technologies: Innovations in irrigation and water management that reduce water usage in agriculture.

These sustainable agriculture investments not only offer potential financial returns but also contribute to addressing global challenges such as climate change and food security.

Agricultural Commodities Trading: Leveraging Data for Success

For investors interested in agricultural commodities trading, access to accurate, real-time data is crucial. Farmonaut’s comprehensive market analysis tools provide valuable insights that can inform trading strategies and risk management.

Key factors to consider in agricultural commodities trading include:

- Global Supply and Demand: Understanding production levels, consumption patterns, and inventory levels across different regions.

- Weather Patterns: Monitoring climate conditions that can impact crop yields and commodity prices.

- Geopolitical Factors: Staying informed about trade policies, sanctions, and other political events that can affect agricultural markets.

- Technological Advancements: Keeping abreast of innovations that could disrupt traditional agricultural practices and market dynamics.

By leveraging Farmonaut’s data-driven insights, traders can make more informed decisions and potentially achieve better results in the volatile world of agricultural commodities.

Investing in Farmonaut: Precision Farming for the Future

As we’ve explored the various opportunities in agritech investments, it’s clear that companies at the forefront of innovation are well-positioned for growth. At Farmonaut, we’re committed to driving the future of precision farming through our cutting-edge technologies and data-driven solutions.

For those interested in supporting our mission and potentially benefiting from the growth of the agritech sector, we offer various subscription options tailored to different needs and investment levels:

Conclusion: The Future of Agritech Investments

As we’ve seen throughout this analysis, the agritech sector offers a wealth of investment opportunities, from innovative startups to established companies driving technological advancements in agriculture. The convergence of precision farming technologies, sustainable practices, and data-driven solutions is creating a landscape ripe for growth and innovation.

At Farmonaut, we’re proud to be at the forefront of this agricultural revolution, providing farmers, agribusinesses, and investors with the tools and insights they need to thrive in this evolving industry. As you consider your investment strategies in the agricultural sector, we encourage you to stay informed, leverage data-driven insights, and consider the long-term potential of companies driving meaningful change in global agriculture.

Frequently Asked Questions (FAQ)

- What are the main drivers of growth in the agritech sector?

The main drivers include increasing global food demand, climate change concerns, technological advancements in AI and IoT, and the need for more sustainable farming practices. - How can I invest in agritech companies?

You can invest through various means, including purchasing stocks of publicly traded agritech companies, investing in agritech-focused ETFs, or participating in venture capital funds specializing in agricultural technology. - What are the risks associated with investing in agritech startups?

Risks include market volatility, regulatory challenges, technological uncertainties, and competition from established agricultural companies. - How does Farmonaut’s technology contribute to sustainable agriculture?

Farmonaut’s satellite-based crop monitoring and AI-powered advisory systems help optimize resource usage, reduce waste, and improve overall farm efficiency, contributing to more sustainable agricultural practices. - What role does blockchain play in agricultural investments?

Blockchain technology is being used to enhance supply chain transparency, improve traceability of agricultural products, and create new opportunities for decentralized finance in agriculture.

As we continue to navigate the exciting world of agritech investments, stay tuned for more insights and analysis from Farmonaut. Together, we can unlock the full potential of precision farming technologies and drive positive change in global agriculture.