South Yorkshire Pensions Invests $100m in Sustainable Timberland: Global Impact of Climate-Focused Forestry Investing

“South Yorkshire Pensions allocated $100 million to sustainable timberland, supporting global climate change and biodiversity initiatives.”

Introduction: South Yorkshire Pensions and the $100m Timberland Investment

As global stakeholders in both finance and sustainability, we observe a paradigm shift in institutional investing as pension funds increasingly seek sustainable, climate-focused asset classes. The recent announcement that the South Yorkshire Pensions Authority (SYPA)—a leading UK local government pension scheme—has committed $100 million (€117.4m) to JP Morgan Asset Management’s timberland investment advisory company illustrates this transformative trend.

This allocation, placed under the stewardship of Campbell Global, is integral to the broader forestry asset management movement. Our goal is to understand how sustainable timberland investment management not only diversifies pension portfolios but also drives progress towards climate change mitigation, carbon sequestration, and biodiversity in timberland, benefiting scheme members and the global community alike.

- Focus Keyword: South Yorkshire Pensions, timberland investment, sustainable forestry, biodiversity, pension fund forestry strategy, climate change investing

- Location Context: This development is rooted in South Yorkshire, reinforcing the commitment by UK local government schemes to climate-centric global timberland assets.

In this comprehensive analysis, we break down every aspect of the transaction, the roles of leading entities like Campbell Global, the financial and environmental metrics that matter, and how innovative technologies—like those from Farmonaut—are accelerating progress in sustainability for both institutional and individual stakeholders.

Why Timberland Investment Management Drives Sustainability

Timberland investment management is rapidly becoming a cornerstone in the movement toward sustainable institutional investing. As responsible investors, we recognize the unique position of timberland as an asset class that links ecological, social, and financial returns. Unlike fossil-fuel-heavy industries or purely extractive commodities, sustainable forestry investments prioritize renewable yields, resilient ecosystems, and measurable reductions in carbon emissions.

Key drivers for pension timbersland investment management include:

- Long-Term Asset Growth: Timberland naturally appreciates over time, offering pension funds stable, inflation-hedging returns that align with their long-dated liabilities.

- Carbon Sequestration Forestry: Managed forests absorb CO₂, directly supporting climate goals and enabling funds to progress towards net zero emissions.

- Biodiversity in Timberland: Sustainable practices preserve and even enhance habitat complexity, supporting flora, fauna, and soil health.

- Water and Habitat Conservation: Forests are critical regulators of water cycles and biodiversity corridors.

- Resilience Against Climate Change: Well-managed timber assets can withstand and adapt to changing climatic conditions, making them durable investments.

By integrating these biological and economic advantages, global investors, especially pension funds like SYPA, are setting a precedent for climate change investing and innovative asset allocation.

Spotlight on Campbell Global: Global Timberland Assets Leadership

Among the world’s top institutional forestry investment managers, Campbell Global stands at the forefront. Based in Portland, Oregon, and operating as JP Morgan’s timberland advisory company, Campbell Global brings over forty years of experience in managing extensive global timberland assets for pension funds, foundations, and institutional investors.

As expert forestry asset managers, Campbell Global oversees more than 5 million acres worldwide, with portfolios spanning North America, Australasia, and other critical forest regions. Their integrated approach emphasizes not only asset value appreciation and robust returns but also carbon sequestration, water conservation, and tangible biodiversity improvements.

- Assets Under Supervision: $10.1 billion (as of the end of last year)

- Acres Managed: 1.4 million (active timberland under management)

- Client Type: Pension funds, foundations, family offices, and institutional investors

This depth of experience and proven stewardship make Campbell Global an ideal advisor for pension authorities such as SYPA. Their commitment to sustainability, transparency, and rigorous measurement is setting the pace for climate-conscious institutional forestry investment.

“Timberland investments for pension funds can sequester up to 2.6 tons of CO2 per acre annually, aiding sustainability.”

How Pension Fund Forestry Strategy Supports Net Zero

Pension funds are keenly aware of the dual mandate to provide long-term security for their beneficiaries while also accounting for societal and environmental responsibilities. The South Yorkshire Pensions Authority is a model for this approach, as its asset-backed forestry strategy aligns seamlessly with the broader net zero objectives outlined by the UK government and international climate agreements.

Here’s how the pension fund forestry strategy addresses climate and net zero:

- Emissions Offsetting: Each acre of managed sustainable forest has measurable carbon sequestration potential (often exceeding 2.6 tons of CO2 per acre per year), allowing pension funds to offset emissions within their wider portfolio.

- Nature-Based Solutions: Timberland investments go beyond mere offsetting—they support the restoration, conservation, and expansion of natural capital on a global scale.

- Diversified, Long-Term Returns: Forestry asset management offers attractive risk-adjusted financial returns that stabilize pension portfolios in volatile markets.

- Supporting Biodiversity and Habitats: By protecting existing forests and establishing new growth, these funds contribute directly to biodiversity in timberland, protecting rare species and natural habitats.

- Stakeholder Engagement: Scheme members increasingly value transparency, positive impact, and sustainability—all of which are ensured by robust, independent forestry management practices.

George Graham, director at SYPA, emphasizes that “Forestry plays a vital role in our natural capital allocation as outlined in our investment strategy. It provides a resilient and diversified source of returns, aiding our journey to net zero and our initiatives to combat climate change and support biodiversity, which our pension scheme members highly value.”

Measuring Impact: Financial Returns, Biodiversity & Climate

One of the most compelling arguments for global timberland investment management is the ability to quantify its wide-reaching impacts—across financial performance, carbon sequestration, biodiversity enhancement, and socio-economic benefits. When compared to traditional asset classes, sustainable timberland stands out for its ability to deliver diversified, attractive, long-term risk-adjusted returns alongside clear and measurable environmental outcomes.

Let’s break down the impact metrics:

- Estimated Annual Return: Sustainable forestry assets are recognized for their inflation-hedging properties and recession resilience, often matching or exceeding returns offered by other real assets like infrastructure or real estate.

- Carbon Sequestration Potential: Each managed acre can remove over 2.6 tons of CO₂ per year—translating to substantive offsets that support climate change investing goals.

- Biodiversity Index Improvement: A structured approach, such as Campbell Global’s, leads to active habitat conservation, protection of keystone species, and overall improvements in ecosystem health.

- Forest Area Managed: The scale of individual and pooled investments enables management of hundreds of thousands of hectares, amplifying positive impacts at a landscape level.

- Social Impact Metrics: Sustainable timberland generates rural employment, enhances local economies, and can contribute to Indigenous and community land rights recognition.

These quantifiable outcomes help satisfy not only financial, but also Environmental, Social, and Governance (ESG) mandates demanded by institutional and global investors.

Impact Comparison Table: Sustainable vs. Traditional Investment

The following table illustrates how the South Yorkshire Pensions’ $100 million investment in sustainable timberland compares with conventional pension investment strategies across key impact metrics:

| Investment Approach | Estimated Annual Return (%) | Carbon Sequestration Potential (tons CO₂/year) | Biodiversity Index Improvement (est. %) | Forest Area Managed (hectares) | Social Impact Metrics (Jobs Supported) |

|---|---|---|---|---|---|

| Sustainable Timberland | 5.5 – 7.5† | 250,000* | +15% to +25% | ~40,000 | 500+ (direct & indirect) |

| Traditional Mixed Asset Portfolio | 4 – 6 | Negligible / None | No direct impact | N/A | Lower (fewer rural jobs) |

†Returns depend on market cycles, age/species of forest, and active management. *Assuming average sequestration of 2.6 tCO₂/acre/year over ~40,000 hectares.

Climate Change Investing and the Global Forestry Market

Investing in sustainable timberland is a recognized method for institutional investors to marry climate change solutions with financial prudence. With a growing concern for meeting net-zero emissions targets and aligning with the Paris Agreement, funds like South Yorkshire Pensions are leveraging JP Morgan timberland advisory expertise to optimize portfolio decarbonization.

Key Trends Fueling Global Forestry Investment Management:

- Emergence of Carbon Markets: New mechanisms for monetizing carbon credits generated from timberland management are adding supplementary sources of returns and incentivizing sustainable practices.

- Investor Demand for ESG Integration: Across the globe, both public and private sector investors increasingly expect evidence of biodiversity, water conservation, and rural development in forestry investments.

- Forest Area Expansion: Capital flows toward afforestation, reforestation, and forest restoration projects, substantially increasing the total acreage and impact of managed global timberland assets.

- Transition to Transparent & Science-Based Reporting: Investors now require verifiable, independently audited sustainability reports that reference real-world impact of their investments—necessitating robust asset management platforms.

With institutional forestry investment increasingly favored worldwide, the role of expert managers such as Campbell and innovative technology providers is more vital than ever.

Learn how to measure and reduce your farm or forestry operation’s carbon emissions with Farmonaut’s Carbon Footprinting solutions. This tool provides actionable data to help investors, landowners, and managers enhance the sustainability of their assets.

The Future of Pension Investments in Sustainable Forestry

As we look ahead, the case for large-scale pension scheme allocation to sustainable forestry only grows stronger. Legislative tailwinds, such as the UK government’s net zero commitments, combined with rising investor and member expectations for responsible stewardship, are driving ongoing interest in timberland investment management.

Opportunities for Pension Funds

- Achieve superior diversification benefits through an asset class with low correlation to equities and bonds.

- Enhance transparency and stakeholder engagement via clear biodiversity, water, and carbon reporting.

- Adapt to climate risk and regulatory requirements by holding resilient, regenerative, and productive forest assets.

- Access new revenue streams through carbon credits and ecosystem services markets.

- Align with the values of pension scheme members, especially in regions like South Yorkshire where community, heritage, and environment are core priorities.

The transition is already underway. With global advisors such as JP Morgan and Campbell Global raising the bar for accountability, the competitive landscape of responsible asset management continues to evolve, placing environmental integrity and financial performance hand-in-hand.

Satellite & AI Technologies Enhancing Sustainable Forestry

Precision forestry asset management and climate change investing require real-time, reliable data. Satellite and artificial intelligence (AI) technologies are revolutionizing the way we monitor, manage, and optimize forestry assets—integral for both forestry managers and institutional investors seeking evidence-based impact.

- Multispectral Imagery: Monitors vegetation health, tree canopy, and soil moisture, allowing for proactive intervention and improved yields.

- Automated Tree Detection: Enables precise tree inventory, growth rate tracking, and biodiversity assessments across large estate portfolios.

- AI-Based Advisory: Delivers actionable intelligence for pest and disease management, fertilization schedules, and harvest optimization.

- Blockchain Traceability: Ensures transparency in timber and non-timber product supply chains, enhancing reputation and compliance.

- Carbon Accounting: Quantifies carbon sequestration and emissions, supporting regulatory reporting and access to carbon markets.

These technologies empower managers—such as those at Campbell Global—to exceed investor requirements, lower operational risk, and truly validate their role in driving global sustainability and biodiversity in timberland.

Enhance transparency in your agricultural and forestry supply chains with Farmonaut’s Blockchain-Based Product Traceability. Trust and traceability are vital for responsible resource management globally.

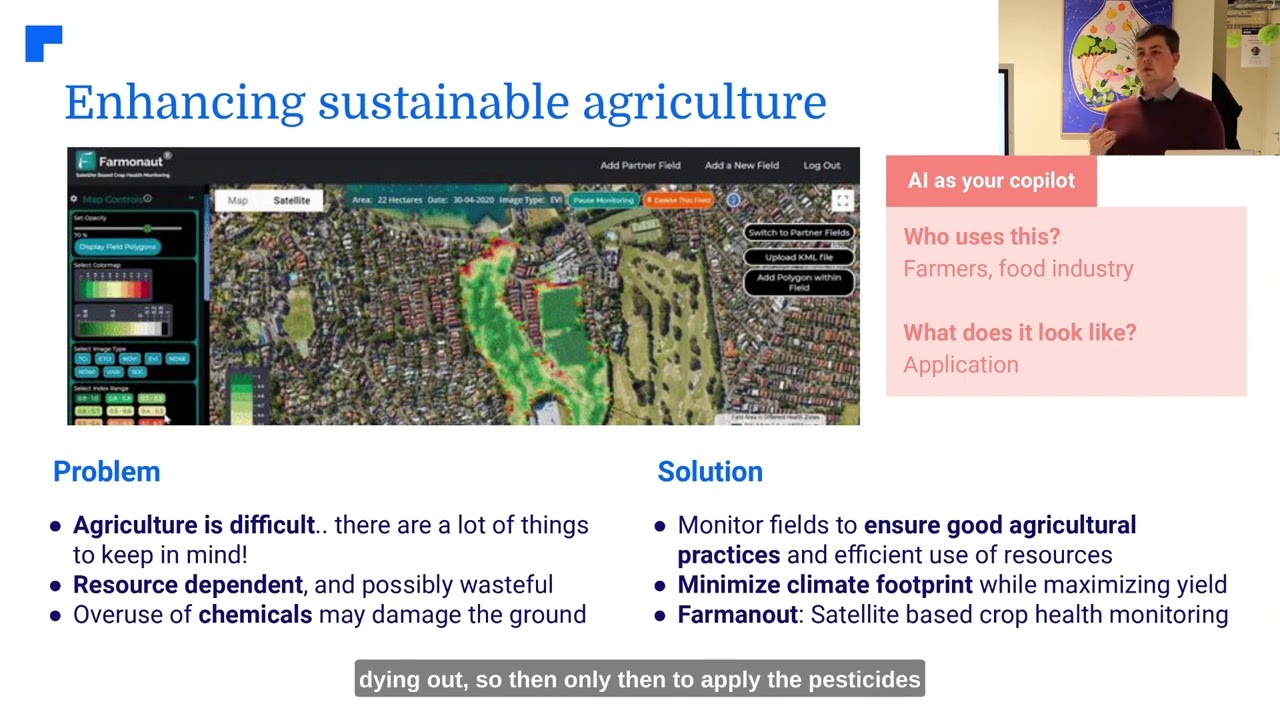

Farmonaut: Empowering Sustainable Agriculture Globally

As we advance toward a data-driven and sustainable future, leveraging sophisticated digital tools is essential for all stakeholders—ranging from pension managers to family farmers. Farmonaut serves as a pioneering force in this domain, offering advanced, satellite-based solutions for farm and resource management across android, iOS, web/browser app, and API platforms.

Key Farmonaut Technologies:

- Satellite-Based Crop Health Monitoring: Provides real-time NDVI, soil moisture, and crop vegetation insights. Helps optimize yields, irrigation, and fertilizer use—making sustainability both actionable and affordable for operators worldwide.

- AI-Based Jeevn Advisory System: Delivers expert, customized farm advice leveraging weather forecasts, AI, and satellite data to raise efficiency and climate resilience.

- Blockchain-Based Traceability: Protects supply chain integrity by making every step transparent and verifiable—crucial for food safety and customer trust.

- Fleet and Resource Management: Enhances efficiency and cost savings for agribusinesses by optimizing vehicle use, logistics, and machinery management.

- Carbon Footprinting: Real-time data helps users quantify and minimize their emissions, facilitating compliance with the latest sustainability requirements.

Farmonaut’s platform offers value not just to individual farmers, but also to agribusinesses, government entities, NGOs, and financial institutions pursuing real impact in climate change investing. Its subscription-based model ensures accessibility for all—regardless of scale.

For large-scale estate owners and timberland managers, Farmonaut’s Fleet Management tool streamlines logistics, reduces costs, and enhances the safety of forest operations around the globe.

Looking to manage thousands of hectares efficiently? Discover Farmonaut’s Large Scale Farm Management platform for scalable, data-driven decision making across plantations and timberland investments.

Choosing the Right Tools for Carbon Sequestration Forestry

Achieving net zero or even carbon-negative status within forestry or agricultural investments is within reach—when informed by robust tools and precise, transparent data. For pension funds, institutional asset managers, and timberland managers, the need for audit-ready, science-based carbon accounting is paramount.

- Active Carbon Monitoring: Farmonaut’s carbon footprint tracker lets you monitor emissions in real-time, spot inefficiencies, and optimize management protocols.

- Expert Advisory Systems: AI-powered advice helps you select, monitor, and optimize the right mix of forestry assets for maximum sequestration with minimum risk.

- Integrated Resource Management: Tools for logistics, supply chain traceability, and large-scale resource deployment ensure that ecosystem and climate goals are efficiently aligned with operational excellence.

For forest plantation and advisory, including agroforestry: Learn more here.

Subscription and API Access for Advanced Farm Management

To ensure scalable, affordable, and adaptable solutions for all stakeholders in the forestry and agricultural sectors, Farmonaut’s subscription-based model caters to everyone—from individual scheme members up to pension authorities and government agencies. The platform’s tiered packages allow users to select the frequency, acreage, and depth of data most suited to their needs.

- Farmonaut Subscriptions: Flexible plans offer farm health monitoring, resource management, and AI advisory for users of all sizes.

- API Access: The Farmonaut API and Developer Documentation let software integrators incorporate real-time satellite and weather data directly into enterprise systems or investor portals, maximizing actionable insight.

- For those administering large estates, the Agro Admin App centralizes tracking and reporting for institutional asset holders across global timberland investments.

Frequently Asked Questions about Timberland Investment

What is sustainable timberland investment management?

Sustainable timberland investment management is the practice of acquiring, managing, and harvesting commercial forests using strategies that create consistent financial returns while ensuring forest regeneration, maintaining biodiversity, protecting water resources, and maximizing carbon sequestration. This investment approach aligns with both financial and environmental stewardship goals.

How does timberland investment contribute to net zero objectives?

Timberland sequesters large amounts of atmospheric CO2 through photosynthesis. Well-managed forests can significantly offset emissions from other parts of a diversified portfolio, helping pension funds, investors, and companies meet net zero targets.

Why is biodiversity important in institutional forestry investments?

Biodiversity in timberland enhances ecological resilience, pest and disease resistance, and soil stability. These benefits translate into long-term risk reduction for investors and support global conservation and climate change goals.

Can timberland investments deliver competitive financial returns?

Yes, sustainable timberland has demonstrated attractive, risk-adjusted annual returns, competitive with traditional real assets and often with lower volatility due to the biological growth characteristics of wood and the ability to delay harvest in weak markets.

What makes Farmonaut relevant for timberland and forestry asset managers?

Farmonaut provides powerful, accessible digital tools for satellite-based monitoring, real-time carbon tracking, AI-driven advisory, blockchain traceability, and fleet/resource management, all of which enhance transparency, productivity, and sustainability in forestry operations.

How can I start monitoring carbon sequestration and biodiversity on my property?

By using Farmonaut’s Carbon Footprinting Module and leveraging its real-time satellite imagery and reporting tools, you can easily track and improve your environmental footprint.

Conclusion: A Blueprint for Climate and Financial Resilience

In conclusion, the South Yorkshire Pensions Authority’s $100 million investment in sustainable timberland through Campbell Global and JP Morgan Asset Management exemplifies how global pension funds can drive both environmental and financial impact. As climate change investing gains traction, tools like Farmonaut help all stakeholders—pension schemes, timberland managers, and individual growers—employ best-in-class technologies to manage assets, enhance returns, and track carbon and biodiversity performance.

By aligning strategic forestry investments with innovative digital management, we can collectively amplify positive outcomes for our portfolios, our planet, and future generations.

For rapid and satellite-verified crop loan or insurance processing, see Farmonaut’s Crop Loan & Insurance platform.