UK Steel Sector Shakeup: Government Intervenes Amid Global Overcapacity and Foreign Investment Concerns

“UK government enacted emergency legislation to maintain control of a major steel company, affecting 95% of British steel production.”

In a dramatic turn of events, the British steel industry finds itself at a critical juncture as the government takes unprecedented steps to safeguard one of the nation’s most strategic sectors. We at Farmonaut, while primarily focused on agricultural technology, recognize the far-reaching implications of this development for the broader industrial landscape and its potential ripple effects on various sectors, including agriculture.

The recent enactment of emergency legislation by the UK government to maintain control of a major steel company has sent shockwaves through the industry and beyond. This move highlights the growing concerns over China’s steel investment in the UK and its impact on the global steel overcapacity issue. As we delve into this complex situation, we’ll explore the multifaceted challenges facing the British steel sector and the government’s approach to balancing international cooperation with national interests.

The Catalyst: China’s Involvement in UK Steel

At the heart of this controversy lies the role of China’s Jingye Group in the British steel industry. The refusal of this Chinese-owned entity to accept a substantial government aid package, reportedly worth around 500 million pounds ($654 million), has precipitated a crisis that threatens the very foundation of UK steel production.

Business Minister Jonathan Reynolds made a stark declaration on Sunday, stating that “China is no longer welcome in Britain’s steel sector.” This pronouncement comes in the wake of the government’s emergency intervention to ensure control of Chinese-owned British Steel.

The situation underscores the delicate balance between attracting foreign investment and protecting national interests in crucial economic sectors. It’s a dilemma that resonates across industries, including agriculture, where technological advancements and foreign investments often intersect with food security concerns.

The Blast Furnace Dilemma

Central to this crisis is the fate of the blast furnaces at the British Steel plant in Scunthorpe. These industrial behemoths, which require constant fueling and are reportedly losing a staggering 700,000 pounds per day, represent both the heart of steel production and a significant financial burden.

The potential closure of these blast furnaces would have far-reaching consequences. As Reynolds pointed out, it would leave Britain as the only major economy unable to produce “virgin steel” from iron ore, coke, and other inputs. This capability is not just a matter of industrial pride; it’s a cornerstone of national security and economic independence.

The situation draws parallels to challenges faced in other sectors, including agriculture, where the maintenance of critical infrastructure and capabilities is essential for food security and economic stability. At Farmonaut, we understand the importance of preserving key agricultural assets while embracing technological advancements, much like the steel industry must balance traditional production methods with modern efficiencies.

Global Overcapacity and Market Pressures

“China’s steel investment in the UK raised concerns, as global steel overcapacity reached 25% above demand in recent years.”

The UK steel sector’s challenges are set against a backdrop of global overcapacity in the steel industry. This oversupply has put immense pressure on steel producers worldwide, leading to intense competition and driving down prices. The situation is further complicated by challenges from U.S. tariffs, which have reshaped global steel trade dynamics.

In this context, Jingye Group’s proposal to import steel from China for further processing in Britain becomes particularly contentious. While potentially cost-effective for the company, such a move would essentially transform British steel facilities into finishing plants, undermining the country’s ability to produce steel from raw materials.

This global perspective on industry challenges resonates with our work at Farmonaut. In agriculture, we often see how global market pressures and overcapacity in certain crops can significantly impact local farmers. Our crop plantation and forest advisory services help farmers navigate these complex market dynamics, much like steel producers must adapt to global industry trends.

Government Intervention and Industrial Strategy

The UK government’s decision to intervene directly in the steel sector marks a significant shift in industrial policy. This move reflects a growing recognition of the strategic importance of certain industries and a willingness to take decisive action to protect them.

Reynolds’ criticism of previous governments as “naive” in allowing Chinese companies into the steel sector signals a potential reevaluation of foreign investment policies, particularly in sensitive industries. This shift in approach could have far-reaching implications for other sectors, including agriculture and technology.

At Farmonaut, we recognize the importance of government support and strategic planning in developing crucial industries. Our large-scale farm management solutions often work in tandem with government initiatives to enhance agricultural productivity and sustainability, demonstrating the potential for public-private partnerships in strategic sectors.

The China Factor: Economic Relations and Strategic Concerns

The steel sector crisis has brought into sharp focus the complex relationship between China and the UK in economic matters. While the current Labour government has stepped up engagement with China, seeking to revive talks that were paused for over six years, the steel situation highlights the challenges in balancing economic cooperation with strategic interests.

Reynolds’ statement that large industrial companies like Jingye Group have direct links to the Chinese Communist Party underscores the geopolitical dimensions of industrial policy. This perspective extends beyond steel, potentially influencing policies in other sectors where Chinese investment is significant.

Interestingly, Reynolds identified other sectors such as car making, life sciences, and agricultural products as less sensitive areas for Chinese investment. This nuanced approach suggests a recognition that different industries may require different levels of protection or openness to foreign investment.

Implications for UK Industry and Economy

The government’s intervention in the steel sector has broad implications for the UK’s industrial landscape and overall economy. Here are some key considerations:

- Industrial Capability: Maintaining domestic steel production capability is crucial for national security and economic independence.

- Job Preservation: The steel industry supports thousands of jobs, both directly and indirectly. Protecting these jobs is a key concern for the government.

- Investment Climate: The government’s actions may impact the UK’s reputation as a destination for foreign investment, particularly from China.

- Supply Chain Resilience: Domestic steel production is essential for numerous industries, including construction, automotive, and defense.

- Environmental Considerations: The future of blast furnaces raises questions about the UK’s commitment to reducing carbon emissions in heavy industry.

These implications extend beyond the steel sector, potentially influencing policies and strategies in other industries. At Farmonaut, we understand the importance of adapting to changing industrial landscapes. Our carbon footprinting services help businesses in various sectors, including agriculture, monitor and reduce their environmental impact, aligning with broader national goals for sustainability and industrial efficiency.

The Role of Technology in Industrial Transformation

As the UK steel industry grapples with these challenges, the role of technology in industrial transformation becomes increasingly apparent. The steel sector, like many traditional industries, faces pressure to innovate and adapt to changing market conditions and environmental requirements.

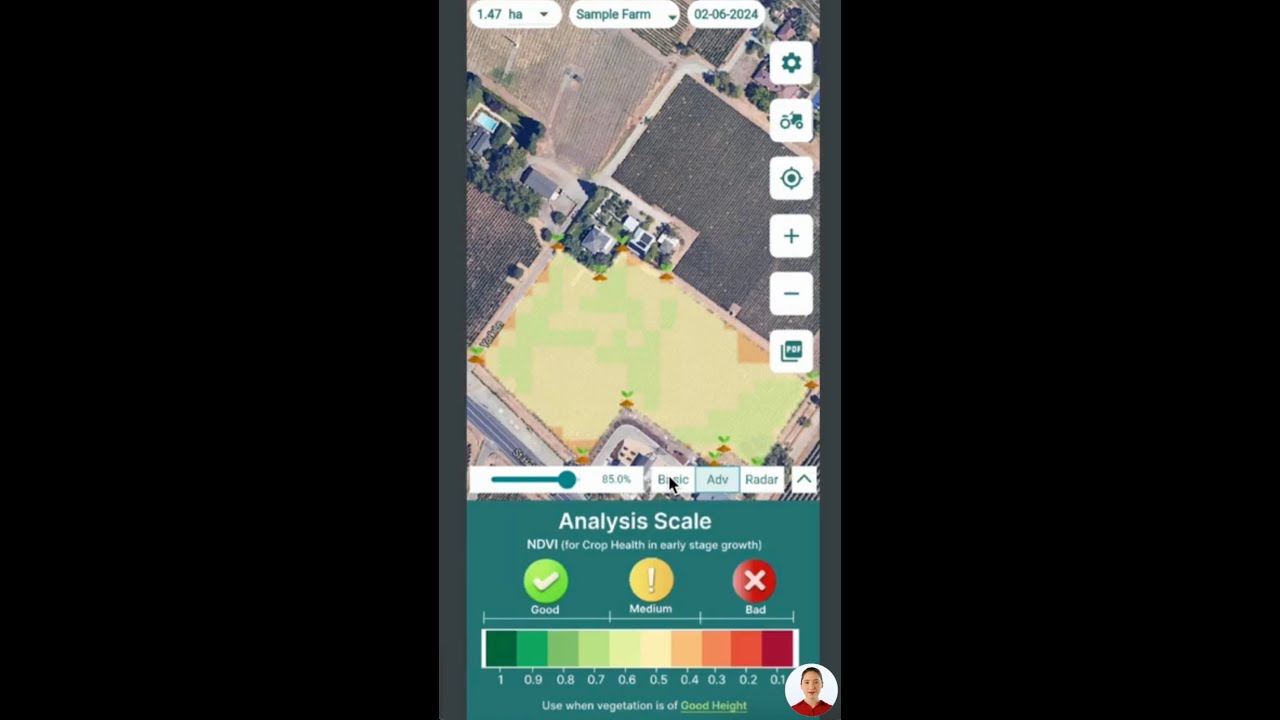

This need for technological advancement resonates with our mission at Farmonaut. While our focus is on agricultural technology, the principles of innovation and data-driven decision-making apply across industries. Our satellite-based crop health monitoring and AI-driven advisory systems demonstrate how technology can revolutionize traditional sectors, improving efficiency and sustainability.

In the context of the steel industry, similar technological innovations could play a crucial role in enhancing productivity, reducing environmental impact, and maintaining competitiveness in the global market. The government’s intervention in the sector could potentially catalyze investments in research and development, driving technological advancements that could secure the industry’s future.

Global Trade Dynamics and Steel Tariffs

The UK steel sector’s challenges are inextricably linked to global trade dynamics, particularly the impact of steel tariffs. The mention of U.S. tariffs in the context of the industry’s struggles highlights the complex web of international trade relationships that influence domestic industrial policies.

These tariffs, originally implemented to protect domestic steel industries, have had far-reaching effects on global steel trade. For the UK, navigating this landscape post-Brexit adds another layer of complexity to the industry’s challenges.

The situation underscores the need for industries to be adaptable and resilient in the face of changing trade policies. At Farmonaut, we recognize similar challenges in the agricultural sector, where global trade dynamics can significantly impact local farmers. Our crop loan and insurance services help farmers manage risks associated with market fluctuations and trade uncertainties, much like steel producers must navigate the complexities of global trade policies.

The Future of UK Steel: Balancing Tradition and Innovation

As we look to the future of the UK steel industry, it’s clear that a delicate balance must be struck between preserving traditional production capabilities and embracing innovation. The government’s intervention provides a temporary reprieve, but long-term solutions will require strategic planning and investment.

Key areas for future development might include:

- Green Steel Initiatives: Investing in technologies to reduce the carbon footprint of steel production.

- Advanced Manufacturing: Incorporating AI and automation to enhance efficiency and product quality.

- Diversification: Exploring new markets and applications for steel products.

- Workforce Development: Training and upskilling workers to adapt to new technologies and production methods.

This forward-looking approach aligns with our philosophy at Farmonaut. In agriculture, we constantly strive to balance traditional farming wisdom with cutting-edge technology. Our fleet management solutions, for instance, help agricultural businesses optimize their operations, demonstrating how technology can enhance efficiency in traditional industries.

Comparative Analysis of UK Steel Industry Challenges

| Challenge | Current Impact | Potential Solutions |

|---|---|---|

| Chinese Investment | High – Increased foreign control of UK steel assets | Emergency legislation to maintain domestic control; Stricter foreign investment regulations |

| Global Overcapacity | High – Depressed prices and market instability | International cooperation to reduce production; Diversification into specialized steel products |

| Blast Furnace Closures | Critical – Threat to UK’s virgin steel production capability | Government support for modernization; Investment in green steel technologies |

| Government Intervention | Medium – Short-term stability but potential long-term market distortion | Develop comprehensive industrial strategy; Public-private partnerships for innovation |

This table illustrates the multifaceted nature of the challenges facing the UK steel industry and the various approaches being considered to address them. It’s clear that there are no simple solutions, and a comprehensive strategy involving government, industry, and potentially international cooperation will be necessary to secure the future of British steel.

Lessons for Other Industries

The challenges and responses in the UK steel sector offer valuable lessons for other industries, including agriculture. Some key takeaways include:

- Strategic Importance: Recognizing and protecting industries crucial for national security and economic independence.

- Innovation Imperative: The need for continuous innovation to remain competitive in global markets.

- Balancing Act: Navigating the complex relationship between foreign investment, domestic control, and national interests.

- Sustainability Focus: The growing importance of environmental considerations in industrial policy and practice.

- Workforce Adaptation: The need to support and retrain workers as industries evolve.

At Farmonaut, we see parallels in the agricultural sector, where issues of food security, technological advancement, and environmental sustainability intersect. Our product traceability solutions, for instance, address the growing demand for transparency and quality assurance in food supply chains, much like the steel industry must adapt to changing market demands and regulatory environments.

Conclusion: A Watershed Moment for UK Industry

The UK government’s intervention in the steel sector marks a watershed moment in the country’s industrial policy. It reflects a growing recognition of the need to protect strategic industries while navigating the complexities of global trade and investment.

As the situation continues to unfold, it will be crucial to monitor its impact not just on the steel industry, but on the broader UK economy and its relationships with international partners, particularly China. The government’s actions in this crisis could set precedents for how other strategic industries are managed in the future.

At Farmonaut, we remain committed to supporting the agricultural sector through technological innovation and data-driven solutions. While our focus is different from the steel industry, we recognize the interconnectedness of various sectors in the national economy. The challenges and solutions in one industry often have lessons and implications for others.

As we move forward, it’s clear that balancing tradition with innovation, national interests with global cooperation, and economic growth with environmental sustainability will be key challenges for all industries. The UK steel sector’s current situation serves as a compelling case study in navigating these complex issues in the 21st-century global economy.

FAQ Section

- Q: Why did the UK government intervene in the steel sector?

A: The government intervened to maintain control of a major steel company after Chinese-owned British Steel refused a substantial aid package, threatening the UK’s ability to produce virgin steel. - Q: What are the main challenges facing the UK steel industry?

A: Key challenges include global overcapacity, foreign investment concerns, potential blast furnace closures, and the need to balance economic interests with national security. - Q: How does this situation impact UK-China relations?

A: The government’s actions signal a shift in approach to Chinese investment in sensitive sectors, potentially affecting broader economic relations between the two countries. - Q: What are the implications for other industries?

A: This situation highlights the importance of protecting strategic industries and may lead to reevaluation of foreign investment policies across various sectors. - Q: How might this affect the UK’s environmental goals?

A: The future of blast furnaces and steel production methods will need to align with the UK’s commitments to reducing carbon emissions, potentially driving innovation in green steel technologies.

For more information on how technology is transforming traditional industries, including agriculture, visit Farmonaut’s web application or explore our API services for developers.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Explore Farmonaut’s innovative solutions: