Maine Man Pleads Guilty: COVID-19 Relief Fraud Exposes Flaws in EIDL and PPP Loan Programs

“Over 1.2 million EIDL loans, totaling $389 billion, were approved by the SBA during the COVID-19 pandemic.”

As we delve into the intricacies of COVID-19 relief fraud, it’s crucial to understand the scale of financial assistance provided during the pandemic. The Economic Injury Disaster Loan (EIDL) program, a cornerstone of the government’s response to the economic crisis, approved over 1.2 million loans amounting to $389 billion. This staggering figure underscores both the unprecedented need for support and the potential vulnerabilities in the system that fraudsters sought to exploit.

In this comprehensive blog post, we’ll explore a recent case of COVID-19 relief fraud involving the Paycheck Protection Program (PPP) and EIDL initiative. Our analysis will shed light on how a small business owner in Maine manipulated these CARES Act financial assistance programs through false applications and misrepresentations. This case serves as a stark reminder of the challenges faced by the Small Business Administration (SBA) and federal authorities in managing pandemic support while combating fraud.

The Case: A Maine Man’s Fraudulent Scheme

In a recent development that has sent shockwaves through the small business community in Portland and beyond, Yani Stancioff, a 29-year-old resident of Camden, Maine, has pleaded guilty to wire fraud charges in U.S. District Court. This case brings to light the vulnerabilities in the COVID-19 economic relief programs and the lengths to which some individuals went to exploit them.

Court records reveal a disturbing pattern of deception spanning from 2020 to 2021. During this period, Stancioff submitted three fraudulent applications to secure funds from the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) initiative. Through his deceitful actions, he managed to obtain $51,666 in relief funds intended for struggling businesses during the pandemic.

The Anatomy of the Fraud

Stancioff’s fraudulent activities were multifaceted and calculated. Let’s break down the key components of his scheme:

- EIDL Application Fraud: Stancioff misrepresented himself as the sole proprietor of a non-existent agricultural business in his EIDL application. This false claim allowed him to tap into funds specifically allocated for the agricultural sector, which was heavily impacted by the pandemic.

- PPP Application Deception: For his PPP applications, Stancioff fabricated the existence of a marketing business. He falsely claimed a gross income of approximately $107,000 for this non-existent entity.

- Document Falsification: To support his fraudulent PPP applications, Stancioff went a step further by submitting falsified documents to the Internal Revenue Service (IRS). This action not only constitutes fraud against the PPP program but also involves federal tax fraud.

The Consequences: Legal Ramifications and Potential Sentencing

The repercussions of Stancioff’s actions are severe and far-reaching. As a result of his guilty plea, he now faces:

- A potential prison sentence of up to 20 years

- A maximum fine of $250,000

- The possibility of three years of supervised release following his prison term

It’s important to note that the final determination of Stancioff’s sentence will be made by a federal district judge. This decision will take into account various factors, including the U.S. Sentencing Guidelines, which provide a framework for consistent sentencing across federal cases.

The Investigation: Uncovering the Fraud

The case against Stancioff was the result of a meticulous investigation conducted by the IRS Criminal Investigation unit. This underscores the federal authorities’ commitment to rooting out fraud linked to COVID-19 relief programs. The involvement of the IRS in this case highlights the multi-faceted approach taken by law enforcement to combat financial crimes related to pandemic relief efforts.

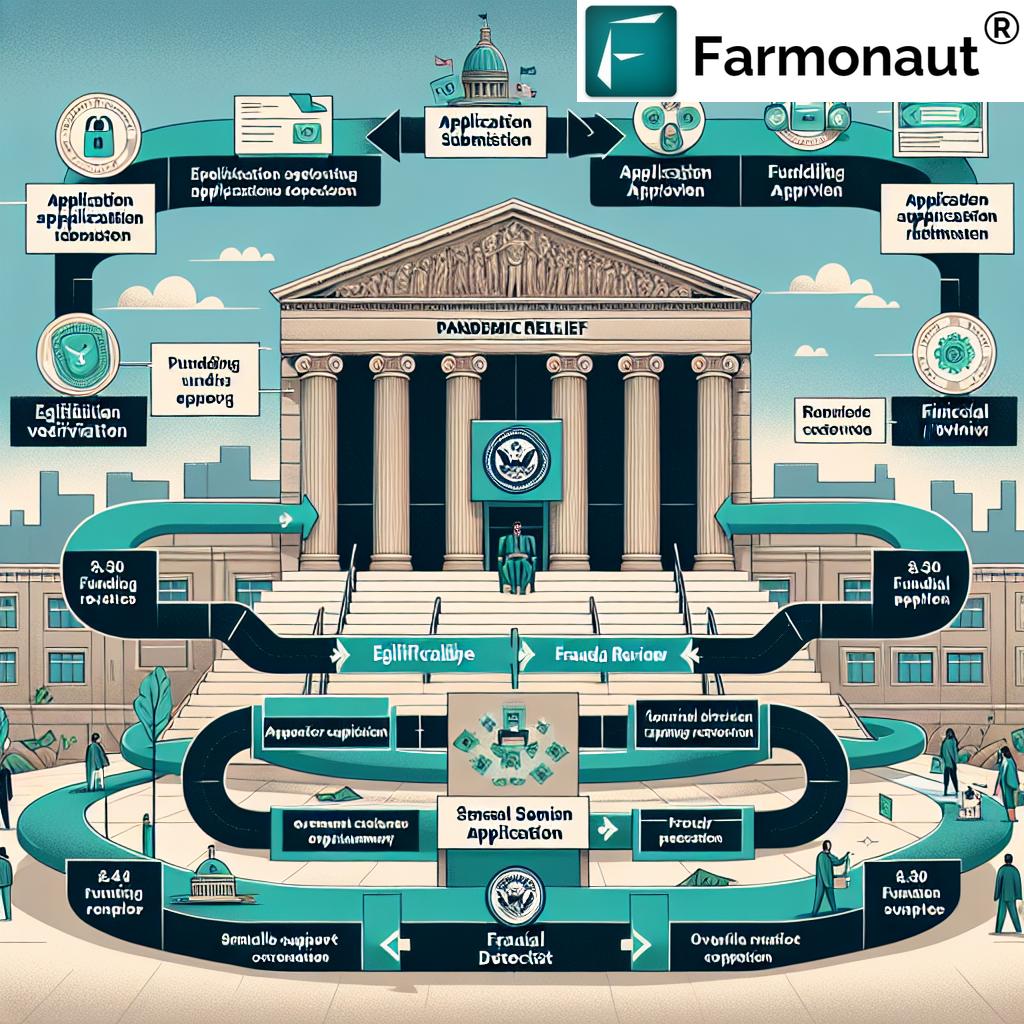

Understanding the CARES Act and Its Relief Programs

To fully grasp the context of Stancioff’s fraud, it’s essential to understand the framework of the COVID-19 relief programs he exploited. The Coronavirus Aid Relief and Economic Security (CARES) Act, enacted on March 29, 2020, was a comprehensive response to the economic devastation caused by the pandemic.

Economic Injury Disaster Loan (EIDL) Program

The EIDL program was designed to provide financial relief to small businesses experiencing temporary loss of revenue due to the COVID-19 crisis. Key features of the EIDL program include:

- Low-interest loans for working capital

- Funds could be used for a variety of business expenses, including payroll, fixed debts, and accounts payable

- Long-term repayment options to keep payments affordable

Paycheck Protection Program (PPP)

The PPP was another crucial component of the CARES Act, aimed at helping small businesses keep their workforce employed during the pandemic. Notable aspects of the PPP include:

- Forgivable loans to small businesses

- Funds primarily intended for payroll costs, but also applicable to rent, utilities, and interest on mortgages

- Administered by the SBA with support from the Department of the Treasury

“The PPP program disbursed $800 billion in forgivable loans to 11.5 million businesses during the pandemic.”

This staggering statistic illustrates the enormous scale of the PPP and its critical role in supporting American businesses during the crisis. However, it also highlights the potential for fraud within such a massive and rapidly deployed program.

Vulnerabilities in the Relief Programs

The case of Yani Stancioff brings to light several vulnerabilities in the COVID-19 relief programs that made them susceptible to fraud:

- Rapid Deployment: The urgent need to distribute funds quickly may have compromised thorough vetting processes.

- Self-Certification: Many aspects of the application process relied on self-reported information, making it easier for unscrupulous individuals to submit false claims.

- Limited Initial Oversight: The sheer volume of applications and the pressure to disburse funds rapidly may have initially limited the ability to conduct in-depth reviews of each application.

- Complex Eligibility Criteria: The nuanced eligibility requirements for different industries and business types may have created opportunities for misrepresentation.

The Impact of Fraud on Legitimate Businesses

While cases like Stancioff’s may seem isolated, they have far-reaching consequences for the business community and the economy at large:

- Depletion of Resources: Every fraudulent claim diverts funds away from legitimate businesses in need.

- Increased Scrutiny: As a result of fraud cases, legitimate applicants may face more rigorous verification processes, potentially delaying much-needed aid.

- Public Trust: Fraud cases can erode public confidence in government assistance programs, potentially discouraging eligible businesses from seeking help.

- Economic Recovery: By misdirecting funds, fraud can slow down overall economic recovery efforts.

Comparison of EIDL and PPP Loan Programs

| Program Features | EIDL | PPP |

|---|---|---|

| Purpose of the loan | Working capital for operating expenses | Primarily for payroll costs |

| Maximum loan amount | Up to $2 million | 2.5x average monthly payroll costs (up to $10 million) |

| Eligibility criteria | Small businesses, nonprofits, agricultural businesses | Small businesses, self-employed individuals, nonprofits |

| Application process | Direct application through SBA website | Application through approved lenders |

| Loan terms | 3.75% for businesses, 2.75% for nonprofits; up to 30 years | 1% interest rate; 2 or 5 years |

| Forgiveness options | Not forgivable | Forgivable if used for eligible expenses |

| Permitted use of funds | Working capital, normal operating expenses | Payroll, rent, utilities, mortgage interest |

| Fraud prevention measures | Self-certification, post-disbursement audits | Lender verification, SBA audits |

This comparison highlights the key differences between the EIDL and PPP programs, providing context for understanding how fraudsters like Stancioff were able to exploit these systems.

The Role of Technology in Fraud Prevention

As we analyze cases like Stancioff’s, it becomes clear that leveraging technology could play a crucial role in preventing future instances of fraud in relief programs. This is where platforms like Farmonaut, while not directly involved in fraud prevention for government programs, demonstrate the potential of technology in enhancing transparency and verification processes.

Farmonaut, a pioneering agricultural technology company, offers advanced, satellite-based farm management solutions. While its primary focus is on improving agricultural practices, the underlying technologies it employs – such as satellite imagery analysis and blockchain-based traceability – showcase how similar approaches could be adapted to verify claims in relief program applications.

For instance, Farmonaut’s use of satellite imagery to monitor crop health and verify farm activities could inspire similar applications in verifying the existence and operations of businesses applying for relief funds. Similarly, the blockchain-based traceability solutions offered by Farmonaut for supply chain transparency could be adapted to create immutable records of business transactions and activities, making it harder for fraudsters to fabricate business histories.

To learn more about how technology can enhance agricultural practices and potentially inspire solutions in other sectors, explore Farmonaut’s offerings:

Lessons Learned and Future Implications

The case of Yani Stancioff and similar instances of COVID-19 relief fraud offer valuable lessons for policymakers, financial institutions, and businesses alike:

- Enhanced Verification Processes: Future relief programs may need to implement more robust verification mechanisms, potentially leveraging technology for real-time data cross-checking.

- Balanced Approach: There’s a need to strike a balance between rapid fund distribution and thorough vetting to ensure aid reaches legitimate businesses quickly while minimizing fraud.

- Ongoing Monitoring: Post-disbursement audits and continuous monitoring of fund usage can help identify and address fraudulent activities promptly.

- Public-Private Partnerships: Collaboration between government agencies and private sector entities could enhance fraud detection capabilities.

- Education and Awareness: Increasing public awareness about the consequences of fraud can serve as a deterrent and encourage reporting of suspicious activities.

The Road Ahead: Strengthening Relief Programs

As we move forward, it’s crucial to apply the lessons learned from cases like Stancioff’s to strengthen future relief programs. This may involve:

- Implementing more sophisticated AI and machine learning algorithms to detect patterns indicative of fraud

- Enhancing interagency cooperation to share data and insights more effectively

- Developing clearer guidelines and more stringent penalties for fraudulent activities

- Investing in technology infrastructure to support more robust verification processes

Conclusion: Balancing Aid and Accountability

The case of Yani Stancioff serves as a stark reminder of the challenges faced in administering large-scale relief programs during times of crisis. While the CARES Act and its associated programs like EIDL and PPP provided crucial support to millions of legitimate businesses, they also became targets for fraudulent activities.

As we reflect on these events, it’s clear that future relief efforts must strike a delicate balance between rapid aid distribution and robust fraud prevention measures. By learning from past experiences and leveraging technological advancements, we can work towards creating more resilient and fraud-resistant support systems for businesses in need.

The fight against COVID-19 relief fraud is ongoing, and cases like Stancioff’s underscore the importance of vigilance, both from authorities and the public. By staying informed and reporting suspicious activities, we can all play a part in ensuring that relief funds reach those who truly need them, supporting genuine economic recovery and resilience in the face of future challenges.

FAQ Section

Q: What are the main differences between EIDL and PPP loans?

A: EIDL loans are designed for working capital and operating expenses, while PPP loans are primarily for payroll costs. EIDL loans are not forgivable, whereas PPP loans can be forgiven if used for eligible expenses.

Q: How can businesses protect themselves from being implicated in relief fraud?

A: Businesses should maintain accurate financial records, thoroughly understand program requirements, and seek professional advice when applying for relief funds. It’s crucial to provide honest and verifiable information in all applications.

Q: What should I do if I suspect someone of committing COVID-19 relief fraud?

A: If you suspect fraud, you should report it to the appropriate authorities. This can include contacting the SBA’s Office of Inspector General, the Department of Justice, or local law enforcement agencies.

Q: Are there ongoing efforts to recover fraudulently obtained relief funds?

A: Yes, federal agencies continue to investigate and prosecute cases of COVID-19 relief fraud. The government is actively working to recover misappropriated funds through legal actions and asset seizures.

Q: How has the government improved fraud prevention in relief programs since the initial rollout?

A: The government has implemented enhanced verification processes, increased interagency cooperation, and leveraged advanced data analytics to better detect and prevent fraudulent activities in relief programs.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Additional Resources

For more information on Farmonaut’s technologies and services:

Stay informed about the latest developments in agricultural technology and how it’s shaping the future of farming:

Learn about Farmonaut’s achievements and innovations:

Discover how Farmonaut is revolutionizing traceability in various industries:

Learn how to effectively use Farmonaut’s image comparison features:

By staying informed and leveraging advanced technologies, we can work towards creating more robust systems that support legitimate businesses while minimizing the risk of fraud in future relief efforts.