Oklahoma’s AI Insurance Revolution: Balancing Innovation and Consumer Protection in the Digital Age

“Oklahoma’s insurance rates are among the highest in the US, with AI potentially influencing future pricing models.”

In the heart of America’s heartland, a technological revolution is quietly reshaping the landscape of the insurance industry. Oklahoma, known for its sprawling plains and unpredictable weather, is now at the forefront of a new frontier: the integration of artificial intelligence (AI) into insurance practices. As we delve into this transformative era, we’ll explore how AI is revolutionizing insurance in Oklahoma, balancing the scales between cutting-edge innovation and crucial consumer protection.

The AI Insurance Revolution: A New Dawn for Oklahoma

The insurance industry in Oklahoma is undergoing a seismic shift, driven by the relentless advance of AI technologies. This shift is not just about automation; it’s about reimagining the very foundations of how insurance operates. From underwriting to claims processing, AI is touching every facet of the insurance value chain, promising increased efficiency, accuracy, and personalization.

However, with great power comes great responsibility. As AI becomes more prevalent in insurance practices, regulators and industry leaders are grappling with a critical question: How can we harness the benefits of AI while ensuring robust consumer protection?

Oklahoma’s Stance: Embracing Innovation with Caution

Oklahoma’s insurance commissioner, Glen Mulready, has set the tone for the state’s approach to AI in insurance. His statement, “With new technologies comes the responsibility to ensure Oklahoma’s industry innovates while maintaining consumer protection,” encapsulates the delicate balance the state is striving to achieve.

This approach aligns with a broader national movement. At least 12 other states and Washington, D.C. have endorsed the National Association of Insurance Commissioners’ (NAIC) model for AI principles. These guidelines emphasize five key concepts: fairness, ethics, accountability, compliance, and transparency.

The Impact of AI on Insurance Rates and Premiums

One of the most significant ways AI is reshaping the insurance landscape is through its influence on rates and premiums. Oklahoma residents are already facing some of the highest insurance costs in the nation:

- Home insurance premiums average $5,711 annually, the third-highest in the U.S.

- Car insurance costs around $2,325 per year, with a sharp 35% increase in 2024 alone.

The integration of AI into insurance pricing models has the potential to dramatically alter these figures. AI’s ability to process vast amounts of data and identify intricate patterns could lead to more accurate risk assessments and, consequently, more personalized pricing.

For consumers, this could mean:

- More tailored premiums based on individual risk profiles

- Potential savings for low-risk individuals

- Increased premiums for those deemed higher risk

However, the use of AI in pricing also raises concerns about fairness and transparency. How can we ensure that AI-driven pricing doesn’t inadvertently discriminate against certain groups? This is where Oklahoma’s regulatory approach becomes crucial.

From “Detect and Repair” to “Predict and Prevent”

The NAIC has highlighted a significant shift in the insurance industry’s operational model. With the advent of AI, we’re seeing a move from a reactive “detect and repair” approach to a proactive “predict and prevent” strategy. This transformation has far-reaching implications for both insurers and policyholders.

For insurers, this shift means:

- Enhanced ability to anticipate and mitigate risks

- Improved operational efficiencies

- Potential reduction in claims frequency and severity

For policyholders, the benefits could include:

- More proactive risk management advice

- Potentially lower premiums for those who engage in preventive measures

- Faster claims processing and payouts

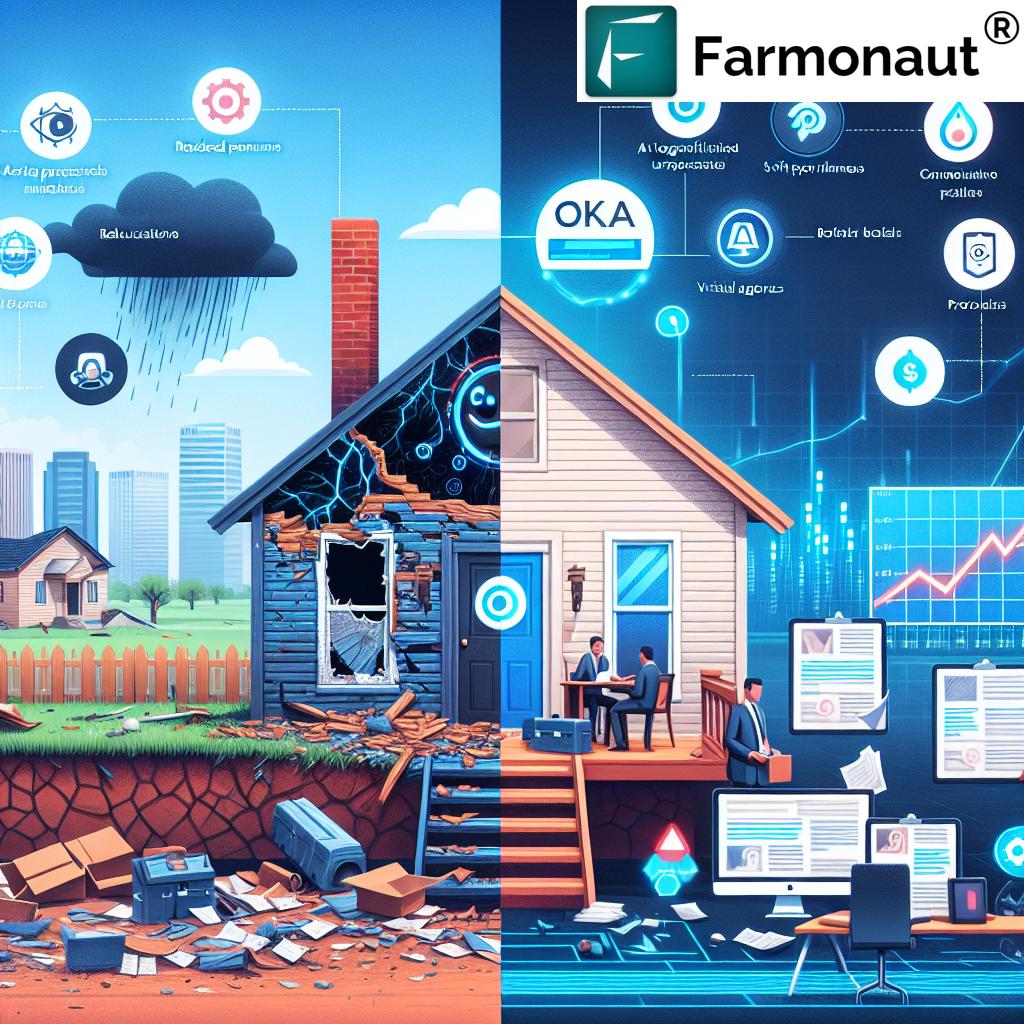

AI’s Role in Claims Processing and Fraud Detection

Two areas where AI is making significant strides in the insurance industry are claims processing and fraud detection. In Oklahoma, where severe weather events like tornadoes and hailstorms are common, efficient claims processing is crucial.

AI is revolutionizing claims processing by:

- Automating initial claims assessments

- Using image recognition to evaluate property damage

- Streamlining the claims workflow to reduce processing times

In fraud detection, AI’s capabilities are equally impressive:

- Pattern recognition to identify potentially fraudulent claims

- Real-time analysis of claims data to flag suspicious activities

- Predictive modeling to anticipate and prevent fraud before it occurs

While these advancements promise increased efficiency and accuracy, they also raise important questions about privacy and fairness. Oklahoma’s regulators are tasked with ensuring that these AI-driven processes comply with existing laws and regulations while protecting consumer rights.

The Data Dilemma: AI’s Lifeblood and Its Challenges

At the heart of AI’s potential in insurance lies data – vast amounts of it. The NAIC describes this data as a “treasure trove” essential for AI’s efficacy. In Oklahoma, as in the rest of the country, insurers are leveraging this data to:

- Enhance customer engagement

- Identify suitable products for specific demographics

- Tailor marketing strategies

However, the collection and use of this data present significant challenges:

- Privacy concerns: How much personal data should insurers have access to?

- Data security: Protecting sensitive information from breaches and cyber attacks

- Algorithmic bias: Ensuring AI models don’t perpetuate or exacerbate existing biases

Oklahoma’s regulators are keenly aware of these challenges. Their approach to AI governance must balance the industry’s need for data with consumers’ right to privacy and fair treatment.

“The National Association of Insurance Commissioners has established AI principles emphasizing fairness, ethics, and transparency in insurance practices.”

Consumer Protection in the Age of AI

As AI becomes more prevalent in Oklahoma’s insurance industry, consumer protection remains paramount. The state’s regulatory approach focuses on several key areas:

- Transparency: Ensuring consumers understand how AI influences their insurance policies and premiums

- Fairness: Preventing discrimination and ensuring equitable treatment

- Accountability: Holding insurers responsible for the outcomes of their AI-driven decisions

- Privacy: Protecting consumers’ personal data from misuse or unauthorized access

These principles align closely with the NAIC’s guidelines, demonstrating Oklahoma’s commitment to responsible AI adoption in the insurance sector.

The Future of AI in Oklahoma’s Insurance Landscape

As we look to the future, it’s clear that AI will play an increasingly significant role in Oklahoma’s insurance industry. The potential benefits are substantial:

- More personalized insurance products

- Faster, more efficient claims processing

- Enhanced risk management and loss prevention

- Improved customer service through AI-powered chatbots and virtual assistants

However, realizing these benefits while safeguarding consumer interests will require ongoing collaboration between insurers, regulators, and technology providers. Oklahoma’s approach to AI in insurance could serve as a model for other states grappling with similar challenges.

AI Impact on Oklahoma Insurance Industry

| Insurance Aspect | Traditional Approach | AI-Driven Approach | Potential Impact on Consumers |

|---|---|---|---|

| Underwriting Process | Manual review of applications and risk factors | Automated analysis of vast data sets for risk assessment | Faster application processing, potentially more accurate risk pricing |

| Claims Processing | Manual inspection and assessment | Automated assessment using image recognition and data analysis | Faster claims resolution, potential for bias in automated systems |

| Fraud Detection | Rule-based systems and manual reviews | Machine learning algorithms to identify patterns and anomalies | Reduced fraudulent claims, lower premiums, but potential for false positives |

| Customer Service | Phone and email support | AI-powered chatbots and virtual assistants | 24/7 support availability, but potential loss of human touch |

| Risk Assessment | Based on historical data and broad categories | Real-time data analysis and predictive modeling | More personalized risk profiles, but concerns about data privacy |

| Premium Pricing | Based on broad risk categories | Dynamic pricing based on individual behavior and real-time data | Potentially lower premiums for low-risk individuals, but higher for others |

Access Farmonaut’s comprehensive API Developer Docs for seamless integration.

Balancing Act: Innovation vs. Consumer Rights

As Oklahoma navigates the AI revolution in insurance, the state faces a delicate balancing act. On one side, there’s the promise of innovation – more efficient processes, personalized products, and potentially lower costs for some consumers. On the other, there’s the imperative to protect consumer rights, ensure fairness, and maintain the integrity of the insurance market.

Key considerations in this balancing act include:

- Regulatory flexibility: Allowing room for innovation while maintaining robust consumer protections

- Transparency requirements: Ensuring insurers clearly communicate how AI influences their decisions

- Data governance: Establishing clear guidelines for the collection, use, and protection of consumer data

- Ethical AI development: Encouraging the development of AI systems that are fair, unbiased, and accountable

Oklahoma’s approach to these challenges could set important precedents for the insurance industry nationwide.

The Role of Consumer Education

As AI becomes more prevalent in insurance, consumer education will play a crucial role. Oklahoma’s regulators and insurers have a responsibility to help consumers understand:

- How AI influences their insurance policies and premiums

- Their rights regarding data privacy and algorithmic decision-making

- The benefits and potential risks of AI-driven insurance products

By empowering consumers with knowledge, Oklahoma can help ensure that the benefits of AI in insurance are realized while minimizing potential harm.

Conclusion: A New Era for Oklahoma Insurance

As we stand on the brink of this AI-driven revolution in Oklahoma’s insurance industry, it’s clear that the landscape is changing rapidly. The potential benefits of AI – from more personalized policies to faster claims processing – are significant. However, realizing these benefits while protecting consumer rights will require ongoing vigilance, collaboration, and innovation.

Oklahoma’s approach to balancing AI innovation with consumer protection could serve as a model for other states and industries grappling with similar challenges. As we move forward, it will be crucial to maintain an open dialogue between insurers, regulators, technology providers, and consumers to ensure that the AI revolution in insurance truly serves the needs of all Oklahomans.

The future of insurance in Oklahoma is undoubtedly AI-powered, but it’s up to all stakeholders to ensure that this future is fair, transparent, and beneficial for all.

FAQs

- How is AI changing the insurance industry in Oklahoma?

AI is revolutionizing various aspects of insurance, including underwriting, claims processing, fraud detection, and customer service. It’s enabling more personalized policies, faster claim resolutions, and potentially more accurate risk assessments. - Will AI lead to lower insurance premiums in Oklahoma?

AI could lead to more personalized pricing, which may result in lower premiums for some consumers, particularly those deemed low-risk. However, it could also lead to higher premiums for others. - How is Oklahoma ensuring consumer protection with AI in insurance?

Oklahoma is following the NAIC’s AI principles, emphasizing fairness, ethics, accountability, compliance, and transparency in the use of AI in insurance. - What are the potential risks of AI in insurance?

Potential risks include algorithmic bias, privacy concerns related to data collection, and the possibility of unfair discrimination in pricing or underwriting decisions. - How can consumers in Oklahoma prepare for AI-driven changes in insurance?

Consumers should stay informed about how AI is used in their policies, understand their rights regarding data privacy, and be prepared to ask questions about how AI influences their insurance rates and coverage.

Earn With Farmonaut: Join our affiliate program and earn 20% recurring commission by helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

As we embrace the AI revolution in Oklahoma’s insurance industry, tools like Farmonaut are leading the way in applying advanced technologies to solve real-world problems. While Farmonaut’s focus is on agricultural technology rather than insurance, it exemplifies how AI and satellite technology can be leveraged to provide valuable insights and improve decision-making processes.

Explore Farmonaut’s innovative solutions: