Tariff Impact on US Consumer Prices: 7 Key Inflation Trends for 2024

1. Introduction: Understanding Tariff Impact on Consumer Prices

2. Consumer Price Index Trends & Economic Background

3. The 7 Key Inflation Trends Shaping US Prices in 2024

4. How Import Duties and Inflation Shape the Cost of Goods in the US

5. Trade Agreement Effects on the US Economy

6. Federal Reserve Inflation Policy Amid Tariffs & Price Hikes

7. Year-on-Year Tariff Impact Comparison Table

8. Consumer Strategies: Coping With Price Hikes from Tariffs

9. Farmonaut: Data-Driven Innovation in Agricultural Economics

10. FAQ: Tariffs, Inflation, and Consumer Prices

Introduction: Understanding Tariff Impact on Consumer Prices

As we navigate 2024, the United States finds itself at the crossroads of economic policy and everyday affordability. Tariffs and import duties have emerged as critical levers, shaping the prices we all pay as consumers. The “tariff impact on consumer prices” is no longer just a topic for economists in Washington—it’s influencing inflation, grocery prices, clothing, household goods, and even the vehicles we drive. With the US consumer price index acting as a bellwether, each new round of tariffs, import taxes, or trade agreement ripples through our economy and budget.

In this comprehensive analysis, we explore how US tariffs and inflationary trends are affecting goods, the economic outlook, and what the latest data tells us. We’ll address which prices are rising, which may soon follow, and how these changes are reflected in core inflation rates. We also examine the critical role of the Federal Reserve, and what new trade agreements mean for our wallets and national economic health.

Key Takeaways:

- Tariffs and duties imposed by US policy have direct and indirect impacts on consumer prices and inflation.

- Recent months reveal a pattern: each tariff hike triggers a chain reaction across various goods, from groceries to autos.

- Trade agreements offer short-term relief, but US average import taxes are at their highest in over 90 years.

- Economic institutions—including the Federal Reserve—face new challenges as they try to balance rates, unemployment, and inflation.

Consumer Price Index Trends & Economic Background

The Consumer Price Index (CPI) is the US economy’s inflation dashboard. In April 2024, CPI data reveals a modest, but significant year-on-year price increase, with consumer prices rising 2.4% compared to a year earlier. This slight uptick comes against a backdrop of presidential tariff policies and shifting trade agreements.

As of April, monthly inflation rates are picking up: core prices (excluding food and energy) are forecast to have risen 2.8% annually, mirroring March’s pace but up from the historically low levels seen at the Fed’s target in recent months. The core inflation rate serves as a crucial gauge, removing volatile categories for clearer trend analysis—and it’s here that the true impact of tariffs and import duties becomes evident.

Historically, tariffs have been used as tools for economic leverage—sometimes to protect domestic industries, sometimes as negotiating chips in trade deals. In the last 12 months, the United States has seen multiple instances of broad-based duties, especially on imports from China, Mexico, and Canada. When these duties are imposed or changed, they not only affect direct competitors but also cascade across supply chains, influencing the cost of goods from raw materials to finished products.

The 7 Key Inflation Trends Shaping US Prices in 2024

Let’s break down the seven most influential trends (“inflation and grocery prices,” “core inflation rates,” and more) guiding the story of US consumer prices in 2024.

-

Tariff Hikes and Product-Specific Price Spikes

US tariffs on goods—including essentials like clothing, shoes, furniture, and groceries—have led to direct price hikes due to tariffs. For example, agricultural goods from Mexico and Canada saw new duties in early 2024, pushing food and produce costs higher. Similarly, import taxes on electronics and autos caused significant monthly surges. -

Supply Chain Delays Lengthen Price Transmission

Economists note that the effect of new tariffs can take months to filter through the system. Existing inventory, goods already in transit, or strategic stockpiling may temporarily insulate consumers, but ultimately, price increases reach the end-user. April’s data starts to reflect these delayed shocks in the “consumer price index trends.” -

Import Duties and Inflation Feed Each Other

Higher import duties elevate the cost of goods in the US, causing inflationary pressure, especially when passed on to the consumer. Companies attempt to stagger price hikes, testing consumer resistance, which leads to a volatile price environment. -

Trade Agreements Bring Temporary Relief, Not Resolution

President Trump’s recent deals, such as with China, reduced certain duties (145% to 30%). Despite these reductions, combined import taxes (universal tariffs, autos, steel, aluminum) keep the average US duty at a near-century high. Economists forecast this will slow economic growth while still inflating goods costs. -

Budget Constraints Temper Demand (Especially for Low- and Middle-Income Households)

Price hikes due to tariffs are met with resistance: financially stretched consumers are less likely to accept increases. As a result, some companies delay passing on tariff costs, hoping for policy relaxation or inventory sell-through. -

Sectoral Variation: Groceries and Autos Rise Faster Than Others

Not all price hikes are created equal. Grocery prices have increased two of the past three months. Auto sales (and prices) surged as US consumers rushed to beat upcoming auto and parts tariffs, resulting in less promotional discounting by dealers. -

Federal Reserve Dilemma: Balancing Rates, Inflation, and Unemployment

Tariffs force the Federal Reserve into a difficult policy position: raising rates to fight inflation, or cutting them to combat rising unemployment. April’s inflation data means the Reserve may need to hold rates steady, despite risks of slower economic growth.

How Import Duties and Inflation Shape the Cost of Goods in the US

The relationship between tariff policy, import duties, and inflation in the United States is dynamic and multi-layered. Let’s break down how these forces affect consumer prices across sectors:

-

Clothing & Apparel:

Increased duties on textiles, clothing, and shoes took effect early 2024. Import-dependent retailers faced higher import taxes, and by April, certain apparel prices rose over 5% compared to last year. -

Furniture & Electronics:

The imposition of new tariffs on furniture imports from China, and duties on electronics, have raised prices for US households, driven partly by a 12% rise in electronic goods duties. -

Groceries & Agricultural Goods:

The ripple effect of tariffs on agricultural imports—including produce, dairy, and staples—has contributed to a more pronounced inflation and grocery prices trend. April’s CPI data shows groceries up, even as other consumer goods prices temporarily fell the prior month.

Companies relying on cross-border food supplies from Mexico and Canada have seen increased operational costs due to duties imposed in February and March. -

Auto Industry:

With the announcement of new tariffs, auto sales temporarily spiked as consumers tried to purchase ahead of price increases. Once existing inventory is depleted, prices are forecast to accelerate, especially if further bilateral deals aren’t reached. -

Necessities Beyond Essentials:

Basic goods, cleaning products, and building materials have all been caught up in the complex web of tariffs and inflation. The result? Budgets for middle-income and low-income consumers are stretched, with higher prices on everything from bedding to pots and pans.

It’s clear that tariffs imposed in Washington have created a staggered pattern of price increases, bringing uncertainty for both businesses and consumers. Firms remain unsure exactly how much of the tariff cost increase they can pass through without hurting demand, echoing the view expressed by Macro Policy Perspectives: testing the waters, observing demand elasticity, and incrementally raising prices over months.

Trade Agreement Effects on the US Economy & Ongoing Inflation

The recent trade agreement between the US and China in April—reducing duties from 145% to 30% on various imported goods—was a headline-grabber. On paper, it lowers direct tax burdens on certain imports, but the combined effect of enduring tariffs (including a 10% universal import tax, and much higher rates on autos, steel, and aluminum) means the “tariff impact on consumer prices” will persist throughout 2024.

For context, The Yale Budget Lab estimates that average US tariffs will remain at 18%—the highest level since 1934—even after the China deal. The same study calculates that these tariffs will lift consumer prices by approximately 1.7%, an increase directly impacting the average household budget by nearly $2,800 per year.

Trade agreements, then, act as partial safety valves: offering momentary reprieve and slowing, but not fully reversing, inflationary forces caused by past and current import duties.

- Import volume shifts: Many companies accelerate purchases prior to new tariff implementation, creating short-term spikes in imports and subsequent lulls that disrupt supply chains and inventory planning.

- Consumer price index (CPI) trends: The CPI reflects these distortions, with sharp upward moves in price categories following major policy announcements.

- Demand elasticity tests: Firms regularly ‘test the waters’ to identify the break point where price increases slow sales, a process that results in a stepwise, rather than smooth, pass-through of tariff-related costs.

How Data-Driven Farm Management Mitigates Tariff Impact

Innovative solutions—like those provided by Farmonaut’s satellite-based agricultural technologies—are helping stakeholders adapt to volatile input prices and cost increases stemming from trade and tariff changes.

- Product Traceability Solutions allow supply chains to maintain transparency and authenticity, critical when dealing with fluctuating international tariffs and safeguarding consumer trust.

- Fleet & Resource Management Tools from Farmonaut support agribusinesses in optimizing logistics, helping to counterbalance increased transportation costs from import duties by maximizing vehicle efficiency and reducing wastage.

- Carbon Footprinting features empower agricultural businesses to track and manage their environmental impact, which is becoming increasingly important as sustainability and compliance influence trade negotiations and international economic policy.

Federal Reserve Inflation Policy Amid Tariffs & Price Hikes

The Federal Reserve, as the US’s monetary authority, is on a tightrope. Chair Jerome Powell recently acknowledged that tariffs and ensuing inflation trends have placed the economy at a rare intersection: simultaneously facing upward pressure on consumer prices and increased risk of unemployment.

Normally, the Reserve would cut rates to combat rising unemployment or raise them to curb inflation. However, tariffs and their cost-driven inflation complicate this calculus. If inflation persists above target levels (CPI near 2.4% annually with potential for further increases), interest rates may need to remain elevated, slowing growth.

Some of the most acute tension can be seen in:

- Conflicting pressures from consumer price index changes—where rates should ideally move in opposite directions depending on stimulus or tightening goals;

- Policy uncertainty generated from frequent and unpredictable tariff imposition and trade deal renegotiations.

One critical API for real-time satellite and weather data can help agricultural and economic researchers model the interplay of policy, agriculture productivity, and consumer costs. Farmonaut’s API Developer Documentation makes this integration seamless for external analytics and forecasting tools.

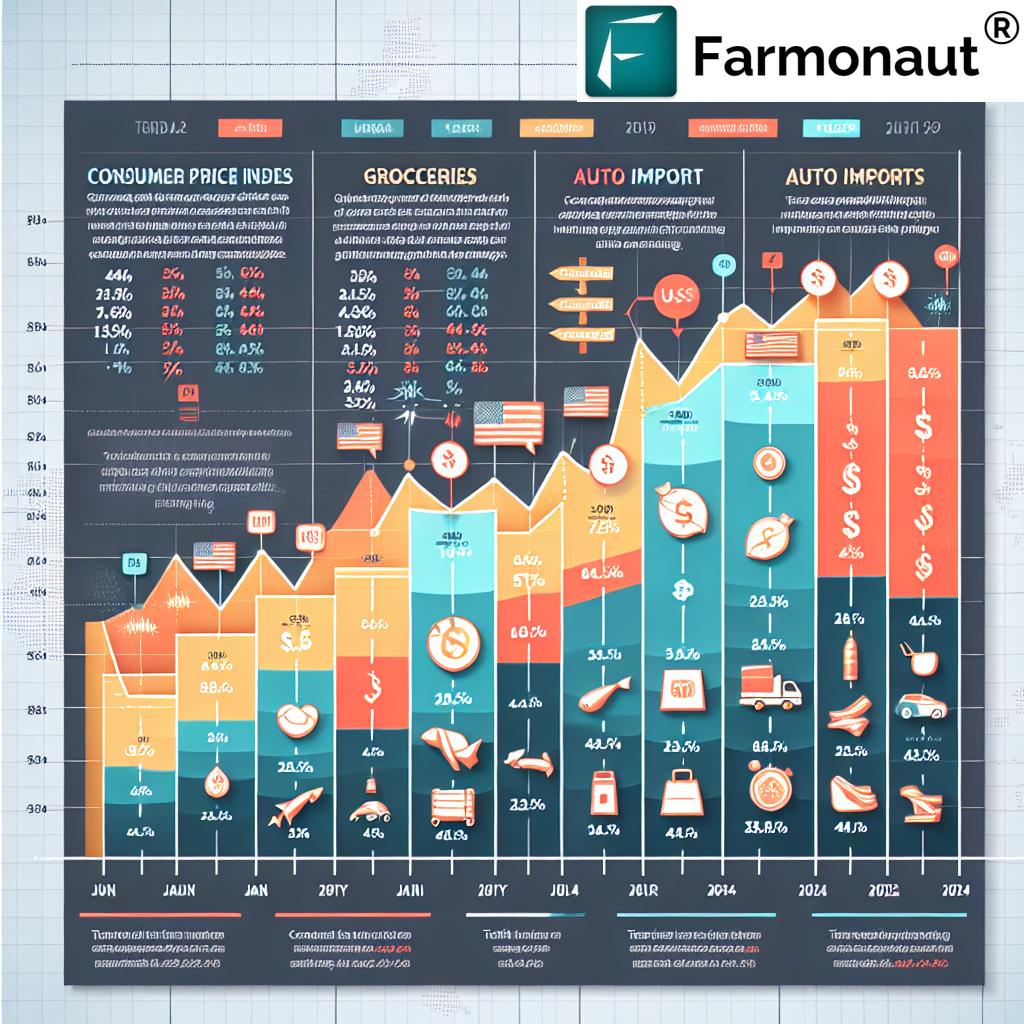

Year-on-Year Tariff Impact Comparison Table: Consumer Price Shifts 2023–2024

The following table compares key sectors affected by US tariffs on goods, tracking 2023’s rates, current trends, and estimates for 2024. These figures aggregate publicly available CPI data, economic forecasts, and reflect the ongoing “tariff impact on consumer prices” as related to import duties and inflation.

| Product Category | 2023 Avg. Tariff Rate (%) | 2024 Est. Tariff Rate (%) | 2023 Avg. Price Increase (%) | 2024 Est. Price Increase (%) | Key Inflation Drivers |

|---|---|---|---|---|---|

| Electronics | 15 | 18 | 3.2 | 4.5 | Import Duties, Supply Chain Costs |

| Apparel (Clothing & Shoes) | 10 | 14 | 4.5 | 5.8 | Tariffs, Import Taxes, FX Volatility |

| Groceries | 8 | 12 | 5.7 | 6.2 | Agricultural Tariffs, Transportation |

| Furniture | 12 | 16 | 2.9 | 4.2 | China Import Duties, Logistics |

| Autos & Car Parts | 20 | 24 | 5.1 | 6.3 | Auto/Supply Chain Tariffs, Consumer Demand |

| Misc. Necessities | 11 | 14 | 2.6 | 3.4 | Broad Tariff Coverage, Import Delays |

The numbers show that tariff increases imposed since early 2023 are directly tied to higher consumer price increases by mid-2024. As we see, price hikes due to tariffs are now a fixture in budgeting for both households and businesses.

Consumer Strategies: Coping With Price Hikes from Tariffs

Given that US tariffs on goods and ongoing inflation now affect product categories from “necessities” to luxury purchases, what can consumers (and the businesses serving them) do? Here are several evidence-backed strategies to help mitigate the “tariff impact on consumer prices”:

- Time Major Purchases: Buy goods like electronics and autos ahead of scheduled tariff enforcement, when possible, to avoid the worst of anticipated price increases.

- Shift to Domestic Alternatives: Where feasible, substitute imported products with US-made alternatives to bypass tariff surcharges.

- Monitor Promotional Offers: Retailers may offer deals or discounts ahead of or in response to tariff-driven price hikes to retain demand during policy transitions.

- Stretch Budget With Bulk Buying: For consumer basics and groceries, purchasing staple items in bulk before the full effect of new import duties and inflation sets in can help households manage monthly expenses.

- Leverage Smart Data Tools for Businesses: For agribusinesses and supply chain managers, adopting advanced satellite and AI-driven solutions (such as those from Farmonaut) can provide better forecasting and adaptive management, counteracting supply disruptions and resource cost increases.

Farmonaut: Data-Driven Innovation in Agricultural Economics

Rising tariffs and inflation aren’t just numbers on government spreadsheets—they carry tangible impacts for farmers, agribusinesses, and end consumers. Farmonaut, as a pioneering agricultural technology provider, helps individuals and organizations turn data into actionable insights in an era of volatile global trade.

- Real-Time Crop Health Monitoring: Farmonaut’s satellite-driven platform supplies individual and large-scale growers with precise NDVI-based vegetation analysis, soil moisture trends, and pest risk detection. These data streams help farmers optimize input use, improving margins even when prices for goods and duties on imports fluctuate.

- AI-Powered Advisory: Through the Jeevn AI System, farmers and agribusinesses gain tailored recommendations based on real-time weather, crop, and soil data, supporting both productivity and cost-saving strategies as inflation and goods prices climb.

- Blockchain-Based Traceability: In a world of complex supply chains and growing demand for transparency, Farmonaut’s traceability solution builds consumer trust, enhances logistics, and helps businesses demonstrate compliance as tariffs, taxes, and international regulations change.

- Fleet and Resource Management: Fleet management tools support cost-cutting and operational efficiency, crucial as import taxes and inflation drive up logistics expenses for agribusinesses.

- Carbon Footprinting for Sustainability: Farmonaut’s digital carbon tracking aids compliance with environmental standards—often a condition for trade agreements that can influence tariffs and access to markets.

- Financial Empowerment: By partnering with financial institutions, Farmonaut’s satellite-based crop verification helps streamline crop loan approvals and minimize insurance fraud—directly strengthening the economic resilience of US farmers as tariffs and duties disrupt traditional financial flows. See more at Crop Loan & Insurance Solutions.

Learn More about Large Scale Farm Management with Farmonaut

FAQ: Tariffs, Inflation, and Consumer Prices

How do tariffs specifically impact US consumer prices?

Tariffs (import duties or taxes) increase the cost of importing goods into the US. Businesses may absorb part of the increase, but much is passed on to consumers through higher prices, particularly as companies “test the waters” to see what the market will bear. Over time, these costs accumulate, raising the consumer price index and fueling inflation.

Why is the impact on prices sometimes delayed?

Goods already in the supply chain—in transit or in stock—are not subject to new tariffs, so price increases are phased in over several months. Companies may also build inventory ahead of tariffs. As that inventory sells through, new, higher-priced goods fill the shelves.

What is the role of the Federal Reserve in managing inflation and tariffs?

The Federal Reserve sets interest rates to control inflation and support employment. Tariffs complicate this: if tariffs drive up prices (inflation), but also hurt jobs (unemployment), the Reserve faces a tough choice between lowering rates to aid the economy or keeping rates high to combat inflation.

Did recent trade agreements help reduce inflation?

Yes and no. Recent deals, such as the US-China tariff reductions, provide temporary relief by lowering direct import duties. However, the combined effect of previous and remaining tariffs means that consumer prices are still likely to climb. Budget impact studies show tariff-related costs remain well above long-term averages.

How can data-driven farm management tools help deal with tariff and inflation volatility?

Technologies like Farmonaut’s platform allow farmers and agribusinesses to optimize crop health, manage resources, and enhance supply chain traceability, thereby improving efficiency, cutting costs, and increasing resilience to import price volatility. These solutions are particularly impactful in sectors like agriculture, where tariffs can rapidly change the economics of production and international trade.

Conclusion: The Road Ahead

The tariff impact on US consumer prices is multifaceted—affecting inflation, consumer budgets, goods costs, and even national economic policy. As we move through 2024, import duties and inflation trends continue to intersect, shaped by domestic policy, international agreements, and the adaptability of both businesses and consumers.

Our reading of the data suggests that preparedness, flexibility, and innovation—powered by real-time information and advanced technology—will be the keys to navigating the uncertainties ahead. Whether you’re a household evaluating your next big purchase, a retailer strategizing on inventory, or a farmer leveraging Farmonaut for smart management, staying informed and agile is paramount.

To experience the power of satellite-based analytics, crop monitoring, and actionable agricultural data, click the links below:

Stay updated with the latest industry trends, policy changes, and technological advancements—because in today’s economy, knowledge is not just power, it’s savings.