Table of Contents

- Introduction: The Role of Greenhouse Insurance in Agriculture

- Understanding Greenhouse Insurance: Basics & Policy Types

- Top 5 Ways to Safeguard Greenhouse Assets

- Top 5 Greenhouse Insurance Options & Coverage Comparison

- Industry Trends and Agricultural Risk Management

- Government Programs Supporting Greenhouse Insurance

- Selecting the Right Greenhouse Insurance Provider

- Farmonaut: Satellite Technology’s Role in Greenhouse Risk Management

- Frequently Asked Questions: Greenhouse Insurance

- Conclusion: Strengthening Protection for the Future

“Over 60% of greenhouse operators now consider insurance essential for risk management, reflecting a major industry trend in 2024.”

Greenhouse Insurance: Top 5 Ways to Safeguard Assets

In the evolving landscape of modern agriculture, greenhouses have become pillars of innovation, providing controlled environments that maximize crop yields, extend growing seasons, and protect against many of nature’s unpredictable variables. With these advantages, however, come a unique set of risks—from severe natural disasters like storms and hail, to equipment breakdown, physical damage, and swift outbreaks of crop-threatening diseases. Protecting these vital operations and the significant investments they represent requires robust risk management strategies, with greenhouse insurance emerging as a foundational component.

As we navigate through an era where both technology and climate exert increasing influence on agriculture, understanding, selecting, and optimizing insurance policies for greenhouse growers becomes paramount. Our comprehensive guide delves into the critical facets of greenhouse insurance—ranging from crop protection and agricultural risk management to emerging industry trends, government-backed programs, and selection tips for the right insurance provider.

Understanding Greenhouse Insurance: Basics & Policy Types

At its core, greenhouse insurance is a specialized branch of agricultural risk management, offering a suite of policies designed to protect commercial and specialty greenhouse operations from the multitude of hazards that could undermine both structures and crops.

Here’s a breakdown to help us understand greenhouse insurance coverage areas and why each is vital to protecting greenhouse investments:

- Property Damage: Protects the greenhouse structure, attached fixtures, and critical equipment (heating, ventilation, irrigation systems) from damage caused by storms, fire, vandalism, and more.

- Crop Loss: Offers financial protection for investments in seeds, labor, and production, compensating for losses resulting from natural disasters, diseases, or adverse environmental events.

- Liability: Safeguards the operation from claims arising if injuries or damages occur on the premises, covering medical fees and legal expenses.

- Business Interruption: Covers income loss and ongoing expenses if the greenhouse business is temporarily stopped due to a covered instance (fire, flood, etc.).

- Equipment Breakdown: Pays for repair or replacement costs when major systems break down, ensuring minimal disruption to operations.

Types of Greenhouse Insurance Policies

Let’s explore the main insurance policies for greenhouse growers in greater detail:

-

Property Insurance for Greenhouses

- Covers: Structure of the greenhouse, attached fixtures, building, and inventory (equipment, tools, critical supplies).

- Purpose: Pays repair or replacement costs after physical damage from covered perils—storms, fires, or vandalism.

-

Crop Insurance for Greenhouses

- Shields investments in crops from losses caused by natural disasters, pest outbreaks, or sudden disease.

- Ensures financial security for the time, seeds, and labor spent during each growing cycle.

-

Liability Coverage for Greenhouse Operations

- Protects against claims if a visitor, worker, or contractor suffers injuries or damages on-site.

- Covers medical fees, legal costs, and, if necessary, settlement compensation.

-

Business Interruption Insurance for Agriculture

- Compensates for income lost when incidents force the operation to a halt.

- Helps cover expenses—like salaries and utilities—during the downtime.

-

Greenhouse Equipment Coverage

- Ensures that when critical systems (heating, ventilation, irrigation) fail, the repair or replacement costs are covered.

- Minimizes operational downtime and limits impact on crop health.

Each of these insurance types serves as a dedicated safeguard, collectively enabling us to build a resilient, future-ready operation capable of withstanding the dynamic risks inherent in greenhouse agriculture.

Top 5 Ways to Safeguard Greenhouse Assets With Insurance

Knowing which insurance solutions are most effective can be transformative for our greenhouse business. Here are the top five strategies and policy components every operator should consider:

-

Comprehensive Property Insurance for Greenhouses

- Protects all physical assets—building, structure, equipment, fixtures, inventory—from damage or loss caused by external events (storms, fire, vandalism).

- Best for: Greenhouses in regions prone to severe weather or with high-value infrastructure.

-

Targeted Crop Insurance for Greenhouses

- Covers financial losses related to crops impacted by uncontrollable circumstances—from disasters to viral diseases.

- Critical for: Farms focusing on specialty or organic commodities.

-

Greenhouse Equipment Coverage

- Insures the repair or immediate replacement of major operational systems (irrigation, heating, ventilation) to maintain seamless production.

- Recommended for: Operations with automated or expensive equipment.

-

Business Interruption Insurance for Agriculture

- Ensures business continuity by covering income loss and fixed expenses during downtime caused by covered incidents.

- Essential for: Large-scale, commercial, or multi-site greenhouse businesses.

-

Strong Liability Coverage for Greenhouse Operations

- Provides protection from unexpected legal claims relating to injuries, accidents, or damages occurring on premises.

- Vital for: Any greenhouse with employees, contract workers, or frequent visitors.

A strategic blend of these policies forms the cornerstone of agricultural risk management for greenhouses worldwide.

“Global greenhouse insurance policies grew by 35% in the past three years, highlighting rising awareness of agricultural risk.”

Top 5 Greenhouse Insurance Options & Coverage Comparison

Making an informed choice starts with a clear side-by-side analysis. Below, we present a carefully designed table comparing the top greenhouse insurance options based on scope, coverage, limits, and other critical details.

| Insurance Provider / Policy | Coverage Type | Estimated Coverage Limit ($) | Deductible Amount ($) | Notable Exclusions | Estimated Premium Range ($/year) | Availability |

|---|---|---|---|---|---|---|

| AgriSecure Comprehensive Greenhouse Policy | Structure, Crops, Equipment, Business Interruption | Up to 2M | 5,000 – 10,000 | Negligence, pre-existing damage, intentional acts | 8,000 – 20,000 | National |

| Farmers Mutual Crop Insurance | Crop Loss, Physical Damage | Up to 1M | 2,500 – 5,000 | Uninsurable pests, chronic diseases | 3,000 – 8,000 | Regional |

| Controlled Environment Program (USDA) | Plants Under Controlled Environment, Disease, Structure | Up to 500,000 | 500 – 1,000 | Non-covered varieties, willful misconduct | 1,500 – 4,000 | National |

| EquipmentPro Breakdown Insurance | Heating, Ventilation, Irrigation Systems | Up to 500,000 | 2,000 – 4,000 | Wear & tear, lack of maintenance | 1,000 – 6,000 | National |

| Whole-Farm Revenue Protection (WFRP) | Multi-Commodity, Revenue-Based, Business Interruption | Up to 17M | 5% – 10% of insured revenue | Intentional illegal acts, unreported commodities | 2,000 – 15,000 | National |

Looking to minimize claims and maximize access for crop insurance and loans?

Explore how Farmonaut’s satellite data verification streamlines insurance and crop loan approvals—improving efficiency, accuracy, and reducing risk for growers and lenders.

Industry Trends and Agricultural Risk Management for Greenhouses

Our approach to agricultural risk management is continually shaped by both rapid technological change and shifting industry expectations. Let’s examine current trends redefining greenhouse insurance:

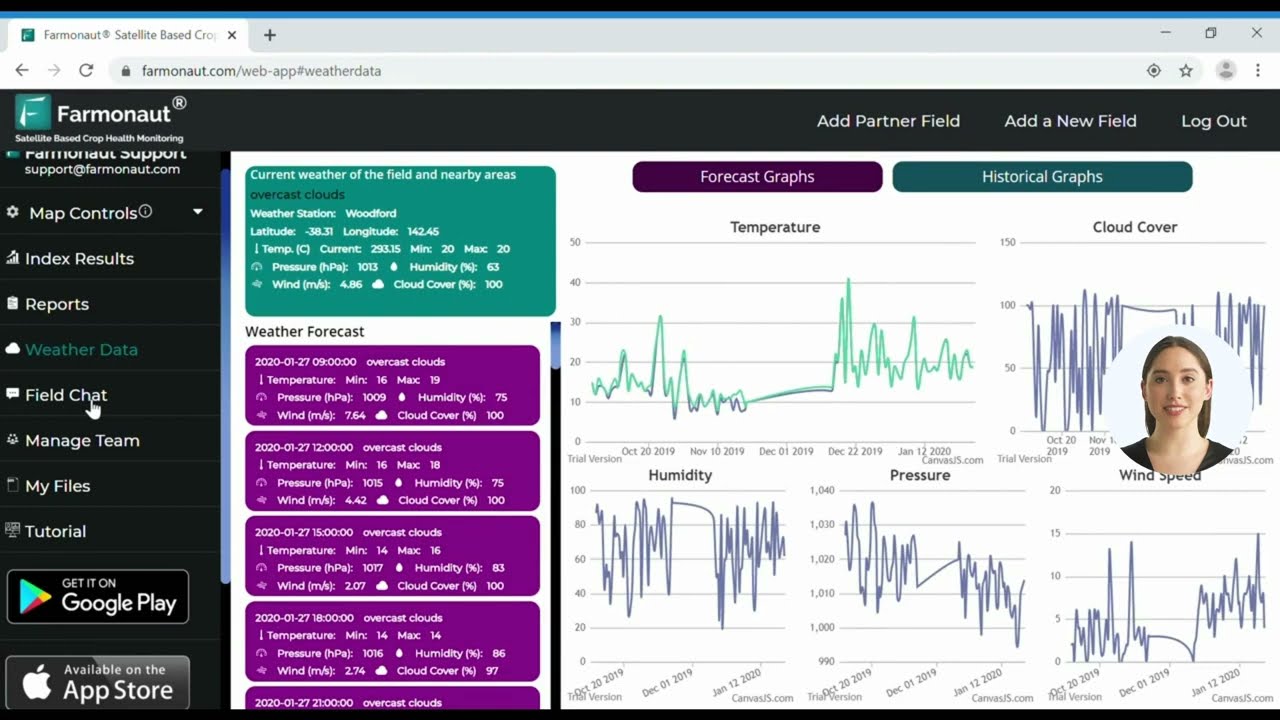

- Technology Integration:

Insurers and growers alike are turning to technology—especially digital policy management portals, claims tracking, and automated notifications—for increased operational efficiency and transparency. - Big Data Utilization:

By harnessing big data, insurance providers can assess risks using live weather information, remote crop health metrics, and historical claims analysis to refine pricing and policy design. - Policy Customization:

There’s a pronounced shift toward insurance for controlled environment agriculture, featuring tailored limits, add-ons for rare perils, and flexible deductible structures that meet the unique operational needs of each greenhouse. - Blockchain-Based Traceability:

Blockchain—like the solutions offered by Farmonaut—is transforming how insurance and compliance data are recorded, ensuring transparency, security, and authenticity across the agricultural supply chain.

- Sustainability and ESG Compliance:

With rising focus on sustainability, greenhouse operators are adopting carbon footprint tracking. Learn more about carbon monitoring with Farmonaut for enhanced environmental reporting and compliance.

Embracing these industry trends not only bolsters protection against risks but also positions our operations for higher revenue and lower overall costs long-term.

Government Programs and Initiatives: Expanding Greenhouse Insurance Coverage

Governments worldwide recognize the need for robust insurance frameworks to protect greenhouse producers and advance controlled environment agriculture. In the United States, several innovative programs are available:

-

USDA’s Controlled Environment Program

- Launched in 2024, this policy offers insurance to plants grown in fully enclosed greenhouses, providing coverage against plant diseases subject to government destruction orders.

- It is tailored for urban, organic, and specialty crop growers, helping diversify the insurance landscape for new and small-scale businesses.

- Learn more at Greenhouse Grower.

-

Whole-Farm Revenue Protection (WFRP)

- A unique offering that provides a risk management safety net for all commodities on a farm, protecting up to $17 million in insured revenue under one policy.

- Ideal for organic, specialty, or diversified greenhouses.

- More details at USDA’s WFRP Page.

-

Micro Farm Program

- Designed specifically for smaller operations, offering a cost-effective way to insure all or most greenhouse commodities with approved revenue up to $350,000.

- Learn more at USDA Micro Farm Program.

Selecting the Right Greenhouse Insurance Provider

With multiple providers now offering insurance tailored to greenhouse operations, making the right choice is crucial for success and peace of mind. We recommend this selection workflow:

-

Identify Specialist Providers:

- Focus on insurers with established experience in agricultural and greenhouse sector coverage.

-

Compare Policy Features:

- Assess inclusions/exclusions (e.g., disaster coverage, equipment insurance, crop limits), looking for the best match with your operation’s needs.

-

Review Customer Experiences:

- Customer testimonials and reviews often reveal how providers handle claims and repairs in real-world scenarios.

-

Evaluate Cost-Efficiency:

- Balance estimated premiums against coverage limits and deductible amounts, prioritizing policies with transparent, competitive pricing.

-

Look for Scalable Solutions:

- As your greenhouse business grows, ensure the insurance provider can scale benefits and protection to meet changing risks.

Optimize operational efficiency and mitigate risks further by leveraging Fleet & Resource Management tools from Farmonaut—streamlining logistics and asset protection across multiple greenhouses or large-scale operations.

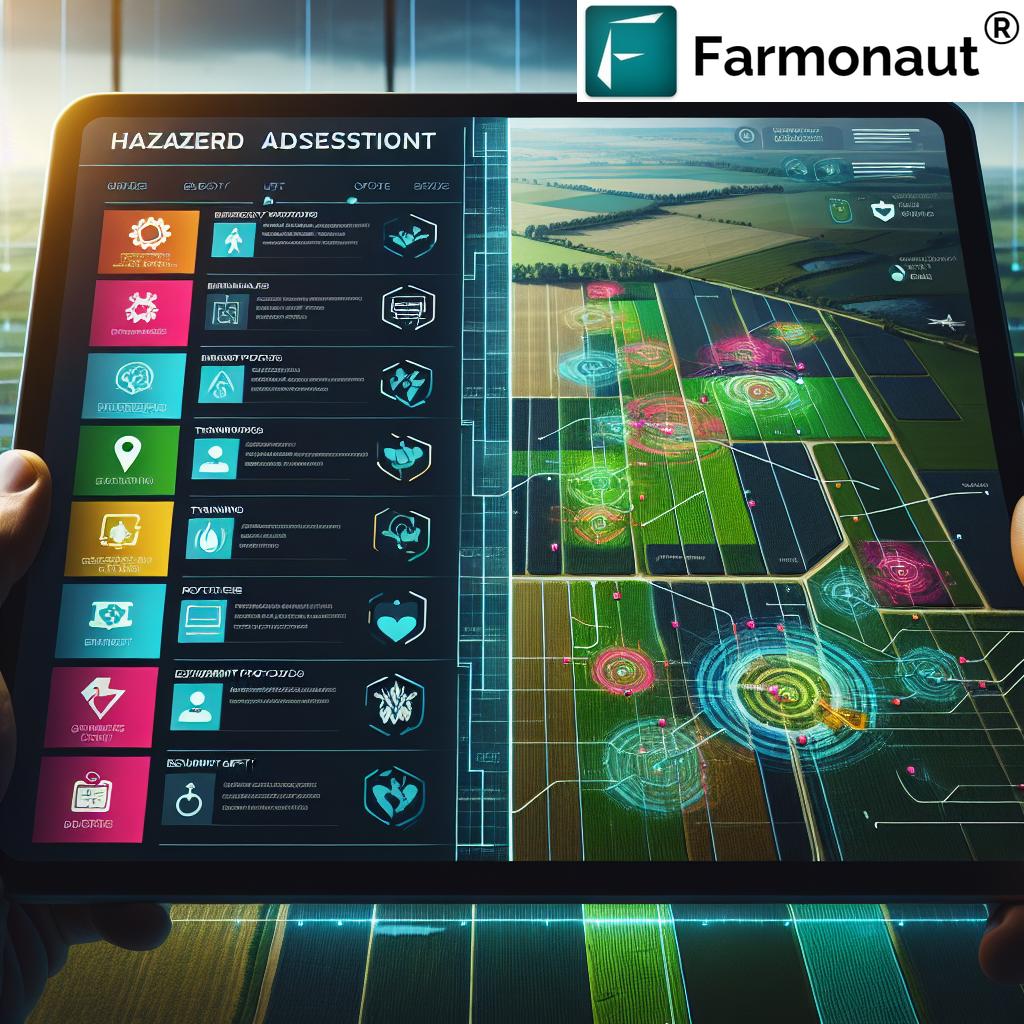

Farmonaut: Satellite Technology’s Role in Greenhouse Risk Management

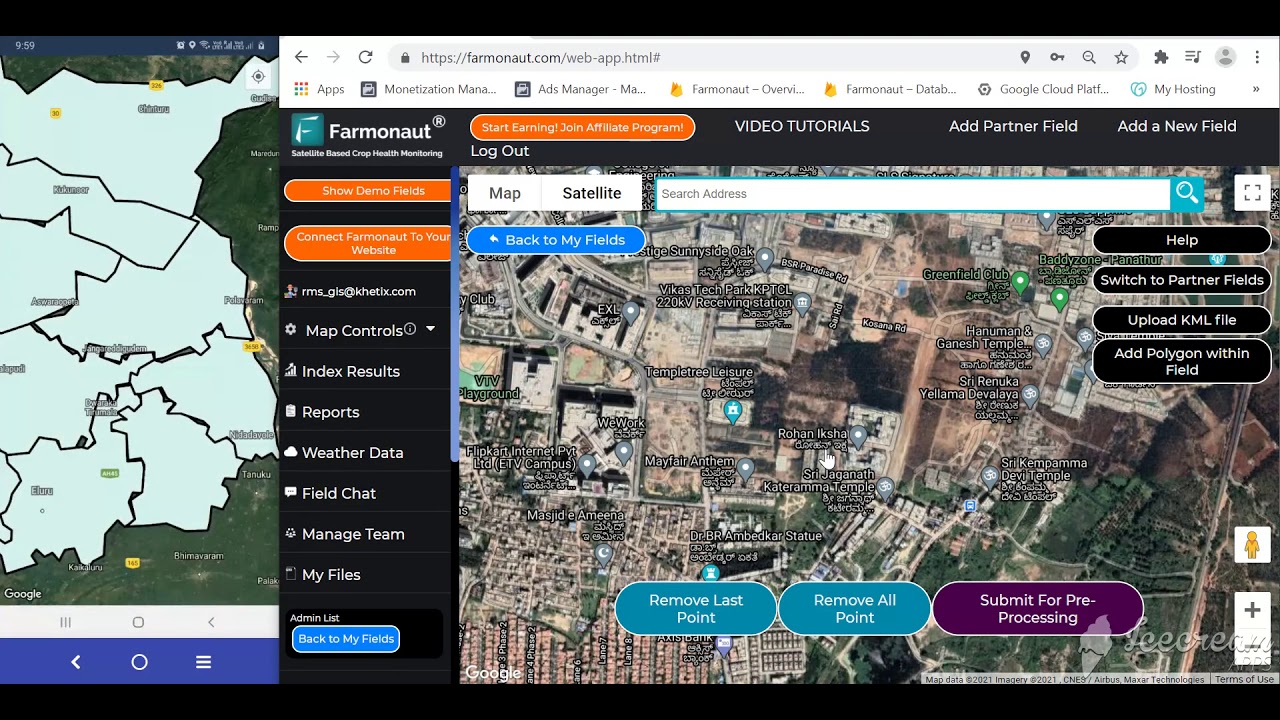

Today, forward-thinking greenhouse operators are integrating advanced technology into day-to-day risk management for early-warning, asset tracking, and improved decision-making. Farmonaut is at the forefront, offering an array of cutting-edge solutions that directly support insurance needs and maximize crop protection:

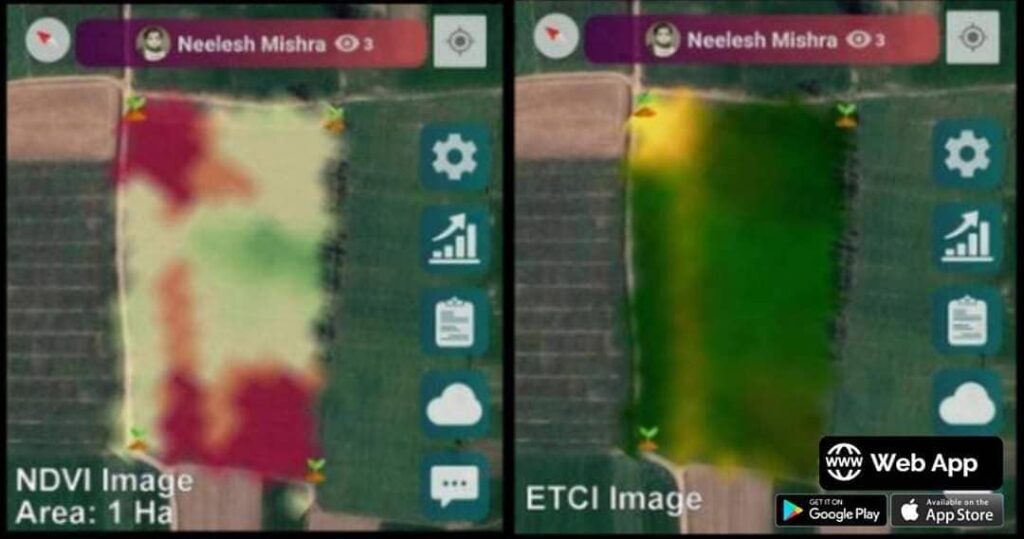

- Satellite Crop Health Monitoring

- Multi-spectral satellite imagery delivers real-time insights into vegetation health (NDVI), soil moisture, and conditions that indicate emerging crop diseases or stress—helping minimize uncertainties and reduce the likelihood of insurance claims.

- AI-Powered Advisory

- The Jeevn AI system uses satellite and field data to provide customized crop management advice, supporting timely interventions that mitigate losses.

- Blockchain-Based Traceability

- Ensures authentic, tamper-proof records of crop origins, interventions, and movement—strengthening transparency for both insurers and commodity buyers.

- Efficient Fleet and Resource Management

- Utilize Farmonaut’s digital fleet management and tracking for agribusinesses to control operational costs and safeguard valuable machinery.

- Carbon Footprinting Insights

- Monitor and manage environmental performance, a growing requirement for eligibility in some insurance policies and government aid.

Farmonaut delivers all of these features via web, Android, and iOS platforms, ensuring data-driven precision agriculture is accessible and affordable for greenhouse managers everywhere. Explore the Farmonaut API and the API Developer Docs to unlock the full potential of remote crop monitoring in your risk management strategy.

Discover how Farmonaut supports large-scale operators:

Maximize productivity and reduce claims by leveraging the Large Scale Farm Management Solution.

Frequently Asked Questions: Greenhouse Insurance

What types of events are typically covered by greenhouse insurance?

Most greenhouse insurance policies cover physical damage caused by natural disasters like storms, fires, and hail, crop loss due to disease or weather, equipment breakdown, liability claims, and business interruption losses. Always check the policy schedule for specific inclusions and exclusions.

Is crop insurance for greenhouses different from open-field crop insurance?

Yes. Crop insurance for greenhouses is tailored for controlled, enclosed environments and may include unique triggers, lower deductibles, and specific coverages (e.g., forced destruction due to disease outbreak). Open-field insurance generally covers broader weather perils.

How does greenhouse equipment coverage benefit my operation?

Greenhouse equipment coverage insures critical systems (heating, irrigation, ventilation) against breakdowns, so repair or replacement costs are covered. This keeps your greenhouse running smoothly and prevents crop losses due to sudden failures.

Can I customize my greenhouse insurance policy?

Absolutely. Many providers now allow full customization—letting you choose additional coverage (like cyber risk, product recall, or higher limits) so your policy is as unique as your operation.

How does real-time data from Farmonaut support risk management and insurance?

Farmonaut’s remote sensing and AI tools deliver early alerts on crop stress, soil moisture irregularities, or pest risks, reducing the frequency and size of insurance claims. This leads to potential premium discounts and better long-term security for your assets.

Does greenhouse insurance cover organic or specialty crops?

Yes. Many modern policies, especially those tied to government programs like the USDA’s, are focused on the specific needs of organic and specialty crop producers. Always confirm with your insurer for explicit inclusion.

What should I consider when selecting an insurance provider?

Reputation, specialization in controlled environment agriculture, clear policy wording, responsive claims handling, competitiveness of quote, and their ability to scale with your business are the key factors.

Conclusion: Strengthening Protection for the Future

As we look ahead, the value of greenhouse insurance in securing sustainable, resilient, and profitable agricultural operations cannot be overstated. With evolving insurance policies for greenhouse growers, powerful new technology, and government-backed programs at our disposal, we now have the resources and information necessary to safeguard every aspect of our greenhouses—from crops and equipment to staff and revenue streams.

By combining robust coverage, diligent risk management practices, and cutting-edge solutions like those offered by Farmonaut, agricultural operations can mitigate present threats and ensure the long-term protection of our investments. Don’t delay in reviewing or updating your own greenhouse insurance today to meet tomorrow’s challenges with confidence.