State Farm Loan Rates: 5 Key Facts for Smarter Financing

Table of Contents

- Introduction: The Role of State Farm Loan Rates

- Understanding State Farm Loans & Agricultural Financing Options

- Types of State Farm Loans: Operating, Ownership, and Emergency Loans

- State Farm Loan Rates, Terms, and Regional Variations

- Agricultural Loan Comparison Table

- The Farm Loan Application Process & Eligibility Requirements

- Benefits & Support Programs for Agricultural Financing

- Key Challenges, Considerations & Local Variations

- Farmonaut Solutions: Satellite-Driven Advances in Agricultural Finance & Management

- FAQ: State Farm Loan Rates and Agricultural Loan Interest Rates

- Conclusion

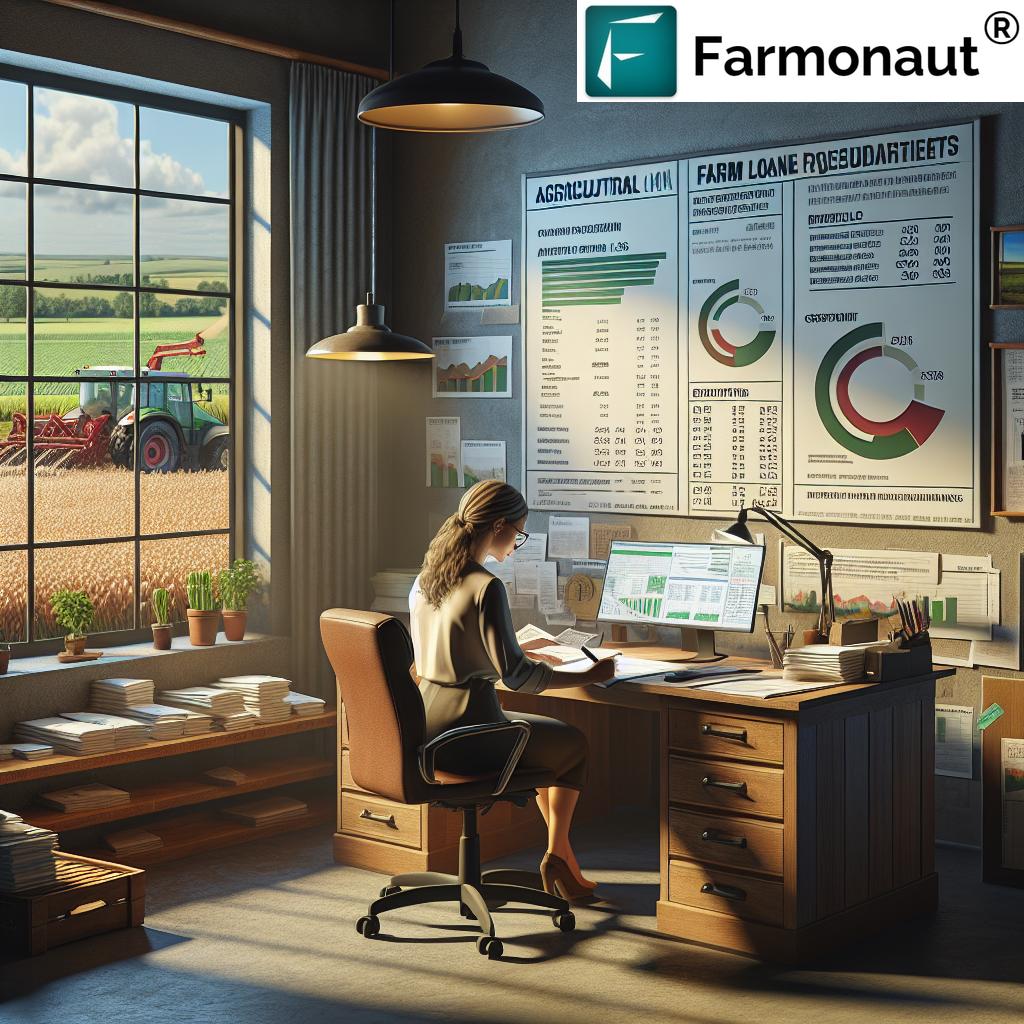

Introduction: The Role of State Farm Loan Rates

State farm loan rates are a critical component for the financial health and sustainability of our agricultural sector. As farmers and ranchers, we rely on loans tailored to the unique cycles and challenges of farming to get the resources necessary to start, expand, or sustain our operations. Whether it’s acquiring land, purchasing equipment, or managing cash flow after unforeseen disasters, the interest and terms set by state and federal agencies can make or break an operation.

In collaboration with federal programs, state farm loans offer agricultural producers accessible financial products with favorable rates and conditions. Today’s post will guide us through the landscape of agricultural financing options, while exploring how we can leverage advanced tools like Farmonaut’s satellite-driven solutions to improve eligibility, verification, and resource planning.

If our interest is in staying up-to-date with state farm loan rates, optimizing our application process, and making informed decisions about farm operating loans, farm ownership loans, or emergency farm loans, this guide will provide the foundational information we need for smarter financing and sustainable growth.

Understanding State Farm Loans & Agricultural Financing Options

State farm loans, or agricultural loan programs administered by state agencies and the USDA Farm Service Agency (FSA), are designed to assist us in meeting various financial needs throughout our farming operations. Unlike conventional commercial lending,

these loans offer favorable farm loan terms tailored to the agricultural sector, maintaining stability, stimulating development, and driving local economies.

- What do state farm loans cover?

State farm loans can help us with:- Purchasing land and acquiring farmland

- Building infrastructure—constructing barns, silos, and irrigation facilities

- Buying equipment, seeds, and agricultural inputs

- Managing operating expenses, like labor and cash flow during slow periods

- Recovery from natural disasters with emergency farm loans

- Who offers these products?

- State government agencies offer direct loans, often in collaboration with the USDA FSA

- State-chartered agricultural loan agencies may supplement or parallel federal programs

- Local lender networks sometimes support specific state-backed programs

By understanding the structure and application process for each loan type, we can identify what best fits our unique farm and region.

Types of State Farm Loans: Operating, Ownership, and Emergency Loans

State farm loans come in several forms to address various aspects of our agricultural needs. Let’s break down the main categories to see which agricultural financing options are available and how their interest rates and repayment terms compare.

-

1. Farm Operating Loans

- Purpose: Cover short-term and annual operating expenses

- Uses: Seeds, fertilizers, feed, labor costs, equipment maintenance

- Offered: Directly by agencies or through participating lenders

- Benefits: Smooths cash flow between planting and harvest, critical for both new and experienced farmers

-

2. Farm Ownership Loans

- Purpose: Long-term investment in land and infrastructure

- Uses: Purchasing farmland, constructing or renovating buildings, soil and water conservation

- Maximum Amounts: Can finance up to $600,000 in some states

- Eligibility: Designed for both beginning and established farmers

-

3. Emergency Farm Loans

- Purpose: Help farms recover from significant losses due to natural disasters (floods, drought, hurricanes, wildfires, etc.)

- Offered: Once a disaster area is declared and certified

- Coverage: Only the actual loss experienced, subject to verification

-

4. Microloans for Farmers

- Purpose: Lower, more accessible loan amounts for beginning farmers or those with limited credit history

- Typical Uses: Inputs, marketing costs, equipment under $100,000

- Benefits: Less paperwork, helps in building credit and gaining eligibility for larger loans

Each of these types is designed with specific criteria to support us at different stages or needs in our farming journey.

State Farm Loan Rates, Terms, and Regional Variations

Let’s focus on interest rates, why they matter, and how they vary based on loan type, region, and even purpose.

As of April 1, 2025, here are the current benchmark rates set by the USDA Farm Service Agency (FSA) for direct loans:

- Farm Operating Loans (Direct): 5.375%

- Farm Ownership Loans (Direct): 5.750%

- Farm Ownership Loans (Direct, Joint Financing): 3.750%

- Farm Ownership Loans (Down Payment): 1.750%

- Emergency Loans (Actual Loss): 3.750%

These rates are subject to change and may vary by state and region. Always check with your local state agency or USDA office for the latest information relevant to your area.

Regional Variations in Agricultural Loan Interest Rates

A comprehensive study (farmdocdaily) found that median interest rates on short-term, non-real estate farm loans range from 5% to 6% depending on location:

- Plains Region: Median 5.9%

- Atlantic Region: Median 5.0%

- Long-term real estate loan rates: 4.7% to 6.5% (regional variability)

This reflects local economic conditions, demand, and the unique needs of each region.

It’s crucial, before applying, that we consult our local or state agency offices to compare options and find the best available farm loan interest rates.

Typical Loan Terms by Loan Type

Loan repayment terms depend on the loan’s intended use, amount, and state/federal guidelines:

- Operating loans: Usually 1-7 years (matches planting-harvest cycle)

- Ownership/Real estate loans: Up to 40 years for land purchases/major infrastructure

- Emergency loans: Often structured to help match the pace of recovery, flexible on repayment start.

- Microloans: Shortest – often 1-3 years; ideal for small, fast turnarounds.

Now that we’ve compared the core types, rates, and repayment durations, here’s a quick side-by-side in table form for better clarity.

Agricultural Loan Comparison Table: Rates, Terms, Eligibility

| Loan Type | Estimated Interest Rate (%) | Maximum Loan Amount | Typical Repayment Term | Primary Purpose | Basic Eligibility Criteria |

|---|---|---|---|---|---|

| Operating Loan | 5.0% – 6.0% | $400,000 – $800,000* | 1–7 years | Seasonal operating expenses, crop/livestock inputs, cash flow | Active farming operation, experience or approved business plan, state residency |

| Ownership Loan | 3.75% – 5.75% | Up to $600,000 | Up to 40 years | Purchasing farmland, infrastructure, water/soil improvements | Land purchase, creditworthiness, down payment, farm management skills |

| Emergency Loan | 3.75% – 4.5% | Up to 100% of actual loss | Adjustable (5–20 years typical) | Recover from natural disasters or unforeseen events | Documented loss from declared disaster, repayment ability |

| Microloan | 5.25% – 6.5% | $50,000 – $100,000 | 1–3 years | Small-scale operation, beginner financing, inputs/tools | Limited history, business plan, state/federal eligibility |

*Loan limits may vary by state and change annually; confirm with your local agency.

Understanding these details helps us weigh loan eligibility requirements, repayment timelines, and how our specific needs fit each loan offering.

The Farm Loan Application Process & Eligibility Requirements

Applying for a state farm loan involves several steps, but preparation makes all the difference. Here’s our guide to navigating the farm loan application process and ensuring the best chance of approval:

- Assess Eligibility

- Check basic farm loan eligibility requirements:

- U.S. citizenship or permanent residency

- Farming experience (or a solid business plan for first-timers)

- Operates a family farm or demonstrates intent to do so

- Residency and primary operation base in the state

- Check basic farm loan eligibility requirements:

- Gather Documentation

- Detailed farm business plan (including crop/livestock plan, marketing strategy, cash flow projections)

- Recent tax returns, balance sheets, and profit/loss statements

- Ownership/lease documents for land, equipment, and buildings

- List of intended use for loan proceeds

- Submit the Application

- Complete all federal/state agency forms and schedules accurately

- Be specific about loan amount requested and purpose

- Review and Decision

- Agency reviews: risk, experience, past performance, and repayment ability

- May request additional details or clarification during underwriting

- Disbursement of Funds

- Once approved, funds are released as agreed—either lump sum or as needed throughout the season/project

- Repayment and Follow-up

- Stay on top of scheduled payments, and proactively communicate with your agency in case of disruptions (e.g., weather events, crop failures, etc.)

The application process can be lengthy and requires careful documentation, but our preparedness makes a clear difference in outcomes.

Benefits & Support Programs for Agricultural Financing

State farm loan rates come with inherent benefits compared to traditional commercial lending, particularly when it comes to favorable terms and support programs for farmers.

- Lower interest rates & flexible repayment terms: Direct government-backed loans often feature rates well below commercial averages, making expansion and investment more affordable.

- Adapted to agricultural cycles: Repayment periods are customized for seasonal ebbs and flows, which align with harvest timings and income realities.

- Support for beginning farmers & microloans:

Specific programs (like microloans for farmers) are designed to assist those with limited history, giving us a stepping stone to larger financing down the road. - Disaster and emergency support: Emergency farm loans bridge the gap after natural disasters and other unforeseen circumstances that put operations at risk.

- Promotion of rural development & local economic stability: By providing financial resources directly to the agricultural sector, these programs promote development and help maintain rural communities.

Eligibility for these programs may depend on our farm’s location, type of production, income, and development goals.

Key Challenges, Considerations & Local Variations in Farm Loan Programs

While state farm loans offer tremendous support, there are challenges and considerations we must keep in mind during the farm loan application process:

- Strict eligibility criteria:

Loan programs often require proof of residency, demonstrated need, sufficient experience, and ongoing compliance. This can be a barrier for some applicants. - Complex application process:

Gathering and accurately submitting extensive documentation can be time-consuming and confusing, especially for first-time applicants. - Regional disparities in rates and availability:

Some regions and states have greater access to low-interest programs than others; interest rates, loan ceilings, and eligibility requirements can differ substantially. - Loan limits and funding cycles:

Annual budget allocations and evolving federal-state collaboration may cap the number of new loans available or delay funding during peak demand periods. - Financial risks and repayment pressure:

Even with favorable terms, failure to meet obligations can affect long-term credit and future eligibility.

It pays to stay connected to local agencies for real-time updates and guidance aligned with your specific location and operation type.

Farmonaut Solutions: Satellite-Driven Advances in Agricultural Finance & Management

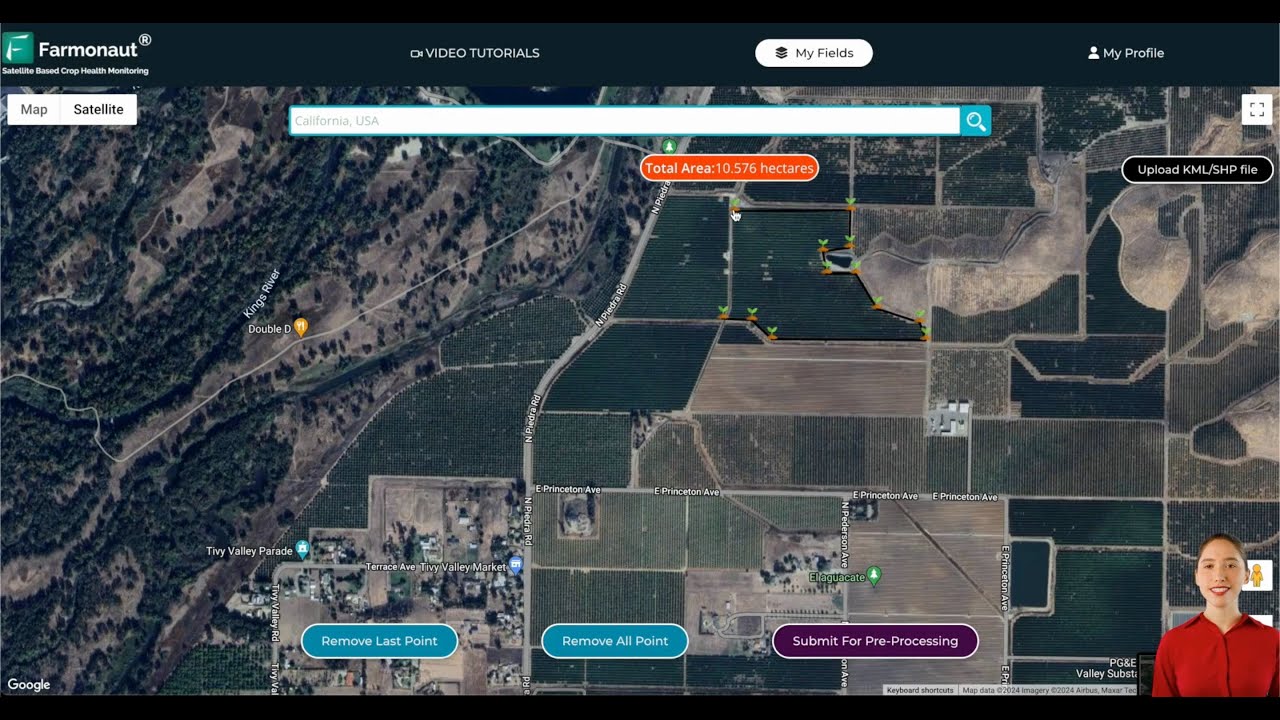

Precision agriculture and agri-finance now intersect, thanks to technology platforms like Farmonaut—a global leader in providing satellite-based farm management solutions for both individual farmers and large agribusinesses. Farmonaut is not a lender or regulatory body, but its platform and API integrations are transforming the way we plan, manage, and verify farms for financial and operational success.

Farmonaut’s Toolkit for Modern Farmers

- Satellite-Based Crop Health Monitoring:

We receive real-time NDVI, soil moisture, and health insights to make evidence-based decisions about inputs (e.g., irrigation, fertilizer, pest management), maximizing our resource use and yields. - Jeevn AI Advisory System:

AI-powered personal advisory delivers customized farm management strategies, weather forecasts, and risk mitigation tips directly to our device. - Blockchain-Based Traceability:

For agribusinesses and supply chain partners, blockchain product traceability ensures every crop or livestock product’s history can be verified, enhancing trust for both buyers and lenders. - Fleet and Resource Management:

The fleet management module helps large farms and agribusinesses coordinate vehicle use, reduce costs, and improve safety. - Carbon Footprinting:

Carbon footprint tracking allows us to document our farm’s sustainability progress and maintain compliance with environmental requirements—which is increasingly important for loan eligibility and insurance approval. - Crop Loan and Insurance Verification:

Through satellite-based verification, Farmonaut increases transparency, reduces fraud, and improves access to financial products—see crop loan and insurance services.

Farmonaut offers all-in-one accessibility via Android, iOS, and web apps, as well as API integration for developers and agribusinesses:

- Farmonaut API Platform for real-time farm and weather data

- API Developer Documentation for easy system implementation

Our flexibility, rapid adoption of new technologies, and ability to verify on-the-ground changes via remote sensing gives us a real advantage—especially during farm loan application documentation or performance monitoring.

For scalable farm management aligned with subsidy or compliance needs, try the smart large-scale farm management suite.

If plantation forestry or specialty advisory is relevant, take advantage of the crop, plantation, and forest advisory tools directly within the Farmonaut app suite.

For user convenience and maximum reach, Farmonaut is available as:

Try Farmonaut now to take the next step in precision farming and maximize your eligibility and performance for all agricultural loan programs.

FAQ: State Farm Loan Rates and Agricultural Loan Interest Rates

What are the benefits of state farm loans over commercial loans?

State farm loans offer lower interest rates, flexible loan terms, and are designed to support the unique cash flow and expense realities of farming. Compared to banks and private lenders, state agencies are often more supportive of beginning or recovering farmers and can tailor eligibility and repayment to our operation’s cycle.

How do I check my eligibility for a state farm loan?

Review the farm loan eligibility requirements for your specific program. Most require residency in the state, farm management skills or a solid business plan, and eligibility based on farm size/type and purpose of the loan. Contact your local state agricultural agency or USDA FSA office for personalized assessment.

Are farm loan interest rates fixed or variable?

Most state and USDA direct farm loans offer fixed rates for the life of the loan, giving us predictability in repayment. Some programs may vary rates by year; always confirm the current rates at the time of your application.

How do I use Farmonaut’s services to improve my financing or insurance application?

Platforms like Farmonaut enable satellite-based farm verification for lenders and insurance firms, making the loan application process smoother by reducing paperwork and validating operational data instantly. Their analytics also help manage risk, potentially improving our repayment ability and credit profile. Try the crop loan and insurance solution for integrated fintech support.

What can emergency farm loans cover?

Emergency farm loans cover losses directly attributable to declared natural disasters—including damaged crops, livestock, buildings, or equipment. The amount is typically capped at the value of the actual loss with eligibility and verification through local agencies.

Where can I find more details on regional farm loan interest rates and programs?

Consult your state agricultural loan agency and USDA FSA current loan rates page for up-to-date, region-specific information. For operational performance, pair financial planning with Farmonaut’s real-time data services to optimize application and eligibility.

Conclusion: Smarter Planning with State Farm Loan Rates & Precision Tools

Selecting the right state farm loan isn’t just about chasing the lowest rate—it’s about finding the best fit for our financial needs, production cycles, and long-term vision. Whether we pursue farm operating loans, invest in ownership loans for land and facilities, or recover from crises with emergency farm loans, understanding how interest rates, terms, and eligibility criteria work is essential.

By leveraging modern management and verification platforms like Farmonaut, we can boost our operational efficiency, improve data-driven decision–making, and facilitate credible, seamless farm loan applications. The result is a more resilient, competitive, and sustainable farm—ready to meet today’s challenges and tomorrow’s opportunities.

Let’s stay informed, proactive, and tech-enabled as we navigate the ever-shifting landscape of state farm loan rates and agricultural financing options.

Explore farm loan options, get the right data with Farmonaut, and sow the seeds for smarter, stable, and sustainable growth.