American Farm Recession: 7 Midwest Impacts

“Midwest farm bankruptcies surged by 20% in 2023, highlighting the severity of the ongoing agricultural recession.”

Table of Contents

- Overview: The Midwest in an Agricultural Recession

- 1. Declining Commodity Prices

- 2. Rising Input Costs for Farmers

- 3. Trade Policies and the Impact of Tariffs on Agriculture

- 4. Farm Financial Stress and Consolidation Trends

- 5. Policy Responses, Government Aid, and Relief Measures

- 6. Effects on Rural Communities and the Broader Economy

- 7. Outlook for American Agriculture

- Comparative Impact Table

- Farmonaut and Technological Solutions for Resilience

- Frequently Asked Questions

Overview: The Midwest in an Agricultural Recession

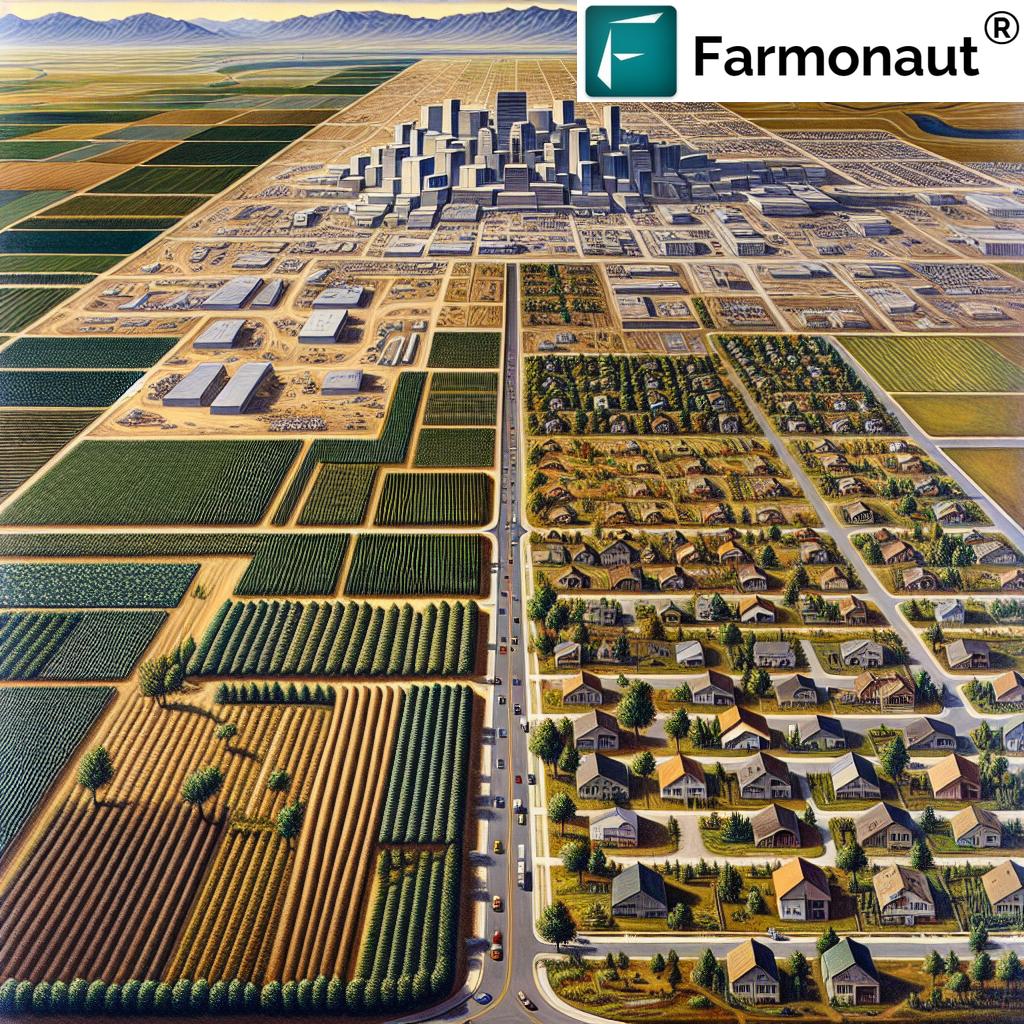

The United States agricultural sector, with the Midwest at its core, is currently entrenched in a profound economic crisis. As a critical hub for corn, soybeans, wheat, and cotton production, the region’s fate heavily influences both national food security and international export markets. Since 2022, this ongoing agricultural recession has been propelled by declining commodity prices, surging input costs for farmers, and disruptions stemming from international trade policies. Our analysis reveals that the repercussions extend far beyond farm gates, shaping the well-being and sustainability of rural communities, constraining the economic prospects of small towns, and amplifying vulnerabilities across the entire food supply chain.

In this blog, we systematically examine the seven most significant impacts of the American farm recession in the Midwest. We will explore the economic challenges confronting farmers, evaluate policy responses and government aid initiatives, assess the implications of ongoing disruptions, and close by considering the outlook for American agriculture. We also highlight how precision agriculture technology, such as Farmonaut’s satellite-based solutions, can support resilience and long-term sustainability.

1. Declining Commodity Prices: Pressure on Midwest Farmers

One of the most pronounced drivers of the current agricultural recession has been the persistent fall in key commodity prices, especially for staple Midwest crops like corn, soybeans, wheat, and cotton. Since 2022, multiple forces have contributed to this downward spiral in prices, creating intense financial stress and pressuring the profit margins of farms throughout the region.

- Market Oversupply: Successive years of strong global harvests, especially in South America and parts of Eastern Europe, have led to an oversupply of major grains on world markets.

- Weakened International Demand: Trade disputes and tariffs have reduced U.S. access to lucrative foreign markets, causing a build-up of unsold inventory and pushing prices lower.

- Global Economic Uncertainties: Persistent uncertainties regarding inflation, interest rates, and international policies have contributed to market hesitation, stalling price recoveries even amid occasional tightening supply scenarios.

According to recent reports, periods of surging corn and soybean prices in early 2025 (amid reduced harvest estimates) proved to be short-lived. The incremental gains simply could not offset the burden of inflated production costs and continued economic volatility. Consequently, even slight market rallies failed to provide sufficient relief to beleaguered farmers.

As profit margins dwindle, many producers are forced to consider scaling back operations or switching to lower-input crops, though these strategies carry their own challenges and risks.

“Input costs for American farmers rose by 15% last year, while commodity prices dropped by nearly 10%.”

2. Rising Input Costs for Farmers: Squeezing Margins Further

Parallel to the ongoing decline in commodity prices, the rising input costs for farmers constitute another severe stressor in the farm economy. Data from the American Farm Bureau Federation indicates that expenses related to seeds, fertilizers, fuel, and labor have sharply increased over the past two years. The compounding effect is a dramatic squeeze on farm profits—often rendering standard crop operations barely break-even or outright loss-making.

- Seeds & Fertilizers: Aggressive price hikes—especially in nitrogen-based fertilizers which are closely linked to global energy markets—have directly increased expenses per planted acre.

- Fuel: Elevated energy markets have meant greater operational costs for fieldwork, transportation, and crop drying.

- Labor: Wages for seasonal and year-round farm labor have also trended upward in response to broader labor market tightness, government policy, and inflation.

Together, these rising input costs mean that even small fluctuations in revenue can have outsized impacts on cash flow and farm financial health. For Midwest producers, this dynamic is particularly pronounced, as large acreage operations amplify per-acre cost increases. Farmers are forced to re-examine every component of their production strategy—often with few viable options for meaningful cost reductions.

How Farmers Can Respond: Leveraging Technology

Precisely managing input use is more critical now than ever. Real-time monitoring tools like Farmonaut’s satellite imagery-based crop health platforms enable Midwest farmers to optimize fertilizer and irrigation applications, minimize unnecessary input use, and improve overall resource management. Fleet management solutions streamline logistics, helping to cut fuel and labor costs by making machinery usage more efficient—vital in an era of cost inflation and tight margins.

For large-scale operators, tools like Farmonaut’s large-scale farm management dashboard provide scalable solutions for entire farm portfolios—including satellite-based tracking of crop growth stages, timely interventions, and comprehensive analytics.

3. Trade Policies and the Impact of Tariffs on Agriculture

U.S. trade policy shifts and escalating tariff measures have delivered yet another blow to an already fragile agricultural sector:

- Early 2025 Tariffs: The imposition of new 25% tariffs on imports from Canada and Mexico, plus increased levies on Chinese goods, provoked rapid retaliatory steps by these trade partners.

- Agricultural Repercussions: U.S. wheat, soybeans, corn, cotton, and poultry rapidly became targets for counter-tariffs, squeezing export revenues and increasing market uncertainties.

- Export Disruptions: The Midwest, as the traditional “breadbasket” for global commodity exports, was disproportionately impacted by canceled orders and declining international demand.

According to detailed reports, these new barriers to trade have created significant economic challenges in rural communities. For affected farmers, especially those who rely on export markets for a large share of annual revenues, the consequences of these trade disruptions on crops are immediate and severe.

Not only do such tariffs disrupt farm production and cash flows, but they can also cause long-term reputational damage—making it harder for the U.S. to regain lost market share even after trade tensions subside.

How Midwest Producers Can Defend Against Trade-Driven Volatility

Diversifying supply chains and maintaining traceable, transparent records of crop health and compliance can help farmers stay competitive in evolving export markets. Farmonaut’s blockchain-based product traceability solution provides precisely this service—offering transparency from farm to consumer and building trust with international partners, even amid policy and tariff shifts.

4. Farm Financial Stress and Farm Consolidation Trends

The combined effects of declining commodity prices, persistent input cost inflation, and trade disruptions are manifesting as acute farm financial stress

The Midwest is especially vulnerable, with medium-sized, family-run farms hit hardest. When smaller farms are unable to manage ongoing expenses or access capital, they are often forced to sell, merge, or be absorbed by larger entities—a process known as farm consolidation. The resulting shift means fewer, larger farm operations and a loss of independent farm identities that have defined Midwest communities for generations.

For those aiming to persevere, data-driven technology is providing a lifeline. Farmonaut’s crop loan and insurance verification tools facilitate more transparent, satellite-based risk assessments. This enables banks and insurance firms to disburse funds more readily, helping farmers better access capital and manage risks, with reduced likelihood of fraud—a critical consideration in an uncertain era.

Recognizing the gravity of the agricultural recession, the U.S. government has stepped in with new aid packages. The American Relief Act of 2025 (passed in December 2024) is a centerpiece of this policy response, delivering:

Despite these substantial measures, gaps remain. The lack of a new farm bill has left some specialty crop growers—especially those in regions dependent on rice and cotton—without sufficient support. The current policy framework, extended only through September 2025, may not be robust enough to accommodate continuing and evolving sector challenges.

Speed and coverage of payments, as well as consistent access to technical support and modernization funds, remain top concerns for Midwest producers navigating a climate of ongoing economic uncertainty.

Looking to integrate real-time satellite and weather data into your systems? Explore the Farmonaut API for seamless access, and support from our API developer documentation.

Midwest rural communities and the broader regional economy bear the brunt of deepening farm financial stress. When farm revenues fall or local operations shutter, the multiplier effect can be profound:

This domino effect leaves Midwest rural towns facing “double jeopardy”: both immediate fiscal pain and long-term population decline, as young people relocate in search of higher-paying, stable jobs outside of agriculture. Analysis points to the urgent need for holistic support measures—not just for individual farmers, but for the entire rural economic fabric.

Resilient communities turn to smart resource use and data-driven intervention. Farmonaut’s carbon footprinting solution (learn more) helps cooperatives and regional governments measure, manage, and report environmental impacts, opening the door to new grants and sustainability market participation while boosting local agricultural reputation.

The road ahead for Midwest and wider American agriculture remains deeply uncertain—but not without hope or avenues for improvement. Key considerations for the future include:

While federal relief and technology adoption buy precious time, only collaborative, sustained action—from policymakers, agri-innovators, and local leaders—will ensure the enduring vibrancy of Midwest and American agriculture.

While sweeping economic and policy challenges define this era of farm recession, innovative technology is paving a path towards stability and future growth. Farmonaut, as a leader in precision agricultural technology, is on a mission to make advanced, affordable solutions available to all farmers—including those weathering hard times in the American Midwest.

Accessible by Android, iOS, web app, and API, Farmonaut is purpose-built for scalability and accessibility. Choose the features that suit your operation size—from individual fields to vast agribusinesses and government programs. For users needing large-scale, multi-farm oversight, explore the Agro Admin App—an integrated dashboard for plantation tracking, health analytics, and resource distribution.

Farmonaut’s focus on eco-efficiency, financial access, and transparent supply chains aligns directly with the Midwest rural sector’s urgent needs—helping not just with crisis recovery, but with laying the foundation for a stronger, future-ready agricultural economy.

Multiple factors, including persistently declining commodity prices (corn, soybeans, wheat, cotton), sharp increases in input costs (seeds, fertilizers, fuel, labor), and international trade disruptions and tariff policies, are driving a severe blow to farm revenues. These, along with ongoing policy uncertainty, have triggered a region-wide economic downturn.

Midwest farmers are increasingly leveraging precision agriculture technology (like Farmonaut’s solutions) to maximize input efficiency, cut operating costs, access up-to-date crop health data, and improve farm management through AI advisory and traceability tools.

Medium-sized, family-owned farms—those without the economies of scale or ready access to extensive credit—face the highest risk. Many are forced to sell or merge, accelerating the trend toward farm consolidation in the region.

While current government aid for farmers (notably via the American Relief Act) is substantial, gaps persist. Not all crop sectors or regions have equal access, and policy uncertainty remains concerning with the pending farm bill. Ongoing support and comprehensive reform are needed.

By providing scalable, affordable access to satellite monitoring, AI-driven advisory, blockchain traceability, fleet/resource optimization, and carbon footprint tracking, platforms like Farmonaut help producers manage costs, access loans/insurance, and build future-ready farm businesses.

Try Farmonaut’s Web, Android, or iOS app to access real-time, actionable data and management tools for your farm operation. For developers and agribusinesses, explore the Farmonaut API and developer docs to integrate the power of precision agriculture into custom platforms.

The ongoing agricultural recession in the American Midwest is more than just a cycle of falling commodity prices or rising input costs for farmers; it is a multifaceted economic crisis with profound consequences for farmers, rural communities, and the national economy. The interplay of international trade disruptions, policy struggles, and accelerating farm consolidation trends is reshaping the landscape of America’s heartland.

Effective response calls for collaborative — and data-driven — action. Technology platforms like Farmonaut provide accessible, powerful tools to help manage volatility, ensure input efficiency, and open new pathways for financing and supply chain trust. To secure the future of Midwest agriculture, policy makers, farmers, and innovators must work together, building resilience not just for today, but for the years ahead.

For more insight and ongoing updates about the American farm recession, agricultural technology, and industry trends, follow our blog and explore the Farmonaut platform for transformative, future-ready farm management.

Accessing Safer Financing with Data-Driven Verification

5. Policy Responses, Government Aid, and Relief Measures

6. Effects on Rural Communities and the Broader Economy

Sustaining Rural Services with Precision Monitoring

7. Outlook for American Agriculture: Navigating the Path Forward

Comparative Impact Table: Midwest Farm Recession – Economic & Social Effects

Impact Area

Estimated Change (%) or Value

Brief Description

Input Costs

+15% (2024–25)

Significant rise in seed, fertilizer, fuel, and labor expenses, straining farm budgets.

Commodity Prices

–10% (2024–25)

Declining value for major crops (corn, soybeans, wheat, cotton), reducing farm incomes.

Farm Income

–12% (2024–25)

Lower profit margins making farm operations unsustainable without intervention.

Employment

–8% (estimated 38,000 Midwest jobs lost)

Mass layoffs in farming and related industries due to farm closures and cost-cutting.

Policy Changes

American Relief Act ($9.8B aid, $21B disaster support)

Direct payments and disaster relief implemented, but new farm bill still pending.

Farm Consolidation

+18% mergers/buyouts (2024–25)

Increasing trend toward fewer, larger farms; loss of medium-sized, family-owned operations.

Rural Services

–10% (service contraction in at-risk towns)

Reductions in local business and civic services as economic base diminishes.

Farmonaut: Technology as a Resilience Driver in Agricultural Recession

Farmonaut Subscription Plans

FAQs: American Farm Recession & Midwest Agricultural Impacts

1. What is causing the current agricultural recession in the Midwest?

2. How are farmers adapting to rising expenses and shrinking margins?

3. Who is most at risk from farm financial stress and consolidation?

4. What role does government aid play, and is it enough?

5. How can technology help Midwest farmers and rural communities?

6. Where can I learn more or try Farmonaut’s agricultural technology?

Conclusion: Confronting the Agricultural Recession in the Midwest