Agricultural Business Succession: 7 Winning Strategies to Ensure Your Farm’s Future

“Nearly 70% of family-owned farms lack a formal succession plan for business continuity.”

“Only 30% of agricultural businesses successfully transition to the next generation of ownership.”

Table of Contents

- Introduction

- The Importance of Succession Planning in Agriculture

- Overview: 7 Winning Strategies for Agricultural Business Succession

- Strategy 1: Assessing the Current State of the Farm Business

- Strategy 2: Identifying and Preparing Successors

- Strategy 3: Developing a Comprehensive Succession Plan

- Strategy 4: Legal and Financial Considerations

- Strategy 5: Family Communication and Engagement

- Strategy 6: Integrating Technology for Succession Continuity

- Strategy 7: Monitoring, Reviewing, and Adapting the Succession Plan

- Comparative Table: Agricultural Business Succession Strategies

- Common Challenges in Farm Succession and How to Overcome Them

- Farmonaut’s Role in Enabling Generational Farm Management

- Frequently Asked Questions

- Conclusion: Sustaining Your Farm Legacy Across Generations

Introduction

In the world of agriculture, continuity is more than a business goal—it’s a commitment to family legacy, community well-being, and the global food supply. Agricultural business succession refers to the structured process of transferring farm ownership and management from one generation to the next. Whether you operate a traditional family farm, a ranch, or manage forestry land, succession planning is essential for ensuring your agricultural enterprise remains viable, competitive, and adaptable in a rapidly evolving industry.

In this comprehensive guide, we’ll explore farm succession planning, family business transition, and detailed strategies for transferring ownership that promote operational continuity and future success. We’ll break down practical steps, challenges, and proven solutions—so you and your family are empowered to protect your business, financial stability, relationships, and heritage for generations to come.

The Importance of Succession Planning in Agriculture

Farm succession planning is a cornerstone of sustainability for agricultural enterprises. As family businesses, farms face unique obstacles:

- Business Continuity: Structured succession minimizes operational disruptions and ensures the continuity of daily farm operations during a generational transition.

- Financial Stability: Succession planning addresses tax liabilities, debt obligations, and asset transfers, safeguarding the economic health of your enterprise and your family’s future.

- Family Harmony: Clarity in communication and role definition prevents conflicts, aligning family members and preserving both the business and personal legacy.

- Preserving Heritage: Effective planning maintains deep ties to the land, community, and historical methods while adapting to evolving practices.

- Adapting to Change: As agriculture embraces technological innovation and sustainability, a strong succession plan positions your farm at the forefront of progress.

According to industry studies, less than one-third of family-owned farms successfully transition to the next generation—often due to lack of planning, unforeseen financial burdens, or breakdowns in family communication. Let’s break this trend with actionable strategies for seamless agricultural succession!

Overview: 7 Winning Strategies for Agricultural Business Succession

Our approach to succession planning for agriculture covers every critical step toward sustainable farm business continuity. Each strategy is grounded in best business and management practices, legal and financial security, and adaptive planning for success.

- Assessing the Current State of the Business

- Identifying and Preparing Successors

- Developing a Comprehensive Succession Plan

- Legal and Financial Considerations

- Family Communication and Engagement

- Integrating Technology for Succession Continuity

- Monitoring, Reviewing, and Adapting the Succession Plan

Strategy 1: Assessing the Current State of the Farm Business

Effective succession is built on understanding where your farm stands today. Thorough assessment provides the foundation for informed planning, resource allocation, and role transitions.

Key Steps:

- Financial Health Audit: Evaluate all assets, liabilities, debts, and revenue streams. Understand cash flow, soil productivity, equipment value, and market trends.

-

SWOT Analysis:

- Strengths: What gives your operation a competitive edge?

- Weaknesses: Where are operational or management gaps?

- Opportunities: What are the market, soil, or technology opportunities you can leverage during a transition?

- Threats: Analyze risks (legislation, environmental, financial) that could affect your business.

- Operational Efficiency Check: Document and evaluate day-to-day operations, workflows, and management structure.

Tip: Use Farmonaut’s Large-Scale Farm Management platform for detailed satellite-driven financial and operational insights. This tool offers a data-driven overview of your fields, helping you track crop health, soil moisture, and more for informed planning.

Strategy 2: Identifying and Preparing Successors

Succession hinges on the right people, with the right preparation. Whether within the family or from trusted staff, identifying future leaders ensures the farm, ranch, or forestry operation thrives beyond a single generation.

- Early Identification: Engage family members or employees who show commitment, aptitude, and values aligned with your business mission.

- Skill Assessment: Analyze gaps in management, finance, soil health, or operational knowledge and create targeted development plans.

- Personalized Training Plans: Provide technical training, hands-on management mentoring, and encourage networking in agribusiness circles.

- Progressive Responsibility: Assign increasing levels of management responsibility (finance, soil/fleet/resource management) to build leadership competency.

- Cultural Legacy: Instill heritage, ethical farming practices, and sustainability values to maintain the operation’s identity during transition.

Digital tools, such as the Farmonaut Crop Plantation/Farm Advisory solution, provide real-time, science-backed advice for emerging leaders, fostering farm business management skills with modern data insights.

Strategy 3: Developing a Comprehensive Succession Plan

A clear, detailed succession plan is vital for a smooth generational handover. Include these essential components for a holistic approach:

Critical Sections for Your Succession Plan:

-

Asset Distribution:

- Specify the allocation of tangible (land, machinery, buildings) and intangible (brand, goodwill, business relationships) assets.

-

Financial Arrangements:

- Determine fair remuneration for retiring generation and establish plans for settling debts, tax obligations, and liabilities.

-

Roles & Milestones Timeline:

- Set clear dates for incremental transfer of responsibilities and ownership.

-

Review Process:

- Schedule annual or semi-annual plan reviews to adapt to operational or market changes.

Use business templates and digital farm management platforms to centralize your succession plan documentation. Such centralization not only ensures clarity for all members of your team but supports accountability and transparency.

“Nearly 70% of family-owned farms lack a formal succession plan for business continuity.”

“Only 30% of agricultural businesses successfully transition to the next generation of ownership.”

Strategy 4: Legal and Financial Considerations in Farm Succession

The legal and financial dimensions of transferring farm ownership are often the most complex—and critical. Addressing these early helps avoid disputes, tax surprises, and unintended business disruptions.

-

Legal Tools for Succession:

- Wills and Trusts: Ensure a clear legal transfer of assets aligned with your vision.

- Buy-Sell Agreements: Define how shares or business interests are sold or transferred among owners and successors.

-

Estate & Inheritance Tax Planning:

- Develop a plan to minimize tax liabilities, addressing federal and local laws governing agricultural inheritance.

-

Financial Structuring:

- Consult with certified financial advisors and agricultural accountants to balance ongoing business health with family obligations.

-

Insurance & Risk Management:

- Leverage Farmonaut Crop Loan & Insurance tools for satellite-based verification—streamlining crop insurance, reducing fraud risk, and improving financial certainty for successors.

Leveraging smart legal and financial advisors ensures compliance, future-proofs the operation, and safeguards your family’s interests for years to come.

Strategy 5: Family Communication and Engagement

Open, regular communication is the key to successful family farm transition. Unified planning and conflict resolution protect both the business and personal relationships—essential for passing on not just assets, but trust and vision.

- Scheduled Family Meetings: Regular, facilitated sessions (in-person or virtual) keep all family members updated on succession progress and new developments.

- Clear Role Definition: Transparently outline each person’s responsibilities—both now and in the future.

- Conflict Mediation: When differences or emotional conflicts arise, professional mediators help navigate toward compromise and mutual understanding.

- Alignment of Business and Family Goals: Balance personal aspirations with operational needs to create a sustainable, shared vision for the family enterprise.

- Succession Documentation: Ensure everyone has access to the full succession plan for family farm, with periodic reviews and feedback opportunities.

Encouraging participation from all stakeholders—inclusive of spouses, partners, and non-family managers—helps build a culture of ownership and accountability, supporting generational transitions.

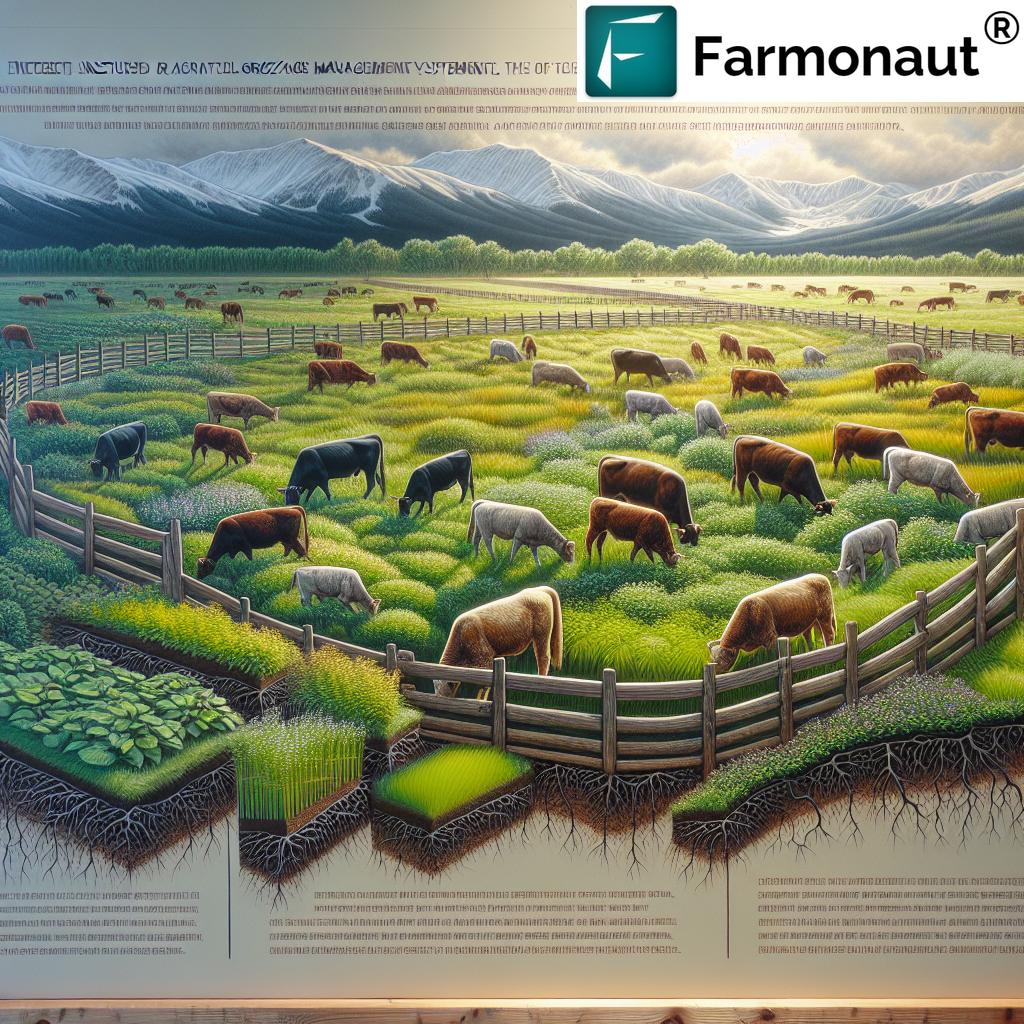

Strategy 6: Integrating Technology for Succession Continuity

Technological innovation is transforming agricultural business succession strategies worldwide. Digital tools streamline operations, support data-driven decision-making, and bridge the gap between generations by making complex information accessible and actionable.

- Precision Agriculture: Platforms like Farmonaut equip farm successors with real-time, satellite-based crop health monitoring, AI-driven farm advisory, and historical yield data to support ongoing operational efficiency.

-

Traceability Solutions:

- Farmonaut’s blockchain-based product traceability secures every step of the supply chain, strengthening consumer and regulatory trust in the business as it transitions to new hands.

-

Fleet and Resource Management:

- With Farmonaut Fleet Management, successors track vehicles, monitor logistics, and optimize input costs for large or multi-location enterprises.

-

Environmental Compliance and Carbon Tracking:

- New generation leaders use Farmonaut’s Carbon Footprinting solution to measure, manage, and minimize farm emissions—vital for sustainable succession planning.

Integrating digital tools during and after transition helps successors not only maintain business health but also adapt to evolving agricultural and environmental requirements.

Farmonaut API & Developer Access

For large enterprises or agricultural platform developers, Farmonaut offers flexible API access and detailed developer documentation. These enable integration of weather, satellite, and resource data into your proprietary management systems for enhanced business continuity.

Strategy 7: Monitoring, Reviewing, and Adapting the Succession Plan

No plan remains static. Agriculture, like any business, is shaped by weather, market shifts, regulations, and technology. Continuous monitoring and adaptation is critical:

- Annual Plan Review: All stakeholders—owners, successors, family, legal and financial advisors—should meet to review progress, adjust to changing conditions, and celebrate transition milestones.

- KPIs and Metrics: Track operational efficiency, asset growth, financial health, and succession-specific metrics (e.g., number of transitioned responsibilities, new technology adoption rate).

- Emergency Plan Update: Build flexibility for unforeseen events (e.g., sudden illnesses, weather events) and update protocols for crisis management.

- Stakeholder Feedback: Gather regular feedback from successors, staff, and other family members for a dynamic, inclusive plan.

Modern platforms—like Farmonaut’s satellite-powered real-time crop dashboards and AI-powered advisories—give current and future leaders the data-driven agility to optimize decisions and quickly pivot as the business landscape evolves.

Comparative Table: Agricultural Business Succession Strategies

| Strategy Name | Key Actions | Estimated Implementation Time | Potential Challenges | Estimated Cost (USD) | Long-term Benefits |

|---|---|---|---|---|---|

| Assessing the Current State | Financial audit, SWOT analysis, operational review, digital data monitoring | 3–6 months | Inefficient record-keeping, incomplete data | $2,000–$10,000* | Identifies risks/opportunities, builds a foundation for all other steps |

| Identifying & Preparing Successors | Skill assessment, training, mentorship, progressive responsibility | 12–24 months | Resistance to new leadership, lack of interest from next generation | $5,000–$30,000 | Leadership readiness, continuity of business & family values |

| Developing the Succession Plan | Asset distribution, financial planning, role definition, documentation | 6–18 months | Disagreements over roles/ownership, changing laws | $3,000–$15,000 | Clear roadmap for transfer, reduced legal/family conflict |

| Legal & Financial Considerations | Estate planning, tax optimization, insurance, consult with advisors | 6–12 months | Complex taxes, costly legal errors | $5,000–$20,000 | Minimized tax liability, secured business future |

| Family Communication & Engagement | Regular meetings, conflict mediation, goal alignment | Ongoing | Family disputes, lack of transparency | $2,000–$8,000 | Improved harmony, legacy preservation |

| Integrating Technology | Adopt digital tools, satellite monitoring, resource/fleet management | 1–6 months (rollout) Ongoing updates |

Skill gaps, cost of technology adoption | $1,000–$40,000 | Greater efficiency, adaptable operations, sustainability |

| Reviewing & Adapting Succession Plan | KPI tracking, periodic reviews/updates, crisis planning | Ongoing (annual or semi-annual) | Complacency, fast-changing market/environmental factors | $500–$3,000 (per review) | Flexible, resilient business across generations |

*Estimates vary by farm size, location, and chosen business/legal advisors.

Common Challenges in Farm Succession and How to Overcome Them

Even the best-laid plans face real-world challenges in farm succession planning—from personal dynamics to financial hurdles and legal complexity. Here’s how we recommend tackling these head-on:

1. Emotional and Family Dynamics

- Disputes can arise over roles, asset division, or management style.

- Generational differences may slow adaptation to new practices or technologies.

Solution: Use professional mediators, foster open dialogue, and encourage shared decision-making. Emphasize the shared goal: continuity and preservation of legacy.

2. Financial Constraints & Tax Liabilities

- Transferring assets can trigger significant taxes and legal fees.

- Debt and loan obligations may become burdensome for the next generation.

Solution: Collaborate with agricultural financial and legal advisors (Farmonaut Crop Loan & Insurance helps document land and supports verification for easier access to finance). Plan ahead for taxes and seek sustainable financing solutions.

3. Resistance to Change & Technology Adoption

- Established operations may be hesitant to shift to modern, digital management systems.

Solution: Start with small pilots, offer training for new farm management technologies (Farmonaut’s satellite-based solution is user-friendly and scalable), and demonstrate rapid benefits to gain buy-in.

4. Undefined Responsibilities & Role Confusion

- Lack of clear role allocation causes inefficiences and conflict.

Solution: Document responsibilities, milestones, and reporting structures. Regularly review these roles as the farm or ranch evolves.

5. Legal Uncertainties

- Evolving laws can impact ownership transfer, environmental obligations, or inheritance.

Solution: Retain up-to-date agricultural legal counsel, and invest in periodic reviews of all succession-related agreements and documents.

6. Operational Disruption During Transition

- Handover periods risk productivity drops and overlooked tasks.

Solution: Use a phased, milestone-based transfer of management, supported by digital monitoring (e.g., Farmonaut dashboards and advisories).

Farmonaut’s Role in Enabling Generational Farm Management

As digital transformation shapes the entire agricultural sector, Farmonaut emerges as a leader in accessible, scalable, and affordable farm management. Here’s how our advanced satellite-based solutions address core succession planning strategies:

- Satellite Crop Health Monitoring: Farmonaut’s real-time NDVI and moisture analysis empower both existing and future farm managers to make precise, objective decisions for yields, soil health, and resource allocation.

- Jeevn AI Advisory: Our personalized AI-driven guidance system delivers instant crop management strategies and weather forecasts—bridging the expertise gap between current owners and successors.

- Blockchain-Based Traceability: By integrating transparent supply chain verification, we help generational businesses maintain product authenticity, protect brand equity, and comply with mandates.

- Fleet Management: Successors can seamlessly inherit logistical tools for optimizing vehicles, scheduling, and reducing operational bottlenecks at scale.

- Carbon Footprinting: Support your family business’s future by tracking and lowering your environmental impact—an increasingly important parameter for market access and government incentives.

- Flexible Access: Our subscription-based platform is accessible via web/app/API—with options suiting single farms, cooperatives, NGOs, and businesses of any size.

Farmonaut’s technology connects tradition with innovation—making succession not just an event, but a launchpad for enduring, future-proof agricultural prosperity.

Frequently Asked Questions: Farm Succession Planning

1. What is the main goal of agricultural business succession?

The main goal is to ensure a smooth, stable transition of ownership and management from one generation to the next—securing operational continuity, financial health, family harmony, and preservation of the farm’s legacy.

2. When should we begin farm succession planning?

It’s recommended to start planning as early as possible—ideally 10–15 years before expected transition. Early planning maximizes options, minimizes conflicts, and allows time for skill-building and legal/financial structuring.

3. How can technology benefit farm succession?

Technology streamlines operations, provides accurate data for decision-making, improves accountability, and prepares successors for modern agricultural challenges. Platforms like Farmonaut offer affordable, scalable solutions for farms of any size.

4. What are key legal tools for successful succession?

Wills, trusts, business entity formation, and buy-sell agreements are essential. Consult agricultural legal advisors to ensure all documentation is up-to-date with local and national laws.

5. How can we avoid conflicts between family members?

Clear communication, transparency, and documentation of all plans and decisions are essential. Regular meetings and, if needed, professional facilitation help foster understanding and prevent disputes.

6. How does Farmonaut support succession planning?

Farmonaut provides digital farm management, crop health monitoring, advisory services, product traceability, and resource management—all accessible via web, mobile, and API. These tools empower both current owners and future leaders to make fact-based decisions for business continuity.

7. What’s the difference between a succession plan and an estate plan?

An estate plan manages the distribution of individual assets after death. A succession plan for family farm covers leadership transition, ongoing operational management, and family business continuity—often overlapping, but with distinct objectives.

8. How do we choose advisors for the succession process?

Look for professionals specializing in agricultural law, finance, and management, with experience in local regulations and family business transitions. Ask for references and review their knowledge of contemporary issues in agriculture.

Conclusion: Sustaining Your Farm Legacy Across Generations

Agricultural business succession is a journey—one that requires foresight, collaboration, continuous learning, and strategic action. By following our 7 winning strategies for farm succession planning, you are equipped to:

- Protect your operation’s financial health, assets, and market position

- Preserve family relationships and the core values underpinning your business

- Navigate legal, tax, and regulatory hurdles with confidence

- Foster the next generation’s readiness for management and ownership

- Integrate technology to build a resilient, sustainable future

Whether you’re preparing for an immediate handover or laying the groundwork for succession decades in advance, every step you take today secures tomorrow’s stability, prosperity, and heritage. The choice to plan succession is the greatest investment we can make for our farm, our family, and the generations yet to come.

Leverage the best of tradition and innovation—explore Farmonaut’s app for satellite-based crop monitoring, AI-powered advisory, blockchain-based traceability, powerful fleet and resource tools, and more.