Revealed: Russia’s Bold Move to Control Wheat Prices Shakes Global Grain Markets

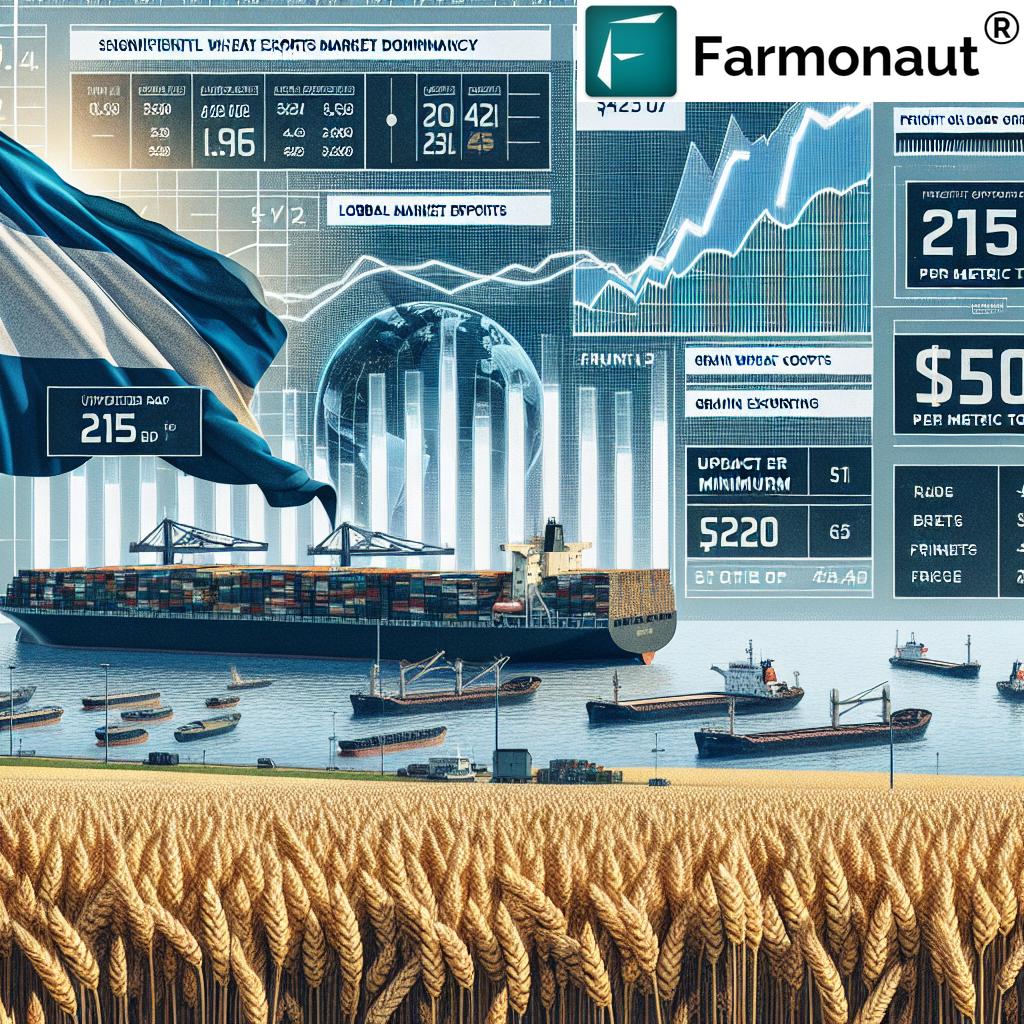

In a groundbreaking development that has sent ripples through the global wheat market, Russia’s Grain Exporters Union has unveiled a new strategy aimed at stabilizing Russian wheat export prices and asserting greater control over the international grain trade. This bold move, representing a significant shift in Russian agricultural policy, has the potential to reshape Black Sea wheat pricing and impact agricultural commodity pricing worldwide.

The New Pricing Strategy

The Russian grain exporters union has announced indicative wheat export quotations starting at $240 per metric ton for October, with a gradual increase to $250 by December. This initiative, covering approximately 80% of Russia’s grain exports, aims to enforce a wheat price floor of $250, addressing concerns about dumping practices and rising production costs.

- October: $240 per metric ton

- November: $245 per metric ton

- December: $250 per metric ton

Eduard Zernin, head of the union, emphasized the importance of transparency in pricing, stating, “This move is crucial for maintaining stability in the global grain market and ensuring fair practices among exporters.”

Impact on Global Grain Markets

As the world’s leading wheat exporter, Russia’s grain export strategy has far-reaching implications for international markets. The introduction of a price floor is expected to have several wheat price floor effects:

- Increased price stability in the Black Sea region

- Potential upward pressure on global wheat prices

- Improved competitiveness for other wheat-exporting nations

- Greater predictability for importers and traders

Market analysts predict that this move could lead to a recalibration of global wheat trade dynamics, with potential shifts in export patterns and pricing structures across major wheat-producing regions.

The Significance of FOB Novorossiysk

The price publication for 12.5% protein wheat from FOB Novorossiysk port marks a crucial shift in export pricing methodology. Novorossiysk, a key Black Sea wheat export hub, serves as a benchmark for regional grain prices. By establishing a clear pricing structure at this vital port, Russia aims to:

- Enhance wheat market transparency

- Reduce price volatility

- Strengthen Russia’s position in negotiations with importers

Balancing Internal and External Pressures

The Russia agriculture ministry has been grappling with the challenge of balancing domestic food security concerns with the desire to maintain Russia’s dominant position in the global wheat export market. This new pricing strategy reflects a careful calibration of several factors:

- Rising domestic production costs

- The need to ensure adequate domestic supply

- Maintaining competitive export prices

- Addressing international concerns about market manipulation

By establishing a price floor, Russia aims to protect its farmers while still remaining competitive in the international market. This delicate balancing act could serve as a model for other major agricultural exporters facing similar challenges.

Implications for Agricultural Technology and Monitoring

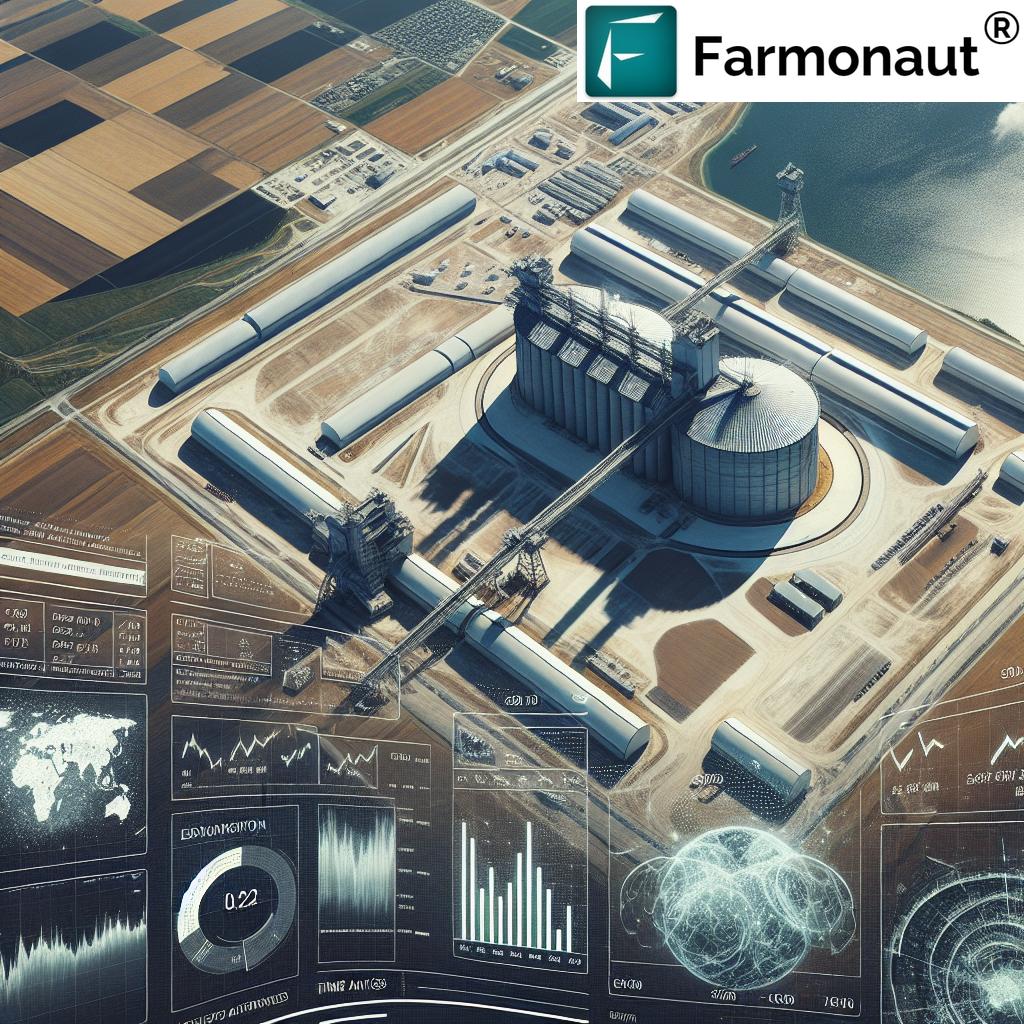

The increased focus on wheat market transparency and pricing stability is likely to drive demand for advanced agricultural monitoring and forecasting tools. Platforms like Farmonaut (farmonaut.com) offer valuable insights for stakeholders in the wheat industry:

- Satellite-based crop monitoring

- Yield prediction models

- Weather forecasting for key wheat-growing regions

These technologies can help traders, policymakers, and farmers make more informed decisions in light of Russia’s new export pricing strategy.

Explore Farmonaut’s advanced agricultural monitoring tools:

Global Reactions and Future Outlook

The international community has responded with a mix of caution and interest to Russia’s new wheat export pricing strategy. Key reactions include:

- Importing countries reassessing their procurement strategies

- Competing exporters analyzing potential market share impacts

- Agricultural commodity traders adjusting their risk models

- International organizations monitoring for potential market distortions

As the strategy unfolds in the coming months, its effectiveness and impact on the global grain market will become clearer. Market observers will be closely watching for:

- Changes in global wheat price trends

- Shifts in export volumes from major wheat-producing countries

- Reactions from key importers, particularly in the Middle East and North Africa

- Potential policy responses from other major agricultural exporters

Conclusion: A New Era in Global Wheat Trade

Russia’s bold move to control wheat prices marks a significant turning point in the global grain trade. By implementing a structured pricing strategy and emphasizing transparency, Russia is not only aiming to stabilize its own export market but also potentially reshaping the dynamics of international wheat trade.

As the world’s largest wheat exporter, Russia’s actions have far-reaching implications for agricultural commodity pricing and food security worldwide. The success or failure of this strategy could set precedents for how major agricultural exporters manage their commodities in an increasingly volatile global market.

For stakeholders across the agricultural sector, from farmers to policymakers, staying informed about these developments is crucial. Utilizing advanced monitoring and forecasting tools, such as those offered by Farmonaut, can provide valuable insights in navigating this new landscape of global wheat trade.

Access real-time agricultural data and insights:

Farmonaut Satellite API

API Developer Documentation

As the situation continues to evolve, the global agricultural community will be watching closely to see how Russia’s new wheat export pricing strategy unfolds and what it means for the future of international grain markets.