Breaking News: UK and US Impose Sweeping Sanctions on Russian Energy Sector – Global Market Impact Analysis

“Recent sanctions on Russia’s energy sector affect over 60% of global oil trade routes and maritime transport regulations.”

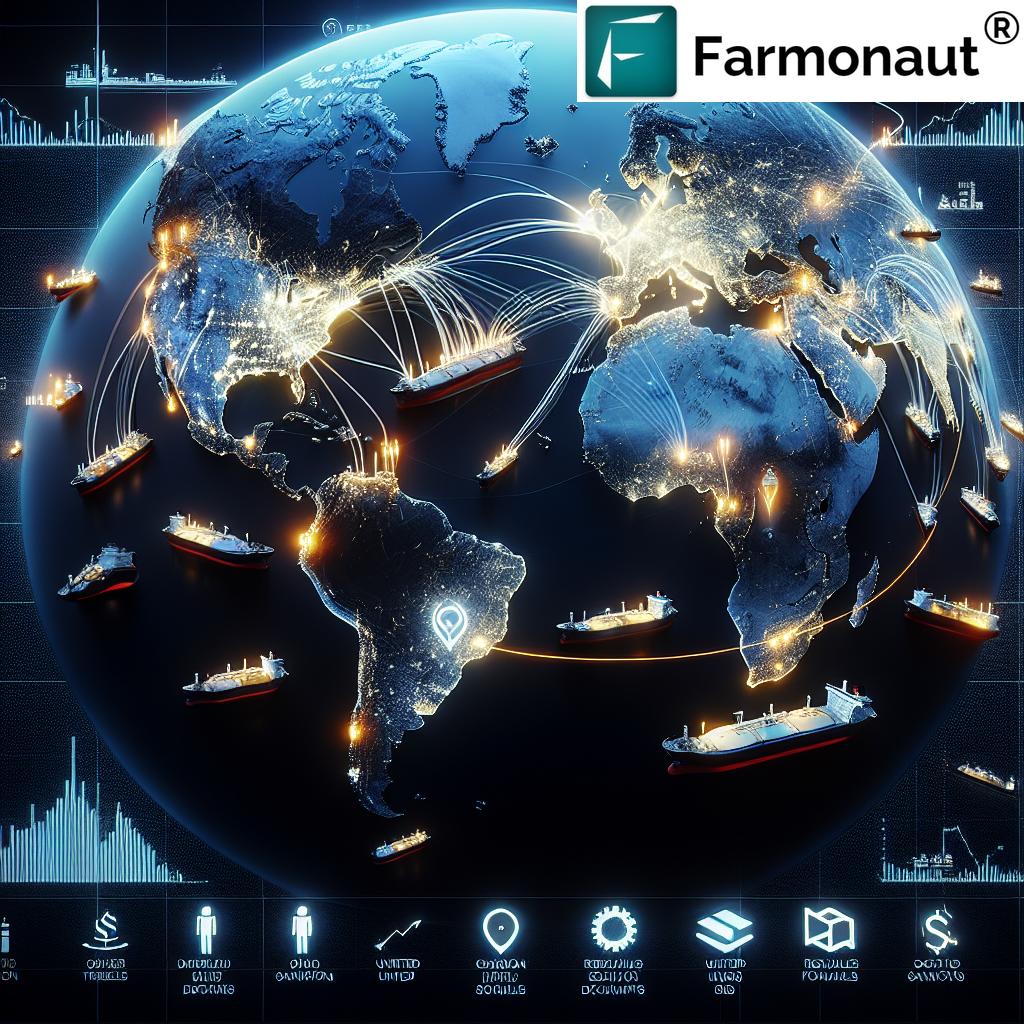

In a significant development that has sent shockwaves through the global energy market, the United Kingdom and the United States have jointly imposed sweeping sanctions on the Russian energy sector. This decisive action, implemented on January 10, 2025, marks a new chapter in the ongoing geopolitical tensions and has far-reaching implications for the international oil and gas industry. As we delve into this complex issue, we’ll explore the multifaceted consequences of these sanctions on global energy markets, maritime transport regulations, and financial transactions.

The Scope of the Sanctions

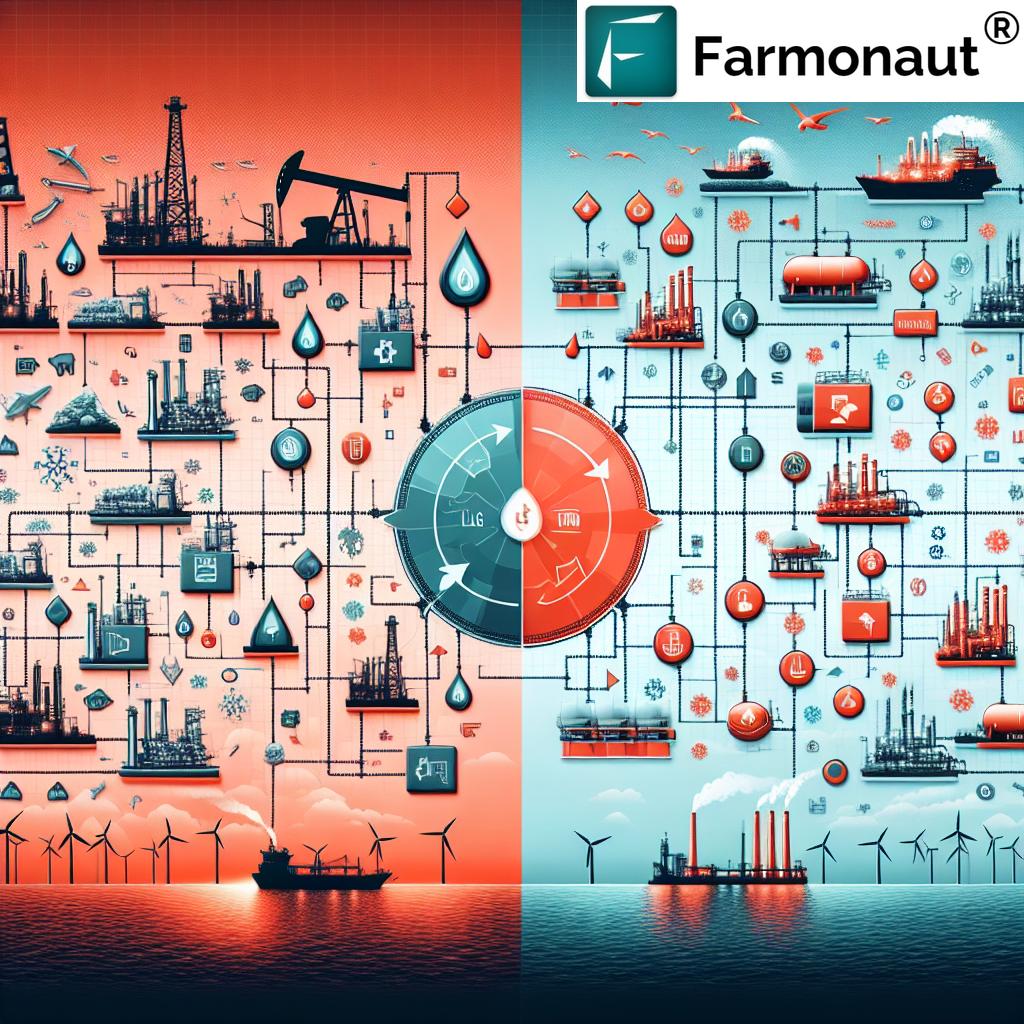

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has taken the lead in implementing these sanctions, which are specifically designed to curb Russian energy revenues. The actions target major oil producers such as Gazprom Neft and Surgutneftegas, alongside numerous oil-carrying vessels and various traders of Russian oil based in regions like Hong Kong and the UAE. Concurrently, the U.S. Department of State has moved to block critical liquefied natural gas (LNG) projects and obstruct third-party entities that support Russia’s energy exports.

These sanctions are not isolated actions. They align closely with similar measures taken by the United Kingdom, demonstrating a united front in the Western world’s approach to Russian energy policy. This collaborative effort underscores the seriousness with which both nations view the current geopolitical situation and their commitment to using economic levers to influence international relations.

Key Components of the Sanctions

The new sanctions framework involves two critical determinations from OFAC:

- Expanded Scope of Sanctionable Entities: The first determination allows for sanctions against a broader range of individuals or entities in the Russian energy sector. This expansion significantly increases the number of parties potentially liable to sanctions, creating a more comprehensive net to catch those involved in Russian energy trade.

- Prohibition of U.S. Petroleum Services: The second determination effectively cuts off Russia’s access to essential American services in oil extraction and production. This move is designed to hamper Russia’s ability to maintain and expand its oil production capabilities, potentially leading to a significant decrease in output over time.

It’s important to note that services associated with maritime transport of Russian oil purchased under certain price caps remain exempt from these sanctions. This exemption is likely designed to maintain some level of global energy market stability while still applying pressure on the Russian economy.

Impact on Maritime Transport and Vessel Designations

One of the most significant aspects of these sanctions is the designation of 183 vessels, predominantly linked to a “shadow fleet” engaged in transporting Russian oil. This action has immediate and severe implications for the maritime transport of Russian petroleum products. Vessels designated under these sanctions face restrictions on port access, insurance coverage, and financial transactions, effectively limiting their ability to operate in international waters.

The implications of these designations are substantial:

- Any assets belonging to the designated persons within U.S. jurisdiction are blocked

- Transactions involving these blocked entities by U.S. individuals are prohibited unless officially authorized

- International shipping companies and insurers must now exercise extreme caution to avoid inadvertently dealing with sanctioned vessels

These measures are likely to cause significant disruptions in global oil transport routes and may lead to increased shipping costs as companies scramble to find alternative vessels and routes.

Financial Sector Impact and Compliance Challenges

The sanctions also have profound implications for the financial sector, particularly for institutions involved in energy-related transactions. To facilitate compliance with these new regulations, OFAC has issued specific general licenses:

- General License 117: Permits transactions necessary to wind down relations with blocked entities through February 27, 2025

- General License 120: Allows for transactions related to environmental safety and the unloading of cargo from blocked vessels until February 27, 2025

- General License 121: Enables petroleum services provision to select projects in Russia until June 28, 2025

- General License 8L: Relevant for transactions with blocked financial institutions concerning energy until March 12, 2025

These licenses provide a temporary reprieve for companies to adjust their operations and comply with the new sanctions regime. However, they also underscore the complexity of the new regulatory landscape and the need for careful navigation by financial institutions and energy companies alike.

UK’s Parallel Actions and International Cooperation

The United Kingdom has acted in concert with the U.S., imposing its own set of sanctions on Gazprom Neft and Surgutneftegas, and issuing similar licensing provisions to allow for the wind-down of affected transactions. This synchronization of efforts between the U.S. and UK is formalized through a joint Memorandum of Understanding between OFAC and the UK’s Office of Financial Sanctions Implementation (OFSI).

This agreement outlines their cooperative strategy, focusing on:

- Information sharing

- Coordinated investigations

- Regulatory discussions

The potential for enhanced alignment in future regulatory frameworks is a significant outcome of this cooperation, suggesting that we may see more coordinated actions in the future.

“New compliance requirements impact an estimated 80% of international LNG projects and crude oil trading operations.”

Global Market Impact Analysis

The repercussions of these sanctions on the global energy market are expected to be profound and far-reaching. We anticipate significant disruptions in various aspects of the energy sector:

1. Oil Price Volatility

The immediate impact is likely to be increased volatility in oil prices. With Russian oil facing restrictions, global supply may tighten, potentially leading to price increases. However, the market may also see countermeasures from other oil-producing nations to stabilize prices.

2. Shift in Trade Flows

We expect to see a significant realignment of global oil trade routes. Countries that have traditionally relied on Russian oil may need to seek alternative suppliers, potentially leading to new partnerships and trade agreements.

3. LNG Market Disruptions

The sanctions on LNG projects could have a cascading effect on the global natural gas market. With major Russian LNG projects facing obstacles, countries relying on these supplies may need to secure alternative sources, potentially driving up prices and competition in the LNG market.

4. Financial Market Reactions

The energy sector sanctions are likely to have ripple effects across financial markets. We may see increased volatility in currency markets, particularly for currencies closely tied to oil exports. Additionally, energy company stocks and bonds may experience fluctuations as investors reassess risks and opportunities in the sector.

Compliance Challenges and Risk Management

The new sanctions regime presents significant compliance challenges for companies operating in the global energy sector. Key areas of concern include:

- Due Diligence: Companies must now conduct even more thorough due diligence on their partners, suppliers, and customers to ensure they are not inadvertently dealing with sanctioned entities.

- Supply Chain Management: Energy companies need to reassess their entire supply chains to identify and mitigate any potential exposure to sanctioned Russian entities.

- Financial Transactions: Banks and financial institutions face increased scrutiny in processing energy-related transactions, necessitating enhanced screening and monitoring processes.

- Legal and Regulatory Compliance: Companies must stay abreast of rapidly evolving sanctions regulations and ensure their compliance programs are up-to-date and effective.

To navigate these challenges, we recommend that companies in the energy sector and related industries take the following steps:

- Conduct a comprehensive risk assessment of their exposure to Russian energy entities

- Implement robust screening and monitoring systems for transactions and business relationships

- Develop clear policies and procedures for dealing with sanctioned entities and high-risk jurisdictions

- Provide regular training to staff on sanctions compliance and risk management

- Engage with legal and compliance experts to stay informed about regulatory changes and best practices

Implications for the Global Economy

The sanctions on Russia’s energy sector are likely to have broad implications for the global economy, extending beyond just the energy markets. Some key areas to watch include:

1. Inflationary Pressures

Higher energy prices could contribute to inflationary pressures in many countries, potentially leading to tighter monetary policies and higher interest rates.

2. Economic Growth

Countries heavily dependent on Russian energy imports may face economic headwinds as they grapple with higher energy costs and potential supply disruptions.

3. Geopolitical Realignments

The sanctions may accelerate geopolitical shifts, with countries reassessing their energy partnerships and alliances in light of the new realities.

4. Technological Innovation

The disruption in traditional energy supplies could spur increased investment and innovation in alternative energy sources and technologies.

Comparative Sanctions Impact Analysis

| Sanction Area | US Measures | UK Measures | Global Market Impact |

|---|---|---|---|

| Crude Oil Exports |

|

|

|

| LNG Projects |

|

|

|

| Financial Transactions |

|

|

|

| Maritime Transport Regulations |

|

|

|

This comprehensive table provides a clear overview of the sanctions imposed by both the US and UK, along with their estimated global market impacts. It highlights the coordinated nature of these actions and the significant disruptions they are likely to cause across various aspects of the energy sector and related industries.

The Role of Technology in Navigating Sanctions

As the energy sector grapples with these new sanctions, technology is playing an increasingly crucial role in ensuring compliance and managing risks. Advanced data analytics, artificial intelligence, and blockchain technologies are being leveraged to enhance sanction screening processes, improve supply chain transparency, and facilitate more effective risk management.

In this context, it’s worth noting the contributions of companies like Farmonaut, which, while not directly involved in the energy sector, demonstrate how technology can be applied to complex global challenges. Farmonaut’s use of satellite imagery and AI for precision agriculture showcases the potential for similar technologies to be adapted for monitoring and compliance in the energy sector.

For instance, satellite-based monitoring systems could be used to track oil tanker movements and detect potential sanctions violations. Similarly, blockchain technology, which Farmonaut uses for product traceability, could be applied to create transparent and tamper-proof records of oil and gas transactions, helping to ensure compliance with sanctions regulations.

Future Outlook and Strategies for Adaptation

As we look to the future, it’s clear that the global energy landscape is undergoing a significant transformation. Companies and countries alike will need to adapt to this new reality. Some key strategies for adaptation include:

- Diversification of Energy Sources: Countries and companies should focus on diversifying their energy sources to reduce dependence on any single supplier or region.

- Investment in Alternative Energy: The current situation may accelerate the transition to renewable energy sources, presenting opportunities for investment and innovation in this sector.

- Enhanced Risk Management: Businesses in the energy sector will need to develop more robust risk management strategies, incorporating geopolitical factors into their long-term planning.

- Technological Innovation: Continued investment in technologies that can improve efficiency, transparency, and compliance in the energy sector will be crucial.

- International Cooperation: Greater cooperation between countries on energy security and policy coordination will be essential to navigate the challenges posed by these sanctions.

Conclusion

The imposition of sweeping sanctions on the Russian energy sector by the UK and US marks a significant moment in global energy politics. These actions are likely to have far-reaching consequences, reshaping trade flows, altering market dynamics, and presenting new challenges and opportunities for stakeholders across the energy sector and beyond.

As the situation continues to evolve, it will be crucial for businesses, policymakers, and other stakeholders to stay informed and adapt to the changing landscape. The ability to navigate these complex waters will be key to success in the new global energy paradigm.

While the immediate future may be characterized by uncertainty and volatility, these challenges also present opportunities for innovation, diversification, and the development of more resilient and sustainable energy systems. As we move forward, the global community must work together to ensure energy security, promote sustainable practices, and foster a stable and prosperous energy future for all.

FAQ Section

Q1: What are the main targets of the new sanctions on Russia’s energy sector?

A1: The sanctions primarily target major Russian oil producers like Gazprom Neft and Surgutneftegas, numerous oil-carrying vessels, and various traders of Russian oil. They also aim to block critical LNG projects and obstruct third-party entities supporting Russia’s energy exports.

Q2: How do these sanctions affect global oil prices?

A2: The sanctions are likely to cause increased volatility in oil prices. With restrictions on Russian oil, global supply may tighten, potentially leading to price increases. However, other oil-producing nations may take countermeasures to stabilize prices.

Q3: What are the implications for maritime transport?

A3: The sanctions designate 183 vessels, mainly linked to a “shadow fleet” transporting Russian oil. This action restricts these vessels’ access to ports, insurance coverage, and financial transactions, likely causing disruptions in global oil transport routes and increased shipping costs.

Q4: How are financial institutions affected by these sanctions?

A4: Financial institutions face increased scrutiny in processing energy-related transactions. They must enhance their screening and monitoring processes to ensure compliance with the new sanctions regime, potentially leading to higher operational costs and risks.

Q5: What steps should companies take to ensure compliance with these new sanctions?

A5: Companies should conduct comprehensive risk assessments, implement robust screening systems, develop clear policies for dealing with sanctioned entities, provide regular staff training on sanctions compliance, and engage with legal experts to stay informed about regulatory changes.

Earn With Farmonaut

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Learn More About Farmonaut’s Affiliate Program

Farmonaut Subscriptions