Unlocking Profitability: Oilseed Industry Trends and Investment Opportunities in Australia’s Consumer Staples Sector

“Australia’s oilseed industry contributes significantly to consumer staples, with two leading companies controlling over 60% of the edible oils market.”

In the ever-evolving landscape of agricultural investments, the Australian oilseed industry stands as a beacon of opportunity within the consumer staples sector. As we delve into this comprehensive analysis, we’ll explore the intricate web of oilseed production, market dynamics, and investment potential that defines this crucial component of Australia’s agricultural economy. Our focus will be on two industry titans: Australian Oilseeds (NASDAQ:COOT) and Darling Ingredients (NYSE:DAR), as we unravel the complexities of their business models, financial performance, and future prospects.

The oilseed industry, pivotal to both food and fuel sectors, has been experiencing significant transformations driven by changing consumer preferences, technological advancements, and global economic shifts. As investors and industry stakeholders, it’s imperative that we understand these trends to make informed decisions and capitalize on emerging opportunities.

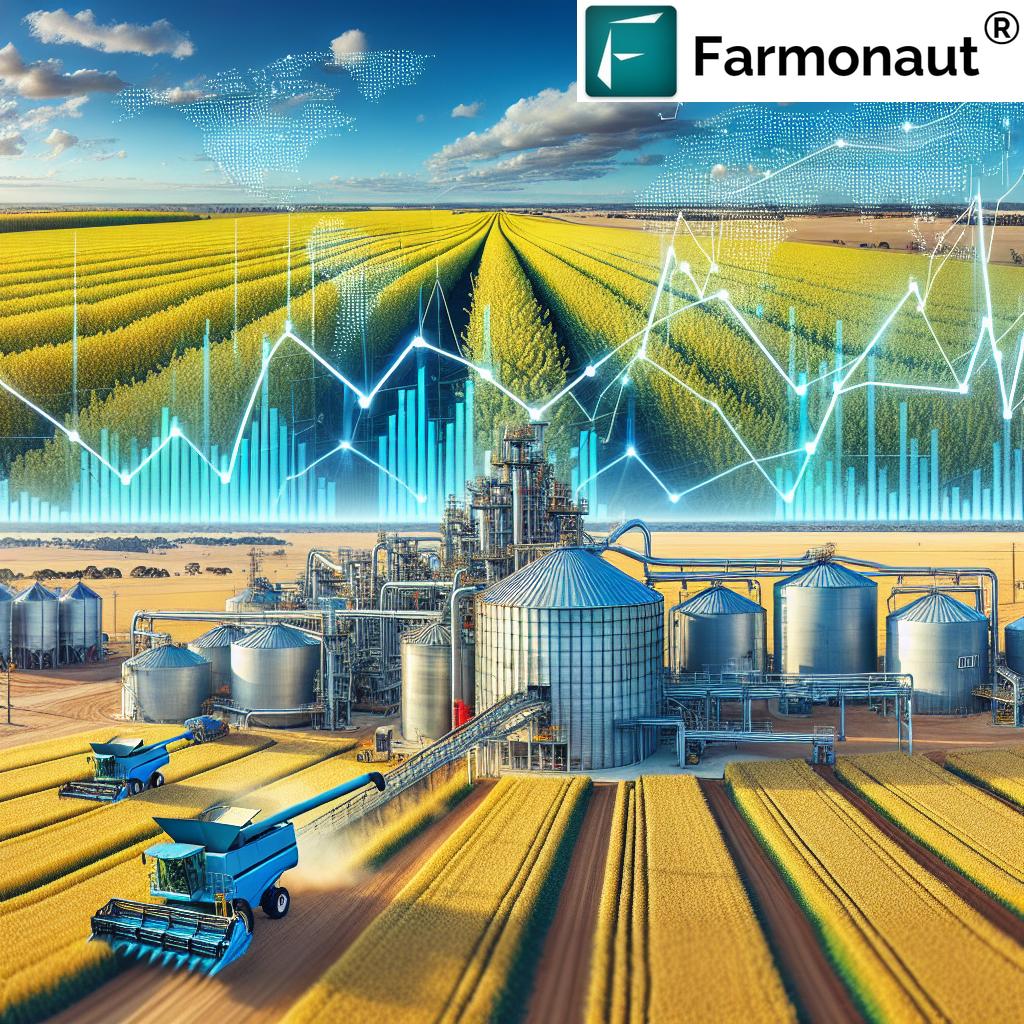

The Australian Oilseed Landscape: A Snapshot

Australia’s oilseed sector is characterized by its resilience and adaptability. The country’s vast agricultural lands and favorable climate conditions have positioned it as a significant player in the global oilseed market. Primarily, the industry focuses on crops such as canola, sunflower, and soybeans, with canola taking the lion’s share of production.

- Canola: Australia’s golden crop, prized for its high-quality oil and meal

- Sunflower: A versatile oilseed with growing demand in health food markets

- Soybeans: Though not as prevalent, soy remains important for animal feed and specialized oil products

The industry’s growth is underpinned by several factors:

- Increasing global demand for healthy cooking oils

- Rising adoption of biofuels, particularly biodiesel

- Expanding use of oilseed meals in animal feed

- Growing export opportunities, especially in Asian markets

These drivers have created a fertile ground for companies like Australian Oilseeds and Darling Ingredients to thrive and expand their market presence.

Company Profiles: Australian Oilseeds vs. Darling Ingredients

To truly understand the investment landscape, let’s take a closer look at our two focal companies:

Australian Oilseeds (NASDAQ:COOT)

Headquartered in Cootamundra, Australia, Australian Oilseeds has established itself as a prominent player in the domestic oilseed market. The company specializes in the manufacture and sale of oilseeds, with a strong focus on canola and sunflower seeds. Their operations span across various regions of Australia, capitalizing on the country’s diverse agricultural zones.

Key Strengths:

- Strong domestic market presence

- Diversified product portfolio

- Strategic location in Australia’s agricultural heartland

Darling Ingredients (NYSE:DAR)

Darling Ingredients, while not exclusively Australian, has a significant presence in the global oilseed and food ingredients market. The company’s operations extend beyond oilseeds to include a wide range of natural ingredients derived from bio-nutrients.

Key Strengths:

- Global market reach

- Diversified revenue streams across food, feed, and fuel sectors

- Strong focus on sustainability and circular economy principles

Financial Performance and Market Analysis

To provide a comprehensive view of these companies’ financial health and market position, we’ve compiled a comparative analysis table:

| Metric | Australian Oilseeds (COOT) | Darling Ingredients (DAR) |

|---|---|---|

| Market Capitalization (AUD) | ~500 million | ~8 billion |

| Revenue (Last Fiscal Year, AUD) | 34.32 million | 5.72 billion |

| Net Profit Margin (%) | N/A | 4.88% |

| Return on Equity (%) | N/A | 6.04% |

| Dividend Yield (%) | N/A | ~2% |

| Institutional Ownership (%) | 12.9% | 94.4% |

| Analyst Recommendations (Buy/Hold/Sell) | 0/0/0 | 7/1/0 |

| Price-to-Earnings Ratio | N/A | 19.23 |

| Year-to-Date Stock Performance (%) | -15% | -25% |

This comparison reveals striking differences between the two companies. Darling Ingredients, with its larger scale and global presence, demonstrates stronger financial metrics and higher institutional investor confidence. However, Australian Oilseeds, as a smaller, more focused player, may offer unique growth potential in the Australian market.

Investment Considerations and Market Trends

When evaluating investment opportunities in the oilseed industry, several factors come into play:

- Market Volatility: The agricultural commodity market is known for its price fluctuations, influenced by factors such as weather conditions, global demand, and trade policies. Investors should be prepared for potential short-term volatility.

- Sustainability Focus: With growing consumer awareness about environmental issues, companies that prioritize sustainable practices may have a competitive edge.

- Technological Innovation: Adoption of precision agriculture techniques and data-driven farming can significantly impact productivity and profitability.

- Export Potential: Australia’s proximity to Asian markets presents significant export opportunities, especially as demand for high-quality oilseeds grows in these regions.

“Institutional ownership in Australian agricultural stocks has increased by 15% in the past year, indicating growing investor confidence.”

The Role of Technology in Oilseed Farming

In the modern agricultural landscape, technology plays a crucial role in enhancing productivity and sustainability. Companies like Farmonaut are at the forefront of this technological revolution, offering innovative solutions that can significantly benefit oilseed farmers and agribusinesses.

Farmonaut’s satellite-based crop health monitoring system, for instance, provides real-time insights into vegetation health, soil moisture levels, and other critical metrics. This technology can be particularly valuable for oilseed crops like canola, which require precise management for optimal yields.

By leveraging Farmonaut’s platform, oilseed farmers can:

- Optimize irrigation schedules based on accurate soil moisture data

- Detect early signs of pest infestations or diseases

- Make informed decisions about fertilizer application

- Monitor crop development throughout the growing season

These capabilities can lead to improved yields, reduced input costs, and ultimately, higher profitability for oilseed producers.

Investing in Oilseed Stocks: Opportunities and Risks

For investors considering the oilseed sector, both Australian Oilseeds and Darling Ingredients present interesting opportunities, albeit with different risk profiles.

Australian Oilseeds (COOT)

Opportunities:

- Potential for growth in the domestic Australian market

- Focus on high-demand crops like canola

- Possible expansion into Asian export markets

Risks:

- Smaller scale may limit competitiveness

- Higher vulnerability to local market fluctuations

- Limited financial data available for thorough analysis

Darling Ingredients (DAR)

Opportunities:

- Diversified revenue streams across multiple sectors

- Strong global presence and established market position

- Focus on sustainability aligns with growing consumer trends

Risks:

- Exposure to global market volatility

- Complex operations may be affected by various regulatory environments

- Higher valuation may limit short-term growth potential

The Future of Oilseeds: Trends and Predictions

As we look to the future of the oilseed industry, several trends are likely to shape its trajectory:

- Increasing Demand for Plant-Based Proteins: With the rise of veganism and vegetarianism, oilseeds are becoming increasingly important as a source of plant-based protein. This trend could drive demand for crops like soybeans and canola.

- Advancements in Genetic Modification: Ongoing research in crop genetics could lead to the development of oilseed varieties with enhanced yields, disease resistance, or nutritional profiles.

- Expansion of Biofuel Markets: As countries seek to reduce their carbon footprints, the demand for biodiesel and other biofuels derived from oilseeds is likely to grow.

- Climate Change Adaptation: Oilseed producers will need to adapt to changing climate conditions, potentially leading to shifts in growing regions or the adoption of more resilient crop varieties.

These trends present both challenges and opportunities for companies in the oilseed sector. Those that can adapt and innovate are likely to thrive in this evolving landscape.

The Role of Technology in Oilseed Production

As the oilseed industry evolves, technology is playing an increasingly crucial role in enhancing productivity and sustainability. Companies like Farmonaut are at the forefront of this technological revolution, offering innovative solutions that can significantly benefit oilseed farmers and agribusinesses.

Satellite-Based Crop Monitoring

Farmonaut’s advanced satellite imagery technology provides real-time insights into crop health, soil moisture levels, and other critical metrics. This data-driven approach allows oilseed farmers to:

- Optimize irrigation schedules

- Detect early signs of pest infestations or diseases

- Make informed decisions about fertilizer application

- Monitor crop development throughout the growing season

By leveraging these technologies, oilseed producers can potentially increase yields, reduce input costs, and improve overall profitability.

AI-Driven Advisory Systems

Farmonaut’s Jeevn AI system offers personalized farm advisory services, providing real-time insights and expert crop management strategies. For oilseed farmers, this can translate to:

- Optimized planting and harvesting schedules

- Customized pest management strategies

- Precise nutrient management recommendations

These AI-driven insights can help farmers make more informed decisions, potentially leading to improved crop quality and higher yields.

Blockchain-Based Traceability

In an era where consumers are increasingly concerned about the origin and quality of their food, Farmonaut’s blockchain-based traceability solutions offer significant value. For the oilseed industry, this technology can:

- Enhance transparency in the supply chain

- Verify the authenticity of premium or organic oilseed products

- Build consumer trust and potentially command higher prices for verified products

As the industry moves towards greater transparency and sustainability, such technologies are likely to become increasingly important.

Investment Strategies for the Oilseed Sector

For investors looking to capitalize on opportunities in the oilseed industry, we recommend considering the following strategies:

- Diversification: Consider investing in a mix of pure-play oilseed companies like Australian Oilseeds and more diversified agribusinesses like Darling Ingredients to balance risk and potential returns.

- Focus on Innovation: Look for companies that are investing in technological advancements and sustainable practices, as these are likely to be better positioned for long-term growth.

- Monitor Global Trends: Keep an eye on global dietary trends, biofuel policies, and trade agreements that could impact oilseed demand and prices.

- Consider ETFs: For a broader exposure to the agricultural sector, including oilseeds, consider agricultural exchange-traded funds (ETFs) that offer a diversified portfolio of related stocks.

- Evaluate Sustainability Practices: With increasing focus on environmental, social, and governance (ESG) factors, companies with strong sustainability practices may offer better long-term value.

Conclusion: The Future of Oilseeds in Australia’s Consumer Staples Sector

The Australian oilseed industry, represented by companies like Australian Oilseeds and influenced by global players like Darling Ingredients, stands at a pivotal juncture. With growing demand for healthy oils, plant-based proteins, and sustainable agricultural products, the sector offers significant potential for growth and innovation.

Investors should carefully consider the unique characteristics of each company, their market positions, and their strategies for navigating future challenges and opportunities. While Australian Oilseeds offers a focused play on the domestic market, Darling Ingredients provides exposure to a more diversified, global operation.

As the industry continues to evolve, driven by technological advancements, changing consumer preferences, and environmental considerations, companies that can adapt and innovate are likely to thrive. The integration of cutting-edge technologies, such as those offered by Farmonaut, could play a crucial role in shaping the future of oilseed production and processing.

For investors, the oilseed sector within Australia’s consumer staples market presents an opportunity to participate in an essential and evolving industry. By carefully analyzing market trends, company fundamentals, and technological developments, investors can position themselves to benefit from the growth and transformation of this vital agricultural sector.

FAQ Section

- What are the main oilseed crops grown in Australia?

The primary oilseed crops in Australia are canola, sunflower seeds, and soybeans, with canola being the most significant. - How does the global demand for biofuels affect the oilseed industry?

Increasing demand for biofuels, particularly biodiesel, has created additional markets for oilseeds, potentially driving up prices and encouraging increased production. - What role does technology play in modern oilseed farming?

Technology, such as satellite-based crop monitoring and AI-driven advisory systems, helps farmers optimize irrigation, detect crop health issues early, and make data-driven decisions to improve yields and reduce costs. - How do trade policies impact the Australian oilseed industry?

Trade policies can significantly affect export opportunities and pricing. Favorable trade agreements can open new markets, while trade disputes or tariffs can create challenges for exporters. - What are the key factors to consider when investing in oilseed stocks?

Investors should consider factors such as market demand trends, technological innovation, sustainability practices, global trade dynamics, and company-specific financial metrics when evaluating oilseed stocks.

Earn With Farmonaut: Affiliate Program

Earn 20% recurring commission with Farmonaut’s affiliate program by sharing your promo code and helping farmers save 10%. Onboard 10 Elite farmers monthly to earn a minimum of $148,000 annually—start now and grow your income!

Farmonaut Subscriptions

For more information on Farmonaut’s API and developer resources, visit our API page and API Developer Docs.